UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): September 6, 2023

Andretti Acquisition Corp.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Cayman Islands |

|

001-41218 |

|

98-1578373 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

7615 Zionsville Road

Indianapolis, Indiana 46268

(Address of principal executive offices, including zip code)

(317) 872-2700

(Registrant’s telephone number, including area code)

Not Applicable

(Former

name or former address, if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ |

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Units, each consisting of one Class A ordinary share, $0.0001 par value, and one-half of one redeemable public warrant |

|

WNNR.U |

|

New York Stock Exchange |

| Class A ordinary shares, $0.0001 par value |

|

WNNR |

|

New York Stock Exchange |

| Public warrants, each whole warrant exercisable for one Class A ordinary share, each at an exercise price of $11.50 per share |

|

WNNR WS |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of

1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01 |

Entry into a Material Definitive Agreement |

Business Combination Agreement

On September 6,

2023, Andretti Acquisition Corp., a Cayman Islands exempted company incorporated with limited liability (“AAC”) entered into a Business Combination Agreement (as it may be amended and/or restated from time to time, the “Business

Combination Agreement”) with Tigre Merger Sub, Inc., a wholly owned subsidiary of AAC (“Merger Sub”) and Zapata Computing, Inc., a Delaware corporation (“Zapata”).

The Business Combination Agreement provides, among other things, that on the terms and subject to the conditions set forth therein, a business combination

between AAC and Zapata will be effected through the merger of Merger Sub with and into Zapata (the “Merger”), with Zapata surviving the Merger as a wholly owned subsidiary of AAC (Zapata, in its capacity as the surviving corporation of the

Merger, is sometimes referred to as the “Surviving Corporation”). The Merger and the other transactions contemplated by the Business Combination Agreement are collectively hereafter referred to as the “Business Combination”. The

date on which the closing of the Merger (the “Closing”) actually occurs is hereinafter referred to as the “Closing Date”.

The

Business Combination Agreement and the Business Combination were approved by the board of directors of each of AAC and Zapata.

Domestication

Immediately prior to the Closing, and subject to the terms and conditions of the Business Combination Agreement, AAC will change its jurisdiction of

incorporation by migrating out of the Cayman Islands and domesticating as a Delaware corporation (the “Domestication”) in accordance with Section 388 of the Delaware General Corporation Law and Part XII of the Cayman Islands Companies

Act (as revised), changing its name to “Zapata Computing Holdings Inc.” (hereinafter referred to as “Parent”). Pursuant to and by virtue of the Domestication, at the effective time of the Domestication and without any action on

the part of any AAC shareholder, (i) each issued and outstanding share of AAC’s Class A ordinary shares, par value $0.0001 per share (the “AAC Class A Common Stock”) and each issued and outstanding share of AAC’s

Class B ordinary shares, par value $0.0001 per share (the “AAC Class B Common Stock” and, together with the AAC Class A Common Stock, the “AAC Common Stock”) shall be converted, on a

one-for-one basis, into one share of common stock, par value $0.0001 per share of Parent (the “New Parent Common Stock”) and (ii) each warrant of AAC that

is outstanding at the time of the Domestication and exercisable for one share of AAC Class A Common Stock shall convert automatically into a warrant exercisable for one share of New Parent Common Stock pursuant to the applicable Warrant

Agreement (as defined in the Business Combination Agreement).

Merger Consideration

At the effective time of the Merger (the “Effective Time”):

| |

(i) |

each share of Zapata’s preferred stock, par value $0.0001 per share (the “Zapata Preferred

Stock”) will be converted into the right to receive a number of newly issued shares of New Parent Common Stock equal to the Per Share Preferred Stock Consideration (as defined in the Business Combination Agreement) in accordance with the terms

of the Business Combination Agreement; |

| |

(ii) |

each share of Zapata’s common stock, par value of $0.0001 (the “Zapata Common Stock”) will be

converted into the right to receive a number of newly issued shares of New Parent Common Stock equal to the Per Share Common Stock Consideration (as defined in the Business Combination Agreement) in accordance with the terms of the Business

Combination Agreement; and |

| |

(iii) |

each option to purchase shares of Zapata’s common stock, whether or not exercisable and whether or not

vested (each, a “Zapata Option”) will automatically be converted into an option to purchase, on the same terms and conditions as were applicable to such Zapata Option immediately prior to the Effective Time, including applicable vesting

conditions, a number of shares of New Parent Common Stock determined in accordance with the terms of the Business Combination Agreement. |

The aggregate value of the consideration that the holders of Zapata’s securities collectively shall be

entitled to receive from AAC in connection with the Business Combination shall not exceed $200,000,000 (calculated with each share of New Parent Common Stock deemed to have a value of $10 per share).

Senior Notes

Prior to the Closing Date, Zapata may

negotiate and enter into a committed equity facility or subscriptions to shares of Zapata capital stock for cash, or issue additional senior promissory notes (the “Senior Notes”), subject to (i) the aggregate principal amount of all

Senior Notes outstanding not exceeding $20,000,000 and (ii) the aggregate amount of equity financing of Zapata raised, committed or issued prior to the closing not exceeding $25,000,000 (inclusive of principal amount and interest).

Under the Business Combination Agreement, AAC will (i) enter into an exchange agreement with each holder of Senior Notes (each, an “Exchange

Agreement”) prior to the Closing, pursuant to which such Senior Notes will be exchanged for shares of New Parent Common Stock in accordance with the terms of such Exchange Agreement and as set forth in the Senior Note Purchase Agreement (as

defined in the Business Combination Agreement) and (ii) at the Effective Time, issue shares of New Parent Common Stock to the holders of Senior Notes then outstanding in exchange for such Senior Notes in accordance with the terms of the Senior

Notes and the Exchange Agreements.

Closing Conditions

The consummation of the Merger is subject to the satisfaction or waiver of certain conditions, including, among others things: (i) receipt of the approval

of the requisite shareholders of Zapata and AAC of the Business Combination and the other matters requiring shareholder approval, (ii) the absence of any law or order enjoining or otherwise prohibiting the consummation of the Business

Combination, (iii) if applicable, the expiration or termination of the waiting period (or any extension thereof) under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, (iv) the effectiveness under the Securities Act of

1933 (as amended) (the “Securities Act”) of the registration statement on Form S-4 to be filed by AAC (the “Registration Statement”) with the U.S. Securities and Exchange Commission (the

“SEC”), (v) receipt of approval for listing by New York Stock Exchange of the New Parent Common Stock to be issued in connection with the Business Combination, (vi) filing of the post-Domestication certificate of incorporation of

Parent with the Delaware Secretary of State and adoption of the post-Domestication bylaws of Parent, (vii) the shareholders of AAC having been provided an opportunity to exercise their redemption rights in accordance with the organizational

documents of AAC and the proxy statement filed as part of the Registration Statement, (viii) entry by AAC into the Exchange Agreements with each holder of Senior Notes pursuant to which such Senior Notes will be exchanged for shares of New

Parent Common Stock at the Effective Time and (ix) other customary bringdown conditions, including the absence of a “Company Material Adverse Effect” (as defined in the Business Combination Agreement) occurring since the date of the

Business Combination Agreement.

Representations, Warranties and Covenants

The Business Combination Agreement contains representations and warranties made by each of the parties thereto that are customary for transactions of this

nature. In addition, the parties to the Business Combination Agreement have agreed to be bound by certain customary covenants for a transaction of this type, including, among others, covenants with respect to (i) the conduct of business by

Zapata and AAC prior to consummation of the Business Combination, (ii) the use of commercially reasonable efforts to obtain all necessary regulatory approvals and material third party consents required for the consummation of the Business

Combination, (iii) the use of reasonable best efforts to take other actions reasonably necessary to satisfy the conditions to the consummation of the Business Combination, (iv) the agreements of AAC and Zapata not to directly or indirectly

initiate, solicit, facilitate or continue inquiries regarding, enter into discussions or negotiations concerning, or enter into an agreement regarding, an alternative acquisition proposal or an alternative business combination, as applicable

(except, (x) with respect to Zapata, discussions with respect to an alternative acquisition proposal that would be approved by the board of directors of Parent, and entered into and announced, after the Closing, and (y) with respect to

AAC, such exclusivity restrictions apply only to the extent not inconsistent with the AAC board of directors’ fiduciary duties), (v) Zapata’s preparation and delivery to

AAC of certain financial statements of Zapata, (vi) the preparation of the Registration Statement and the proxy statement required to be filed with the SEC under the Securities Act in

connection with the Business Combination and the taking of certain other actions to obtain the requisite approval of AAC’s shareholders of the adoption and approval of the Business Combination and the Business Combination Agreement, the

Domestication and certain other proposals relating to the Business Combination.

Further, Zapata has agreed to solicit the written consent or affirmative

vote of (w) the holders of at least a majority of the voting power of the outstanding shares of Zapata Common Stock and Zapata Preferred Stock, consenting or voting (as the case may be) together on an “as-converted”-to-common-stock basis (as required pursuant to Section 251 of the General Corporation Law of the State of Delaware), (x) the holders of at

least a majority of the outstanding shares of Zapata Preferred Stock, consenting or voting (as the case may be) separately as a single class on an

“as-converted”-to-common-stock basis, and (y) the holders of at least a majority of the outstanding shares of the

Series B Preferred Stock of Zapata, consenting or voting (as the case may be) separately as a class (clauses (w), (x) and (y) collectively, the “Requisite Majority”), in each case, in favor of the approval and adoption of the Business

Combination Agreement, the Merger and all other transactions contemplated by the Business Combination Agreement (the “Requisite Approval”).

The

representations, warranties and covenants made under the Business Combination Agreement will terminate at the Closing, except for certain covenants and agreements that by their terms expressly apply in whole or in part after the Closing.

Equity Incentive Award Plan and Employee Stock Purchase Plan

Prior to the Closing, AAC will adopt an equity incentive award plan in the form attached as Exhibit F to the Business Combination Agreement and an employee

stock purchase plan in the form attached as Exhibit G to the Business Combination Agreement, subject to the receipt of the AAC shareholder approval.

Termination

The Business Combination Agreement may be

terminated under certain customary and limited circumstances prior to the consummation of the Business Combination, including:

| |

(i) |

by mutual written consent of AAC and Zapata; |

| |

(ii) |

by either AAC or Zapata if the Closing has not occurred on or before April 18, 2024 (the “Outside

Date”), subject to extension until the September 6, 2024 if (x) all conditions to Closing other than the conditions with respect to antitrust approvals and waiting periods, the effectiveness of the Registration Statement and the approval

of the New Parent Common Stock to be issued in connection with the Business Combination to be approved for listing on the NYSE and (y) AAC’s shareholders have approved at a general meeting an amended to the amended and restated memorandum

and articles of association of AAC extending the date on which AAC must complete a business combination to a date that is on or after such extended Outside Date; |

| |

(iii) |

by either AAC or Zapata if the Business Combination has been permanently enjoined or prohibited by the terms of

a final and non-appealable governmental order or law; |

| |

(iv) |

by either AAC or Zapata if the AAC shareholder approval is not obtained at AAC’s shareholder meeting to

approve the Business Combination (and related matters), subject to any adjournment or recess of the meeting; |

| |

(v) |

by AAC if the Requisite Approval of the Zapata stockholders has not been obtained (and Zapata fails to deliver

the written consent with respect to such Requisite Approval) within 24 hours after the Registration Statement becomes effective; |

| |

(vi) |

by AAC if Zapata has breached the Business Combination Agreement and such breach gives rise to a failure of a

closing condition and cannot be cured or has not been cured by the earlier of 30 days following notice by AAC or the Outside Date; |

| |

(vii) |

by Zapata if AAC has breached the Business Combination Agreement and such breach gives rise to a failure of a

closing condition and cannot be cured or has not been cured by the earlier of 30 days following notice by Zapata or the Outside Date; |

| |

(viii) |

by written notice from AAC if Zapata fails to deliver the PCAOB Financials (as defined in the Business

Combination Agreement) by October 31, 2023 (or the date on which the Registration Statement is ready to be filed by AAC but for delivery of the PCAOB Financials, if later); and |

| |

(ix) |

by written notice from AAC if Zapata fails to deliver the Stockholder Support Agreements (as defined below)

from the Key Zapata Stockholders (as defined below) constituting a Requisite Majority within 24 hours from the date of the Business Combination Agreement. |

In the event that the Business Combination Agreement is terminated by AAC in accordance with its termination rights set forth in items (v) and (ix)

above, then Zapata must pay AAC (as promptly as reasonably practicable and, in any event, within two business days following such termination) a termination fee equal to (i) $1,000,000 plus (ii) the aggregate amount of all reasonable,

documented and out-of-pocket fees and expenses incurred by AAC or Andretti Sponsor LLC (the “Sponsor”) in connection with the Business Combination from the

date of the Business Combination Agreement up to and including the date of termination; provided, that such Termination Fee shall under no circumstances exceed $5,000,000 in the aggregate.

The foregoing description of the Business Combination Agreement and the transactions contemplated thereby is not complete and is subject to, and qualified in

its entirety by reference to, the actual agreement, a copy of which is filed with this Current Report on Form 8-K as Exhibit 2.1, and the terms of which are incorporated herein by reference.

The Business Combination Agreement has been attached to provide investors with information regarding its terms. It is not intended to provide any other

factual information about AAC, Zapata or the other parties thereto. In particular, the assertions embodied in the representations and warranties in the Business Combination Agreement were made as of a specified date, are modified or qualified by

information in one or more confidential disclosure letters prepared in connection with the execution and delivery of the Business Combination Agreement, may be subject to a contractual standard of materiality different from what might be viewed as

material to investors, or may have been used for the purpose of allocating risk between the parties. Accordingly, the representations and warranties in the Business Combination Agreement are not necessarily characterizations of the actual state of

facts about AAC, Zapata or the other parties thereto at the time they were made or otherwise and should only be read in conjunction with the other information that AAC makes publicly available in reports, statements and other documents filed with

the SEC.

Other Agreements

The Business

Combination Agreement contemplates the execution of various additional agreements and instruments, on or before the Closing, including, among others, the following:

Stockholder Support Agreements

In connection with the

Business Combination Agreement, certain stockholders of Zapata who collectively hold a Requisite Majority of the outstanding voting power of Zapata capital stock (collectively, the “Key Zapata Stockholders” and each, a “Key Zapata

Stockholder”) are entering into support agreements with AAC and Zapata (each, a “Stockholder Support Agreement” and collectively, the “Stockholder Support Agreements”). Under the Stockholder Support Agreements, each Key

Zapata Stockholder agrees that within 24 hours after the Registration Statement becomes effective, such Key Zapata Stockholder will execute and deliver a written consent with respect to the outstanding shares of Zapata Common Stock and/or Zapata

Preferred Stock held by such Key Zapata Stockholder (the “Zapata Covered Shares”) adopting and approving the Business Combination Agreement and the transactions contemplated thereby, including the Merger. In addition to the foregoing, the

Key Zapata Stockholders are agreeing that, at any meeting of the holders of the stockholders of Zapata, such Key Zapata Stockholder will appear at the

meeting and cause its Zapata Covered Shares to be voted (i) in favor of the Merger and the adoption of the Business Combination Agreement and (ii) against any alternative acquisition

proposal for Zapata or any other action that would materially delay, materially postpone or materially adversely affect the Merger or any of the other transactions contemplated by the Business Combination Agreement.

Under the Stockholder Support Agreements, the Key Zapata Stockholders further are agreeing, among other things, to exclusivity restrictions with respect to

alternative acquisition proposals for Zapata, and restrictions on transfers of their Zapata Covered Shares, except that Key Zapata Stockholders that hold Zapata Preferred Stock will, under the terms of their respective Stockholder Support

Agreements, be entitled, prior to the filing of the Registration Statement, to sell all or a portion of the Zapata Preferred Stock held by such stockholder to third parties who agree to sign a Stockholder Support Agreement and agree to the same lock-up provisions as the selling stockholder.

The foregoing description of the Stockholder Support Agreements is not

complete and is subject to, and qualified in its entirety by reference to, the forms of Stockholder Support Agreement, copies of which are attached hereto as Exhibits C-1 and

C-2 to the Business Combination Agreement, which are attached hereto as Exhibits 10.1 and 10.2, and the terms of which are incorporated herein by reference.

Lock-Up Agreements

Concurrently with the execution of the Business Combination Agreement, AAC and certain Zapata stockholders have entered into

lock-up agreements (the “Lock-Up Agreements”), which will become effective upon the consummation of the Business Combination.

Pursuant to the Lock-Up Agreements:

| |

(i) |

Holders of Zapata Common Stock party to a Lock-Up Agreement have agreed

that they will not, during the period beginning as of the effective time of the Business Combination and ending on the date that is the earliest of (i) one year after the Closing Date, (ii) the date on which the closing price of the shares

of New Parent Common Stock equals or exceeds $12.00 per share (as adjusted for stock splits, stock dividends, reorganizations and recapitalizations) for any 20 trading days within any 30 trading day period commencing at least 150 days after the

Closing Date and (iii) the consummation after the Effective Time of a liquidation, merger, capital stock exchange, reorganization or other similar transaction that results in all of Parent’s stockholders having the right to exchange their

shares of New Parent Common Stock for cash, securities or other property (a “Liquidity Event”), directly or indirectly, offer, sell, contract to sell, pledge, grant any option to purchase, make any short sale or otherwise dispose of any

shares of New Parent common stock, or any options or warrants to purchase any shares of New Parent Common Stock, or any securities convertible into, exchangeable for or that represent the right to receive shares of New Parent common stock, or any

interest in any of the foregoing, whether owned, directly or beneficially, at the time of entry into such Lock-Up Agreement or thereafter acquired (in each case, subject to certain exceptions set forth in the Lock-Up Agreements). |

| |

(ii) |

Holders of Zapata preferred stock party to a Lock-Up Agreement (the

“Preferred Stockholder Parties”) have agreed that they will not, directly or indirectly, offer, sell, contract to sell, pledge, grant any option to purchase, make any short sale or otherwise dispose of any shares of New Parent Common

Stock, or any options or warrants to purchase any shares of New Parent Common Stock, or any securities convertible into, exchangeable for or that represent the right to receive shares of New Parent Common Stock, or any interest in any of the

foregoing, whether owned, directly or beneficially, at the time of entry into the Lock-Up Agreements or thereafter acquired (in each case, subject to certain exceptions set forth in the Lock-Up Agreements) during the period beginning as of the effective time of the Business Combination and ending on the date that is the earliest of (i) six months after the Closing Date, (ii) the date on

which the closing price of the shares of New Parent Common Stock equals or exceeds $12.00 per share (as adjusted for stock splits, stock dividends, reorganizations and recapitalizations) for any 20 trading days within any 30 trading day period

commencing at least 90 days after the Closing Date, (iii) a Liquidity Event and (iv) if after the Effective Time a third party makes a tender offer or similar transaction to all of Parent’s stockholders to acquire at least 50.1%

(which minimum condition shall be non-waivable) of the outstanding shares of New Parent Common Stock for cash, securities or other property (a “Third Party Tender”), the last day on which

|

| |

shares of New Parent Common Stock may be tendered or otherwise committed in connection with such Third Party Tender (provided that, in the case of this clause (iv), (x) the Lock-Up Period shall expire only for the purpose of tendering or otherwise committing shares of New Parent Common Stock in the Third Party Tender itself and not otherwise transacting in such shares outside the Third

Party Tender and (y) if such Third Party Tender is not completed, the Lock-Up Period shall be revived and continue in accordance with its terms). |

The Lock-Up Agreement entered into by Preferred Stockholder Parties also provides that during the lock-up period, the Preferred Stockholder Parties may sell through a registered broker-dealer selected by Parent up to 100% of the New Parent Common Stock acquired by such Preferred Stockholder Party at the Closing,

subject to the following limitations: (i) no more than 50% of such Preferred Stockholder Party’s New Parent Common Stock may be transferred in each three-month period following the Closing and (ii) a daily trading limit equal to such

Preferred Stockholder Party’s pro rata share of 50% of the volume of New Parent Common Stock that has traded on the New York Stock Exchange (or other exchange or other market where the New Parent Common Stock is then traded) on that day. The Lock-Up Agreement entered into by the Preferred Stockholder Parties further contains provisions providing that if Parent waives, terminates or otherwise shortens the lock-up

period of any other stockholder of Parent subject to a lock-up (including Sponsor under the Sponsor Support Agreement (as defined below) or the lock-up restrictions

contained in the bylaws of Parent adopted at the time of the Domestication), the Preferred Stockholder Parties are entitled to a pro rata adjustment to their applicable Lock-Up Periods.

The foregoing description of the Lock-Up Agreements is not complete and is subject to, and qualified in its entirety

by reference to, the forms of Lock-Up Agreement, copies of which are attached hereto as Exhibits E-1 and E-2 to the Business

Combination Agreement, which are attached hereto as Exhibits 10.4 and 10.5, and the terms of which are incorporated herein by reference.

Registration

Rights Agreement

In connection with the execution of the Business Combination Agreement, AAC, the Sponsors and certain stockholders of Zapata entered

into an amended and restated registration rights agreement (the “Registration Rights Agreement”), which will become effective upon the consummation of the Business Combination. Pursuant to the Registration Rights Agreement, AAC agreed to

file a shelf registration statement with respect to the registrable securities under the Registration Rights Agreement within 45 days of the closing of the Business Combination. Up to twice in any 12-month

period, certain legacy AAC and Zapata stockholders may request to sell all or any portion of their registrable securities in an underwritten offering so long as the total offering price is reasonably expected to exceed $50 million or all of

such holders’ remaining registrable securities. AAC also agreed to provide customary “piggyback” registration rights. The Registration Rights Agreement also provides that AAC will pay certain expenses relating to such registrations

and indemnify the stockholders against certain liabilities.

The foregoing description of the Registration Rights Agreement is not complete and is subject

to, and qualified in its entirety by reference to, the Registration Rights Agreement, a copy of which is attached hereto as Exhibit D to the Business Combination Agreement, which is attached hereto as Exhibit 10.6, and is incorporated herein by

reference.

Sponsor Support Agreement

Concurrently with the execution of the Business Combination Agreement, AAC, the Sponsor, and certain key stockholders of the Sponsor entered into a certain

Sponsor Support Agreement (the “Sponsor Support Agreement”), which amends and restates in its entirety that certain letter, dated January 12, 2022 by and among such parties. Pursuant to the Sponsor Support Agreement, those certain

shareholders who are parties thereto agreed to (i) vote all shares of AAC Common Stock beneficially owned by them, including any additional shares of AAC Common Stock they acquire ownership of or the power to vote, in favor of the Business

Combination, the Merger and all other transactions contemplated by the Business Combination Agreement, (ii) the continued lock-up of the founder shares held by such persons for the earlier of (i) one year

or (ii) the date on which the post-Closing share price equals or exceeds $12 for 20 trading days in a 30-trading day period commencing at least 150 days after the date of the Business Combination (or in

the event of a liquidation, merger or other similar event) and (iii) continued lock-up of the private placement warrants until 30 days following the date of the Business Combination.

Additionally, the Sponsor and Sol Verano Blocker 1 LLC, a Delaware limited liability company (the

“Sponsor Co-Investor” have agreed that up to 30% of the founder shares held by Sponsor and Sponsor Co-Investor (and not subject to prior assignment agreements

entered into in connection with the Extraordinary General Meeting held on July 14, 2023) (such founder shares, the “Sponsor Founder Shares”) will be subject to certain vesting and forfeiture conditions based on the available cash to Parent

at Closing as follows:

| |

(i) |

If the Closing Available Cash (as defined in the Sponsor Support Agreement) is an amount equal to

$25 million or more, then all Sponsor Founder Shares will be fully vested. |

| |

(ii) |

If the Closing Available Cash is $10 million or less, then 30% of the Sponsor Founder Shares shall be

unvested and subject to forfeiture (as further described below). |

| |

(iii) |

If the Closing Available Cash is more than $10 million but less than $25 million, then the number of

Sponsor Founder Shares that will be unvested and subject to forfeiture will be determined by straight line interpolation between zero and 30% of the number of Sponsor Founder Shares. |

Any Sponsor Founder Shares subject to vesting will become vested if, within three years of the Closing, the closing price of the New Parent Common Stock on

the New York Stock Exchange (or other exchange or other market where the New Parent Common Stock is then traded) equals or exceeds $12.00 per share (as adjusted for stock splits, stock dividends, reorganizations and recapitalizations) for any 20

trading days within any 30 trading day period, or if there is a change of control of Parent. If neither of these events occur within three years of the Closing, then the unvested Sponsor Founder Shares will be forfeited.

The foregoing description of the Sponsor Support Agreement is not complete and is subject to, and qualified in its entirety by reference to, the form of

Sponsor Support Agreement, which is attached hereto as Exhibit 10.3, and the terms of which are incorporated herein by reference.

| Item 7.01 |

Regulation FD Disclosure. |

On September 6, 2023, AAC and Zapata issued a press release announcing their entry into the Business Combination Agreement. The press release is attached

hereto as Exhibit 99.1 and incorporated by reference herein.

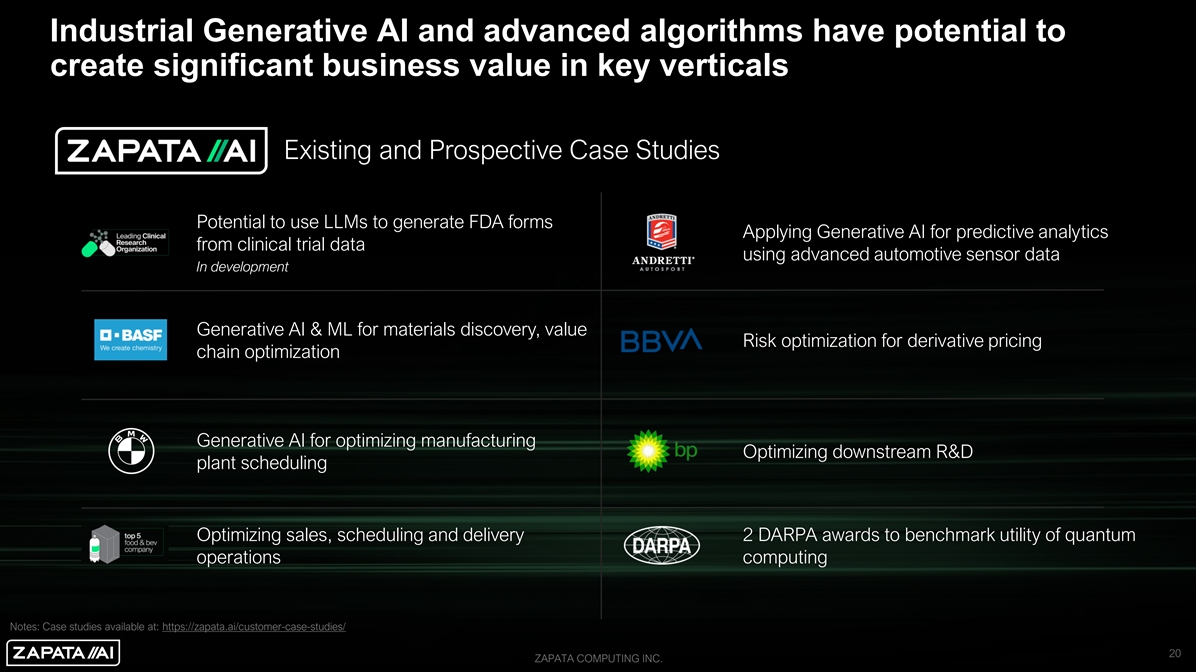

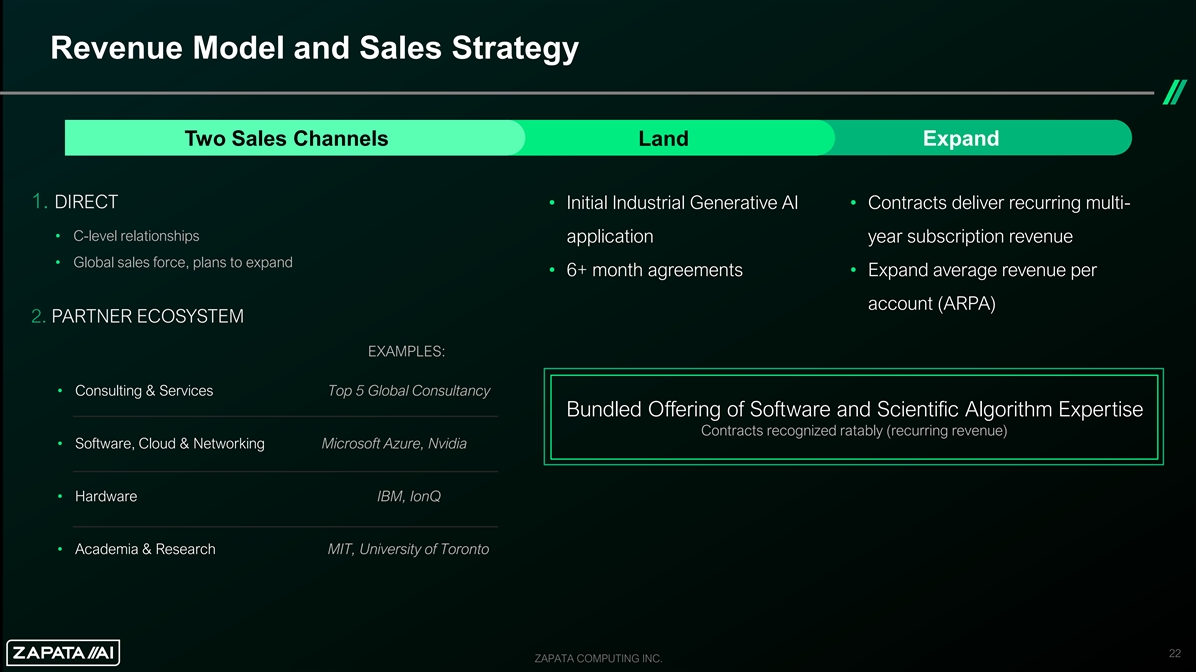

Furnished as Exhibit 99.2 hereto and incorporated into this Item 7.01 by reference is the

investor presentation that AAC and Zapata have prepared for use in connection with the announcement of the Business Combination.

On September 6, 2023,

AAC will hold a conference call to discuss the Business Combination at 8:30 a.m. Eastern time. A copy of the script for the conference call is furnished herewith as Exhibit 99.3.

The foregoing (including Exhibits 99.1, 99.2 and 99.3) are being furnished pursuant to Item 7.01 and will not be deemed to be filed for purposes of

Section 18 of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise be subject to the liabilities of that section, nor will it be deemed to be incorporated by reference in any filing under the

Securities Act or the Exchange Act.

FORWARD-LOOKING STATEMENTS

Certain statements included in this Current Report on Form 8-K (the “Current Report”) that are not historical

facts are forward-looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied by words such as “believe,”

“may,” “will,” “estimate,” “continue,” “anticipate” “intend,” “expect,” “should,” “would,” “plan,” “predict,” “potential,”

“seem” “seek” “future” “outlook,” and similar expressions that predict or indicate future events or trends or that are not statements of historical matters.

These forward-looking statements include, but are not limited to, statements regarding estimates and forecasts of financial and performance metrics and

projections of market opportunity. These statements are based on various assumptions, whether or not identified in this Current Report, and on the current expectations of the management of Zapata and AAC, as the case may be, and are not predictions

of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by an investor

as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are beyond the control of Zapata and AAC. These forward-looking

statements are subject to a number of risks and uncertainties, including changes in domestic and foreign business, market, financial, political and legal conditions, the inability of Zapata or AAC to successfully or timely consummate the Business

Combination, including the risk that any regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the expected benefits of the Business Combination, the occurrence of any event, change

or other circumstances that could give rise to the termination of negotiations and any subsequent definitive agreements with respect to the Business Combination; the outcome of any legal proceedings that may be instituted against AAC, Zapata, the

combined company or others following the announcement of the Business Combination and any definitive agreements with respect thereto; the inability to complete the Business Combination due to the failure to obtain approval of the shareholders of

AAC, the ability to meet stock exchange listing standards following the consummation of the Business Combination; the risk that the Business Combination disrupts current plans and operations of Zapata as a result of the announcement and consummation

of the Business Combination, failure to realize the anticipated benefits of the Business Combination, risks relating to the uncertainty of the projected financial information, risks related to the performance of Zapata’s business and the timing

of expected business or revenue milestones, and the effects of competition on Zapata’s business. If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these

forward-looking statements. In addition, forward-looking statements reflect Zapata’s expectations, plans or forecasts of future events and views as of the date of this Current Report. Zapata anticipates that subsequent events and developments

will cause Zapata’s assessments to change. Neither AAC nor Zapata undertakes or accepts any obligation to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or any change in

events, conditions or circumstances on which any such statement is based. These forward-looking statements should not be relied upon as representing AAC’s or Zapata’s assessments of any date subsequent to the date of this Current Report.

Accordingly, undue reliance should not be placed upon the forward-looking statements.

IMPORTANT ADDITIONAL INFORMATION AND WHERE TO FIND IT

In connection with the contemplated transaction, AAC intends to file a Registration Statement, which will include a proxy statement/prospectus, with the SEC.

Additionally, AAC will file other relevant materials with the SEC in connection with the transaction. A definitive proxy statement/final prospectus will also be sent to the shareholders of AAC, seeking any required shareholder approval. This Current

Report is not a substitute for the Registration Statement, the definitive proxy statement/final prospectus, or any other document that AAC will send to its shareholders. Before making any voting or investment decision, investors and security holders

of AAC are urged to carefully read the entire Registration Statement and proxy statement/prospectus, when they become available, and any other relevant documents filed with the SEC as well as any amendments or supplements to these documents, because

they will contain important information about the transaction. Shareholders will also be able to obtain copies of such documents, without charge, once available, at the SEC’s website at www.sec.gov. In addition, the documents filed by AAC may

be obtained free of charge from AAC at andrettiacquisition.com. Alternatively, these documents, when available, can be obtained free of charge from AAC upon written request to Andretti Acquisition Corp., 7615 Zionsville Road, Indianapolis, Indiana

46268, or by calling (317) 872-2700. The information contained on, or that may be accessed through, the websites referenced in this Current Report is not incorporated by reference into, and is not a part of,

this Current Report.

PARTICIPANTS IN THE SOLICITATION

AAC, AAC’s sponsors, Zapata and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of

proxies from the shareholders of AAC, in connection with the Business Combination. Information regarding AAC’s directors and executive officers is contained in AAC’s Annual Report on Form 10-K for

the year ended December 31, 2023, which is filed with the SEC. Additional information regarding the interests of those participants, the directors and executive officers of Zapata and other persons who may be deemed participants in the

transaction may be obtained by reading the Registration Statement and the proxy statement/prospectus and other relevant documents filed with the SEC when they become available. Free copies of these documents may be obtained as described above.

NO OFFER OR SOLICITATION

This Current Report is for informational purposes only and shall not constitute a proxy statement or solicitation of a proxy, consent, or authorization with

respect to any securities or in respect of the Business Combination. This Current Report shall also not constitute an offer to sell or a solicitation of an offer to buy any securities, nor shall there be any sale, issuance, or transfer of securities

in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. No offering of securities shall be made except by means of

a prospectus meeting the requirements of Section 10 of the Securities Act or an exemption therefrom.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits:

|

|

|

| Exhibit |

|

Description |

|

|

| 2.1* |

|

Business Combination Agreement dated as of September 6, 2023, by and among Andretti Acquisition Corp., Tigre Merger Sub, Inc. and Zapata Computing, Inc. |

|

|

| 10.1 |

|

Form of Stockholder Support Agreement (Individual – Common Stock) (incorporated by reference to Exhibit C-1 to Exhibit 2.1 filed herewith). |

|

|

| 10.2 |

|

Form of Stockholder Support Agreement (Entity – Preferred Stock) (incorporated by reference to Exhibit C-2 to Exhibit 2.1 filed herewith). |

|

|

| 10.3 |

|

Sponsor Support Agreement dated as of September 6, 2023, by and among Andretti Sponsor LLC, Sol Verano Blocker 1 LLC, Andretti Acquisition Corp., Zapata Computing, Inc. and certain other parties thereto. |

|

|

| 10.4 |

|

Form of Lock-Up Agreement (Common Stockholders) (incorporated by reference to Exhibit E-1 to Exhibit 2.1 filed herewith). |

|

|

| 10.5 |

|

Form of Lock-Up Agreement (Preferred Stockholders) (incorporated by reference to Exhibit E-2 to Exhibit 2.1 filed herewith). |

|

|

| 10.6 |

|

Form of Registration Rights Agreement (incorporated by reference to Exhibit D to Exhibit 2.1 filed herewith). |

|

|

| 99.1 |

|

Press Release issued by Andretti Acquisition Corp. and Zapata Computing, Inc. on September 6, 2023. |

|

|

| 99.2 |

|

Investor Presentation of Andretti Acquisition Corp. and Zapata Computing, Inc., dated September 6, 2023. |

|

|

| 99.3 |

|

Script from Conference Call to be held by Andretti Acquisition Corp. on September 6, 2023. |

|

|

| 104 |

|

Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

| * |

Certain exhibits and schedules to this Exhibit have been omitted in accordance with Regulation S-K Item 601(b)(2). AAC agrees to furnish supplementally a copy of all omitted exhibits and schedules to the Securities and Exchange Commission upon its request. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

| Date: September 6, 2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ANDRETTI ACQUISITION CORP. |

|

|

|

|

|

|

|

|

By: |

|

/s/ William M. Brown |

|

|

|

|

|

|

Name: William M. Brown |

|

|

|

|

|

|

Title: President and Chief Financial Officer |

Exhibit 2.1

BUSINESS COMBINATION AGREEMENT

by

and among

ANDRETTI ACQUISITION CORP.,

TIGRE MERGER SUB, INC.,

and

ZAPATA COMPUTING, INC.

Dated as of

September 6, 2023

TABLE OF CONTENTS

Page

|

|

|

|

|

|

|

|

|

| ARTICLE I. DEFINITIONS |

|

3 |

|

|

|

|

|

| |

|

SECTION 1.01. |

|

Certain Definitions |

|

|

3 |

|

|

|

SECTION 1.02. |

|

Further Definitions |

|

|

17 |

|

|

|

SECTION 1.03. |

|

Construction |

|

|

20 |

|

|

|

| ARTICLE II. DOMESTICATION; AGREEMENT AND PLAN OF MERGER |

|

21 |

|

|

|

|

|

|

|

SECTION 2.01. |

|

Domestication |

|

|

21 |

|

|

|

SECTION 2.02. |

|

The Merger |

|

|

21 |

|

|

|

SECTION 2.03. |

|

Effective Time; Closing |

|

|

21 |

|

|

|

SECTION 2.04. |

|

Effect of the Merger |

|

|

22 |

|

|

|

SECTION 2.05. |

|

Certificate of Incorporation; Bylaws |

|

|

22 |

|

|

|

SECTION 2.06. |

|

Directors and Officers |

|

|

22 |

|

|

|

| ARTICLE III. CONVERSION OF SECURITIES; EXCHANGE OF COMPANY CAPITAL STOCK |

|

23 |

|

|

|

|

|

|

|

SECTION 3.01. |

|

Conversion of Securities |

|

|

23 |

|

|

|

SECTION 3.02. |

|

Exchange of Company Capital Stock |

|

|

25 |

|

|

|

SECTION 3.03. |

|

Stock Transfer Books |

|

|

28 |

|

|

|

SECTION 3.04. |

|

Payment of Expenses |

|

|

29 |

|

|

|

SECTION 3.05. |

|

Appraisal Rights |

|

|

29 |

|

|

|

| ARTICLE IV. REPRESENTATIONS AND WARRANTIES OF THE COMPANY |

|

30 |

|

|

|

|

|

|

|

SECTION 4.01. |

|

Organization and Qualification; Subsidiaries |

|

|

30 |

|

|

|

SECTION 4.02. |

|

Organizational Documents |

|

|

31 |

|

|

|

SECTION 4.03. |

|

Capitalization |

|

|

31 |

|

|

|

SECTION 4.04. |

|

Authority Relative to this Agreement |

|

|

32 |

|

|

|

SECTION 4.05. |

|

No Conflict; Required Filings and Consents |

|

|

33 |

|

|

|

SECTION 4.06. |

|

Permits; Compliance |

|

|

34 |

|

|

|

SECTION 4.07. |

|

Financial Statements |

|

|

34 |

|

|

|

SECTION 4.08. |

|

Absence of Certain Changes or Events |

|

|

36 |

|

|

|

SECTION 4.09. |

|

Absence of Litigation |

|

|

36 |

|

|

|

SECTION 4.10. |

|

Employee Benefit Plans |

|

|

36 |

|

|

|

SECTION 4.11. |

|

Labor and Employment Matters |

|

|

39 |

|

|

|

SECTION 4.12. |

|

Real Property; Title to Assets |

|

|

41 |

|

|

|

SECTION 4.13. |

|

Intellectual Property Rights |

|

|

42 |

|

|

|

SECTION 4.14. |

|

Data Processing; Privacy; Security |

|

|

44 |

|

|

|

SECTION 4.15. |

|

Taxes |

|

|

45 |

|

|

|

SECTION 4.16. |

|

Environmental Matters |

|

|

47 |

|

|

|

SECTION 4.17. |

|

Material Contracts |

|

|

48 |

|

|

|

SECTION 4.18. |

|

Insurance |

|

|

50 |

|

i

|

|

|

|

|

|

|

|

|

| |

|

SECTION 4.19. |

|

Board Approval; Vote Required |

|

|

50 |

|

|

|

SECTION 4.20. |

|

Certain Business Practices |

|

|

50 |

|

|

|

SECTION 4.21. |

|

Trade Compliance |

|

|

51 |

|

|

|

SECTION 4.22. |

|

Committee on Foreign Investment in the United States (CFIUS) |

|

|

51 |

|

|

|

SECTION 4.23. |

|

Government Contracts |

|

|

51 |

|

|

|

SECTION 4.24. |

|

Interested Party Transactions |

|

|

55 |

|

|

|

SECTION 4.25. |

|

Exchange Act |

|

|

56 |

|

|

|

SECTION 4.26. |

|

Brokers |

|

|

56 |

|

|

|

SECTION 4.27. |

|

Registration Statement |

|

|

56 |

|

|

|

SECTION 4.28. |

|

Exclusivity of Representations and Warranties |

|

|

56 |

|

|

|

| ARTICLE V. REPRESENTATIONS AND WARRANTIES OF PARENT AND MERGER SUB |

|

57 |

|

|

|

|

|

|

|

SECTION 5.01. |

|

Corporate Organization |

|

|

57 |

|

|

|

SECTION 5.02. |

|

Organizational Documents |

|

|

58 |

|

|

|

SECTION 5.03. |

|

Capitalization |

|

|

58 |

|

|

|

SECTION 5.04. |

|

Authority Relative to This Agreement |

|

|

59 |

|

|

|

SECTION 5.05. |

|

No Conflict; Required Filings and Consents |

|

|

59 |

|

|

|

SECTION 5.06. |

|

Compliance |

|

|

60 |

|

|

|

SECTION 5.07. |

|

SEC Filings; Financial Statements; Sarbanes-Oxley |

|

|

60 |

|

|

|

SECTION 5.08. |

|

Absence of Certain Changes or Events |

|

|

62 |

|

|

|

SECTION 5.09. |

|

Absence of Litigation |

|

|

62 |

|

|

|

SECTION 5.10. |

|

Board Approval; Vote Required |

|

|

63 |

|

|

|

SECTION 5.11. |

|

No Prior Operations of Merger Sub |

|

|

63 |

|

|

|

SECTION 5.12. |

|

Brokers |

|

|

63 |

|

|

|

SECTION 5.13. |

|

Parent Trust Fund |

|

|

64 |

|

|

|

SECTION 5.14. |

|

Employees |

|

|

64 |

|

|

|

SECTION 5.15. |

|

Taxes |

|

|

65 |

|

|

|

SECTION 5.16. |

|

Listing |

|

|

67 |

|

|

|

SECTION 5.17. |

|

Parent and Merger Sub’s Investigation and Reliance |

|

|

67 |

|

|

|

SECTION 5.18. |

|

Affiliate Agreements |

|

|

67 |

|

|

|

SECTION 5.19. |

|

Opinion of Financial Advisor |

|

|

68 |

|

|

|

SECTION 5.20. |

|

Registration Statement |

|

|

68 |

|

|

|

| ARTICLE VI. CONDUCT OF BUSINESS PENDING THE MERGER |

|

68 |

|

|

|

|

|

|

|

SECTION 6.01. |

|

Conduct of Business by the Company Pending the Merger |

|

|

68 |

|

|

|

SECTION 6.02. |

|

Conduct of Business by Parent and Merger Sub Pending the Merger |

|

|

73 |

|

|

|

SECTION 6.03. |

|

Financing |

|

|

74 |

|

|

|

SECTION 6.04. |

|

Claims Against Trust Account |

|

|

75 |

|

ii

|

|

|

|

|

|

|

|

|

|

|

| ARTICLE VII. ADDITIONAL AGREEMENTS |

|

77 |

|

|

|

|

|

|

|

SECTION 7.01. |

|

Proxy Statement; Registration Statement |

|

|

77 |

|

| |

|

SECTION 7.02. |

|

Parent Shareholders’ Meeting; and Merger Sub Stockholder’s Approval |

|

|

78 |

|

|

|

SECTION 7.03. |

|

Company Stockholders’ Written Consent |

|

|

79 |

|

|

|

SECTION 7.04. |

|

Access to Information; Confidentiality |

|

|

79 |

|

|

|

SECTION 7.05. |

|

Company Solicitation |

|

|

80 |

|

|

|

SECTION 7.06. |

|

Parent Exclusivity |

|

|

81 |

|

|

|

SECTION 7.07. |

|

Employee Benefits Matters |

|

|

82 |

|

|

|

SECTION 7.08. |

|

Directors’ and Officers’ Indemnification |

|

|

83 |

|

|

|

SECTION 7.09. |

|

Notification of Certain Matters |

|

|

83 |

|

|

|

SECTION 7.10. |

|

Further Action; Reasonable Best Efforts |

|

|

84 |

|

|

|

SECTION 7.11. |

|

Public Announcements |

|

|

85 |

|

|

|

SECTION 7.12. |

|

Tax Matters |

|

|

85 |

|

|

|

SECTION 7.13. |

|

Stock Exchange Listing |

|

|

87 |

|

|

|

SECTION 7.14. |

|

Antitrust |

|

|

87 |

|

|

|

SECTION 7.15. |

|

PCAOB Financials |

|

|

88 |

|

|

|

SECTION 7.16. |

|

Trust Account |

|

|

88 |

|

|

|

SECTION 7.17. |

|

Governance Matters |

|

|

89 |

|

|

|

SECTION 7.18. |

|

Public Filings |

|

|

89 |

|

|

|

SECTION 7.19. |

|

Section 16 Matters |

|

|

89 |

|

|

|

SECTION 7.20. |

|

Transaction Litigation |

|

|

90 |

|

|

|

SECTION 7.21. |

|

Termination of Certain Company Agreements |

|

|

90 |

|

|

|

SECTION 7.22. |

|

Stockholder Support Agreements |

|

|

90 |

|

|

|

SECTION 7.23. |

|

Company Insider Loans |

|

|

90 |

|

|

|

SECTION 7.24. |

|

Amendments to Ancillary Agreements |

|

|

90 |

|

|

|

| ARTICLE VIII. CONDITIONS TO THE MERGER |

|

90 |

|

|

|

|

|

|

|

SECTION 8.01. |

|

Conditions to the Obligations of Each Party |

|

|

90 |

|

|

|

SECTION 8.02. |

|

Conditions to the Obligations of Parent and Merger Sub |

|

|

91 |

|

|

|

SECTION 8.03. |

|

Conditions to the Obligations of the Company |

|

|

93 |

|

|

|

| ARTICLE IX. TERMINATION, AMENDMENT AND WAIVER |

|

93 |

|

|

|

|

|

|

|

SECTION 9.01. |

|

Termination |

|

|

93 |

|

|

|

SECTION 9.02. |

|

Effect of Termination |

|

|

95 |

|

|

|

SECTION 9.03. |

|

Termination Fee |

|

|

95 |

|

|

|

| ARTICLE X. GENERAL PROVISIONS |

|

96 |

|

|

|

|

|

|

|

SECTION 10.01. |

|

Notices |

|

|

96 |

|

|

|

SECTION 10.02. |

|

Nonsurvival of Representations, Warranties and Covenants |

|

|

97 |

|

|

|

SECTION 10.03. |

|

Severability |

|

|

97 |

|

|

|

SECTION 10.04. |

|

Entire Agreement; Assignment |

|

|

97 |

|

|

|

SECTION 10.05. |

|

Parties in Interest |

|

|

97 |

|

|

|

SECTION 10.06. |

|

Governing Law; Jurisdiction |

|

|

97 |

|

|

|

SECTION 10.07. |

|

Waiver of Jury Trial |

|

|

98 |

|

|

|

SECTION 10.08. |

|

Headings |

|

|

98 |

|

iii

|

|

|

|

|

|

|

|

|

| |

|

SECTION 10.09. |

|

Counterparts |

|

|

98 |

|

|

|

SECTION 10.10. |

|

Specific Performance |

|

|

99 |

|

|

|

SECTION 10.11. |

|

Non-Recourse |

|

|

99 |

|

|

|

SECTION 10.12. |

|

Expenses |

|

|

99 |

|

|

|

SECTION 10.13. |

|

Amendment |

|

|

99 |

|

|

|

SECTION 10.14. |

|

Waiver |

|

|

100 |

|

|

|

SECTION 10.15. |

|

Schedules and Exhibits |

|

|

100 |

|

|

|

|

| EXHIBIT A |

|

Form of Post-Closing Parent Certificate of Incorporation |

| EXHIBIT B |

|

Form of Post-Closing Parent Bylaws |

| EXHIBIT C-1 |

|

Form of Stockholder Support Agreement (Common Stockholders) |

| EXHIBIT C-2 |

|

Form of Stockholder Support Agreement (Preferred Stockholders) |

| EXHIBIT D |

|

Form of Registration Rights Agreement |

| EXHIBIT E-1 |

|

Form of Lock-Up Agreement (Common Stockholders) |

| EXHIBIT E-2 |

|

Form of Lock-Up Agreement (Preferred Stockholders) |

| EXHIBIT F |

|

Form of Parent Equity Plan |

| EXHIBIT G |

|

Form of Parent ESPP |

| SCHEDULE A |

|

Key Company Stockholders |

| SCHEDULE B |

|

Company Knowledge Parties |

|

| Company Disclosure Schedule |

| Parent Disclosure Schedule |

iv

BUSINESS COMBINATION AGREEMENT

This Business Combination Agreement dated as of September 6, 2023 (this “Agreement”) is among Andretti Acquisition

Corp., a Cayman Islands exempted company incorporated with limited liability (which shall transfer by way of continuation to and domesticate as a Delaware corporation in accordance herewith, “Parent”), Tigre Merger Sub, Inc., a

Delaware corporation (“Merger Sub”), and Zapata Computing, Inc., a Delaware corporation (the “Company”). Capitalized terms used but not defined elsewhere herein have the meanings assigned to them in

Section 1.01.

WHEREAS, Parent is a special purpose acquisition company incorporated as an exempted company with

limited liability in the Cayman Islands for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses;

WHEREAS, subject to the terms and conditions of this Agreement, immediately prior to the Closing, (a) Parent will transfer by way of

continuation to and domesticate as a Delaware corporation in accordance with Section 388 of the Delaware General Corporation Law (the “DGCL”) and Part XII of the Cayman Act (the “Domestication”), and

(b) in connection with such Domestication, the certificate of incorporation in substantially the form attached as Exhibit A (the “Post-Closing Parent Certificate of Incorporation”) pursuant to

which Parent shall have a single class of common stock, par value $0.0001 per share (the “New Parent Common Stock”) having one (1) vote per share, and the bylaws in substantially the form attached as

Exhibit B (the “Post-Closing Parent Bylaws”), which will become the governing documents of Parent from and after the effectiveness of the Domestication, each until thereafter amended in

accordance with its terms and applicable Law;

WHEREAS, in connection with the Domestication, (a) each Class A ordinary share

and each Class B ordinary share of Parent that is outstanding at the time of the Domestication will be converted into one share of New Parent Common Stock, and (b) each warrant of Parent that is outstanding at the time of the Domestication

and exercisable for one Class A ordinary share of Parent shall convert automatically into a warrant exercisable for one share of New Parent Common Stock pursuant to the applicable Warrant Agreement;

WHEREAS, Merger Sub is a wholly-owned direct subsidiary of Parent;

WHEREAS, upon the terms and subject to the conditions of this Agreement and in accordance with the DGCL, Parent and the Company will enter

into a business combination transaction pursuant to which Merger Sub will merge with and into the Company (the “Merger”), with the Company surviving the Merger as a wholly owned subsidiary of Parent;

WHEREAS, the Board of Directors of the Company (the “Company Board”) has (a) determined that this Agreement and the

Transactions (including the Merger) are fair to, and in the best interests of, the Company and its stockholders, (b) approved the execution, delivery and performance of this Agreement and the consummation of the Transactions (including the

Merger), on the terms and subject to the conditions set forth herein, and declared their advisability, and (c) resolved to recommend the approval and adoption of this Agreement and the Transactions (including the Merger) by the stockholders of

the Company and directed that this Agreement and the Merger be submitted for consideration by the Company’s stockholders;

WHEREAS, the Board of Directors of Parent (the “Parent Board”) has

(a) determined that this Agreement and the Transactions (including the Merger) are fair to, and in the best interests of, Parent and its shareholders, (b) determined that the aggregate fair market value of the Company is equal to at least

80% of the assets held in the Trust Account (net of amounts previously disbursed to the Parent’s management for Taxes and excluding the amount of deferred underwriting discounts held in the Trust Account), (c) approved the Transactions

(including the Merger) as a Business Combination, (d) approved the execution, delivery and performance of this Agreement and the consummation of the Transactions (including the Merger), on the terms and subject to the conditions set forth

herein, and declared their advisability, and (e) resolved to recommend the approval and adoption of this Agreement and the Transactions (including the Merger) by the Parent Shareholders and directed that this Agreement and the Merger be

submitted for consideration by the Parent Shareholders;

WHEREAS, the Board of Directors of Merger Sub (the “Merger Sub

Board”) has (a) determined that this Agreement and the Merger are fair to, and in the best interests of, Merger Sub and its sole stockholder, (b) approved and adopted this Agreement and the Merger and declared their advisability,

(c) approved the Merger and the other Transactions, (d) recommended the approval and adoption of this Agreement and the Merger by the sole stockholder of Merger Sub, and (e) directed that this Agreement and the Transactions (including

the Merger) be submitted for consideration by the sole stockholder of Merger Sub;

WHEREAS, Parent, the Company and the Key Company

Stockholders (who constitute a Requisite Majority), promptly following the execution and delivery of this Agreement, shall enter into Stockholder Support Agreements, dated as of the date of this Agreement (the “Stockholder Support

Agreements”), pursuant to which, among other things, the Key Company Stockholders will irrevocably agree to vote their shares of Company Capital Stock in favor of the adoption and approval of this Agreement, the Merger and the other

Transactions at the time specified therein, substantially in the form attached as Exhibit C-1 or Exhibit C-2, as applicable;

WHEREAS, Parent, Andretti Sponsor LLC, a Delaware limited liability company (the “Sponsor”) and certain key equityholders of

the Sponsor, concurrently with the execution and delivery of this Agreement, are entering into that certain Sponsor Support Agreement (the “Sponsor Support Agreement”), pursuant to which, among other things, the Sponsor and such key

equityholders will vote their Parent Common Stock in favor of this Agreement, the Merger and the other Transactions at the time specified therein;

WHEREAS, Parent, certain stockholders of the Company, Sponsor and SOL Verano Blocker 1 LLC, a Delaware limited liability company (the

“Sponsor Co-Investor”), concurrently with the execution and delivery of this Agreement, are entering into an amended and restated Registration Rights Agreement (the “Registration

Rights Agreement”) to be effective upon the Closing, substantially in the form attached as Exhibit D;

WHEREAS, Parent,

the Company and certain stockholders of the Company, concurrently with the execution and delivery of this Agreement, are entering into certain Lock-Up Agreements (the

“Lock-Up Agreements”) to be effective upon the Closing, substantially in the form attached as Exhibit E-1 or Exhibit E-2, as applicable;

2

WHEREAS, prior to the consummation of the Transactions, Parent shall, subject to obtaining

the Parent Shareholder Approval, adopt the Equity Plan and ESPP in accordance with the terms of Section 7.07;

WHEREAS, for U.S. federal and applicable state and local income tax purposes, it is intended that (a) the Domestication shall qualify as

a “reorganization” within the meaning of Section 368(a)(1)(F) of the Code, (b) the Merger shall qualify as a “reorganization” within the meaning of Section 368(a) of the Code, with the Company, Merger Sub and

Parent as parties to such reorganization within the meaning of Section 368(b) of the Code, and (c) this Agreement constitutes a “plan of reorganization” within the meaning of Sections 354 and 361 of the Code and Treasury

Regulations Sections 1.368-2(g) and 1.368-3(a) with respect to each of the Domestication and the Merger (collectively, the “Intended Tax Treatment”).

NOW, THEREFORE, in consideration of the foregoing, the parties hereby agree as follows:

ARTICLE I.

DEFINITIONS

SECTION 1.01. Certain Definitions. For purposes of this Agreement:

“affiliate” means, with respect to any specified person, any person who, directly or indirectly through one or more

intermediaries, controls, is controlled by, or is under common control with, such specified person.

“Aggregate Common Stock

Consideration” means a number of shares of New Parent Common Stock (deemed to have a value of ten dollars ($10) per share) with an aggregate implied value equal to the Consideration Cap minus the aggregate implied value of the Aggregate

Preferred Stock Consideration.

“Aggregate Common Stock Consideration Value” means a dollar amount equal to the product

of (i) the Aggregate Common Stock Consideration multiplied by (ii) $10.

“Aggregate Option Exercise Price”

means the aggregate of the exercise prices payable to the Company by the holders of Company Options, excluding any

Out-of-the-Money Options, upon the exercise of such Company Options.

“Aggregate Preferred Stock Consideration” means the sum of the Series A Aggregate Consideration, the Series B-1 Aggregate Consideration, the Series B-2 Aggregate Consideration and the Series Seed Aggregate Consideration.

“Ancillary Agreements” means the Stockholder Support Agreements, the Sponsor Support Agreement, the Registration Rights

Agreement, Lock-Up Agreements, the Financing Agreements (if any), the Company Financing Agreements (if any), the Equity Plan, the ESPP and all other agreements, certificates and instruments executed and

delivered by Parent, Merger Sub or the Company in connection with the Transactions.

3

“Anti-Corruption Laws” means the United States Foreign Corrupt Practices

Act, the United Kingdom Bribery Act 2010, any national and international law enacted to implement the OECD Convention on Combating Bribery of Foreign Officials in International Business Transactions, and any Laws of any other jurisdiction (national,

state or local) where the Company operates concerning or relating to public sector or private sector bribery or corruption.

“Business Day” means a day other than a Saturday, Sunday or other day on which commercial banks in New York,

New York are authorized or required by Law to close.

“Business Systems” means all Software, computer hardware

(whether general or special purpose), electronic data processing, information, record keeping, communications, or telecommunications networks, interfaces, platforms, websites, servers, peripherals, and computer systems, including any outsourced

systems and processes, that are owned or used in the conduct of the business of the Company.

“Cayman Act” means the

Companies Act (As Revised) of the Cayman Islands.

“Code” means the U.S. Internal Revenue Code of 1986, as amended.

“Company Acquisition Proposal” means any proposal or offer from any person or “group” (as defined in the Exchange

Act) (other than Parent, Merger Sub or their respective affiliates) relating to, in a single transaction or a series of related transactions, (A) any direct or indirect acquisition or purchase of a business that constitutes 10% or more of the

net revenues, net income or assets of the Company and its subsidiaries, taken as a whole, (B) any direct or indirect acquisition of 10% or more of the consolidated assets of the Company and its subsidiaries, taken as a whole (based on the fair

market value thereof, as determined in good faith by the Company Board), including through the acquisition of one or more subsidiaries of the Company owning such assets, (C) acquisition of beneficial ownership, or the right to acquire

beneficial ownership, of 10% or more of the total voting power of the equity securities of the Company, or any merger, reorganization, consolidation, share exchange, business combination, recapitalization, liquidation, dissolution or similar

transaction involving the Company (or any subsidiary of the Company whose business constitutes 10% or more of the net revenues, net income or assets of the Company and its subsidiaries, taken as a whole) or (D) any issuance (other than

issuances in respect of any Company Equity Financing or pursuant to the Senior Note Purchase Agreement in accordance with the terms of Section 6.03 and subject to the limitations set forth therein) or sale or

other disposition (including by way of merger, reorganization, division, consolidation, share exchange, business combination, recapitalization or other similar transaction) of 10% or more of the total voting power of the equity securities of the

Company.

“Company Capital Stock” means the Company Common Stock and the Company Preferred Stock.

“Company Certificate of Incorporation” means the Third Amended and Restated Certificate of Incorporation of the Company,

filed with the Secretary of State of the State of Delaware on August 28, 2020, as amended by the Certificate of Amendment of Third Amended and Restated Certificate of Incorporation of the Company, filed with the Secretary of State of the State

of Delaware on July 12, 2021.

4

“Company Common Stock” means the Company’s common stock, par value of

$0.0001 per share.

“Company Data” means all data and information Processed by or for the Company.

“Company Equity Financing” means any committed equity facility or other subscription to shares of Company Capital Stock (or

any other form of instrument that may convert into equity securities of the Company) that provides cash to the Company, whether entered into prior to or after the date of this Agreement.

“Company Financing Agreements” means any agreement entered into, or to be entered into, by the Company relating to an Equity

Financing.

“Company IP” means, collectively, all Company-Owned IP and Company-Licensed IP.

“Company-Licensed IP” means all Intellectual Property owned or purported to be owned by a third party and licensed to the

Company or to which the Company otherwise has a right to use.

“Company Material Adverse Effect” means any event,

circumstance, change, condition, development, effect or occurrence (each, an “Effect,” and collectively “Effects”) that, individually or in the aggregate with any one or more other Effects, that (a) has had, or

would reasonably be expected to have a material adverse effect on the business, condition (financial or otherwise), assets or results of operations of the Company, or (b) would reasonably be expected to prevent, materially delay or materially

impair or impede the performance by the Company of its obligations under this Agreement or the consummation of the Merger or any of the other Transactions; provided, however, that with respect to clause (a) only, none of the

following shall be deemed to constitute, alone or in combination, or be taken into account in the determination of whether, there has been or will be a Company Material Adverse Effect: (i) any change or proposed change in or in the

interpretation of any applicable Laws (including any COVID-19 Measures) after the date of this Agreement or GAAP; (ii) events or conditions generally affecting the industries or geographic areas in which

the Company operates; (iii) any change in general economic conditions, including changes in the credit, debt, securities, financial or capital markets (including changes in interest or exchange rates, prices of any security or market index or

commodity or any disruption of such markets); (iv) acts of war, sabotage, civil unrest, terrorism, epidemics, pandemics or disease outbreaks (including COVID-19), or any escalation or worsening of any such

acts of war, sabotage, civil unrest, terrorism epidemics, pandemics or disease outbreaks, or changes in global, national, regional, state or local political or social conditions; (v) any hurricane, tornado, flood, earthquake, natural disaster,

or other acts of God; (vi) any actions taken by the Company as expressly required by this Agreement (other than action required to be taken by Section 6.01(a)) or the failure of the Company to take any action that the

Company is expressly prohibited by the terms of this Agreement from taking; (vii) the announcement or execution, pendency or consummation of the Domestication, the Merger or any of the other Transactions (including the impact thereof on

relationships with customers,

5

suppliers, employees or Governmental Authorities) (provided, that the exceptions in this clause (vii) shall not be deemed to apply to the representations and warranties set forth in

Section 4.05 or the conditions set forth in Section 8.02(a)); (viii) any failure in and of itself to meet any projections, forecasts, guidance, estimates, milestones, budgets or financial or

operating predictions of revenue, earnings, cash flow or cash position; provided that this clause (viii) shall not prevent or otherwise affect a determination that any Effect underlying such failure has resulted in, or contributed to, or would

reasonably be expected to contribute to or result in, a Company Material Adverse Effect; or (ix) any actions taken, or failures to take action, in each case, which Parent has expressly requested in writing, except in the cases of clauses

(i) through (v), in each case, to the extent that the Company is materially and disproportionately affected thereby as compared with other participants in the industries in which the Company operates.