Corporate Governance

Director Independence

Under the NYSE corporate governance listing standards, a majority of Applied’s directors must satisfy the NYSE criteria for independence. In addition to having to satisfy stated minimum requirements, no director qualifies under the standards unless the Board affirmatively determines the director has no material relationship with Applied. In assessing a relationship’s materiality, the Board has adopted categorical standards, which may be found via hyperlink from our website’s investor relations area.

The Board has determined that all directors other than Mr. Schrimsher, our President & Chief Executive Officer, meet these independence standards.

Director Attendance at Meetings

During the fiscal year ended June 30, 2023, the Board held five meetings. Each director attended at least 75% of the total number of meetings of the Board and the committees on which the director served.

Applied expects directors to attend the annual meeting of shareholders, just as they are expected to attend Board meetings. All the directors attended last year’s annual meeting.

Membership on Other Boards

Directors must be willing to devote sufficient time to carrying out their duties and responsibilities effectively and to avoid actual or potential conflicts of interest that may arise from serving on other boards of directors. To that end, the Board has adopted a policy that a director who is not a named executive officer of a public company may serve as a director on up to four boards of public companies, including Applied. For directors who are also serving as a named executive officer of a public company, the maximum number of public company boards on which the director may serve is two.

Meetings of Non-Management Directors

At the Board’s regular meetings, the non-management directors meet in executive sessions without management. Mr. Wallace, the Board’s independent Chairman, calls and presides at the sessions. On the independent directors’ behalf, the Chairman provides feedback to management from the sessions, collaborates with management in developing Board meeting schedules and agendas, and performs other duties as determined by the Board or the Corporate Governance & Sustainability Committee.

Board Leadership Structure

The Board periodically evaluates its leadership structure under circumstances existing at the time. The Board has long maintained separate positions of Chairman and Chief Executive Officer (“CEO”) and elected an independent director to serve as Chairman. Mr. Wallace currently serves as Chairman.

The Board believes its current leadership structure best serves the Board’s oversight of management, the Board’s carrying out of its responsibilities on the shareholders’ behalf, and Applied’s overall corporate governance. The Board also believes the separation of the roles allows the CEO to focus his efforts on operating and managing the company.

Committees

The Board’s Audit, Corporate Governance & Sustainability, and Executive Organization & Compensation Committees are composed solely of independent directors, as defined in NYSE listing standards and Applied’s categorical standards, and, in the case of the Audit Committee, under federal securities laws.

|

|

|

| |

|

| 16 |

|

Applied Industrial Technologies 2023 Proxy Statement |

Corporate Governance

The committee members’ names and number of meetings held in fiscal 2023 follow:

|

|

|

|

|

| Audit Committee Four Meetings |

|

Corporate Governance & Sustainability Committee Three Meetings |

|

Executive Organization & Compensation Committee Five Meetings |

| Vincent K. Petrella, Chair Madhuri A. Andrews Shelly M. Chadwick Mary Dean Hall Dan P. Komnenovich Robert J. Pagano, Jr. |

|

Peter C. Wallace, Chair Madhuri A. Andrews Shelly M. Chadwick Mary Dean Hall Dan P. Komnenovich Robert J. Pagano, Jr. Vincent K. Petrella Joe A. Raver |

|

Joe A. Raver, Chair Robert J. Pagano, Jr. Vincent K. Petrella Peter C. Wallace |

We describe the committees below. Their charters, posted via hyperlink from the investor relations area of Applied’s website, contain descriptions that are more detailed. The Board also has a standing Executive Committee which, during intervals between Board meetings and subject to the Board’s control and direction, possesses and may exercise the Board’s powers. The Executive Committee, whose members include the Chairman, the CEO, and the committee chairs, met once in fiscal 2023.

Audit Committee. The Audit Committee assists the Board in fulfilling its oversight responsibility with respect to the integrity of Applied’s accounting, auditing, and reporting processes. Each year, the committee appoints, determines the compensation of, evaluates, and oversees the independent auditor’s work, reviews the auditor’s independence, and approves non-audit work to be performed by the auditor. The committee also reviews, with management and the auditor, annual and quarterly financial statements, the scope of the independent and internal audit programs, audit results, and the adequacy of Applied’s internal accounting and financial controls.

The Board has determined that each Audit Committee member is independent for purposes of section 10A of the Securities Exchange Act of 1934 and that Shelly M. Chadwick, Mary Dean Hall, Dan P. Komnenovich, Robert J. Pagano, Jr., and Vincent K. Petrella are “audit committee financial experts,” as defined in Item 407(d)(5) of Securities and Exchange Commission (“SEC”) Regulation S-K.

The Audit Committee’s report is on page 75 of this proxy statement.

Corporate Governance & Sustainability Committee. The Corporate Governance & Sustainability Committee assists the Board by reviewing and evaluating potential director nominees, Board and CEO performance, Board governance, director compensation, compliance with laws, public policy matters, sustainability and social subjects, and other issues. The committee also administers long-term incentive awards to directors under the 2019 Long-Term Performance Plan.

Executive Organization & Compensation Committee. The Executive Organization & Compensation Committee monitors and oversees Applied’s management succession planning and leadership development processes, nominates candidates for the slate of officers to be elected by the Board, and reviews, evaluates, and approves executive officers’ compensation and benefits. The committee also administers incentive awards to executives under the 2019 Long-Term Performance Plan, including the annual Management Incentive Plan. Pay Governance LLC (“Pay Governance”) serves as the committee’s independent executive compensation consultant.

In approving executive officers’ compensation and benefits, the committee bases its decisions on a number of considerations, including the following: the committee’s own reasoned judgment; peer group and market survey information; recommendations provided by the independent consultant; and recommendations from Applied’s CEO as to the other executive officers’ compensation and benefits.

|

|

|

| |

|

| Applied Industrial Technologies 2023 Proxy Statement |

|

17 |

Corporate Governance

For more information on the committee, please read, beginning on page 24, the “Compensation Discussion and Analysis” portion of this proxy statement.

Board’s Role in Risk Oversight

Risk is inherent in every enterprise and Applied faces many risks of varying size and intensity. While management is responsible for day-to-day management of those risks, the Board, as a whole and through its committees, oversees and monitors risk management. In this role, the Board is responsible for determining that the risk management processes designed and implemented by management are adequate and functioning as designed.

The Board believes that robust communication with management is essential for risk management oversight. Senior management attends quarterly Board meetings and responds to directors’ questions or concerns about risk management and other matters. At these meetings, management regularly presents to the Board on strategic matters involving our operations, and the directors and management engage in dialogue about the company’s strategies, challenges, risks, and opportunities. Each year, management reports more broadly on the company’s enterprise risk management process. The non-management directors also meet regularly in executive session without management to discuss a variety of topics, including risk.

In addition, the Board devotes time and attention to cybersecurity and information management risks. Applied’s Vice President – Information Technology reports regularly (three times in 2023) to the Board on cybersecurity matters and related risk exposures. These reports include the results of the Company’s continuous security awareness training, as well as its adherence to ISO27001 framework.

While the Board is ultimately responsible for risk oversight, the committees assist the Board in the areas described below, with each committee chair presenting reports to the Board regarding the committee’s deliberations and actions.

| • |

|

The Audit Committee assists with respect to risk management in the areas of financial reporting, internal controls, and compliance with legal and regulatory requirements. |

| • |

|

The Executive Organization & Compensation Committee assists with respect to management of risks related to executive succession and retention and arising from our executive compensation policies and programs. |

| • |

|

The Corporate Governance & Sustainability Committee assists with respect to management of risks associated with Board organization and membership, and other corporate governance matters, as well as company culture, ethical compliance, and other sustainability and social subjects. |

We have assessed the risks arising from Applied’s compensation policies and practices for employees, including the executive officers. The findings were reviewed with the Executive Organization & Compensation Committee. Based on the assessment, we believe our compensation policies and practices do not encourage excessive risk-taking and are not reasonably likely to have a material adverse effect on Applied.

Environmental, Social and Governance Oversight

As noted above, the Corporate Governance & Sustainability Committee has been charged with assisting the Board in managing risks associated with sustainability and social subjects. As part of their oversight, the Corporate Governance & Sustainability Committee receives updates at each committee meeting on the ESG activities and strategy. The Corporate Governance & Sustainability Committee is currently comprised of all of the Board’s independent directors.

Applied also voluntarily discloses key ESG matters and metrics both on its website and in its annual Sustainability Report. The most recent Sustainability Report is available on its website at www.applied.com/sustainability. Unless specifically stated herein, documents and information on our website are not incorporated by reference in this proxy statement.

|

|

|

| |

|

| 18 |

|

Applied Industrial Technologies 2023 Proxy Statement |

Corporate Governance

Communications with Board of Directors

Shareholders and other interested parties may communicate with a director by writing to that individual c/o Applied’s Secretary at 1 Applied Plaza, Cleveland, Ohio 44115. In addition, they may contact the non-management directors or key Board committees by e-mail, anonymously if desired, through a form located in the investor relations area of Applied’s website at www.applied.com. The Board has instructed Applied’s Secretary to review the communications and to exercise judgment not to forward correspondence such as routine business inquiries and complaints, business solicitations, and frivolous communications. The Secretary delivers summary reports on the nature of all the communications to the Audit Committee and the Corporate Governance & Sustainability Committee.

Director Nominations

In identifying and evaluating director candidates, the Corporate Governance & Sustainability Committee first considers Applied’s developing needs and desired characteristics of a new director, as determined from time to time by the committee. The committee then considers candidate attributes, including the following: business, strategic, and financial skills; independence, integrity, and time availability; diversity of gender, race, ethnicity, and other personal characteristics; and overall experience in the context of the Board’s needs. From time to time, the committee engages a professional search firm, to which it pays a fee, to assist in identifying and evaluating potential nominees.

The committee will also consider qualified director candidates recommended by shareholders. Shareholders can submit recommendations by writing to Applied’s Secretary at 1 Applied Plaza, Cleveland, Ohio 44115. For consideration by the committee in the annual director nominating process, shareholders must submit recommendations at least 120 days prior to the anniversary of the date on which our proxy statement was released to shareholders in connection with the previous year’s annual meeting. Shareholders must include appropriate detail regarding the shareholder’s identity and the candidate’s business, professional, and educational background, diversity considerations, and independence. The committee does not intend to evaluate candidates proposed by shareholders differently than other candidates.

Transactions with Related Persons

Applied’s Code of Business Ethics expresses the principle that situations presenting a conflict of interest must be avoided. In furtherance of this principle, the Board has adopted a written policy, administered by the Corporate Governance & Sustainability Committee, for the review and approval, or ratification, of transactions with related persons.

The related party transaction policy applies to a proposed transaction in which (1) Applied is a participant, (2) a director, executive officer or significant shareholder, or an immediate family member of such a person, has a direct or indirect material interest, and (3) the aggregate amount involved exceeds $50,000 in a fiscal year or is otherwise material to the related person. The policy provides that the Corporate Governance & Sustainability Committee will consider, among other things, whether the transaction is on terms no less favorable than those provided to unaffiliated third parties under similar circumstances, and the extent of the related person’s interest. No director may participate in discussion or approval of a transaction for which the director is a related person.

Warren E. Hoffner, our Vice President, General Manager – Fluid Power & Flow Control, is an executive officer. Mr. Hoffner joined the company in 1996 when we acquired a distribution business owned by him and his father. Two related party lease arrangements have survived from the acquisition and been renewed from time to time: (1) we lease a building from a company owned 50% by Mr. Hoffner’s father (who retired at the time of the acquisition) at a current rental rate of $160,683 per year, with a term expiring in 2026; and (2) we lease a second building from Mr. Hoffner’s father at a current rental rate of $132,836 per year, also with a term

|

|

|

| |

|

| Applied Industrial Technologies 2023 Proxy Statement |

|

19 |

Executive Compensation

Detailed Review of Compensation Components

Base Salary. The Committee observes a general policy that base salaries for executive officers who have held their positions for at least three years and are meeting performance expectations should approximate the market median for comparable positions. As with all pay components, however, the Committee, using its subjective judgment, sets salaries higher or lower to reward individual performance and skills and other considerations such as those mentioned above.

In 2023, after considering the Peer Group data, executive pay trends in the broader market, and the more subjective factors referenced above, the Committee approved base salary adjustments, with Mr. Schrimsher earning a 2% raise.

The Committee’s actions maintained the officers’ pay at competitive levels relative to market medians and reflected a discipline of managing base salaries within the framework of Applied’s pay philosophy and competitive data.

Annual Incentive Pay. With the annual Management Incentive Plan, the Committee seeks to reward executive officers, in cash, for achieving fiscal year goals. In general, the Committee seeks to pay total cash compensation near the market median when Applied meets its goals, and to pay above (or below) the median when Applied exceeds (or falls short of) its goals.

At the beginning of the fiscal year, after the Board reviews Applied’s annual business plan as prepared and presented by management, the Committee develops objective goals and targets for the Management Incentive Plan. The Committee considers the market outlook and the business plan, along with the available opportunities and attendant risks.

In 2023, the Committee established goals based on company-wide measures that it considers key indicators of shareholder value creation:

| • |

|

Net Income – bottom-line profitability; and |

| • |

|

Average Working Capital as a Percentage of Sales – a measure of operating working capital management efficiency. |

Average working capital as a percentage of sales is calculated, for purposes of the 2023 Management Incentive Plan, by taking the arithmetic average, for the four quarters of the fiscal year, of the following calculations: average working capital for the quarter as a percentage of sales for the twelve months ending with the quarter end.

Sixty percent of each executive officer’s Management Incentive Plan payout was determined based on the level of achievement of net income and 20% was determined based on the level of achievement of average working capital as a percentage of sales, as well as each executive officer’s target incentive award value. The Committee sets goals for the performance measures that it believes are attainable, but that require executives to perform at a consistently high level to achieve target award values. In the prior year, 2022, net income was $256.9 million and average working capital as a percentage of sales was 25.4% for determining 2022 Management Incentive Plan payouts.

|

|

|

| |

|

| 32 |

|

Applied Industrial Technologies 2023 Proxy Statement |

Executive Compensation

The remaining 20% of each executive officer’s plan opportunity was tied to the Committee’s subjective evaluation of individual performance, considering performance relative to strategic objectives, including sustainability and social matters.

After evaluating individual performance, with Mr. Schrimsher reporting on the other officers’ performance, the Committee approved the following payouts for this final component: Mr. Schrimsher, $250,800; Mr. Wells, $75,460; Mr. Hoffner, $49,800; Mr. Loring, $43,450; Mr. Vasquez, $50,400; and Mr. Bauer, $36,960.

Shown below are the NEOs’ total 2023 Management Incentive Plan payouts:

|

|

|

|

|

| Name |

|

Annual Incentive Payout ($) |

|

| N. Schrimsher |

|

|

1,654,026 |

|

| D. Wells |

|

|

536,040 |

|

| W. Hoffner |

|

|

384,157 |

|

| K. Loring |

|

|

335,173 |

|

| J. Vasquez |

|

|

332,388 |

|

| F. Bauer (1) |

|

|

285,109 |

|

| (1) |

Mr. Bauer earned a partial year payout for the period extending through a post-retirement consulting period. |

The average NEO payout, as a percentage of the target awards, for those NEOs that were with Applied as of June 30, 2023, was 156.3%.

Considering company goals only, Management Incentive Plan achievements for the most recent five years, as a percentage of targeted achievement, were as follows:

|

|

|

| Year |

|

Achievement of Company Goals (Combined %) |

| 2023 |

|

167.9 |

| 2022 |

|

180.0 |

| 2021 |

|

200.0 |

| 2020 |

|

99.7 |

| 2019 |

|

61.3 |

Long-Term Incentives. Early in the year, the Committee made long-term incentive awards to the executive officers under the 2019 Long-Term Performance Plan.

The plan rewards executives for achieving long-term goals and authorizes incentive awards in a variety of forms. The Committee makes awards annually, after reviewing the previous fiscal year’s financial results.

As with the other primary compensation components, the Committee sets the awards’ value after reviewing the independent consultant’s target compensation study. In most years, the Committee seeks to provide awards with a targeted value near the market median for equivalent positions, with variation to reward individual performance and skills, as well as to reflect factors such as long-term potential, responsibility, tenure in the position, internal equity, retention considerations, and the position’s importance in Applied’s organization.

The Committee uses long-term incentive awards for purposes of motivation, alignment with long-term company goals, and retention. The Committee intends to pay total long-term compensation near the market median

|

|

|

| |

|

| 34 |

|

Applied Industrial Technologies 2023 Proxy Statement |

Executive Compensation

| • |

|

Restricted Stock Units (22.5% of CEO’s Target Long-Term Incentive Value; 25% for Other NEOs) |

RSUs are grants valued in shares of Applied stock, but shares are not issued to executives until the grants vest on the third anniversary of the award date, assuming continued employment with Applied. The Committee believes cliff vesting is more demanding than typical market practice, but appropriate considering the nature of the award. RSU grants under the 2019 Long-Term Performance Plan provide for the accrual of dividend equivalents and payment on vesting.

The Committee considers RSUs to be a good tool for retaining executives. Because their value will increase or decrease over the three-year vesting period along with Applied’s stock, RSUs also promote efforts to maximize long-term shareholder return.

| • |

|

2023-2025 Performance Shares (55% of CEO’s Target Long-Term Incentive Value; 50% for Other NEOs) |

Performance shares provide incentives to achieve goals over a three-year period. At the beginning of a period, the Committee sets a target number of shares of Applied stock to be paid to each executive at the end of the period, assuming continued employment. The actual payout is then calculated, relative to the target, based on Applied’s achievement of objective goals.

As a new three-year period begins, the Committee reviews the business plan and market outlook for each year of the period. Then, after also considering the independent consultant’s guidance as to market practices, the Committee determines performance measures and goal ranges at which payouts can be earned for each year; i.e., the goals for each year of a three-year period are established and approved at the start of the three-year period.

Applied’s approach, as opposed to setting goals covering the full three-year period, reduces the risk that a year of over- or under-performance unduly influences payouts for the full three years.

The Committee sets goals it believes are attainable without inappropriate risk-taking, but that still require executives to perform on a sustained basis at a consistently high level to achieve the targeted payout.

Payouts can range from 0% to 200% of the target number of shares. The target payout is 100% of the target number assigned to the executive. The Grants of Plan-Based Awards table on page 45 shows the threshold, target, and maximum payouts for performance shares awarded in 2023.

Because the payout is measured in shares, the award’s value depends on both the company’s operating performance and its stock price, motivating executives throughout the performance period with regard to both.

For the 2023-2025 performance shares, consistent with prior years, the Committee set separate goals for each year of the period, with 75% of an award tied to Applied’s EBITDA and 25% to ROA. ROA improvements can be achieved by, among other things, increasing sales and margins, as well as improving working capital management, all of which are important objectives for industrial distributors.

The Committee considered these metrics to be appropriate measures of management’s impact on operating performance and efficiency over a three-year period. The metrics also balanced the Management Incentive Plan’s emphasis on bottom-line results and cash flow.

Each participant’s targeted number of shares for the three-year period is divided into one-third for each year. Shares awarded for achievement during a particular year are then “banked” for distribution at the end of the three-year term and do not affect the banking of shares for the other years.

|

|

|

| |

|

| 36 |

|

Applied Industrial Technologies 2023 Proxy Statement |

Executive Compensation

| • |

|

Nonqualified deferred compensation plans |

The Committee believes that providing competitive supplemental retirement benefits is important for executive recruitment and retention. Statutory limits exist, however, on the value of benefits executives can receive under the company’s qualified savings plan.

Accordingly, Applied maintains the Key Executive Restoration Plan (the “KERP”), an unfunded, nonqualified deferred compensation plan. To participate in the KERP, an executive must be designated by the Committee or the Board. Applied credits a bookkeeping account for each participant with an amount equal to (i) 6.25% (unless the Committee or the Board specifies a different percentage) of the participant’s base salary and annual actual cash incentive pay for the calendar year, minus (ii) the amount of company contributions credited to the participant under the RSP. Account balances are deemed invested in mutual funds selected by the participant from a menu of diverse investment options. Because of the use of incentive pay in the KERP formula, company contributions are tied in part to Applied’s annual performance results.

To be eligible for KERP account credits, participants must be employed on the last day of a year or have retired, died, or become disabled during the year. Unless otherwise determined by the Committee or the Board, credits to a participant’s account vest based on years of service with Applied, 25% per year. In addition, a participant will be 100% vested in the event of attainment of age 65, death, disability, or certain separations from service within one year after a change in control (as defined in the KERP).

Each NEO participates in the KERP. The Committee set Mr. Schrimsher’s account credit percentage at 10%.

Applied also maintains the Supplemental Defined Contribution Plan, which permits highly compensated U.S. employees to defer portions of their pay and to accumulate nonqualified savings. Applied does not contribute to the plan and participants are not provided above-market or guaranteed returns. We describe the plan, along with the KERP, more fully in “Nonqualified Deferred Compensation,” at pages 49-50.

Applied maintains a contributory health care plan as well as life and disability insurance plans for U.S. employees. Executive officers may also participate in executive life and disability insurance programs.

Applied provides continuation health care coverage, at the employee contribution rate, to executive officers who retire after reaching age 55, with at least ten years’ service, for the 18-month period under the Consolidated Omnibus Budget Reconciliation Act of 1986 (“COBRA”). In addition, when the retiree attains age 65, Applied provides Medicare supplement coverage through a third-party policy. Individuals first elected as executive officers after 2012 are not eligible for these benefits. Mr. Schrimsher is the only remaining active eligible executive.

Perquisites and Other Personal Benefits. Applied does not offer perquisites such as company automobiles or allowances, financial planning and tax services, or country clubs to the NEOs.

Applied provides executive officers five weeks’ vacation per calendar year; other employees get five weeks when they reach 25 years of service. Unused vacation time is forfeited at the end of each calendar year.

Change in Control and Termination Benefits. Upon his hire, Applied and Mr. Schrimsher entered into a CEO-level severance agreement providing termination benefits as described in “Potential Payments upon Termination or Change in Control,” beginning on page 51. Applied does not have employment contracts with the other NEOs, nor does it have an executive severance policy. The Committee retains discretion to determine

|

|

|

| |

|

| Applied Industrial Technologies 2023 Proxy Statement |

|

39 |

Executive Compensation

| |

awards are described in the Compensation Discussion and Analysis beginning at page 34 and the Grants of Plan-Based Awards table at page 45. The amounts reported for 2023 in the Stock Awards column are totals of the following: |

|

|

|

|

|

| Name |

|

RSUs ($) |

|

Performance Shares ($) |

| N. Schrimsher |

|

789,792 |

|

1,940,776 |

| D. Wells |

|

176,664 |

|

350,140 |

| W. Hoffner |

|

114,312 |

|

240,096 |

| K. Loring |

|

124,704 |

|

250,100 |

| J. Vasquez |

|

93,528 |

|

200,080 |

| F. Bauer |

|

124,704 |

|

240,096 |

Performance shares’ grant date fair values assume performance at the target achievement level. If instead it were assumed that the highest level of performance would be achieved, then the values would be twice the amounts reported for the performance shares.

| (2) |

Amounts shown reflect Management Incentive Plan earnings. |

| (3) |

Mr. Bauer participated in the Supplemental Executive Retirement Benefits Plan (“SERP”), a nonqualified defined benefit plan that was frozen in 2012. He was the last remaining active participant and was fully vested in his benefit. The amounts in this column reflect increases in the estimated actuarial present values of his historical accrued benefit. |

The 2023 figure is the difference between the number in the Pension Benefits table on page 51 for 2023 year-end and the same item calculated for July 1, 2022. See the notes to that table for information about how estimated amounts were calculated.

In 2012, the Committee stopped the accrual of additional plan benefits by virtue of years of service and compensation levels. Accordingly, the values in this column relate to changes in the discount rate and the components of the three-segment interest rate structure, as well as to mortality factor adjustments, as described below.

The SERP uses interest rates and mortality tables imposed on tax-qualified pension plans by Internal Revenue Code (“Code”) section 417(e). The present value for 2023 reflects a 5.50% discount rate and the three-year installment payment stream beginning August 1, 2023, elected by Mr. Bauer. The three-year installment is actuarially equivalent to the lump sum value of his benefit determined using the three-segment interest rate structure in effect for January 2022; 1.41% for the first five years, 3.02% for the next 15 years, and 3.36% thereafter.

The value for 2022 reflects a 4.50% discount rate and a three-segment interest rate structure in effect for January 2022, with 1.41% for the first five years, 3.02% for the next 15 years, and 3.36% thereafter. The value for 2021 reflects a 1.75% discount rate and a three-segment interest rate structure in effect for January 2021, with 0.50% for the first five years, 2.38% for the next 15 years, and 3.17% thereafter.

In addition, in each successive year, the mortality table reflects adjustments pursuant to Code section 417(e). With the exception of fiscal 2023 which utilized Mr. Bauer’s final calculated benefits, present values were determined assuming zero probability of termination, retirement, death, or disability before normal retirement age (age 65).

| (4) |

Amounts in this column for 2023 are totals of the following: |

| |

• |

|

Retirement Savings Plan (section 401(k) plan) matching contributions, |

| |

• |

|

Company contributions for executive life insurance, for a $300,000 benefit, and |

| |

• |

|

Estimated values of perquisites and other personal benefits. |

Amounts relating to the following perquisites and other personal benefits provided to NEOs are included: annual expense related to post-retirement health care coverage for Messrs. Schrimsher (the only remaining active executive eligible for this benefit) and Bauer, company contributions for officer-level accident insurance benefits, and the items described in the next sentence. No perquisite or personal benefit exceeded the greater of $25,000 or 10% of the total amount of perquisites and personal benefits in 2023, except for the following items: upon his retirement, Mr. Bauer received a payout for unused accrued vacation of $43,076; and, post-retirement, Mr. Bauer earned legal consulting fees of $88,262.

|

|

|

| |

|

| Applied Industrial Technologies 2023 Proxy Statement |

|

43 |

Vote to Approve 2023 Long-Term Performance Plan

ITEM 4: VOTE TO APPROVE 2023 LONG-TERM PERFORMANCE PLAN

In August 2023, the Executive Organization & Compensation Committee (the “Committee”) adopted, subject to shareholder approval, the Applied Industrial Technologies, Inc. 2023 Long-Term Performance Plan (the “Plan”). The Committee also directed that this proposal to approve the Plan be submitted to shareholders at the annual meeting. If approved by the shareholders, the Plan will replace our 2019 Long-Term Performance Plan (the “2019 Plan”), which was approved by shareholders at the 2019 annual meeting. No awards have been approved under the Plan. No future awards will be granted under the 2019 Plan if the Plan is approved at the 2023 annual meeting.

We are seeking shareholder approval of the Plan so that (i) incentive stock options granted under the Plan meet the requirements of the Code, and (ii) we satisfy NYSE corporate governance listing standards.

The Committee believes that the Plan will further our compensation philosophy and programs. Our ability to attract, retain and motivate top quality executives, employees and non-employee directors is material to our success, and the Committee has concluded that our ability to achieve these objectives would be enhanced by the ability to make grants under the Plan. In addition, the Committee believes that the interests of Applied and our shareholders will be advanced if we can offer our executives, employees, and non-employee directors the opportunity to acquire equity interests in Applied.

Important Differences between the Plan and the 2019 Plan

The Plan is very similar to the 2019 Plan previously approved by shareholders. However, the Plan contains certain important differences from the 2019 Plan, including that the Plan:

| • |

|

Provides that the aggregate number of shares that may be awarded under the Plan shall be 1,600,000. |

| • |

|

Clarifies that dividend and dividend equivalent rights on unvested awards must comply with Section 409A or an exception thereto. |

Summary of Material Terms of the Plan

The following summary is a brief description of the Plan. This summary is qualified in its entirety by reference to the Plan and is to be interpreted solely in accordance with the Plan, a copy of which is attached as the Appendix to this proxy statement.

General

The Plan is designed to foster and promote Applied’s long-term growth and performance by (i) strengthening Applied’s ability to develop and retain an outstanding management team, (ii) motivating superior performance by means of long-term performance-related incentives, and (iii) enabling key employees and non-employee directors to participate in Applied’s long-term growth and financial success.

Administration

The Committee administers the Plan with respect to all awards to employee-participants. The Committee has full and exclusive power and authority to interpret the Plan, to grant waivers of Plan restrictions, and to adopt rules, regulations, and guidelines under the Plan. In particular, the Committee has authority to (i) select eligible

|

|

|

| |

|

| 68 |

|

Applied Industrial Technologies 2023 Proxy Statement |

Vote to Approve 2023 Long-Term Performance Plan

participants for awards; (ii) determine the number and type of awards to be granted; (iii) determine the terms and conditions, consistent with the terms of the Plan, of any awards granted; (iv) adopt, alter, and repeal administrative rules, guidelines, and practices governing the Plan; (v) interpret the terms and provisions of the Plan and any awards granted; (vi) prescribe the form of any agreement or instrument executed in connection with any award; and (vii) otherwise supervise the Plan’s administration. All decisions made by the Committee are final and binding on all employee-participants. The Committee may delegate any of its authority under the Plan to those persons it deems appropriate. In connection with any delegation, the Committee will take into consideration the implications for complying with SEC Rule 16b-3.

The Corporate Governance & Sustainability Committee of the Board of Directors administers the Plan and exercises all authority with respect to awards to non-employee directors.

Benefits Payable to Executive Officers and Directors

Awards granted under the Plan in any fiscal year are subject to the discretion of the Committee, subject to the terms of the Plan. The Plan does not provide for automatic award grants and the amount and nature of awards granted can vary from year to year. The benefits payable to the executive officers under the 2019 Plan in the most recently completed fiscal year are set forth in the Summary Compensation Table on page 42. Because grants of awards under the Plan are discretionary, the benefits that will be received under the Plan by the executive officers as a group, non-executive officer employees as a group, and directors who are not executive officers as a group, are not currently determinable.

Participants

All employees of Applied and its subsidiaries, all non-employee directors and any other person selected by the Committee whose participation the Committee has determined to be in the best interests of Applied are eligible to participate in the Plan. The selection of participants is within the Committee’s sole discretion. As of June 30, 2023, approximately 6,200 employees and eight non-employee directors were eligible to become participants under the Plan. The number of other persons who may become participants is not determinable, but expected to be very small.

Awards

Under the Plan, the Committee is authorized to grant awards in the form of stock, any form of stock option, stock appreciation rights, performance shares, restricted stock, other stock-based awards, or cash. Awards may be granted singly, in combination, or in tandem under the Plan.

Performance-Based Award Criteria

The Committee has broad discretion to select the time and performance criteria on which performance-based awards vest. Performance criteria for performance-based awards will be established by the Committee at the time of grant. Performance-based awards vest on the satisfaction of performance goals established by the Committee and are paid only after the attainment of the applicable performance goals has been certified in writing by the Committee. Performance-based awards subject to Section 409A of the Code must have performance periods of at least 12 months.

Limitations on Awards

The maximum number of shares with respect to which options, stock appreciation rights, or stock awards may be granted to an individual participant in any calendar year is 750,000 shares. The maximum number of shares cumulatively available for the grant of incentive stock options under the Plan is 500,000 shares. The maximum

|

|

|

| |

|

| Applied Industrial Technologies 2023 Proxy Statement |

|

69 |

Vote to Approve 2023 Long-Term Performance Plan

amount of any cash award that may be granted under the Plan to any individual in any calendar year is $4 million. The maximum annual compensation (cash and stock) payable to a non-employee director is $750,000. Subject to these limitations and to the terms and conditions of the Plan, the aggregate number of shares that may be awarded under the Plan may not exceed 1.6 million shares. Shares issued by Applied through the assumption or substitution of outstanding grants from an acquired corporation or entity do not reduce the number of shares available for grants under the Plan.

No Liberal Recycling of Shares

Shares that were subject to a prior award but that were not issued due to termination, cancellation, or forfeiture of such award or that were not issued due to withholding relating to such award are not available for future grants. Shares tendered as payment for option exercises and shares purchased by Applied using stock option exercise proceeds are unavailable for future grants. The whole number of shares that are the subject of a stock-settled awards shall be counted against the shares available for future grants.

Cancellation and Rescission of Awards

Unless an award otherwise provides, if the Committee determines, in good faith, that during a participant’s employment with Applied or during the period ending twelve months following the participant’s separation of service, the participant has committed an act inimical to Applied’s interest, the Committee may terminate or rescind, and, if applicable, the participant may be required immediately to repay an award issued, exercised or paid within the previous twelve months. Acts inimical to Applied’s interests shall include willful inattention to duty; willful violation of Applied’s published policies; acts of fraud or dishonesty involving Applied’s business; solicitation of Applied’s employees, customers, or vendors to terminate or alter their relationship with Applied to Applied’s detriment; unauthorized use or disclosure of information regarding Applied’s business, employees, customers, or vendors; and competition with Applied. By exercising or accepting payment of an award, a participant certifies that they are in compliance with the terms and conditions of the Plan, and the failure to comply with the provisions summarized under this heading prior to, or during the six months after, any exercise, payment or delivery pursuant to an award (except in the event of an intervening change in control) shall cause such exercise, payment or delivery to be subject to rescission by Applied. In addition, a participant also agrees that the award shall be subject to repayment and/or forfeiture based on willful behavior that results in a material violation of any ethics or governance policy adopted by the Board.

Clawback

In addition to the provisions above under the heading “Cancellation and Rescission of Awards,” by accepting or exercising any award granted under the Plan, a participant agrees to be bound and abide by any policies adopted by Applied pursuant to Section 304 of the Sarbanes-Oxley Act of 2002, Section 954 of the Dodd-Frank Wall Street Reform and Consumer Protection Act and any rules or exchange listing standards promulgated thereunder calling for the repayment and/or forfeiture of any award or payment resulting from an accounting restatement.

Stock Options

Under the Plan, options to purchase shares may be granted at an exercise price that is not less than the fair market value on the date of grant based on the closing price of shares on the NYSE, as determined by the Committee. A stock option may be in the form of an incentive stock option that, in addition to being subject to the terms established by the Committee, complies with Section 422 of the Code. Section 422 of the Code provides that the aggregate fair market value (determined at the time the option is granted) of shares exercisable for the first time by a participant during any calendar year shall not exceed $100,000; that the

|

|

|

| |

|

| 70 |

|

Applied Industrial Technologies 2023 Proxy Statement |

APPENDIX - 2023 Long-Term Performance Plan

APPENDIX

APPLIED INDUSTRIAL TECHNOLOGIES, INC.

2023 LONG-TERM PERFORMANCE PLAN

The Applied Industrial Technologies, Inc. 2023 Long-Term Performance Plan (the “Plan”) is designed to foster and promote the long-term growth and performance of the Company by: (a) strengthening the Company’s ability to develop and retain an outstanding management team, (b) motivating superior performance by means of long-term performance-related incentives and (c) enabling key employees and directors to participate in the continued growth and financial success of the Company. These objectives will be promoted by awarding to such person’s performance-based stock awards, restricted stock, restricted stock units, Stock Options, stock appreciation rights and/or other performance or stock-based awards or cash.

The Plan is intended to replace the Applied Industrial Technologies, Inc. 2019 Long-Term Performance Plan, and no further awards will be granted thereunder after the Effective Date.

(a) “Award” — The grant of stock or any form of Stock Option, stock appreciation right, performance share, restricted stock, restricted stock units, other stock-based award or cash whether granted singly, in combination or in tandem, to a Participant pursuant to such terms, conditions and limitations as the Committee may establish in order to fulfill the objectives of the Plan.

(b) “Award Agreement” — The instrument, agreement or other document given to a Participant by the Company that, in addition to the Plan, sets forth the terms, conditions and limitations applicable to an Award.

(c) “Board” — The Board of Directors of the Company.

(d) “Cause” — (i) the willful and continued failure by a Participant to perform substantially the Participant’s duties with the Company or one of its affiliates (other than for disability or Good Reason), after a written demand for substantial performance is delivered to the Participant by the Board or the Chief Executive Officer of the Company (“Chief Executive Officer”) which specifically identifies the manner in which the Board or Chief Executive Officer believes that the Participant has not substantially performed the Participant’s duties, or (ii) the willful engagement by the Participant in illegal conduct or gross misconduct involving moral turpitude that is materially and demonstrably injurious to the Company; provided, however, that no act or failure to act shall be considered “willful” unless it is done, or omitted to be done, in bad faith or without the Participant’s reasonable belief that such action or omission was in the best interests of the Company. Any act, or failure to act, based on authority given the Participant pursuant to a resolution duly adopted by the Board or on the instructions of the Chief Executive Officer or a senior officer of the Company or based on the advice of counsel for the Company shall be conclusively presumed to be done, or omitted to be done, in good faith and in the best interests of the Company. Notwithstanding the foregoing, in the event that a Participant has entered into an employment, severance, or change-in-control agreement with the Company, the definition “Cause” as set forth in the most recently executed agreement will apply for all purposes of this Plan for such Participant, as opposed to the definition set forth herein.

(e) “Code” — The Internal Revenue Code of 1986, as amended from time to time.

|

|

|

| |

|

| Applied Industrial Technologies 2023 Proxy Statement |

|

77 |

APPENDIX - 2023 Long-Term Performance Plan

(f) “Committee” — The Executive Organization and Compensation Committee of the Company’s Board, or such other committee of the Board that is designated by the Board, shall administer the Plan with respect to all Awards to Participants who are employees of the Company. The Corporate Governance and Sustainability Committee of the Company’s Board, or such other committee of the Board that is designated by the Board, shall administer the Plan with respect to all Awards to Participants who are Nonemployee Directors of the Company. The Committee shall be constituted so as to satisfy any applicable legal requirements including the requirements of Rule 16b-3 promulgated under the Securities Exchange Act of 1934 or any similar rule which may subsequently be in effect (“Rule 16b-3”). The members shall be appointed by, and serve at the pleasure of, the Board and any vacancy on the Committee shall be filled by the Board. For purposes of the provisions of Section 13 of the Plan, the Chief Executive Officer is hereby delegated authority to act on the Committee’s behalf with respect to any Participant, other than the Chief Executive Officer.

(g) “Common Shares” or “shares” — Authorized and issued or unissued shares of common stock without par value of the Company.

(h) “Company” — Applied Industrial Technologies, Inc., an Ohio corporation.

(i) “Director” — Any individual who is a member of the Board.

(j) “Fair Market Value” — The closing price of Common Shares as reported by the New York Stock Exchange for the date in question, provided that if no sales of Common Shares were made on said exchange on that date, the closing price of Common Shares as reported for the preceding day on which sales of Common Shares were made on that exchange.

(k) “Nonemployee Director” — Any Director who is not an employee of the Company or a Subsidiary.

(l) “Good Reason” — (i) a material diminution in a Participant’s authority, duties, or responsibilities, (ii) a material diminution in the authority, duties, or responsibilities of the person to whom a Participant reports immediately prior to a Change in Control, (iii) a material diminution by the Company of a Participant’s annual base salary that was paid to the Participant immediately prior to the Change in Control, (iv) a material change in the geographic location where a Participant provides service to the Company, or (v) any failure of any successor (whether direct or indirect, by purchase, merger, consolidation or otherwise) to all or substantially all of the business and/or assets of the Company, by agreement in form and substance satisfactory to a Participant, to expressly assume and agree to comply with the terms of an Award in the same manner and to the same extent that the Company would be required to perform it if no such succession had taken place; provided further, that, Good Reason shall not have occurred unless a Participant gives the Company written notice within ninety (90) days of the initial existence of the condition claimed by the Participant in good faith to constitute Good Reason and the Company fails to remedy the condition within thirty (30) days of such notice. A Participant shall not be deemed to have a Separation from Service for Good Reason unless such Separation from Service by the Participant occurs no later than two (2) years after the occurrence of the event constituting Good Reason.

(m) “Participant” — Any employee of the Company or a Subsidiary, a Nonemployee Director or any other person whose participation the Committee determines is in the best interests of the Company and to whom an Award is made under the Plan.

(n) “Retirement” or “Retire” — Any Separation from Service at or after attainment of age sixty-five (65), or after attainment of age fifty-five (55) and the completion of at least ten (10) years of employment with the Company and its Subsidiaries.

(o) “Section 409A” — Section 409A of the Code as well as regulations and guidance issued thereunder.

|

|

|

| |

|

| 78 |

|

Applied Industrial Technologies 2023 Proxy Statement |

APPENDIX - 2023 Long-Term Performance Plan

the authority to: (i) select eligible Participants as recipients of Awards; (ii) determine the number and type of Awards to be granted; (iii) determine the terms and conditions, not inconsistent with the terms hereof, of any Award granted; (iv) adopt, alter and repeal such administrative rules, guidelines and practices governing the Plan as it shall, from time to time, deem advisable; (v) interpret the terms and provisions of the Plan and any Award granted; (vi) prescribe the form of any agreement or instrument executed in connection with any Award; and (vii) otherwise supervise the administration of the Plan. In addition, the Committee shall have authority, without amending the Plan, to grant Awards hereunder to Participants who are foreign nationals or employed outside the United States or both, on terms and conditions different from those specified herein as may, in the sole judgment and discretion of the Committee, be necessary or desirable to further the purpose of the Plan. All decisions made by the Committee pursuant to the provisions hereof shall be made in the Committee’s sole discretion and shall be final and binding on all persons, including the Company, its shareholders, employees, Participants, and their estates and beneficiaries.

Notwithstanding the powers and authorities of the Committee set forth in this Section 5:

(a) The Committee shall not permit the repricing of Stock Options by any method, including through cancellation and reissuance; and

(b) The Committee may only accelerate the vesting or exercisability of an Award: (i) upon Separation from Service by a Participant and as permitted under Section 409A to the extent an Award is subject to Section 409A, or (ii) upon Separation from Service of a Participant due to death or disability (provided, however, that with respect to an Award that is, or contains a payment provision for, nonqualified deferred compensation subject to Section 409A, “disability” shall have the meaning set forth in Treasury Regulation Section 1.409A-3(i)(4)).

| 6. |

Delegation of Authority |

The Committee may delegate any of its authority hereunder to such subcommittees or persons as it deems appropriate. Any such delegation will take into consideration the implication for complying with Rule 16b-3.

The Committee shall determine the type or types of Award(s) to be made to each Participant and shall set forth in the related Award Agreement the terms, conditions and limitations applicable to each Award. Awards may include but are not limited to those listed in this Section. Awards may be granted singly, in combination or in tandem or in exchange for a previously granted Award; provided that the exercise price for any Stock Options shall not be less than the Fair Market Value on the date of grant of the new Award (except to the extent the Stock Options are granted as replacement Stock Options for stock options acquired by the Company, in which case such replacement Stock Option shall satisfy the requirements of Section 409A of the Code). Awards may also be made in combination or in tandem with, in replacement of, or as alternatives to, grants or rights under any other employee plan of the Company, including the plan of any acquired entity. All Awards payable in Common Shares shall have vesting periods determined by the Committee, which in no event shall be less than one (1) year.

(a) Stock Option — A grant of a right to purchase a specified number of Common Shares during a specified period and at a specified price not less than the Fair Market Value on the date of grant, as determined by the Committee. A Stock Option may be in the form of an incentive Stock Option (“ISO”) that, in addition to being subject to applicable terms, conditions and limitations established by the Committee, complies with Section 422 of the Code which, among other limitations, currently provides that the aggregate Fair Market Value (determined at the time the option is granted) of Common Shares exercisable for the first time by a Participant during any calendar year shall not exceed $100,000 (or such other limit as may be required by the Code); that the exercise price shall be not less than 100% of Fair Market Value on the date of the grant; and that

|

|

|

| |

|

| 80 |

|

Applied Industrial Technologies 2023 Proxy Statement |

APPENDIX - 2023 Long-Term Performance Plan

such options shall be exercisable for a period of not more than ten years and may be granted no later than ten years after the effective date of this Plan. ISOs shall be granted only to key employees of the Company as permitted under Section 422 and 424 of the Code.

(b) Stock Appreciation Right (“SAR”) — A right to receive a payment, in cash and/or Common Shares, equal to the excess of the Fair Market Value of a specified number of Common Shares on the date the SAR is exercised over the Fair Market Value on the date of grant of the SAR as set forth in the applicable Award Agreement.

(c) Stock Award — An Award made in Common Shares and other Awards that are valued in whole or in part by reference to, or are otherwise based on, Common Shares. All or part of any Stock Award may be subject to conditions established by the Committee and set forth in the Award Agreement.

(d) Restricted Stock Units — An Award providing for the deferred issuance of Common Shares (or the cash value of a specified number of Common Shares). All or any part of any Award of Restricted Stock Units may be subject to conditions established by the Committee and set forth in the Award Agreement.

(e) Cash Award — An Award denominated in cash with the eventual payment amount subject to future service and such other restrictions and conditions as may be established by the Committee, and as set forth in the Award Agreement. The maximum amount of any cash Award payable to any Participant in any one calendar year shall be four million dollars ($4,000,000).

(f) Performance-Based Awards—Awards that are intended to be “performance based” shall vest based on the satisfaction of performance goals established by the Committee at the time an Award is granted. Payment of any performance-based Award shall only be made only after the attainment of the applicable performance goals has been determined by the Committee (including in duly adopted resolutions of the Committee). The Committee shall retain the discretion to adjust performance goals relating to performance-based Awards, either on a formula or discretionary basis or any combination, as the Committee determines. Any performance-based Award that is nonqualified deferred compensation subject to Section 409A must be made with respect to performance periods that are at least twelve (12) months.

(g) Compensation of Nonemployee Directors – The total annual compensation of a Nonemployee Director, including all Awards (whether payable in cash or shares) granted under the Plan, shall not exceed $750,000.

Payment of Awards may be made as specified in an Award Agreement and as determined by the Committee in its sole discretion, in the form of cash, Common Shares or combinations thereof and may include such restrictions as the Committee shall determine, including in the case of Common Shares, restrictions on transfer and forfeiture provisions. When transfer of shares is so restricted or subject to forfeiture provisions, such shares are referred herein as “Restricted Stock.” Further, with Committee approval, payments may be deferred, either in the form of installments or a future lump sum payment. The Committee may permit selected Participants to elect to defer payments of some or all types of Awards (except Stock Options and SARs) in accordance with procedures established by the Committee to assure that any such deferral complies with applicable requirements of the Code, in particular, Section 409A, including, at the choice of Participants, the capability to make further deferrals for payment after Retirement. Any deferred payment, whether elected by the Participant or specified by the Award Agreement or by the Committee, may require the payment to be forfeited in accordance with the provisions of Section 13 of the Plan. Dividends or dividend equivalent rights may be extended to and made part of any Award denominated in shares or units of Common Shares, subject to

|

|

|

| |

|

| Applied Industrial Technologies 2023 Proxy Statement |

|

81 |

APPENDIX - 2023 Long-Term Performance Plan

The Board or the Committee may amend the terms of any Award theretofore granted, prospectively or retroactively, but no such amendment shall impair the rights of any Participant without the Participant’s consent. The Board or the Committee may also make Awards hereunder in replacement of, or as alternatives to, Awards previously granted to Participants, except for previously granted options having higher exercise prices, but including without limitation grants or rights under any other plan of the Company or of any acquired entity. Notwithstanding the foregoing, the Board or the Committee shall consider the requirements of Section 409A in making any such amendment.

Notwithstanding the foregoing and except as provided in Section 15 of this Plan, without shareholder approval, the terms of outstanding Awards may not be amended to reduce the exercise price of outstanding Stock Options or SARs or cancel outstanding Stock Options or SARs in exchange for cash, other awards or Stock Options or SARs with an exercise price that is less than the exercise price of the original Stock Options or SARs.

| 12. |

Termination of Employment |

If a Participant incurs a Separation from Service for any reason, all unexercised, deferred and unpaid Awards shall be exercisable or paid in accordance with the applicable Award Agreement, which may provide that the Committee may authorize, as it deems appropriate, the continuation of all or any part of Awards granted prior to such Separation from Service; provided that the Committee shall consider the requirements of Section 409A when making any such authorization.

| 13. |

Cancellation and Rescission of Awards |

Unless the Award Agreement specifies otherwise, the Committee may cancel any Awards at any time if the Participant is not in compliance with all other applicable provisions of the Award Agreement, the Plan and with the following conditions:

(a) If the Committee determines, in good faith, that during the Participant’s employment with the Company or during the period ending twelve (12) months following the Participant’s Separation from Service, the Participant has committed an act inimical to the Company’s interests, then the Committee may terminate or rescind, and, if applicable, the Participant may be required immediately to repay an Award issued, exercised or paid within the previous twelve (12) months. Acts inimical to the Company’s interests shall include willful inattention to duty; willful violation of the Company’s published policies; acts of fraud or dishonesty involving the Company’s business; solicitation of the Company’s employees, customers or vendors to terminate or alter their relationship with the Company to the Company’s detriment; unauthorized use or disclosure of information regarding the Company’s business, employees, customers, or vendors; and competition with the Company. By accepting an Award, a Participant also agrees that any Award shall be subject to repayment and/or forfeiture based on willful behavior that results in a material violation of any ethics or governance policy adopted by the Board. All determinations by the Committee shall be effective as of the time of the Participant’s act.

(b) A Participant shall not, without prior written authorization from the Company, disclose to anyone outside the Company, or use in other than the Company’s business, any confidential information or material relating to the business of the Company, acquired by the Participant either during or after employment with the Company.

(c) By exercising or accepting payment of an Award, a Participant thereby certifies that he or she is in compliance with the terms and conditions of the Plan. At the request of the Company, Participants shall be required to confirm in writing such certification to the Company. Such confirmation shall be delivered within ten (10) days of a request by the Company. Failure to comply with the provisions of paragraph (a), (b) or (c) of this Section 13 prior to, or during the six (6) months after, any exercise, payment or delivery pursuant to an

|

|

|

| |

|

| Applied Industrial Technologies 2023 Proxy Statement |

|

83 |

APPENDIX - 2023 Long-Term Performance Plan

Award (except in the event of an intervening Change in Control as defined below) shall cause such exercise, payment or delivery to be subject to rescission by the Company. If such exercise, payment or delivery is rescinded, the Company shall notify the Participant in writing of any such rescission within two (2) years after such exercise, payment or delivery. Within ten (10) days after receiving such a notice from the Company, the Participant shall pay to the Company the amount of any gain realized or payment received as a result of the rescinded exercise, payment or delivery pursuant to an Award. Such payment shall be made either in cash or by returning to the Company the number of Common Shares that the Participant received in connection with the rescinded exercise, payment or delivery.

(d) By accepting or exercising any Award granted under the Plan (or any predecessor plan), a Participant agrees to abide and be bound by any policies adopted by the Company pursuant to Section 304 of the Sarbanes-Oxley Act of 2002, Section 954 of the Dodd-Frank Wall Street Reform and Consumer Protection Act, and any rules or exchange listing standards promulgated thereunder calling for the repayment and/or forfeiture of any Award or payment resulting from an accounting restatement. The repayment and/or forfeiture provisions shall apply whether or not the Participant is presently employed by or affiliated with the Company.

Except as may be otherwise provided in the relevant Award Agreement, no Award or any benefit under the Plan shall be assignable or transferable, or payable to or exercisable by, anyone other than the Participant to whom the Award or any benefit under the Plan was granted.

In the event of any change in capitalization of the Company by reason of a stock split, stock dividend, combination, reclassification of shares, recapitalization, merger, consolidation, exchange of shares, spin-off, spin-out or other distribution of assets to shareholders, or similar event, the Committee may adjust proportionally (i) the Common Shares (1) reserved under the Plan, (2) available for ISOs and (3) covered by outstanding Awards denominated in shares or units; (ii) the share prices related to outstanding Awards; and (iii) the appropriate Fair Market Value and other price determinations for such Awards. In the event of any other change affecting the Common Shares or any distribution (other than normal cash dividends) to holders of capital stock, such adjustments as may be deemed equitable by the Committee, shall be made to give proper effect to such event. In the event of a corporate merger, consolidation, acquisition of property or stock, separation, reorganization or liquidation, the Committee shall be authorized to issue Stock Options or assume stock options, whether or not in a transaction to which Section 424 of the Code applies, by means of substitution of new Stock Options for previously issued options or an assumption of previously issued options.

(a) Within the one- (1-) year period immediately following any Change in Control (as defined below), in the event (x) an employee-Participant has a Separation from Service either by the Participant for Good Reason or by the Company without Cause or (y) a Nonemployee Director-Participant no longer serves as a member of the Board for any reason, then, as of the date immediately preceding the date of such Participant’s Separation from Service or termination of service on the Board, as applicable, with respect to such Participant, (i) all Stock Options or SARs then outstanding shall become fully exercisable, whether or not then exercisable, (ii) all restrictions and conditions of all Stock Awards then outstanding shall be deemed satisfied, (iii) all Cash Awards shall be deemed to have been fully-earned at target levels and (iv) all Performance-Based Awards shall vest based on the Company’s actual performance relative to the performance goals for the individual years (partial years shall be prorated by days) in the performance period that elapsed prior to the Separation from Service.

|

|

|

| |

|

| 84 |

|

Applied Industrial Technologies 2023 Proxy Statement |

APPENDIX - 2023 Long-Term Performance Plan

(b) A “Change in Control” with respect to Awards that do not constitute nonqualified deferred compensation within the meaning of Section 409A shall have occurred when any of the following events shall occur:

(i) The Company is merged, consolidated or reorganized into or with another corporation or other legal person, and immediately after such merger, consolidation or reorganization less than a majority of the combined voting power of the then-outstanding securities of such corporation or person immediately after such transaction are held in the aggregate by the holders of Voting Stock (as that term is hereafter defined) of the Company immediately prior to such transaction;

(ii) The Company sells all or substantially all of its assets to any other corporation or other legal person, and, immediately after such sale, less than a majority of the combined voting power of the then-outstanding securities of such corporation or person immediately after such sale are held in the aggregate by the holders of Voting Stock of the Company immediately prior to such sale;

(iii) There is a report filed or required to be filed on Schedule 13D or Schedule 14D-1 (or any successor schedule, form or report), each as promulgated pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”), disclosing that any person (as the term “person” is used in Section 13(d)(3) or Section 14(d)(2) of the Exchange Act) has become the beneficial owner (as the term “beneficial owner” is defined under Rule 13d-3 or any successor rule or regulation promulgated under the Exchange Act) of securities representing 30% or more of the combined voting power of the then-outstanding securities entitled to vote generally in the election of directors of the Company (“Voting Stock”);

(iv) The Company files a report or proxy statement with the Securities and Exchange Commission pursuant to the Exchange Act disclosing in response to Form 8-K or Schedule 14A (or any successor schedule, form or report or item therein) that a change in control of the Company has occurred or will occur in the future pursuant to any then-existing contract or transaction; or

(v) If during any period of two consecutive years, individuals who at the beginning of any such period constitute the Directors of the Company cease for any reason to constitute at least a majority thereof, provided, however, that for purposes of this clause (v), each Director who is first elected, or first nominated for election by the Company’s shareholders by a vote of at least two-thirds of the Directors of the Company (or a committee thereof) then still in office who were Directors of the Company at the beginning of any such period will be deemed to have been a Director of the Company at the beginning of such period.

Notwithstanding the foregoing provisions of Section 16(b)(iii) or (iv) hereof, unless otherwise determined in a specific case by majority vote of the Board, a “Change in Control” shall not be deemed to have occurred for purposes of the Plan solely because (i) the Company, (ii) an entity in which the Company directly or indirectly beneficially owns 50% or more of the voting securities or interest, or (iii) any Company-sponsored employee stock ownership plan or any other employee benefit plan of the Company, either files or becomes obligated to file a report or a proxy statement under or in response to Schedule 13D, Schedule 14D-1, Form 8-K or Schedule 14A (or any successor schedule, form or report or item therein) under the Exchange Act, disclosing beneficial ownership by it of shares of Voting Stock, whether in excess of 30% or otherwise, or because the Company reports that a change in control of the Company has occurred or will occur in the future by reason of such beneficial ownership.

(c) A “Change in Control” with respect to Awards that constitute nonqualified deferred compensation within the meaning of Section 409A shall mean a change in the ownership or effective control of the Company or a change in the ownership of a substantial portion of the assets of the Company that constitutes a “change in control” under Section 409A.

|

|

|

| |

|

| Applied Industrial Technologies 2023 Proxy Statement |

|

85 |

Pay vs Performance Disclosure - USD ($)

|

12 Months Ended |

Jun. 30, 2023 |

Jun. 30, 2022 |

Jun. 30, 2021 |

| Pay vs Performance Disclosure |

|

|

|

| Pay vs Performance Disclosure, Table |

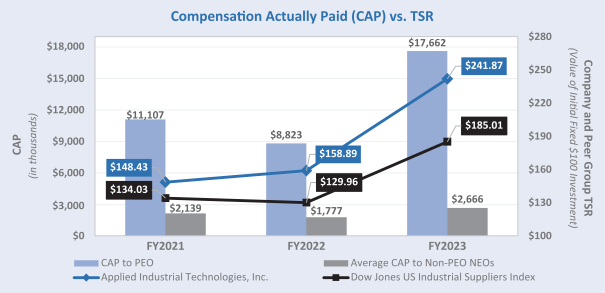

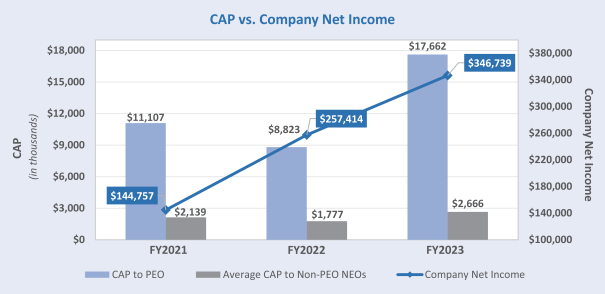

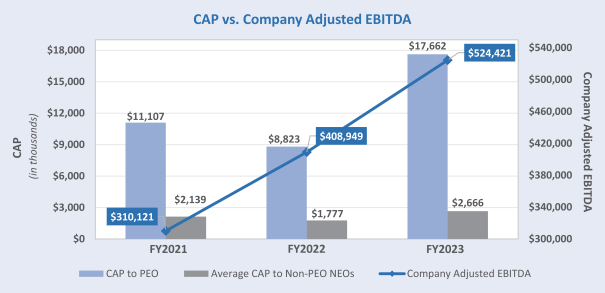

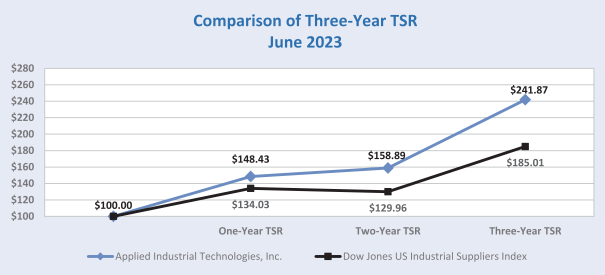

Pay Versus Performance Disclosure This disclosure has been prepared in accordance with the SEC’s pay versus performance rules in Item 402(v) of Regulation S-K under the 1934 Act (“Item 402(v)”) and does not necessarily reflect value actually realized by the NEOs or how the Executive Organization & Compensation Committee evaluates compensation decisions in light of Applied’s or individual performance. For discussion of how the Executive Organization & Compensation Committee seeks to align pay with performance when making compensation decisions, please review the Compensation Discussion and Analysis beginning on page 24. The following tables and related disclosures provide information concerning (i) the total compensation of our principal executive officer (“PEO”) and our non-PEO Named Executive Officers (collectively, the “Other NEOs”) as presented in the Summary Compensation Table on page 42, (ii) the “compensation actually paid” (“CAP”) to our PEO and our Other NEOs, as calculated pursuant to Item 402(v), (iii) certain financial performance measures, and (iv) the relationship of the CAP to those financial performance measures.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Summary

Compensation

Table (SCT)

Total for PEO |

|

|

Compensation

Actually Paid

to PEO |

|

|

Average

SCT Total

for Other

NEOs |

|

|

Average

Compensation

Actually Paid

to Other NEOs |

|

|

Value of Initial Fixed $100

Investment Based On: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6,361,505 |

|

|

|

17,661,702 |

|

|

|

1,383,353 |

|

|

|

2,666,450 |

|

|

|

241.87 |

|

|

|

185.01 |

|

|

|

346,739 |

|

|

|

524,421 |

|

|

|

|

5,840,834 |

|

|

|

8,823,200 |

|

|

|

1,353,747 |

|

|

|

1,776,726 |

|

|

|

158.89 |

|

|

|

129.96 |

|

|

|

257,414 |

|

|

|

408,949 |

|

|

|

|

6,084,592 |

|

|

|

11,107,443 |

|

|

|

1,412,320 |

|

|

|

2,139,081 |

|

|

|

148.43 |

|

|

|

134.03 |

|

|

|

144,757 |

|

|

|

310,121 |

|

| (1) |

Neil A. Schrimsher was our PEO for each year presented. The individuals comprising the Other NEOs for each year presented are listed below: |

| |

(i) |

2023 – David K. Wells, Warren E. Hoffner, Kurt W. Loring, Jason W. Vasquez, and Fred D. Bauer. |

| |

(ii) |

2022 and 2021 – David K. Wells, Fred D. Bauer, Warren E. Hoffner, and Kurt W. Loring. |

| (2) |

The tables below show the adjustments, each of which is required by SEC rules, to calculate CAP amounts from the SCT Total of our PEO and our Other NEOs. These amounts do not reflect the actual amount of compensation earned by or paid to our executives during the applicable years, but rather are amounts determined in accordance with Item 402(v). | PEO SCT Total to CAP Reconciliation

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|