MCI Capital, LC Announces Extension of Offer Period for Cash Tender Offer for Ordinary Shares of Atento S.A.

December 15 2022 - 3:00AM

MCI Capital, LC (“MCI”), a wholly owned subsidiary of MCI, LC,

announced today that it is extending the offer period for its

previously announced cash tender offer to purchase up to 1,525,000

ordinary shares of Atento S.A. (NYSE:ATTO) (“Atento”) at a purchase

price of $5.00 per share until 5:00 p.m., New York City time, on

December 30, 2022. The tender offer was previously scheduled to

expire at 12:00 midnight, New York City time, at the end of the day

on December 16, 2022. The offer is now extended to the tenth

business day after its previously scheduled expiration. To date no

ordinary shares of Atento have been deposited in response to the

tender offer. As previously announced, if more than 1,525,000

shares are tendered in the tender offer, then, subject to the terms

and conditions of the tender offer, MCI will purchase shares from

shareholders who properly tender shares on a pro rata basis based

on the aggregate number of shares tendered. The tender offer is

conditioned upon, among other things, a minimum of 775,000 shares

being validly tendered and not withdrawn in accordance with its

terms.

Tenders of the shares in the tender offer must be

made prior to its expiration and may be withdrawn at any time prior

to the expiration in accordance with the terms described in the

offer documents.

Important Information About the Tender

Offer This press release does not constitute an offer to

buy or solicitation of an offer to sell any ordinary shares of

Atento or any other securities. This press release is for

informational purposes only. MCI has filed with the SEC a Tender

Offer Statement on Schedule TO, including an offer to purchase, a

letter of transmittal and related documents, which set forth in

detail the terms of the tender offer, and Atento filed with the SEC

a Solicitation/Recommendation Statement on Schedule 14D-9 with

respect to the offer. THE TENDER OFFER MATERIALS (INCLUDING THE

OFFER TO PURCHASE, RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER

TENDER OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION

STATEMENT CONTAIN IMPORTANT INFORMATION THAT SHOULD BE READ

CAREFULLY AND CONSIDERED BY ATENTO'S SHAREHOLDERS BEFORE ANY

DECISION IS MADE WITH RESPECT TO THE TENDER OFFER. Atento

shareholders are able to obtain the Tender Offer Statement and

other filed documents for free at the SEC’s website at www.sec.gov.

Atento shareholders may also obtain free copies of the tender offer

materials by contacting the Information Agent, MacKenzie Partners,

Inc., at tenderoffer@mackenziepartners.com or by phone toll free at

(800) 322-2885.

About MCI: MCI, LC is a holding

company for multiple operating companies that provide a diverse set

of tech-enabled business process outsourcing (BPO) and customer

experience (CX) technology services. MCI Capital, LC is a wholly

owned subsidiary of MCI, LC.

This press release contains forward-looking

statements based on current expectations that involve a number of

risks and uncertainties. The forward-looking statements in this

press release are also forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933 and Section

21E of the Securities Exchange Act of 1934. Actual results,

performance, or achievements could differ materially from those

contemplated, expressed, or implied by the forward-looking

statements contained herein. Risks and uncertainties include, but

are not limited to, those relating to the tender offer described in

this press release, including that the conditions to closing the

tender offer may not be satisfied or, to the extent permitted by

applicable law, may be waived by MCI in its sole discretion,

uncertainties as to the number of shares that will be tendered and

purchased in the tender offer, and risks relating to the market

price and liquidity of Atento’s ordinary shares. Reference is also

made to the risks and uncertainties relating to the business,

operations, affairs, results, and financial condition of Atento

detailed in reports filed by Atento with the SEC, including its

Annual Report on Form 20-F for the year ended December 31, 2021

(including the “Risk Factors” section thereof), which may be viewed

on the SEC's website at www.sec.gov. MCI cautions that the

foregoing factors are not exclusive. Readers should not place undue

reliance on any forward-looking statement, which speaks only as of

the date made. In addition, past performance may not be indicative

of future results.

Atento (NYSE:ATTO)

Historical Stock Chart

From Oct 2024 to Nov 2024

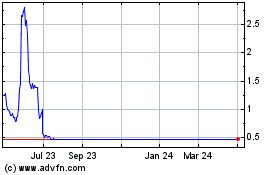

Atento (NYSE:ATTO)

Historical Stock Chart

From Nov 2023 to Nov 2024