Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

July 06 2023 - 6:19AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report

of Foreign Private Issuer Pursuant to Rule 13a-16 or 15d-16 under the Securities Exchange Act of 1934

For the month of July, 2023

Commission File Number: 001-36671

ATENTO S.A.

(Translation of Registrant’s name into English)

1, rue Hildegard Von Bingen, 1282, Luxembourg

Grand Duchy of Luxembourg

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover of Form 20-F or Form 40-F.

Form 20-F [ X ] Form 40-F [ ]

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes [ ] No [ X ]

Note: Regulation S-T Rule 101(b)(1) only permits the

submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes [ ] No [ X ]

Note: Regulation S-T Rule 101(b)(7) only permits the

submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must

furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the

registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities

are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the

registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or

other Commission filing on EDGAR.

Atento S.A. (NYSE: ATTO, “Atento”)

announced on June 23, 2023, its entry into a term sheet providing for a new interim financing of at least $30 million and a path to a

comprehensive restructuring transaction to significantly deleverage its balance sheet. The draw-down conditions for the first tranche

of new interim financing included execution of a restructuring support agreement, which was entered on June 30, 2023.

The new interim financing involved Atento entering

into agreements for (i) a new interim financing of at least $30 million through the issuance of new money notes due 2025 (“New Money

2025 Notes”) in tranches over time, the first tranche of which for US$17 million was funded on 30 June 2023, (ii) amendments to

the existing $39.6 million senior secured notes due 2025 issued in February 2023 (“Existing 2025 Notes”) and (iii) the exchange

of certain senior secured notes due 2026 for new notes due 2025 (“Junior Lien 2025 Notes”) secured on a junior lien basis

to Atento’s Existing 2025 Notes and New Money 2025 Notes.

Copies of the financing documents and cleansing

materials are exhibits to this Form 6-K.

1

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

ATENTO S.A.

Date: July 5, 2023

By:

/s/ Dimitrius Oliveira

Name: Dimitrius Oliveira

Title: Chief Executive Officer

2

INDEX OF EXHIBITS

Exhibit 99.1

Junior Lien 2025 Note Purchase Agreement dated 30 June 2023

Exhibit 99.2

Junior Lien 2025 Notes Deed of Covenant dated 30 June 2023

Exhibit 99.3

Junior Lien 2025 Notes Guarantor Deed of Accession of Atento Argentina S.A. dated 30 June 2023

Exhibit 99.4

Intercreditor Agreement dated 30 June 2023

Exhibit 99.5

Deed of Accession of Atento Argentina S.A. to Intercreditor Agreement dated 30 June 2023

Exhibit 99.6

Cleansing Information

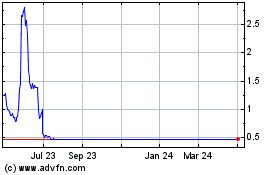

Atento (NYSE:ATTO)

Historical Stock Chart

From Oct 2024 to Nov 2024

Atento (NYSE:ATTO)

Historical Stock Chart

From Nov 2023 to Nov 2024