iShares Launches the iShares MSCI China Exchange Traded Fund

March 31 2011 - 9:37AM

Marketwired

BlackRock, Inc. (NYSE: BLK) today announced that its iShares®

Exchange Traded Funds (ETFs) business, the world's largest manager

of ETFs, is launching the iShares MSCI China Index Fund (NYSE Arca:

MCHI) on the NYSE Arca. iShares now offers 40 international single

country ETFs. The fund is the first China ETF to be benchmarked to

the large- and mid-cap MSCI universe, and provides exposure to the

top 85% of Chinese equities by market cap.

"The new iShares MSCI China Index Fund provides clients access

to one of the fastest growing economies in the world," said Noel

Archard, Head of US Product at iShares at BlackRock. "The fund

further complements our single country product suite, which has

seen significant activity over the past few months as investors

increasingly look to single country funds to express nuanced views

on global markets."

According to Russ Koesterich, iShares Global Chief Investment

Strategist at BlackRock, China is projected to continue to offer

attractive investment opportunities as it transitions from an

export- to consumption-based economy. China continues to be one of

the fastest growing economies in the world with an estimated growth

of 10.3% in 2010(1). Investors can combine MCHI with the iShares

MSCI China Small Cap Index Fund (NYSE Arca: ECNS), which began

trading in September 2010, to create comprehensive MSCI China

exposure.

The iShares MSCI China Index Fund is designed to track the MSCI

China Index. The underlying index is designed to measure the

performance of the top 85% of equity securities by market

capitalization in the Chinese equity markets. Securities are

weighted based on the total market value of their shares so that

securities with higher total market values generally have a higher

representation in the index. As of the end of February, the largest

sector weightings of the index include financials (37.0%), energy

(18.4%) and telecom (11.4%).

About BlackRock BlackRock is a leader in

investment management, risk management and advisory services for

institutional and retail clients worldwide. At December 31, 2010,

BlackRock's AUM was $3.561 trillion. BlackRock offers products that

span the risk spectrum to meet clients' needs, including active,

enhanced and index strategies across markets and asset classes.

Products are offered in a variety of structures including separate

accounts, mutual funds, iShares® (exchange traded funds), and other

pooled investment vehicles. BlackRock also offers risk management,

advisory and enterprise investment system services to a broad base

of institutional investors through BlackRock Solutions®.

Headquartered in New York City, as of December 31, 2010, the firm

has approximately 9,100 employees in 25 countries and a major

presence in key global markets, including North and South America,

Europe, Asia, Australia and the Middle East and Africa. For

additional information, please visit the Company's website at

www.blackrock.com.

About iShares iShares is the global

product leader in exchange traded funds with over 460 funds

globally across equities, fixed income and commodities, which trade

on 19 exchanges worldwide. The iShares Funds are bought and sold

like common stocks on securities exchanges. The iShares Funds are

attractive to many individual and institutional investors and

financial intermediaries because of their relative low cost, tax

efficiency and trading flexibility. Investors can purchase and sell

shares through any brokerage firm, financial advisor, or online

broker, and hold the funds in any type of brokerage account. The

iShares customer base consists of the institutional segment of

pension plans and fund managers, as well as the retail segment of

financial advisors and high net worth individuals.

Carefully consider the funds' investment

objectives, risk factors, and charges and expenses before

investing. This and other information can be

found in the funds' prospectuses, which may be obtained by calling

1-800-iShares (1-800-474-2737) or by visiting www.iShares.com. Read the prospectus

carefully before investing.

Investing involves risk, including possible

loss of principal.

In addition to the normal risks associated with investing,

international investments may involve risk of capital loss from

unfavorable fluctuation in currency values, from differences in

generally accepted accounting principles or from economic or

political instability in other nations. Emerging markets involve

heightened risks related to the same factors as well as increased

volatility and lower trading volume. Securities focusing on a

single country and narrowly focused investments typically exhibit

higher volatility.

Transactions in shares of the iShares Funds will result in

brokerage commissions and will generate tax consequences. iShares

Funds are obliged to distribute portfolio gains to shareholders.

Shares of the iShares Funds may be sold throughout the day on the

exchange through any brokerage account. However, shares may only be

redeemed directly from a Fund by Authorized Participants, in very

large creation/redemption units.

The iShares Funds are not sponsored, endorsed, issued, sold or

promoted by MSCI Inc. This company does not make any representation

regarding the advisability of investing in the Funds. Neither SEI,

nor BlackRock Institutional Trust Company, N.A., nor any of their

affiliates, are affiliated with the company listed above.

The iShares Funds ("Funds") are distributed by SEI Investments

Distribution Co. ("SEI"). BlackRock Fund Advisors ("BFA") serves as

the investment advisor to the Funds. BlackRock Fund Distribution

Company ("BFDC") assists in the marketing of the Funds. BFA and

BFDC are affiliates of BlackRock, Inc., none of which is affiliated

with SEI.

©2011 BlackRock Institutional Trust Company, N.A. iShares® is a

registered trademark of BlackRock Institutional Trust Company, N.A.

All other trademarks, servicemarks or registered trademarks are the

property of their respective owners. iS-4461-0311

* Not FDIC Insured * No Bank Guarantee * May

Lose Value

(1) CIA Factbook, as of 2/11

Add to Digg Bookmark with del.icio.us Add to Newsvine

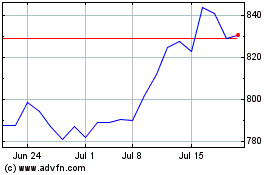

BlackRock (NYSE:BLK)

Historical Stock Chart

From May 2024 to Jun 2024

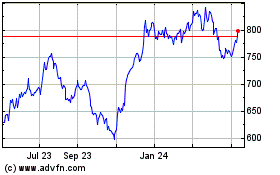

BlackRock (NYSE:BLK)

Historical Stock Chart

From Jun 2023 to Jun 2024