CPWR Earnings Beat by a Penny - Analyst Blog

July 25 2013 - 10:04AM

Zacks

Compuware Corp (CPWR) reported

first quarter 2014 earnings of 7 cents per share, which beat the

Zacks Consensus Estimate by a penny.

Earnings (including stock based compensation and related tax

effect) jumped 16.7% from the year-ago quarter and 75.0% from the

previous quarter. The strong earnings growth was primarily driven

by lower cost and improving margins.

Quarter Details

Revenues inched up a modest 0.6% from the year-ago quarter but

declined 5.2% from the previous quarter to $227.5 million. Revenues

were slightly ahead of the Zacks Consensus Estimate of $225.0

million.

The modest year-over-year growth was primarily driven by strong

performance from Changepoint (up 17.2%), Covisint (up 17.1%),

professional services (up 5.5%) and APM (up 3.2%), which offset

weak growth in Mainframe (down 8.3%) and Uniface (down 6.2%).

The sequential decline was primarily attributed to weak results

from APM (down 4.9%), Mainframe (down 10.1%), Uniface (down 22.4%)

and Covisint (down 6.3%), which were partially offset by strong

performance in changepoint (up 5.1%) and professional services (up

12.8%).

Operating expenses (excluding restructuring expenses) as a

percentage of revenues declined 10 basis points (bps) from the

year-ago and 20 bps from the previous quarter. This was primarily

attributed to lower sales & marketing expense, which as a

percentage of revenues contracted 140 bps from the year-ago quarter

and 200 bps from the previous quarter.

Operating margin (excluding restructuring expenses) improved 10 bps

from the year-ago quarter and 20 bps from the previous quarter due

to lower-than-expected rise in expenses. Net income as percentage

of revenues increased 150 bps from the year-ago quarter but

declined 200 bps sequentially.

At the end of the first quarter of 2014, cash and cash equivalents

amounted to $81.3 million, down from $89.8 million in the previous

quarter. Long-term debt stood at $15.0 million as compared to $18.0

million in the previous quarter.

Compuware declared and paid its first quarterly dividend of $0.125

per share during the quarter. The company bought back 300K shares

for approximately $3.5 million.

Outlook

Compuware reiterated its fiscal 2014 outlook. Management continues

to expect revenues in the range of $1.004 to $1.012 billion (up 7%

year over year) while non-GAAP earnings are expected to be in the

range of 47 cents - 49 cents per share. The company expects to save

$45 million in costs in fiscal 2014. Management expects to save

$80.0 to $100.0 million in costs by fiscal 2016.

Compuware expects both the APM and Changepoint segment to grow 15%

from the year-ago period. Management expects revenues from Uniface

to grow 2%, while professional services are expected to increase

6.0% from 2013. However, revenues from Mainframe are expected to

decline 5% in fiscal 2014.

Recommendation

We believe that Compuware’s innovative product pipeline,

initiatives to reduce costs and gain new programs will boost

profitability going forward.

However, Compuware operates in an intensely competitive landscape

and competes with the likes of BMC Software Inc.

(BMC), CA Technologies

(CA) and International Business

Machines Corp (IBM) with respect to one

or more offerings.

Moreover, execution challenges (related to acquisition, geography

and people) are the major headwinds going forward.

Currently, Compuware has a Zacks Rank #4 (Sell).

BMC SOFTWARE (BMC): Free Stock Analysis Report

CA INC (CA): Free Stock Analysis Report

COMPUWARE CORP (CPWR): Free Stock Analysis Report

INTL BUS MACH (IBM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

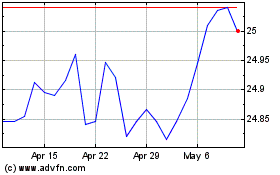

Xtrackers California Mun... (NASDAQ:CA)

Historical Stock Chart

From May 2024 to Jun 2024

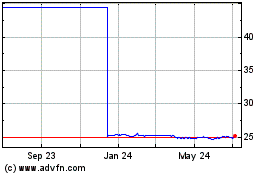

Xtrackers California Mun... (NASDAQ:CA)

Historical Stock Chart

From Jun 2023 to Jun 2024