DALLAS, Feb. 24 /PRNewswire-FirstCall/ -- Ashford Hospitality

Trust, Inc. (NYSE:AHT) today reported the following results and

performance measures for the fourth quarter ended December 31,

2009. The proforma performance measurements for Occupancy, Average

Daily Rate (ADR), revenue per available room (RevPAR), and Hotel

Operating Profit (or Hotel EBITDA) include the Company's 102 hotels

owned and included in continuing operations as of December 31,

2009. Unless otherwise stated, all reported results compare the

fourth quarter ended December 31, 2009, with the fourth quarter

ended December 31, 2008 (see discussion below). The reconciliation

of non-GAAP financial measures is included in the financial tables

accompanying this press release. FINANCIAL HIGHLIGHTS AND LIQUIDITY

-- Corporate unrestricted cash at the end of the quarter was $165.2

million -- Total revenue decreased 18.3% to $234.6 million from

$287.3 million -- RevPAR decreased 13.5% for the quarter --

Operating profit margin decreased 297 basis points -- Net loss

available to common shareholders was $76.9 million, or $1.30 per

diluted share, compared with net income of $135.1 million, or $1.34

per diluted share, in the prior-year quarter -- Adjusted funds from

operations (AFFO) was $0.32 per diluted share -- Cash available for

distribution (CAD) was $0.22 per diluted share -- Fixed charge

coverage ratio was 1.69x under the senior credit facility covenant

versus a required minimum of 1.25x CAPITAL ALLOCATION --

Repurchased 6.3 million common shares in the quarter for $28.0

million and a total of 30.1 million shares for $81.3 million in

2009 -- Capex invested in the quarter was $17.4 million, for a

total of $69.2 million in 2009 -- Capital market hedging strategies

resulted in $52.3 million of interest expense savings in 2009

IMPAIRMENT During the fourth quarter, the Company recorded an

impairment of $59.3 million related to its Westin O'Hare in

suburban Chicago. The Company had suspended making mortgage

payments pursuant to grace periods granted by the lender under a

forbearance agreement and has been working with the special

servicer on the $101 million loan for a consensual deed in lieu of

foreclosure. The impairment represents the difference between the

asset's net book value and the current fair market value. Once the

deed in lieu of foreclosure to the lender is completed, which is

anticipated to be in the first or second quarter of 2010, the

Company will report a non cash gain of approximately $53.0 million

to the level of the non-recourse debt on the asset and effectively

a net impairment of $6.3 million. CAPITAL STRUCTURE At December 31,

2009, the Company's net debt to total gross assets (as defined by

the corporate credit facility) was 59.0%. As of December 31, 2009,

the Company had $2.8 billion of mortgage debt. Including the swap

and flooridors its blended average interest rate was 2.95%.

Including its $1.8 billion interest rate swap, 98% of the Company's

debt is variable-rate debt. The Company's weighted average debt

maturity including extension options is 5.2 years. On November 19,

2009, the Company closed on the refinancing of its remaining 2010

debt maturity and made significant progress on the Company's 2011

maturities through transactions with Prudential Mortgage Capital

Company and Wheelock Street Capital with a $145.0 million

non-recourse loan. The loan includes an A-Note from Prudential and

a B-Note from Wheelock Street with a combined interest rate of

12.26% and a term of six years. The loans are secured by the

Embassy Suites Crystal City, Embassy Suites Orlando Airport,

Embassy Suites Santa Clara, Embassy Suites Portland and the Hilton

Costa Mesa. The proceeds paid off a $75.0 million loan maturing in

2010 and a $65.0 million loan maturing in 2011, and provide $4.0

million for capital improvements to be drawn over a 24-month

period. The Hilton Auburn Hills and the Hilton Rye Town, which were

included in the maturing loans, are now unencumbered. On November

19, 2009, the Company also completed the sale of the Westin

Westminster mezzanine loan that was defeased by the original

borrower in 2007 as part of a refinancing. The total gross proceeds

received by the Company amounted to $13.6 million before

transaction costs. The loan had an outstanding balance of $11.0

million with a September 1, 2011 maturity. The Company negotiated

for the release of the portfolio of government agency securities

serving as the defeased loan collateral, and sold the actual

securities via an auction. The Company obtained pricing in excess

of the par amount due to the high pay coupon compared to current

market rates. Effective December 1, 2009, the Company and the

special servicer who is administering the $29.1 million first

mortgage on the Company's Hyatt Regency Dearborn mutually agreed to

transfer the Company's possession and control of the hotel to a

court-appointed receiver. As a result of the transfer, the Company

deconsolidated the hotel and its other net assets from its

financial reporting in the amount of $32.0 million (previously

impaired by $10.9 million in the second quarter of 2009) and the

hotel's $29.1 million mortgage indebtedness, and recognized a loss

on the deconsolidation of debt of $2.9 million in the fourth

quarter. Additionally, the Company reclassified the hotel's results

of operations through the effective date of the transfer to

discontinued operations on its statement of operations. Effective

December 29, 2009, the Company refinanced its $19.74 million loan

secured by the Hilton El Conquistador Hotel and Country Club in

Tucson, Arizona. The loan was set to mature in June 2011. The new

non-recourse financing with MetLife for the same amount bears

interest at the greater of 5.5% or LIBOR plus 350 basis points and

is interest only for a term of five years. During 2009, the Company

completed a total of $285 million in financings, re-financings and

loan modifications. The Company has no debt maturities in 2010 and

has $209 million of hard debt maturities in 2011, $203 million of

which matures in December 2011 and is secured by a portfolio of

hotels. SUBSEQUENT EVENTS On February 12, 2010, the Company

completed the previously disclosed discounted payoff with the

borrower on the Company's $33.6 million mezzanine loan, which was

secured by interests in the Ritz Carlton Key Biscayne and set to

mature in 2017. The Company received $20 million in cash and a $4

million note secured by interests in the property and that matures

in 2017. The Company had previously recorded an impairment of $10.7

million to account for the discounted payoff in the third quarter

of 2009. PORTFOLIO REVPAR As of December 31, 2009, the Company had

a portfolio of direct hotel investments consisting of 102

properties classified in continuing operations. During the fourth

quarter, 95 of the hotels included in continuing operations were

not under renovation. The Company believes reporting its operating

metrics for continuing operations on a proforma total basis (all

102 hotels) and proforma not-under-renovation basis (95 hotels) is

a measure that reflects a meaningful and focused comparison of the

operating results in its direct hotel portfolio. The Company's

reporting by region and brand includes the results of all 102

hotels in continuing operations. Details of each category are

provided in the tables attached to this release. -- Proforma RevPAR

decreased 13.3% for hotels not under renovation on a 10.8% decrease

in ADR to $123.61 and a 181 basis point decline in occupancy --

Proforma RevPAR decreased 13.5% for all hotels on a 10.6% decrease

in ADR to $124.26 and a 214 basis point decline in occupancy HOTEL

EBITDA MARGINS AND QUARTERLY SEASONALITY TRENDS For the 95 hotels

as of December 31, 2009, that were not under renovation, Proforma

Hotel EBITDA decreased 24.4% to $50.3 million. Proforma Hotel

EBITDA margin (expressed as a percentage of Total Hotel Revenue)

declined 276 basis points to 23.3%. For all 102 hotels included in

continuing operations as of December 31, 2009, Proforma Hotel

EBITDA decreased 25.5% to $55.8 million and Hotel EBITDA margin

decreased 297 basis points to 23.3%. Ashford believes

year-over-year Hotel EBITDA and Hotel EBITDA margin comparisons are

more meaningful to gauge the performance of the Company's hotels

than sequential quarter-over-quarter comparisons. Given the

substantial seasonality in the Company's portfolio and its active

capital recycling, to help investors better understand this

seasonality, the Company provides quarterly detail on its Proforma

Hotel EBITDA and Proforma Hotel EBITDA margin for the current and

certain prior-year periods based upon the number of core hotels in

the portfolio as of the end of the current period. As Ashford's

portfolio mix changes from time to time so will the seasonality for

Proforma Hotel EBITDA and Proforma Hotel EBITDA margin. The details

of the quarterly calculations for the previous four quarters for

the current portfolio of 102 hotels included in continuing

operations are provided in the tables attached to this release.

Monty J. Bennett, Chief Executive Officer, commented, "Our

operations, capital markets, and share repurchase strategies

continued to address many of our top priorities for the year such

as offsetting declining RevPAR trends with interest expense

savings, eliminating near-term debt maturities and creating value

with a disciplined share repurchase strategy. Looking ahead to

2010, we still expect the operating environment to continue to be

extremely challenging, requiring a continued cost control focus."

INVESTOR CONFERENCE CALL AND SIMULCAST Ashford Hospitality Trust,

Inc. will conduct a conference call on Thursday, February 25, 2010,

at 11 a.m. ET. The number to call for this interactive

teleconference is (212) 231-2905. A replay of the conference call

will be available through March 4, 2010, by dialing (402) 977-9140

and entering the confirmation number, 21449088. The Company will

also provide an online simulcast and rebroadcast of its fourth

quarter 2009 earnings release conference call. The live broadcast

of Ashford's quarterly conference call will be available online at

the Company's website at http://www.ahtreit.com/ on Thursday,

February 25, 2010, beginning at 11 a.m. ET. The online replay will

follow shortly after the call and continue for approximately one

year. Substantially all of our non-current assets consist of real

estate investments and debt investments secured by real estate.

Historical cost accounting for real estate assets implicitly

assumes that the value of real estate assets diminishes predictably

over time. Since real estate values instead have historically risen

or fallen with market conditions, most industry investors consider

supplemental measures of performance, which are not measures of

operating performance under GAAP, to assist in evaluating a real

estate company's operations. These supplemental measures include

FFO, AFFO, EBITDA, Hotel Operating Profit, and CAD. FFO is computed

in accordance with our interpretation of standards established by

NAREIT, which may not be comparable to FFO reported by other REITs

that do not define the term in accordance with the current NAREIT

definition or that interpret the NAREIT definition differently than

us. Neither FFO, AFFO, EBITDA, Hotel Operating Profit, nor CAD

represents cash generated from operating activities as determined

by GAAP and should not be considered as an alternative to a) GAAP

net income (loss) as an indication of our financial performance or

b) GAAP cash flows from operating activities as a measure of our

liquidity, nor are such measures indicative of funds available to

satisfy our cash needs, including our ability to make cash

distributions. However, management believes FFO, AFFO, EBITDA,

Hotel Operating Profit, and CAD to be meaningful measures of a

REIT's performance and should be considered along with, but not as

an alternative to, net income and cash flow as a measure of our

operating performance. Ashford Hospitality Trust is a

self-administered real estate investment trust focused on investing

in the hospitality industry across all segments and at all levels

of the capital structure, including direct hotel investments,

second mortgages, mezzanine loans and sale-leaseback transactions.

Additional information can be found on the Company's web site at

http://www.ahtreit.com/. Certain statements and assumptions in this

press release contain or are based upon "forward-looking"

information and are being made pursuant to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

These forward-looking statements are subject to risks and

uncertainties. When we use the words "will likely result," "may,"

"anticipate," "estimate," "should," "expect," "believe," "intend,"

or similar expressions, we intend to identify forward-looking

statements. Such forward-looking statements include, but are not

limited to, the timing for closing, the impact of the transaction

on our business and future financial condition, our business and

investment strategy, our understanding of our competition and

current market trends and opportunities and projected capital

expenditures. Such statements are subject to numerous assumptions

and uncertainties, many of which are outside Ashford's control.

These forward-looking statements are subject to known and unknown

risks and uncertainties, which could cause actual results to differ

materially from those anticipated, including, without limitation:

general volatility of the capital markets and the market price of

our common stock; changes in our business or investment strategy;

availability, terms and deployment of capital; availability of

qualified personnel; changes in our industry and the market in

which we operate, interest rates or the general economy; and the

degree and nature of our competition. These and other risk factors

are more fully discussed in Ashford's filings with the Securities

and Exchange Commission. EBITDA is defined as net income before

interest, taxes, depreciation and amortization. EBITDA yield is

defined as trailing twelve month EBITDA divided by the purchase

price. A capitalization rate is determined by dividing the

property's annual net operating income by the purchase price. Net

operating income is the property's funds from operations minus a

capital expense reserve of either 4% or 5% of gross revenues. Funds

from operations ("FFO"), as defined by the White Paper on FFO

approved by the Board of Governors of the National Association of

Real Estate Investment Trusts ("NAREIT") in April 2002, represents

net income (loss) computed in accordance with generally accepted

accounting principles ("GAAP"), excluding gains (or losses) from

sales or properties and extraordinary items as defined by GAAP,

plus depreciation and amortization of real estate assets, and net

of adjustments for the portion of these items related to

unconsolidated entities and joint ventures. The forward-looking

statements included in this press release are only made as of the

date of this press release. Investors should not place undue

reliance on these forward-looking statements. We are not obligated

to publicly update or revise any forward-looking statements,

whether as a result of new information, future events or

circumstances, changes in expectations or otherwise. ASHFORD

HOSPITALITY TRUST, INC. AND SUBSIDIARIES CONSOLIDATED BALANCE

SHEETS (in thousands, except share amounts) December 31,

-------------- 2009 2008 ---- ---- (Unaudited) ASSETS Investment in

hotel properties, net $3,383,759 $3,568,215 Cash and cash

equivalents 165,168 241,597 Restricted cash 77,566 69,806 Accounts

receivable, net 31,503 41,110 Inventories 2,975 3,341 Notes

receivable 55,655 212,815 Investment in unconsolidated joint

venture 20,736 19,122 Deferred costs, net 20,960 24,211 Prepaid

expenses 13,234 12,903 Interest rate derivatives 94,645 88,603

Other assets 3,471 6,766 Intangible assets, net 2,988 3,077 Due

from third-party hotel managers 41,838 48,116 ------ ------ Total

assets $3,914,498 $4,339,682 ========== ========== LIABILITIES AND

EQUITY Liabilities Indebtedness $2,772,396 $2,790,364 Capital

leases payable 83 207 Accounts payable and accrued expenses 91,387

93,476 Dividends payable 5,566 6,285 Unfavorable management

contract liabilities 18,504 20,950 Due to related parties 1,009

2,378 Due to third-party hotel managers 1,563 3,855 Other

liabilities 7,932 8,124 ----- ----- Total liabilities 2,898,440

2,925,639 --------- --------- Series B-1 Cumulative Convertible

Redeemable Preferred stock, 7,447,865 issued and outstanding 75,000

75,000 Redeemable noncontrolling interests in operating partnership

85,167 107,469 Equity: Stockholders' equity of the Company

Preferred stock, $0.01 par value, 50,000,000 shares authorized:

Series A Cumulative Preferred Stock, 1,487,900 shares and 2,185,000

shares issued and outstanding at December 31, 2009 and 2008 15 22

Series D Cumulative Preferred Stock, 5,666,797 shares and 6,394,347

shares issued and outstanding at December 31, 2009 and 2008 57 64

Common stock, $0.01 par value, 200,000,000 shares authorized,

122,748,859 shares issued, 57,596,878 shares and 86,555,149 shares

outstanding at December 31, 2009 and 2008 1,227 1,227 Additional

paid-in capital 1,436,009 1,450,146 Accumulated other comprehensive

loss (897) (860) Accumulated deficit (412,011) (124,782) Treasury

stock, at cost (65,151,981 shares and 36,193,710 shares at December

31, 2009 and 2008) (186,424) (113,598) -------- -------- Total

stockholders' equity of the Company 837,976 1,212,219

Noncontrolling interests in consolidated joint ventures 17,915

19,355 ------ ------ Total equity 855,891 1,231,574 -------

--------- Total liabilities and equity $3,914,498 $4,339,682

========== ========== ASHFORD HOSPITALITY TRUST, INC. AND

SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS (in thousands,

except per share amounts) Three Months Ended Year Ended December

31, December 31, -------------- -------------- 2009 2008 2009 2008

---- ---- ---- ---- (Unaudited) REVENUE Rooms $171,462 $204,562

$678,278 $831,029 Food and beverage 49,095 58,772 175,351 221,826

Rental income from operating leases 1,820 1,979 5,650 6,218 Other

11,571 13,138 45,714 51,324 ------ ------ ------ ------ Total hotel

revenue 233,948 278,451 904,993 1,110,397 Interest income from

notes receivable 479 8,777 10,876 24,050 Asset management fees and

other 174 60 726 2,013 --- --- --- ----- Total Revenue 234,601

287,288 916,595 1,136,460 ------- ------- ------- ---------

EXPENSES Hotel operating expenses Rooms 42,054 46,546 158,647

181,957 Food and beverage 34,175 41,374 125,343 156,540 Other

direct 6,436 7,418 25,383 28,359 Indirect 70,843 81,850 269,879

313,141 Management fees 9,654 11,507 36,431 44,518 ----- ------

------ ------ Total hotel expenses 163,162 188,695 615,683 724,515

Property taxes, insurance, and other 15,871 16,335 61,113 60,739

Depreciation and amortization 38,027 40,383 155,458 164,055

Impairment charges 58,735 - 208,007 - Gain on insurance settlement

(1,329) - (1,329) - Corporate general and administrative:

Stock-based compensation 1,141 1,646 5,037 6,834 Other general and

administrative 5,796 2,152 24,914 21,868 ----- ----- ------ ------

Total Operating Expenses 281,403 249,211 1,068,883 978,011 -------

------- --------- ------- OPERATING (LOSS) INCOME (46,802) 38,077

(152,288) 158,449 Equity (loss) in earnings of unconsolidated joint

venture 623 (4,509) 2,486 (2,205) Interest income 44 468 297 2,062

Other income 21,416 3,910 56,556 10,153 Interest expense (35,329)

(37,433) (137,871) (148,162) Amortization of loan costs (1,816)

(1,732) (7,679) (6,420) Write-off of premiums, loan costs, premiums

and exit fees, net (1,111) - (181) (1,226) Unrealized (loss) gain

on derivatives (17,616) 118,481 (31,782) 79,620 ------- -------

------- ------ (LOSS) INCOME FROM CONTINUING OPERATIONS BEFORE

INCOME TAXES (80,591) 117,262 (270,462) 92,271 Income tax (expense)

benefit (1,097) 238 (1,521) (657) ------ --- ------ ---- (LOSS)

INCOME FROM CONTINUING OPERATIONS (81,688) 117,500 (271,983) 91,614

(Loss) income from discontinued operations (2,577) 37,522 (16,677)

54,057 ------ ------ ------- ------ NET (LOSS) INCOME (84,265)

155,022 (288,660) 145,671 Loss (income) from consolidated joint

ventures attributable to noncontrolling interests 136 1,463 765

(1,444) Net loss (income) attributable to redeemable noncontrolling

interests in operating partnership 12,085 (15,771) 37,653 (15,033)

------ ------- ------ ------- NET (LOSS) INCOME ATTRIBUTABLE TO THE

COMPANY (72,044) 140,714 (250,242) 129,194 Preferred dividends

(4,830) (5,588) (19,322) (26,642) ------ ------ ------- ------- NET

(LOSS) INCOME ATTRIBUTABLE TO COMMON STOCKHOLDERS $(76,874)

$135,126 $(269,564) $102,552 ======== ======== ========= ========

(LOSS) INCOME PER SHARE: Basic (Loss) income from continuing

operations attributable to common stockholders $(1.26) $1.09

$(3.72) $0.47 (Loss) income from discontinued operations

attributable to common stockholders (0.04) 0.36 (0.21) 0.44 -----

---- ----- ---- Net (loss) income attributable to common

stockholders $(1.30) $1.45 $(3.93) $0.91 ====== ===== ====== =====

Diluted (Loss) income from continuing operations attributable to

Ashford common stockholders $(1.26) $1.01 $(3.72) $0.47 (Loss)

income from discontinued operations attributable to Ashford common

stockholders (0.04) 0.33 (0.21) 0.44 ----- ---- ----- ---- Net

(loss) income attributable to Ashford common stockholders $(1.30)

$1.34 $(3.93) $0.91 ====== ===== ====== ===== Weighted average

common shares outstanding - basic 59,101 91,905 68,597 111,295

====== ====== ====== ======= Weighted average common shares

outstanding - diluted 59,101 112,801 68,597 111,295 ====== =======

====== ======= Amounts attributable to common stockholders: (Loss)

income from continuing operations, net of tax $(69,835) $106,958

$(235,655) $80,199 (Loss) income from discontinued operations, net

of tax (2,209) 33,756 (14,587) 48,995 Preferred dividends (4,830)

(5,588) (19,322) (26,642) ------ ------ ------- ------- Net (loss)

income attributable to common stockholders $(76,874) $135,126

$(269,564) $102,552 ======== ======== ========= ======== ASHFORD

HOSPITALITY TRUST, INC. AND SUBSIDIARIES RECONCILIATION OF NET

INCOME TO EBITDA (in thousands) Three Months Ended Year Ended

December 31, December 31, -------------- -------------- 2009 2008

2009 2008 ---- ---- ---- ---- (Unaudited) Net (loss) income

$(84,265) $155,022 $(288,660) $145,671 Loss (income) from

consolidated joint ventures attributable to noncontrolling

interests 136 1,463 765 (1,444) Net loss (income) attributable to

redeemable noncontrolling interests in operating partnership 12,085

(15,771) 37,653 (15,033) ------ ------- ------ ------- Net (loss)

income attributable to the Company (72,044) 140,714 (250,242)

129,194 Interest income (44) (456) (289) (2,020) Interest expense

and amortization of loan costs 36,945 38,885 145,171 157,274

Depreciation and amortization 37,341 40,545 153,907 172,262 Net

loss (income) attributable to redeemable noncontrolling interests

in operating partnership (12,085) 15,771 (37,653) 15,033 Income tax

expense (benefit) 979 (267) 1,565 1,093 --- ---- ----- ----- EBITDA

(8,908) 235,192 12,459 472,836 Amortization of unfavorable

management contract liabilities (752) (753) (2,446) (2,446) Loss

(gain) on sale of note receivable/properties, net of taxes 511

(40,199) 511 (48,514) Gain on insurance settlement (1,329) -

(1,329) - Write-off of loan costs, premiums and exit fees(1) 1,111

789 181 798 Non-recurring severance payments - 582 - 582 Impairment

charges 58,735 5,461 218,878 5,461 Income from interest rate

derivatives (2) (19,079) (4,108) (52,282) (10,352) Unrealized loss

(gain) on derivatives 17,616 (118,481) 31,782 (79,620) -------

------- -------- -------- Adjusted EBITDA $47,905 $78,483 $207,754

$338,745 ======= ======= ======== ======== RECONCILIATION OF NET

INCOME TO FUNDS FROM OPERATIONS ("FFO") (in thousands, except per

share amounts) Three Months Ended Year Ended December 31, December

31, -------------- -------------- 2009 2008 2009 2008 ---- ----

---- ---- (Unaudited) Net (loss) income $(84,265) $155,022

$(288,660) $145,671 Loss (income) from consolidated joint ventures

attributable to noncontrolling interests 136 1,463 765 (1,444) Net

loss (income) attributable to redeemable noncontrolling interests

in operating partnership 12,085 (15,771) 37,653 (15,033) Preferred

dividends (4,830) (5,588) (19,322) (26,642) ------ ------ -------

------- Net loss attributable to common stockholders (76,874)

135,126 (269,564) 102,552 Depreciation and amortization on real

estate 37,271 40,441 153,621 171,791 Loss (gain) on sale of note

receivable/properties, net of taxes 511 (40,199) 511 (48,514) Gain

on insurance settlement (1,329) - (1,329) - Net loss (income)

attributable to redeemable noncontrolling interests in operating

partnership (12,085) 15,771 (37,653) 15,033 ------- ------ -------

------ FFO available to common stockholders (52,506) 151,139

(154,414) 240,862 Dividends on convertible preferred stock 1,043

1,043 4,171 5,735 Write-off of loan costs, premiums and exit

fees(1) 1,111 789 181 798 Non-recurring severance payments - 582 -

582 Impairment charges 58,735 5,461 218,878 5,461 Unrealized loss

(gain) on derivatives 17,616 (118,481) 31,782 (79,620) ------

-------- ------ ------- Adjusted FFO $25,999 $40,533 $100,598

$173,818 ======= ======= ======== ======== Adjusted FFO per diluted

share available to common stockholders $0.32 $0.36 $1.12 $1.31

===== ===== ===== ===== Weighted average diluted shares 80,892

112,802 89,987 132,677 ====== ======= ====== ======= (1) The

amounts include write-off of debt premiums of $1,341 for the

refinancing of a mortgage loan for the year ended December 31, 2009

and $2,086 for the sale of a hotel property for the year ended

December 31, 2008. (2) Cash income from interest rate derivatives

is excluded from the adjusted EBITDA calculations for all periods

presented. ASHFORD HOSPITALITY TRUST, INC. AND SUBSIDIARIES CASH

AVAILABLE FOR DISTRIBUTION ("CAD") (in thousands, except per share

amounts) (Unaudited) Three Months Three Months Ended Per Ended Per

December 31, Diluted December 31, Diluted 2009 Share 2008 Share

------------ ------- ------------ ------- Net (loss) income

attributable to common stockholders $(76,874) $(0.95) $135,126

$1.20 Dividends on convertible preferred stock 1,043 0.01 1,043

0.01 ----- ---- ----- ---- Total (75,831) (0.94) 136,169 1.21

Depreciation and amortization on real estate 37,271 0.46 40,441

0.36 Net (loss) income attributable to redeemable noncontrolling

interests in operating partnership (12,085) (0.15) 15,771 0.14

Stock-based compensation 1,141 0.02 1,646 0.02 Amortization of loan

costs 1,748 0.02 1,686 0.01 Write-off of loan costs, premiums and

exit fees (1) 1,111 0.01 789 0.01 Amortization of unfavorable

management contract liabilities (752) (0.01) (753) (0.01) Loss

(gain) on sale of note receivable/properties, net of taxes 511 0.01

(40,199) (0.36) Gain on insurance settlement (1,329) (0.02) - -

Non-recurring severance payments - - 582 0.01 Impairment charges

58,735 0.73 5,461 0.05 Unrealized loss (gain) on derivatives 17,616

0.22 (118,481) (1.05) Capital improvements reserve (10,311) (0.13)

(12,047) (0.11) ------- ----- ------- ----- CAD $17,825 $0.22

$31,065 $0.28 ======= ===== ======= ===== Year Year Ended Per Ended

Per December 31, Diluted December 31, Diluted 2009 Share 2008 Share

----------- ------- ----------- ----- Net (loss) income

attributable to common stockholders $(269,564) $(3.00) $102,552

$0.77 Dividends on convertible preferred stock 4,171 0.05 5,735

0.05 ----- ---- ----- ---- Total (265,393) (2.95) 108,287 0.82

Depreciation and amortization on real estate 153,621 1.71 171,791

1.30 Net (loss) income attributable to redeemable noncontrolling

interests in operating partnership (37,653) (0.42) 15,033 0.11

Stock-based compensation 5,037 0.06 6,834 0.05 Amortization of loan

costs 7,427 0.08 6,610 0.05 Write-off of loan costs, premiums and

exit fees (1) 181 - 798 0.01 Amortization of unfavorable management

contract liabilities (2,446) (0.03) (2,446) (0.02) Loss (gain) on

sale of note receivable/properties, net of taxes 511 0.01 (48,514)

(0.36) Gain on insurance settlement (1,329) (0.01) - -

Non-recurring severance payments - - 582 - Impairment charges

218,878 2.43 5,461 0.04 Unrealized loss (gain) on derivatives

31,782 0.35 (79,620) (0.60) Capital improvements reserve (40,580)

(0.45) (50,108) (0.38) ------- ----- ------- ----- CAD $70,036

$0.78 $134,708 $1.02 ======= ===== ======== ===== (1) The amounts

include write-off of debt premiums of $1,341 for the refinancing of

a mortgage loan for the year ended December 31, 2009 and $2,086 for

the sale of a hotel property for the year ended December 31, 2008.

ASHFORD HOSPITALITY TRUST, INC. AND SUBSIDIARIES DEBT SUMMARY

DECEMBER 31, 2009 (dollars in thousands) (Unaudited) Indebtedness

Collateral Maturity Interest Rate ------------ ---------- --------

------------- Senior credit facility Notes receivable April 2010

LIBOR + 2.75% to 3.5% Mortgage loan 10 hotels May 2010 LIBOR +

1.65% Mortgage loan 5 hotels December 2010 LIBOR + 1.72% Mortgage

loan 1 hotel January 2011 8.32% Mortgage loan 1 hotel March 2011

LIBOR (floor at 2.5%) + 3.75% Mortgage loan 2 hotel August 2011

LIBOR + 2.75% Mortgage loan 1 hotel March 2012 LIBOR + 4% Mortgage

loan 1 hotel December 2014 Greater of 5.5% or LIBOR + 3.5% Mortgage

loan 8 hotels December 2014 5.75% Mortgage loan 1 hotel January

2015 7.78% Mortgage loan 10 hotels July 2015 5.22% Mortgage loan 8

hotels December 2015 5.70% Mortgage loan 5 hotels December 2015

12.26% Mortgage loan 5 hotels February 2016 5.53% Mortgage loan 5

hotels February 2016 5.53% Mortgage loan 5 hotels February 2016

5.53% Mortgage loan 1 hotel December 2016 5.81% Mortgage loan 1

hotel April 2017 5.91% Mortgage loan 2 hotels April 2017 5.95%

Mortgage loan 3 hotels April 2017 5.95% Mortgage loan 5 hotels

April 2017 5.95% Mortgage loan 5 hotels April 2017 5.95% Mortgage

loan 5 hotels April 2017 5.95% Mortgage loan 7 hotels April 2017

5.95% TIF loan 1 hotel June 2018 12.85% Mortgage loan 1 hotel April

2034 Greater of 6% or Prime + 1% Indebtedness Fixed-Rate Debt

Floating-Rate Debt Total Debt ------------ ---------------

------------------ ---------- Senior credit $- $250,000 (1)(2)

$250,000 facility - 167,202 (1) 167,202 Mortgage loan - 203,400 (3)

203,400 Mortgage loan 5,816 - 5,816 Mortgage loan - 52,500 (1)

52,500 Mortgage loan - 156,600 (1) 156,600 Mortgage loan - 60,800

(1) 60,800 Mortgage loan - 19,740 19,740 Mortgage loan 110,899 -

110,899 Mortgage loan 4,345 - 4,345 Mortgage loan 160,490 - 160,490

Mortgage loan 100,576 - 100,576 Mortgage loan 141,402 - 141,402

Mortgage loan 115,645 - 115,645 Mortgage loan 95,905 - 95,905

Mortgage loan 83,075 - 83,075 Mortgage loan 101,000 (4) - 101,000

Mortgage loan 35,000 - 35,000 Mortgage loan 128,251 - 128,251

Mortgage loan 260,980 - 260,980 Mortgage loan 115,600 - 115,600

Mortgage loan 103,906 - 103,906 Mortgage loan 158,105 - 158,105

Mortgage loan 126,466 - 126,466 TIF loan 7,783 - 7,783 Mortgage

loan - 6,910 6,910 ---------- ---------- ---------- Total debt

$1,855,244 $917,152 $2,772,396 ========== ========== ==========

Percentage 66.9% 33.1% 100.0% ========== ========== ==========

Weighted average interest rate at December 31, 2009 6.30% 2.97%

5.19% ========== ========== ========== Total debt with the effect

of interest rate swap $55,244 $2,717,152 $2,772,396 ==========

========== ========== Percentage with the effect of interest rate

swap 2.0% 98.0% 100.0% ========== ========== ========== Weighted

average interest rate with the effect of interest rate swap 2.95%

2.97% 2.95% ========== ========== ========== (1) Each of these

loans has two one-year extension options. (2) Based on the

debt-to-assets ratio defined in the loan agreement, interest rate

on this debt was at LIBOR plus 3% as of December 31, 2009. (3) This

loan has a one-year extension option remaining. (4) We are

currently working with the lender for a deed-in-lieu of

foreclosure. ASHFORD HOSPITALITY TRUST, INC. AND SUBSIDIARIES DEBT

BY MATURITY ASSUMING EXTENSION OPTIONS NOT SUBJECT TO COVERAGE/LTV

TESTS ARE EXERCISED DECEMBER 31, 2009 (in thousands) (Unaudited)

2010 2011 2012 2013 2014 Thereafter Total ---- ---- ---- ---- ----

------------ ------- Secured credit facility $250,000(1) $- $- $- -

$- $250,000 Mortgage loan secured by 10 hotel properties, Wachovia

Floater - - 167,202 - - - 167,202 Mortgage loan secured by five

hotel properties - 203,400 - - - - 203,400 Mortgage loan secured by

Manchester Courtyard - 5,816 - - - - 5,816 Mortgage loan secured by

JW Marriott San Francisco - - 52,500(1) - - - 52,500 Mortgage loan

secured by two hotel properties - 156,600(2) - - - - 156,600

Mortgage loan secured by Arlington Marriott - - - - 60,800 - 60,800

Mortgage loan secured by El Conquistador Hilton - - - - 19,740 -

19,740 Mortgage loan secured by eight hotel properties, UBS Pool 1

- - - - 110,899 - 110,899 Mortgage loan secured by 10 hotel

properties, Merrill Lynch Pool 1 - - - - - 160,490 160,490 Mortgage

loan secured by eight hotel properties, UBS Pool 2 - - - - -

100,576 100,576 Mortgage loan secured by five hotel properties - -

- - - 141,402 141,402 Mortgage loan secured by five hotel

properties, Merrill Lynch Pool 2 - - - - - 115,645 115,645 Mortgage

loan secured by five hotel properties, Merrill Lynch Pool 3 -

95,905 95,905 Mortgage loan secured by five hotel properties,

Merrill Lynch Pool 7 - 83,075 83,075 Mortgage loan secured by

Westin O'Hare - - - - - 101,000(3) 101,000 Mortgage loan secured by

Philadelphia Courtyard, Wachovia Stand-Alone - - - - - 35,000

35,000 Mortgage loan secured by two hotel properties, Wachovia

Fixed Rate Pool 3 - - - - - 128,251 128,251 Mortgage loan secured

by three hotel properties, Wachovia Fixed Rate Pool 7 - - - - -

260,980 260,980 Mortgage loan secured by five hotel properties,

Wachovia Fixed Rate Pool 1 - - - - - 115,600 115,600 Mortgage loan

secured by five hotel properties, Wachovia Fixed Rate Pool 5 - - -

- - 103,906 103,906 Mortgage loan secured by five hotel properties,

Wachovia Fixed Rate Pool 6 - - - - - 158,105 158,105 Mortgage loan

secured by seven hotel properties, Wachovia Fixed Rate Pool 2 - - -

- - 126,466 126,466 TIF loan secured by Philadelphia Courtyard - -

- - - 7,783 7,783 Mortgage loan secured by Houston Hampton Inn - -

- - - 4,345 4,345 Mortgage loan secured by Jacksonville Residence

Inn - - - - - 6,910 6,910 ---------------- -------- -------- ------

-------- ---------- ---------- $250,000 $365,816 $219,702 $-

$191,439 $1,745,439 $2,772,396 ======== ======== ======== ======

======== ========== ========== NOTE: These maturities assume no

event of default would occur. (1) Extensions available but certain

coverage tests have to be met. (2) Extensions available but certain

LTV tests have to be met. (3) We are currently working with the

lender for a deed-in-lieu of foreclosure. ASHFORD HOSPITALITY

TRUST, INC. KEY PERFORMANCE INDICATORS - PRO FORMA (Unaudited)

Three Months Ended Year Ended December 31, December 31,

------------------------ ----------------------- 2009 2008

%Variance 2009 2008 %Variance ---- ---- --------- ---- ----

--------- ALL HOTELS INCLUDED IN CONTINUING OPERATIONS: Room

revenues (in thousands) $177,882 $211,789 -16.01% $697,760 $853,895

-18.29% RevPAR $78.52 $90.76 -13.49% $85.10 $103.15 -17.50%

Occupancy 63.19% 65.33% -2.14% 65.87% 71.73% -5.86% ADR $124.26

$138.93 -10.56% $129.20 $143.80 -10.15% Three Months Ended Year

Ended December 31, December 31, ------------------------

----------------------- 2009 2008 %Variance 2009 2008 %Variance

---- ---- --------- ---- ---- --------- ALL HOTELS NOT UNDER

RENOVATION INCLUDED IN CONTINUING OPERATIONS: Room revenues (in

thousands) $161,977 $192,492 -15.85% $630,359 $771,261 -18.27%

RevPAR $78.10 $90.07 -13.29% $84.10 $101.90 -17.47% Occupancy

63.19% 65.00% -1.81% 65.54% 71.32% -5.78% ADR $123.61 $138.57

-10.80% $128.33 $142.87 -10.18% NOTES: (1) The above pro forma

table assumes the 95 hotel properties owned and included in

continuing operations at December 31, 2009, but not under

renovation for the three and twelve months ended December 31, 2009,

were owned as of the beginning of the periods presented. (2)

Excluded Hotels Under Renovation: Hilton Torrey Pines, Hilton

Nassau Bay, Residence Inn Orlando Sea World, Edison Courtyard,

Embassy Suites Orlando Airport, Marriott Bridgewater, Embassy

Suites Portland (3) As the Company's Courtyard by Marriott hotel in

Philadelphia, Pennsylvania, is leased to a third-party tenant on a

triple-net lease basis, the Company only records rental income

related to this operating lease for GAAP purposes. However, in the

above pro forma table, all room revenues related to this hotel are

reflected, which is consistent with the Company's other hotels.

ASHFORD HOSPITALITY TRUST, INC. PRO FORMA HOTEL OPERATING PROFIT

(dollars in thousands) (Unaudited) ALL HOTELS INCLUDED IN

CONTINUING OPERATIONS: Three Months Ended December 31,

------------------ 2009 2008 % Variance ---- ---- --------------

REVENUE Rooms $177,882 $211,789 -16.0% Food and beverage 50,217

60,111 -16.5% Other 11,389 12,903 -11.7% ------ ------ ----- Total

hotel revenue 239,488 284,803 -15.9% ------- ------- ----- EXPENSES

Rooms 43,354 47,943 -9.6% Food and beverage 34,887 42,188 -17.3%

Other direct 6,520 7,486 -12.9% Indirect 72,434 82,133 -11.8%

Management fees, includes base and incentive fees 10,531 13,566

-22.4% ------ ------ ----- Total hotel operating expenses 167,726

193,316 -13.2% Property taxes, insurance, and other 15,972 16,644

-4.0% ------ ------ ---- HOTEL OPERATING PROFIT (Hotel EBITDA)

55,790 74,843 -25.5% Hotel EBITDA Margin 23.30% 26.27% -2.97%

Minority interest in earnings of consolidated joint ventures 1,482

1,778 -16.6% ----- ----- ----- HOTEL OPERATING PROFIT (Hotel

EBITDA), excluding minority interest in joint ventures $54,308

$73,065 -25.7% ======= ======= ===== Year Ended December 31,

---------------- 2009 2008 % Variance ---- ---- --------------

REVENUE Rooms $697,760 $853,895 -18.3% Food and beverage 178,773

225,503 -20.7% Other 45,103 49,540 -9.0% ------ ------ ---- Total

hotel revenue 921,636 1,128,938 -18.4% ------- --------- -----

EXPENSES Rooms 162,908 186,641 -12.7% Food and beverage 127,640

159,061 -19.8% Other direct 25,642 28,617 -10.4% Indirect 273,243

312,155 -12.5% Management fees, includes base and incentive fees

40,435 53,646 -24.6% ------ ------ ----- Total hotel operating

expenses 629,868 740,120 -14.9% Property taxes, insurance, and

other 61,871 61,342 0.9% ------ ------ --- HOTEL OPERATING PROFIT

(Hotel EBITDA) 229,897 327,476 -29.8% Hotel EBITDA Margin 24.94%

29.00% -4.06% Minority interest in earnings of consolidated joint

ventures 6,030 8,146 -26.0% ----- ----- ----- HOTEL OPERATING

PROFIT (Hotel EBITDA), excluding minority interest in joint

ventures $223,867 $319,330 -29.9% ======== ======== ===== NOTE: The

above pro forma table assumes the 102 hotel properties owned and

included in continuing operations at December 31, 2009 were owned

as of the beginning of the periods presented. ALL HOTELS NOT UNDER

RENOVATION INCLUDED IN CONTINUING OPERATIONS: Three Months Ended

December 31, ---------------- 2009 2008 % Variance ----- -----

-------------- REVENUE Rooms (1) $161,977 $192,492 -15.9% Food and

beverage 44,190 51,621 -14.4% Other 9,762 11,157 -12.5% -----

------ ----- Total hotel revenue 215,929 255,270 -15.4% -------

------- ----- EXPENSES Rooms (1) 39,709 43,732 -9.2% Food and

beverage 30,980 37,044 -16.4% Other direct 5,603 6,406 -12.5%

Indirect 65,304 73,967 -11.7% Management fees, includes base and

incentive fees 9,722 12,468 -22.0% ----- ------ ----- Total hotel

operating expenses 151,318 173,617 -12.8% Property taxes,

insurance, and other 14,301 15,125 -5.4% ------ ------ ---- HOTEL

OPERATING PROFIT (Hotel EBITDA) 50,310 66,528 -24.4% Hotel EBITDA

Margin 23.30% 26.06% -2.76% Minority interest in earnings of

consolidated joint ventures 1,482 1,778 -16.6% ----- ----- -----

HOTEL OPERATING PROFIT (Hotel EBITDA), excluding minority interest

in joint ventures $48,828 $64,750 -24.6% ======= ======= ===== Year

Ended December 31, ---------------- 2009 2008 % Variance -----

----- -------------- REVENUE Rooms (1) $630,359 $771,261 -18.3%

Food and beverage 156,565 194,007 -19.3% Other 38,869 42,418 -8.4%

------ ------ ---- Total hotel revenue 825,793 1,007,686 -18.1%

------- --------- ----- EXPENSES Rooms (1) 148,428 169,560 -12.5%

Food and beverage 113,202 139,410 -18.8% Other direct 22,092 24,466

-9.7% Indirect 245,602 280,320 -12.4% Management fees, includes

base and incentive fees 37,154 49,145 -24.4% ------ ------ -----

Total hotel operating expenses 566,478 662,901 -14.5% Property

taxes, insurance, and other 55,153 55,368 -0.4% ------ ------ ----

HOTEL OPERATING PROFIT (Hotel EBITDA) 204,162 289,417 -29.5% Hotel

EBITDA Margin 24.72% 28.72% -4.00% Minority interest in earnings of

consolidated joint ventures 6,030 8,146 -26.0% ----- ----- -----

HOTEL OPERATING PROFIT (Hotel EBITDA), excluding minority interest

in joint ventures $198,132 $281,271 -29.6% ======== ======== =====

NOTES: (1) The above pro forma table assumes the 95 hotel

properties owned and included in continuing operations at December

31, 2009, but not under renovation for the three and twelve months

ended December 31, 2009, were owned as of the beginning of the

periods presented. (2) Excluded Hotels Under Renovation: Hilton

Torrey Pines, Hilton Nassau Bay, Residence Inn Orlando Sea World,

Edison Courtyard, Embassy Suites Orlando Airport, Marriott

Bridgewater, Embassy Suites Portland (3) As the Company's Courtyard

by Marriott hotel in Philadelphia, Pennsylvania, is leased to a

third-party tenant on a triple-net lease basis, the Company only

records rental income related to this operating lease for GAAP

purposes. However, in the above pro forma table, all room revenues

related to this hotel are reflected, which is consistent with the

Company's other hotels. ASHFORD HOSPITALITY TRUST, INC. PRO FORMA

HOTEL REVPAR BY REGION (Unaudited) Three Months Ended Year Ended

Number Number December 31, December 31, of of ---------------------

--------------------- Region Hotels Rooms 2009 2008 % Change 2009

2008 % Change ------ ------ ----- ---- ---- -------- ---- ----

-------- Pacific(1) 21 5,205 $84.86 $99.83 -15.0% $91.08 $115.52

-21.2% Mountain(2) 8 1,704 65.37 77.17 -15.3% 74.34 96.63 -23.1%

West North Central(3) 3 690 65.45 73.97 -11.5% 70.38 86.48 -18.6%

West South Central(4) 10 2,086 77.43 98.66 -21.5% 83.69 103.50

-19.1% East North Central(5) 9 1,852 59.78 69.68 -14.2% 62.47 81.48

-23.3% East South Central(6) 2 236 64.85 70.61 -8.2% 75.19 88.22

-14.8% Middle Atlantic(7) 9 2,481 86.46 94.50 -8.5% 85.12 101.32

-16.0% South Atlantic (8) 38 7,728 80.39 90.71 -11.4% 91.10 104.10

-12.5% New England(9) 2 159 71.32 79.25 -10.0% 69.14 85.76 -19.4%

--- ------ ------ ------ ----- ------ ------- ----- Total Portfolio

102 22,141 $78.52 $90.76 -13.5% $85.10 $103.15 -17.5% === ======

====== ====== ===== ====== ======= ===== (1) Includes Alaska,

California, Oregon, and Washington (2) Includes Nevada, Arizona,

New Mexico, and Utah (3) Includes Minnesota and Kansas (4) Includes

Texas (5) Includes Ohio, Michigan, Illinois, and Indiana (6)

Includes Kentucky and Alabama (7) Includes New York, New Jersey,

and Pennsylvania (8) Includes Virginia, Florida, Georgia, Maryland,

District of Columbia, and North Carolina (9) Includes Massachusetts

and Connecticut NOTES: (1) The above pro forma table assumes the

102 hotel properties owned and included in continuing operations at

December 31, 2009 were owned as of the beginning of the periods

presented. (3) As the Company's Courtyard by Marriott hotel in

Philadelphia, Pennsylvania, is leased to a third-party tenant on a

triple-net lease basis, the Company only records rental income

related to this operating lease for GAAP purposes. However, in the

above pro forma table, all room revenues related to this hotel are

reflected, which is consistent with the Company's other hotels.

ASHFORD HOSPITALITY TRUST, INC. PRO FORMA HOTEL REVPAR BY BRAND

(Unaudited) Three Months Ended Year Ended Number Number December

31, December 31, of of --------------------- ----------------------

Brand Hotels Rooms 2009 2008 % Change 2009 2008 % Change -----

------ ----- ---- ---- -------- ---- ---- -------- Hilton 34 7,513

$81.69 $94.09 -13.2% $90.05 $109.09 -17.5% Hyatt 1 242 101.35 97.22

4.2% 105.06 132.65 -20.8% Inter- Continental 2 420 128.85 123.26

4.5% 129.49 145.12 -10.8% Independent 2 317 60.14 55.87 7.6% 69.10

55.66 24.1% Marriott 57 11,714 78.18 91.74 -14.8% 83.56 100.93

-17.2% Starwood 6 1,935 57.52 67.83 -15.2% 65.11 88.01 -26.0% ---

------ ------ ------ ----- ------ ------- ----- Total Portfolio 102

22,141 $78.52 $90.76 -13.5% $85.10 $103.15 -17.5% === ====== ======

====== ===== ====== ======= ===== NOTES: (1) The above pro forma

table assumes the 102 hotel properties owned and included in

continuing operations at December 31, 2009 were owned as of the

beginning of the periods presented. (3) As the Company's Courtyard

by Marriott hotel in Philadelphia, Pennsylvania, is leased to a

third-party tenant on a triple-net lease basis, the Company only

records rental income related to this operating lease for GAAP

purposes. However, in the above pro forma table, all room revenues

related to this hotel are reflected, which is consistent with the

Company's other hotels. ASHFORD HOSPITALITY TRUST, INC. PRO FORMA

HOTEL OPERATING PROFIT BY REGION (dollars in thousands) (Unaudited)

Number of Number of Region Hotels Rooms ------ ------ ----- Pacific

(1) 21 5,205 Mountain (2) 8 1,704 West North Central (3) 3 690 West

South Central (4) 10 2,086 East North Central (5) 9 1,852 East

South Central (6) 2 236 Middle Atlantic (7) 9 2,481 South Atlantic

(8) 38 7,728 New England (9) 2 159 --- ------ Total Portfolio 102

22,141 === ====== Three Months Ended December 31, ------------

Region 2009 % Total 2008 % Total % Change ------ ---- ------- ----

------- -------- Pacific (1) $14,348 25.7% $20,688 27.6% -30.6%

Mountain (2) 2,150 3.8% 3,652 4.9% -41.1% West North Central (3)

1,563 2.8% 1,995 2.7% -21.7% West South Central (4) 5,552 10.0%

8,372 11.2% -33.7% East North Central (5) 2,874 5.2% 3,516 4.7%

-18.3% East South Central (6) 362 0.6% 553 0.7% -34.5% Middle

Atlantic (7) 7,868 14.1% 8,925 11.9% -11.8% South Atlantic (8)

20,735 37.2% 26,702 35.7% -22.3% New England (9) 338 0.6% 440 0.6%

-23.2% ------- ----- ------- ----- ----- Total Portfolio $55,790

100.0% $74,843 100.0% -25.5% ======= ===== ======= ===== ===== Year

Ended December 31, ------------ Region 2009 % Total 2008 % Total %

Change ------ ---- ------- ---- ------- -------- Pacific (1)

$57,508 25.0% $91,489 27.9% -37.1% Mountain (2) 12,771 5.6% 22,238

6.8% -42.6% West North Central (3) 6,654 2.9% 9,498 2.9% -29.9%

West South Central (4) 23,590 10.3% 31,633 9.7% -25.4% East North

Central (5) 10,398 4.5% 21,025 6.4% -50.5% East South Central (6)

2,412 1.0% 3,154 1.0% -23.5% Middle Atlantic (7) 23,304 10.1%

32,747 10.0% -28.8% South Atlantic (8) 92,123 40.1% 113,896 34.8%

-19.1% New England (9) 1,137 0.5% 1,796 0.5% -36.7% -------- -----

-------- ----- ----- Total Portfolio $229,897 100.0% $327,476

100.0% -29.8% ======== ===== ======== ===== ===== (1) Includes

Alaska, California, Oregon, and Washington (2) Includes Nevada,

Arizona, New Mexico, and Utah (3) Includes Minnesota and Kansas (4)

Includes Texas (5) Includes Ohio, Michigan, Illinois, and Indiana

(6) Includes Kentucky and Alabama (7) Includes New York, New

Jersey, and Pennsylvania (8) Includes Virginia, Florida, Georgia,

Maryland, District of Columbia, and North Carolina (9) Includes

Massachusetts and Connecticut NOTES: (1) The above pro forma table

assumes the 102 hotel properties owned and included in continuing

operations at December 31, 2009 were owned as of the beginning of

the periods presented. (3) As the Company's Courtyard by Marriott

hotel in Philadelphia, Pennsylvania, is leased to a third-party

tenant on a triple-net lease basis, the Company only records rental

income related to this operating lease for GAAP purposes. However,

in the above pro forma table, all room revenues related to this

hotel are reflected, which is consistent with the Company's other

hotels. ASHFORD HOSPITALITY TRUST, INC. PRO FORMA HOTEL OPERATING

PROFIT MARGIN (Unaudited) 95 HOTELS NOT UNDER RENOVATION AND

INCLUDED IN CONTINUING OPERATIONS AT DECEMBER 31, 2009 AS IF SUCH

HOTELS WERE OWNED AS OF THE BEGINNING OF THE PERIODS PRESENTED:

HOTEL OPERATING PROFIT (HOTEL EBITDA) MARGIN: 4th Quarter 2009

23.30% 4th Quarter 2008 26.06% ----- Variance -2.76% ===== HOTEL

OPERATING PROFIT (HOTEL EBITDA) MARGIN VARIANCE BREAKDOWN: Rooms

-1.20% Food & Beverage and Other Departmental 0.08%

Administrative & General -0.25% Sales & Marketing 0.35%

Hospitality -0.05% Repair & Maintenance -0.45% Energy -0.47%

Franchise Fee -0.19% Management Fee 0.02% Incentive Management Fee

0.36% Insurance -0.46% Property Taxes -0.53% Other Taxes 0.28%

Leases/Other -0.25% ----- Total -2.76% ===== NOTE: As the Company's

Courtyard by Marriott hotel in Philadelphia, Pennsylvania, is

leased to a third-party tenant on a triple-net lease basis, the

Company only records rental income related to this operating lease

for GAAP purposes. However, in the above pro forma table, all

operating results related to this hotel are reflected, which is

consistent with the Company's other hotels. ASHFORD HOSPITALITY

TRUST, INC. PRO FORMA SEASONALITY TABLE (dollars in thousands)

(Unaudited) ALL 102 HOTELS OWNED AND INCLUDED IN CONTINUING

OPERATIONS AS OF DECEMBER 31, 2009: 2009 2009 2009 2009 4th Quarter

3rd Quarter 2nd Quarter 1st Quarter TTM ----------- -----------

----------- ----------- --- Total Hotel Revenue $239,488 $216,433

$233,947 $231,768 $921,636 Hotel EBITDA $55,790 $50,049 $61,126

$62,932 $229,897 Hotel EBITDA Margin 23.3% 23.1% 26.1% 27.2% 24.9%

EBITDA % of Total TTM 24.3% 21.8% 26.6% 27.4% 100.0% JV Interests

in EBITDA $1,482 $1,139 $1,839 $1,570 $6,030 NOTES: (1) The above

pro forma table assumes the 102 hotel properties owned and included

in continuing operations at December 31, 2009 were owned as of the

beginning of the periods presented. (3) As the Company's Courtyard

by Marriott hotel in Philadelphia, Pennsylvania, is leased to a

third-party tenant on a triple-net lease basis, the Company only

records rental income related to this operating lease for GAAP

purposes. However, in the above pro forma table, all room revenues

related to this hotel are reflected, which is consistent with the

Company's other hotels. ASHFORD HOSPITALITY TRUST, INC. Capital

Expenditures Calendar 102 Hotels (a) 2009

------------------------------------- Actual Actual Actual Actual

1st 2nd 3rd 4th Rooms Quarter Quarter Quarter Quarter ----- -------

------- ------- ------- Sheraton Anchorage 370 x Marriott Legacy

Center 404 x Hilton Rye Town 446 x x x Hilton Nassau Bay - Clear

Lake 243 x x x x Residence Inn Orlando Sea World 350 x x Courtyard

Edison 146 x x Embassy Suites Orlando Airport 174 x x Embassy

Suites Portland - Downtown 276 x Hilton La Jolla Torrey Pines 296 x

Marriott Bridgewater 347 x Capital Hilton 408 Sheraton City Center

- Indianapolis 371 Embassy Suites Philadelphia Airport 263 Hilton

Costa Mesa 486 Embassy Suites Las Vegas Airport 220 Sheraton

Minneapolis West 222 Crowne Plaza Beverly Hills 260 Hilton Tucson

El Conquistador Golf Resort 428 Embassy Suites Crystal City -

Reagan Airport 267 Hilton Minneapolis Airport 300 Marriott Seattle

Waterfront 358 Embassy Suites Austin Arboretum 150 Fairfield Inn

and Suites Kennesaw 87 ----- 2010 Estimated Estimated Estimated

Estimated 1st 2nd 3rd 4th Quarter Quarter Quarter Quarter -------

------- ------- ------- Sheraton Anchorage x Marriott Legacy Center

x Hilton Rye Town Hilton Nassau Bay - Clear Lake x x Residence Inn

Orlando Sea World Courtyard Edison Embassy Suites Orlando Airport

Embassy Suites Portland - Downtown x Hilton La Jolla Torrey Pines x

Marriott Bridgewater x x Capital Hilton x x x Sheraton City Center

- Indianapolis x x Embassy Suites Philadelphia Airport x Hilton

Costa Mesa x x Embassy Suites Las Vegas Airport x x Sheraton

Minneapolis West x x Crowne Plaza Beverly Hills x x Hilton Tucson

El Conquistador Golf Resort x x Embassy Suites Crystal City -

Reagan Airport x Hilton Minneapolis Airport x Marriott Seattle

Waterfront x Embassy Suites Austin Arboretum x Fairfield Inn and

Suites Kennesaw x (a) Only hotels which have had or are expected to

have significant capital expenditures that could result in

displacement during 2009 and 2010 are included in this table.

DATASOURCE: Ashford Hospitality Trust, Inc. CONTACT: David

Kimichik, Chief Financial Officer, +1-972-490-9600; Tripp Sullivan,

Corporate Communications, Inc., +1-615-254-7318 Web Site:

http://www.ahtreit.com/

Copyright

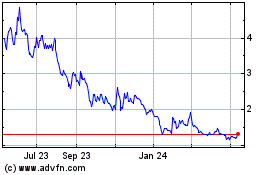

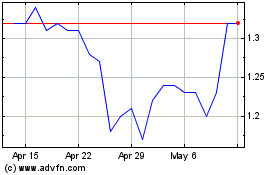

Ashford Hospitality (NYSE:AHT)

Historical Stock Chart

From May 2024 to Jun 2024

Ashford Hospitality (NYSE:AHT)

Historical Stock Chart

From Jun 2023 to Jun 2024