Carlisle Companies Incorporated (NYSE:CSL) reported earnings before

interest and income taxes (�EBIT�) from continuing operations of

$69.5 million for the quarter ended September 30, 2006, an increase

of 31% above EBIT of $52.9 million for the same period 2005.

Richmond McKinnish, Carlisle President and CEO, commented, �We

continue to see strength in many of our end markets for the

remainder of 2006 and into 2007. We are increasing our guidance for

income from continuing operations for the full year 2006 to the

range of $5.35 to $5.50 per diluted share from the previous range

of $5.25 to $5.45 per diluted share.� Income from continuing

operations, net of tax, of $43.4 million, or $1.39 per diluted

share, for the third quarter 2006, compared to $36.0 million, or

$1.17 per diluted share, for the third quarter 2005. Income from

continuing operations for the third quarter 2005 included a $3.0

million, or $0.10 per diluted share, benefit for the reduction in

income tax liabilities as a result of final settlement of certain

federal and state tax filings. Net sales of $648.4 million from

continuing operations in the third quarter 2006 were up $103.0

million, or an increase of 19%, as compared to net sales of $545.4

million for the same period 2005. Organic sales growth accounted

for $89.0 million, or 86%, of the improvement over the prior-year

quarter, primarily as a result of strong organic growth in the

Company�s construction materials, specialty trailer and wire and

cable businesses. The organic sales growth rate was 16.3% for the

third quarter 2006 as compared to an organic growth rate of 3.0%

for the third quarter 2005. Acquisitions in the Company�s braking

business accounted for $11.9 million, or 12%, of the growth over

the third quarter 2005, while changes in foreign currency exchange

rates contributed $2.1 million, or 2%. While Carlisle manages its

businesses under the three operating groups, Construction

Materials, Industrial Components and Diversified Components,

effective for the quarter ended September 30, 2006 and going

forward, Carlisle will present five financial reporting segments as

set forth below. The Construction Materials and Industrial

Components financial reporting segments remain unchanged. The

Diversified Components group will be represented by the Specialty

Products segment which contains the braking business, the

Transportation Products segment which contains the specialty

trailer business, and the General Industry segment (�All Other�

segment) which contains the wire and cable, foodservice and

refrigerated truck bodies businesses. Construction Materials: Net

sales of $311.8 million in the third quarter of 2006 were 33% above

$235.1 million of net sales in the third quarter of 2005 primarily

due to higher membrane and insulation volumes. Third quarter 2006

EBIT of $52.5 million was 23% above third quarter 2005 EBIT of

$42.6 million. EBIT margin for Construction Materials declined

slightly in the third quarter 2006 compared to a very strong third

quarter 2005 due to higher raw material costs and changes in sales

mix. Segment EBIT for each of the quarters ended September 30, 2006

and 2005 included earnings related to the Company�s equity share of

income at its European roofing joint venture, Icopal, of $4.2

million. Industrial Components: Net sales of $164.1 million for the

three months ended September 30, 2006 compared with net sales of

$164.5 million for the same period in 2005 as consumer demand in

the outdoor power equipment market remained soft. EBIT of $6.8

million in the third quarter of 2006 was 31% above EBIT of $5.2

million reported in the same quarter of 2005 on increased selling

prices and production efficiencies. Specialty Products: The

Company�s braking business recorded net sales of $44.8 million for

the three months ended September 30, 2006, an increase of 33% above

net sales of $33.7 million for the same period in 2005. The sales

increase was primarily due to two acquisitions for the braking

business in the last half of 2005. The acquisitions also

contributed to the increase in EBIT to $2.6 million in the third

quarter of 2006 compared to $1.2 million in the third quarter of

2005. Transportation Products: The Company�s specialty trailer

business continued to experience both sales and earnings growth

with strong sales in specialized, material hauling and construction

trailers. Net sales of $45.0 million in the third quarter of 2006

were 11% higher than net sales of $40.7 million for the same period

of 2005. EBIT in the third quarter of 2006 was $7.1 million

compared to $6.2 million in the third quarter of 2005, an increase

of 15%. General Industry: Net sales of $82.7 million in the third

quarter of 2006 were 16% above net sales of $71.4 million in the

third quarter of 2005 while EBIT in the third quarter of 2006 of

$7.7 million was 88% higher than EBIT of $4.1 million for the same

period of 2005. The wire and cable business, foodservice business

and refrigerated truck body business all experienced favorable

comparisons to the prior year. Discontinued Operations The losses

from discontinued operations, net of tax, in the third quarter of

2006 was $4.9 million, or $0.15 per diluted share, as compared to

losses from discontinued operations in the third quarter of 2005 of

$16.3 million, or $0.53 per diluted share. Net Income Net income

for the third quarter ended September 30, 2006 of $38.5 million, or

$1.24 per diluted share, was 96% higher than net income in the

third quarter ended September 30, 2005 of $19.7 million, or $0.64

per diluted share. The increase in net income for the third quarter

2006 was due primarily to the improved income from continuing

operations as well as the reduction in losses associated with the

discontinued operations. The increase in net income was achieved

despite a higher effective tax rate of 32.4% for the third quarter

2006 compared with an effective tax rate of 25.9% for the third

quarter 2005 reflecting the aforementioned settlement of certain

income tax liabilities. Cash Flow In August 2006, Carlisle issued

$150.0 million in ten-year notes at an interest rate of 6.125% in

anticipation of the Company�s 7.25% $150.0 million notes maturing

January 2007. The August 2006 note proceeds were utilized in the

interim period to reduce shorter-term borrowings and the Company�s

utilization of its receivable securitization facility. Cash used in

operating activities of $34.2 million for the nine months ended

September 30, 2006 includes a reduction in operating cash flow of

$137.9 million caused by the reduction in the utilization of the

securitization facility. Cash used in investing activities was

$69.6 million in 2006 compared to $89.8 million in 2005. Capital

expenditures of $72.9 million for the nine months ended September

30, 2006 compared with capital expenditures of $81.1 million for

the same period in 2005 with the Construction Materials segment

representing the majority of the expenditures for both periods.

Cash used for investing activities in 2005 included $28.3 million

to fund a brake business acquisition for the Specialty Products

segment. Cash provided by financing activities of $110.1 million in

2006 compared to cash provided by financing activities of $29.3

million in 2005. The year-over-year change in financing cash flow

is partially due to the aforementioned notes issued in August 2006.

The Company also used approximately $36.0 million in 2005 to

purchase 0.5 million shares of common stock. Backlog Backlog from

continuing operations at September 30, 2006 of $280.1 million

compared favorably with backlog of $269.9 million at June 30, 2006

and backlog of $250.2 million at September 30, 2005. Increased

backlog for the Company�s construction materials, braking,

specialty trailer, and wire and cable businesses contributed to the

year-over-year improvement. Conference Call and Webcast The Company

will discuss third quarter 2006 results on a conference call for

investors on Tuesday, October 24, 2006 at 2:00 p.m. Eastern. The

call may be accessed live at

http://www.carlisle.com/investors/conference_call.html, or the

taped call may be listened to shortly following the live call at

the same website location until November 7, 2006. A PowerPoint

presentation will also be available for viewing and/or printing at

the same website location. Forward-Looking Statements This news

release contains forward-looking statements within the meaning of

the Private Securities Litigation Reform Act of 1995. These

statements are based on management's current expectations and are

subject to uncertainty and changes in circumstances. Actual results

may differ materially from these expectations due to changes in

global economic, business, competitive, market and regulatory

factors. More detailed information about these factors is contained

in the Company's filings with the Securities and Exchange

Commission. The Company undertakes no duty to update

forward-looking statements. Carlisle is a diversified global

manufacturing company serving the construction materials,

commercial roofing, specialty tire and wheel, power transmission,

heavy-duty brake and friction, heavy-haul truck trailer,

foodservice, and data transmission industries. CARLISLE COMPANIES

INCORPORATED Financial Results For the periods ended September 30

(In millions, except per share data) (Unaudited) � Third Quarter

Nine Months 2006� 2005* % Change� � 2006� 2005* % Change� Net sales

$ 648.4� $ 545.4� 19% $ 1,961.0� $ 1,673.5� 17% � Income from

continuing operations, net of tax $ 43.4� $ 36.0� 20% $ 137.7� $

107.0� 29% � Income (loss) from discontinued operations, net of tax

� (4.9) � (16.3) NM� � (1.9) � (24.4) NM� Net income $ 38.5� $

19.7� 96% $ 135.8� $ 82.6� 64% � Basic earnings per share

Continuing operations $ 1.41� $ 1.18� 19% $ 4.50� $ 3.47� 30%

Discontinued operations � (0.15) � (0.54) NM� � (0.06) � (0.79) NM�

Net income $ 1.26� $ 0.64� 97% $ 4.44� $ 2.68� 66% � Diluted

earnings per share Continuing operations $ 1.39� $ 1.17� 19% $

4.43� $ 3.43� 29% Discontinued operations � (0.15) � (0.53) NM� �

(0.06) � (0.78) NM� Net income $ 1.24� $ 0.64� 94% $ 4.37� $ 2.65�

65% � SEGMENT FINANCIAL DATA (Continuing Operations) (In millions)

� Third Quarter 2006� 2005* Sales EBIT % Sales Sales EBIT % Sales

Construction Materials $ 311.8� $ 52.5� 16.8% $ 235.1� $ 42.6�

18.1% Industrial Components 164.1� 6.8� 4.1% 164.5� 5.2� 3.2%

Specialty Products 44.8� 2.6� 5.8% 33.7� 1.2� 3.6% Transportation

Products 45.0� 7.1� 15.8% 40.7� 6.2� 15.2% General Industry � 82.7�

� 7.7� 9.3% � 71.4� � 4.1� 5.7% Subtotal 648.4� 76.7� 11.8% 545.4�

59.3� 10.9% Corporate � -� � (7.2) � -� � (6.4) Total $ 648.4� $

69.5� 10.7% $ 545.4� $ 52.9� 9.7% � Nine Months 2006� 2005* Sales

EBIT % Sales Sales EBIT % Sales Construction Materials $ 832.6� $

131.4� 15.8% $ 634.6� $ 96.0� 15.1% Industrial Components 602.9�

51.9� 8.6% 595.7� 49.7� 8.3% Specialty Products 144.7� 13.0� 9.0%

110.1� 8.5� 7.7% Transportation Products 137.6� 23.6� 17.2% 117.4�

16.3� 13.9% General Industry � 243.2� � 21.0� 8.6% � 215.7� � 16.5�

7.6% Subtotal 1,961.0� 240.9� 12.3% 1,673.5� 187.0� 11.2% Corporate

� -� � (23.7) � -� � (21.5) Total $ 1,961.0� $ 217.2� 11.1% $

1,673.5� $ 165.5� 9.9% � * 2005 figures have been revised to

reflect discontinued operations and conform with the 2006 segment

presentation. NM = Not Meaningful CARLISLE COMPANIES INCORPORATED

Consolidated Statement of Earnings For the periods ended September

30 (In thousands except per share data) (Unaudited) Third Quarter

Nine Months 2006� 2005* % Change� � 2006� 2005* % Change� Net sales

$ 648,446� $ 545,389� 18.9% $ 1,960,990� $ 1,673,522� 17.2% Cost

and expenses: Cost of goods sold 519,102� 439,804� 18.0% 1,557,591�

1,336,850� 16.5% Selling and administrative expenses 59,559�

51,346� 16.0% 180,622� 161,357� 11.9% Research and development

expenses 3,726� 3,874� -3.8% 11,311� 11,607� -2.6% Other (income)

expense, net � (3,448) � (2,518) NM� � (5,708) � (1,753) NM� �

Earnings before interest & income taxes 69,507� 52,883� 31.4%

217,174� 165,461� 31.3% � Interest expense, net � 5,308� � 4,271�

24.3% � 14,927� � 12,309� 21.3% � Earnings before income taxes

64,199� 48,612� 32.1% 202,247� 153,152� 32.1% � Income taxes �

20,819� � 12,586� 65.4% � 64,590� � 46,156� 39.9% Income from

continuing operations, net of tax � 43,380� � 36,026� 20.4% �

137,657� � 106,996� 28.7% Percent of net sales 6.7% 6.6% 7.0% 6.4%

� Income (loss) from discontinued operations, net of tax � (4,832)

� (16,323) NM� � (1,887) � (24,359) NM� � Net income $ 38,548� $

19,703� 95.6% $ 135,770� $ 82,637� 64.3% � Basic earnings per share

Continuing operations $ 1.41� $ 1.18� 19.5% $ 4.50� $ 3.47� 29.7%

Discontinued operations � (0.15) � (0.54) NM� � (0.06) � (0.79) NM�

Basic earnings per share $ 1.26� $ 0.64� 96.9% $ 4.44� $ 2.68�

65.7% � Diluted earnings per share Continuing operations $ 1.39� $

1.17� 18.8% $ 4.43� $ 3.43� 29.2% Discontinued operations � (0.15)

� (0.53) NM� � (0.06) � (0.78) NM� Diluted earnings per share $

1.24� $ 0.64� 93.8% $ 4.37� $ 2.65� 64.9% � Average shares

outstanding (000's) - basic � 30,679� � 30,593� � 30,589� � 30,836�

Average shares outstanding (000's) - diluted � 31,101� � 30,895� �

31,087� � 31,193� � Dividends $ 8,319� $ 7,650� � $ 23,680� $

21,954� � Dividends per share $ 0.270� $ 0.250� 8.0% $ 0.770� $

0.710� 8.5% * 2005 figures have been revised to reflect

discontinued operations. NM = Not Meaningful CARLISLE COMPANIES

INCORPORATED Comparative Condensed Consolidated Balance Sheet (In

thousands) (Unaudited) September 30, December 31, 2006� 2005�

Assets Current Assets Cash and cash equivalents $ 44,717� $ 38,745�

Receivables 396,867� 162,959� Inventories 366,120� 334,711� Prepaid

expenses and other 64,161� 57,118� Current assets held for sale �

57,373� � 67,639� Total current assets � 929,238� � 661,172�

Property, plant and equipment, net 457,561� 431,996� Other assets

429,812� 423,644� Non-current assets held for sale � 44,467� �

46,445� $ 1,861,078� $ 1,563,257� � Liabilities and Shareholders'

Equity Current Liabilities Short-term debt, including current

maturities $ 177,699� $ 57,993� Accounts payable 157,571� 127,558�

Accrued expenses 148,706� 145,357� Current liabilities associated

with assets held for sale � 46,887� � 41,803� Total current

liabilities � 530,863� � 372,711� Long-term debt 275,261� 282,426�

Other liabilities 177,801� 176,911� Non-current liabilities

associated with assets held for sale 2,258� 970� Shareholders'

equity � 874,895� � 730,239� $ 1,861,078� $ 1,563,257� CARLISLE

COMPANIES INCORPORATED Comparative Condensed Consolidated Statement

of Cash Flows For the Nine Months Ended September 30 (In thousands)

(Unaudited) 2006� 2005* Operating activities Net income $ 135,770�

$ 82,637� Reconciliation of net earnings to cash flows:

Depreciation and amortization 43,699� 42,497� Non-cash compensation

5,478� 1,529� Excess tax benefits from share based compensation

(4,141) -� Gain on equity investments (1,957) (389) Foreign

exchange loss -� 1,634� Deferred taxes 2,197� 3,869� Loss on

investments, property and equipment, net 8,149� 30,815� Receivables

under securitization program (137,900) 2,900� Working capital

(84,354) (44,983) Other � (1,170) � (1,797) Net cash (used in)

provided by operating activities � (34,229) � 118,712� Investing

activities Capital expenditures (72,871) (81,130) Acquisitions, net

of cash (1,875) (28,339) Proceeds from investments, property and

equipment 3,993� 18,676� Other � 1,188� � 967� Net cash used in

investing activities � (69,565) � (89,826) Financing activities Net

change in short-term debt and revolving credit lines (30,681)

83,015� Proceeds from long-term debt 148,875� -� Reductions of

long-term debt (6,285) (1,762) Dividends (23,680) (21,954) Excess

tax benefits from share based compensation 4,141� -� Treasury

shares and stock options, net 13,279� (31,530) Other � 4,405� �

1,486� Net cash provided by financing activities � 110,054� �

29,255� Effect of exchange rate changes on cash � (288) � (528)

Change in cash and cash equivalents 5,972� 57,613� Cash and cash

equivalents Beginning of period � 38,745� � 25,018� End of period $

44,717� $ 82,631� � * 2005 figures have been revised to reflect

discontinued operations. Carlisle Companies Incorporated (NYSE:CSL)

reported earnings before interest and income taxes ("EBIT") from

continuing operations of $69.5 million for the quarter ended

September 30, 2006, an increase of 31% above EBIT of $52.9 million

for the same period 2005. Richmond McKinnish, Carlisle President

and CEO, commented, "We continue to see strength in many of our end

markets for the remainder of 2006 and into 2007. We are increasing

our guidance for income from continuing operations for the full

year 2006 to the range of $5.35 to $5.50 per diluted share from the

previous range of $5.25 to $5.45 per diluted share." Income from

continuing operations, net of tax, of $43.4 million, or $1.39 per

diluted share, for the third quarter 2006, compared to $36.0

million, or $1.17 per diluted share, for the third quarter 2005.

Income from continuing operations for the third quarter 2005

included a $3.0 million, or $0.10 per diluted share, benefit for

the reduction in income tax liabilities as a result of final

settlement of certain federal and state tax filings. Net sales of

$648.4 million from continuing operations in the third quarter 2006

were up $103.0 million, or an increase of 19%, as compared to net

sales of $545.4 million for the same period 2005. Organic sales

growth accounted for $89.0 million, or 86%, of the improvement over

the prior-year quarter, primarily as a result of strong organic

growth in the Company's construction materials, specialty trailer

and wire and cable businesses. The organic sales growth rate was

16.3% for the third quarter 2006 as compared to an organic growth

rate of 3.0% for the third quarter 2005. Acquisitions in the

Company's braking business accounted for $11.9 million, or 12%, of

the growth over the third quarter 2005, while changes in foreign

currency exchange rates contributed $2.1 million, or 2%. While

Carlisle manages its businesses under the three operating groups,

Construction Materials, Industrial Components and Diversified

Components, effective for the quarter ended September 30, 2006 and

going forward, Carlisle will present five financial reporting

segments as set forth below. The Construction Materials and

Industrial Components financial reporting segments remain

unchanged. The Diversified Components group will be represented by

the Specialty Products segment which contains the braking business,

the Transportation Products segment which contains the specialty

trailer business, and the General Industry segment ("All Other"

segment) which contains the wire and cable, foodservice and

refrigerated truck bodies businesses. Construction Materials: Net

sales of $311.8 million in the third quarter of 2006 were 33% above

$235.1 million of net sales in the third quarter of 2005 primarily

due to higher membrane and insulation volumes. Third quarter 2006

EBIT of $52.5 million was 23% above third quarter 2005 EBIT of

$42.6 million. EBIT margin for Construction Materials declined

slightly in the third quarter 2006 compared to a very strong third

quarter 2005 due to higher raw material costs and changes in sales

mix. Segment EBIT for each of the quarters ended September 30, 2006

and 2005 included earnings related to the Company's equity share of

income at its European roofing joint venture, Icopal, of $4.2

million. Industrial Components: Net sales of $164.1 million for the

three months ended September 30, 2006 compared with net sales of

$164.5 million for the same period in 2005 as consumer demand in

the outdoor power equipment market remained soft. EBIT of $6.8

million in the third quarter of 2006 was 31% above EBIT of $5.2

million reported in the same quarter of 2005 on increased selling

prices and production efficiencies. Specialty Products: The

Company's braking business recorded net sales of $44.8 million for

the three months ended September 30, 2006, an increase of 33% above

net sales of $33.7 million for the same period in 2005. The sales

increase was primarily due to two acquisitions for the braking

business in the last half of 2005. The acquisitions also

contributed to the increase in EBIT to $2.6 million in the third

quarter of 2006 compared to $1.2 million in the third quarter of

2005. Transportation Products: The Company's specialty trailer

business continued to experience both sales and earnings growth

with strong sales in specialized, material hauling and construction

trailers. Net sales of $45.0 million in the third quarter of 2006

were 11% higher than net sales of $40.7 million for the same period

of 2005. EBIT in the third quarter of 2006 was $7.1 million

compared to $6.2 million in the third quarter of 2005, an increase

of 15%. General Industry: Net sales of $82.7 million in the third

quarter of 2006 were 16% above net sales of $71.4 million in the

third quarter of 2005 while EBIT in the third quarter of 2006 of

$7.7 million was 88% higher than EBIT of $4.1 million for the same

period of 2005. The wire and cable business, foodservice business

and refrigerated truck body business all experienced favorable

comparisons to the prior year. Discontinued Operations The losses

from discontinued operations, net of tax, in the third quarter of

2006 was $4.9 million, or $0.15 per diluted share, as compared to

losses from discontinued operations in the third quarter of 2005 of

$16.3 million, or $0.53 per diluted share. Net Income Net income

for the third quarter ended September 30, 2006 of $38.5 million, or

$1.24 per diluted share, was 96% higher than net income in the

third quarter ended September 30, 2005 of $19.7 million, or $0.64

per diluted share. The increase in net income for the third quarter

2006 was due primarily to the improved income from continuing

operations as well as the reduction in losses associated with the

discontinued operations. The increase in net income was achieved

despite a higher effective tax rate of 32.4% for the third quarter

2006 compared with an effective tax rate of 25.9% for the third

quarter 2005 reflecting the aforementioned settlement of certain

income tax liabilities. Cash Flow In August 2006, Carlisle issued

$150.0 million in ten-year notes at an interest rate of 6.125% in

anticipation of the Company's 7.25% $150.0 million notes maturing

January 2007. The August 2006 note proceeds were utilized in the

interim period to reduce shorter-term borrowings and the Company's

utilization of its receivable securitization facility. Cash used in

operating activities of $34.2 million for the nine months ended

September 30, 2006 includes a reduction in operating cash flow of

$137.9 million caused by the reduction in the utilization of the

securitization facility. Cash used in investing activities was

$69.6 million in 2006 compared to $89.8 million in 2005. Capital

expenditures of $72.9 million for the nine months ended September

30, 2006 compared with capital expenditures of $81.1 million for

the same period in 2005 with the Construction Materials segment

representing the majority of the expenditures for both periods.

Cash used for investing activities in 2005 included $28.3 million

to fund a brake business acquisition for the Specialty Products

segment. Cash provided by financing activities of $110.1 million in

2006 compared to cash provided by financing activities of $29.3

million in 2005. The year-over-year change in financing cash flow

is partially due to the aforementioned notes issued in August 2006.

The Company also used approximately $36.0 million in 2005 to

purchase 0.5 million shares of common stock. Backlog Backlog from

continuing operations at September 30, 2006 of $280.1 million

compared favorably with backlog of $269.9 million at June 30, 2006

and backlog of $250.2 million at September 30, 2005. Increased

backlog for the Company's construction materials, braking,

specialty trailer, and wire and cable businesses contributed to the

year-over-year improvement. Conference Call and Webcast The Company

will discuss third quarter 2006 results on a conference call for

investors on Tuesday, October 24, 2006 at 2:00 p.m. Eastern. The

call may be accessed live at

http://www.carlisle.com/investors/conference_call.html, or the

taped call may be listened to shortly following the live call at

the same website location until November 7, 2006. A PowerPoint

presentation will also be available for viewing and/or printing at

the same website location. Forward-Looking Statements This news

release contains forward-looking statements within the meaning of

the Private Securities Litigation Reform Act of 1995. These

statements are based on management's current expectations and are

subject to uncertainty and changes in circumstances. Actual results

may differ materially from these expectations due to changes in

global economic, business, competitive, market and regulatory

factors. More detailed information about these factors is contained

in the Company's filings with the Securities and Exchange

Commission. The Company undertakes no duty to update

forward-looking statements. Carlisle is a diversified global

manufacturing company serving the construction materials,

commercial roofing, specialty tire and wheel, power transmission,

heavy-duty brake and friction, heavy-haul truck trailer,

foodservice, and data transmission industries. -0- *T CARLISLE

COMPANIES INCORPORATED Financial Results For the periods ended

September 30 (In millions, except per share data) (Unaudited) Third

Quarter Nine Months -------------------------

--------------------------- 2006 2005* % Change 2006 2005* % Change

------------------------- --------------------------- Net sales $

648.4 $545.4 19% $1,961.0 $1,673.5 17% Income from continuing

operations, net of tax $ 43.4 $ 36.0 20% $ 137.7 $ 107.0 29% Income

(loss) from discontinued operations, net of tax (4.9) (16.3) NM

(1.9) (24.4) NM ---------------- ------------------ Net income $

38.5 $ 19.7 96% $ 135.8 $ 82.6 64% ================

================== Basic earnings per share Continuing operations $

1.41 $ 1.18 19% $ 4.50 $ 3.47 30% Discontinued operations (0.15)

(0.54) NM (0.06) (0.79) NM ---------------- ------------------ Net

income $ 1.26 $ 0.64 97% $ 4.44 $ 2.68 66% ================

================== Diluted earnings per share Continuing operations

$ 1.39 $ 1.17 19% $ 4.43 $ 3.43 29% Discontinued operations (0.15)

(0.53) NM (0.06) (0.78) NM ---------------- ------------------ Net

income $ 1.24 $ 0.64 94% $ 4.37 $ 2.65 65% ================

================== SEGMENT FINANCIAL DATA (Continuing Operations)

(In millions) Third Quarter 2006 2005* -------------------------

--------------------------- Sales EBIT % Sales Sales EBIT % Sales

------------------------- --------------------------- Construction

Materials $ 311.8 $ 52.5 16.8% $ 235.1 $ 42.6 18.1% Industrial

Components 164.1 6.8 4.1% 164.5 5.2 3.2% Specialty Products 44.8

2.6 5.8% 33.7 1.2 3.6% Transportation Products 45.0 7.1 15.8% 40.7

6.2 15.2% General Industry 82.7 7.7 9.3% 71.4 4.1 5.7%

---------------- ------------------ Subtotal 648.4 76.7 11.8% 545.4

59.3 10.9% Corporate - (7.2) - (6.4) ----------------

------------------ Total $ 648.4 $ 69.5 10.7% $ 545.4 $ 52.9 9.7%

================ ================== Nine Months 2006 2005*

------------------------- --------------------------- Sales EBIT %

Sales Sales EBIT % Sales -------------------------

--------------------------- Construction Materials $ 832.6 $131.4

15.8% $ 634.6 $ 96.0 15.1% Industrial Components 602.9 51.9 8.6%

595.7 49.7 8.3% Specialty Products 144.7 13.0 9.0% 110.1 8.5 7.7%

Transportation Products 137.6 23.6 17.2% 117.4 16.3 13.9% General

Industry 243.2 21.0 8.6% 215.7 16.5 7.6% ----------------

------------------ Subtotal 1,961.0 240.9 12.3% 1,673.5 187.0 11.2%

Corporate - (23.7) - (21.5) ---------------- ------------------

Total $1,961.0 $217.2 11.1% $1,673.5 $ 165.5 9.9% ================

================== * 2005 figures have been revised to reflect

discontinued operations and conform with the 2006 segment

presentation. NM = Not Meaningful *T -0- *T CARLISLE COMPANIES

INCORPORATED Consolidated Statement of Earnings For the periods

ended September 30 (In thousands except per share data) (Unaudited)

Third Quarter ------------------------------- 2006 2005* % Change

------------------------------ Net sales $ 648,446 $ 545,389 18.9%

------------------------------ Cost and expenses: Cost of goods

sold 519,102 439,804 18.0% Selling and administrative expenses

59,559 51,346 16.0% Research and development expenses 3,726 3,874

-3.8% Other (income) expense, net (3,448) (2,518) NM

------------------------------ Earnings before interest &

income taxes 69,507 52,883 31.4% Interest expense, net 5,308 4,271

24.3% ------------------------------ Earnings before income taxes

64,199 48,612 32.1% Income taxes 20,819 12,586 65.4%

------------------------------ Income from continuing operations,

net of tax 43,380 36,026 20.4% ------------------------------

Percent of net sales 6.7% 6.6% Income (loss) from discontinued

operations, net of tax (4,832) (16,323) NM

------------------------------ Net income $ 38,548 $ 19,703 95.6%

============================== Basic earnings per share

--------------------------------------- Continuing operations $

1.41 $ 1.18 19.5% Discontinued operations (0.15) (0.54) NM

------------------------------ Basic earnings per share $ 1.26 $

0.64 96.9% ============================== Diluted earnings per

share --------------------------------------- Continuing operations

$ 1.39 $ 1.17 18.8% Discontinued operations (0.15) (0.53) NM

------------------------------ Diluted earnings per share $ 1.24 $

0.64 93.8% ============================== Average shares

outstanding (000's) - basic 30,679 30,593 ---------------------

Average shares outstanding (000's) - diluted 31,101 30,895

--------------------- Dividends $ 8,319 $ 7,650

------------------------------ Dividends per share $ 0.270 $ 0.250

8.0% ------------------------------ Nine Months

------------------------------- 2006 2005* % Change

------------------------------- Net sales $1,960,990 $1,673,522

17.2% ------------------------------- Cost and expenses: Cost of

goods sold 1,557,591 1,336,850 16.5% Selling and administrative

expenses 180,622 161,357 11.9% Research and development expenses

11,311 11,607 -2.6% Other (income) expense, net (5,708) (1,753) NM

------------------------------- Earnings before interest &

income taxes 217,174 165,461 31.3% Interest expense, net 14,927

12,309 21.3% ------------------------------- Earnings before income

taxes 202,247 153,152 32.1% Income taxes 64,590 46,156 39.9%

------------------------------- Income from continuing operations,

net of tax 137,657 106,996 28.7% -------------------------------

Percent of net sales 7.0% 6.4% Income (loss) from discontinued

operations, net of tax (1,887) (24,359) NM

------------------------------- Net income $ 135,770 $ 82,637 64.3%

=============================== Basic earnings per share

------------------------------------- Continuing operations $ 4.50

$ 3.47 29.7% Discontinued operations (0.06) (0.79) NM

------------------------------- Basic earnings per share $ 4.44 $

2.68 65.7% =============================== Diluted earnings per

share ------------------------------------- Continuing operations $

4.43 $ 3.43 29.2% Discontinued operations (0.06) (0.78) NM

------------------------------- Diluted earnings per share $ 4.37 $

2.65 64.9% =============================== Average shares

outstanding (000's) - basic 30,589 30,836 ----------------------

Average shares outstanding (000's) - diluted 31,087 31,193

---------------------- Dividends $ 23,680 $ 21,954

------------------------------- Dividends per share $ 0.770 $ 0.710

8.5% ------------------------------- * 2005 figures have been

revised to reflect discontinued operations. NM = Not Meaningful *T

-0- *T CARLISLE COMPANIES INCORPORATED Comparative Condensed

Consolidated Balance Sheet (In thousands) (Unaudited) September 30,

December 31, 2006 2005 ------------------------------ Assets

Current Assets Cash and cash equivalents $ 44,717 $ 38,745

Receivables 396,867 162,959 Inventories 366,120 334,711 Prepaid

expenses and other 64,161 57,118 Current assets held for sale

57,373 67,639 ------------------------------ Total current assets

929,238 661,172 ------------------------------ Property, plant and

equipment, net 457,561 431,996 Other assets 429,812 423,644

Non-current assets held for sale 44,467 46,445

------------------------------ $ 1,861,078 $ 1,563,257

============================== Liabilities and Shareholders' Equity

Current Liabilities Short-term debt, including current maturities $

177,699 $ 57,993 Accounts payable 157,571 127,558 Accrued expenses

148,706 145,357 Current liabilities associated with assets held for

sale 46,887 41,803 ------------------------------ Total current

liabilities 530,863 372,711 ------------------------------

Long-term debt 275,261 282,426 Other liabilities 177,801 176,911

Non-current liabilities associated with assets held for sale 2,258

970 Shareholders' equity 874,895 730,239

------------------------------ $ 1,861,078 $ 1,563,257

============================== *T -0- *T CARLISLE COMPANIES

INCORPORATED Comparative Condensed Consolidated Statement of Cash

Flows For the Nine Months Ended September 30 (In thousands)

(Unaudited) 2006 2005* -------------------- Operating activities

Net income $ 135,770 $ 82,637 Reconciliation of net earnings to

cash flows: Depreciation and amortization 43,699 42,497 Non-cash

compensation 5,478 1,529 Excess tax benefits from share based

compensation (4,141) - Gain on equity investments (1,957) (389)

Foreign exchange loss - 1,634 Deferred taxes 2,197 3,869 Loss on

investments, property and equipment, net 8,149 30,815 Receivables

under securitization program (137,900) 2,900 Working capital

(84,354) (44,983) Other (1,170) (1,797) -------------------- Net

cash (used in) provided by operating activities (34,229) 118,712

-------------------- Investing activities Capital expenditures

(72,871) (81,130) Acquisitions, net of cash (1,875) (28,339)

Proceeds from investments, property and equipment 3,993 18,676

Other 1,188 967 -------------------- Net cash used in investing

activities (69,565) (89,826) -------------------- Financing

activities Net change in short-term debt and revolving credit lines

(30,681) 83,015 Proceeds from long-term debt 148,875 - Reductions

of long-term debt (6,285) (1,762) Dividends (23,680) (21,954)

Excess tax benefits from share based compensation 4,141 - Treasury

shares and stock options, net 13,279 (31,530) Other 4,405 1,486

-------------------- Net cash provided by financing activities

110,054 29,255 -------------------- Effect of exchange rate changes

on cash (288) (528) -------------------- Change in cash and cash

equivalents 5,972 57,613 Cash and cash equivalents Beginning of

period 38,745 25,018 -------------------- End of period $ 44,717 $

82,631 -------------------- * 2005 figures have been revised to

reflect discontinued operations. *T

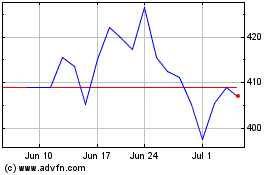

Carlisle Companies (NYSE:CSL)

Historical Stock Chart

From May 2024 to Jun 2024

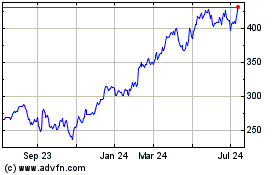

Carlisle Companies (NYSE:CSL)

Historical Stock Chart

From Jun 2023 to Jun 2024