MORNING UPDATE: Mankus-Lavelle Group issues alerts for DIS, MXO, KG, SIMG, and CNET

August 10 2005 - 10:28AM

PR Newswire (US)

CHICAGO, Aug. 10 /PRNewswire/ -- Mankus-Lavelle Group issues the

following Morning Update at 8:30 AM EDT with new PriceWatch Alerts

for key stocks. Before the open... PriceWatch Alerts for DIS, MXO,

KG, SIMG, and CNET, Market Overview, Today's Economic Calendar, and

the Quote Of The Day. QUOTE OF THE DAY "Those high oil prices are a

burden on U.S. families, on firms' production costs." -- Ben

Bernanke, chairman, White House Council of Economic Advisers New

PriceWatch Alerts for DIS, MXO, KG, SIMG, and CNET... PRICEWATCH

ALERTS -- HIGH RETURN COVERED CALL OPTIONS ----------- -- Disney

(The Walt) Co. (NYSE:DIS) Last Price 26.14 -- JAN 25.00 CALL

OPTION@ $2.10 -> 4.0 % Return assigned* -- Maxtor Corp.

(NYSE:MXO) Last Price 5.31 -- OCT 5.00 CALL OPTION@ $0.65 -> 7.3

% Return assigned* -- King Pharmaceuticals, Inc. (NYSE:KG) Last

Price 12.59 -- OCT 12.50 CALL OPTION@ $0.70 -> 5.1 % Return

assigned* -- Silicon Image, Inc. (NASDAQ:SIMG) Last Price 9.22 --

DEC 7.50 CALL OPTION@ $2.35 -> 9.2 % Return assigned* -- CNET

Networks, Inc. (NASDAQ:CNET) Last Price 13.51 -- OCT 12.50 CALL

OPTION@ $1.65 -> 5.4 % Return assigned* * To learn more about

how to use these alerts and for our FREE report, "The 18 Warning

Signs That Tell You When To Dump A Stock", go to:

http://www.investorsobserver.com/mu18 (Note: You may need to copy

the link above into your browser then press the [ENTER] key) **

FREE Access to the Market Intelligence Center where you will find

the news, insight and intelligence that can make a difference in

the way you invest, go to: http://www.investorsobserver.com/FreeMIC

NOTE: All stocks and options shown are examples only. These are not

recommendations to buy or sell any security. NEWS LEADERS AND

LAGGARDS So far today, Cisco Systems, Shanda Interactive

Entertainment, and Comcast lead the list of companies with the most

news stories while Mittal Steel and Advanced Medical Optics are

showing a spike in news. Yahoo!, Electronic Arts, and Qualcomm have

the highest srtIndex scores to top the list of companies with

positive news while Fannie Mae and First Data Corp lead the list of

companies with negative news reports. American International Group

has popped up with a high positive news sraIndex score. For the

FREE article titled, "Earnings Season Decoded -- An Essential 15

Point Checklist For Finding Winning Stocks." go to:

http://www.wallstreetsecretsplus.com/go/freemu/ MARKET OVERVIEW

Overseas trading is doing remarkably well this morning, as 13 of

the 15 foreign indices that we track are currently in positive

territory. The cumulative average return on the group stands at

0.579. In Asia, a positive reaction in the U.S. to the Fed's latest

rate hike gave a boost of confidence to traders, as both the Nikkei

and the Hang Seng posted 100+ point gains on Wednesday. It was much

the same story in Europe, when indices across the pond began

trading earlier this morning. Decreased fears over inflation in the

U.S. have lent a hand in Europe, as bullishness from the Asian

market spilled over into early Wednesday trading. With Tuesday's

excitement behind them, many traders on the Street have little to

look forward to in the economic calendar today. The main attraction

will be the reports from the Department of Energy and the American

Petroleum Institute on the state of petroleum supplies. Most

analysts expect a second straight increase in crude supplies, and

should this come to fruition, many investors may turn their eyes

toward Friday's trade deficit figure. A miss, on the other hand,

could secure the headlines for the day on new record crude prices.

Be prepared for the investing week ahead with Bernie Schaeffer's

FREE Monday Morning Outlook. For more details and to sign up, go

to: http://www.investorsobserver.com/freemo DYNAMIC MARKET

OPPORTUNITIES Whether investors believe the real-estate bubble is

in for a sudden and catastrophic pop or they think the current

momentum will end with a slower, gentler easing, the one fact that

appears to be universal is that the current housing boom is

unsustainable. But it seems that too many homeowners and investors

are gambling that the market will continue its unbelievable run.

During the second quarter, 74% of refinanced Freddie Mac-owned

mortgages resulted in principals that were at least 5% larger than

the original. It appears those homeowners are being deterred from

refinancing in order to lock in lower interest rates. Now, they are

going through additional paperwork to turn a profit. After all, the

average value of a home has climbed by 20% this year, so why not

take advantage of some of the profit? The problem occurs because

the profit is really only a paper profit. Once the housing market

slows, even slightly, those profits will turn to losses. For most

homeowners, their homes' equity accounts for most of their wealth.

If they suddenly find themselves owing more than their house is

worth, they could be in serious trouble. Even scarier is the number

of people getting trapped by the siren call of interest-only loans.

Just five years ago, these loans accounted for less than 2% of new

mortgages. Today, as homebuyers try to get the biggest house they

can afford, economists say these dangerous loans account for over

70% of all new applications. Buyers of interest-only loans are

banking on two things. They hope the value of their house will rise

and they hope their income increases. But if neither of these two

rather unpredictable events occurs by the time the homeowner is

required to begin paying the house's principal, such debtors could

find themselves in trouble. Often, mortgage payments will rise by

more than 40% after the initial interest-only period ends. That's a

hefty jump, no matter how much income a homeowner has. Read more

analysis from the 247Profits Group every trading day with the FREE

247Profits e-Dispatch, featuring insightful economic commentary,

profitable investment recommendations, and full access to a leading

team of financial experts. Register for free here:

http://www.247profits.com/enter.html TODAY'S ECONOMIC CALENDAR 7:00

a.m. Aug 6 MBA Refinancing Index 10:30 a.m. Aug 5 US Energy Dept

Gasoline 10:30 a.m. Aug 5 US Energy Dept Crude Oil Stocks 10:30

a.m. Aug 5 US Energy Dept Distillate Stocks 2:00 p.m. July Treasury

Budget Statement The Mankus-Lavelle Group is an independent

brokerage branch of brokersXpress, LLC, a wholly owned subsidiary

of optionsXpress Holdings, Inc. The Mankus-Lavelle Group has some

of the most experienced, respected options professionals in the

industry. Both novice option investors and experienced traders are

attracted to MLG. Less experienced investors appreciate Mankus-

Lavelle Group's friendly expert guidance while more seasoned

investors value Mankus-Lavelle Group's highly trained staff of

option experts. To improve your understanding of options get a free

option kit at: http://www.mlgos.com/ . If you are familiar with

stock investing but not sure what options can do for you, call

1-800-230-5570 for a FREE 3-point portfolio check up. Securities

offered through brokersXpress, LLC Member NASD/SPIC. Corporate

Office: 39 South LaSalle Street, Suite 220, Chicago, Illinois

60603-1608 brokersXpress(SM) is the online broker-dealer for

independent reps and advisors. Powered by the award-winning

technology of optionsXpress(R), its parent company, brokersXpress

provides a leading-edge trading platform particularly powerful for

reps and advisors who employ option strategies. For more

information on how partnering with brokersXpress can empower your

business to new levels, contact us confidentially by e-mail at .

Member NASD/SPIC. CRD# 127081 This Morning Update was prepared with

data and information provided by: InvestorsObserver.com -- Better

Strategies for Making Money -> For Investors With a Sense of

Humor. Only $1 for your first month plus seven free bonuses worth

over $420, see: http://www.investorsobserver.com/must Quote.com

QCharts -- Real time quotes and streaming technical charts to keep

you up with the market. Analyze, predict, and stay ahead. For a

Free 30 day trial go to: http://www.investorsobserver.com/MUQuote2

247profits.com -- You'll get exclusive financial commentary, access

to a global network of experts and undiscovered stock alerts.

Register NOW for the FREE 247profits e-Dispatch. Go to:

http://www.investorsobserver.com/TPA Schaeffer's Investment

Research -- Sign up for your FREE e-weekly, Monday Morning Outlook,

Bernie Schaeffer's look ahead at the markets. Sign Up Now

http://www.investorsobserver.com/freemo PowerOptionsPlus -- The

Best Way To Find, Compare, Analyze, and Make Money On Options

Investments. For a 14-Day FREE trial and 5 FREE bonuses go to:

http://www.investorsobserver.com/poweropt All stocks and options

shown are examples only. These are not recommendations to buy or

sell any security and they do not represent in any way a positive

or negative outlook for any security. Potential returns do not take

into account your trade size, brokerage commissions or taxes which

will affect actual investment returns. Stocks and options involve

risk and are not suitable for all investors and investing in

options carries substantial risk. Prior to buying or selling

options, a person must receive a copy of Characteristics and Risks

of Standardized Options available from Michael at 800-230-5570 or

at http://www.cboe.com/Resources/Intro.asp . Privacy policy

available upon request. DATASOURCE: Mankus-Lavelle Group CONTACT:

Mike Lavelle, of Mankus-Lavelle Group, +1-800-230-5570 Web site:

http://www.mlgos.com/

Copyright

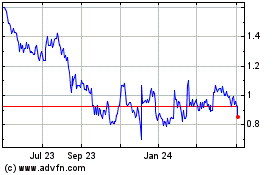

ZW Data Action Technolog... (NASDAQ:CNET)

Historical Stock Chart

From Jun 2024 to Jul 2024

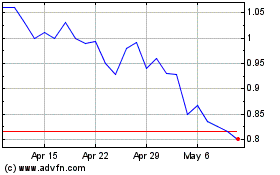

ZW Data Action Technolog... (NASDAQ:CNET)

Historical Stock Chart

From Jul 2023 to Jul 2024