PPDI Short of a Penny, Grows Y/Y - Analyst Blog

April 28 2011 - 8:00AM

Zacks

Pharmaceutical Product Development,

Inc. (PPDI) reported first quarter 2011 earnings of

32 cents per share, above the year-ago earnings of 14 cents per

share. Earnings growth was driven by higher revenue, improved gross

margins and reduced SG&A expenses. Earnings however came a

penny below the Zacks Consensus Estimate of 33 cents.

Quarterly revenue of $383.2 million was up 10.5% over the

prior-year period and also ahead of the Zacks Consensus Estimate of

$360 million. Revenue growth was driven by strong performance of

the Clinical Development segment.

The Quarter in Detail

The company operates through two segments - Clinical Development

Services and Laboratory Services

Clinical Development Services: The segment

includes global phase II-IV clinical trial management

services. In the first quarter, the segment revenue was

$279.7 million, up 12.2% over the prior-year period driven by solid

growth in all geographic regions. The segment saw strong increases

in request for proposals (RFP’s) activity, the majority of which

came from big pharma and mid-sized biotech companies.

Laboratory Services: The segment includes phase

I clinic, cGMP, bioanalytical, central laboratory, vaccines and

biologics, and BioDuro/discovery services. In the first quarter,

the segment revenue was $76.5 million, up only 2.6% over the

prior-year period and down 9.8% sequentially. Revenues in this

segment were negatively impacted by higher-than-expected

cancellations in the phase I clinic and lighter results in the

bioanalyical and vaccines business.

Management is hopeful of a recovery in the laboratory services

segment in the second quarter of 2011 and improvement thereafter

driven by new authorizations in the phase I clinic, bioanalytical

lab, and cGMP Lab. The hope of a turnaround is backed by the three

strategic, outsourcing relationships that PPD established in the

quarter. Of these, two were preferred provider relationships for

phase 1 service and the third was a cGMP laboratory service.

In the reported quarter, the company posted a book-to-bill ratio

of 1.31, above 1.20 reported in the fourth quarter of 2010. Gross

bookings were $640 million and cancellations were $174.1 million in

the reported quarter.

Total backlog came in at $3.6 billion, with an average duration

of 33 months (down from 34 months reported in the fourth quarter of

2010).

Gross margin was 50% in the first quarter, driven by strong

gross margins in the clinical development segment. SG&A expense

declined to 28.5% of revenues in the quarter compared with 33.8% in

the prior-year quarter as the company continues to focus on

reducing these expenses to drive productivity gains and improve

revenues.

Our Recommendation

We currently have an Outperform recommendation on Pharmaceutical

Product Development. The company retains a Zacks #2 Rank, which

translates into a short-term Buy rating. We are impressed by the

company’s strong bookings, stable backlog duration, sound expense

control and improving margins.

Pharmaceutical Product Development is a leading contract

research organization (CRO) providing drug discovery and

development services to pharmaceutical and biotechnology

companies.

Companies like Pharmaceutical Product Development and

Charles River Laboratories (CRL) suffered in

2008-2009 due to a decline in demand for their services in time of

a depressed economy. The environment for CRO’s is gradually

improving. The improving RFP flows and key strategic partnerships

secured by PPD with bio-pharma customers are a testament to such a

revival, which would in its turn result in bottom-line growth.

CHARLES RVR LAB (CRL): Free Stock Analysis Report

PHARMA PROD DEV (PPDI): Free Stock Analysis Report

PHARMA PROD DEV (PPDI): Free Stock Analysis Report

Zacks Investment Research

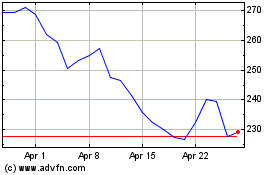

Charles River Laboratories (NYSE:CRL)

Historical Stock Chart

From May 2024 to Jun 2024

Charles River Laboratories (NYSE:CRL)

Historical Stock Chart

From Jun 2023 to Jun 2024