AllianceBernstein Announces September 30, 2009 Assets Under Management

October 09 2009 - 11:53AM

PR Newswire (US)

Third Quarter 2009 Earnings Conference Call to be Held on October

29, 2009 at 5:00 P.M. (EDT) NEW YORK, Oct. 9 /PRNewswire-FirstCall/

-- AllianceBernstein Holding L.P. (NYSE:AB) and AllianceBernstein

L.P. today reported that during the month of September, preliminary

assets under management increased by approximately $16 billion, or

3.3%, to $498 billion at September 30, 2009, as positive investment

returns were partially offset by modest net outflows, primarily in

the Institutional Investments channel. ALLIANCEBERNSTEIN L.P. (THE

OPERATING PARTNERSHIP) ASSETS UNDER MANAGEMENT ($ billions)

---------------------------------------- ---------- At September

30, 2009 At Aug 31, (preliminary) 2009

---------------------------------------- ---------- Institutional

Private Investments Retail Client Total Total ------------- ------

------ ----- ---------- Equity Value $112 $38 $26 $176 $171 Growth

53 23 17 93 90 ---- ---- ---- ---- ---- Total Equity 165 61 43 269

261 ---- ---- ---- ---- ---- Fixed Income 127 38 31 196 189

Other(1) 16 17 - 33 32 ---- ---- ---- ---- ---- Total $308 $116 $74

$498 $482 ==== ==== ==== ==== ====

---------------------------------------- At August 31, 2009

---------------------------------------- Total $298 $112 $72 $482

==== ==== ==== ==== (1) Includes Index, Structured and Asset

Allocation services. THIRD QUARTER 2009 EARNINGS CONFERENCE CALL

INFORMATION AllianceBernstein's management will review third

quarter 2009 financial and operating results on Thursday, October

29, 2009 during a conference call beginning at 5:00 p.m. (EDT),

following the release of its financial results after the close of

the New York Stock Exchange. The conference call will be hosted by

Peter S. Kraus, Chairman and Chief Executive Officer, David A.

Steyn, Chief Operating Officer and Robert H. Joseph, Jr., Chief

Financial Officer. Parties may access the conference call by either

webcast or telephone: 1. To listen by webcast, please visit

AllianceBernstein's Investor Relations website at

http://ir.alliancebernstein.com/investorrelations at least 15

minutes prior to the call to download and install any necessary

audio software. 2. To listen by telephone, please dial (866)

556-2265 in the U.S. or (973) 935-8521 outside the U.S., 10 minutes

before the 5:00 p.m. (EDT) scheduled start time. The conference ID#

is 34279638. The presentation that will be reviewed during the

conference call will be available on AllianceBernstein's Investor

Relations website shortly after the release of third quarter 2009

financial results on October 29, 2009. A replay of the webcast will

be made available beginning at approximately 7:00 p.m. (EDT) on

October 29, 2009 and will be available on AllianceBernstein's

website for one week. An audio replay of the conference call will

also be available for one week. To access the audio replay, please

call (800) 642-1687 from the U.S., or outside the U.S. call (706)

645-9291, and provide conference ID# 34279638. About

AllianceBernstein AllianceBernstein is a leading global investment

management firm that offers high-quality research and diversified

investment services to institutional clients, individuals and

private clients in major markets around the world.

AllianceBernstein employs more than 500 investment professionals

with expertise in growth equities, value equities, fixed income

securities, blend strategies and alternative investments and,

through its subsidiaries and joint ventures, operates in more than

20 countries. AllianceBernstein's research disciplines include

fundamental research, quantitative research, economic research and

currency forecasting capabilities. Through its integrated global

platform, AllianceBernstein is well-positioned to tailor investment

solutions for its clients. AllianceBernstein also offers

independent research, portfolio strategy and brokerage-related

services to institutional investors. At September 30, 2009,

AllianceBernstein Holding L.P. owned approximately 34.9% of the

issued and outstanding AllianceBernstein Units and AXA, one of the

largest global financial services organizations, owned an

approximate 64.1% economic interest in AllianceBernstein. Cautions

regarding Forward-Looking Statements Certain statements provided by

management in this news release are "forward-looking statements"

within the meaning of the Private Securities Litigation Reform Act

of 1995. Such forward-looking statements are subject to risks,

uncertainties, and other factors that could cause actual results to

differ materially from future results expressed or implied by such

forward-looking statements. The most significant of these factors

include, but are not limited to, the following: the performance of

financial markets, the investment performance of sponsored

investment products and separately managed accounts, general

economic conditions, industry trends, future acquisitions,

competitive conditions, and government regulations, including

changes in tax regulations and rates and the manner in which the

earnings of publicly traded partnerships are taxed. We caution

readers to carefully consider such factors. Further, such

forward-looking statements speak only as of the date on which such

statements are made; we undertake no obligation to update any

forward-looking statements to reflect events or circumstances after

the date of such statements. For further information regarding

these forward-looking statements and the factors that could cause

actual results to differ, see "Risk Factors" and "Cautions

Regarding Forward-Looking Statements" in our Form 10-K for the year

ended December 31, 2008 and Form 10-Q for the quarter ended June

30, 2009. Any or all of the forward-looking statements that we make

in this news release, Form 10-K, Form 10-Q, other documents we file

with or furnish to the SEC, and any other public statements we

issue, may turn out to be wrong. It is important to remember that

other factors besides those listed in "Risk Factors" and "Cautions

Regarding Forward-Looking Statements", and those listed above,

could also adversely affect our revenues, financial condition,

results of operations and business prospects. DATASOURCE:

AllianceBernstein L.P. CONTACT: Philip Talamo, Investor Relations,

+1-212-969-2383, , or John Meyers, Media, +1-212-969-2301,

Copyright

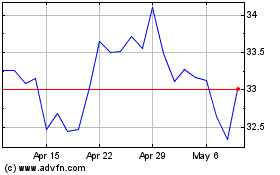

AllianceBernstein (NYSE:AB)

Historical Stock Chart

From May 2024 to Jun 2024

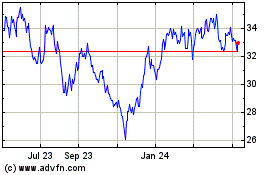

AllianceBernstein (NYSE:AB)

Historical Stock Chart

From Jun 2023 to Jun 2024