Current Report Filing (8-k)

February 12 2021 - 5:40PM

Edgar (US Regulatory)

0001566044

false

--12-31

0001566044

2021-02-12

2021-02-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 12, 2021

VYNE Therapeutics Inc.

(Exact name of registrant as specified

in its charter)

|

Delaware

|

|

001-38356

|

|

45-3757789

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification Number)

|

520 U.S. Highway 22, Suite 204

Bridgewater, New Jersey 08807

(Address of principal executive offices,

including Zip Code)

(800) 775-7936

(Registrant’s telephone number,

including area code)

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b)

of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, $0.0001 par value

|

|

VYNE

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company x

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act.

Item 3.03. Material Modification to

Rights of Security Holders.

To the extent

required by Item 3.03 of Form 8-K, the information contained in Item 5.03 of this Current Report on Form 8-K is incorporated herein

by reference.

Item 5.03. Amendments to Articles

of Incorporation or Bylaws; Change in Fiscal Year.

On February

12, 2021, VYNE Therapeutics Inc. (the “Company”) filed a Certificate of Amendment (the “Certificate of Amendment”)

to the Company’s Amended and Restated Certificate of Incorporation (the “Certificate of Incorporation”) with

the Secretary of State of the State of Delaware to effect a 1-for-4 reverse stock split of the outstanding shares of the Company’s

common stock, par value $0.0001 per share (the “Common Stock”), and a reduction in the number of authorized shares

of the Common Stock by a corresponding ratio (the “Reverse Stock Split”). The Reverse Stock Split became effective

as of 5:00 p.m. (Eastern time) on February 12, 2021.

As

previously reported, on August 3, 2020, the Company held its annual meeting of stockholders (the “Annual

Meeting”), at which the Company’s stockholders approved an amendment to the Certificate of Incorporation to

effect a reverse stock split of the Common Stock at a reverse stock split ratio ranging from 1-for-2 to 1-for-7, to be

determined by the Board of Directors (the “Board”) at a later date, and a reduction in the number of authorized

shares of the Common Stock by a corresponding ratio. On February 10, 2021, the Board approved the implementation of the

Reverse Stock Split at a ratio of 1-for-4. The primary objective of the Reverse Stock Split is to reduce the number of shares

outstanding to a number more consistent with other companies with similar market capitalizations as the Company, as discussed

in the Company’s last proxy statement.

As a result

of the Reverse Stock Split, every four shares of issued and outstanding Common Stock will be automatically combined into one issued

and outstanding share of Common Stock, without any change in the par value per share. No fractional shares will be issued as a

result of the Reverse Stock Split. In lieu thereof, the Company’s transfer agent will aggregate all fractional shares and

sell them as soon as practicable after the effective time at the then-prevailing prices on the open market. After the transfer

agent’s completion of such sale, stockholders who would have been entitled to a fractional share as a result of the Reverse

Stock Split will instead receive a cash payment from the transfer agent in an amount equal to their respective pro rata share of

the total proceeds of that sale.

Following the Reverse Stock Split, there will be 51.3

million shares of Common Stock issued and outstanding, subject to adjustment for the treatment of fractional shares. The

number of authorized shares of Common Stock under the Certificate of Incorporation will be reduced from 300 million shares to

75 million shares. A proportionate adjustment was also made to the maximum number of shares issuable under the

Company’s 2018 Omnibus Incentive Plan, 2019 Equity Incentive Plan, and the equity awards outstanding thereunder, as

well as the Company’s Employee Share Purchase Plan.

Stockholders

who hold their shares in book-entry form or in “street name” (through a broker, bank or other holder of record) will

not be required to take any action.

The Common

Stock will begin trading on a split-adjusted basis on the Nasdaq Global Select Market at the market open on February 16, 2021.

The trading symbol for the Common Stock will remain “VYNE.” The new CUSIP number for the Common Stock following the

Reverse Stock Split is 92941V 209.

The foregoing

description of the Reverse Stock Split does not purport to be complete and is qualified in its entirety by reference to the complete

text of the Certificate of Amendment, a copy of which is filed with this report as Exhibit 3.1 and is incorporated into this report

by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

The

following exhibit is filed herewith:

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

VYNE

Therapeutics Inc.

|

|

|

|

|

|

/s/

Mutya Harsch

|

|

|

By:

Mutya Harsch

|

|

|

Chief

Legal Officer and General Counsel

|

Date: February 12, 2021

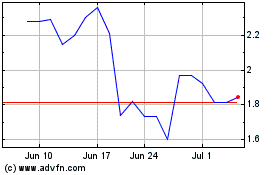

VYNE Therapeutics (NASDAQ:VYNE)

Historical Stock Chart

From Mar 2024 to Apr 2024

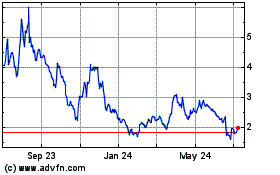

VYNE Therapeutics (NASDAQ:VYNE)

Historical Stock Chart

From Apr 2023 to Apr 2024