Ameriprise Financial, Inc. (NYSE: AMP):

Ameriprise Financial, Inc. Fourth Quarter and

Full-Year Results Summary

(in millions, except pershare amounts,

unaudited)

Three Months Ended December 31, Year

Ended December 31, 2010 2009 %

Change 2010 2009 % Change

GAAP Net revenues $ 2,678 $ 2,269 18 % $ 9,976 $ 7,805 28 %

Net income attributable toAmeriprise

Financial

$ 305 $ 237 29 % $ 1,122 $ 722 55 % Earnings per diluted share $

1.18 $ 0.90 31 % $ 4.28 $ 2.95 45 %

Return on equity, excludingAOCI

11.5 % 8.8 %

Operating Net revenues $ 2,632 $ 2,211

19 % $ 9,581 $ 7,730 24 % Earnings $ 312 $ 240 30 % $ 1,173 $ 752

56 % Earnings per diluted share $ 1.21 $ 0.91 33 % $ 4.47 $ 3.08 45

%

Return on equity, excludingAOCI

12.6 % 9.2 %

Weighted average commonshares

outstanding:

Basic 252.7 258.9 257.4 242.2 Diluted 258.9 263.3 262.3

244.4

(Operating measures exclude net realized

gains/losses, integration/restructuring expenses and the impact of

the adoption of a 2010 accounting standard that required the

company to consolidate approximately $6 billion of client assets in

certain investment entities on its balance sheet and report related

revenues and expenses through its income statement. Reconciliation

tables of GAAP to operating results are included throughout this

release.)

(1) Net income represents net income

attributable to Ameriprise Financial.

Ameriprise Financial, Inc. (NYSE: AMP) today reported net income

of $305 million for the fourth quarter of 2010 compared to $237

million for the fourth quarter of 2009. Net income per diluted

share for the fourth quarter of 2010 was $1.18 compared to $0.90 a

year ago.

Operating earnings increased 30 percent to $312 million in the

fourth quarter of 2010 compared to $240 million a year ago.

Operating earnings per diluted share were $1.21 in the fourth

quarter of 2010, up 33 percent from $0.91 a year ago. Operating

earnings growth was driven by strength in Asset Management and

Advice & Wealth Management.

Operating net revenues were $2.6 billion in the fourth quarter

of 2010, up 19 percent from $2.2 billion a year ago, due to growth

in asset-based fees driven by the Columbia Management acquisition,

market appreciation and retail client net inflows, as well as

increased client activity levels.

As of December 31, 2010 the company’s excess capital position

remained more than $1.5 billion after deploying approximately $573

million in 2010 to repurchase approximately 13.1 million shares of

its common stock. The company’s investment portfolio ended the

quarter with $1.5 billion in net unrealized gains.

Return on shareholders’ equity excluding AOCI was 11.5 percent

for the 12 months ended December 31, 2010. Operating return on

equity excluding AOCI was 12.6 percent for the same time period, an

increase of 340 basis points from a year ago.

For the full year, the company reported net income of $1.1

billion. Operating earnings in 2010 were a record $1.2 billion, or

$4.47 per diluted share, compared to $752 million in 2009, or $3.08

per diluted share. Earnings growth was driven by improved client

activity, market appreciation and retail client net inflows, as

well as improved scale from the Columbia Management

acquisition.

The company continued to generate a higher percentage of

earnings from its less capital-demanding businesses. Excluding

Corporate & Other segment results, Advice & Wealth

Management and Asset Management accounted for 54 percent of fourth

quarter 2010 pretax operating earnings compared to 30 percent in

fourth quarter 2009.

"We delivered record earnings in 2010 and significantly

increased operating return on equity, ending the year at 12.6

percent," said Jim Cracchiolo, chairman and chief executive

officer. "This quarter marked a good finish to a great year, with

strong earnings in our Advice & Wealth Management and Asset

Management segments leading the way. We continued to drive client

asset growth and advisor productivity improvements, and we are

realizing significant benefits from the Columbia Management

acquisition."

"Despite the backdrop of ongoing economic challenges, 2010 was a

year of significant growth for Ameriprise Financial; I am pleased

with our position and the momentum we generated."

Ameriprise Financial, Inc. Notable Fourth Quarter

Items

(in millions, except per share amounts,

unaudited)

Per Diluted Share 2010

2009 2010 2009

Variable annuity guarantees net ofDAC and

DSIC expense, after-tax(1)

$ (28 ) $ (3 ) $ (0.11 ) $ (0.01 ) Phoenix hail storm expense,

after-tax(1) $ (7 ) — $ (0.03 ) —

(1) After-tax is calculated using the

statutory tax rate of 35%.

The following notable after-tax items are included in fourth

quarter operating earnings:

- A $28 million expense, or $0.11 per

diluted share, related to variable annuity guarantees driven by

RiverSource Life’s credit spread narrowing in the quarter and the

impact of credit spread on a declining living benefit liability.

The company does not hedge the credit spread used for the

accounting valuation and does not report the change in valuation as

a realized gain or loss.

- A $7 million expense, or $0.03 per

diluted share, from higher claims driven by a hail storm in the

Phoenix area.

Additional variance items, including the impact of market

appreciation on DAC and DSIC amortization (mean reversion), are

included at the segment level.

Taxes

The effective tax rate on net income excluding net income (loss)

attributable to non-controlling interests and the required

consolidation of certain investment entities was 22.1 percent in

the fourth quarter of 2010. The lower effective tax rate in the

quarter reduced the full-year effective tax rate to 23.7

percent.

Fourth Quarter 2010 Business Highlights

- Total owned, managed and administered

assets were $673 billion at December 31, 2010, up 47 percent from a

year ago as a result of the acquisition of Columbia Management,

market appreciation and retail client net inflows.

- Total retail client assets in Advice

& Wealth Management increased 12 percent year-over-year to $329

billion, reflecting market appreciation and strong retail client

net inflows.

- Advisor productivity, measured as

operating net revenue per advisor, increased 21 percent compared to

a year ago. Growth was primarily driven by improved client

activity, increased assets under management from market

appreciation and retail client net inflows, as well as the

company's focus on experienced advisors. Total advisors declined 5

percent from a year ago reflecting the departure of lower producing

advisors, partially offset by experienced advisor recruiting.

- Asset Management AUM increased 88

percent to $457 billion driven by the acquisition of Columbia

Management and year-over-year equity market appreciation, partially

offset by net outflows. Retail net outflows improved to $290

million in the quarter, primarily due to net inflows at

Threadneedle. Institutional net outflows of $5.7 billion included

approximately $4.7 billion in lower basis point insurance

portfolios.

- Equity investment performance at

Columbia Management and Threadneedle remained strong across one-,

three- and five-year periods.

- Wrap assets increased 19 percent

year-over-year to $113 billion and included $2.0 billion in net

inflows in the fourth quarter of 2010.

- Variable annuity net inflows of $401

million were essentially flat compared to a year ago and more than

offset continued fixed annuity net outflows. During the quarter,

the company discontinued new sales of RiverSource variable

annuities in non-Ameriprise channels to further strengthen the risk

and return characteristics of the business. The fixed annuity

business was not impacted by the decision.

- Variable universal life / universal

life (VUL/UL) policyholder account balances increased 8 percent to

$9.5 billion.

Liquidity and Balance Sheet as of December 31, 2010

Conservative capital management

- The company continued to maintain more

than $1.5 billion in excess capital.

- During the quarter, the company

repurchased 3.8 million shares of its common stock for $200

million. For the year, the company repurchased 13.1 million shares

of its common stock for $573 million.

- In 2010, the company returned 67

percent of 2010 net income to shareholders.

- RiverSource Life Insurance Company’s

preliminary estimate of its risk-based capital ratio was 590

percent.

- The debt-to-total capital ratio

attributable to Ameriprise Financial was 17.7 percent. The

debt-to-total capital ratio was 16.2 percent, excluding

non-recourse debt, the impact of consolidated investment entities

and the 75 percent equity credit for the junior subordinated notes.

The company’s cash flow coverage ratio increased to 13X.

- The company will continue to use

enterprise risk management capabilities and product hedging to

anticipate and mitigate risk. The company’s variable annuity

hedging program continued to perform well.

Substantial liquidity

- Cash and cash equivalents were $2.9

billion, with $1.3 billion at the holding company level and $1.8

billion in free cash.

- The company retired $340 million of

debt maturing during the quarter. The company’s next outstanding

debt maturity is in 2015.

High-quality investment

portfolio

- The total investment portfolio,

including cash and cash equivalents, was $39.9 billion at year end

and remained well positioned for continued stress in the credit and

commercial mortgage markets. The portfolio has an average duration

of approximately 3.7 years, and the company's asset liability

management programs are positioned for a potential increase in

interest rates.

- The company’s available for sale

portfolio ended the quarter with $1.5 billion in net unrealized

gains. The $0.8 billion sequential decline in unrealized gains was

primarily driven by the increase in Treasury rates in the

quarter.

Detailed information about the company’s

investment portfolio is available at ir.ameriprise.com.

Fourth Quarter 2010 Segment Results

Ameriprise Financial, Inc. Advice & Wealth

Management Segment Results (in millions, unaudited)

Quarter Ended December 31, 2010 Quarter

Ended December 31, 2009 GAAP

Less: Adjustments(1)

Operating GAAP

Less: Adjustments(1)

Operating

% Change

Advice & Wealth Management Net revenues $ 1,016 $

1 $ 1,015 $ 873 $ (2 ) $ 875 16 % Expenses 925 —

925 855 15 840 10 Pretax income $ 91 $

1 $ 90 $ 18 $ (17 ) $ 35 157

(1) Includes net realized gains/losses and

integration charges.

Advice & Wealth Management reported pretax income of

$91 million for the fourth quarter of 2010. Segment operating

earnings were $90 million compared to $35 million a year ago.

Fourth quarter 2010 pretax margin was 9.0 percent. Pretax operating

margin was 8.9 percent for the fourth quarter of 2010 compared to

4.0 percent a year ago.

Operating net revenues increased 16 percent, or $140 million, to

a record $1.0 billion. Revenue growth was primarily due to higher

management and distribution fees from increased client activity and

higher assets under management.

Operating expenses increased 10 percent, or $85 million, to $925

million, primarily due to higher advisor compensation from business

growth, partially offset by re-engineering benefits.

The company continued to increase the productivity of its

advisors. Net revenue per advisor increased 21 percent compared to

a year ago due to increased client activity, higher assets under

management from market appreciation and retail client net inflows,

as well as the company's focus on experienced advisors.

Ameriprise Financial, Inc. Asset Management

Segment Results (in millions, unaudited)

Quarter Ended December 31, 2010 Quarter Ended

December 31, 2009 GAAP

Less: Adjustments(1)

Operating GAAP

Less: Adjustments(1)

Operating

% Change

Asset Management Net revenues $ 774 $ 1 $ 773 $ 465 $

— $ 465 66 % Expenses 634 24 610 395

7 388 57 Pretax income $ 140 $ (23 ) $ 163 $ 70 $ (7

) $ 77 112

(1) Includes net realized gains and

integration charges.

Item: Hedge fund performance fees $ 22 $ 30

Asset Management reported pretax income of $140 million

for the fourth quarter of 2010. Segment operating earnings were

$163 million compared to $77 million a year ago. Fourth quarter

2010 pretax margin was 18.1 percent. Pretax operating margin was

21.1 percent for the fourth quarter of 2010 compared to 16.6

percent a year ago.

Operating net revenues increased 66 percent, or $308 million, to

$773 million, driven by an increase in management fees due to

growth in assets from the Columbia acquisition, market appreciation

and a continued shift to higher revenue yielding asset classes.

Fourth quarter 2010 operating net revenues included lower hedge

fund revenues compared to a year ago.

Operating expenses increased 57 percent, or $222 million, to

$610 million, primarily reflecting increased ongoing general and

administrative and distribution expenses from the acquisition and

performance-based compensation. For the year, the company realized

approximately $75 million in integration gross synergies and

approximately $100 million in integration-related expenses, which

were consistent with original estimates.

Segment AUM increased 88 percent from a year ago to $457

billion, primarily due to the Columbia acquisition and market

appreciation. Retail net outflows declined to $290 million in the

quarter driven by inflows at Threadneedle. Institutional net

outflows at Columbia and Threadneedle were primarily in lower basis

point insurance portfolios. The following provides a summary of the

U.S. Asset Management and Threadneedle businesses:

- Columbia Management AUM were $355

billion at December 31, 2010 compared to $149 billion a year ago,

driven by the Columbia acquisition and market appreciation,

partially offset by net outflows. Retail net outflows improved

sequentially to $1.5 billion in the quarter. The majority of the

$4.0 billion in institutional net outflows in the quarter were in

lower basis point insurance portfolios. Equity and fixed income

investment performance remained strong across one-, three- and

five-year periods.

- Threadneedle AUM were $106 billion at

December 31, 2010, up 8 percent from a year ago, reflecting

year-over-year market appreciation and retail net inflows,

partially offset by negative foreign currency translation and

institutional net outflows. Institutional net outflows in the

quarter primarily reflected continued outflows in Zurich-related

portfolios. Total net outflows of $633 million in the fourth

quarter of 2010 reflected net outflows in lower basis point

institutional portfolios, partially offset by $1.2 billion in

retail net inflows from higher sales from European investors.

Investment track records remained strong across one-, three- and

five-year periods.

Ameriprise Financial, Inc. Annuities Segment

Results (in millions, unaudited)

Quarter Ended

December 31, 2010 Quarter Ended December 31, 2009

GAAP

Less: Adjustments(1)

Operating GAAP

Less: Adjustments(1)

Operating

% Change

Annuities Net revenues $ 642 $ 3 $ 639 $ 620 $ 16 $

604 6 % Expenses 511 — 511 463 —

463 10 Pretax income $ 131 $ 3 $ 128 $ 157 $ 16 $ 141 (9 )

(1) Includes net realized gains. Items: DAC and DSIC benefits [mean

reversion] $ 23 $ 3

Variable annuity guarantees, net of DACand

DSIC

$ (43 ) $ (5 )

Annuities reported pretax income of $131 million for the

fourth quarter of 2010. Segment operating earnings were $128

million for the fourth quarter of 2010 down $13 million from a year

ago, primarily due to an $18 million decrease in earnings from mean

reversion and variable annuity guarantees.

Operating net revenues increased 6 percent, or $35 million, to

$639 million, reflecting increased management fees from higher

separate account balances and higher fees from variable annuity

guarantees, partially offset by a decline in operating net

investment income.

Operating expenses in the quarter included $43 million of net

variable annuity living benefit expense, primarily due to the

unhedged impact of reflecting RiverSource Life’s credit spread in

the accounting valuation of the liability. In addition, expenses

included a $23 million decrease in DAC and DSIC amortization driven

by the market impact on separate account balances (mean

reversion).

Variable annuity net inflows of $401 million in the fourth

quarter of 2010 were partially offset by continued fixed annuity

net outflows reflecting low client demand given current interest

rates. During the quarter, the company discontinued new sales of

RiverSource variable annuities in non-Ameriprise channels to

further strengthen the risk and return characteristics of the

business.

Ameriprise Financial, Inc. Protection Segment

Results (in millions, unaudited)

Quarter Ended December 31, 2010 Quarter Ended December

31, 2009 GAAP

Less: Adjustments(1)

Operating GAAP

Less: Adjustments(1)

Operating

% Change

Protection Net revenues $ 525 $ (1 ) $ 526 $ 528 $ 13

$ 515 2 % Expenses 440 — 440 399

— 399 10 Pretax income $ 85 $ (1 ) $ 86 $ 129 $ 13 $ 116 (26

)

(1) Includes net realized

gains/losses.

Items: DAC and DSIC benefits [mean reversion] $ 3 $ 1 Auto

liability claims $ (16 ) $ — Phoenix hail storm expense $ (11 ) $ —

Protection reported pretax income of $85 million for the

fourth quarter of 2010. Segment operating earnings were $86

million, down $30 million from a year ago driven by increased auto

and home losses.

Operating net revenues increased 2 percent, or $11 million, to

$526 million, primarily due to higher operating investment income

driven by improvement in portfolio rate and asset growth, as well

as auto and home premium growth, and higher management fees from

VUL separate account growth.

Operating expenses increased 10 percent, or $41 million, to $440

million, primarily due to a $45 million increase in benefit

expenses. These increases included $11 million in catastrophe

losses from a hail storm in the Phoenix area and a $16 million

reserve increase for higher auto liability claims. Increased

expenses in the life and health business were primarily driven by

higher reserves for universal life products with secondary

guarantees. The company increased ongoing reserve levels for this

product beginning in the third quarter of 2010. In addition, while

disability income and long-term care claims in the quarter were

higher than in fourth quarter 2009, fourth quarter 2010 claims

declined sequentially and were in line with expectations.

Life insurance in force declined 1 percent from a year ago to

$192 billion. Auto & Home continued to grow its policy counts,

up 9 percent compared to a year ago. Retention remained strong.

Ameriprise Financial, Inc. Corporate & Other

Segment Results (in millions, unaudited)

Quarter Ended December 31, 2010 Quarter Ended

December 31, 2009 GAAP

Less: Adjustments(1)

Operating GAAP

Less: Adjustments(1)

Operating

% Change

Corporate & Other

Net revenues $ 46 $ 52 $ (6 ) $ 30 $ 32 $ (2 ) NM Expenses

128 67 61 73 4 69 (12 )% Pretax

income $ (82 ) $ (15 ) $ (67 ) $ (43 ) $ 28 $ (71 ) 6

(1) Includes revenues and expenses of the

consolidated investment entities, net realized gains/losses and

integration/restructuring charges.

NM Not Meaningful --

variance of 100% or greater

Corporate & Other reported a pretax loss of $82

million for the fourth quarter of 2010. Segment operating loss was

$67 million in the quarter, compared to a loss of $71 million a

year ago. The fourth quarter of 2010 operating results excluded a

$4 million pretax expense related to the company’s decision to

discontinue new sales of RiverSource variable annuities through

non-Ameriprise distribution channels.

Ameriprise Financial, Inc. is a diversified financial services

company serving the comprehensive financial planning needs of the

mass affluent and affluent. For more information visit ameriprise.com.

Ameriprise Financial Services, Inc. offers financial planning

services, investments, insurance and annuity products. RiverSource

insurance and annuity products are issued by RiverSource Life

Insurance Company, and in New York only by RiverSource Life

Insurance Co. of New York, Albany, New York. Only RiverSource Life

Insurance Co. of New York is authorized to sell insurance and

annuity products in the state of New York. These companies are all

part of Ameriprise Financial, Inc. CA License #0684538. RiverSource

Distributors, Inc. (Distributor), Member FINRA.

Forward-Looking Statements

This news release contains forward-looking statements that

reflect management’s plans, estimates and beliefs. Actual results

could differ materially from those described in these

forward-looking statements. Examples of such forward-looking

statements include:

- the statement of belief in this news

release that the company will continue to use enterprise risk

management capabilities and product hedging to anticipate and

mitigate risk;

- the statements of belief in this news

release that the company's investment portfolio is well positioned

for continued stress in the credit and commercial mortgage markets

and that the investment portfolio is positioned for a potential

increase in interest rates;

- statements of the company’s plans,

intentions, positioning, expectations, objectives or goals,

including those relating to asset flows, mass affluent and affluent

client acquisition strategy, client retention and growth of our

client base, financial advisor productivity, retention, recruiting

and enrollments, general and administrative costs, consolidated tax

rate, return of capital to shareholders, and excess capital

position and financial flexibility to capture additional growth

opportunities;

- other statements about future economic

performance, the performance of equity markets and interest rate

variations and the economic performance of the United States and of

global markets; and

- statements of assumptions underlying

such statements.

The words “believe,” “expect,” “anticipate,” “optimistic,”

“intend,” “plan,” “aim,” “will,” “may,” “should,” “could,” “would,”

“likely,” “forecast,” “on pace,” “project” and similar expressions

are intended to identify forward-looking statements but are not the

exclusive means of identifying such statements. Forward-looking

statements are subject to risks and uncertainties, which could

cause actual results to differ materially from such statements.

Such factors include, but are not limited to:

- changes in the valuations, liquidity

and volatility in the interest rate, credit default, equity market

and foreign exchange environments;

- changes in capital and credit market

conditions including the availability and cost of capital;

- changes in relevant accounting

standards, as well as changes in the litigation and regulatory

environment, including ongoing legal proceedings and regulatory

actions, the frequency and extent of legal claims threatened or

initiated by clients, other persons and regulators, and

developments in regulation and legislation, including the rules and

regulations implemented or to be implemented in connection with the

Dodd-Frank Wall Street Reform and Consumer Protection Act;

- investment management performance and

consumer acceptance of the company’s products;

- effects of competition in the financial

services industry and changes in product distribution mix and

distribution channels;

- changes to the company’s reputation

that may arise from employee or affiliated advisor misconduct,

legal or regulatory actions, improper management of conflicts of

interest or otherwise;

- the company’s capital structure,

including indebtedness, limitations on subsidiaries to pay

dividends, and the extent, manner, terms and timing of any share or

debt repurchases management may effect as well as the opinions of

rating agencies and other analysts and the reactions of market

participants or the company’s regulators, advisors, distribution

partners or customers in response to any change or prospect of

change in any such opinion;

- risks of default, capacity constraint

or repricing by issuers or guarantors of investments the company

owns or by counterparties to hedge, derivative, insurance or

reinsurance arrangements or by manufacturers of products the

company distributes, experience deviations from the company’s

assumptions regarding such risks, the evaluations or the prospect

of changes in evaluations of any such third parties published by

rating agencies or other analysts, and the reactions of other

market participants or the company’s regulators, advisors,

distribution partners or customers in response to any such

evaluation or prospect of changes in evaluation;

- experience deviations from the

company’s assumptions regarding morbidity, mortality and

persistency in certain annuity and insurance products, or from

assumptions regarding market returns assumed in valuing DAC and

DSIC or market volatility underlying our valuation and hedging of

guaranteed living benefit annuity riders, or from assumptions

regarding anticipated claims and losses relating to our automobile

and home insurance products;

- changes in capital requirements that

may be indicated, required or advised by regulators or rating

agencies;

- the impacts of the company’s efforts to

improve distribution economics and to grow third-party distribution

of its products;

- the ability to complete the acquisition

opportunities the company negotiates and to pursue other growth

opportunities;

- the company’s ability to realize the

financial, operating and business fundamental benefits or to obtain

regulatory approvals regarding integrations we plan for the

acquisitions we have completed or may pursue and contract to

complete in the future, as well as the amount and timing of

integration expenses;

- the ability and timing to realize

savings and other benefits from re-engineering and tax

planning;

- changes in the capital markets and

competitive environments induced or resulting from the partial or

total ownership or other support by central governments of certain

financial services firms or financial assets; and

- general economic and political factors,

including consumer confidence in the economy, the ability and

inclination of consumers generally to invest as well as their

ability and inclination to invest in financial instruments and

products other than cash and cash equivalents, the costs of

products and services the company consumes in the conduct of its

business, and applicable legislation and regulation and changes

therein, including tax laws, tax treaties, fiscal and central

government treasury policy, and policies regarding the financial

services industry and publicly held firms, and regulatory rulings

and pronouncements.

Management cautions the reader that the foregoing list of

factors is not exhaustive. There may also be other risks that

management is unable to predict at this time that may cause actual

results to differ materially from those in forward-looking

statements. Readers are cautioned not to place undue reliance on

these forward-looking statements, which speak only as of the date

on which they are made. Management undertakes no obligation to

update publicly or revise any forward-looking statements. The

foregoing list of factors should be read in conjunction with the

“Risk Factors” discussion under Part 1, Item 1A of and elsewhere in

our Annual Report on Form 10-K for the year ended December 31, 2009

and under Part 2, Item 1A of our Quarterly Report on Form 10-Q for

the quarter ended September 30, 2010 available at

ir.ameriprise.com.

The financial results discussed in this news release represent

past performance only, which may not be used to predict or project

future results. The financial results and values presented in this

news release and the below-referenced Statistical Supplement are

based upon asset valuations that represent estimates as of the date

of this news release and may be revised in the company’s Annual

Report on Form 10-K for the year ended December 31, 2010. For

information about Ameriprise Financial entities, please refer to

the Fourth Quarter 2010 Statistical Supplement available at

ir.ameriprise.com and the tables that follow in this news

release.

Ameriprise Financial, Inc. Reconciliation Table:

GAAP Income Statement to Operating Income Statement

(in millions, unaudited)

Quarter Ended December

31, 2010 Quarter Ended December 31, 2009 GAAP

Less: Adjustments(1)

Operating GAAP

Less: Adjustments(1)

Operating

% Change

Revenues

Management andfinancial advice fees

$ 1,192 $ (10 ) $ 1,202 $ 855 $ (1 ) $ 856 40 % Distribution fees

449 — 449 391 — 391 15 Net investment income 542 43 499 535 19 516

(3 ) Premiums 295 — 295 287 — 287 3 Other revenues 214

13 201 229 43 186 8 Total

revenues 2,692 46 2,646 2,297 61 2,236 18

Banking and depositinterest expense

14 — 14 28 3 25 (44 )

Total net revenues 2,678 46 2,632

2,269 58 2,211 19

Expenses

Distribution expenses

674 — 674 504 — 504 34 Interest credited tofixed accounts 223 — 223

229 — 229 (3 ) Benefits, claims, lossesand settlement expenses 465

— 465 349 — 349 33

Amortization of deferredacquisition

costs

84 — 84 120 — 120 (30 ) Interest and debt expense 78 51 27 28 — 28

(4 )

General andadministrative expense(2)

789 30 759 708 25 683 11

Total expenses 2,313 81 2,232

1,938 25 1,913 17 Pretax income 365 (35

) 400 331 33 298 34 Income tax provision 86 (2 )

88 57 (1 ) 58 52

Net income

279 (33 ) 312 274 34 240

30

Less: Net income (loss) attributable

tononcontrolling interests

(26 ) (26 ) — 37 37 — —

Net income attributable to

Ameriprise Financial

$ 305 $ (7 ) $ 312

$ 237 $ (3 ) $ 240

30 %

(1) Includes the elimination of management

fees earned by the company from the consolidated investment

entities and the related expense, revenues and expenses of the

consolidated investment entities, net realized gains/losses and

integration/restructuring charges. Income tax provision is

calculated using the statutory tax rate of 35% on applicable

adjustments.

(2) 2010 adjustments include $4 million in

severance and related expenses from discontinuing new sales of

RiverSource variable annuities through non-Ameriprise distribution

channels.

Ameriprise Financial, Inc. Reconciliation Table:

GAAP Income Statement to Operating Income Statement (in

millions, unaudited)

Year Ended December 31, 2010

Year Ended December 31, 2009 GAAP

Less: Adjustments(1)

Operating GAAP

Less: Adjustments(1)

Operating

% Change

Revenues

Management andfinancial advice fees

$ 3,961 $ (38 ) $ 3,999 $ 2,704 $ (2 ) $ 2,706 48 % Distribution

fees 1,708 — 1,708 1,420 — 1,420 20 Net investment income 2,313 308

2,005 2,002 55 1,947 3 Premiums 1,179 — 1,179 1,098 — 1,098 7 Other

revenues 885 125 760 722 28

694 10 Total revenues 10,046 395 9,651 7,946 81 7,865 23

Banking and depositinterest expense 70 — 70

141 6 135 (48 )

Total net revenues

9,976 395 9,581 7,805 75

7,730 24 Expenses

Distribution expenses

2,431 — 2,431 1,782 — 1,782 36 Interest credited tofixed accounts

909 — 909 903 — 903 1 Benefits, claims, lossesand settlement

expenses 1,757 — 1,757 1,342 — 1,342 31 Amortization of deferred

acquisition costs 127 — 127 217 — 217 (41 ) Interest and debt

expense 290 181 109 127 — 127 (14 )

General andadministrative expense(2)

2,828 129 2,699 2,514 105

2,409 12

Total expenses 8,342 310 8,032

6,885 105 6,780 18 Pretax income 1,634

85 1,549 920 (30 ) 950 63 Income tax provision 349

(27 ) 376 183 (15 ) 198 90

Net

income 1,285 112 1,173 737

(15 ) 752 56

Less: Net income attributable

tononcontrolling interests

163 163 — 15 15 — —

Net income attributable to Ameriprise Financial

$ 1,122 $ (51 ) $

1,173 $ 722 $ (30 )

$ 752 56 %

(1) Includes the elimination of

management fees earned by the company from the consolidated

investment entities and the related expense, revenues and expenses

of the consolidated investment entities, net realized gains/losses

and integration/restructuring charges. Income tax provision is

calculated using the statutory tax rate of 35% on applicable

adjustments.

(2) 2010 adjustments include $4

million in severance and related expenses from discontinuing new

sales of RiverSource variable annuities through non-Ameriprise

distribution channels.

Ameriprise Financial, Inc. Reconciliation Table:

Effective Tax Rate Quarter Ended

Year Ended (in millions, unaudited)

December 31, 2010

December 31, 2010 Pretax income $ 365 $ 1,634 Less:

Pretax income (loss) attributable to noncontrolling interests

(26 ) 163 Pretax income excluding consolidated

investment entities (CIEs) $ 391 $ 1,471 Income tax

provision $ 86 $ 349 Effective tax rate 23.7 % 21.4 %

Effective tax rate excluding noncontrolling interests 22.1 % 23.7 %

Ameriprise Financial, Inc. Reconciliation Table:

Ameriprise Financial Debt to Ameriprise Financial Capital Ratio

December 31, 2010

As Reported As Reported Excluding

Excluding Impact of 75% Adjustments with (in

millions, unaudited)

As Reported

Adjustments(1)

Adjustments(1)

Equity Credit

75% Equity Credit(1)

Ameriprise Financial Debt $ 2,317 $ 59 $ 2,258 $ 231 $ 2,027

Ameriprise Financial Capital $ 13,067 $ 588 $ 12,479 $ 12,479

Ameriprise Financial Debt to Ameriprise Financial

Capital 17.7 % 18.1 % 16.2

%

(1) Includes fair value hedges,

unamortized discounts, non-recourse debt of muni inverse floaters

and equity impacts attributable to consolidated investment

entities.

Ameriprise Financial, Inc. Return on Equity (ROE)

Excluding Accumulated Other Comprehensive Income (Loss) “AOCI”

Calculation for the 12 Months Ended December 31, 2010

(in millions, unaudited)

ROE excluding AOCI Less: Adjustments(1)

Operating ROE(2) Return $ 1,122 $ (51 ) $

1,173 Equity excluding AOCI $ 9,774 $ 455 $ 9,319

Return on Equity excluding AOCI 11.5 % 12.6 %

Ameriprise Financial, Inc. Return on Equity (ROE)

Excluding Accumulated Other Comprehensive Income (Loss) “AOCI”

Calculation for the 12 Months Ended December 31, 2009

(in millions, unaudited)

ROE excluding AOCI Less: Adjustments(1)

Operating

ROE(2) Return $ 722 $ (30 ) $ 752 Equity

excluding AOCI $ 8,208 $ — $ 8,208 Return on Equity

excluding AOCI 8.8 % 9.2 %

(1) Adjustments reflect the trailing

twelve months’ sum of after-tax net realized gains/losses and

integration/restructuring charges less the equity impacts

attributable to the consolidated investment entities.

(2) Operating return on equity excluding

accumulated other comprehensive income (loss) and consolidated

investment entities is calculated using the trailing twelve months

of earnings excluding the after-tax net realized gains/losses and

integration/restructuring charges in the numerator, and Ameriprise

Financial shareholders’ equity excluding the impact of

consolidating investment entities using a five point average of

quarter-end equity in the denominator.

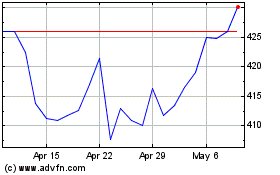

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From Jul 2023 to Jul 2024