By Anna Wilde Mathews and Peter Loftus

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (January 17, 2020).

The annual J.P. Morgan health care conference is taking place

this week in San Francisco. Here are some of the hot topics under

discussion at the four-day event, which wraps up Thursday.

Politics Looms Too Large

Investors are overreacting to political developments, Centene

Corp. CEO Michael Neidorff said in a Wednesday interview during the

conference, and added that he is "beyond surprised" at how shares

of managed-care companies have been moving around due to news

related to the presidential campaign.

"There is no rational reason to let a Des Moines Register poll"

affect investment decisions in the sector, he said. Mr. Neidorff

said the U.S. can't afford a single-payer government health-care

system and he doesn't expect one to be enacted.

"Single payers control cost by limiting access," he said. "All

we're talking about with Medicare for All is politics, we're not

talking about good policy."

Congress Could Act on Drug Prices

The pharmaceutical industry's top U.S. lobbyist sees signs that

Congress could agree on legislation to reduce drug costs this year,

potentially in May when certain government health funding expires

and is up for renewal.

Steve Ubl, president of the Pharmaceutical Research and

Manufacturers of America, said there are areas of overlap between

certain drug-price bills in the Democratic-controlled House and a

bipartisan bill that passed the Senate Finance Committee last

year.

"To be honest, we don't love every aspect of every one of these

bills, but if Congress wants to act on drug pricing, the contours

of an agreement are there," Mr. Ubl said during a panel discussion

at the conference on Tuesday. "The real question is whether

politics will supersede the discussion."

The trade group, known as PhRMA, opposes provisions of a House

bill that gives the federal Medicare program power to negotiate

drug prices and cap U.S. prices at a percentage of foreign prices.

But PhRMA supports provisions that cap patients' out-of-pocket

costs for drugs.

J&J Sees Price Pressure

Johnson & Johnson says it is counting on prescription volume

growth rather than price hikes to fuel U.S. sales growth in its

pharmaceutical unit.

While J&J has raised U.S. list prices for some of its drugs,

average net prices -- those J&J realizes after paying rebates

and discounts -- have declined in the past couple of years.

"I don't see pricing getting easier," Jennifer Taubert, head of

J&J's pharmaceuticals unit, said at the conference on

Monday.

Cigna, Oscar Plan a Plan

Cigna Corp. and Oscar Insurance Corp. will launch their joint

small-business insurance plan in a handful of markets by the start

of next year, Oscar CEO Mario Schlosser said in an interview.

The product will first roll out around the third quarter of

2020, he said, and "my hope would be, over time, we can go into all

the markets."

Cigna isn't taking a stake in Oscar, he said, though the two

companies will share risk on the new product, which will use

Cigna's provider network relationships and Oscar's technology.

CVS Expanding Health Hubs

CVS Health Corp. says it has around 50 of its new health hub

stores open, in markets including Philadelphia, and aims for more

than 600 by the end of this year.

The company doesn't disclose the hub stores' profitability, but

says it has seen increased front-store sales, greater customer

engagement and greater pharmacy penetration.

"That is what is giving us the confidence to move with the rapid

rollout, " CEO Larry Merlo said. The company says it will offer

more financial detail once it has a critical mass of stores, this

summer.

Lilly Injects New Thinking

A year ago, Eli Lilly & Co. struck a deal to acquire

cancer-drug developer Loxo Oncology Inc. for $8 billion. Recently

Lilly took the unusual step of putting Loxo executives in charge of

Lilly's oncology research.

More typically, a biotech's leadership departs after being

bought by a larger company. But in Lilly's case, "in a 145-year-old

company, it helps to inject new thinking, new people," Lilly's

R&D chief, Daniel Skovronsky said on the sidelines of the

conference. He said the move will allow Lilly to be more agile in

developing cancer drugs.

BD Doesn't Expect Big Deals

Medical-supplies giant Becton, Dickinson and Co. has no

near-term plans for another major acquisition on the scale of its

purchases of CareFusion Corp. and C.R. Bard Inc. in recent

years.

Instead, once BD pays down debt from the $24 billion Bard deal

to a certain level, "we'll redirect a large amount" of the freed-up

cash flow for smaller, "tuck-in" deals, incoming CEO Tom Polen told

The Wall Street Journal on the sidelines of the conference.

Write to Anna Wilde Mathews at anna.mathews@wsj.com and Peter

Loftus at peter.loftus@wsj.com

(END) Dow Jones Newswires

January 17, 2020 02:47 ET (07:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

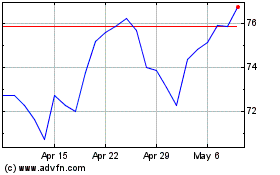

Centene (NYSE:CNC)

Historical Stock Chart

From Oct 2024 to Nov 2024

Centene (NYSE:CNC)

Historical Stock Chart

From Nov 2023 to Nov 2024