Current Report Filing (8-k)

June 25 2021 - 4:21PM

Edgar (US Regulatory)

false000107173900010717392021-06-242021-06-24

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 24, 2021

CENTENE CORPORATION

(Exact Name of Registrant as Specified in Charter)

|

Delaware

|

001-31826

|

42-1406317

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

|

7700 Forsyth Blvd.,

St. Louis, Missouri

|

63105

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (314) 725-4477

(Former Name or Former Address, if Changed Since Last Report): N/A

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.001 Par Value

|

|

CNC

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (Sec.230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (Sec.240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

On June 24, 2021, Centene Corporation (the “Company”) entered into an underwriting agreement (the “Underwriting Agreement”) with J.P. Morgan Securities LLC,

as representative of the several underwriters named therein (the “Underwriters”), pursuant to which the Company agreed to sell to the Underwriters $1,800,000,000 aggregate principal amount of its 2.450% Senior Notes due 2028, for resale by the

Underwriters (the “Offering”) pursuant to the Company’s registration statement on Form S-3ASR (File No. 333-238050).

The Underwriting Agreement includes customary representations, warranties, covenants and closing conditions. It also provides for customary indemnification by

each of the Company and the Underwriters against certain liabilities and customary contribution provisions in respect of those liabilities.

The Company intends to use the net proceeds of the Offering to finance a portion of the cash consideration payable in connection with Centene’s previously

announced acquisition of Magellan Health Inc. (“Magellan Health” and such proposed acquisition, the “Magellan Acquisition”) and to pay related fees and expenses. The closing of the Offering is not conditioned on the closing of the Magellan

Acquisition. If the Magellan Acquisition is not completed, Centene expects to use the net proceeds of the Offering for debt repayment and general corporate purposes.

A copy of the Underwriting Agreement is attached hereto as Exhibit 1.1 to this Current Report on Form 8-K and is incorporated herein by

reference. The above description of the material terms of the Underwriting

Agreement does not purport to be complete and is qualified in its entirety by reference to such Exhibit.

On June 24, 2021, the Company issued a press release announcing the commencement of the Offering. A copy of the press release is attached hereto as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

On June 24, 2021, the Company issued a press release announcing the pricing of the Offering. A copy of the press release is attached hereto as Exhibit 99.2 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit Number.

|

Description

|

|

|

Underwriting Agreement, dated as of June 24, 2021, between Centene Corporation and J.P. Morgan Securities LLC, as representative of the several

underwriters named therein.

|

|

|

Press release, dated June 24, 2021, related to the commencement of the Offering.

|

|

|

Press release, dated June 24, 2021, related to the pricing of the Offering.

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

CENTENE CORPORATION

|

|

|

|

|

Date: June 25, 2021

|

By:

|

/s/ Andrew L. Asher

|

|

|

|

Andrew L. Asher

|

|

|

|

Executive Vice President and Chief Financial Officer

|

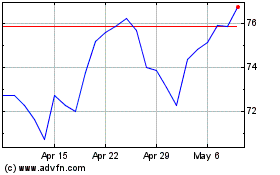

Centene (NYSE:CNC)

Historical Stock Chart

From Oct 2024 to Nov 2024

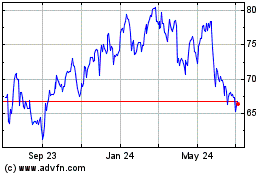

Centene (NYSE:CNC)

Historical Stock Chart

From Nov 2023 to Nov 2024