Bladex Joins Russell 3000 Index

July 09 2007 - 4:11PM

PR Newswire (US)

PANAMA CITY, July 9 /PRNewswire-FirstCall/ -- Banco Latinoamericano

de Exportaciones, S.A. ("Bladex") (NYSE:BLX), a leading provider of

trade finance services for the Latin American and Caribbean region,

announced today that its stock was recently added to the

broad-market Russell 3000(R) Index according to the official

membership list posted on http://www.russell.com/. Membership in

the Russell 3000, which remains in place for one year, means

automatic inclusion in the large-cap Russell 1000(R) Index or in

the small-cap Russell 2000(R), as well as in the appropriate growth

and value style indexes. Russell determines membership for its

equity indexes primarily by objective, market-capitalization

rankings and style attributes. Russell indexes are widely used by

investment managers and institutional investors for index funds,

and as benchmarks for both passive and active investment

strategies. An industry-leading $4 trillion in assets are currently

benchmarked to them. "This is a major step in supporting the

liquidity of our stock, providing shareholders the opportunity to

invest in a proxy for the growth of our dynamic region," stated

Jaime Rivera, Chief Executive Officer of Bladex. About Russell

Russell Investment Group aims to improve financial security for

people by providing strategic advice, world-class implementation,

state-of-the-art performance benchmarks and a range of

institutional-quality investment products. With more than $200

billion in assets under management, Russell serves individual,

institutional and advisor clients in more than 40 countries.

Russell provides access to some of the world's best money managers.

It helps investors put this access to work in corporate defined

benefit and defined contribution plans, and in the life savings of

individual investors. Russell's indexes are unmanaged and cannot be

invested in directly. For more information on Russell indexes, go

to http://www.russell.com/. About Bladex Bladex is a supranational

bank originally established by the Central Banks of Latin American

and Caribbean countries to support trade finance in the Region.

Based in Panama, its shareholders include central banks and state-

owned entities in 23 countries in the Region, as well as Latin

American and international commercial banks, along with

institutional and retail investors. Through March 31, 2007, Bladex

had disbursed accumulated credits of over $146 billion. For further

information, please access Bladex on the Internet at

http://www.blx.com/ or contact: Bladex, Head Office Calle 50 y

Aquilino de la Guardia, Panama City, Panama Attention: Carlos Yap

S., Senior Vice President - Finance Tel.: (507) 210-8563, E-mail:

-or- i-advize Corporate Communications, Inc. 82 Wall Street, Suite

805 New York, NY 10005 Attention: Melanie Carpenter / Peter Majeski

Tel.: (212) 406-3690, E-mail: DATASOURCE: Banco Latinoamericano de

Exportaciones, S.A. CONTACT: Carlos Yap S., Senior Vice President -

Finance, Banco Latinoamericano de Exportaciones, +011-507-210-8563,

; or Melanie Carpenter or Peter Majeski, i-advize Corporate

Communications, Inc., +1-212-406-3690, , for Bladex Web site:

http://www.blx.com/

Copyright

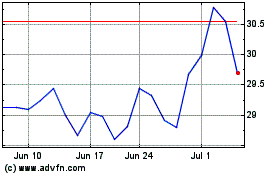

Banco Latinoamericano de... (NYSE:BLX)

Historical Stock Chart

From Jun 2024 to Jul 2024

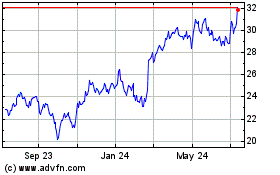

Banco Latinoamericano de... (NYSE:BLX)

Historical Stock Chart

From Jul 2023 to Jul 2024