Federal Realty Edges Past Estimates - Analyst Blog

November 10 2011 - 3:00AM

Zacks

Federal Realty Investment

Trust (FRT), a leading real estate investment trust

(REIT), reported third quarter 2011 FFO (funds from operations) of

$63.9 million or $1.01 per share compared with $58.8 million or

$0.95 per share in the year-earlier quarter.

Fund from operations, a widely used

metric to gauge the performance of REITs, is obtained after adding

depreciation and amortization and other non-cash expenses to net

income. The reported quarterly FFO beat the Zacks Consensus

Estimate by 2 cents.

Total revenue during the reported

quarter increased to $137.7 million from $133.4 million in the

year-ago quarter. The reported revenue were marginally ahead of the

Zacks Consensus Estimate of $137.0 million.

Despite challenging market

conditions, Federal Realty executed healthy leasing activities

during the quarter. The company signed 92 leases spanning 385,000

square feet of retail space during third quarter 2011.

On a same-store basis, the company

leased 353,000 square feet at an average cash-basis contractual

rent increase of 8.0% per square foot. The average same-store

contractual rent for the first year of new leases was $31.62 per

square foot, compared to $29.24 for the last year of the prior

leases.

Same-store rents per square foot

(GAAP) increased 18.0% on an average during the quarter. As of

September 30, 2011, Federal Realty's average contractual, cash

basis minimum rent for retail and commercial space was $23.04 per

square foot.

Same-store net operating income,

excluding redevelopment and expansion properties increased 2.4% on

a year-over-year basis. The overall portfolio was 93.3% leased at

the end of the quarter, compared with 93.9% in the prior-year

quarter, while the same-store portfolio was 94.0% leased compared

with 94.5% in the year-ago period.

Federal Realty continues to focus

on a low-risk business strategy of growth through prudent leasing

of assets and completion of redevelopment projects at high

risk-adjusted returns. The company is strengthening its presence in

the core markets by acquiring new assets, which would eventually

lead to better operational and ownership flexibility throughout the

entire portfolio.

Federal Realty maintained its

quarterly dividend rate of 69 cents per share or $2.76 per share on

an annualized basis. At quarter-end, the company had cash and cash

equivalents of $22.1 million. With strong quarterly results,

Federal Realty increased its FFO guidance for full year 2011 from

the earlier range of $3.95 – $4.02 per share to $4.02 – $4.04. In

addition, the company provided an initial FFO guidance for fiscal

2012 in the range of $4.16 – $4.22 per share.

We maintain our ‘Neutral’

recommendation on Federal Realty, which currently retains a Zacks

#3 Rank that translates into a short-term ‘Hold’ rating. We also

have a ‘Neutral’ recommendation and a Zacks #2 Rank (short-term

‘Buy’) for Acadia Realty Trust (AKR), one of the

competitors of Federal Realty.

ACADIA RLTY TR (AKR): Free Stock Analysis Report

FED RLTY INV (FRT): Free Stock Analysis Report

Zacks Investment Research

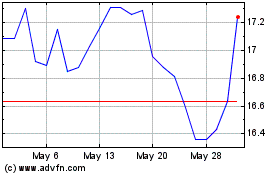

Acadia Realty (NYSE:AKR)

Historical Stock Chart

From May 2024 to Jun 2024

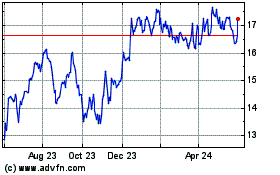

Acadia Realty (NYSE:AKR)

Historical Stock Chart

From Jun 2023 to Jun 2024