0000793074false00007930742024-02-062024-02-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 6, 2024

WERNER ENTERPRISES, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Nebraska | 0-14690 | 47-0648386 |

(State or other jurisdiction of

incorporation) | (Commission File Number) | (I.R.S. Employer

Identification No.) |

| |

| 14507 Frontier Road | | |

| Post Office Box 45308 | | |

| Omaha | , | Nebraska | | 68145-0308 |

| (Address of principal executive offices) | | (Zip Code) |

(402) 895-6640

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR40.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.01 Par Value | | WERN | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 2.02. RESULTS OF OPERATIONS AND FINANCIAL CONDITION.

On February 6, 2024, the registrant issued a press release regarding, among other things, its financial results for the fourth quarter and year ended December 31, 2023. A copy of the press release is furnished as Exhibit 99.1 to this Form 8-K.

In accordance with General Instruction B.2 to the Form 8-K, the information under this Item 2.02 and the press release furnished as Exhibit 99.1 to this Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section 18, nor shall such information and exhibit deemed incorporated by reference in any filing under the Exchange Act or the Securities Act of 1933, as amended (the “Securities Act”), unless the registrant expressly states that such information and exhibit are to be considered “filed” under the Exchange Act or incorporates such information and exhibit by specific reference in an Exchange Act or Securities Act filing.

The press release furnished as Exhibit 99.1 to this Form 8-K may contain forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act and made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, as amended. Such forward-looking statements are based on information presently available to the registrant’s management and are current only as of the date made. Actual results could also differ materially from those anticipated as a result of a number of factors, including, but not limited to, those discussed in the registrant’s Annual Report on Form 10-K for the year ended December 31, 2022 and subsequently filed Quarterly Reports on Form 10-Q. For those reasons, undue reliance should not be placed on any forward-looking statement. The registrant assumes no duty or obligation to update or revise any forward-looking statement, although it may do so from time to time as management believes is warranted or as may be required by applicable securities law. Any such updates or revisions may be made by filing reports with the U.S. Securities and Exchange Commission, through the issuance of press releases or by other methods of public disclosure.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits.

| | | | | | | | |

| | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| WERNER ENTERPRISES, INC. |

| | |

Date: February 6, 2024 | By: | | /s/ Christopher D. Wikoff |

| | | Christopher D. Wikoff |

| | | Executive Vice President, Treasurer and

Chief Financial Officer |

| | |

Date: February 6, 2024 | By: | | /s/ James L. Johnson |

| | | James L. Johnson |

| | | Executive Vice President and

Chief Accounting Officer |

Exhibit 99.1

Werner Enterprises Reports Fourth Quarter and Annual 2023 Results

Fourth Quarter 2023 Highlights (all metrics compared to fourth quarter 2022)

•Total revenues of $821.9 million, down 5%

•Operating income of $37.9 million, down 57%; non-GAAP adjusted operating income of $39.2 million, down 56%

•Operating margin of 4.6%, down 570 basis points; non-GAAP adjusted operating margin of 4.8%, down 560 basis points

•Diluted EPS of $0.37, down 61%; non-GAAP adjusted diluted EPS of $0.39, down 61%

2023 Highlights (all metrics compared to 2022)

•Total revenues of $3.28 billion, relatively flat

•Operating income of $176.4 million, down 45%; non-GAAP adjusted operating income of $189.7 million, down 43%

•Operating margin of 5.4%, down 440 basis points; non-GAAP adjusted operating margin of 5.8%, down 430 basis points

•Diluted EPS of $1.76, down 53%; non-GAAP adjusted diluted EPS of $1.93, down 48%

OMAHA, Neb., February 6, 2024 -- Werner Enterprises, Inc. (Nasdaq: WERN), a premier transportation and logistics provider, today reported results for the fourth quarter and year ended December 31, 2023.

“Freight conditions remained challenging in the fourth quarter with ongoing pricing pressure. Despite this, our nearly 14,000 talented Werner team members and cycle-tested management team focused on what we can control. Our Dedicated business proved to be durable and resilient, generating double-digit margins and growing revenue per truck for the 9th year out of the last decade. Our One-Way Trucking business’ miles per truck improved nearly 9% year over year during the quarter, while rate per mile decline was more favorable than industry benchmarks. Logistics volume was strong, and revenue grew over 6% year over year, extending to 13 straight quarters of growth,” said Derek J. Leathers, Chairman and CEO. “We continue to execute on structural cost changes, realizing over $40 million of savings in 2023, helping to partially offset market dynamics and conditions out of our control, such as rate pressure, cost inflation and declining resale values of equipment. During the quarter, operating cash flow remained strong, which we used to reinvest in the business, pay down over $40 million in debt and return value to our shareholders. Improved production, our elevated rigor on operational excellence, cost savings, innovation, and capital deployment positions us well to benefit as the market comes more into balance.”

Total revenues for the quarter were $821.9 million, a decrease of $39.5 million compared to the prior year quarter, due to a $54.7 million decrease in Truckload Transportation Services (“TTS”) revenues, partially offset by Logistics revenues growth of $13.5 million, or 6%, including the ReedTMS acquisition. A significant portion of the TTS revenue decline was due to $24.9 million lower fuel surcharge revenues. Net of trucking fuel surcharge revenues, consolidated total revenues decreased $14.6 million, or 2%, during the quarter.

Werner Enterprises, Inc. - Release of February 6, 2024

Page 2

Operating income of $37.9 million decreased $50.4 million, or 57%, while operating margin of 4.6% decreased 570 basis points. On a non-GAAP basis, adjusted operating income of $39.2 million decreased $50.7 million, or 56%. Adjusted operating margin of 4.8% declined 560 basis points from 10.4% for the same quarter last year.

TTS operating income decreased $46.0 million, and TTS adjusted operating income decreased $45.9 million. Logistics operating income decreased $5.3 million and adjusted operating income decreased $5.0 million. Corporate and Other (including driving schools) operating income increased $0.8 million.

Net interest expense of $7.3 million increased $2.2 million primarily due to higher interest rates for variable rate debt and an increase in average debt outstanding. The effective income tax rate during the the quarter was 23.1%, compared to 24.7% in fourth quarter 2022.

During fourth quarter 2023, we had losses on our strategic investments of $0.3 million, compared to losses of $2.2 million, or $0.03 per share, in fourth quarter 2022. Consistent with prior reporting, increases or decreases to the values of these strategic investments are adjusted out for determining non-GAAP adjusted net income and non-GAAP adjusted earnings per share.

Net income attributable to Werner of $23.6 million decreased 61%. On a non-GAAP basis, adjusted net income attributable to Werner of $24.6 million decreased 61%. Diluted EPS of $0.37 decreased 61%. On a non-GAAP basis, adjusted diluted EPS of $0.39 decreased 61%.

Key Consolidated Financial Metrics

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended

December 31, |

| (In thousands, except per share amounts) | 2023 | | 2022 | | Y/Y

Change | | 2023 | | 2022 | | Y/Y

Change |

| Total revenues | $ | 821,945 | | | $ | 861,491 | | | (5) | % | | $ | 3,283,499 | | | $ | 3,289,978 | | | 0 | % |

| Truckload Transportation Services revenues | 580,093 | | | 634,787 | | | (9) | % | | 2,310,810 | | | 2,428,686 | | | (5) | % |

| Werner Logistics revenues | 226,963 | | | 213,485 | | | 6 | % | | 910,433 | | | 793,492 | | | 15 | % |

Operating income | 37,932 | | | 88,381 | | | (57) | % | | 176,416 | | | 323,076 | | | (45) | % |

| Operating margin | 4.6 | % | | 10.3 | % | | (570) bps | | 5.4 | % | | 9.8 | % | | (440) bps |

| Net income attributable to Werner | 23,573 | | | 60,166 | | | (61) | % | | 112,382 | | | 241,256 | | | (53) | % |

| Diluted earnings per share | 0.37 | | | 0.94 | | | (61) | % | | 1.76 | | | 3.74 | | | (53) | % |

Adjusted operating income (1) | 39,206 | | | 89,917 | | | (56) | % | | 189,705 | | | 333,164 | | | (43) | % |

Adjusted operating margin (1) | 4.8 | % | | 10.4 | % | | (560) bps | | 5.8 | % | | 10.1 | % | | (430) bps |

Adjusted net income attributable to Werner (1) | 24,639 | | | 62,840 | | | (61) | % | | 122,721 | | | 239,164 | | | (49) | % |

Adjusted diluted earnings per share (1) | 0.39 | | | 0.99 | | | (61) | % | | 1.93 | | | 3.70 | | | (48) | % |

(1) See attached Reconciliation of Non-GAAP Financial Measures - Consolidated.

Truckload Transportation Services (TTS) Segment

•Revenues of $580.1 million decreased $54.7 million; trucking revenues, net of fuel surcharge, decreased 6%

•Operating income of $34.3 million decreased $46.0 million; non-GAAP adjusted operating income of $37.2 million decreased $45.9 million due to a lower rate per mile in One-Way Truckload, smaller overall fleet size, and lower gains on the sale of property and equipment

•Operating margin of 5.9% decreased 680 basis points from 12.7%

•Non-GAAP adjusted operating margin, net of fuel surcharge, of 7.5% decreased 830 basis points from 15.8%

•Average segment trucks in service totaled 8,168, a decrease of 541 trucks year over year, or 6%

•Dedicated unit trucks at quarter end totaled 5,265, or 66% of the total TTS segment fleet, compared to 5,450 trucks, or 63%, a year ago

Werner Enterprises, Inc. - Release of February 6, 2024

Page 3

•Average revenues per truck per week, net of fuel surcharges, increased 0.2% for TTS and increased 0.9% for Dedicated

During fourth quarter 2023, Dedicated experienced net reduction in average trucks, down 3.3% year over year and down 0.3% sequentially. Dedicated revenue per truck per week increased 0.9% year over year, and despite a highly competitive environment and normal churn, pipeline opportunities remain healthy and client retention remains strong. One-Way Truckload customer freight demand during fourth quarter 2023 was stable with slightly better-than-expected peak volumes, but at significantly reduced pricing compared to the prior-year period. One-Way rate per mile was down 8.6% and fleet size was smaller year over year (down 11.0%), offset with the third consecutive quarter of higher total miles per truck (up 8.7%).

Key Truckload Transportation Services Segment Financial Metrics

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended

December 31, |

| (In thousands) | 2023 | | 2022 | | Y/Y

Change | | 2023 | | 2022 | | Y/Y

Change |

| Trucking revenues, net of fuel surcharge | $ | 487,408 | | | $ | 518,393 | | | (6) | % | | $ | 1,949,445 | | | $ | 1,982,639 | | | (2) | % |

| Trucking fuel surcharge revenues | 84,675 | | | 109,611 | | | (23) | % | | 332,388 | | | 419,240 | | | (21) | % |

| Non-trucking and other revenues | 8,010 | | | 6,783 | | | 18 | % | | 28,977 | | | 26,807 | | | 8 | % |

| Total revenues | $ | 580,093 | | | $ | 634,787 | | | (9) | % | | $ | 2,310,810 | | | $ | 2,428,686 | | | (5) | % |

Operating income | $ | 34,339 | | | $ | 80,341 | | | (57) | % | | $ | 169,330 | | | $ | 294,555 | | | (43) | % |

| Operating margin | 5.9 | % | | 12.7 | % | | (680) bps | | 7.3 | % | | 12.1 | % | | (480) bps |

| Operating ratio | 94.1 | % | | 87.3 | % | | 680 bps | | 92.7 | % | | 87.9 | % | | 480 bps |

Adjusted operating income (1) | $ | 37,165 | | | $ | 83,104 | | | (55) | % | | $ | 180,453 | | | $ | 303,902 | | | (41) | % |

Adjusted operating margin (1) | 6.4 | % | | 13.1 | % | | (670) bps | | 7.8 | % | | 12.5 | % | | (470) bps |

Adjusted operating margin, net of fuel surcharge (1) | 7.5 | % | | 15.8 | % | | (830) bps | | 9.1 | % | | 15.1 | % | | (600) bps |

Adjusted operating ratio (1) | 93.6 | % | | 86.9 | % | | 670 bps | | 92.2 | % | | 87.5 | % | | 470 bps |

Adjusted operating ratio, net of fuel surcharge (1) | 92.5 | % | | 84.2 | % | | 830 bps | | 90.9 | % | | 84.9 | % | | 600 bps |

(1) See attached Reconciliation of Non-GAAP Financial Measures - Truckload Transportation Services (TTS) Segment.

Werner Logistics Segment

•Revenues of $227.0 million increased $13.5 million, or 6%, including ReedTMS acquisition which closed in November 2022

•Operating income of $4.6 million decreased $5.3 million

•Operating margin of 2.0% decreased 260 basis points from 4.6%

•Adjusted operating income of $3.0 million decreased $5.0 million

•Adjusted operating margin of 1.3% decreased 250 basis points from 3.8%

Truckload Logistics revenues (77% of Logistics revenues) increased 15%, driven by a double-digit increase in shipments (including November 2022 ReedTMS acquisition), partially offset by a decline in revenue per shipment.

Intermodal revenues (12% of Logistics revenues) decreased 27%, due to fewer shipments and lower revenue per shipment year over year; although we achieved the third consecutive quarter of a sequential increase in shipments.

Final Mile revenues (11% of Logistics revenues) increased $1.4 million, or 6%.

Logistics operating income decreased $5.3 million and adjusted operating income decreased $5.0 million in fourth quarter 2023, due to a competitive freight and rate market in fourth quarter 2023 despite generally stronger volume and load growth overall.

Werner Enterprises, Inc. - Release of February 6, 2024

Page 4

Key Werner Logistics Segment Financial Metrics

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended

December 31, | |

| (In thousands) | 2023 | | 2022 | | Y/Y

Change | | 2023 | | 2022 | | Y/Y

Change |

| Total revenues | $ | 226,963 | | | $ | 213,485 | | | 6 | % | | $ | 910,433 | | | $ | 793,492 | | | 15 | % |

| Operating expenses: | | | | | | | | | | | |

| Purchased transportation expense | 193,132 | | | 174,463 | | | 11 | % | | 761,948 | | | 653,185 | | | 17 | % |

| Other operating expenses | 29,256 | | | 29,154 | | | 0 | % | | 132,606 | | | 104,123 | | | 27 | % |

| Total operating expenses | 222,388 | | | 203,617 | | | 9 | % | | 894,554 | | | 757,308 | | | 18 | % |

| Operating income | $ | 4,575 | | | $ | 9,868 | | | (54) | % | | $ | 15,879 | | | $ | 36,184 | | | (56) | % |

| Operating margin | 2.0 | % | | 4.6 | % | | (260) bps | | 1.7 | % | | 4.6 | % | | (290) bps |

Adjusted operating income (1) | $ | 3,023 | | | $ | 8,028 | | | (62) | % | | $ | 18,045 | | | $ | 35,844 | | | (50) | % |

Adjusted operating margin (1) | 1.3 | % | | 3.8 | % | | (250) bps | | 2.0 | % | | 4.5 | % | | (250) bps |

(1) See attached Reconciliation of Non-GAAP Financial Measures - Werner Logistics Segment.

Cash Flow and Capital Allocation

Cash flow from operations in fourth quarter 2023 was $118.3 million compared to $116.0 million in fourth quarter 2022, an increase of 2%. Operating cash flow margins improved greater than 90 basis points for fourth quarter 2023 to 14% of operating revenues and increased 80 basis points year to date 2023 to 14% of operating revenues.

Net capital expenditures in fourth quarter 2023 were $34.5 million compared to $63.5 million in fourth quarter 2022, a decrease of 46%. We plan to continue to invest in new trucks, trailers and our terminals to improve our driver experience, optimize operational efficiency and more effectively manage our maintenance, safety and fuel costs. The average ages of our truck and trailer fleets were 2.1 years and 4.9 years, respectively, as of December 31, 2023.

Gains on sales of property and equipment in fourth quarter 2023 were $3.1 million, or $0.04 per share, compared to $25.9 million, or $0.30 per share, in fourth quarter 2022. Year over year, we sold 11% fewer trucks and over 60% more trailers and realized substantially lower average gains per truck and trailer. Gains on sales of property and equipment are reflected as a reduction of Other Operating Expenses in our income statement.

We did not repurchase shares of our common stock in fourth quarter 2023. As of December 31, 2023, we had 2.3 million shares remaining under our share repurchase authorization.

As of December 31, 2023, we had $62 million of cash and cash equivalents and $1.5 billion of stockholders’ equity. Total debt outstanding was $649 million at December 31, 2023. After considering letters of credit issued, we had available liquidity consisting of cash and cash equivalents and available borrowing capacity as of December 31, 2023 of $526 million.

Werner Enterprises, Inc. - Release of February 6, 2024

Page 5

Introducing 2024 Guidance

| | | | | | | | | | | | | |

| 2023 Guidance

(as of 11/1/23) | 2023 Actual

(as of 12/31/23) | 2024 Guidance

(as of 2/6/24) | | |

| TTS truck count from BoY to EoY | (5)% to (3)%

(annual) | (7)%

(2023) | (3)% to 0%

(annual) | | |

| Net capital expenditures | $425M to $450M

(annual) | $409M

(2023) | $260M to $310M

(annual) | | |

| TTS Guidance | | | | | |

| Dedicated RPTPW* growth | 0% to 3%

(annual)

| 1.5%

(2023) | 0% to 3%

(annual) | | |

| One-Way Truckload RPTM* growth | (9)% to (7)%

(4Q23 vs. 4Q22) | (8.6)%

(4Q23 vs. 4Q22) | (6)% to (3)%

(1H24 vs. 1H23) | | |

* Net of fuel surcharge revenues

Assumptions

•Effective income tax rate of 24.5% to 25.5% in 2024 compared to 24.0% in 2023.

•Expect average truck age of 2.1 years and average trailer age of 5.0 years as of 12/31/24, compared to 2.1 years and 4.9 years as of 12/31/23, respectively.

Werner Enterprises, Inc. - Release of February 6, 2024

Page 6

Call Information

Werner Enterprises, Inc. will conduct a conference call to discuss fourth quarter 2023 earnings today beginning at 4:00 p.m. CT. The news release, live webcast of the earnings conference call, and accompanying slide presentation will be available at werner.com in the “Investors” section under “News & Events” and then “Events Calendar.” To participate in the conference call, please dial (844) 701-1165 (domestic) or (412) 317-5498 (international). Please mention to the operator that you are dialing in for the Werner Enterprises call.

A replay of the conference call will be available on February 6, 2024 at approximately 6:00 p.m. CT through March 6, 2024 by dialing (877) 344-7529 (domestic) or (412) 317-0088 (international) and using the access code 1321524. A replay of the webcast will also be available at werner.com in the “Investors” section under “News & Events” and then “Events Calendar.”

About Werner Enterprises

Werner Enterprises, Inc. (Nasdaq: WERN) delivers superior truckload transportation and logistics services to customers across the United States, Mexico and Canada. With 2023 revenues of $3.3 billion, an industry-leading modern truck and trailer fleet, nearly 14,000 talented associates and our innovative Werner EDGE® technology, we are an essential solutions provider for customers who value the integrity of their supply chain and require safe and exceptional on-time service. Werner provides Dedicated and One-Way Truckload services as well as Logistics services that include truckload brokerage, freight management, intermodal and final mile. As an industry leader, Werner is deeply committed to promoting sustainability and supporting diversity, equity and inclusion.

This press release may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, as amended. Such forward-looking statements are based on information presently available to the Company’s management and are current only as of the date made. Actual results could also differ materially from those anticipated as a result of a number of factors, including, but not limited to, those discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 and subsequently filed Quarterly Reports on Form 10-Q.

For those reasons, undue reliance should not be placed on any forward-looking statement. The Company assumes no duty or obligation to update or revise any forward-looking statement, although it may do so from time to time as management believes is warranted or as may be required by applicable securities law. Any such updates or revisions may be made by filing reports with the U.S. Securities and Exchange Commission (“SEC”), through the issuance of press releases or by other methods of public disclosure.

Contact:

Christopher D. Wikoff

Executive Vice President, Treasurer

and Chief Financial Officer

(402) 894-3700

Source: Werner Enterprises, Inc.

Werner Enterprises, Inc. - Release of February 6, 2024

Page 7

Consolidated Financial Information

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| INCOME STATEMENT |

| (Unaudited) |

| (In thousands, except per share amounts) |

| | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended

December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| $ | | % | | $ | | % | | $ | | % | | $ | | % |

| Operating revenues | $ | 821,945 | | | 100.0 | | | $ | 861,491 | | | 100.0 | | | $ | 3,283,499 | | | 100.0 | | | $ | 3,289,978 | | | 100.0 | |

| Operating expenses: | | | | | | | | | | | | | | | |

Salaries, wages and benefits | 269,816 | | | 32.8 | | | 260,531 | | | 30.2 | | | 1,072,558 | | | 32.7 | | | 1,020,609 | | | 31.0 | |

Fuel | 85,478 | | | 10.4 | | | 111,447 | | | 12.9 | | | 345,001 | | | 10.5 | | | 437,299 | | | 13.3 | |

Supplies and maintenance | 63,124 | | | 7.7 | | | 65,406 | | | 7.6 | | | 256,494 | | | 7.8 | | | 253,096 | | | 7.7 | |

Taxes and licenses | 25,999 | | | 3.2 | | | 25,289 | | | 2.9 | | | 102,684 | | | 3.1 | | | 97,929 | | | 3.0 | |

Insurance and claims | 33,964 | | | 4.1 | | | 44,301 | | | 5.2 | | | 138,516 | | | 4.2 | | | 147,365 | | | 4.5 | |

| Depreciation and amortization | 75,712 | | | 9.2 | | | 73,826 | | | 8.6 | | | 299,509 | | | 9.1 | | | 279,923 | | | 8.5 | |

Rent and purchased transportation | 224,418 | | | 27.3 | | | 207,662 | | | 24.1 | | | 886,284 | | | 27.0 | | | 777,464 | | | 23.6 | |

Communications and utilities | 4,523 | | | 0.6 | | | 4,429 | | | 0.5 | | | 18,480 | | | 0.6 | | | 15,856 | | | 0.5 | |

Other | 979 | | | 0.1 | | | (19,781) | | | (2.3) | | | (12,443) | | | (0.4) | | | (62,639) | | | (1.9) | |

Total operating expenses | 784,013 | | | 95.4 | | | 773,110 | | | 89.7 | | | 3,107,083 | | | 94.6 | | | 2,966,902 | | | 90.2 | |

| Operating income | 37,932 | | | 4.6 | | | 88,381 | | | 10.3 | | | 176,416 | | | 5.4 | | | 323,076 | | | 9.8 | |

| Other expense (income): | | | | | | | | | | | | | | | |

Interest expense | 8,819 | | | 1.1 | | | 5,824 | | | 0.7 | | | 33,535 | | | 1.0 | | | 11,828 | | | 0.4 | |

Interest income | (1,523) | | | (0.2) | | | (751) | | | (0.1) | | | (6,701) | | | (0.2) | | | (1,731) | | | (0.1) | |

| Loss (gain) on investments in equity securities, net | 242 | | | — | | | 2,208 | | | 0.3 | | | 278 | | | — | | | (12,195) | | | (0.4) | |

| Loss from equity method investment | 92 | | | — | | | — | | | — | | | 1,046 | | | 0.1 | | | — | | | — | |

Other | 100 | | | — | | | 112 | | | — | | | 477 | | | — | | | 388 | | | — | |

| Total other expense (income) | 7,730 | | | 0.9 | | | 7,393 | | | 0.9 | | | 28,635 | | | 0.9 | | | (1,710) | | | (0.1) | |

| Income before income taxes | 30,202 | | | 3.7 | | | 80,988 | | | 9.4 | | | 147,781 | | | 4.5 | | | 324,786 | | | 9.9 | |

| Income tax expense | 6,970 | | | 0.9 | | | 19,977 | | | 2.3 | | | 35,491 | | | 1.1 | | | 79,206 | | | 2.4 | |

| Net income | 23,232 | | | 2.8 | | | 61,011 | | | 7.1 | | | 112,290 | | | 3.4 | | | 245,580 | | | 7.5 | |

| Net loss (income) attributable to noncontrolling interest | 341 | | | 0.1 | | | (845) | | | (0.1) | | | 92 | | | — | | | (4,324) | | | (0.2) | |

| Net income attributable to Werner | $ | 23,573 | | | 2.9 | | | $ | 60,166 | | | 7.0 | | | $ | 112,382 | | | 3.4 | | | $ | 241,256 | | | 7.3 | |

| Diluted shares outstanding | 63,780 | | | | | 63,695 | | | | | 63,718 | | | | | 64,579 | | | |

| Diluted earnings per share | $ | 0.37 | | | | | $ | 0.94 | | | | | $ | 1.76 | | | | | $ | 3.74 | | | |

Werner Enterprises, Inc. - Release of February 6, 2024

Page 8

| | | | | | | | | | | |

| CONDENSED BALANCE SHEET |

| (In thousands, except share amounts) |

| | | |

| December 31,

2023 | | December 31,

2022 |

| (Unaudited) | | |

| | | |

| ASSETS | | | |

| Current assets: | | | |

Cash and cash equivalents | $ | 61,723 | | | $ | 107,240 | |

| Accounts receivable, trade, less allowance of $9,337 and $10,271, respectively | 444,944 | | | 518,815 | |

| Other receivables | 25,479 | | | 29,875 | |

Inventories and supplies | 18,077 | | | 14,527 | |

Prepaid taxes, licenses and permits | 16,505 | | | 17,699 | |

| Other current assets | 67,900 | | | 74,459 | |

Total current assets | 634,628 | | | 762,615 | |

Property and equipment | 2,951,654 | | | 2,885,641 | |

| Less – accumulated depreciation | 978,698 | | | 1,060,365 | |

Property and equipment, net | 1,972,956 | | | 1,825,276 | |

Goodwill | 129,104 | | | 132,717 | |

| Intangible assets, net | 86,477 | | | 81,502 | |

Other non-current assets (1) | 334,771 | | | 295,145 | |

| Total assets | $ | 3,157,936 | | | $ | 3,097,255 | |

| | | |

| LIABILITIES, TEMPORARY EQUITY AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| | | |

Accounts payable | $ | 135,990 | | | $ | 124,483 | |

Current portion of long-term debt | 2,500 | | | 6,250 | |

| Insurance and claims accruals | 81,794 | | | 78,620 | |

Accrued payroll | 50,549 | | | 49,793 | |

| Accrued expenses | 30,282 | | | 20,358 | |

| | | |

Other current liabilities | 29,470 | | | 30,016 | |

Total current liabilities | 330,585 | | | 309,520 | |

Long-term debt, net of current portion | 646,250 | | | 687,500 | |

| Other long-term liabilities | 54,275 | | | 59,677 | |

Insurance and claims accruals, net of current portion (1) | 239,700 | | | 244,946 | |

| Deferred income taxes | 320,180 | | | 313,278 | |

| Total liabilities | 1,590,990 | | | 1,614,921 | |

| Temporary equity - redeemable noncontrolling interest | 38,607 | | | 38,699 | |

Stockholders’ equity: | | | |

Common stock, $.01 par value, 200,000,000 shares authorized; 80,533,536 shares issued; 63,444,681 and 63,223,003 shares outstanding, respectively | 805 | | | 805 | |

Paid-in capital | 134,894 | | | 129,837 | |

Retained earnings | 1,953,385 | | | 1,875,873 | |

| Accumulated other comprehensive loss | (9,684) | | | (11,292) | |

| Treasury stock, at cost; 17,088,855 and 17,310,533 shares, respectively | (551,061) | | | (551,588) | |

| Total stockholders’ equity | 1,528,339 | | | 1,443,635 | |

| Total liabilities, temporary equity and stockholders’ equity | $ | 3,157,936 | | | $ | 3,097,255 | |

(1) Under the terms of our insurance policies, we are the primary obligor of the damage award in a previously disclosed adverse jury verdict, and as such, we have recorded a $79.2 million receivable from our third-party insurance providers in other non-current assets and a corresponding liability of the same amount in the long-term portion of insurance and claims accruals in the unaudited condensed balance sheets as of December 31, 2023 and 2022.

Werner Enterprises, Inc. - Release of February 6, 2024

Page 9

| | | | | | | | | | | | | | | | | | | | | | | |

| SUPPLEMENTAL INFORMATION |

| (Unaudited) |

| (In thousands) |

| | | | | |

| Three Months Ended

December 31, | | Year Ended

December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Capital expenditures, net | $ | 34,537 | | | $ | 63,507 | | | $ | 408,698 | | | $ | 317,579 | |

| Cash flow from operations | 118,347 | | | 115,995 | | | 474,366 | | | 448,711 | |

| Return on assets (annualized) | 2.9 | % | | 8.2 | % | | 3.6 | % | | 8.8 | % |

| Return on equity (annualized) | 6.0 | % | | 16.8 | % | | 7.3 | % | | 17.5 | % |

Segment Financial and Operating Statistics Information

| | | | | | | | | | | | | | | | | | | | | | | |

| SEGMENT INFORMATION |

| (Unaudited) |

| (In thousands) |

| | | | | |

| Three Months Ended

December 31, | | Year Ended

December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenues | | | | | | | |

| Truckload Transportation Services | $ | 580,093 | | | $ | 634,787 | | | $ | 2,310,810 | | | $ | 2,428,686 | |

| Werner Logistics | 226,963 | | | 213,485 | | | 910,433 | | | 793,492 | |

Other (1) | 18,974 | | | 16,257 | | | 78,063 | | | 71,185 | |

| Corporate | 420 | | | 431 | | | 1,883 | | | 1,833 | |

| Subtotal | 826,450 | | | 864,960 | | | 3,301,189 | | | 3,295,196 | |

Inter-segment eliminations (2) | (4,505) | | | (3,469) | | | (17,690) | | | (5,218) | |

| Total | $ | 821,945 | | | $ | 861,491 | | | $ | 3,283,499 | | | $ | 3,289,978 | |

Operating Income (Loss) | | | | | | | |

| Truckload Transportation Services | $ | 34,339 | | | $ | 80,341 | | | $ | 169,330 | | | $ | 294,555 | |

| Werner Logistics | 4,575 | | | 9,868 | | | 15,879 | | | 36,184 | |

Other (1) | (244) | | | (2,419) | | | 69 | | | (2,604) | |

| Corporate | (738) | | | 591 | | | (8,862) | | | (5,059) | |

| Total | $ | 37,932 | | | $ | 88,381 | | | $ | 176,416 | | | $ | 323,076 | |

(1) Other includes our driver training schools, transportation-related activities such as third-party equipment maintenance and equipment leasing, and other business activities.

(2) Inter-segment eliminations represent transactions between reporting segments that are eliminated in consolidation.

Werner Enterprises, Inc. - Release of February 6, 2024

Page 10

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| OPERATING STATISTICS BY SEGMENT |

| (Unaudited) |

| | | | | | | |

| Three Months Ended

December 31, | | | | Year Ended

December 31, | | |

| 2023 | | 2022 | | % Chg | | 2023 | | 2022 | | % Chg |

| Truckload Transportation Services segment | | | | | | | | | | | |

| Average trucks in service | 8,168 | | | 8,709 | | | (6.2) | % | | 8,326 | | | 8,437 | | | (1.3) | % |

Average revenues per truck per week (1) | $ | 4,590 | | | $ | 4,579 | | | 0.2 | % | | $ | 4,502 | | | $ | 4,519 | | | (0.4) | % |

| Total trucks (at quarter end) | | | | | | | | | | | |

| Company | 7,740 | | | 8,305 | | | (6.8) | % | | 7,740 | | | 8,305 | | | (6.8) | % |

| Independent contractor | 260 | | | 295 | | | (11.9) | % | | 260 | | | 295 | | | (11.9) | % |

| Total trucks | 8,000 | | | 8,600 | | | (7.0) | % | | 8,000 | | | 8,600 | | | (7.0) | % |

| Total trailers (at quarter end) | 27,850 | | | 27,650 | | | 0.7 | % | | 27,850 | | | 27,650 | | | 0.7 | % |

One-Way Truckload | | | | | | | | | | | |

| Trucking revenues, net of fuel surcharge (in 000’s) | $ | 178,118 | | | $ | 201,460 | | | (11.6) | % | | $ | 713,762 | | | $ | 766,013 | | | (6.8) | % |

| Average trucks in service | 2,929 | | | 3,292 | | | (11.0) | % | | 3,042 | | | 3,153 | | | (3.5) | % |

| Total trucks (at quarter end) | 2,735 | | | 3,150 | | | (13.2) | % | | 2,735 | | | 3,150 | | | (13.2) | % |

| Average percentage of empty miles | 14.92 | % | | 13.58 | % | | 9.9 | % | | 14.36 | % | | 12.70 | % | | 13.1 | % |

Average revenues per truck per week (1) | $ | 4,678 | | | $ | 4,708 | | | (0.6) | % | | $ | 4,512 | | | $ | 4,672 | | | (3.4) | % |

Average % change YOY in revenues per total mile (1) | (8.6) | % | | 0.4 | % | | | | (5.5) | % | | 8.6 | % | | |

| Average % change YOY in total miles per truck per week | 8.7 | % | | (4.6) | % | | | | 2.2 | % | | (7.4) | % | | |

| Average completed trip length in miles (loaded) | 594 | | | 633 | | | (6.2) | % | | 595 | | | 675 | | | (11.9) | % |

Dedicated | | | | | | | | | | | |

| Trucking revenues, net of fuel surcharge (in 000’s) | $ | 309,290 | | | $ | 316,933 | | | (2.4) | % | | $ | 1,235,683 | | | $ | 1,216,626 | | | 1.6 | % |

| Average trucks in service | 5,239 | | | 5,417 | | | (3.3) | % | | 5,284 | | | 5,284 | | | — | % |

| Total trucks (at quarter end) | 5,265 | | | 5,450 | | | (3.4) | % | | 5,265 | | | 5,450 | | | (3.4) | % |

Average revenues per truck per week (1) | $ | 4,541 | | | $ | 4,501 | | | 0.9 | % | | $ | 4,496 | | | $ | 4,428 | | | 1.5 | % |

Werner Logistics segment | | | | | | | | | | | |

| Average trucks in service | 39 | | | 45 | | | (13.3) | % | | 37 | | | 52 | | | (28.8) | % |

| Total trucks (at quarter end) | 35 | | | 39 | | | (10.3) | % | | 35 | | | 39 | | | (10.3) | % |

| Total trailers (at quarter end) | 2,960 | | | 2,315 | | | 27.9 | % | | 2,960 | | | 2,315 | | | 27.9 | % |

(1) Net of fuel surcharge revenues

Non-GAAP Financial Measures and Reconciliations

To supplement our financial results presented in accordance with generally accepted accounting principles in the United States of America (“GAAP”), we provide certain non-GAAP financial measures as defined by the SEC Regulation G, including non-GAAP adjusted operating income; non-GAAP adjusted operating margin; non-GAAP adjusted operating margin, net of fuel surcharge; non-GAAP adjusted net income attributable to Werner; non-GAAP adjusted diluted earnings per share; non-GAAP adjusted operating revenues, net of fuel surcharge; non-GAAP adjusted operating expenses; non-GAAP adjusted operating expenses, net of fuel surcharge; non-GAAP adjusted operating ratio; and non-GAAP adjusted operating ratio, net of fuel surcharge. We believe these non-GAAP financial measures provide a more useful comparison of our performance from period to period because they exclude the effect of items that, in our opinion, do not reflect our core operating performance. Our non-GAAP financial measures are not meant to be considered in isolation or as substitutes for their comparable GAAP measures and should be read only in conjunction with our consolidated financial statements prepared in accordance with GAAP. There are limitations to using non-GAAP financial measures. Although we believe that they improve comparability in analyzing our period to period performance, they could limit comparability to other companies in our industry if those companies define these measures differently. Because of these limitations, our non-GAAP financial measures should not be considered measures of income generated by our business. Management compensates for these limitations by primarily relying on GAAP results and using non-GAAP financial measures on a supplemental basis.

Werner Enterprises, Inc. - Release of February 6, 2024

Page 11

The following tables present reconciliations of each non-GAAP financial measure to its most directly comparable GAAP financial measure as required by SEC Regulation G. In addition, information regarding each of the excluded items as well as our reasons for excluding them from our non-GAAP results is provided below.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES – CONSOLIDATED

(unaudited)

(In thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

Non-GAAP Adjusted Operating Income and Non-GAAP Adjusted Operating Margin (1) | | $ | | % of Op. Rev. | | $ | | % of Op. Rev. | | $ | | % of Op. Rev. | | $ | | % of Op. Rev. |

| Operating income and operating margin – (GAAP) | | $ | 37,932 | | | 4.6 | % | | $ | 88,381 | | | 10.3 | % | | $ | 176,416 | | | 5.4 | % | | $ | 323,076 | | | 9.8 | % |

| Non-GAAP adjustments: | | | | | | | | | | | | | | | | |

Insurance and claims (2) | | 1,457 | | | 0.2 | % | | 1,387 | | | 0.1 | % | | 5,664 | | | 0.2 | % | | 5,394 | | | 0.2 | % |

Amortization of intangible assets (3) | | 2,517 | | | 0.3 | % | | 2,036 | | | 0.2 | % | | 10,325 | | | 0.3 | % | | 6,113 | | | 0.2 | % |

Acquisition expenses (4) | | — | | | — | % | | 613 | | | 0.1 | % | | — | | | — | % | | 1,081 | | | — | % |

Contingent consideration adjustments (5) | | (2,700) | | | (0.3) | % | | (2,500) | | | (0.3) | % | | (2,700) | | | (0.1) | % | | (2,500) | | | (0.1) | % |

| Non-GAAP adjusted operating income and non-GAAP adjusted operating margin | | $ | 39,206 | | | 4.8 | % | | $ | 89,917 | | | 10.4 | % | | $ | 189,705 | | | 5.8 | % | | $ | 333,164 | | | 10.1 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

Non-GAAP Adjusted Net Income Attributable to Werner and Non-GAAP Adjusted Diluted EPS (1) | $ | | Diluted EPS | | $ | | Diluted EPS | | $ | | Diluted EPS | | $ | | Diluted EPS |

| Net income attributable to Werner and diluted EPS – (GAAP) | $ | 23,573 | | | $ | 0.37 | | | $ | 60,166 | | | $ | 0.94 | | | $ | 112,382 | | | $ | 1.76 | | | $ | 241,256 | | | $ | 3.74 | |

| Non-GAAP adjustments: | | | | | | | | | | | | | | | |

Insurance and claims (2) | 1,457 | | | 0.02 | | | 1,387 | | | 0.02 | | | 5,664 | | | 0.09 | | | 5,394 | | | 0.08 | |

Amortization of intangible assets, net of amount attributable to noncontrolling interest (3) | 2,345 | | | 0.04 | | | 1,864 | | | 0.03 | | | 9,637 | | | 0.15 | | | 5,425 | | | 0.08 | |

Acquisition expenses (4) | — | | | — | | | 613 | | | 0.01 | | | — | | | — | | | 1,081 | | | 0.02 | |

Contingent consideration adjustments (5) | (2,700) | | | (0.04) | | | (2,500) | | | (0.04) | | | (2,700) | | | (0.04) | | | (2,500) | | | (0.04) | |

Loss (gain) on investments in equity securities, net (6) | 242 | | | — | | | 2,208 | | | 0.04 | | | 278 | | | 0.01 | | | (12,195) | | | (0.19) | |

Loss from equity method investment (7) | 92 | | | — | | | — | | | — | | | 1,046 | | | 0.02 | | | — | | | — | |

| | | | | | | | | | | | | | | |

Income tax effect of above adjustments (8) | (370) | | | — | | | (898) | | | (0.01) | | | (3,586) | | | (0.06) | | | 703 | | | 0.01 | |

| Non-GAAP adjusted net income attributable to Werner and non-GAAP adjusted diluted EPS | $ | 24,639 | | | $ | 0.39 | | | $ | 62,840 | | | $ | 0.99 | | | $ | 122,721 | | | $ | 1.93 | | | $ | 239,164 | | | $ | 3.70 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended

December 31, | | Year Ended

December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

Non-GAAP Adjusted Operating Revenues, Net of Fuel Surcharge (1) | | $ | | $ | | $ | | $ |

| Operating revenues – (GAAP) | | $ | 821,945 | | | $ | 861,491 | | | $ | 3,283,499 | | | $ | 3,289,978 | |

| Non-GAAP adjustment: | | | | | | | | |

Trucking fuel surcharge (9) | | (84,675) | | | (109,611) | | | (332,388) | | | (419,240) | |

| Non-GAAP Operating revenues, net of fuel surcharge | | $ | 737,270 | | | $ | 751,880 | | | $ | 2,951,111 | | | $ | 2,870,738 | |

Werner Enterprises, Inc. - Release of February 6, 2024

Page 12

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES – TRUCKLOAD TRANSPORTATION SERVICES (TTS) SEGMENT

(unaudited)

(In thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

Non-GAAP Adjusted Operating Income and Non-GAAP Adjusted Operating Margin (1) | | $ | | % of Op. Rev. | | $ | | % of Op. Rev. | | $ | | % of Op. Rev. | | $ | | % of Op. Rev. |

| Operating income and operating margin – (GAAP) | | $ | 34,339 | | | 5.9 | % | | $ | 80,341 | | | 12.7 | % | | $ | 169,330 | | | 7.3 | % | | $ | 294,555 | | | 12.1 | % |

| Non-GAAP adjustments: | | | | | | | | | | | | | | | | |

Insurance and claims (2) | | 1,457 | | | 0.3 | % | | 1,387 | | | 0.2 | % | | 5,664 | | | 0.3 | % | | 5,394 | | | 0.2 | % |

Amortization of intangible assets (3) | | 1,369 | | | 0.2 | % | | 1,376 | | | 0.2 | % | | 5,459 | | | 0.2 | % | | 3,953 | | | 0.2 | % |

| | | | | | | | | | | | | | | | |

| Non-GAAP adjusted operating income and non-GAAP adjusted operating margin | | $ | 37,165 | | | 6.4 | % | | $ | 83,104 | | | 13.1 | % | | $ | 180,453 | | | 7.8 | % | | $ | 303,902 | | | 12.5 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

Non-GAAP Adjusted Operating Expenses and Non-GAAP Adjusted Operating Ratio (1) | | $ | | % of Op. Rev. | | $ | | % of Op. Rev. | | $ | | % of Op. Rev. | | $ | | % of Op. Rev. |

| Operating expenses and operating ratio – (GAAP) | | $ | 545,754 | | | 94.1 | % | | $ | 554,446 | | | 87.3 | % | | $ | 2,141,480 | | | 92.7 | % | | $ | 2,134,131 | | | 87.9 | % |

| Non-GAAP adjustments: | | | | | | | | | | | | | | | | |

Insurance and claims (2) | | (1,457) | | | (0.3) | % | | (1,387) | | | (0.2) | % | | (5,664) | | | (0.3) | % | | (5,394) | | | (0.2) | % |

Amortization of intangible assets (3) | | (1,369) | | | (0.2) | % | | (1,376) | | | (0.2) | % | | (5,459) | | | (0.2) | % | | (3,953) | | | (0.2) | % |

| | | | | | | | | | | | | | | | |

| Non-GAAP adjusted operating expenses and non-GAAP adjusted operating ratio | | $ | 542,928 | | | 93.6 | % | | $ | 551,683 | | | 86.9 | % | | $ | 2,130,357 | | | 92.2 | % | | $ | 2,124,784 | | | 87.5 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | Year Ended

December 31, |

Non-GAAP Adjusted Operating Expenses, Net of Fuel Surcharge; Non-GAAP Adjusted Operating Margin, Net of Fuel Surcharge; and Non-GAAP Adjusted Operating Ratio, Net of Fuel Surcharge (1) | | 2023 | | 2022 | | 2023 | | 2022 |

| $ | | $ | | $ | | $ |

| Operating revenues – (GAAP) | | $ | 580,093 | | | $ | 634,787 | | | $ | 2,310,810 | | | $ | 2,428,686 | |

Less: Trucking fuel surcharge (9) | | (84,675) | | | (109,611) | | | (332,388) | | | (419,240) | |

| Operating revenues, net of fuel surcharge – (Non-GAAP) | | 495,418 | | | 525,176 | | | 1,978,422 | | | 2,009,446 | |

| Operating expenses – (GAAP) | | 545,754 | | | 554,446 | | | 2,141,480 | | | 2,134,131 | |

| Non-GAAP adjustments: | | | | | | | | |

Trucking fuel surcharge (9) | | (84,675) | | | (109,611) | | | (332,388) | | | (419,240) | |

Insurance and claims (2) | | (1,457) | | | (1,387) | | | (5,664) | | | (5,394) | |

Amortization of intangible assets (3) | | (1,369) | | | (1,376) | | | (5,459) | | | (3,953) | |

| | | | | | | | |

| Non-GAAP adjusted operating expenses, net of fuel surcharge | | 458,253 | | | 442,072 | | | 1,797,969 | | | 1,705,544 | |

| Non-GAAP adjusted operating income | | $ | 37,165 | | | $ | 83,104 | | | $ | 180,453 | | | $ | 303,902 | |

| Non-GAAP adjusted operating margin, net of fuel surcharge | | 7.5 | % | | 15.8 | % | | 9.1 | % | | 15.1 | % |

| Non-GAAP adjusted operating ratio, net of fuel surcharge | | 92.5 | % | | 84.2 | % | | 90.9 | % | | 84.9 | % |

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES – WERNER LOGISTICS SEGMENT

(unaudited)

(In thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

Non-GAAP Adjusted Operating Income and Non-GAAP Adjusted Operating Margin (1) | | $ | | % of Op. Rev. | | $ | | % of Op. Rev. | | $ | | % of Op. Rev. | | $ | | % of Op. Rev. |

| Operating income and operating margin – (GAAP) | | $ | 4,575 | | | 2.0 | % | | $ | 9,868 | | | 4.6 | % | | $ | 15,879 | | | 1.7 | % | | $ | 36,184 | | | 4.6 | % |

| Non-GAAP adjustments: | | | | | | | | | | | | | | | | |

Amortization of intangible assets (3) | | 1,148 | | | 0.5 | % | | 660 | | | 0.3 | % | | 4,866 | | | 0.6 | % | | 2,160 | | | 0.2 | % |

Contingent consideration adjustment (5) | | (2,700) | | | (1.2) | % | | (2,500) | | | (1.1) | % | | (2,700) | | | (0.3) | % | | (2,500) | | | (0.3) | % |

| Non-GAAP adjusted operating income and non-GAAP adjusted operating margin | | $ | 3,023 | | | 1.3 | % | | $ | 8,028 | | | 3.8 | % | | $ | 18,045 | | | 2.0 | % | | $ | 35,844 | | | 4.5 | % |

Werner Enterprises, Inc. - Release of February 6, 2024

Page 13

(1) Non-GAAP adjusted operating income; non-GAAP adjusted operating margin; non-GAAP adjusted operating margin, net of fuel surcharge; non-GAAP adjusted net income attributable to Werner; non-GAAP adjusted diluted earnings per share; non-GAAP adjusted operating revenues, net of fuel surcharge; non-GAAP adjusted operating expenses; non-GAAP adjusted operating expenses, net of fuel surcharge; non-GAAP adjusted operating ratio; and non-GAAP adjusted operating ratio, net of fuel surcharge should be considered in addition to, rather than as substitutes for, GAAP operating income; GAAP operating margin; GAAP net income attributable to Werner; GAAP diluted earnings per share; GAAP operating revenues; GAAP operating expenses; and GAAP operating ratio, which are their most directly comparable GAAP financial measures.

(2) We accrued pre-tax insurance and claims expense for interest related to a previously disclosed excess adverse jury verdict rendered on May 17, 2018 in a lawsuit arising from a December 2014 accident. The Company is appealing this verdict. Additional information about the accident was included in our Current Report on Form 8-K dated May 17, 2018. Under our insurance policies in effect on the date of this accident, our maximum liability for this accident is $10.0 million (plus pre-judgment and post-judgment interest) with premium-based insurance coverage that exceeds the jury verdict amount. We continue to accrue pre-tax insurance and claims expense for interest at $0.5 million per month until such time as the outcome of our appeal is finalized. Management believes excluding the effect of this item provides a more useful comparison of our performance from period to period. This item is included in our Truckload Transportation Services segment in our Segment Information table.

(3) Amortization expense related to intangible assets acquired in our business acquisitions is excluded because management does not believe it is indicative of our core operating performance. This item is included in our Truckload Transportation Services and Werner Logistics segments.

(4) We incurred business acquisition-related expenses including legal and professional fees. Acquisition-related expenses are excluded as management believes these costs are not representative of the costs of managing our on-going business. The expenses are included within other operating expenses in our Income Statement and in Corporate operating income in our Segment Information table.

(5) Contingent consideration, also referred to as earnout, adjustments related to our business acquisitions are excluded because management does not believe these adjustments are indicative of our core operating performance. These adjustments are recorded in other operating expenses in our Income Statement and are included in our Werner Logistics segment.

(6) Represents non-operating mark-to-market adjustments for gains/losses on our minority equity investments, which we account for under Accounting Standards Codification (“ASC”) 321, Investments – Equity Securities. Management believes excluding the effect of gains/losses on our investments in equity securities provides a more useful comparison of our performance from period to period. We record changes in the value of our investments in equity securities in other expense (income) in our Income Statement.

(7) Represents earnings/losses from our equity method investment, which we account for under ASC 323, Investments - Equity Method and Joint Ventures. Management believes excluding the effect of earnings/losses from our equity method investment provides a more useful comparison of our performance from period to period. We record earnings/losses from our equity method investment in other expense (income) in our Income Statement.

(8) The income tax effect of the non-GAAP adjustments is calculated using the incremental income tax rate excluding discrete items, and the income tax effect for 2023 has been updated to reflect the annual incremental income tax rate.

(9) Fluctuating fuel prices and fuel surcharge revenues impact the total company operating ratio and the TTS segment operating ratio when fuel surcharges are reported on a gross basis as revenues versus netting the fuel surcharges against fuel expenses. Management believes netting fuel surcharge revenues, which are generally a more volatile source of revenue, against fuel expenses provides a more consistent basis for comparing the results of operations from period to period.

v3.24.0.1

Document and Entity Information Document

|

Feb. 06, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 06, 2024

|

| Entity File Number |

0-14690

|

| Entity Registrant Name |

WERNER ENTERPRISES, INC.

|

| Entity Central Index Key |

0000793074

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

NE

|

| Entity Tax Identification Number |

47-0648386

|

| Entity Address, Address Line One |

14507 Frontier Road

|

| Entity Address, Address Line Two |

Post Office Box 45308

|

| Entity Address, City or Town |

Omaha

|

| Entity Address, State or Province |

NE

|

| Entity Address, Postal Zip Code |

68145-0308

|

| City Area Code |

402

|

| Local Phone Number |

895-6640

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 Par Value

|

| Trading Symbol |

WERN

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

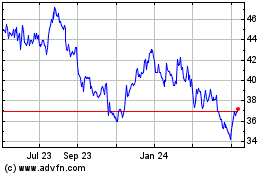

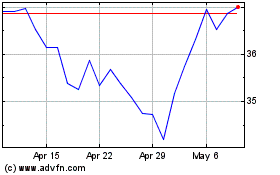

Werner Enterprises (NASDAQ:WERN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Werner Enterprises (NASDAQ:WERN)

Historical Stock Chart

From Apr 2023 to Apr 2024