UPDATE: Home Loan Servicing Closes Down 3% Post-IPO

February 29 2012 - 5:49PM

Dow Jones News

Shares of Home Loan Servicing Solutions Ltd. (HLSS), a company

created by an Ocwen Financial Corp. (OCN) executive to buy up

certain mortgage-related rights and liabilities from Ocwen,

declined 3.1% on their first day of trading Wednesday.

The company's shares closed at $13.56 on the Nasdaq, down from

their initial public offering price of $14. It sold 13.3 million

shares at the low end of its expected price range of $14 to

$16.

Headquartered in the Cayman Islands, Home Loan Servicing was

created to acquire mortgage-servicing rights and other income from

servicing mortgage loans. By just acquiring the rights, the company

will not originate or purchase mortgage loans; in fact, it won't

even actually service the loans. It plans to hire Ocwen to do

that.

Prior to its IPO, Home Loan Servicing was owned entirely by

William C. Erbey, the chairman of Ocwen Financial; the 13.3 million

shares sold in the deal represented 95% of the float, so he owns

about 5% post-IPO.

The money raised in the IPO will be used to purchase the right

to receive servicing and other fees from Ocwen Loan Servicing LLC,

a subsidiary of Ocwen Financial, on a portion of its pooling and

servicing agreements. Its executives were in senior management

roles at Ocwen Financial up until the IPO, when they -- with the

exception of Erbey -- resigned from Ocwen to join Home Loan

Servicing. The company plans to eventually purchase "substantially

all" the remaining mortgage-servicing rights currently owned by

Ocwen Loan Servicing.

That fits in with Erbey's strategy of making Ocwen into a more

"equity-light" fee-for-service business. The chairman of the two

companies laid out Home Loan Servicing's role in lightening Ocwen's

load in an Ocwen earnings release last week.

"In the near-term, [Home Loan Servicing] should provide us

additional capital for growth, without dilution to existing

shareholders, and make Ocwen more competitive on transactions. Over

time, we would hope to move most of Ocwen's mortgage servicing

rights and advances to [Home Loan]. The impact of this should be

higher returns on equity than we could achieve by keeping the

assets on Ocwen's balance sheet," Erbey said in an earnings release

last week.

However, in acquiring those mortgage servicing rights, Home Loan

is also shouldering the cost of associated servicing cash advances

to cover delinquent principal, taxes and interest on home loans.

Such advances provide liquidity to mortgage-backed securitizations;

they're not meant to provide credit to mortgage lenders or

homeowners.

Servicing advances are usually reimbursed from payments that are

eventually made by a homeowner or through the liquidation of the

property. But anything that lengthens the foreclosure process

increases the amount of servicing advances that must be made, and

increases the time it takes to get reimbursed.

Foreclosures timelines have generally been increasing over the

last two years due to an uptick in the number of delinquent loans,

and regulators could further increase the timeline, based on

inquiries into the whether banks have complied with foreclosure

laws. Home Loan Servicing warns that any increase in foreclosure

timelines would increase interest expense, and reduce the cash

available to pay operating expenses or to pay dividends.

A downgrade in Ocwen Loan Servicing's servicer rating could also

hurt business, Home Loan Servicing warns. In December, Fitch

downgraded Ocwen Loan Servicing's servicer ratings from RPS2 to

RPS3 and RSS2 to RSS3 and kept it on negative rating watch.

Ocwen's stock closed Wednesday at $16.11, down 2 cents.

Home Loan says its business plan will result in predictable

revenue and expenses, generating a stable income stream. It plans

to distribute at least 90% of its net income to its shareholders

via dividends. On Jan. 30, Home Loan's board declared a contingent

interim dividend of 10 cents a share per month for each of the

three full months following the IPO. On an annualized basis of

$1.20, that results in a yield of 8.6% at the IPO price.

The company's strategy is complicated by the transfer of legal

ownership of mortgage-servicing rights from the seller, which

requires the prior approval or consent of various third parties,

including rating agencies. That's the case with its initial deal

with Ocwen Loan Servicing, which doesn't have the necessary

approvals and consents as of the IPO closing. Home Loan Servicing

says that shouldn't affect its business strategy or performance. If

a seller hasn't obtained the necessary approvals and consents, the

company instead plans to acquire the rights to receive the

servicing fees that the current servicer receives, as it has done

with Ocwen's first batch.

As compensation for its servicing work after Home Loan buys the

rights, Ocwen Loan Servicing will receive a monthly base fee

initially equal to 12% of servicing fees collected each month, with

the opportunity to earn a monthly performance-based incentive

fee.

The mortgage-servicing assets that the new company will purchase

are a portion of the assets acquired by Ocwen Loan Servicing when

it purchased the U.S. subprime mortgage-servicing business of HomEq

Servicing in September 2010. The estimated price for the initial

purchase is $181 million. The company says it obtained an opinion

from the Mortgage Industry Advisory Corporation, an independent

valuation firm, of the fairness of the purchase price.

One of the risks Home Loan cites in its prospectus is its status

as a new company. It has no track record of performance to show

investors. It warns that its business model is untested and its

operations don't begin until after the IPO and the initial

acquisition from Ocwen. The closing date of that initial

acquisition isn't specified in the company's prospectus.

Wells Fargo & Co. (WFC), Barclays PLC's (BCS) Barclays

Capital, Citigroup Inc. (C) and Deutsche Bank AG (DB) managed Home

Loan Servicing's offering.

-By Lynn Cowan, Dow Jones Newswires; 301-270-0323;

lynn.cowan@dowjones.com

(Al Yoon contributed to this article.)

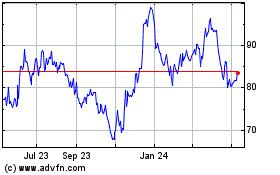

Brunswick (NYSE:BC)

Historical Stock Chart

From Jun 2024 to Jul 2024

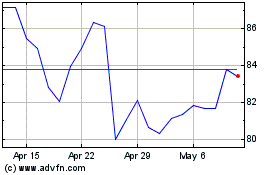

Brunswick (NYSE:BC)

Historical Stock Chart

From Jul 2023 to Jul 2024