CNET Networks, Inc. (Nasdaq:CNET): -- Company Posts Total Revenue

of $86.3 Million -- Interactive Revenue up 28% -- Monthly Unique

Users up 24% and Average Daily Page Views up 61% CNET Networks,

Inc. (Nasdaq:CNET) today reported results for the third quarter

ended September 30, 2005. "In the third quarter, we continued to

deliver on our key growth objectives, including 28 percent

interactive revenue growth, increasing profit margins and strong

free cash flow generation," said Shelby Bonnie, chairman and chief

executive officer of CNET Networks. "The strong growth in users and

usage that we have experienced over the past year positions us with

significant inventory and capacity to take advantage of the

continued strength in the online advertising industry." -- Total

revenues for the third quarter equaled $86.3 million, a 22 percent

increase compared to revenues of $70.5 million for the same period

of 2004. -- Interactive revenue increased 28 percent to $78.6

million in the third quarter versus $61.4 million in the same

period of 2004. -- Including an $8.9 million non-cash asset

impairment charge associated with Computer Shopper magazine and the

impairment of the carrying value of an office building in

Switzerland, the company reported an operating loss of $917,000

during the third quarter of 2005. The non-cash asset impairment

charge was recognized as a result of our annual goodwill impairment

evaluation of Computer Shopper magazine which resulted in a

reassessment of the carrying value of goodwill as well as the

write-down of a building in Switzerland to its estimated fair value

based on current market data. Excluding the non-cash asset

impairment charge, operating income was $8.0 million. This compares

to operating income of $1.8 million in the third quarter of 2004.

-- Operating income before depreciation, amortization, and asset

impairment was $15.4 million, a 118 percent increase compared to

$7.1 million during the third quarter of 2004. -- The profit margin

of operating income before depreciation, amortization, and asset

impairment increased to 18 percent from 10 percent during the third

quarter of 2004. -- Net cash provided by operating activities for

the third quarter of 2005 was $12.7 million, up from $775,000 in

the third quarter of 2004. Free cash flow for the third quarter of

2005 was $7.4 million. Free cash flow is defined as cash flow from

operating activities less capital expenditures. -- Including an

$8.9 million non-cash asset impairment charge and $1.9 million loss

on investments related to the full write-down of the company's

investment in two private companies which it deems unrecoverable,

the company reported a net loss for the third quarter of 2005 of

$3.4 million, or $0.02 per share. Excluding the non-cash asset

impairment charge and loss on investments, net income was $7.5

million, or $0.05 per diluted share. This compares with net income

of $1.1 million, or $0.01 per diluted share, for the same period of

2004. Business Review "As a leading interactive content company, we

know how to attract passionate audiences, addressing the needs of

the people who are the most interested in the categories we cover,"

said Bonnie. "The past quarter reflects our continued efforts to

enhance the functionality of our sites and provide a comprehensive

experience, with the goal of expanding our audience and deepening

our relationship with them." -- CNET Networks' global network of

Internet properties reached an average of 110 million unique

monthly users during the third quarter of 2005(1), an increase of

24 percent from the third quarter of 2004. Average daily page views

increased to over 99 million during the third quarter(1), up 61

percent from the year-ago quarter. -- CNET Networks' properties

continued to make strides to enhance the authentic brand experience

for both users and marketers across its sites with the launch of

new features and updates. Examples include: -0- *T -- CNET News.com

recently re-launched with emphasis on "News of Change" that

highlights the growing impact of technology on all aspects of life.

The site, which has focused primarily on business news for

technology decision makers, now provides broader coverage on the

business, political, and cultural impact of technology, enabling

users to track the technology-related news that is most valuable to

them, personally as well as professionally. In addition to

broadening the scope of award-winning editorial coverage, the front

door and the individual story pages now feature three views of the

day's news, incorporating the insight and expertise from the CNET

News.com editorial team, the usage activity of, and opinions of its

readers, and the user's own personal news preferences. -- Earlier

this quarter, CNET Download.com re-launched with a new look and

feel, including the beta launch of a video download feature built

on its existing collections of software, music and games. The new

offering includes free video samples and clips, ranging from movie

trailers, to independent video content, to how-to videos. -- This

month, CNET Networks' Games & Entertainment division redesigned

its GameSpot and MP3.com Web sites to match the look and feel of

its TV.com site, which launched in June with a cutting-edge design

that strikes a balance between its comprehensive content and

community features. The redesigns enhance the user experience on

each individual site, while providing users a universal navigation

experience across the three sites. This is the first step of an

ongoing strategic integration aimed at providing users the ability

to seamlessly follow their interests across the video games,

digital music, and television genres through universal search and

navigation. In addition, marketers gain the opportunity to launch

targeted yet scalable advertising campaigns in a rich, authentic

online environment across all of the company's games and

entertainment properties. -- Several CNET Networks properties

scaled their podcasting features during the third quarter. Recent

examples include: -- CNET.com launched the daily "Buzz Out Loud,"

an entertaining take on the latest personal technology news from

CNET's editors, as well as "Car Tech," a weekly podcast about the

latest advancements in car technologies. -- In addition, building

on their product review licensing partnership with The San

Francisco Chronicle, CNET.com editors participate in the online

publication's weekly podcast, "Tech Talk," providing consumers

audio product insight and recommendations. -- CNET News.com hosts

"Top Technology News" daily, featuring reporters' takes on the most

noteworthy breaking technology stories. -- GameSpot launched "The

HotSpot," a weekly audio report on the hottest trends in gaming. --

ZDNet continues to host its long-standing "The Dan & David

Show," providing commentary on the IT industry from ZDNet editors.

*T -- One year ago in August, CNET Networks acquired Webshots.

Since then, the site has maintained its position as a leader among

the photography-related sites and has dramatically enhanced

community participation, tripling the size of its photo library to

a total of more than 285 million publicly and privately shared

photos to become the largest public photo library available online.

Webshots continues to innovate and enhance its community content

features and functionality, as well as integrate new marketing

partners such as New Line Cinema, Warner Brothers Films, and

AOL.com. -- During the third quarter, CNET Networks saw continued

momentum in securing content licensing agreements with leading

media and retail organizations, which recognize the value of

incorporating the company's high-demand, top-quality content into

their media offerings. The latest partnerships build on the

company's established long list of licensing agreements with top

online, print, and retail media providers. Most recently, CNET.com

entered into content licensing arrangements with RadioShack.com,

Forbes.com Auto, USAToday.com's Technology Review section, USA

Today NOW Personal Technology magazine, and in-store media

networks, STORS and Four Winds Interactive. -- During the third

quarter, CNET News.com took first-place honors in the "2005 Online

Breaking News" category of the Society of Professional Journalists'

annual "Excellence in Journalism" awards. In addition, CNET.com's

Digital Living was awarded a Communication Arts Interactive "annual

11 Award" for design. Business Outlook For the fourth quarter of

2005, management anticipates total revenues of $102 million to

$109.5 million. Interactive revenues are expected to be in the

range of $95 million to $100 million, and publishing revenues are

expected to be between $7.0 million and $9.5 million. Management

estimates operating income between $21.5 million and $26.5 million

during the fourth quarter, and operating income before depreciation

and amortization of between $29 million and $34 million for the

quarter. Earnings per share are expected to be in the range of

$0.13 and $0.16 during the fourth quarter. For the full-year 2005,

management is estimating total revenues will be in the range of

$347.5 million and $355 million. Management expects Interactive

revenue to be in the range of $319 million to $324 million, and

publishing revenues are expected to be between $28.5 million and

$31.0 million. Including the impact of the $8.9 million non-cash

asset impairment during the third quarter of 2005, management

estimates operating income between $28.6 million and $33.6 million

during 2005. Excluding non-cash asset impairment, management

expects operating income between $37.3 million and $42.3 million.

Management expects operating income before depreciation,

amortization and asset impairment to be between $65 million and $70

million. Including non-cash asset impairment and a $1.9 million

non-cash impairment of investments, earnings per share is expected

to be in the range of $0.16 and $0.19 for the year. Excluding these

items, earnings per share is expected to be in the range of $0.23

to $0.26 for the year. More detailed guidance, as well as a table

that reconciles operating income (loss) before depreciation,

amortization, and asset impairment guidance to operating income

(loss) guidance can be found on the "Guidance to the Investment

Community" sheet that accompanies this press release. Conference

Call and Webcast CNET Networks will host a conference call to

discuss its third quarter 2005 financial results and business

outlook beginning at 5:00 p.m. ET (2:00 p.m. PT), today, October

24, 2005. To listen to the discussion, please visit

http://ir.cnetnetworks.com and click on the link provided for the

webcast conference call or dial (800) 344-1035 (international

dial-in: (706) 679-3076). A replay of the conference call will be

available via webcast at the URL listed above or by calling (800)

642-1687 (international dial-in: (706) 645-9291) and entering the

conference ID number 1347130. The company's past financial news

releases, related financial and operating information, and access

to all Securities and Exchange Commission filings, can also be

accessed at http://ir.cnetnetworks.com. Safe Harbor This press

release and its attachments include forward-looking information and

statements that are subject to risks and uncertainties that could

cause actual results to differ materially. These forward-looking

statements include the statements under the sections entitled

"Business Outlook" and "Guidance to the Investment Community" which

sets forth our estimated financial performance for the fourth

quarter and full year of 2005, and statements regarding our growth

prospects and expectations regarding the future success of our

products and services. In addition, management expects to provide

forward-looking information statements on the conference call to be

held shortly following the issuance of this release, which are also

subject to risks and uncertainties that could cause actual results

to differ materially. The forward-looking statements in this

release and on the conference call are identified by the words

"expect," "estimate," "target," "believe," "goal," "anticipate,"

"intend" and similar expressions or are otherwise identified in the

context in which they are made as being forward-looking. These

statements are only effective as of the date of this release and we

undertake no duty to publicly update these forward-looking

statements, whether as a result of new information, future

developments or otherwise. The risks and uncertainties that could

cause actual results to differ materially from those projected

include: a lack of growth or a decrease in marketing spending on

the Internet due to failure of marketers to adopt the Internet as

an advertising medium at the rate that we currently anticipate; a

lack of growth or decrease in marketing spending on CNET Networks'

properties in particular, which could be prompted by competition

from other media outlets, both on and off the Internet,

dissatisfaction with CNET Networks' services, or economic

difficulties in our clients' businesses; economic conditions such

as weakness in corporate or consumer spending, which could prompt a

reduction in overall advertising expenditures or expenditures

specifically on our properties; the failure of existing advertisers

to meet or renew their advertising commitments as we anticipate,

which would cause us to not to meet our financial projections; the

failure to attract advertisers outside of our traditional

technology and consumer electronics categories, which would cause

us to not meet our financial projections; a continued decline in

revenues from our print publications as advertising dollars shift

to other media; the acquisition of businesses or the launch of new

lines of business, which could decrease our cash position, increase

operating expense, and dilute operating margins; an increase in

intellectual property licensing fees, which could increase

operating expense, including amortization; the risk of future

impairment of our intangible assets, goodwill or investments based

on a decline in our business or investments; and general risks

associated with our business. For risks about CNET Networks'

business, see its Annual Form 10-K for the year ended December 31,

2004 and subsequent Forms 10-Q and 8-K, including disclosures under

the captions "Risk Factors" and "Management's Discussion and

Analysis of Financial Conditions and Results of Operations," which

are filed with the Securities and Exchange Commission and are

available on the SEC's website at www.sec.gov. About CNET Networks,

Inc. CNET Networks, Inc. is a worldwide media company and creator

of content environments for the interactive age. CNET Networks

takes pride in being "a different kind of media company," creating

richer, deeper interactive experiences by combining the wisdom and

passion of users, marketers and its own expert editors. CNET

Networks' leading brands -- such as CNET, GameSpot, MP3.com,

Webshots, and ZDNet -- focus on the personal technology,

entertainment, and business technology categories. The company has

a strong presence in the US, Asia and Europe. (1) CNET Networks

July 2005 - September 2005 (internal log data) -0- *T Consolidated

Statements of Operations Unaudited (in thousands, except share and

per share data) Three Months Ended Nine Months Ended September 30,

September 30, ------------ ------------ ------------ ------------

2005 2004 2005 2004 ------------ ------------ ------------

------------ Revenues Interactive $ 78,646 $ 61,351 $ 223,926 $

176,099 Publishing 7,653 9,108 21,598 25,845 ------------

------------ ------------ ------------ Total revenues 86,299 70,459

245,524 201,944 Operating expenses: Cost of revenues 40,535 36,617

119,278 105,167 Sales and marketing 19,693 17,954 58,283 54,080

General and administrative 10,654 8,803 31,917 27,732 Depreciation

4,403 3,695 12,513 14,941 Amortization of intangible assets 2,974

1,578 7,479 4,134 Asset impairment 8,957 - 8,957 - ------------

------------ ------------ ------------ Total operating expenses

87,216 68,647 238,427 206,054 Operating income (loss) (917) 1,812

7,097 (4,110) Non-operating income (expense): Realized gains on

investments - - 568 11,338 Impairment of privately held investments

(1,885) - (2,083) - Interest income 375 353 1,259 1,376 Interest

expense (532) (709) (2,322) (5,418) Other (152) (270) (292) (356)

------------ ------------ ------------ ------------ Total non-

operating income (expense) (2,194) (626) (2,870) 6,940 ------------

------------ ------------ ------------ Income (loss) before income

taxes (3,111) 1,186 4,227 2,830 Income tax expense (benefit) 268

125 (521) 372 ------------ ------------ ------------ ------------

Net income (loss) $ (3,379) $ 1,061 4,748 $ 2,458 ============

============ ============ ============ Basic net income (loss) per

share $ (0.02) $ 0.01 0.03 $ 0.02 ============ ============

============ ============ Diluted net income (loss) per share $

(0.02) $ 0.01 0.03 $ 0.02 ============ ============ ============

============ Shares used in calculating basic net income (loss) per

share 147,057,102 143,410,759 145,208,529 143,060,255 Shares used

in calculating diluted net income (loss) per share 147,057,102

149,772,652 151,992,886 150,132,791 Consolidated Balance Sheets

Unaudited (in thousands, except share data) September 30, December

31, 2005 2004 ------------ ----------- ASSETS Current Assets: Cash

and cash equivalents $ 61,837 $ 29,560 Investments in marketable

debt securities 33,593 22,193 Accounts receivable, net 63,228

66,712 Other current assets 12,304 15,155 ------------ -----------

Total current assets 170,962 133,620 Restricted cash 4,574 19,774

Investments in marketable debt securities 12,674 22,199 Property

and equipment, net 53,311 48,989 Other assets 19,296 21,722

Intangible assets, net 37,280 34,756 Goodwill 132,944 126,287

------------ ----------- Total assets $ 431,041 $ 407,347

============ =========== LIABILITIES AND STOCKHOLDERS' EQUITY

Current liabilities: Accounts payable $ 7,425 $ 6,903 Revolving

credit facility - 5,000 Accrued liabilities 57,774 61,992 Current

portion of long-term debt 2,717 4,007 ------------ -----------

Total current liabilities 67,916 77,902 Non-current liabilities:

Long-term debt 138,614 135,614 Other liabilities 690 252

------------ ----------- Total liabilities 207,220 213,768

Stockholders' equity: Common stock; $0.0001 par value; 400,000,000

shares authorized; 149,185,141 outstanding at September 30, 2005

and 144,455,283 outstanding at December 31, 2004 15 14 Additional

paid-in-capital 2,745,557 2,719,576 Accumulated other comprehensive

loss (13,140) (12,652) Treasury stock, at cost (30,453) (30,453)

Accumulated deficit (2,478,158) (2,482,906) ------------

----------- Total stockholders' equity 223,821 193,579 ------------

----------- Total liabilities and stockholders' equity $ 431,041 $

407,347 ============ =========== Statements of Cash Flows Unaudited

(in thousands) Three Months Ended Nine Months Ended September 30,

September 30, ------------------ ------------------- 2005 2004 2005

2004 -------- -------- -------- --------- Cash flows from operating

activities: Net Income (loss) $ (3,379) $ 1,061 $ 4,748 $ 2,458

Adjustments to reconcile net income (loss) to net cash provided by

operating activities: Depreciation and amortization 7,376 5,273

19,991 19,075 Asset impairments 8,957 - 8,957 - Asset disposals 11

5 42 279 Noncash interest expense 47 170 291 1,533 Allowance for

doubtful accounts 294 1,246 1,311 2,798 Equity losses in investees

66 - 308 - Gain on sale of marketable securities and privately held

investments - - (568) (11,338) Loss on impairment of privately held

investments 1,860 - 2,058 - Changes in operating assets and

liabilities, net of acquisitions: Accounts receivable (646) (1,639)

2,580 1,997 Other assets 1,372 2,066 1,040 (410) Accounts payable

(2,291) (975) 510 (2,251) Accrued liabilities (951) (4,856) (5,896)

(2,779) Other long-term liabilities (51) (1,576) (164) (1,632)

-------- -------- -------- --------- Net cash provided by operating

activities 12,665 775 35,208 9,730 -------- -------- --------

--------- Cash flows from investing activities: Purchase of

marketable debt securities (27,305) (1,004) (31,580) (32,969)

Proceeds from sale of marketable debt securities 18,418 27,805

35,402 39,964 Proceeds from sales of investments in privately held

companies - 34 568 13,240 Release of restrictions on cash 10,200 -

10,200 - Investments in privately held companies (71) (250) (1,759)

(982) Net cash paid for acquisitions - (57,679) (15,924) (64,821)

Capital expenditures (5,262) (3,762) (16,974) (10,635) --------

-------- -------- --------- Net cash used in investing activities

(4,020) (34,856) (20,067) (56,203) -------- -------- --------

--------- Cash flows from financing activities: Payments received

on stockholders' notes - - - 137 Net proceeds from issuance of

convertible notes - - - 120,800 Net proceeds from employee stock

purchase plan 272 275 910 722 Net proceeds from exercise of options

15,378 592 22,826 4,647 Principal payments on borrowings (4,988)

(65) (5,873) (113,975) -------- -------- -------- --------- Net

cash provided by financing activities 10,662 802 17,863 12,331

-------- -------- -------- --------- Net increase (decrease) in

cash and cash equivalents 19,307 (33,279) 33,004 (34,142) Effect of

exchange rate changes on cash and cash equivalents 332 (229) (727)

(2,653) Cash and cash equivalents at the beginning of the period

42,198 62,626 29,560 65,913 -------- -------- -------- ---------

Cash and cash equivalents at the end of the period $ 61,837 $

29,118 $ 61,837 $ 29,118 ======== ======== ======== =========

Business Segments Unaudited (in thousands) CNET's primary areas of

measurement and decision-making include two principal business

segments. CNET has determined that its business segments are U.S.

Media and International Media. U.S. Media consists of an online

network focused on three content categories: personal technology,

games and entertainment and business technology. International

Media includes the delivery of online technology information and

several technology print publications in non-U.S. markets.

Management believes that segment operating income (loss) before

depreciation and amortization and asset impairment expenses is an

appropriate measure of evaluating the operating performance of the

company's segments. However, segment operating income (loss) before

depreciation and amortization and asset impairment expenses should

not be considered a substitute for operating income, cash flows or

other measures of financial performance prepared in accordance with

generally accepted accounting principles. U.S. International Media

Media Other (1,2) Total --------- ------------- --------- --------

Three Months Ended September 30, 2005 Revenues $ 70,272 $16,027 $ -

$ 86,299 Operating expenses 55,341 15,541 16,334 87,216 --------

------- -------- -------- Operating income (loss) $ 14,931 $ 486

$(16,334) $ (917) ======== ======= ======== ======== Three Months

Ended September 30, 2004 Revenues $ 57,278 $13,181 $ - $ 70,459

Operating expenses 49,536 13,838 5,273 68,647 -------- -------

-------- -------- Operating income (loss) $ 7,742 $ (657) $ (5,273)

$ 1,812 ======== ======= ======== ======== Nine Months Ended

September 30, 2005 Revenues $200,116 $45,408 $ - $245,524 Operating

expenses 162,545 46,933 28,949 238,427 -------- ------- --------

-------- Operating income (loss) $ 37,571 $(1,525) $(28,949) $

7,097 ======== ======= ======== ======== Nine Months Ended

September 30, 2004 Revenues $164,406 $37,538 $ - $201,944 Operating

expenses 145,556 41,423 19,075 206,054 -------- ------- --------

-------- Operating income (loss) $ 18,850 $(3,885) $(19,075) $

(4,110) ======== ======= ======== ======== (1) For the three months

ended September 30, 2005, Other represents operating expenses

related to depreciation of $4,403, amortization of $2,974 and asset

impairments of $8,957. For the three months ended September 30,

2004, Other represents operating expenses related to depreciation

of $3,695 and amortization of $1,578. (2) For the nine months ended

September 30, 2005, Other represents operating expenses related to

depreciation of $12,513, amortization of $7,479 and asset

impairments of $8,957. For the nine months ended September 30,

2004, Other represents operating expenses related to depreciation

of $14,941 and amortization of $4,134. Quarterly Statistical

Highlights Unaudited Q3-05 Q2-05 Q1-05 Q4-04 Q3-04 ------- -------

------- ------- ------- Total Quarterly Revenue ($mm) $ 86.3 $ 84.5

$ 74.7 $ 89.2 $ 70.5 Revenue Distribution (%)(a) Marketing Services

79% 80% 78% 79% 75% Licensing, Fees and User 12% 11% 14% 11% 12%

Publishing 9% 9% 8% 10% 13% Advertiser Metrics CNET Networks Top

100 US Advertisers' Renewal Rate (Q-to-Q) 97% 95% 97% 96% 95% CNET

Networks Top 100 US Advertisers' % of Network Revenue 55% 55% 56%

54% 57% Select Business Metrics Network Unique Users (mm) 110.1

115.1 105.9 103.0 88.7 Network Average Daily Page Views (mm) 99.4

97.7 94.7 85.0 61.8 Balance Sheet Highlights ($mm) Cash $ 61.8 $

42.2 $ 34.9 $ 29.5 $ 29.1 Marketable Debt Securities 46.3 32.1 42.3

44.4 44.7 Restricted Cash 4.6 19.8 19.8 19.8 19.8 ------ ------

------ ------ ------ Total Cash and Equivalents $112.7 $ 94.1 $

97.0 $ 93.7 $ 93.6 Total Debt $141.3 $146.4 $146.5 $144.6 $129.3

Days Sales Outstanding (DSO) 66 67 72 67 65 (a) Revenue

distribution definitions are as follows: Marketing Services --

sales of advertisements on our Internet network through

impression-based and activity-based advertising. Licensing, Fees

and User -- licensing our product database, online content,

subscriptions to online services, and other paid services.

Publishing -- sales of advertisements in our print publications,

subscriptions and newsstand sales of publications, and custom

publishing services. Guidance to the Investment Community

----------------------------------------------------------------------

Q3-05 Q4-05 estimate FY 2005 estimate $ in millions, except Actual

Low - High Low - High per share

---------------------------------------------- Interactive Revenues

$78.6 $95.0 - $100.0 $319.0 - $324.0 Publishing Revenues $7.7 $7.0

- $9.5 $28.5 - $31.0 Total Revenues $86.3 $102.0 - $109.5 $347.5 -

$355.0 Operating income before depreciation, amortization and asset

impairment $15.4 $29.0 - $34.0 $65.0 - $70.0 Depreciation expense

($4.4) ($4.8) ($17.3) Amortization expense ($3.0) ($2.7) ($10.2)

Impairment of assets ($8.9) - ($8.9) Operating income ($0.9) $21.5

- $26.5 $28.6 - $33.6 Interest expense, net ($0.2) ($0.3) ($1.4)

Other income (expense) ($2.0) ($0.3) ($2.1) Tax benefit (expense)

($0.3) ($0.5) $0.02 Earnings per share ($0.02) $0.13 - $0.16 $0.16

- $0.19

----------------------------------------------------------------------

Note: FY 2005 earnings per share guidance includes $8.9 million

non- cash asset impairment expense and $1.9 million realized loss

on investment as reported in the third quarter 2005. Excluding

these items, FY 2005 earnings per share guidance would be in the

range of $0.23 to $0.26. Note: 4Q 2005 earnings per share guidance

is based on a diluted share count of approximately 165 million

shares, of which 8.3 million shares are attributable to the impact

of EITF 04-8. Safe Harbor Statement This press release and its

attachments include forward-looking information and statements that

are subject to risks and uncertainties that could cause actual

results to differ materially. These forward-looking statements

include the statements under the section entitled "Business

Outlook," which sets forth our estimated financial performance for

the fourth quarter and full year of 2005, and statements regarding

our growth prospects and expectations regarding the future success

of our products and services. In addition, management expects to

provide forward-looking information statements on the conference

call to be held shortly following the issuance of this release,

which are also subject to risks and uncertainties that could cause

actual results to differ materially. The forward-looking statements

in this release and on the conference call are identified by the

words "expect," "estimate," "target," "believe," "goal,"

"anticipate," "intend" and similar expressions or are otherwise

identified in the context in which they are made as being

forward-looking. These statements are only effective as of the date

of this release and we undertake no duty to publicly update these

forward-looking statements, whether as a result of new information,

future developments or otherwise. The risks and uncertainties that

could cause actual results to differ materially from those

projected include: a lack of growth or a decrease in marketing

spending on the Internet due to failure of marketers to adopt the

Internet as an advertising medium at the rate that we currently

anticipate; a lack of growth or decrease in marketing spending on

CNET Networks' properties in particular, which could be prompted by

competition from other media outlets, both on and off the Internet,

dissatisfaction with CNET Networks' services, or economic

difficulties in our clients' businesses; economic conditions such

as weakness in corporate or consumer spending, which could prompt a

reduction in overall advertising expenditures or expenditures

specifically on our properties; the failure of existing advertisers

to meet or renew their advertising commitments as we anticipate,

which would cause us to not to meet our financial projections; the

failure to attract advertisers outside of our traditional

technology and consumer electronics categories, which would cause

us to not meet our financial projections; a continued decline in

revenues from our print publications as advertising dollars shift

to other media; the acquisition of businesses or the launch of new

lines of business, which could decrease our cash position, increase

operating expense, and dilute operating margins; an increase in

intellectual property licensing fees, which could increase

operating expense, including amortization; the risk of future

impairment of our intangible assets, goodwill or investments based

on a decline in our business or investments; and general risks

associated with our business. For risks about CNET Networks'

business, see its Annual Form 10-K for the year ended December 31,

2004 and subsequent Forms 10-Q and 8-K, including disclosures under

the captions "Risk Factors" and "Management's Discussion and

Analysis of Financial Conditions and Results of Operations," which

are filed with the Securities and Exchange Commission and are

available on the SEC's website at www.sec.gov. Operating Income

(Loss) Reconciliation (in thousands) Three Months Nine Months Ended

Ended September 30, September 30, ----------------

----------------- 2005 2004 2005 2004 ----------------

----------------- Operating income (loss) before depreciation,

amortization and asset impairment $ (917) $1,812 $ 7,097 $(4,110)

Asset impairment 8,957 - 8,957 - ---------------- -----------------

Operating income before asset impairment 8,040 1,812 16,054 (4,110)

Depreciation 4,403 3,695 12,513 14,941 Amortization of intangible

assets 2,974 1,578 7,479 4,134 ---------------- -----------------

Operating income before depreciation, amortization and asset

impairment $15,417 $7,085 $36,046 $14,965 ================

================= The company believes that "operating income

(loss) before depreciation, amortization and asset impairment" is

useful to management and investors in evaluating the current

operating performance of the company, since depreciation and

amortization include the impact of past transactions and costs that

are not necessarily directly related to the current underlying

capital requirements or performance of the business operations.

Management refers to "operating income before depreciation,

amortization and asset impairment" to compare historical operating

results, in making operating decisions and for planning and

compensation purposes. A limitation associated with this measure is

that it does not reflect the costs of certain capitalized tangible

and intangible assets used in generating revenue. Management

evaluates the costs of these assets through other financial

measures such as capital expenditures. "Operating income before

depreciation, amortization and asset impairment" should be

considered in addition to, and not as a substitute for, other

measures of financial performance prepared in accordance with US

GAAP. Reconciliation of Net Gain (Loss) from Unusual Items (in

thousands, except share and per share data) Three Months Ended Nine

Months Ended September 30, September 30, --------------------------

-------------------------- 2005 2004 2005 2004

-------------------------- -------------------------- Net income

(loss) $ (3,379) $ 1,061 $ 4,748 $ 2,458 =========== ============

============ ============ Unusual Items: Asset impairment(1) $

8,957 $ - $ 8,957 $ - (Gain) Loss on privately held investments(2)

1,885 - 1,515 (11,338) Accelerated depreciation(3) - - - 3,513

Foreign currency gain (3) - - - (1,720) Prepayment penalty (4) - -

- 1,625 Additional interest (4) - - - 1,394 ------------

------------ ------------ ------------ Effect on earnings from

unusual items 10,842 - 10,472 (6,526) ------------ ------------

------------ ------------ Net income (loss) excluding unusual items

$ 7,463 $ 1,061 $ 15,220 $ (4,068) ============ ============

============ ============ Diluted net income (loss) per share

excluding unusual items $ 0.05 $ 0.01 $ 0.10 $ (0.03) ============

============ ============ ============ Shares used in calculating

diluted net income (loss) per share 154,296,961 149,772,652

151,992,886 143,060,255 (1) During the three months ended September

30, 2005, the company recorded an asset impairment of $7.3 million

associated with the write-down of goodwill and tradename of our

Computer Shopper reporting unit and a $1.6 million of loss

associated with the evaluation of the carrying value of its office

building held for sale in Switzerland. (2) The company recognized

$1.9 million and $2.1 million of losses associated with impairments

of private investments during the three and nine months ended

September 30, 2005, respectively. The company recognized $11.3

million of gains, net of impairments, on the sale of investments

during the nine months ended September 30, 2004. (3) During the

nine months ended September 30, 2004, the company recorded $3.5

million of accelerated depreciation and a related $1.7 million

foreign currency gain associated with the evaluation of the

carrying value of its office buildings and other fixed assets in

Switzerland upon integration of those operations into US Media. The

foreign currency gain is included in the "Other" line of the income

statement. (4) In conjunction with the retirement of the company's

5% Convertible Subordinated Notes in 2004, the company recorded a

$1.6 million prepayment penalty and additional interest expense of

$1.4 million. The prepayment penalty is included in the "Other"

line of the income statement. The company believes that this

information is useful to investors because these items are

infrequent in nature and may affect the comparability of the

current quarter and full year results to other quarter and full

year results. Free Cash Flow Reconciliation (Unaudited) (in

thousands) Three Months Nine Months Ended Ended September 30,

September 30, ----------------- ------------------ 2005 2004 2005

2004 -------- ------- --------- -------- Cash flow from operating

activities $12,665 $ 775 $ 35,208 $ 9,730 Capital expenditures

(5,262) (3,762) (16,974) (10,635) ------- ------- -------- --------

Free cash flow $ 7,403 $(2,987) $ 18,234 $ (905) ======= =======

======== ======== Free Cash Flow is defined as net cash provided by

operating activities less capital expenditures. The company

believes that free cash flow provides useful information about the

amount of cash generated by the business after the purchase of

property and equipment. A limitation of free cash flow is that it

does not represent the total increase or decrease in the cash

balance for the period. Free cash flow should be considered in

addition to, and not as a substitute for, other measures of

financial performance prepared in accordance with US GAAP. *T

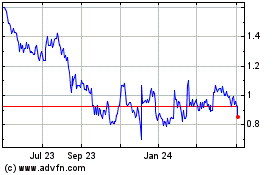

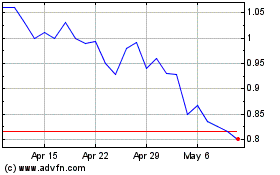

ZW Data Action Technolog... (NASDAQ:CNET)

Historical Stock Chart

From Jun 2024 to Jul 2024

ZW Data Action Technolog... (NASDAQ:CNET)

Historical Stock Chart

From Jul 2023 to Jul 2024