Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

May 17 2021 - 5:17PM

Edgar (US Regulatory)

Filed Pursuant to Rule 433 under the Securities Act of 1933

Free Writing Prospectus

dated May 17, 2021

Relating to Preliminary Prospectus Supplement dated May 17, 2021

Registration Nos. 333-232256, 333-232256-01, 333-232256-02,

333-232256-03, 333-232256-04, 333-232256-05 and 333-232256-06

US$250,000,000 5.000% Subordinated Notes due 2081 (the “Notes”)

May 17, 2021

The information in this pricing

term sheet relates to Brookfield Infrastructure Finance ULC’s offering of the Notes and should be read together with the preliminary prospectus supplement dated May 17, 2021 relating to the offering (the “Preliminary Prospectus

Supplement”), including the documents incorporated by reference therein, and the base prospectus dated May 17, 2021, filed pursuant to Rule 424(b) under the Securities Act of 1933, as amended. The information in this communication supersedes

the information in the Preliminary Prospectus Supplement and the accompanying base prospectus to the extent inconsistent with the information in the Preliminary Prospectus Supplement and the accompanying base prospectus. Terms used herein but not

defined herein shall have the meanings as set forth in the Preliminary Prospectus Supplement. All references to dollar amounts are references to U.S. dollars.

|

|

|

|

|

Issuer:

|

|

Brookfield Infrastructure Finance ULC (the “Issuer”)

|

|

|

|

|

Guarantors:

|

|

Brookfield Infrastructure Partners L.P. (the “Partnership”)

Brookfield Infrastructure L.P.

BIP Bermuda Holdings I Limited

Brookfield Infrastructure Holdings (Canada) Inc.

Brookfield

Infrastructure US Holdings I Corporation

BIPC Holdings Inc.

|

|

|

|

|

Security:

|

|

US$250,000,000 5.000% Subordinated Notes due 2081

|

|

|

|

|

Ranking:

|

|

Subordinated unsecured

|

|

|

|

|

Principal Amount of Notes:

|

|

US$250,000,000

|

|

|

|

|

Denominations:

|

|

US$25 and integral multiples of US$25 in excess thereof

|

|

|

|

|

Maturity:

|

|

May 24, 2081

|

|

|

|

|

Coupon:

|

|

5.000%

|

|

|

|

|

Regular Record Dates for Interest:

|

|

March 16, June 15, September 15 and December 16, whether or not such day is a business day

|

|

|

|

|

Interest Payment Dates:

|

|

March 31, June 30, September 30 and December 31, commencing on September 30, 2021

|

|

|

|

|

Day Count Convention:

|

|

30/360

|

|

|

|

|

|

Optional Interest Deferral:

|

|

So long as no event of default has occurred and is continuing, the Issuer may elect, at its sole option, at any date other than an Interest Payment Date, to defer the interest payable on the Notes on one or more occasions for up to

five consecutive years. There is no limit on the number of Deferral Periods that may occur. Any such deferral will not constitute an event of default or any other breach under the Indenture and the Notes. Deferred interest will accrue until paid. A

Deferral Period terminates on any Interest Payment Date where the Issuer pays all accrued and unpaid interest on such date. No Deferral Period may extend beyond the Maturity Date.

|

|

|

|

|

First Call Date:

|

|

May 24, 2026

|

|

|

|

|

Optional Redemption on or after May 24, 2026:

|

|

On or after May 24, 2026, the Issuer may, at its option, on giving not more than 60 nor less than 15 days’ notice to the holders of the Notes, redeem the Notes, in whole at any time or in part from time to time. The redemption

price will be 100% of the principal amount of the Notes being redeemed, together with accrued and unpaid interest to, but excluding, the date fixed for redemption. Notes that are redeemed shall be cancelled and shall not be reissued.

|

|

|

|

|

Optional Redemption Upon a Ratings Event:

|

|

At any time following the occurrence of a Rating Event, the Issuer may, at its option, redeem the Notes (in whole but not in part) at a redemption price equal to 102% of the principal amount thereof, together with accrued and unpaid

interest to, but excluding, the date fixed for redemption.

|

|

|

|

|

Optional Redemption Upon a Change in Tax Law:

|

|

At any time, after the occurrence of a Tax Event, subject to applicable laws, the Issuer may, at its option, redeem the Notes (in whole but not in part) at a redemption price equal to 100% of the principal amount thereof, together

with accrued and unpaid interest to, but excluding, the relevant redemption date.

|

|

|

|

|

Pricing Date:

|

|

May 17, 2021

|

|

|

|

|

Expected Settlement Date:

|

|

May 24, 2021 (T+5)

|

|

|

|

|

Price to Public:

|

|

100%

|

|

|

|

|

Underwriting Discounts and Commissions1:

|

|

US$0.7875 per Note for retail investors (US$4,600,165.50 in the aggregate)

US$0.5000 per Note for institutional investors (US$1,179,260.00 in the aggregate)

|

|

|

|

|

Net Proceeds (before

expenses) to the

Issuer:

|

|

US$244,220,574.50

|

|

|

|

|

Listing:

|

|

The Issuer will apply to list the Notes on the New York Stock Exchange under the symbol “BIPH”

|

|

1

|

One or more of the underwriters will sell to an affiliate of Brookfield Asset Management US$45 million Notes at

the public offering price (for which no underwriting discount or commissions will be paid).

|

- 2 -

|

|

|

|

|

Automatic Exchange:

|

|

The Notes, including accrued and unpaid interest thereon, will be exchanged automatically (the “Automatic Exchange”), without the consent of the holders thereof, into units of a newly issued series of Class A

Preferred Units, being Class A Preferred Limited Partnership Units, Series 15 (the “Exchange Preferred Units”) upon the occurrence of: (i) the making by the Issuer of a general assignment for the benefit of its creditors

or a proposal (or the filing of a notice of its intention to do so) under the Bankruptcy and Insolvency Act (Canada); (ii) any proceeding instituted by the Issuer and/or the Partnership seeking to adjudicate them as bankrupt (including

any voluntary assignment in bankruptcy) or insolvent or, where the Issuer and/or the Partnership are insolvent, seeking liquidation, winding up, dissolution, reorganization, arrangement, compromise, adjustment, protection, relief or composition of

their debts under any law relating to bankruptcy or insolvency in Canada or Bermuda (as applicable), or seeking the entry of an order for the appointment of a receiver, interim receiver, trustee or other similar official for the Issuer and/or the

Partnership or in respect of all or any substantial part of their property and assets in circumstances where the Issuer and/or the Partnership are adjudged as bankrupt (including any voluntary assignment in bankruptcy) or insolvent; (iii) a

receiver, interim receiver, trustee or other similar official is appointed over the Issuer and/or the Partnership or for all or substantially all of their property and assets by a court of competent jurisdiction in circumstances where the Issuer

and/or the Partnership are adjudged as bankrupt (including any voluntary assignment in bankruptcy) or insolvent under any law relating to bankruptcy or insolvency in Canada or Bermuda (as applicable); or (iv) any proceeding is instituted

against the Issuer and/or the Partnership seeking to adjudicate them as bankrupt (including any voluntary assignment in bankruptcy) or insolvent, or where the Issuer and/or the Partnership are insolvent, seeking liquidation, winding up, dissolution,

reorganization, arrangement, compromise, adjustment, protection, relief or composition of their debts under any law relating to bankruptcy or insolvency in Canada or Bermuda (as applicable), or seeking the entry of an order for the appointment of a

receiver, interim receiver, trustee or other similar official for the Issuer and/or the Partnership or in respect of all or any substantial part of their property and assets in circumstances where the Issuer and/or the Partnership are adjudged as

bankrupt or insolvent under any law relating

|

- 3 -

|

|

|

|

|

|

|

to bankruptcy or insolvency in Canada or Bermuda (as applicable), and in any such case, such proceeding has not been stayed or dismissed

within 60 days of the institution of any such proceeding or the actions sought in such proceedings occur (including the entry of an order for relief against the Issuer and/or the Partnership or the appointment of a receiver, interim receiver,

trustee, or other similar official for them or for all or substantially all of their property and assets) (each, an “Automatic Exchange Event”).

The Automatic Exchange shall occur upon an Automatic Exchange Event (the “Exchange Time”). As of the Exchange Time, noteholders will have the

right to receive one Exchange Preferred Unit for each US$25 principal amount of Notes held together with the number of Exchange Preferred Units (including fractional units, if applicable) calculated by dividing the amount of accrued and unpaid

interest, if any, on the Notes, by US$25. Such right will be automatically exercised, and the Notes shall be automatically exchanged, without the consent of the holders of the Notes, into the newly issued series of fully paid Exchange Preferred

Units. At such time, all outstanding Notes shall be deemed to be immediately and automatically surrendered without need for further action by noteholders, who shall thereupon automatically cease to be holders of Notes and all rights of each such

holder as a debtholder of the Issuer and as a beneficiary of the subordinated guarantees of the Guarantors shall automatically cease.

|

|

|

|

|

Dividend Stopper Undertaking:

|

|

Unless the Issuer has paid all interest that has been deferred or is then payable on the Notes, subject to certain exceptions, neither the Issuer nor the Partnership will (i) declare any distributions or dividends on the

Distribution Restricted Securities or pay any interest on any Parity Indebtedness, (ii) redeem, purchase or otherwise retire Distribution Restricted Securities or Parity Indebtedness, or (iii) make any payment to holders of any of the

Distribution Restricted Securities or any Parity Indebtedness in respect of distributions or dividends not declared or paid on such Distribution Restricted Securities or interest not paid on such Parity Indebtedness, respectively, provided

that the foregoing clauses (i) and (iii) shall not apply in respect of any pro rata dividend or distribution or any other payment on any Parity Indebtedness which is made with a pro rata payment of any accrued and payable interest with

respect to the Notes.

|

- 4 -

|

|

|

|

|

CUSIP/ISIN:

|

|

11276B 109 / U11276B1098

|

|

|

|

|

Expected Rating*:

|

|

BBB- (S&P)

|

|

|

|

|

Joint Book-Running Managers:

|

|

BofA Securities, Inc.

Citigroup Global Markets Inc.

Morgan Stanley & Co. LLC

RBC Capital Markets, LLC

Wells Fargo Securities, LLC

|

|

|

|

|

Co-Managers:

|

|

Deutsche Bank Securities Inc.

Mizuho Securities USA LLC

MUFG Securities Americas Inc.

SMBC Nikko Securities America, Inc.

TD Securities (USA) LLC (together with the Joint Book-Running Managers, the “Underwriters”)

|

|

*

|

Note: A securities rating is not a recommendation to buy, sell or hold securities and may be subject to

review, revision, suspension, reduction or withdrawal at any time by the assigning rating agency.

|

The Notes will not be offered

or sold, directly or indirectly, in Canada or to any resident of Canada.

The Issuer and the Guarantors have filed a joint registration statement

(including a prospectus and a prospectus supplement) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus and prospectus supplement in that registration statement and other documents

the Partnership has filed with the SEC for more complete information about the Issuer, the Guarantors and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov.

Alternatively, the Issuer and the Guarantors, any underwriter or any dealer participating in the offering will arrange to send you the prospectus and

prospectus supplement if you request it by calling BofA Securities, Inc. toll-free at 1-800-294-1322, Citigroup Global Markets

Inc. toll-free at 1-800-831-9146, Morgan Stanley & Co. LLC toll-free at 1-866-718-1649, RBC Capital Markets, LLC toll-free at 1-866-375-6829 or Wells Fargo Securities, LLC toll-free at 1-800-645-3751.

- 5 -

No key information document (“KID”) required by Regulation (EU) No. 1286/2014 (as amended,

the “PRIIPs Regulation”) for offering or selling the Notes or otherwise making them available to retail investors in the European Economic Area (“EEA”) has been prepared as the Notes will not be made available to any retail

investor in the EEA.

No KID required by Regulation (EU) No 1286/2014 as it forms part of domestic law of the United Kingdom (“UK”) by

virtue of the European Union (Withdrawal) Act 2018, as amended (“EUWA”) (the “UK PRIIPs Regulation”) for offering or selling the Notes or otherwise making them available to retail investors in the UK has been prepared as the

Notes will not be made available to any retail investor in the UK.

- 6 -

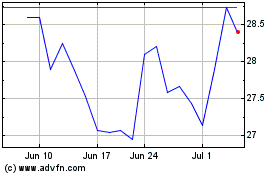

Brookfield Infrastructur... (NYSE:BIP)

Historical Stock Chart

From May 2024 to Jun 2024

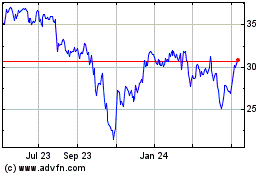

Brookfield Infrastructur... (NYSE:BIP)

Historical Stock Chart

From Jun 2023 to Jun 2024