CALGARY, ALBERTA (NYSE: CNQ) Vice-Chairman, John Langille,

stated, "2008 will be a year of execution. Canadian Natural has

always taken the approach that focusing on economic returns is more

important than growth at any cost. 2008 is likely reflective of

this more than any other year in our history. On the natural gas

side of the business, we are faced with eroded economics due to low

commodity prices and a new royalty regime in Alberta that reduces

the returns on certain types of drilling. Canadian Natural

continues to high-grade our projects to ensure that the maximum

value to shareholders will be achieved in 2008. As expected, this

reduction in capital will result in a decrease in natural gas

production throughout 2008 due to normal production declines not

being offset by new resource production. The new royalty regime

introduced by the Province of Alberta effective for 2009 will take

the vast majority of any increases in natural gas prices for most

of our natural gas wells. As such, the ability to increase natural

gas drilling activity with increasing gas prices is severely

impacted."

Steve Laut, President & Chief Operating Officer, further

commented "Crude oil prices remain robust although muted by the

strong Canadian dollar. The disparity between low natural gas

prices and high crude oil prices affords us the opportunity at

Primrose to optimize the economics of production of mature

wellbores by steaming and producing these reserves now. As a

result, the Company is capturing reserves which may not otherwise

be economic under our long term price assumptions. New pad drilling

will be reduced in 2008 as will new production volumes. In 2009,

Primrose East will provide significant in-situ production growth

and new pad development will again occur in existing Primrose

Fields.

In addition to these initiatives, we are currently developing

four major projects with targeted productive capacity of between

176,000 and 180,000 barrels per day. As such, 2008 becomes a year

of emphasis on execution and optimization. The largest of these

projects is, of course, the Horizon Project Phase 1, which is

targeted for first oil in Q3 2008.

We are pleased to provide further clarity on our execution

strategy to expand the Horizon Project for Phase 2/3 to targeted

production levels between 232,000 to 250,000 barrels per day of SCO

by 2013. We believe we can have better control over execution and

costs by avoiding the mega-project mindset. Hence we have

reconfigured the expansion into four distinct tranches that

optimize our available human and financial resources and which help

to ensure a more controllable, effective execution. The first

tranche of this revised Phase 2/3 plan will be largely complete in

2007 through the completion of construction of certain

infrastructure on the Horizon site, the purchase of certain long

lead items, and front end engineering and design. During 2008, the

second tranche of Phases 2/3 of the Horizon Project is targeted to

remove redundancies in the Mining and Ore Preparation Area, and

debottlenecking the existing plant - resulting in increased

productive capacity of the facility between 6,000 and 15,000 SCO

bbl/d by 2010. Tranche 3 of Phases 2/3 of the Horizon Project is

targeted for approval in late 2008 and Tranche 4 in 2010. We now

have a better defined path forward and will continue execution on

this very economic project.

We are convinced that Canadian Natural has the people, the

assets and the resolve to continue to deliver superior returns to

our shareholders on our conventional crude oil and natural gas

assets, as well as on the Horizon Project over the longer

term."

HIGHLIGHTS OF THE 2008 BUDGET

- Crude oil and NGLs production target of 316,000 to 366,000

bbl/d before royalties, representing a midpoint increase of 3% from

the midpoint of 2007 annual guidance. The increase reflects the

commencement of operations at the Horizon Project, but is partially

offset by the long term production optimization cycle at Primrose,

polymer conversion at Pelican Lake, and reduced activity in the

North Sea.

- Natural gas production target of 1,429 to 1,513 mmcf/d before

royalties, representing a midpoint decrease of 12% from the

midpoint of 2007 annual guidance. The decrease reflects lower

activity levels due to reduced economics, relative to crude oil,

and the resulting lower drilling activity in Alberta largely due to

the anticipated changes from the Alberta Royalty Review.

- Equivalent production target of 554,000 to 618,000 boe/d

before royalties, representing a midpoint decrease of 4% from the

midpoint of 2007 annual guidance. Entry to exit production is

targeted to increase 6% in 2008.

- Cash flow from operations estimate of $4.6 billion to $5.1

billion ($8.50 - $9.40 per common share) based upon a forecast

average West Texas Intermediate crude oil price of US$73.00/bbl, a

Lloyd Blend heavy oil differential of 30%, a NYMEX natural gas

price of US$7.00/mmbtu and an exchange rate of C$1.00 =

US$1.00.

- Canadian conventional crude oil and natural gas capital

expenditures of $1.7 billion in 2008, representing a 33% reduction

in capital spending from 2007 levels. Of the reduction in capital

spending, 78% ($645 million) is due to a reduced drilling program

in Alberta largely as a result of the impact of the Royalty Review

changes.

- International conventional crude oil and natural gas capital

expenditures are budgeted to be $689 million.

- Construction capital expenditures on the Horizon Oil Sands

Project are budgeted at $600 to $1,020 million for completion of

Phase 1.

- The Company is moving forward with Phase 2/3 of the Horizon

Project with a four-tranche development plan increasing targeted

capacity to 232,000 to 250,000 Synthetic Crude Oil ("SCO") bbl/d of

by 2013. Tranche 2 of the Phase 2/3 expansion expenditures are

budgeted at $439 million in 2008. Tranche 1 of Phase 2/3 expansion

will be largely completed in 2007.

- Continued strong balance sheet management with targeted debt

to book capitalization at the end of 2008 of approximately 43% and

debt to EBITDA of 1.9x.

- The 2008 program is highlighted by the ongoing development of

four major development projects that will create value for 2009 and

in the Future:

Estimated

Reserves Target

Proved Reclassified 2008 Production

Reserves(1) by 2008 CAPEX Capacity

(mmbbl) (mmbbl) ($ millions) (bbl/d)

----------------------------------------------------------------------------

Conventional crude

oil and natural gas

Baobab 65 14(2) $ 150 6,000-10,000

Olowi 15 5(2) $ 235 20,000

Primrose East 174 50(2) $ 245 40,000

Oil Sands mining

Horizon - Phase 1

(SCO reserves) 1,596 1,596(3) $600-1,020 110,000

----------------------------------------------------------------------------

176,000-180,000

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) Net reserves, after royalties, Dec. 31, 2006 Evaluation.

(2) Company estimates - reserves reclassification from Proved Undeveloped to

Proved Producing.

(3) Company estimates - reserves reclassification from development stage to

production stage.

Production and Financial Guidance

Canadian Natural continues its strategy of maintaining a large

portfolio of varied projects, which enables the Company to provide

consistent growth in production and high shareholder returns over

an extended period of time. Annual budgets are developed,

scrutinized throughout the year and changed if necessary in the

context of project returns, product pricing expectations, and

balance in project risks and time horizons. Canadian Natural

maintains a high ownership level and operatorship level in all of

its properties and can therefore control the nature, timing and

extent of expenditures in each of its project areas.

The budgeted capital expenditures in 2007 and 2008 are as follows:

($ millions) 2007 Forecast 2008 Budget

----------------------------------------------------------------------------

Conventional crude oil and natural gas

----------------------------------------------------------------------------

North America natural gas $ 991 $ 617

North America crude oil and NGLs 1,533 1,075

North Sea 474 231

Offshore West Africa 159 458

Property acquisitions, dispositions and

midstream (16) 390

----------------------------------------------------------------------------

$ 3,141 $ 2,771

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Horizon Oil Sands Project

----------------------------------------------------------------------------

Phase 1 - Construction $ 2,741 $ 600 - 1,020

Phase 1 - Operating inventory and

capital inventory - 109

Phase 1 - Commissioning costs - 184

Phase 2/3 - Tranche 1 133 -

Phase 2/3 - Tranche 2 - 439

Sustaining capital - 19

Capitalized interest and other costs 451 379

----------------------------------------------------------------------------

3,325 1,730 - 2,150

----------------------------------------------------------------------------

$ 6,466 $ 4,501 - 4,921

----------------------------------------------------------------------------

----------------------------------------------------------------------------

The above capital expenditure budget incorporates the following levels of

drilling activity:

Drilling activity (number of net wells) 2007 Forecast 2008 Budget

----------------------------------------------------------------------------

Targeting natural gas 456 314

Targeting crude oil 615 537

Stratigraphic test / service wells 257 36

----------------------------------------------------------------------------

Total 1,328 887

----------------------------------------------------------------------------

----------------------------------------------------------------------------

North American Natural Gas

The North American 2008 targeted natural gas program will result in a

decreased drilling program in Alberta and increased drilling outside

Alberta.

Natural gas -(number of net wells) 2007 Forecast 2008 Budget Change

----------------------------------------------------------------------------

Alberta 346 195 -44%

British Columbia and Saskatchewan 110 119 +8%

----------------------------------------------------------------------------

Total 456 314 -31%

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Type of well

Coal Bed Methane and Shallow 156 161 +3%

Conventional 233 104 -55%

Cardium 23 14 -39%

Deep 39 32 -18%

Foothills 5 3 -40%

----------------------------------------------------------------------------

Total 456 314 -31%

----------------------------------------------------------------------------

----------------------------------------------------------------------------

- Natural gas drilling in Alberta is targeted to be reduced by

44% due to the anticipated future impact of royalty changes

effective 2009. In Alberta 36% of the wells targeted to be drilled

will be low rate shallow natural gas and coal bed methane wells.

The Company's activities outside Alberta are targeted to increase

8% due mainly to a large development program in the Hatton region

of Saskatchewan.

- The shift in natural gas spending between categories and

provinces reflects both changing economics due to commodity price

forecasts and the anticipated implementation of the new Royalty

Regime within the Province of Alberta, effective 2009. The new

Alberta royalty regime dramatically reduces drilling economics of

certain play types at current and higher price forecasts in future

years by extending the project payout period due to a front end

loaded royalty structure. As such, further cuts in both

conventional and high productive rate deep natural gas wells are

expected in future years as they would not benefit from first year

production under the current regime in Alberta.

- Our guidance range for North American natural gas production

is 1,405 - 1,485 mmcf/d before royalties, a decrease of 12% from

the midpoint of 2007 guidance.

North American Conventional Crude Oil and NGLs

The North American 2008 crude oil and NGLs drilling program consists of:

Crude oil - (number of net wells) 2007 Forecast 2008 Budget Change

----------------------------------------------------------------------------

Alberta 500 388 -22%

British Columbia / Saskatchewan /

Manitoba 106 138 +30%

----------------------------------------------------------------------------

Total 606 526 -13%

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Type of well

Conventional heavy 356 311 -13%

Thermal heavy 58 32 -45%

Light 65 78 +20%

Pelican Lake 127 105 -17%

----------------------------------------------------------------------------

Total 606 526 -13%

----------------------------------------------------------------------------

----------------------------------------------------------------------------

- At Primrose, the Company has chosen to concentrate the 2008

thermal drilling program on the new Primrose East Expansion project

and defer drilling at the existing Primrose North and South

projects until 2009. As a result, production from the existing

operations at Primrose will rely on relatively mature wells. As

part of the cyclic steam process, steam oil ratios ("SORs") climb

and well productivity declines as a well matures. The Company is

taking advantage of the opportunity of the robust economics of

steaming mature wells in the current commodity price environment of

low natural gas prices and high crude oil prices.

- As expected thermal production is targeted to peak in late

2007/early 2008 as the Primrose North wells commence their

production phase. Production will then decline throughout the

remainder of 2008, resulting in higher SORs and higher

corresponding operating costs. Drilling will resume at Primrose

North, Primrose South and Wolf Lake in 2009 as Canadian Natural

will continue to develop the excellent Clearwater, Grand Rapids and

McMurray reservoirs on these leases.

- At Pelican Lake, Canadian Natural is targeted to significantly

expand the polymer flood as a result of the success the Company has

had in 2007. Results have met or exceeded expectation, which

provides the confidence to apply this process to large regions of

the pool. This will involve converting many producers to polymer

injection wells, which will require a "reservoir fill-up" period of

12 to 18 months prior to seeing a positive crude oil production

response from the process. The result is that 2008 targeted

production at Pelican Lake will be essentially flat while awaiting

response from these conversions.

- The guidance range for North American conventional crude oil

and NGLs production is 221,000 - 245,000 bbl/d before

royalties.

International

2007 Forecast 2008 Budget Change

Crude oil -(number of net wells)

----------------------------------------------------------------------------

UK North Sea 5 4 -20%

Offshore West Africa 4 7 +75%

----------------------------------------------------------------------------

Total 9 11 +22%

----------------------------------------------------------------------------

----------------------------------------------------------------------------

North Sea

- Canadian Natural anticipates drilling approximately 4 net

platform wells while continuing its successful workover and

recompletion program.

- As a result of reduced activity and major turnarounds, the

2008 guidance range for North Sea crude oil production is 44,000 to

54,000 bbl/d, representing an expected decrease of 12% from

midpoint 2007 guidance.

Offshore West Africa

- Canadian Natural anticipates spending approximately $150

million in 2008 on the development of the Baobab Field in Cote

d'Ivoire, Offshore West Africa, re-completing the wells that

experienced sanding issues. The Company is targeting to have 2

wells back on production by the end of 2008.

- The Company is budgeted to spend approximately $235 million

completing the Olowi project, in Gabon, Offshore West Africa,

targeting first crude oil in Q4/08. The peak production is targeted

to be 20,000 bbl/d, net to Canadian Natural.

- The 2008 guidance range for Offshore West Africa crude oil

production is 24,000 to 32,000 bbl/d before royalties. This

represents approximately 20% increase in entry to exit

production.

Horizon Oil Sands Project

- The Horizon Project is targeting first crude oil for Q3/08.

Phase 1 construction capital is targeted to range from $600 million

to $1,020 million in 2008, representing a cost to completion

forecast range of 8% to 14% over the original $6.8 billion

estimate.

- The Company has decided to implement a plan for Phases 2/3

involving a four-tranche approach to develop targeted capacity of

232,000 to 250,000 SCO bbl/d by 2013. The development plan for the

Phase 2/3 expansion is characterized by smaller incremental

projects. The execution strategy takes project control to the next

step where Canadian Natural will complete the detailed engineering

and design work, procure equipment, and award well defined,

complete construction work packages. This strategy will take more

time to complete but will ensure greater cost control and will

provide intermediate production gains.

- This execution strategy plan for Phase 2/3 gives Canadian

Natural better project control over execution and costs and allows

for greater capital flexibility. The incremental approach also

ensures the availability of the people and project teams to

complete the expansion while maximizing the learnings from Phase 1.

It will maintain the balance sheet strength of Canadian Natural and

the ability to respond accordingly to commodity price fluctuations.

This will minimize distraction for effective Phase 1 start-up and

optimization and allow the Company to maximize its learnings from

Phase 1. The Company will not be creating a mega project, allowing

access to a greater depth of contractors.

-- Tranche 1 was largely completed in 2006/07, which involved

front-end loading, building coker foundations and the pipe racks

for Phase 2/3, and ordering certain long-lead vessels, which are

targeted to arrive in Q1/08.

-- Tranche 2 will involve procuring additional mining equipment,

constructing a third ore preparation plant, constructing additional

gas recovery and sulphur trains, and debottlenecking the existing

plant. The capital cost over the next three years is estimated to

be $1.1 billion and will provide increased plant capacity and

targeted production gains of between 6,000 and 15,000 SCO

bbl/d.

-- Tranche 3 will involve additional mining equipment and

construction of extraction trains, coker expansions, and CO2

recovery units. This tranche will result in lower operating costs,

improved "uptime" and reliability, and targeted production

increases of 10,000 to 20,000 SCO bbl/d.

-- Tranche 4 will involve construction of two additional ore

preparation plants, additional froth treatment and extraction

facilities, support facilities, a diluent recovery unit, a vacuum

recovery unit, and further hydrotreating units. This will take the

targeted production to 232,000 to 250,000 SCO bbl/d, lower

operating costs, and improve "uptime" and reliability.

- The 2008 guidance range for the Horizon Project production is

27,000 to 35,000 SCO bbl/d.

Financial Review

- Canadian Natural is committed to maintaining its strong

financial position, allowing the Company to withstand volatile

crude oil and natural gas commodity prices and the operational

risks inherent in the crude oil and natural gas business

environment. The Company continues to build the necessary financial

capacity to complete the numerous projects under development in the

Company.

- Based upon the previously referenced price deck, capital

expenditure and production levels, Canadian Natural expects to exit

2008 with debt to book capitalization of approximately 43% and with

a debt to EBITDA of 1.9x.

- Canadian Natural expects to exit 2008 with new targeted

production capacities of 176,000 to 180,000 bbl/d from four major

projects. This significant increase in cash flow / net income

generation capacity is targeted to strengthen the Company's balance

sheet metrics to 35% to 39% debt to book capitalization and 1.3x to

1.5x debt to EBITDA by December 2009.

- In 2009, all business segments are expected to be generating

significant free cash flow available for Canadian Natural's capital

allocation process.

Guidance

Detailed guidance on revised production levels, capital

allocation and operating costs can be found on the Company's

website at

http://www.cnrl.com/investor_info/corporate_guidance/.

Forward-Looking Statements

Certain statements in this document or documents incorporated

herein by reference for Canadian Natural Resources Limited (the

"Company") constitute "forward-looking statements" within the

meaning of the United States Private Securities Litigation Reform

Act of 1995. These forward-looking statements can generally be

identified as such because of the context of the statements

including words such as the Company "believes", "anticipates",

"expects", "plans", "estimates", "targets", or words of a similar

nature.

The forward-looking statements are based on current expectations

and are subject to known and unknown risks, uncertainties and other

factors that may cause the actual results, performance or

achievements of the Company, or industry results, to be materially

different from any future results, performance or achievements

expressed or implied by such forward-looking statements. Such

factors include, among others: general economic and business

conditions which will, among other things, impact demand for and

market prices of the Company's products; foreign currency exchange

rates; economic conditions in the countries and regions in which

the Company conducts business; political uncertainty, including

actions of or against terrorists, insurgent groups or other

conflict including conflict between states; industry capacity;

ability of the Company to implement its business strategy,

including exploration and development activities; impact of

competition; availability and cost of seismic, drilling and other

equipment; ability of the Company to complete its capital programs;

ability of the Company to transport its products to market;

potential delays or changes in plans with respect to exploration or

development projects or capital expenditures; ability of the

Company to attract the necessary labour required to build its

projects; operating hazards and other difficulties inherent in the

exploration for and production and sale of crude oil and natural

gas; availability and cost of financing; success of exploration and

development activities; timing and success of integrating the

business and operations of acquired companies; production levels;

uncertainty of reserve estimates; actions by governmental

authorities; government regulations and the expenditures required

to comply with them (especially safety and environmental laws and

regulations); asset retirement obligations; and other circumstances

affecting revenues and expenses. Our domestic operations are

subject to governmental risks that may impact our operations. Our

domestic operations have been, and at times in the future may be

affected by political developments and by federal, provincial and

local laws and regulations such as restrictions on production,

changes in taxes, royalties and other amounts payable to

governments or governmental agencies, price or gathering rate

controls and environmental protection regulations. The impact of

any one factor on a particular forward-looking statement is not

determinable with certainty as such factors are interdependent upon

other factors, and the Company's course of action would depend upon

its assessment of the future considering all information then

available.

Statements relating to "reserves" are deemed to be

forward-looking statements as they involve the implied assessment

based on certain estimates and assumptions that the reserves

described can be profitably produced in the future.

Readers are cautioned that the foregoing list of important

factors is not exhaustive. Although the Company believes that the

expectations conveyed by the forward-looking statements are

reasonable based on information available to it on the date such

forward-looking statements are made, no assurances can be given as

to future results, levels of activity and achievements. All

subsequent forward-looking statements, whether written or oral,

attributable to the Company or persons acting on its behalf are

expressly qualified in their entirety by these cautionary

statements. Except as required by law, the Company assumes no

obligation to update forward-looking statements should

circumstances or Management's estimates or opinions change.

Investor Open House 2007 - Webcast

The members of Canadian Natural's Management team will be

presenting a detailed discussion regarding our 2008 Budget at

Canadian Natural's Investor Open House 2007 commencing at 8:30 a.m.

Mountain Time (10:30 a.m. Eastern Time) this discussion can be

accessed at www.cnrl.com/investor_info/calendar.html

The full day's presentations on Tuesday, November 27, 2007 will

be available on the Company's website at

www.cnrl.com/investor_info/calendar.html beginning at 8:30 a.m.

Mountain Time (10:30 a.m. Eastern Time). An audio re-broadcast of

the highlights will be available on Wednesday, November 29,

2007.

The webcast is also being distributed over PrecisionIR's

Investor Distribution Network to both institutional and individual

investors. Investors can listen to the call through www.vcall.com

or by visiting any of the investor sites in PrecisionIR's

Individual Investor Network.

Contacts: Canadian Natural Resources Limited Allan P. Markin

Chairman (403) 514-7777 (403) 514-7888 (FAX) Canadian Natural

Resources Limited John G. Langille Vice-Chairman (403) 514-7777

(403) 514-7888 (FAX) Canadian Natural Resources Limited Steve W.

Laut President and Chief Operating Officer (403) 514-7777 (403)

514-7888 (FAX) Canadian Natural Resources Limited Douglas A. Proll

Chief Financial Officer and Senior Vice-President, Finance (403)

514-7777 (403) 514-7888 (FAX) Canadian Natural Resources Limited

Corey B. Bieber Vice-President, Finance & Investor Relations

(403) 514-7777 (403) 514-7888 (FAX) Canadian Natural Resources

Limited 2500, 855 - 2nd Street S.W. Calgary, Alberta T2P 4J8 Email:

ir@cnrl.com Website: www.cnrl.com

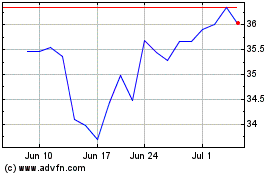

Canadian Natural Resources (NYSE:CNQ)

Historical Stock Chart

From May 2024 to Jun 2024

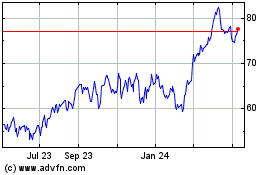

Canadian Natural Resources (NYSE:CNQ)

Historical Stock Chart

From Jun 2023 to Jun 2024