IPO WATCH: TDC, Gjensidige Set Price Ranges As Deal Pace Slows

November 25 2010 - 12:01PM

Dow Jones News

Danish telecoms operator TDC A/S (TDC.KO) Thursday set the price

range for a secondary share sale and concurrent share buyback,

while Norwegian insurer Gjensidige Forsikring ASA set a range on

its initial public offering valuing it at up to NOK32 billion ($5.3

billion).

TDC said NTC, the private equity consortium that bought it five

years ago, is offering up to 241.5 million existing shares,

including an overallotment, at 47-56 Danish kroner ($8.40-$10) a

share. At the same time, TDC is offering to spend DKK9 billion

($1.6 billion) to buy back existing shares.

The private equity firms hold 88% of TDC and there is a 12% free

float among minority holders. After the transaction, Chief

Executive Henrik Poulsen said the free float will rise to 40%-45%

and that NTC won't sell any of its remaining shares for at least

180 days.

In Norway, investors can buy shares in Gjensidige from the

foundation that owns it at a price of NOK54 to NOK64 apiece.

Between 25%-40% of the company's stock will be owned by retail and

institutional investors and employees after the offer, the company

said.

Both transactions will price around Dec. 9, as the IPO market

winds down for the year.

Bankers on Thursday said the focus is now on next year's

business, though additional block sales of existing shares by large

holders are expected in the coming weeks. These kinds of

transactions have far outpaced IPO volume in recent months, as

selling shareholders have taken advantage of rising stock markets

to place deals.

More rights issues are also expected to be announced. The result

of Banco Bilbao Vizcaya Argentaria SA's (BBVA) EUR5 billion capital

increase to buy 24.9% of Turkey's Garanti Bankasi AS (GAREN.F.IS)

is expected to be released by Friday, a person working on the

transaction said.

Other completed business this week included a GBP270 million IPO

by the John Laing Infrastructure Fund, a vehicle set up to buy an

initial portfolio from John Laing Group of 19 operational, global

infrastructure public/private partnership projects.

JLIF is the second infrastructure fund to be listed in London

this year following GCP Infrastructure Investments Ltd. (GCP.LN),

as investors seek to capitalize on a surge in part private-part

public projects that are a useful tool for governments trying to

cut deficits.

Another, existing investment vehicle, Burford Capital Ltd.

(BUR.LN), on Wednesday said it raised an additional $175 million to

put toward its strategy of financing commercial litigation.

The company had floated in October 2009 with GBP80 million

($126.5 million).

Two further offerings in London's alternative investments sector

are due to be completed next month. BH Credit Catalysts Ltd., run

by Brevan Howard Asset Management LLP, will invest in a single

credit hedge fund strategy focused on distressed debt and expects

to join the main market on Dec. 14.

CQS Diversified Fund Ltd., a vehicle investing in several hedge

funds run by London's CQS, expects to join the main market a day

later, on Dec. 15.

-By Margot Patrick, Dow Jones Newswires; +44 (0)20 7842 9451;

margot.patrick@dowjones.com

(Marietta Cauchi contributed to this article.)

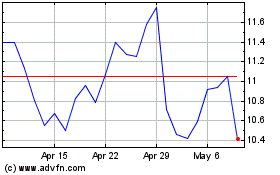

BBVA Bilbao Vizcaya Arge... (NYSE:BBVA)

Historical Stock Chart

From Oct 2024 to Nov 2024

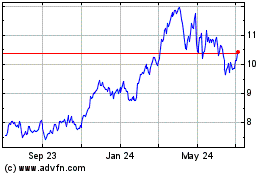

BBVA Bilbao Vizcaya Arge... (NYSE:BBVA)

Historical Stock Chart

From Nov 2023 to Nov 2024