Filed Pursuant to Rule 424(b)(7)

Registration

Number 333-273467

PROSPECTUS SUPPLEMENT

(to

Prospectus dated July 27, 2023)

CELESTICA INC.

6,757,198

Subordinate Voting Shares Offered by the Selling Shareholder

The selling shareholder identified

in this prospectus supplement (“Selling Shareholder”) is offering 6,757,198 subordinate voting shares, without par value (“Subordinate

Voting Shares”), of Celestica Inc. (the “Company”) by this prospectus supplement and the accompanying prospectus. The

Subordinate Voting Shares to be sold by the Selling Shareholder consist of (a) Subordinate Voting Shares that are issued to the Selling

Shareholder by the Company immediately prior to the closing of the offering upon the conversion by such Selling Shareholder of an equivalent

number of multiple voting shares of the Company (“Multiple Voting Shares”) (including the conversion of Multiple Voting Shares

that are acquired by the Selling Shareholder from OMI Partnership Holdings Ltd., a wholly-owned subsidiary of the Selling Shareholder

(“OMI”) immediately prior to closing) and (b) Subordinate Voting Shares that are acquired by the Selling Shareholder

from its affiliates and associates immediately prior to closing.

The Company is not selling

any Subordinate Voting Shares in this offering and will not receive any proceeds from the sale of Subordinate Voting Shares covered by

this prospectus supplement. The Selling Shareholder will pay underwriting discounts and commission in connection with the offering. The

Company will pay all expenses of the registration of the Subordinate Voting Shares and certain other offering expenses.

The Underwriters (as

defined under the section captioned “Underwriting”) have agreed to purchase our Subordinate Voting Shares from the Selling

Shareholder at a price of $20.52 per share, which will result in $138,657,702.96 of proceeds to the Selling Shareholder before expenses.

The Underwriters propose to offer the Subordinate Voting Shares from time to time for sale in one or more transactions on the New York

Stock Exchange (“NYSE”) in the over-the-counter market, through negotiated transactions or otherwise at market prices prevailing

at the time of sale, at prices related to prevailing market prices or at negotiated prices. See “Underwriting” for additional

information regarding underwriting compensation.

The Subordinate Voting Shares

are listed on the NYSE and the Toronto Stock Exchange (“TSX”) and trade under the symbol “CLS.” The last reported

sales price of the Subordinate Voting Shares on July 31, 2023 was $21.98 per share on the NYSE and C$28.98 per share on the TSX.

You are urged to obtain current market quotations for the Subordinate Voting Shares.

The Offering is being

made concurrently in Canada under the terms of a prospectus supplement to a short form base shelf prospectus for the Province of Québec

dated May 30, 2023, and an amended and restated short form base shelf prospectus dated May 30, 2023 amending and restating the

short form base shelf prospectus dated March 30, 2023 for all other provinces and territories of Canada. Neither this prospectus

supplement nor the accompanying prospectus constitutes a prospectus under Canadian securities laws and therefore does not qualify the

securities offered hereunder in Canada.

INVESTING

IN THE SUBORDINATE VOTING SHARES INVOLVES A HIGH DEGREE OF RISK. BEFORE BUYING ANY SUBORDINATE VOTING SHARES, YOU SHOULD CAREFULLY CONSIDER

THE RISKS DESCRIBED IN THE SECTION CAPTIONED “RISK FACTORS” BEGINNING ON PAGE S-3 OF THIS PROSPECTUS SUPPLEMENT, IN

THE ACCOMPANYING PROSPECTUS AND IN THE DOCUMENTS INCORPORATED OR DEEMED INCORPORATED BY REFERENCE INTO THIS PROSPECTUS SUPPLEMENT AND

ACCOMPANYING PROSPECTUS.

NONE OF THE SECURITIES

AND EXCHANGE COMMISSION OR ANY STATE SECURITIES COMMISSION OR CANADIAN SECURITIES REGULATOR HAS APPROVED OR DISAPPROVED OF THESE SECURITIES

OR DETERMINED IF THIS PROSPECTUS SUPPLEMENT OR THE ACCOMPANYING PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY

IS A CRIMINAL OFFENSE.

The

Underwriters expect to deliver the Subordinate Voting Shares against payment on or about August 4, 2023.

BofA Securities

The date of this prospectus supplement is August

1, 2023

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

ABOUT THIS PROSPECTUS SUPPLEMENT

All references in this prospectus supplement to

“Celestica,” the “Company,” “our,” “us” and “we” refer to Celestica Inc.,

an Ontario, Canada corporation, and its consolidated subsidiaries, except where the context otherwise requires or as otherwise indicated.

Except as indicated otherwise: (i) all dollar amounts are expressed in United States (“U.S.”) dollars; and (ii) all

references to "U.S.$" or "$" are to U.S. dollars and all references to "C$" are to Canadian dollars.

This document is in two parts. The first part

is the prospectus supplement, which describes the specific terms of this offering and also adds, updates, and changes information contained

in the accompanying prospectus and the documents incorporated by reference into this prospectus supplement and the accompanying prospectus.

The second part is the accompanying prospectus, which gives more general information, some of which may not apply to this offering. This

prospectus supplement and the accompanying prospectus are part of a registration statement on Form F-3 that we filed with the Securities

and Exchange Commission (“SEC”) as a “well-known seasoned issuer” as defined in Rule 405 of the U.S. Securities

Act of 1933, as amended (“Securities Act”), using the “shelf” registration process.

This prospectus supplement and the accompanying

prospectus include important information about us and other information you should know before investing in our Subordinate Voting Shares.

This prospectus supplement also adds, updates and changes information contained in the accompanying prospectus and in any documents incorporated

by reference herein and therein. To the extent the information contained in this prospectus supplement differs or varies from the information

contained in the accompanying prospectus or any document filed prior to the date of this prospectus supplement and incorporated by reference,

the information in this prospectus supplement will control. However, if any statement in one of these documents is inconsistent with a

statement in another document having a later date—for example, a document incorporated by reference in this prospectus supplement

or the accompanying prospectus—the statement in the document having the later date modifies or supersedes the earlier statement

as our business, financial condition, results of operations and prospects may have changed since the earlier date.

We urge you to read carefully this entire prospectus

supplement and the accompanying prospectus, together with the information described under the headings “Incorporation of Certain

Documents by Reference” and “Where You Can Find More Information” in this prospectus supplement and accompanying

prospectus, and any free writing prospectus that we may file with the SEC in connection with this offering before making an investment

decision. Further, this prospectus supplement and the accompanying prospectus do not contain all of the information included in the registration

statement. The registration statement filed with the SEC includes or incorporates by reference exhibits that provide more details about

the matters discussed in this prospectus supplement and the accompanying prospectus. You may obtain the information incorporated by reference

into this prospectus supplement without charge by following the instructions under “Where You Can Find More Information”

below.

The distribution of this prospectus supplement

and the accompanying prospectus may be restricted by law in certain jurisdictions. You should inform yourself about and observe any of

these restrictions. Persons outside the U.S. who come into possession of this prospectus supplement or the accompanying prospectus must

inform themselves about and observe any restrictions relating to this offering and the distribution of this prospectus supplement and

the accompanying prospectus outside the U.S. We are not, and the Underwriters and the Selling Shareholder are not, making an offer to

sell or soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted, or where the person

making the offer or solicitation is not qualified to do so, or to any person to whom it is unlawful to make the offer or solicitation.

As used in this prospectus supplement, the term

“Underwriters” refers to the underwriters identified on the cover page hereof. To the extent there is only a single

underwriter so identified, the term “Underwriters” refers to such single underwriter.

This prospectus supplement and the accompanying

prospectus are based on information provided by us and by other sources that we believe are reliable. This prospectus supplement and the

accompanying prospectus summarize certain documents and other information, and we refer you to them for a more complete understanding

of what we discuss in this prospectus supplement and the accompanying prospectus. All of the summaries are qualified in their entirety

by the actual documents. We urge you to read the registration statement of which this prospectus supplement and the accompanying prospectus

are a part in its entirety, including all amendments, exhibits, schedules and supplements to that registration statement. In making an

investment decision, you must rely on your own examination of the Company and the terms of the offering and the securities, including

the merits and risks involved.

None of us, the Selling Shareholder, or the

Underwriters have authorized any dealer, salesperson or other person to give any information or to make any representation other than

those contained in or incorporated by reference into this prospectus supplement, the accompanying prospectus or any applicable free writing

prospectus. You must not rely upon any information or representation not contained in or incorporated by reference into this prospectus

supplement, the accompanying prospectus or any applicable free writing prospectus as if we had authorized it. This prospectus supplement,

the accompanying prospectus and any applicable free writing prospectus do not constitute an offer to sell or the solicitation of an offer

to buy any securities other than the registered securities to which they relate, nor does this prospectus supplement, the accompanying

prospectus or any applicable free writing prospectus constitute an offer to sell or the solicitation of an offer to buy securities in

any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. You should not assume that

the information contained in this prospectus supplement, the accompanying prospectus, the documents incorporated herein and therein by

reference and any applicable free writing prospectus is correct on any date after their respective dates, even though this prospectus

supplement, the accompanying prospectus or an applicable free writing prospectus is delivered or securities are sold on a later date.

Our business, financial condition, results of operations and cash flows may have changed since those dates.

We are not making any representation to any purchaser

of the Subordinate Voting Shares registered hereby regarding the legality of an investment in the Subordinate Voting Shares by such purchaser.

You should not consider any information in this prospectus supplement and the accompanying prospectus to be legal, business or tax advice,

and you should consult your own legal, business and tax advisors for advice regarding an investment in the Subordinate Voting Shares offered

hereby.

This prospectus supplement assumes that the

Selling Shareholder is selling (a) Subordinate Voting Shares that are issued to the Selling Shareholder by the Company

immediately prior to the closing of the offering upon the conversion by the Selling Shareholder of an equivalent number of Multiple

Voting Shares (including the conversion of Multiple Voting Shares that are acquired by the Selling Shareholder from OMI immediately

prior to closing) and (b) Subordinate Voting Shares that are acquired by the Selling Shareholder from its affiliates and

associates immediately prior to closing, which Subordinate Voting Shares are already currently deemed to be beneficially owned by

the Selling Shareholder or Mr. Gerald W. Schwartz. This Prospectus Supplement further assumes that, following the closing of

the offering, all of the outstanding Multiple Voting Shares will have been converted into Subordinate Voting Shares on a one-for-one

basis and that, immediately following closing of the offering, there will not be any Multiple Voting Shares outstanding. See “Selling

Shareholder.”

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

We caution you that

certain statements contained in this prospectus supplement and the accompanying prospectus (including in our documents incorporated

herein and therein by reference) are forward-looking statements within the meaning of Section 27A of the Securities Act and

Section 21E of the U.S. Securities Exchange Act of 1934, as amended (“Exchange Act”), and contain forward- looking

information within the meaning of Canadian securities laws. These forward-looking statements include statements that are predictive

in nature and depend upon or refer to future events or conditions, and include, but are not limited to, statements related to: the

completion of this offering and the execution of ancillary agreements made in connection with this offering; the intentions of Onex

Corporation (“Onex”) with respect to Celestica’s securities; the conversion of Multiple Voting Shares held by the

Selling Shareholder into Subordinate Voting Shares immediately prior to the closing of the offering; there not being any Multiple

Voting Shares issued and outstanding immediately following completion of the offering; the Company's intentions in respect of future annual general meetings of shareholders; the acquisition by the Selling Shareholder of Subordinate Voting Shares and Multiple

Voting Shares from OMI, its affiliates and associates prior the closing of the offering; as well as statements related to: our

priorities, intended areas of focus, targets, objectives and goals; trends in the electronics manufacturing services

(“EMS”) industry and our segments (and/or their constituent businesses), and their anticipated impact; the anticipated

impact of current market conditions on each of our segments (and/or their constituent businesses) and near-term expectations;

anticipated and potential restructuring and potential divestiture actions; our anticipated financial and/or operating results and

outlook; our expectations with respect to insurance recoveries for tangible losses in connection with the June 2022 fire at our

Batam facility in Indonesia; our strategies; our credit risk; the potential impact of acquisitions, or program wins, transfers,

losses or disengagements; materials, component and supply chain constraints; coronavirus disease 2019 (“COVID-19”)

resurgences or mutations; shipping delays; anticipated expenses, capital expenditures, other working capital requirements and

contractual obligations (and intended methods of funding our cash requirements); our intended repatriation of certain undistributed

earnings from foreign subsidiaries (and amounts we do not intend to repatriate in the foreseeable future); diversity and inclusion,

employee engagement, and other environmental, social and governance matters; the potential impact of international tax reform; the

potential impact of tax and litigation outcomes; our ability to use certain tax losses; intended investments in our business; the

potential impact of the pace of technological changes, customer outsourcing, program transfers, and the global economic environment;

the intended method of funding Subordinate Voting Share repurchases and our restructuring provision; the impact of our outstanding

indebtedness; liquidity and the sufficiency of our capital resources; our intention (when in our discretion) to settle outstanding

equity awards with Subordinate Voting Shares; our financial statement estimates and assumptions; recently-adopted accounting

pronouncements and amendments; the potential impact of price reductions and longer payment terms; our compliance with covenants

under our credit facility; refinancing debt at maturity; interest rates and expense; the potential adverse impacts of events outside

of our control; mandatory prepayments under our credit facility; pension plan funding requirements and obligations, and the impact

of annuity purchases; income tax incentives; accounts payable cash flow levels; accounts receivable sales; our cash generating units

with goodwill; our future warranty obligations; cybersecurity threats and incidents; our intentions with respect to environmental

assessments for newly-leased or acquired properties; our expectations with respect to expiring leases; the pay-for-performance

alignment of our executive compensation program; our intention to retain earnings for general corporate purposes; and costs in

connection with our pursuit of acquisitions and strategic transactions. Also, documents which we subsequently file with (or furnish

to) the SEC and are incorporated herein by reference will contain such forward-looking statements. Forward-looking statements may,

without limitation, be preceded by, followed by, or include words such as "believes," "expects,"

"anticipates," "estimates," "intends," "plans," "continues," "target,"

"goal," "project," "potential," "possible," "contemplate," "seek," or

similar expressions, or may employ such future or conditional verbs as "may," "might," "will,"

"could," "should" or "would," or may otherwise be indicated as forward- looking statements by

grammatical construction, phrasing or context. For forward-looking statements, we claim the protection of the safe harbor for

forward-looking statements contained in the U.S. Private Securities Litigation Reform Act of 1995 and applicable Canadian securities

laws. In addition, any statements concerning future financial performance, ongoing business strategies or prospects, and possible

future actions, which may be provided, are also forward-looking statements. Forward-looking statements are based on our current

expectations and projections about future events and involve risks and uncertainties that could cause our actual results to differ

materially from those expressed or implied by our forward-looking statements. These risks and uncertainties include, without

limitation, those described under “Risk Factors” in this prospectus supplement, and those detailed from time to

time in those reports filed or furnished with the SEC which are incorporated by reference herein, including, but not limited to,

those set forth in the section entitled “Risk Factors” in our Annual

Report on Form 20-F for the year ended December 31, 2022, and in those portions of any subsequent Reports on

Form 6-K furnished to the SEC that indicate such portions are to be deemed incorporated by reference into our registration

statements (and prospectuses that form a part thereof). In addition, other risks and uncertainties not presently known to us or that

we currently consider less significant could affect the accuracy of our forward-looking statements. Although we believe our

estimates and assumptions to be reasonable, such estimates and assumptions may prove to be inaccurate. Forward-looking statements

are also based on economic and market factors and the industry in which we do business, among other things. Forward-looking

statements are provided to assist readers in understanding management's current expectations and plans relating to the future.

Readers are cautioned that such information may not be appropriate for other purposes, and are not guarantees of future performance.

Forward- looking statements speak only as of the date the statements are made. Except as required by applicable law, we undertake no

obligation to update or revise forward-looking statements, whether as a result of new information, future events or otherwise. We

caution you not to unduly rely on the forward-looking statements when evaluating the information presented herein. All forward-

looking statements attributable to us are expressly qualified by these cautionary statements.

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights information contained elsewhere in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein. This summary does not contain all of the information you should consider before making a decision to invest in our Subordinate Voting Shares. You should read this entire prospectus supplement and the accompanying prospectus, including the documents incorporated by reference herein and therein, carefully before making an investment decision, especially the sections entitled “Risk Factors” herein and therein and our consolidated financial statements and notes to those consolidated financial statements incorporated by reference herein and therein.

Our Business

Celestica delivers innovative supply chain solutions globally to customers in two operating and reporting segments: Advanced Technology Solutions (“ATS”) and Connectivity & Cloud Solutions (“CCS”).

Celestica’s ATS segment consists of its ATS end market, and is comprised of its Aerospace & Defense (“A&D”), Industrial, HealthTech, and Capital Equipment businesses. Celestica’s Capital Equipment business is comprised of its semiconductor, display, and robotics equipment businesses. The CCS segment consists of Celestica’s Communications and Enterprise end markets. The Enterprise end market is comprised of Celestica’s servers and storage businesses. Celestica’s customers include original equipment manufacturers, cloud-based and other service providers, including hyperscalers, and other companies in a wide range of industries. The Company’s global headquarters is located in Toronto, Ontario, Canada. Celestica operates a network of sites and centers of excellence strategically located in North America, Europe and Asia, with specialized end-to-end supply chain capabilities tailored to meet specific market and customer product lifecycle requirements.

Celestica offers a comprehensive range of product manufacturing and related supply chain services to customers in both of its segments, including design and development, new product introduction, engineering services, component sourcing, electronics manufacturing and assembly, testing, complex mechanical assembly, systems integration, precision machining, order fulfillment, logistics, asset management, product licensing, and after-market repair and return services. The Company’s Hardware Platform Solutions offering, within the CCS segment, includes the development of infrastructure platforms, hardware and software design solutions and services that can be used as-is, or customized for specific applications in collaboration with Celestica’s customers, and management of program design and aspects of the supply chain, manufacturing, and after-market support.

Products and services in the ATS segment can include the following: government-certified and highly-specialized manufacturing, electronic and enclosure-related services for A&D customers; high-precision semiconductor and display equipment and integrated subsystems; a wide range of industrial automation, controls, test and measurement devices; engineering-focused engagements, including full product development in the areas of telematics, human machine interface, Internet-of-Things and embedded systems; advanced solutions for surgical instruments, diagnostic imaging and patient monitoring; and efficiency products to help manage and monitor the energy and power industries. Products and services in the CCS segment consist predominantly of enterprise-level data communications and information processing infrastructure products and systems, and can include routers, switches, data center interconnects, edge solutions, servers and storage-related products used by a wide range of businesses and cloud-based and other service providers to manage digital connectivity, commerce and social media applications.

Corporate Information

Celestica was incorporated in Ontario, Canada on September 27, 1996 and it operates under the Business Corporations Act (Ontario). Celestica’s principal executive offices are located at 5140 Yonge Street, Suite 1900, Toronto, Ontario, Canada M2N 6L7, telephone number is (416) 448-5800.

Prior to its incorporation, Celestica was an IBM manufacturing unit that provided manufacturing services to IBM for more than 75 years. In 1993, Celestica began providing electronics manufacturing services to non-IBM customers. In October 1996, Celestica was purchased from IBM by an investor group led by Onex Corporation (“Onex”), and in 1998, Celestica completed its initial public offering.

| The Offering |

|

| |

|

|

Selling Shareholder

Subordinate Voting Shares offered by the Selling Shareholder |

Onex Corporation

6,757,198 |

| |

|

| Subordinate Voting Shares outstanding prior to this offering |

112,520,339 as of July 28, 2023 |

| |

|

| Subordinate Voting Shares outstanding after this offering |

119,328,962. The number of Subordinate Voting Shares to be outstanding immediately after the completion of the offering is based on 112,520,339 Subordinate Voting Shares outstanding on July 28, 2023, assumes conversion of 6,808,623 of our outstanding Multiple Voting Shares into an equivalent number of Subordinate Voting Shares, and excludes the following potentially dilutive equity grants as of July 28, 2023: 393,472 Subordinate Voting Shares issuable upon the exercise of outstanding stock options, and 63,877 Subordinate Voting Shares issuable upon the vesting of outstanding restricted share units. |

| |

|

| Multiple Voting Shares outstanding after this offering |

0 |

| |

|

| Use of Proceeds |

We will not receive any of the proceeds from the sale of Subordinate Voting Shares by the Selling Shareholder in this offering. See the section captioned “Use of Proceeds” on page S-8. |

| |

|

| Dividend Policy |

We do not currently intend to pay cash dividends on our

Subordinate Voting Shares. |

| |

|

| NYSE and TSX trading symbol |

CLS |

| |

|

| Risk Factors |

Investing in our Subordinate Voting Shares involves a high degree of risk. See the section captioned “Risk Factors” on page S-3 for a discussion of certain risks you should consider before investing in our Subordinate Voting Shares. |

RISK FACTORS

Investing in our

Subordinate Voting Shares involves a high degree of risk. Before deciding whether to invest in our securities, you should carefully consider

the risks and uncertainties described below and in Item 3.D. ‒ Risk Factors of our most recent Annual Report on Form 20-F,

which risk factors are specifically incorporated by reference herein, and any updates to those Risk Factors in those portions of any of

our subsequent Reports on Form 6-K furnished to the SEC that indicate such portions are to be deemed incorporated by reference into

our registration statements (and prospectuses that form a part thereof), as well as all other information in this prospectus supplement

and the accompanying prospectus, including the financial statements and other documents summarized in or incorporated by reference into

this prospectus supplement and the accompanying prospectus and any free writing prospectus that we may authorize for use in connection

with this offering. There may be other unknown or unpredictable economic, business, competitive, regulatory or other factors that could

have material adverse effects on our future results. Past financial performance may not be a reliable indicator of future performance,

and historical trends should not be used to anticipate results or trends in future periods. Each of the risks described in these sections

and documents could materially and adversely affect our business, financial condition, results of operations and prospects. The trading

price of our Subordinate Voting Shares could decline due to any of these risks, and you may lose all or part of your investment. Please

also read carefully the section entitled “Cautionary Note Regarding Forward-Looking Statements.”

Please see “Where

You Can Find More Information” and “Incorporation of Certain Information by Reference” for information on

where you can find the documents we have filed with or furnished to the SEC and which documents are incorporated into this prospectus

supplement by reference.

Risks Related to Our Business

and Operations

Our business could be impacted

as a result of actions by activist shareholders or others.

We may be subject,

from time to time, to legal and business challenges in the operation of our company due to actions instituted by activist shareholders

or others. Responding to such actions could be costly and time-consuming, may not align with our business strategies and could divert

the attention of our Board of Directors and senior management from the pursuit of our business strategies. Perceived uncertainties as

to our future direction as a result of shareholder activism may lead to the perception of a change in the direction of the business or

other instability and may make it more difficult to attract and retain qualified personnel and business partners and may affect our relationships

with vendors, customers and other third parties.

Risks Related to the International

Nature of our Business

A U.S. government shutdown could

adversely impact our results of operations.

A U.S. government shutdown could result

in a U.S. credit rating downgrade, significant U.S. and global economic and financial market dislocations, interest rate and foreign exchange

rate impacts and other potential unforeseen consequences that could have a material adverse effect on our results of operations and financial

condition.

Risks Related to Our Subordinate

Voting Shares and this Offering

We cannot predict the impact that

the offer of the Subordinate Voting Shares may have on the market price of our Subordinate Voting Shares and the value of your investment

in our Company.

We cannot predict

the effect, if any, that sales of, or the availability for sale of, Subordinate Voting Shares by the Selling Shareholder pursuant to this

prospectus supplement and the accompanying prospectus will have on the market price of such securities prevailing from time to time. The

fact that substantial amounts of our Subordinate Voting Shares will enter the public market could adversely affect the prevailing market

price of our Subordinate Voting Shares and could impair our ability to fund acquisitions or to raise capital in the future through the

sales of our securities. This offering or other sales of substantial amounts of our Subordinate Voting Shares, or the perception that

such sales could occur, could adversely affect prevailing market prices for such stock.

Following the completion of the

offering, the Company will no longer be controlled by Onex and will become widely-held with the result that it may become more vulnerable

to take-over or tender offer.

Following closing of the offering, all

of the outstanding Multiple Voting Shares will have been converted into Subordinate Voting Shares on a one-for-one basis and Onex will

no longer be the Company’s controlling shareholder. As a result, the Company will lose the benefit of the stability afforded to

it by having a committed, long-term controlling shareholder. In addition, voting power will be spread out amongst a wide shareholder base

without a controlling shareholder and the inherent protection from an unsolicited take-over bid afforded by a dual class share structure

will no longer exist. Accordingly, the Company may become more vulnerable to a take-over bid or a tender offer.

We may lose our foreign private

issuer status.

We are a foreign

private issuer, and are therefore not required to comply with all of the periodic disclosure and current reporting requirements of the

Exchange Act applicable to U.S. domestic issuers. If more than 50% of our outstanding voting securities are directly or indirectly owned

of record by residents of the U.S., we would lose our foreign private issuer status. If we were to lose our foreign private issuer status,

we would be required to comply with the Exchange Act reporting and other requirements applicable to U.S. domestic issuers, which are more

detailed and extensive than the requirements for foreign private issuers. For example, we would be required to change our basis of accounting

from IFRS to U.S. GAAP, which could also result in potentially material changes to historical financial statements previously prepared

on the basis of IFRS. We would also have to comply with U.S. federal proxy requirements, our officers, directors, and more than 10% shareholders

will become subject to the short-swing profit disclosure and recovery provisions of Section 16 of the Exchange Act, and we would

lose our ability to rely upon exemptions from certain corporate governance rules of the NYSE.

The market price of our Subordinate

Voting Shares has been volatile and will fluctuate and you may not be able to sell your Subordinate Voting Shares at or above the price

at which you acquired your shares.

Volatility in our

business can result in significant Subordinate Voting Shares price and volume fluctuations. Factors such as changes in our financial estimates

or operating results, buy/sell recommendations by securities analysts, the timing of announcements by us or our competitors concerning

significant product developments, acquisitions or financial performance, other events affecting companies in the electronics industry,

currency fluctuations, general market fluctuations, macro-economic conditions, general stock market conditions, substantial sales of our

Subordinate Voting Shares and/or other external factors may cause the market price of our Subordinate Voting Shares to decline. In addition,

if our operating results do not meet the expectations of securities analysts or investors, the price of our Subordinate Voting Shares

could decline. Furthermore, the existence of our normal course issuer bid (“NCIB”) may cause our Subordinate Voting Shares

price to be higher than it would be in the absence of such a program, and repurchases under the NCIB expose us to risks resulting from

a reduction in the size of our "public float," which may reduce our trading volume as well as our Subordinate Voting Shares

price. You may be unable to sell your stock at or above your purchase price.

We do not anticipate paying cash

dividends on our Subordinate Voting Shares in the foreseeable future, so any short-term return on your investment will depend on the market

price of our Subordinate Voting Shares.

Any determination

to pay cash dividends in the future will be at the discretion of our Board of Directors and will depend on our financial condition, operating

results, capital requirements, general business conditions and other factors that our Board of Directors may deem relevant. As a result,

capital appreciation, if any, of our Subordinate Voting Shares will be the sole source of gain, if any, for the foreseeable future.

We have granted stock options

and restricted share units (“RSUs”) to certain employees and directors as compensation which may depress our Subordinate Voting

Shares price and result in dilution to our shareholders.

As

of July 28, 2023, 2023, we had the following potentially dilutive equity grants outstanding under our Long Term Incentive Plan

(“LTIP”): 393,472 outstanding stock options and 63,877 outstanding RSUs; each vested option or unit entitling the holder

thereof to receive one Subordinate Voting Share (or if pursuant to a permitted election, cash) pursuant to the terms thereof,

subject to certain time or performance-based vesting conditions. The LTIP permits the

grant of additional stock options, RSUs and performance share units (PSUs). Sales of a substantial number of shares of our

Subordinate Voting Shares in the public market by holders of exercised stock options, vested RSUs or vested PSUs may depress the

prevailing market price for our Subordinate Voting Shares and could impair our ability to raise capital through the future sale of

our equity securities. Additionally, if exercised stock options or vested share units are settled in Subordinate Voting Shares

issued by the Company (permitted under the LTIP), our Subordinate Voting Shares holders will incur dilution.

There can be no assurance that

we will continue to repurchase Subordinate Voting Shares for cancellation.

Although we currently

have an NCIB in effect, whether we repurchase Subordinate Voting Shares under such NCIB for cancellation, and the amount and timing of

any such repurchases, is subject to the restrictions under our credit facility, capital availability and periodic determinations by our

Board of Directors that Subordinate Voting Share repurchases are in the best interest of our shareholders and are in compliance with all

applicable laws and agreements. Any future permitted Subordinate Voting Share repurchases, including their timing and amount, may be affected

by, among other factors: our consolidated leverage ratio (as defined in our credit facility); our views on potential future capital requirements

for strategic transactions, including acquisitions; debt service requirements; our credit rating; changes to applicable tax laws or corporate

laws; and changes to our business model. In addition, the amount we spend and the number of Subordinate Voting Shares we are able to repurchase

for cancellation under any NCIB or substantial issuer bid may further be affected by a number of other factors, including the Subordinate

Voting Shares we arrange to be purchased by non-independent brokers to satisfy stock-based compensation awards, the price of our Subordinate

Voting Shares and blackout periods in which we are restricted from repurchasing Subordinate Voting Shares. Our Subordinate Voting Shares

repurchases may change from time to time, and even if permitted under our credit facility, we cannot provide assurance that we will continue

to repurchase Subordinate Voting Shares for cancellation in any particular amounts, or at all. A reduction in or elimination of our Subordinate

Voting Share repurchases could have a negative effect on the stock price of the Subordinate Voting Shares.

Future sales, or the perception

of future sales, of a substantial amount of Celestica’s Subordinate Voting Shares may depress the price of Celestica’s Subordinate

Voting Shares.

If Celestica’s

shareholders sell substantial amounts of Celestica’s Subordinate Voting Shares in the public market, or there is a perception in

the market that the holders of a large number of Subordinate Voting Shares intend to sell Subordinate Voting Shares, the market price

of Celestica’s Subordinate Voting Shares could decline. These sales, or the perception of such future sales, also might make it

more difficult for the Company to sell its equity or equity related securities in the future at a time and price that it deems appropriate.

Celestica may issue additional

securities in the future, including preferred shares.

Celestica’s

Restated Articles of Incorporation (“Articles”) provide that the Company may issue an unlimited number of Subordinate Voting

Shares, an unlimited number of Multiple Voting Shares and an unlimited number of preferred shares, issuable in one or more series, subject

to the rules of any stock exchange on which the Company’s securities may be listed from time to time; however, the issuance

of Multiple Voting Shares would require the affirmative vote of the holders of two-thirds of the Subordinate Voting Shares voting with

respect to the matter. If Celestica were to issue any additional Subordinate Voting Shares or preferred shares or such other classes of

authorized shares that are convertible or exchangeable for Subordinate Voting Shares, the percentage ownership of existing shareholders

may be reduced and diluted. The Company cannot foresee the terms and conditions of any future offerings of its securities nor the effect

of such offerings on the market price of Subordinate Voting Shares. Any issuance of a significant percentage of the Company’s securities,

or the perception that such issuances may occur, could have a material adverse effect on the market price of Subordinate Voting Shares

and limit the Company’s ability to fund its operations through capital raising transactions in the future. Celestica does not have

any present plans to issue any preferred shares. However, the Board of Directors of the Company has the authority to issue preferred shares

and determine the price, designation, rights (including voting and dividend rights), preferences, privileges, restrictions and conditions

of these shares and determine to whom they shall be issued.

CAPITALIZATION AND INDEBTEDNESS

The

following table sets forth our capitalization and indebtedness (other than intra-company indebtedness), determined in accordance

with IFRS, as of June 30, 2023. You should read this table in conjunction with our audited consolidated financial statements

and the related notes thereto for the year ended December 31, 2022 included in our Annual

Report on Form 20-F for the year ended December 31, 2022 and our unaudited interim condensed consolidated financial

statements for the three and six month periods ended June 30, 2023 included as Exhibit 99.2 to our Report on Form 6-K

furnished to the SEC on July 26, 2023 (“Interim Q2 2023 Financials”), each of which we incorporate by reference in

this prospectus supplement, as described in “Incorporation of Certain Information by Reference” below.

| | |

As at June 30, 2023 | |

| | |

(in millions) | |

| Cash and cash equivalents | |

$ | 360.7 | |

| Debt | |

| | |

| Lease Obligations*(1) | |

$ | 168.5 | |

| Obligations under Credit Facility* (2) | |

| 618.0 | |

| Total long-term debt | |

$ | 786.5 | |

| Shareholders’ equity | |

| | |

| Capital stock (3) | |

$ | 1,677.8 | |

| Treasury Stock | |

| (27.8 | ) |

| Contributed Surplus | |

| 1,041.8 | |

| Deficit | |

| (996.4 | ) |

| Accumulated other comprehensive loss | |

| (14.8 | ) |

| Total Shareholder’s Equity | |

$ | 1,680.6 | |

| Total Capitalization | |

$ | 2,467.1 | |

* secured by certain assets of the Company

|

(1) |

These lease obligations represent

the present value of unpaid lease payment obligations recognized as liabilities as of June 30, 2023, which have been discounted

using our incremental borrowing rate on the lease commencement dates. In addition to these lease obligations, we have commitments under

additional real property leases not recognized as liabilities as of June 30, 2023 because such leases had not yet commenced as of

such date. A description of these leases and minimum lease obligations thereunder are disclosed in note 24 to our audited consolidated

financial statements for the year ended December 31, 2022, included in our Annual Report on Form 20-F for the year ended December 31, 2022, which is incorporated herein by reference. |

| (2) | Our credit facility is comprised

of a term loan in the original principal amount of $350.0 million (“Initial Term Loan”), a term loan in the original

principal amount of $365.0 million (“Incremental Term Loan”), and a $600.0 million revolving credit facility

(“Revolver”). The Initial Term Loan matures on June 27, 2025. The Incremental Term Loan and the Revolver each

mature on March 28, 2025, unless either (i) the Initial Term Loan has been prepaid or refinanced or (ii) commitments

under the Revolver are available and have been reserved to repay the Initial Term Loan in full, in which case such obligations

mature on December 6, 2026. The amounts in the table represent aggregate remaining term loan amounts outstanding as of

June 30, 2023 (as of such date, other than ordinary course letters of credit described below, there were no amounts outstanding

under the Revolver). In addition, at June 30, 2023, we had $33.1 million outstanding in letters of credit and surety bonds,

including $17.3 million that were issued under our credit facility. |

| (3) |

Our authorized capital consists of an unlimited number of preference shares, issuable in series, without nominal or par value, an unlimited number of Subordinate Voting Shares, without nominal or par value (which entitle the holder to one vote per share), and an unlimited number of Multiple Voting Shares, without nominal or par value (which entitle the holder to 25 votes per share). At June 30, 2023, no preference shares, 112,520,339 Subordinate Voting Shares and 6,808,623 Multiple Voting Shares were issued and outstanding (all of which are fully paid). As of such date, we also had 393,472 outstanding stock options, 4,129,754 outstanding RSUs, 4,834,886 outstanding PSUs, representing 100% of the target amount granted (amounts that will vest range from 0% to 200% of the target amount granted), and 1,407,181 outstanding DSUs, each vested option or unit entitling the holder thereof to receive one Subordinate Voting Share (or in certain cases, cash) pursuant to the terms thereof (subject to certain time or performance-based vesting conditions). |

At July 28, 2023, no preference shares,

112,520,339 Subordinate Voting Shares and 6,808,623 Multiple Voting Shares were issued and outstanding (all of which are fully paid).

As of such date, we also had 393,472 outstanding stock options, 4,106,768 outstanding RSUs, 4,834,886 outstanding PSUs, representing 100%

of the target amount granted (amounts that will vest range from 0% to 200% of the target amount granted), and 1,407,181 outstanding DSUs,

each vested option or unit entitling the holder thereof to receive one Subordinate Voting Share (or in certain cases, cash) pursuant to

the terms thereof (subject to certain time or performance-based vesting conditions).

Effect of Conversion of Multiple

Voting Shares into Subordinate Voting Shares

Following the closing of the offering and the

related conversion of all outstanding Multiple Voting Shares into Subordinate Voting Shares on a one-for-one basis, the Company will have

only Subordinate Voting shares issued and outstanding, each of which will entitle the holder to one vote per share. Onex will also no

longer hold a majority of the voting interest in the Company and all of the Company’s shareholders will be entitled to a voting

interest that is proportionate to their equity ownership interest. The issuance of further Multiple Voting Shares would require the affirmative

vote of the holders of two-thirds of the Subordinate Voting Shares voting with respect to the matter. We have no current intention to

seek such a vote. At a future annual general meeting of shareholders, the Company expects to ask shareholders to vote on a resolution

to amend the Articles to (a) eliminate the Multiple Voting Shares as an authorized class of shares of the Company and (b) rename

the Subordinate Voting Shares as “common shares.”

The following table sets forth information with respect to

stock options outstanding as at July 28, 2023 (all of which were granted under our LTIP). The options are held by one executive officer

and one employee. No other stock options issued by Celestica are outstanding.

Outstanding Options

| Beneficial Holders |

|

Number of

Subordinate

Voting Shares

Under Option |

|

Exercise

Price |

|

Date/Year of

Issuance |

|

Date of Expiry |

| Employee |

|

94,518 |

|

$ |

10.58 |

|

November 5, 2021 |

|

November 5, 2031 |

| |

|

|

| Executive Officer |

|

298,954 |

|

C$ |

17.52 |

|

August 1, 2015 |

|

August 1, 2025 |

| |

|

|

|

|

|

|

|

|

|

|

Except as set forth

in the notes to our Interim Q2 2023 Financials (incorporated by reference herein as described below), there have been no subsequent events

between June 30, 2023 and the date of this document that would have a material impact on our authorized or issued share capital or

the total debt reported above.

DILUTION

Net tangible book

value dilution per share to new investors (“Per Share Dilution”) represents the difference between the amount per Subordinate

Voting Share paid by purchasers of such shares in this offering and the net tangible book value per share immediately after completion

of this offering. As of June 30, 2023, our unaudited net tangible book value was approximately $1,032 million, or approximately $8.65

per share. Net tangible book value per share represents the amount of our total tangible assets, excluding goodwill and other intangible

assets, less total liabilities, divided by the 112,520,339 Subordinate Voting Shares and 6,808,623 Multiple Voting Shares outstanding

as of June 30, 2023. Because the Subordinate Voting Shares to be sold in this offering are either already outstanding, or will be

converted on a one-for-one basis immediately prior to closing from already outstanding Multiple Voting Shares, and the Company will not

receive any proceeds from this offering, the net tangible book value per share would not change. However, if you invest in our Subordinate

Voting Shares, your interest will be diluted immediately to the extent of the difference between the public offering price per Subordinate

Voting Share and the net tangible book value per share after this offering.

USE OF PROCEEDS

We will not receive any proceeds from

the sale of Subordinate Voting Shares by the Selling Shareholder pursuant to this offering.

EXPENSES

The following is

a statement of the estimated expenses, other than any underwriting discounts and commissions, that we expect to incur in connection with

the issuance and distribution of the securities registered under this registration statement:

| Commission registration fee | |

$ |

15,162.80 | * |

| Printing expenses | |

| 23,000 | |

| Legal fees and expenses | |

| 325,000 | |

| Accountants’ fees and expenses | |

| 275,000 | |

| Transfer agent and registrar fees | |

| 10,000 | |

| Total | |

$ | 648,162.80 | |

* $663,273.84

has been paid to the Commission and may be used to pay for securities offered pursuant to this prospectus supplement. The payment of any

additional fees has been deferred in accordance with Rule 456(b) and 457(r) of the Securities Act.

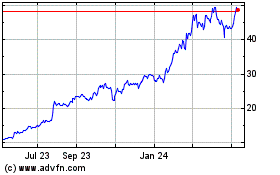

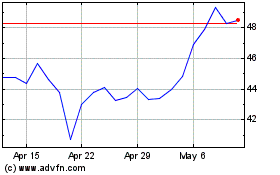

TRADING PRICE AND VOLUME

The outstanding

Multiple Voting Shares are not quoted or listed for trading on a marketplace. The outstanding Subordinate Voting Shares are listed on

the NYSE and the TSX, in each case under the symbol “CLS”.

The following table

sets forth, for the 12-month period prior to the date of this prospectus supplement, the reported high and low prices and the aggregate

volume of trading of the Subordinate Voting Shares on the NYSE:

| |

|

Price (US$) |

|

|

|

Trading |

|

| Period | |

High | | |

Low | | |

|

Volume | |

| 2022 | |

| | |

| | |

| |

| July | |

| 10.910 | | |

| 9.120 | | |

| 9,291,425 | |

| August | |

| 11.690 | | |

| 10.110 | | |

| 8,537,593 | |

| September | |

| 10.445 | | |

| 8.210 | | |

| 7,173,928 | |

| October | |

| 11.680 | | |

| 8.340 | | |

| 12,029,566 | |

| November | |

| 11.800 | | |

| 10.330 | | |

| 7,918,759 | |

| December | |

| 11.545 | | |

| 10.570 | | |

| 6,747,359 | |

| 2023 | |

| | | |

| | | |

| | |

| January | |

| 14.280 | | |

| 10.990 | | |

| 9,755,802 | |

| February | |

| 13.970 | | |

| 12.810 | | |

| 9,227,064 | |

| March | |

| 13.315 | | |

| 11.530 | | |

| 9,681,496 | |

| April | |

| 13.005 | | |

| 10.750 | | |

| 11,044,168 | |

| May | |

| 13.180 | | |

| 10.500 | | |

| 11,325,385 | |

| June | |

| 14.970 | | |

| 12.220 | | |

| 21,794,594 | |

| July | |

| 22.010 | | |

| 14.370 | | |

| 27,986,247 | |

Source: FactSet

The following table sets forth, for the

12-month period prior to the date of this prospectus supplement, the reported high and low prices and the aggregate volume of trading

of the Subordinate Voting Shares on the TSX:

| |

|

Price (C$) |

|

|

|

Trading |

|

| Period | |

High | | |

Low | | |

|

Volume | |

| 2022 | |

| | |

| | |

| |

| July | |

| 14.010 | | |

| 11.810 | | |

| 3,209,199 | |

| August | |

| 15.130 | | |

| 13.250 | | |

| 3,765,875 | |

| September | |

| 13.550 | | |

| 11.280 | | |

| 3,835,142 | |

| October | |

| 15.860 | | |

| 11.590 | | |

| 5,418,018 | |

| November | |

| 15.660 | | |

| 14.150 | | |

| 3,591,586 | |

| December | |

| 15.650 | | |

| 14.440 | | |

| 3,007,463 | |

| 2023 | |

| | | |

| | | |

| | |

| January | |

| 19.030 | | |

| 14.940 | | |

| 4,394,372 | |

| February | |

| 18.610 | | |

| 17.360 | | |

| 3,533,868 | |

| March | |

| 18.260 | | |

| 15.900 | | |

| 4,298,385 | |

| April | |

| 17.500 | | |

| 14.590 | | |

| 5,069,874 | |

| May | |

| 18.070 | | |

| 14,305 | | |

| 5,401.911 | |

| June | |

| 19.800 | | |

| 16.470 | | |

| 4,357,792 | |

| July | |

| 29.000 | | |

| 19.060 | | |

| 8,104,319 | |

Source: TSX MarketData

DIVIDEND POLICY

We do not anticipate paying cash dividends

on our Subordinate Voting Shares in the foreseeable future, so any short-term return on your investment will depend on the market price

of our Subordinate Voting Shares. Any determination to pay cash dividends in the future will be at the discretion of our Board of Directors

and will depend on our financial condition, operating results, capital requirements, general business conditions and other factors that

our Board of Directors may deem relevant. As a result, capital appreciation, if any, of our Subordinate Voting Shares will be the sole

source of gain, if any, for the foreseeable future.

SELLING SHAREHOLDER

We are registering

6,757,198 Subordinate Voting Shares for resale by the Selling Shareholder named below. The term “Selling Shareholder” also

includes any transferees, pledgees, donees, or other successors in interest to the Selling Shareholder named in the table below.

The Selling Shareholder will pay underwriting

discounts and commission in connection with the offering. The Company will pay approximately $650,000 of the expenses of this offering,

including all SEC registration fees.

The number of shares disclosed in the

table below as “beneficially owned” are those beneficially owned as determined under the rules of the SEC. Such information

is not necessarily indicative of ownership for any other purpose. Under the rules of the SEC, a person is deemed to be a “beneficial

owner” of a security if that person has or shares “voting power,” which includes the power to vote or to direct the

voting of such security, or “investment power,” which includes the power to dispose of or to direct the disposition of such

security. Beneficial ownership as of any date includes Subordinate Voting Shares as to which the Selling Shareholder has the right to

acquire within 60 days of such date. Although beneficial ownership of Subordinate Voting Shares under this definition includes the Multiple

Voting Shares on an as-converted basis (as Multiple Voting Shares are convertible into Subordinate Voting Shares at any time), beneficial

ownership of each class of security is shown separately in the table below. In addition, under these rules, more than one person may be

deemed a beneficial owner of the same securities. Except as indicated in the table below and accompanying footnotes, the Selling Shareholder

has sole voting and sole investment power with respect to all shares that they beneficially own.

For information about our relationship with

Onex, see “Controlling Shareholder Interest” in Item 4.B., and “Major Shareholders and Related Party

Transactions — Related Party Transactions” in Item 7 of our Annual

Report on Form 20-F for the year ended December 31, 2022, which is incorporated by reference herein. Following the

closing of the offering, all of the outstanding Multiple Voting Shares will have been converted into Subordinate Voting Shares on a

one-for-one basis. Although Onex is the Company’s controlling shareholder on the date hereof, immediately following the

completion of this offering, there will not be any Multiple Voting Shares outstanding, and Onex will no longer be the

Company’s controlling shareholder.

Percentages in the table below are based

on 112,520,339 Subordinate Voting Shares and 6,808,623 Multiple Voting Shares outstanding as of July 28, 2023.*

The following table, which was prepared

based on information filed publicly or supplied to us by the Selling Shareholder, sets forth: the number of Subordinate Voting Shares

and Multiple Voting Shares beneficially owned by the Selling Shareholder, the percentage of each class so owned, the percentage of all

equity shares of the Company so owned, and the percentage of voting power so held, both prior to and after the sale of the Subordinate

Voting Shares covered by this prospectus supplement and the accompanying prospectus, as well as the number of Subordinate Voting Shares

that such Selling Shareholder is offering under this prospectus supplement and the accompanying prospectus. Please read the footnotes

accompanying this table carefully.

| |

Shares Beneficially Owned Prior to the Offering |

Number of

Subordinate

Voting

Shares

Offered (1) |

Shares

Beneficially Owned After the Offering2 |

| |

Subordinate

Voting Shares |

Multiple Voting

Shares |

|

|

|

Subordinate

Voting Shares |

Multiple Voting

Shares |

|

|

Name of

Shareholder (3) |

Number |

% of

Class |

Number |

% of

Class |

% of All

Equity

Shares |

% of

Voting

Power |

|

Number |

% of

Class |

Number |

% of

Class |

% of

All

Equity

Shares |

% of

Voting

Power |

| Onex Corporation (4) |

147,826 |

0.1% |

6,808,623 |

100% |

5.8% |

60.3% |

6,757,198 |

0 |

-- |

0 |

-- |

-- |

-- |

| (1) | The Subordinate Voting Shares to be sold by the Selling Shareholder in this offering consist of (i) Subordinate

Voting Shares that are issued to the Selling Shareholder by the Company immediately prior to the closing of this offering upon the conversion

by the Selling Shareholder of an equivalent number of Multiple Voting Shares (including the conversion of Multiple Voting Shares that

are acquired by the Selling Shareholder from OMI immediately prior to such closing); and (ii) Subordinate Voting Shares that are

acquired by the Selling Shareholder from its affiliates and associates immediately prior to such closing, including 44,923 Subordinate

Voting Shares beneficially owned by Mr. Gerald Schwartz but not by Onex as of July 28, 2023. The Subordinate Voting Shares to be sold by the Selling Shareholder in the offering exclude: (i) 134,293 MIP Shares (as defined in footnote

(4) below); and (ii) 109,881 Subordinate Voting Shares that will no longer be beneficially owned or controlled by Onex immediately prior

to the closing of the offering, as described in footnote (4) below. |

| (2) | Immediately following completion of the offering and the conversion of the currently outstanding Multiple

Voting Shares into Subordinate Voting Shares on a one-for-one basis, there will be 119,328,962 Subordinate Voting Shares outstanding and

there will not be any Multiple Voting Shares outstanding. |

| (3) | Mr. Schwartz is the Chairman of the Board of Onex, and indirectly owns multiple voting shares of

Onex carrying the right to elect a majority of the Onex board of directors. Accordingly, under applicable securities laws, Mr. Schwartz

is deemed to be the beneficial owner of all Celestica shares beneficially owned by Onex. Mr. Schwartz has advised Celestica, however,

that he disclaims beneficial ownership of such shares. |

* On a fully-diluted basis, assuming all outstanding

securities issued by the Company are converted into or exercised, exchanged or redeemed for Subordinate Voting Shares (including the conversion

of all Multiple Voting Shares for an equivalent number of Subordinate Voting Shares), Onex would currently beneficially own 6,956,449

Subordinate Voting Shares, representing approximately 5.8% of the Subordinate Voting Shares. Upon completion of the offering Onex would

not beneficially own any Subordinate Voting Shares.

| (4) | Onex beneficially owns 5,863,613 Multiple Voting Shares directly, and 945,010 Multiple Voting Shares

through OMI, a wholly-owned subsidiary of Onex. Accordingly, under applicable securities laws, Onex is deemed to be the beneficial

owner of the Celestica shares beneficially owned by OMI (which is not a selling shareholder in the offering). Immediately prior to

closing, the 945,010 Multiple Voting Shares held through OMI will be acquired by Onex and be subsequently converted to an equivalent

number of Subordinate Voting Shares to be sold by the Selling Shareholder in the offering. Pursuant to the terms of certain Onex management investment

plans, Onex beneficially owns (but not directly) or controls 147,826 Subordinate Voting Shares (“MIP Shares”). 134,293

MIP Shares will not be sold in the offering, and will, pursuant to the terms of such Onex management investment plans, no longer be

beneficially owned or controlled by Onex following the completion of the offering. Immediately prior to the closing of the offering

and immediately following the conversion of the Multiple Voting Shares held by the Selling Shareholder into an equivalent number of

Subordinate Voting Shares, Onex will transfer beneficial ownership of 109,881 Subordinate Voting Shares to or for the benefit of a

former executive of Onex, in satisfaction of pre-existing commitments under such Onex management investment plans, and as such,

following the offering, those 109,881 Subordinate Voting Shares will no longer be beneficially owned or controlled by Onex. 814,546

of the Multiple Voting Shares beneficially owned by Onex are subject to options granted to certain officers of Onex pursuant to

certain Onex management investment plans, which options may be exercised upon specified dispositions by Onex (directly or

indirectly) of Celestica's securities, with respect to which Onex has the right to vote or direct the vote ("MIP

Options"), including 688,807 MIP Options granted to Mr. Schwartz. Each Multiple Voting Share will, upon exercise of such

MIP Options, be automatically converted into one Subordinate Voting Share. However, the MIP Options are synthetic options on the

corresponding number of Multiple Voting Shares held by Onex, so that if the grantee elected to exercise such MIP Options, Onex could

elect to settle the MIP Options with cash. |

Celestica’s Articles provide "coat-tail"

protection to the holders of the Subordinate Voting Shares by providing that the Multiple Voting Shares will be converted automatically

into Subordinate Voting Shares upon any transfer thereof, except (i) a transfer to Onex or any affiliate of Onex or (ii) a transfer

of 100% of the outstanding Multiple Voting Shares to a purchaser who also has offered to purchase all of the outstanding Subordinate Voting

Shares for a per share consideration identical to, and otherwise on the same terms as, that offered for the Multiple Voting Shares, and

the Multiple Voting Shares held by such purchaser thereafter shall be subject to the share provisions relating to conversion (including

with respect to the provisions described herein) as if all references to Onex were references to such purchaser. In addition, if (i) any

holder of any Multiple Voting Shares ceases to be an affiliate of Onex, or (ii) Onex and its affiliates, collectively, cease to have

the right, in all cases, to exercise the votes attached to, or to direct the voting of, any of the Multiple Voting Shares held by Onex

and its affiliates, such Multiple Voting Shares shall convert automatically into Subordinate Voting Shares on a one- for-one basis. For

these purposes, (i) Onex includes any successor corporation resulting from an amalgamation, merger, arrangement, sale of all or substantially

all of its assets, or other business combination or reorganization involving Onex, provided that such successor corporation beneficially

owns directly or indirectly all Multiple Voting Shares beneficially owned directly or indirectly by Onex immediately prior to such transaction

and is controlled by the same person or persons as controlled Onex prior to the consummation of such transaction; (ii) a corporation

shall be deemed to be a subsidiary of another corporation if, but only if, (a) it is controlled by that other, or that other and

one or more corporations each of which is controlled by that other, or two or more corporations each of which is controlled by that other,

or (b) it is a subsidiary of a corporation that is that other's subsidiary; (iii) "affiliate" means a subsidiary of

Onex or a corporation controlled by the same person or company that controls Onex; and (iv) "control" means beneficial

ownership of, or control or direction over, securities carrying more than 50% of the votes that may be cast to elect directors if those

votes, if cast, could elect more than 50% of the directors. For these purposes, a person is deemed to beneficially own any security which

is beneficially owned by a corporation controlled by such person. In addition, if at any time the number of outstanding Multiple Voting

Shares shall represent less than 5% of the aggregate number of the outstanding Multiple Voting Shares and Subordinate Voting Shares, all

of the outstanding Multiple Voting Shares shall be automatically converted at such time into Subordinate Voting Shares on a one-for-one

basis. Onex, which beneficially owns, controls or directs, directly or indirectly all of the outstanding Multiple Voting Shares, has entered

into an agreement with Celestica and Computershare Trust Company of Canada (as successor to the Montreal Trust Company of Canada), as

trustee for the benefit of the holders of the Subordinate Voting Shares, for the purpose of ensuring that the holders of Subordinate Voting

Shares will not be deprived of any rights under applicable take-over bid legislation to which they would be otherwise entitled in the

event of a take-over bid (as that term is defined in applicable securities legislation) if Multiple Voting Shares and Subordinate Voting

Shares were of a single class of shares. Subject to certain permitted forms of sale, such as identical or better offers to all holders

of Subordinate Voting Shares, Onex has agreed that it, and any of its affiliates that may hold Multiple Voting Shares from time to time,

will not sell any Multiple Voting Shares, directly or indirectly, pursuant to a take-over bid (as that term is defined under applicable

securities legislation) under circumstances in which any applicable securities legislation would have required the same offer or a follow-up

offer to be made to holders of Subordinate Voting Shares if the sale had been a sale of Subordinate Voting Shares rather than Multiple

Voting Shares, but otherwise on the same terms.

The address of Onex is: 161 Bay Street,

P.O. Box 700, Toronto, Ontario, Canada M5J 2S1.

UNDERWRITING

The Company, the Selling Shareholder

and the Underwriters named in the table below (collectively, the “Underwriters,” provided that to the extent there

is only a single underwriter named below, the term “Underwriters” shall be deemed to refer to such single underwriter) have

entered into an underwriting agreement with respect to the Subordinate Voting Shares being offered. Subject to certain conditions, the

Underwriters have agreed to purchase the number of Subordinate Voting Shares indicated in the following table.

| Underwriters |

Number

of Subordinate Voting Shares |

| BofA Securities, Inc. |

6,757,198 |

| Total |

6,757,198 |

The offering is

being made concurrently in the United States and in each of the provinces and territories of Canada. The Subordinate Voting Shares will

be offered in the United States through those Underwriters who are registered to offer the Subordinate Voting Shares for sale in the United

States, and such other registered dealers as may be designated by the Underwriters. The Subordinate Voting Shares will be offered in each

of the provinces and territories of Canada through those Underwriters or their Canadian affiliates who are registered to offer the Subordinate

Voting Shares for sale in such provinces and territories and such other registered dealers as may be designated by the Underwriters. Subject

to applicable law, the Underwriters, or such other registered dealers as may be designated by the Underwriters, may offer the Subordinate

Voting Shares outside of the United States and Canada.

The obligations

of the Underwriters under the underwriting agreement are subject to customary conditions, including the delivery of certain documents

and legal opinions and the condition that there shall not have occurred any of the following: (i) a suspension or material limitation

in trading in securities generally on the NYSE or on the TSX; (ii) a suspension or material limitation in trading in our securities

on the NYSE or on the TSX; (iii) a general moratorium on commercial banking activities in the United States or Canada declared by

the relevant authorities, or a material disruption in commercial banking or securities settlement or clearance services in the United

States or Canada; (iv) the outbreak or escalation of hostilities involving the United States or Canada or the declaration by the

United States or Canada of a national emergency or war; or (v) the occurrence of any other calamity or crisis or any change in financial,

political or economic conditions in the United States or Canada or elsewhere, if the effect of any such event specified in clause (iv) or

(v) in the Underwriters’ judgment such as to make it impracticable or inadvisable to proceed with our offering or the delivery

of our Subordinate Voting Shares. The Underwriters, however, are obligated to take and pay for all of the Subordinate Voting Shares being

offered.

The Company and

the Selling Shareholder have agreed to indemnify the Underwriters and their directors, officers and employees against certain liabilities,

including, without restriction, liabilities under the Securities Act and civil liabilities under Canadian securities legislation, and

to contribute to any payments the Underwriters may be required to make in respect thereof. The Company and the Selling Shareholder have

agreed to indemnify one another against liabilities with respect to certain information related solely to the respective party and furnished

in writing to the other for use in this prospectus supplement.

Pricing of the Offering

The Underwriters have

agreed to purchase the Subordinate Voting Shares from the Selling Shareholder at a price of $20.52 per share, which will result in $138,657,702.96

of proceeds to the Selling Shareholder before expenses. The Underwriters propose to offer the Subordinate Voting Shares from time to

time for sale in one or more transactions on the NYSE, in the over-the-counter market, through negotiated transactions or otherwise at

market prices prevailing at the time of sale, at prices related to prevailing market prices or at negotiated prices, and the compensation

realized by the Underwriters will be dependent on such selling prices.

The

offering of the Subordinate Voting Shares by the Underwriters is subject to receipt and acceptance and subject to the

Underwriters’ right to reject any order in whole or in part, and the right is reserved to close the subscription books at any

time without notice.

Fees

In consideration

for their services in connection with the offering, the Underwriters will receive the aggregate of the difference, if any, between the

price at which they purchase the Subordinate Voting Shares from the Selling Shareholder and the price at which the Underwriters sell such

Subordinate Voting Shares to the public pursuant to the offering. The fees and expenses of the offering, excluding underwriting discounts

and commissions, are estimated at approximately $1,150,000, approximately $650,000 of which are payable by the Company. The Company

has also agreed to reimburse the Underwriters for expenses relating to the clearance of this offering with the Financial Industry Regulatory

Authority up to $5,000.

Lock-Up Arrangements

The Company and

its officers and directors have agreed with the Underwriters, subject to certain exceptions, not to dispose of or hedge any of their Subordinate

Voting Shares or securities convertible into or exchangeable for Subordinate Voting Shares during the period from the date of the underwriting

agreement continuing through the date 45 days after the date of this prospectus supplement, except with the prior written consent of the

Underwriters. This agreement does not apply to any existing employee benefit plans or the conversion of Multiple Voting Shares into Subordinate

Voting Shares by the Selling Shareholder for sale in the offering. The Company’s officers and directors do not intend to subscribe

for Subordinate Voting Shares in this offering.

Settlement

The Subordinate Voting

Shares to be distributed to the public under the offering will be deposited on the closing date, which is expected to be on or about

August 4, 2023, under the book-based system of registration and registered in the name of The Depository Trust Company (“DTC”)

or its nominee or CDS Clearing and Depository Services Inc. (“CDS”) or its nominee. No certificates evidencing the Subordinate

Voting Shares will be issued to purchasers of the Subordinate Voting Shares. Purchasers of the Subordinate Voting Shares will receive

only a customer confirmation from the Underwriters or other registered dealer from or through whom a beneficial interest in the Subordinate

Voting Shares is purchased.

Price Stabilization, Short Positions and Passive Market

Making

In connection with

the offering, the Underwriters may, subject to applicable law, over allocate or effect transactions which stabilize or maintain the market

price of the Subordinate Voting Shares at levels other than those which otherwise might prevail on the open market, including: stabilizing