The Securities Law Firm of Menzer & Hill, P.A. Announces Its Continuing Investigation into The Sales Practices of Broker-Deal...

April 12 2011 - 8:45AM

Business Wire

The Securities Law Firm of Menzer & Hill, P.A.

(www.suemyadvisor.com) announced today that it is continuing its

investigation of the sales practices of brokerage firms that

solicited purchases of Lehman Brothers Principal Protected Notes

(“Notes”). Many broker-dealers marketed the Notes as safe, secure,

investments without informing the purchasers of the true risks

associated with the Notes, including the fact that the Notes were

tied to the credit worthiness of the guarantor, Lehman Brothers.

When Lehman Brothers filed for bankruptcy, the value of the Notes

became essentially worthless.

Investors that have purchased Notes through a brokerage account

or managed account offered by Merrill Lynch, a subsidiary of Bank

of America (NYSE: BAC), Morgan Stanley (NYSE: MS), Wells Fargo

Advisors (NYSE: WFC), Ameriprise Financial (NYSE: AMP), UBS (NYSE:

UBS), LPL Financial (NASDAQ GS: LPLA), Raymond James (NYSE: RJF),

Barclays (NYSE: BCS), Edward Jones, or other brokerage firms and

have sustained losses should contact the attorneys at the

Securities Law Firm of Menzer & Hill, P.A. to determine if they

have a claim for a recovery of losses.

For a free case evaluation or to discuss any other investment

losses, please contact the Securities Arbitration Firm of Menzer

& Hill, P.A. at 888-923-9223, or visit us on the web at

www.suemyadvisor.com.

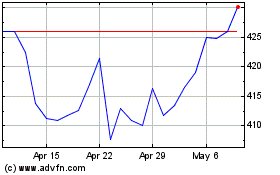

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From Jul 2023 to Jul 2024