About the Industry

The Metals & Mining industry encompasses the extraction

(mining) as well as the primary and secondary processing of metals

and minerals such as aluminum, gold, precious metals, coal and

steel. The industry is oligarchic in structure, with a few

producers accounting for the lion’s share of the output.

The largest segment of the global metals market is iron and steel,

followed by aluminum. The iron and steel segment comprises more

than half the industry in terms of volume. This industry includes

metal ore exploration and mining services, as well as iron and

steel foundries for smelting, rolling, forging, spinning,

recycling, stamping, polishing and plating of iron and steel

products such as pipes, tubes, wire, spring, rolls and bars.

The precious metal and mineral industry consists of companies

engaged in the extraction and primary processing of gold, silver,

platinum, diamond, semi-precious stones, uranium and other rare

minerals and ores, along with the cultivation of pearls.

Overall Industry Outlook

The global metal industry is cyclical, highly competitive and has

historically been characterized by overcapacity (excess of supply

over demand). Metal producers are subject to cyclical fluctuations

in London Metal Exchange (LME) prices, general economic conditions

and end-use markets.

Profitability at the individual company level depends on volume and

operating efficiency. Large producers with huge resources are able

to discover and develop new deposits, thereby boosting reserves,

while the smaller ones own fewer mines.

Mergers and acquisitions (M&A) have historically been a

critically important growth strategy for mining companies. The year

2009 experienced a lull in M&A activity under the impact of the

global economic downturn and the focus shifted from business growth

to business survival, as companies looked to safeguard their

teetering balance sheets rather than seeking expansion.

However, reversing the trend, 2010 witnessed a surge in mining

deals as the rise in commodity prices, economic recovery, demand in

developing markets, growing scarcity of resources and refreshed

balance sheets spurred merger activity.

2011 was a busy year in terms of M&A activity despite the

European debt crisis, earthquake in Japan, social unrest in the

Middle East, and downgrade of the U.S. government’s debt rating. We

expect the momentum in M&A to sustain in 2012 as well. Armed

with healthy balance sheets, reduced economic uncertainty and a

pent-up demand for new projects, we expect the companies in the

industry to accelerate deal activity with a re-focus on

consolidation.

In an industry plagued with rising energy and raw material costs,

increasing productivity and reducing costs are the keys to success.

Given the cyclical nature of the metals industry, low-volume,

high-cost producers need to generate sufficient cash or ensure a

strong borrowing position during market peaks to survive the market

troughs.

Continuing consolidation supports the sector’s ability to influence

the price of input costs and companies can also obtain synergies

and economies of scale through the operation of vertically

integrated raw materials sources. Expansion in low-cost countries

will ensure lower labor costs and also help tap their growth

potential.

The Glencore-Xstrata merger currently in the offing is one of the

biggest ever in the mining sector. If it materializes, it would

result in a combined new business of $90 billion and will be the

world's biggest exporter of coal for power plants and the largest

producer of zinc. This will be the largest mining transaction in

history, dwarfing the earlier major deals like Rio Tinto-Alcan in

2007 and Vale-Inco in 2006.

Demand in the metals and mining industry has benefitted from the

strong growth in emerging markets. China and India in particular,

are witnessing higher production and consumption of metals. Per

capita consumption levels in both these countries are calibrating

to U.S levels, which could, theoretically at least, double metal

demand in the longer term.

China is the world’s largest consumer of metals and is expected to

remain so in the future. Overall, we expect global metal demand to

improve in the long term with the recovery of user industries.

Demand as well as production for industrial metals in Japan had

been recently affected, as factories were shut down in the

aftermath of the country’s strongest earthquake and tsunami. Japan

is the biggest buyer of aluminum and the second largest buyer of

copper ore.

We believe the industry will continue to benefit from the metal

demand generated from the country’s rebuilding activity. Sovereign

debt issues and sluggish growth in Europe however remain lingering

concerns.

A Detailed Look into Metals

Steel

As the major shareholder (about 60%) of the metals market, the

steel industry was severely bruised by the global economic

downturn. But the recovery has been swift and forceful. According

to the World Steel Association, world crude steel production was a

record 1,527 million tons (Mt) in 2011, outperforming the 2010

record of 1,414 Mt, a 6.8% jump.

China continues to retain its status as the largest steel producing

country, yielding almost half of the global output at 46%, and

growing 8.9% year over year. Japan, the second largest producer

country, however posted a 1.8% decline due to the earthquake.

The United States remained in the third position, producing 86.2 Mt

of crude steel, 7.1% higher than 2010 and comprising 6% of the

total global output.

North America’s crude steel production was 118.9 Mt, an increase of

6.8% on 2010. In Asia, overall growth was noted at 7.9% and

Europe rose 4.6%. As per January figures, in the current fiscal,

world crude steel production was 117 Mt, a 7.8% dip from January

2011 but flat with December 2011 levels.

Reflecting on the 2011 results of the steel companies in our

coverage - ArcelorMittal (MT), AK Steel

Holding Corporation (AKS) and Nucor

Corporation (NUE) -- revenues increased across the board

due to higher average steel prices and increase in shipments.

ArcelorMittal, the world’s largest steel producing company,

produced 91.9 million tons in fiscal 2011, representing 6% of the

world's steel output. ArcelorMittal’s 2011 sales increased 10% to

$94 billion and for AK Steel sales climbed 8% to $6.5 billion.

Nucor recorded sales increase of 21% to reach $20 billion.

In terms of profitability, Nucor stood tall with its fiscal 2011

EPS of $2.45, almost six fold the 42 cents earned in 2010.

ArcelorMittal’s EPS in fiscal 2011 plummeted 31% to $1.19. AK Steel

reversed its year-ago loss to earn 9 cents (excluding special

items) in 2011. U.S. Steel Corp (X), though still

in red, narrowed its fiscal 2011 loss per share to 47 cents from

the year-ago loss of $3.36.

Currently, Nucor, United Steel and AK Steel retain a Zacks #3 Rank

(Hold) for the short term (1 to 3 months) that corresponds with our

Neutral recommendations in the long term. ArcelorMittal retains a

Zacks #4 Rank (Sell) and we have recently downgraded our long-term

recommendation from Neutral to Underperform.

The steel industry had been severely affected by the global

economic crisis. However, there were signs of a turnaround from the

second half of 2009 which continued into 2010 and 2011 at tandem

with global economic activity. Demand for steel products

nonetheless remains below pre-recession levels. We expect the

recovery to be slow and steady in 2012.

The steel companies expect volumes to improve in 2012 on recovering

demand from improving end-markets, backed by a recuperating global

economy. They expect operating results to significantly improve

from 2011 levels mainly driven by improved average realized prices

and higher shipments. Steel consumption is expected to grow in the

automotive, transportation, energy, industrial, and the

agricultural sectors.

The automotive and construction markets have historically been the

largest consumers of steel. The automotive sector is showing

significant promise. In February 2012, total motor vehicle sales

reached the highest level since February 2008 at 15.1 million SAAR

(Seasonally Adjusted Annual Rate). For the first two months of

2012, sales have averaged 14.6 million SAAR, outperforming the

Street expectations.

The construction sector has been a drag on the steel companies’

earnings. However, we see some early signs of recovery in

non-residential construction.

According to the American Institute of Architects, the architecture

billings index, an economic indicator that provides an

approximately nine to twelve month glimpse into the future of

non-residential construction spending activity, was 50.9 in January

2012. The index has remained over 50 for the third consecutive

month, a sure indicator of an overall rise in demand.

The optimism is seen across most regions of the country and the

major construction sectors. However, given the continued

uncertainty in the market, we expect soft to very moderate

near-term growth in demand in this sector.

According to the data released by the U.S. Department of Housing

and Urban Development, housing starts increased 1.5% to a

seasonally adjusted annual rate of 699,000 in January 2012 from

December 2011 and 9.9% above January 2011.

Building permits in January were at a seasonally adjusted annual

rate of 676,000, 0.7% above the December figure of 671,000 and 19%

above the January 2011 number. These figures provide a glimmer of

hope that U.S. residential construction is finally on a road to

recovery.

Based on expected economic growth from developing countries like

China, India and South Korea, steel prices will be pushed up higher

in the future. However, the European debt crisis and its potential

global impact remain an overhang on the steel industry.

Given the scenario in Europe, ArcelorMittal has idled 5 of its 25

blast furnaces in Europe. The company will continue to align its

steel growth projects to match demand situations. Furthermore, the

company’s focus on its mining business given its more attractive

returns has resulted in some planned steel investments being

deferred.

Gold

As per the World Gold Council reports, 2011 was a milestone year

for gold as global demand for the yellow metal grew 0.4% to 4,067.1

tons at an estimated value of $205.5 billion -- the highest tonnage

level with a value exceeding $200 billion since 1997. The increase

was mainly propelled by the investment sector, particularly in

India, China and Europe.

Mine production increased 4% year over year to a record level of

2809.5 tons. However, there was a decline noted in recycling

activity as consumers held on to their gold in the expectation of

even higher prices. Central banks purchases rose significantly to

440 tons from 77 tons in the prior year reflecting the need to

diversify assets, reduce reliance on one or two foreign currencies

and rebalance reserves. Central banks have been net buyers for

three straight years, the longest stretch since 1973.

Demand for gold bars and coins were robust due to the concerns

raging in Europe, inflation in some countries and the

unsatisfactory performance of a range of alternative instruments.

The ongoing crisis in Europe has positively affected the demand for

gold given the need for asset protection.

Jewelry demand was particularly strong in the first half of 2011

driven by the two major markets, China and India, due to the timing

of local festivals. China and India remain the major consumers of

gold, generating 55% of global jewelry demand and 49% of global

demand. However, record prices in September combined with price

volatility deviated customers towards other investment

products.

On the whole, a 28% increase in average annual price led to an

annual decline of 3% in tonnage demand in fiscal 2011.

Notwithstanding this, annual demand was a record $99.2 billion.

Gold demand in the technology sector was at 463.5 tons worth $23.4

billion, a 28% increase year over year. Particular strength was

noted in automotive electronics, industrial electronics and

wireless equipment segments. However, the memory sector weakened

considerably and is expected to remain so in 2012 as well. Severe

flooding in Thailand which affected hard disk drive shipments,

ongoing turmoil in Europe, and shift toward other non-precious

metals also contributed to the weakness.

Gold prices in 2011 ranged from a low of $1,310 per ounce to a high

of $1,895 per ounce. The record gold price of $1,895 per ounce was

attained in September, 33% higher than the 2010 peak of $1,421 per

ounce recorded in November 2010. Average gold price was $1,572 per

ounce in 2011 compared with the prior year average of $1,223 per

ounce.

So far in 2012, gold has ranged from $1,598 per ounce to $1,781 per

ounce, with an average of $1,698 per ounce. Continuing concerns

about Europe's financial problems and China’s reduced economic

growth forecast led to the climb. Given the performance in 2011,

and thus far in 2012, we expect his year to be stellar for the

yellow metal.

Gold remains a coveted asset given its long-term supply and demand

dynamics and influenced by macro-economic factors. Concerns

regarding economic growth in developed countries made gold an

attractive and safe investment option. The European sovereign debt

crisis made European investors use gold as a currency hedge.

Pressure on the US dollar against various currencies coupled with

higher inflation expectations in many countries, including India

and China, pushed up gold prices.

The value and wealth preservation attributes of gold continue to

attract investors and consumers. Jewelry and investment demand in

non-western markets continues to rebound while industrial demand

has started to recover in response to an improvement in economic

conditions. India, which alone consumes nearly 45%−50% of the world

gold production, should drive demand for gold along with China.

China will likely emerge as the largest gold market in the world in

2012 and Chinese gold demand is expected to double in 10 years.

Higher prices bode well for gold producers, which should benefit

giants such as Barrick Gold Corporation (ABX),

Agnico-Eagle (AEM) and Goldcorp

Inc. (GG). However, gold producers like Newmont

Mining (NEM) and Kinross Gold Corporation

(KGC) suffer from lower ore grades that subdue production levels,

increase mining costs and negate the benefits of rising gold

prices.

Ironically, rallying gold prices are not having the same effect on

the share prices of the gold companies. This is reflected in our

overall long-term neutral view on the space. Investors prefer

alternative financial products that allow them to invest in gold

rather than investing in gold companies per se that are grappling

with labor issues, escalating cost and other risks.

As the major economies continue to recover, investor confidence in

the stock markets will be restored, causing gold prices to fall. In

reality this is not going to happen anytime soon. The stocks of

Barrick Gold, Newmont Mining, Goldcorp and Kinross Gold Corporation

retain a Zacks #3 Rank (Hold). However, Agnico Eagle holds a Zacks

#5 Rank (Strong Sell).

Aluminum

The aluminum industry is highly cyclical, with prices subject to

worldwide supply and demand forces along with other influences. The

global economic downturn had a drastically negative impact on the

aluminum industry, leading to an unprecedented decline in LME-based

aluminum prices, weak end markets, fall in demand, increased global

inventories, and higher costs of borrowing and diminished credit

availability. The sector has however recovered from recessionary

lows.

Alcoa Inc. (AA), the world leader in the

production and management of primary aluminum, in response to the

global economic downturn implemented a number of operational and

financial actions to improve its cost structure and liquidity,

including curtailing production, halting non-critical capital

expenditures, accelerating new sourcing strategies for raw

materials, divesting non-core assets, reducing global headcount,

suspending its share repurchase program, reducing its quarterly

common stock dividend and resorting to other liquidity

enhancements.

For fiscal 2011, Alcoa reported adjusted earnings of 72 cents per

share, reversing the year-ago loss of 3 cents per share. The

company anticipates that global aluminum demand will go up 7% and

burgeoning demand for aluminum along with market-related production

cutbacks will lead to a global aluminum industry deficit of 600,000

metric tons in 2012.

Aluminium demand started on a strong note in 2011 but weakened in

the second half. Overall, aluminium demand grew 10% in the year

after 13% growth witnessed in 2010. Overall, Alcoa believes that

the long-term prospects for aluminum remain bright and envisions

that global demand for aluminum will double by 2020.

Market conditions for aluminum products are expected to improve

globally, particularly in aerospace (10–11%), driven by rising

demand for large commercial aircraft. The strong performance at the

automotive sector in the fourth quarter is expected to sustain in

2012, growing at en estimated clip of 3–5%. Commercial

transportation is expected to grow 2–5%, packaging in the range of

2–3% and building and construction markets in the band of 4–5%.

Region-wise, in 2012, China is expected to lead the pack with a

growth of 12% followed shortly by India with a 10% rise. Asia

(excluding China) is expected to record a growth of 9% and North

America 3%. Russia and Brazil are expected to increase 4% and 3%,

respectively. Europe, besieged by sovereign debt problems, is

expected to remain flat year over year.

Since the sudden decline from peak prices in mid-2008, aluminum

prices have subsequently increased. In 2010, global aluminum prices

rose 13%. However, in the fourth quarter of fiscal 2011, aluminum

prices plunged 27% from peak levels in April 2011. This was

perpetrated by market concerns that the eurozone debt crisis could

affect the global manufacturing industry and would lead to a huge

downside in metals demand.

Consequently, profits for the mining companies took a blow

compelling them to cut back on production. Rio Tinto announced

plans to sell its aluminium assets and close its smelter in order

to cut costs.

Alcoa plans to close or curtail 531,000 metric tons, or

approximately 12% of its global smelting capacity, in the first

half of 2012. This will lower the company’s cost position by 10

percentage points and improve its competitiveness. Energy prices

and other input costs are expected to pose challenges for the

aluminum industry. In addition to the curtailments, the company

will step up actions to reduce the escalating cost of raw

materials.

In the medium to long term, aluminum consumption will improve

globally with revival palpable in the automotive and packaging

industries, one of the key consumer markets. Aluminum is widely

used for packaging, beverage cans, food containers and foil

products.

The automobile market is also becoming increasingly aluminum

intensive, benefiting from the recyclability and the light weight

of the metal. Further, the surge in copper price this year is

triggering a switch among manufacturers to aluminum. Automobiles,

air conditioners and industrial components manufacturers are now

shifting their focus on the more economical aluminum.

We expect aluminum demand to increase over the next three years,

outstripping supply growth. As a result, the aluminum market is

likely to see deficits for a prolonged period. This provides a

backdrop supportive of high alumina and aluminum prices. China and

India are undergoing rapid industrialization.

Both these factors are positive for underlying aluminum demand.

Leading aluminum producers such as Alcoa and Aluminum

Corporation of China (ACH) should benefit from the

improving demand outlook.

Currently, both Alcoa and Aluminum Corporation of China hold a

Zacks #3 Rank (Hold) supported by our long-term Neutral

recommendation.

Copper

Copper has become a major industrial metal given its properties of

high ductility, malleability, and thermal and electrical

conductivity, and its resistance to corrosion. In terms of

consumption, it ranks third after iron and aluminum. Construction

is the single largest market, followed by electronics and

electronic products, transportation, industrial machinery, and

consumer and general products.

Copper is an internationally traded commodity, and its prices are

determined by the major metals exchanges – the London Metal

Exchange (LME), New York Mercantile Exchange (COMEX) and Shanghai

Futures Exchange (SHFE). Prices on these exchanges reflect the

global balance of copper supply and demand, which can be volatile

and cyclical.

Copper prices were at high levels from 2006 through most of 2008 as

limited supplies, combined with growing demand from China and other

emerging economies, resulted in high copper prices and low levels

of inventories.

In December 2008 copper prices dipped to a low of $1.26 per pound

due to reduced consumption, turbulence in the U.S. financial

markets and concerns about the global economy. However, copper

prices have since improved from the 2008 lows, thanks to strong

demand from emerging markets and limited supply.

During the past three years, copper prices have fluctuated with LME

spot copper prices ranging from $1.38 to $4.60 per pound. During

2011, LME spot copper prices ranged from $3.08 per pound to a

record high of $4.60 per pound, with an average of $4.00 per pound.

This rising trend has benefited copper producers like

Freeport-McMoRan Copper & Gold Inc. (FCX) and

Southern Copper Corporation (SCCO).

Not denying volatility in prices, which would always be there, we

have a bullish stance on copper prices, long term. Prices will be

influenced by demand from China, economic activity in the U.S. and

other industrialized countries, the timing of new supplies of

copper and production levels of mines and copper smelters.

The outlook for the copper business remains positive, supported by

widespread use of copper, limited supplies from existing mines and

the absence of significant new development projects. Companies that

have a high leverage to copper prices will benefit immensely from

the potential demand for the metal in the developing markets.

Freeport and Southern Copper retain a Zacks #3 Rank in agreement

with our Neutral recommendation on the shares.

ALCOA INC (AA): Free Stock Analysis Report

BARRICK GOLD CP (ABX): Free Stock Analysis Report

ALUMINUM CP-ADR (ACH): Free Stock Analysis Report

AGNICO EAGLE (AEM): Free Stock Analysis Report

AK STEEL HLDG (AKS): Free Stock Analysis Report

FREEPT MC COP-B (FCX): Free Stock Analysis Report

GOLDCORP INC (GG): Free Stock Analysis Report

KINROSS GOLD (KGC): Free Stock Analysis Report

ARCELOR MITTAL (MT): Free Stock Analysis Report

NEWMONT MINING (NEM): Free Stock Analysis Report

NUCOR CORP (NUE): Free Stock Analysis Report

SOUTHERN COPPER (SCCO): Free Stock Analysis Report

UTD STATES STL (X): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

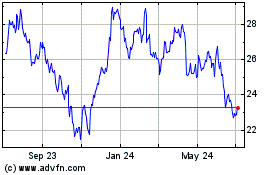

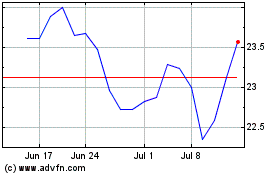

Arcelor Mittal (NYSE:MT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Arcelor Mittal (NYSE:MT)

Historical Stock Chart

From Jul 2023 to Jul 2024