As

filed with the Securities and Exchange Commission on March

31, 2020

Registration

No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

VISTAGEN THERAPEUTICS, INC.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

2834

|

20-5093315

|

|

(State

or Other Jurisdiction of

Incorporation

or Organization)

|

(Primary

Standard Industrial

Classification

Code Number)

|

(I.R.S.

Employer

Identification

Number)

|

343 Allerton Ave.

South San Francisco, California 94090

(650) 577-3600

(Address,

including zip code, and telephone number,

including

area code, of registrant’s principal executive

offices)

Shawn K. Singh

Chief Executive Officer

VistaGen Therapeutics, Inc.

343 Allerton Avenue

South San Francisco, California 94080

(650) 577-3600

(Name,

address, including zip code, and telephone number,

including

area code, of agent for service)

Copies to

Daniel W. Rumsey, Esq.

Jessica R. Sudweeks, Esq.

Disclosure Law Group, a Professional Corporation

655 West Broadway, Suite 870

San Diego, CA 92101

Telephone: (619) 272-7050

Facsimile: (619) 330-2101

Approximate date of commencement of proposed sale to the

public: As soon as practicable after this registration

statement becomes effective.

If any

of the securities being registered on this Form are to be offered

on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, check the following

box. [X]

If this

Form is filed to register additional securities for an offering

pursuant to Rule 462(b) under the Securities Act, check the

following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same

offering. ☐

If this

Form is a post-effective amendment filed pursuant to Rule 462(c)

under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier

effective registration statement for the same

offering. ☐

If this

Form is a post-effective amendment filed pursuant to Rule 462(d)

under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier

effective registration statement for the same

offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer,

an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of

“large accelerated filer,” “accelerated

filer,” “smaller reporting company” and

“emerging growth company” in Rule 12b-2 of the Exchange

Act:

|

Large accelerated filer

|

[

]

|

Accelerated filer

|

[

]

|

|

Non-accelerated

filer

|

[

]

|

Smaller reporting company

|

[X]

|

|

|

Emerging

growth company

|

[

]

|

If an

emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange Act. ☐

CALCULATION OF REGISTRATION FEE

Title

of each class of

securities

to be registered

|

Amount

to

be

registered

(1)

|

Proposed

maximum

offering

price per

share

(2)

|

Proposed

maximum

aggregate

offering

price

|

Amount

of

registration

fee

|

|

Common stock, par

value $0.001 per share

|

9,592,607

|

$0.46

|

$4,412,599.22

|

$572.76

|

(1)

Pursuant

to Rule 416 under the Securities Act of 1933, as amended, this

registration statement shall be deemed to cover the additional

securities of the same class as the securities covered by this

registration statement issued or issuable prior to completion of

the distribution of the securities covered by this registration

statement as a result of a split of, or a stock dividend on, the

registered securities.

(2)

Pursuant

to Rule 457(c) of the Securities Act of 1933, as amended,

calculated on the basis of the average of the high and low prices

per share of the registrant’s common stock as reported by The

Nasdaq Capital Market on March 25, 2020.

The

Registrant hereby amends this Registration Statement on such date

or dates as may be necessary to delay its effective date until the

Registrant shall file a further amendment which specifically states

that this Registration Statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933

or until the Registration Statement shall become effective on such

date as the Commission, acting pursuant to said Section 8(a),

may determine.

The information in this preliminary prospectus is not complete and

may be changed. These securities may not be sold until the

registration statement filed with the Securities and Exchange

Commission is effective. This preliminary prospectus is not an

offer to sell these securities nor does it seek an offer to buy

these securities in any jurisdiction where the offer or sale is not

permitted.

|

PRELIMINARY PROSPECTUS

|

SUBJECT TO COMPLETION

|

DATED MARCH 31, 2020

|

9,592,607 Shares of Common

Stock

This

prospectus relates to the offer and sale of up to 9,592,607 shares

of common stock, par value $0.001, of VistaGen Therapeutics, Inc.,

a Nevada corporation, by Lincoln Park Capital Fund, LLC

(Lincoln Park) or the selling

stockholder.

The

shares of common stock being offered by the selling stockholder

have been or may be issued pursuant to a purchase agreement that we

entered into with Lincoln Park on March 24, 2020. See The Lincoln Park Transaction for a

description of that agreement and Selling Stockholder for additional

information regarding Lincoln Park. The prices at which Lincoln

Park may sell the shares will be determined by the prevailing

market price for the shares or in negotiated

transactions.

We are

not selling any securities under this prospectus and will not

receive any of the proceeds from the sale of shares by the selling

stockholder.

The

selling stockholder may sell the shares of common stock described

in this prospectus in a number of different ways and at varying

prices. See Plan of

Distribution for more information about how the selling

stockholder may sell the shares of common stock being registered

pursuant to this prospectus. The selling stockholder is an

“underwriter” within the meaning of Section 2(a)(11) of

the Securities Act of 1933, as amended (the

Securities Act)

.

The

selling stockholder will pay all brokerage fees and commissions and

similar expenses. We will pay the expenses (except brokerage fees

and commissions and similar expenses) incurred in registering the

shares, including legal and accounting fees. See Plan of Distribution.

Our

common stock is currently listed on The Nasdaq Capital Market under

the symbol “VTGN”. On March 31, 2020, the last reported

sale price of our common stock on The Nasdaq Capital Market was

$0.44 per share.

Investing in our common stock involves a high degree of risk. You

should review carefully the risks and uncertainties described under

“Risk Factors” beginning on page 6 of this prospectus,

and under similar headings in any amendments or supplements to this

prospectus.

Neither

the Securities and Exchange Commission nor any state securities

commission has approved or disapproved of these securities or

passed upon the adequacy or accuracy of this prospectus. Any

representation to the contrary is a criminal offense.

The

date of this prospectus is

,

2020.

|

|

1

|

|

|

6

|

|

|

9

|

|

|

10

|

|

|

11

|

|

|

12

|

|

|

13

|

|

|

14

|

|

|

18

|

|

|

19

|

|

|

21

|

|

|

21

|

|

|

21

|

|

|

II-2

|

|

|

|

|

|

|

This summary highlights information contained elsewhere in this

prospectus and does not contain all of the information you should

consider in making your investment decision. Before deciding to

invest in our common stock, you should read this entire prospectus

carefully, including the sections of this prospectus entitled

“Risk Factors” and “Management’s Discussion

and Analysis of Financial Condition and Results of

Operations” and our consolidated financial statements and

related notes contained elsewhere in this prospectus. Unless the

context otherwise requires, the words “VistaGen Therapeutics,

Inc.” “VistaGen,” “we,” “the

Company,” “us” and “our” refer to

VistaGen Therapeutics, Inc., a Nevada corporation. “VistaStem

Therapeutics, Inc.” and “VistaGen California”

refer to our wholly owned subsidiary, VistaGen Therapeutics, Inc.,

a California corporation doing business as VistaStem Therapeutics,

Inc.

Business Overview

We are a multi-asset, clinical-stage

biopharmaceutical company committed to developing differentiated

new generation medications for anxiety, depression and other

central nervous system (CNS) diseases and disorders with high unmet need. Our

pipeline includes three clinical-stage CNS drug candidates, each

with a differentiated mechanism of action, an exceptional safety

profile in all clinical studies to date, and therapeutic potential

in multiple CNS markets. We aim to become a fully-integrated

biopharmaceutical company that develops and commercializes

innovative CNS therapies for large and growing mental health and

neurology markets where current treatments are inadequate to meet

the needs of millions of patients and caregivers

worldwide.

PH94B Neuroactive Nasal Spray for Anxiety-related

Disorders

PH94B neuroactive nasal spray is an odorless,

first-in-class, fast-acting synthetic neurosteroid with therapeutic

potential in a wide range of neuropsychiatric indications involving

anxiety or phobia. Conveniently self-administered in microgram

doses without systemic exposure, we are initially developing PH94B

as a potential fast-acting, non-sedating, non-addictive new

generation treatment of social anxiety disorder

(SAD).

SAD affects over 20 million Americans and, according to the

National Institutes of Health (NIH), is the third most common psychiatric condition

after depression and substance abuse. A person with SAD feels

symptoms of anxiety or fear in certain social situations, such as

meeting new people, dating, being on a job interview, answering a

question in class, or having to talk to a cashier in a store. Doing

everyday things in front of people - such as eating or drinking in

front of others or using a public restroom - also causes anxiety or

fear. A person with SAD is afraid that he or she will be

humiliated, judged, and rejected. The fear that people with

SAD have in social situations is so strong that they feel it is

beyond their ability to control. As a result, SAD gets in the way

of going to work, attending school, or doing everyday things in

situations with potential for interpersonal interaction. People

with SAD may worry about these and other things for weeks before

they happen. Sometimes, they end up staying away from places or

events where they think they might have to do something that will

embarrass or humiliate them. Some people with SAD have

performance anxiety. They feel physical symptoms of fear and

anxiety in performance situations, such as giving a lecture, a

speech or a presentation at school or work, as well as playing a

sports game, or dancing or playing a musical instrument on

stage. Without treatment, SAD can last for many years or a

lifetime and prevent a person from reaching his or her full

potential.

Only three drugs, all oral antidepressants

(ADs), are approved by the U.S Food and Drug

Administration (FDA) specifically for treatment of SAD. These

FDA-approved chronic ADs have slow onset of therapeutic effect

(often taking many weeks to months) and significant side effects

(often beginning soon after administration). Slow onset of effect,

chronic administration and significant side effects may make the

FDA-approved ADs inadequate or inappropriate treatment alternatives

for many individuals affected by SAD episodically. VistaGen’s

PH94B is fundamentally differentiated from all current anxiolytics,

including all ADs approved by the FDA for treatment of SAD.

Intranasal self-administration of only approximately 3.2 micrograms

of PH94B binds to nasal chemosensory receptors that, in turn,

activate key neural circuits in the brain that lead to rapid

suppression of fear and anxiety. In Phase 2 and pilot Phase 3

clinical studies to date, PH94B has not shown psychological side

effects (such as dissociation or hallucinations), systemic

exposure, sedation or other side effects and safety concerns that

may be caused by the current ADs approved by the FDA for treatment

of SAD, as well as by benzodiazepines and beta blockers, which are

not approved by the FDA to treat SAD but which may be prescribed by

psychiatrists and physicians for treatment of SAD on an off-label

basis.

In a peer-reviewed, published double-blind,

placebo-controlled Phase 2 clinical trial, PH94B neuroactive nasal

spray was significantly more effective than placebo in reducing

both public-speaking (performance) anxiety (p=0.002) and social

interaction anxiety (p=0.009) in laboratory challenges of

individuals with SAD within 15 minutes of self-administration of a

non-systemic 1.6 microgram dose of PH94B. Based on its novel

mechanism of pharmacological action, rapid-onset of therapeutic

effects and exceptional safety and tolerability profile in Phase 2

and pilot Phase 3 clinical trials to date, we are preparing for

Phase 3 clinical development of PH94B for treatment of SAD in

adults. Our goal is to develop and commercialize PH94B as the first

FDA-approved, fast-acting, on-demand, at-home treatment for SAD.

Additional potential anxiety-related neuropsychiatric indications

for PH94B include general anxiety disorder, peripartum anxiety

(pre- and post-partum anxiety), preoperative or pre-testing (e.g.,

pre-MRI) anxiety, panic disorder, post-traumatic stress disorder

and specific social phobias. The FDA has granted

Fast Track designation for development of our PH94B neuroactive

nasal spray for on-demand treatment of SAD, the FDA’s first

such designation for a drug candidate for SAD.

|

|

|

|

|

|

|

|

|

|

|

|

PH10 Neuroactive Nasal Spray for Depression and Suicidal

Ideation

PH10 neuroactive nasal spray is an odorless,

first-in-class, fast-acting synthetic neurosteroid with therapeutic

potential in a wide range of neuropsychiatric indications involving

depression and suicidal ideation. Conveniently self-administered in

microgram doses without systemic exposure, we are initially

developing PH94B as a potential fast-acting, non-sedating,

non-addictive new generation treatment of major depressive disorder

(MDD).

Depression

is a serious medical illness and a global public health concern

that can occur at any time over a person's life. While most people

will experience depressed mood at some point during their lifetime,

MDD is different. MDD is the chronic, pervasive feeling of utter

unhappiness and suffering, which impairs daily functioning.

Symptoms of MDD include diminished pleasure or loss of interest in

activities, changes in appetite that result in weight changes,

insomnia or oversleeping, psychomotor agitation, loss of energy or

increased fatigue, feelings of worthlessness or inappropriate

guilt, difficulty thinking, concentrating or making decisions, and

thoughts of death or suicide and attempts at suicide. Current

FDA-approved medications available in the multi-billion-dollar

global AD market often fall far short of satisfying the unmet

medical needs of millions suffering from the debilitating effects

of depression.

While

current FDA-approved ADs are widely used, about two-thirds of

patients with MDD do not respond to their initial AD treatment.

Inadequate response to current ADs is among the key reasons MDD is

one of the leading public health concerns in the United States,

creating a significant unmet medical need for new agents with

fundamentally different mechanisms of action and side effect and

safety profiles.

PH10 is a new generation antidepressant with a

mechanism of action that is fundamentally different from all

current ADs. After self-administration, a non-systemic

microgram-level dose of PH10 binds to nasal chemosensory receptors

that, in turn, activate key neural circuits in the brain that can

lead to rapid-onset antidepressant effects, but without the

psychological side effects (such as dissociation and

hallucinations) or safety concerns that maybe be caused by

ketamine-based therapy (KBT), including intravenous ketamine or esketamine

nasal spray, or the significant side effects of current ADs. In an

exploratory 30-patient Phase 2a clinical trial, PH10,

self-administered at a dose of 6.4 micrograms, was well-tolerated

and demonstrated significant (p=0.022) rapid-onset antidepressant

effects, which were sustained over an 8-week period, as measured by

the Hamilton Depression Rating Scale (HAM-D), without side effects

or safety concerns that may be caused by KBT. Based on positive

results from this exploratory Phase 2a study, we are preparing for

Phase 2b clinical development of PH10 in MDD. With its exceptional

safety profile during clinical development to date, we believe

PH10, as a convenient at-home therapy, has potential for multiple

applications in global depression markets, including as a

stand-alone front-line therapy for MDD, as an add-on therapy to

augment current FDA-approved ADs for patients with MDD who have an

inadequate response to standard ADs, and to prevent relapse

following successful treatment with KBT.

AV-101, an Oral NMDA Receptor Antagonist

AV-101

(4-Cl-KYN) targets the NMDAR (N-methyl-D-aspartate receptor), an

ionotropic glutamate receptor in the brain. Abnormal NMDAR function

is associated with numerous CNS diseases and disorders. AV-101 is

an oral prodrug of 7-chloro-kynurenic acid (7-Cl-KYNA), which is a

potent and selective full antagonist of the glycine co-agonist site

of the NMDAR that inhibits the function of the NMDAR. Unlike

ketamine and many other NMDAR antagonists, 7-Cl-KYNA is not an ion

channel blocker. In all studies to date, AV-101 has exhibited no

dissociative or hallucinogenic psychological side effects or safety

concerns similar to those that may be caused by amantadine and KBT.

With its exceptionally few side effects and excellent safety

profile, AV-101 has potential to be a differentiated oral, new

generation treatment for multiple large-market CNS indications

where current treatments are inadequate to meet high unmet patient

needs. The FDA has granted Fast Track designation for development

of AV-101 as both a potential adjunctive treatment for MDD and as a

non-opioid treatment for neuropathic pain.

We recently completed a double-blind,

placebo-controlled, multi-center Phase 2 clinical trial of AV-101

as a potential adjunctive treatment, together with a standard

FDA-approved oral AD (either a selective serotonin reuptake

inhibitor (SSRI) or a

serotonin norepinephrine reuptake inhibitor (SNRI)), in

MDD patients who had an inadequate response to a stable dose

of a standard AD (the Elevate

Study). Topline results of the

Elevate Study (n=199) indicated that the AV-101 treatment arm (1440

mg) did not differentiate from placebo on the primary endpoint

(change in the Montgomery-Åsberg Depression Rating Scale

(MADRS-10) total score compared to baseline), potentially due to

sub-therapeutic levels of 7-Cl-KYNA in the brain. As in prior

clinical studies, AV-101 was well tolerated, with no

psychotomimetic side effects or drug-related serious adverse

events.

|

|

|

|

|

|

|

|

|

|

|

|

Recent discoveries from successful AV-101

preclinical studies suggest that there is a substantially increased

brain concentration of AV-101 and its active metabolite, 7-Cl-KYNA,

when AV-101 is given together with probenecid, a safe and

well-known oral anion transport inhibitor used to treat gout. These

surprising effects were first revealed in our recent preclinical

studies, although they are consistent with well-documented clinical

studies of probenecid increasing the therapeutic benefits of

several unrelated classes of approved drugs, including

certain antibacterial, anticancer and antiviral drugs. When probenecid was administered adjunctively

with AV-101 in an animal model, substantially increased brain

concentrations of both AV-101 (7-fold) and of 7-Cl-KYNA (35-fold)

were discovered. We

also recently identified that some of the same kidney transporters

that reduce drug concentrations in the blood, by excretion in the

urine, are also found in the blood brain barrier and function to

reduce 7-Cl-KYNA levels in the brain by pumping it out of the brain

and back into the blood. In the recent preclinical studies with

AV-101 and probenecid, we discovered that blocking those

transporters in the blood brain barrier with probenecid resulted,

as noted above, in a substantially increased brain concentration of

7-Cl-KYNA. This 7-Cl-KYNA efflux-blocking effect of probenecid,

with the resulting increased brain levels and duration of

7-Cl-KYNA, suggests the potential impact of AV-101 with probenecid

could result in far more profound therapeutic benefits for patients

with MDD and other NMDAR-focused CNS diseases and disorders than

demonstrated in the Elevate Study.

Some of the new discoveries from our

recent AV-101 preclinical studies with adjunctive probenecid were

presented by a collaborator of VistaGen at the British

Pharmacological Society’s Pharmacology 2019 annual conference

in Edinburgh, UK in December 2019.

In addition, a Phase 1b target engagement study

completed after the Elevate Study by the Baylor College of Medicine

(Baylor) with financial support from the U.S. Department

of Veterans Affairs (VA), involved 10 healthy volunteer U.S. military

Veterans who received single doses of AV-101 (720 mg or 1440 mg) or

placebo, in a double-blind, randomized, cross-over controlled

trial. The primary goal of the study was to identify and define a

dose-response relationship between AV-101 and multiple

electrophysiological (EEG) biomarkers related to NMDAR function, as well as

blood biomarkers associated with suicidality (the

Baylor

Study). The findings from the

Baylor Study suggest that, in healthy Veterans, the higher dose of

AV-101 (1440 mg) was associated with dose-related increase in the

40 Hz Auditory Steady State Response (ASSR), a robust measure of the integrity of inhibitory

interneuron synchronization that is associated with NMDAR

inhibition. Findings from the successful Baylor Study were

presented at the 58th Annual Meeting of the American College of

Neuropsychopharmacology (ACNP) in Orlando, Florida in December

2019.

The

successful Baylor Study and the recent discoveries in our

preclinical studies involving AV-101 and adjunctive probenecid

suggest that it may be possible to increase therapeutic

concentrations and duration of 7-Cl-KYNA in the brain, and thus

increase NMDAR antagonism in MDD patients with an inadequate

response to standard ADs when AV-101 and probenecid are combined.

During 2020, we plan to conduct additional AV-101 preclinical

studies with adjunctive probenecid to evaluate its potential

applicability to MDD, suicidal ideation and other NMDAR-focused CNS

indications for which we have existing preclinical data with AV-101

as a monotherapy, including epilepsy, levodopa-induced dyskinesia,

and neuropathic pain, to determine the most appropriate path

forward for potential future clinical development and

commercialization of AV-101.

VistaStem Therapeutics – Stem Cell Technology for Drug Rescue

and Regenerative Medicine

In addition to our current CNS drug candidates, we

have stem cell technology-based, pipeline-enabling programs through

our wholly-owned subsidiary, VistaStem Therapeutics

(VistaStem). VistaStem is focused on applying human

pluripotent stem cell (hPSC) technologies, including our customized cardiac

bioassay system, CardioSafe

3D, to discover and develop

small molecule New Chemical Entities (NCEs) for our CNS pipeline or out-licensing. In

addition, VistaStem’s stem cell technologies involving

hPSC-derived blood, cartilage, heart and liver cells have multiple

potential applications in the cell therapy (CT) and regenerative medicine (RM)

fields.

To advance potential CT and RM applications of

VistaStem’s hPSC technologies related to heart cells, we

licensed to BlueRock Therapeutics LP, a next generation CT/RM

company formed jointly by Bayer AG and Versant Ventures, rights to

develop and commercialize certain proprietary technologies relating

to the production of cardiac stem cells for the treatment of heart

disease. As a result of its acquisition of BlueRock Therapeutics in

2019, Bayer AG now holds rights to develop and commercialize

VistaStem’s hPSC technologies relating to the production of

heart cells for the treatment of heart disease

(the Bayer

Agreement). In a manner

similar to the Bayer Agreement, we may pursue additional

collaborations involving rights to develop and commercialize

VistaStem’s hPSC technologies for production of blood,

cartilage, and/or liver cells for CT and RM applications,

including, among other indications, treatment of arthritis, cancer

and liver disease.

|

|

|

|

|

|

|

|

|

|

|

|

Recent Developments

January 2020 Registered Direct Offering and Concurrent Offering of

Warrants

On January 24, 2020, we entered into a

securities purchase agreement with certain accredited investors

pursuant to which we received gross cash proceeds of $2.75 million

upon the sale of an aggregate of 3,870,077 shares of our common

stock at a purchase price of $0.71058 per share (the

January 2020

Offering). Concurrently with

the January 2020 Offering, we also commenced a private placement in

which we issued and sold warrants exercisable for an aggregate of

3,870,077 unregistered shares of our common stock (the

Warrant

Shares), having an exercise

price of $0.73 per Warrant Share.

Corporate Information

VistaGen Therapeutics, Inc., a Nevada

corporation, is the parent of VistaGen Therapeutics, Inc. (dba

VistaStem Therapeutics, Inc.), a wholly owned California

corporation founded in 1998. Our principal executive offices are

located at 343 Allerton Avenue, South San Francisco, California

94080, and our telephone number is (650) 577-3600. Our website

address is www.vistagen.com.

The information contained on our website is not part of this

prospectus supplement or the accompanying prospectus. We have

included our website address as a factual reference and do not

intend it to be an active link to our website.

Lincoln Park Purchase Agreement

On March 24, 2020, we entered into a purchase

agreement (the Purchase

Agreement) and a registration

rights agreement (the Registration Rights

Agreement) with Lincoln Park

pursuant to which Lincoln Park committed to purchase up to

$10,250,000 of our common stock.

Under the terms and subject to the conditions of

the Purchase Agreement, we have the right, but not the obligation,

to sell to Lincoln Park, and Lincoln Park is obligated to purchase

up to $10,250,000 of shares of our common stock. On March 24, 2020,

we sold 500,000 shares of common stock to Lincoln Park under the

Purchase Agreement at a price of $0.50 per share for proceeds of

$250,000. Future sales of common stock under the Purchase

Agreement, if any, will be subject to certain limitations, and may

occur from time to time, at our sole discretion, over the 24-month

period commencing on the date that a registration statement of

which this prospectus forms a part, which we agreed to file with

the Securities and Exchange Commission (the SEC) pursuant to the Registration Rights Agreement,

is declared effective by the SEC and a final prospectus in

connection therewith is filed and the other conditions set forth in

the Purchase Agreement are satisfied (such date on which all of

such conditions are satisfied, the Commencement

Date).

After the Commencement Date, on any business day

over the term of the Purchase Agreement, we have the right, in our

sole discretion, to direct Lincoln Park to purchase up to 100,000

shares on such business day (the Regular

Purchase), subject to increases

under certain circumstances as provided in the Purchase Agreement.

The purchase price per share for each such Regular Purchase will be

based on prevailing market prices of the Company’s common

stock immediately preceding the time of sale as computed under the

Purchase Agreement. In each case, Lincoln Park’s maximum

commitment in any single Regular Purchase may not exceed

$1,000,000. In addition to Regular Purchases, provided that we

present Lincoln Park with a purchase notice for the full amount

allowed for a Regular Purchase, we may also direct Lincoln Park to

make accelerated purchases

and additional accelerated purchases as described in the Purchase

Agreement.

Under applicable rules of the Nasdaq Capital

Market, the aggregate number of shares that we can sell to Lincoln

Park under the Purchase Agreement may in no case exceed 19.99%

of our common stock outstanding immediately prior to the execution

of the Purchase Agreement (which is 9,592,607 shares of common

stock) (the Exchange

Cap), unless (i) stockholder

approval is obtained to issue more, in which case the Exchange Cap

will not apply, or (ii) the average price of all applicable sales

of our common stock to Lincoln Park under the Purchase Agreement

equals or exceeds the closing price of our common stock on the

Nasdaq Capital Market immediately preceding the signing of the

Purchase Agreement, plus an incremental amount such that

issuances and sales of our common stock to Lincoln Park under the

Purchase Agreement would be exempt from the Exchange Cap limitation

under applicable rules of the Nasdaq Capital

Market.

Lincoln

Park has no right to require us to sell any shares of common stock

to Lincoln Park, but Lincoln Park is obligated to make purchases as

we direct, subject to certain conditions. In all instances, we may

not sell shares of our common stock to Lincoln Park under the

Purchase Agreement if it would result in Lincoln Park beneficially

owning more than 9.99% of our common stock. There are no upper

limits on the price per share that Lincoln Park must pay for shares

of our common stock pursuant to the Purchase

Agreement.

The

Purchase Agreement and the Registration Rights Agreement contain

customary representations, warranties, agreements and conditions

and indemnification obligations of the parties. We have the right

to terminate the Purchase Agreement at any time, at no cost or

penalty. We issued to Lincoln Park 750,000 shares of common

stock, or approximately 2.7% of the value of the shares of common

stock issuable under the Purchase Agreement, in consideration for

entering into the Purchase Agreement.

Issuances of our

common stock in this offering will not affect the rights or

privileges of our existing stockholders, except that the economic

and voting interests of each of our existing stockholders will be

diluted as a result of any such issuance. Although the number of

shares of common stock that our existing stockholders own will not

decrease, the shares owned by our existing stockholders will

represent a smaller percentage of our total outstanding shares

after any such issuance to Lincoln Park.

|

|

|

|

|

|

|

|

|

|

|

|

The Offering

|

|

|

|

|

|

|

|

|

|

Shares of common stock offered by the selling

stockholders

|

|

9,592,607 shares consisting

of:

●

500,000 shares sold to Lincoln Park at $0.50

per share on the Execution Date (the Initial Purchase Shares);

●

8,342,607

shares we may sell to Lincoln Park under the Purchase Agreement

from time to time after the date of this prospectus;

and

●

750,000 commitment shares issued to Lincoln

Park on the Execution Date (the Commitment Shares).

|

|

|

|

|

|

|

|

|

|

Shares of common stock outstanding before this

offering

|

|

47,963,042 shares of common stock.

|

|

|

|

|

|

|

|

|

|

Shares of common stock to be outstanding after giving effect to the

issuance of 9,592,607 shares under the Purchase Agreement

registered hereunder

|

|

57,555,649 shares of common stock.

|

|

|

|

|

|

|

|

|

|

Use of proceeds

|

|

We will

receive no proceeds from the sale of shares of common stock by

Lincoln Park in this offering. We may receive up to $10,000,000

aggregate gross proceeds under the Purchase Agreement from any

sales we make to Lincoln Park pursuant to the Purchase Agreement

after the date of this prospectus.

Any

proceeds that we receive from sales to Lincoln Park under the

Purchase Agreement will be used for working capital and general

corporate purposes. See Use of

Proceeds.

|

|

|

|

|

|

|

|

|

|

Terms of this offering

|

|

The

selling stockholder, including its transferees, donees, pledgees,

assignees and successors-in-interest, may sell, transfer or

otherwise dispose of any or all of the shares of common stock

offered by this prospectus from time to time on The Nasdaq Capital

Market or any other stock exchange, market or trading facility on

which the shares are traded or in private transactions. The shares

of common stock may be sold at fixed prices, at market prices

prevailing at the time of sale, at prices related to prevailing

market price or at negotiated prices.

|

|

|

|

|

|

|

|

|

|

Nasdaq symbol

|

|

Our

common stock is listed on The Nasdaq Capital Market under the

symbol “VTGN”.

|

|

|

|

|

|

|

|

|

|

Risk Factors

|

|

Investing

in our common stock involves a high degree of risk. You should

review carefully the risks and uncertainties described in or

incorporated by reference under the heading “Risk Factors” in this prospectus,

the documents we have incorporated by reference herein, and under

similar headings in other documents filed after the date hereof and

incorporated by reference into this prospectus. See

“Incorporation of Certain

Information by Reference” and “Where You Can Find More

Information”.

|

|

|

|

Unless

otherwise noted, the number of shares of our common stock prior to

and after this offering is based on 49,213,042 shares outstanding as of

March 30, 2020 and excludes:

●

750,000 shares

of common stock reserved for

issuance upon conversion of 500,000 shares our Series A

Preferred Stock held by one institutional investor and one

accredited individual investor ;

●

1,160,240 shares

of common stock reserved for issuance upon conversion

of 1,160,240 shares of our Series B 10% Convertible

Preferred Stock held by two institutional investors;

●

2,318,012 shares

of common stock reserved for issuance upon conversion

of 2,318,012 shares of our Series C Convertible Preferred

Stock held by one institutional investor;

●

22,555,281 shares

of common stock that have been reserved for issuance upon exercise

of outstanding warrants, with a weighted average exercise price of

$1.64 per share;

●

7,768,088 shares

of common stock reserved for issuance upon exercise of outstanding

stock options under our 2019 Omnibus Equity Incentive Plan, with a

weighted average exercise price of $1.41 per share;

and

●

6,730,162 shares

of common stock reserved for future issuance in connection with

future grants under our 2019 Omnibus Equity Incentive

Plan.

●

1,000,000 shares of

common stock reserved for future issuance in connection with future

sales under our 2019 Employee Stock Purchase Plan.

|

|

Our Annual Report on Form 10-K for the fiscal year ended March 31,

2019 and our Quarterly Report on Form 10-Q for the quarters ended

June 30, 2019, September 30, 2019 and December 31, 2019, which are

incorporated by reference into this prospectus, as well as our

other filings with the SEC, include material risk factors relating

to our business. Those risks and uncertainties and the risks and

uncertainties described below are not the only risks and

uncertainties that we face. Additional risks and uncertainties that

are not presently known to us or that we currently deem immaterial

or that are not specific to us, such as general economic

conditions, may also materially and adversely affect our business

and operations. If any of those risks and uncertainties or the

risks and uncertainties described below actually occurs, our

business, financial condition or results of operations could be

harmed substantially. In such a case, you may lose all or part of

your investment. You should carefully consider the risks and

uncertainties described below and those risks and uncertainties

incorporated by reference into this prospectus supplement, as well

as the other information included in this prospectus supplement,

before making an investment decision with respect to our common

stock.

Risks Related to this Offering

The sale or issuance of our common stock to Lincoln Park may cause

dilution and the sale of the shares of common stock acquired by

Lincoln Park, or the perception that such sales may occur, could

cause the price of our common stock to fall.

On

March 24, 2020, we entered into the Purchase Agreement with Lincoln

Park, pursuant to which Lincoln Park has committed to purchase up

to $10,250,000 of our common stock, including the Initial Purchase

Shares. Upon the execution of the Purchase Agreement, we issued

750,000 Commitment Shares to Lincoln Park as a fee for its

commitment to enter into the Purchase Agreement and purchase shares

of our common stock thereunder. The remaining shares of our common

stock that may be issued under the Purchase Agreement may be sold

by us to Lincoln Park, at our sole discretion, from time to time

over a 24-month period commencing after the satisfaction of certain

conditions set forth in the Purchase Agreement, including that the

SEC has declared effective the registration statement that includes

this prospectus. The purchase price for the shares that we may sell

to Lincoln Park under the Purchase Agreement will fluctuate based

on the prevailing price of our common stock on the date(s) of

purchase. Depending on market liquidity at the time, sales of such

shares may cause the trading price of our common stock to

fall.

We

generally have the right to control the timing and amount of any

future sales of our shares to Lincoln Park. Additional sales of our

common stock, if any, to Lincoln Park will depend upon market

conditions and other factors to be determined solely by us. We may

ultimately decide to sell to Lincoln Park all, some or none of the

8,342,607 additional shares of

our common stock that may be available for us to sell pursuant to

the Purchase Agreement. If and when we do sell any additional

shares to Lincoln Park, after Lincoln Park has acquired the shares,

Lincoln Park may resell all, some or none of those shares at any

time or from time to time in its discretion. Therefore, sales to

Lincoln Park by us could result in substantial dilution to the

interests of other holders of our common stock. Additionally, the

sale of a substantial number of shares of our common stock to

Lincoln Park, or the anticipation of such sales, could make it more

difficult for us to sell equity or equity-related securities in the

future at a time and at a price that we might otherwise wish to

effect sales.

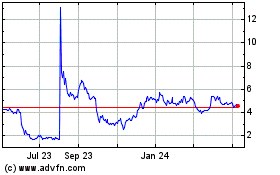

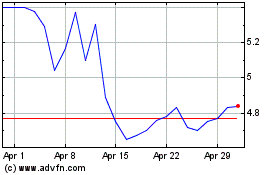

Our stock price may be volatile, and you may not be able to resell

shares of our common stock at or above the price you

paid.

The

public trading price for our common stock can be affected by a

number of factors, including:

●

plans

for, progress of or results from nonclinical and clinical

development activities related to our product

candidates;

●

the

failure of the FDA or other regulatory authority to approve our

product candidates;

●

announcements

of new products, technologies, commercial relationships,

acquisitions or other events by us or our competitors;

●

the

success or failure of other CNS therapies;

●

regulatory

or legal developments in the U.S. and other countries;

●

announcements

regarding our intellectual property portfolio;

●

failure

of our product candidates, if approved, to achieve commercial

success;

●

fluctuations

in stock market prices and trading volumes of similar

companies;

●

variations

in our quarterly operating results;

●

changes

in our financial guidance or securities analysts’ estimates

of our financial performance;

●

sales

or purchases of large blocks of our common stock, including sales

or purchases by our executive officers, directors and significant

stockholders;

●

establishment of

short positions by holders or non-holders of our

stock;

●

additions

or departures of key personnel;

●

discussion

of us or our stock price by the press and by online investor

communities; and

●

general market conditions and overall fluctuations

in U.S. equity markets, including fluctuations attributable to the

recent outbreak of the novel coronavirus (COVID-19);

●

conditions

that are outside of our control, such as the impact of health and

safety concerns from the current outbreak of COVID-19 or other

unforeseeable circumstances; and

●

other

risks and uncertainties described in these risk factors and the

risk factors incorporated into this prospectus by

reference.

In recent years, the stock markets generally and

the stock prices of many companies in the pharmaceutical industry

have experienced extreme price and volume fluctuations that have

often been unrelated or disproportionate to the operating

performance of those companies. Broad market and industry factors

may significantly affect the market price of our common stock,

regardless of our actual operating performance. These fluctuations

may be even more pronounced in the trading market for our common

stock shortly following this offering. If the market price of shares of our common stock

does not ever exceed the price at which shares are acquired under

the Purchase Agreement, you may not be able to resell shares of our

common stock at or above the price you paid.

We may require additional financing to sustain our operations and

without it we may not be able to continue operations.

We may

direct Lincoln Park to purchase up to $10,250,000 worth of shares

of our common stock under our agreement over a 24-month period

generally in amounts up to 100,000 shares of our common stock,

which share amount may be increased to include additional shares of

our common stock depending on the market price of our common stock

at the time of sale, and subject to a maximum limit of $1,000,000

per purchase, on any such business day. In addition to the 750,000

Commitment Shares and 500,000 Initial Purchase Shares, an

additional 8,342,607 shares of our common stock are being offered

under this prospectus that may be sold by us to Lincoln Park, at

our discretion, from time to time over a 24-month period commencing

after the date of the Commencement. Depending on the price per

share at which we sell our common stock to Lincoln Park pursuant to

the Purchase Agreement, we may need to sell to Lincoln Park more

shares of our common stock than are offered under this prospectus

in order to receive aggregate gross proceeds equal to $10,250,000.

The number of shares ultimately offered for resale by Lincoln Park

is dependent upon the number of shares we sell to Lincoln Park

under the Purchase Agreement.

The

extent we rely on Lincoln Park as a source of funding will depend

on a number of factors including the prevailing market price of our

common stock and the extent to which we are able to secure working

capital from other sources. If obtaining sufficient funding from

Lincoln Park were to prove unavailable or prohibitively dilutive,

we will need to secure another source of funding in order to

satisfy our working capital needs. Even if we sell all $10,250,000

under the Purchase Agreement to Lincoln Park, we may still need

additional capital to fully implement our business, operating and

development plans. Should the financing we require to sustain our

working capital needs be unavailable or prohibitively expensive

when we require it, the consequences could be a material adverse

effect on our business, operating results, financial condition and

prospects.

Future sales and issuances of our common stock or other securities

may result in significant dilution and could cause the price of our

common stock to decline.

To

raise capital, we may sell common stock, convertible securities or

other equity securities in one or more transactions at prices and

in a manner we determine from time to time, including pursuant to

the Purchase Agreement with Lincoln Park. These sales, or the

perception in the market that the holders of a large number of

shares intend to sell shares, could reduce the market price of our

common stock. These sales may also result in material dilution to

our existing stockholders, and new investors could gain rights

superior to our existing stockholders.

In

addition, sales of a substantial number of shares of our

outstanding common stock in the public market could occur at any

time. Certain of our stockholders, including Lincoln Park, hold a

substantial number of our common stock that many of them are now

able to sell in the public market. Sales of stock by these

stockholders could have a material adverse effect on the trading

price of our common stock.

We

cannot predict what effect, if any, sales of our shares in the

public market or the availability of shares for sale will have on

the market price of our common stock. However, future sales of

substantial amounts of our common stock in the public market,

including shares issued upon exercise of outstanding warrants or

options, or the perception that such sales may occur, could

adversely affect the market price of our common

stock.

Our management will have broad discretion over the use of the net

proceeds from our sale of shares of common stock to Lincoln Park,

you may not agree with how we use the proceeds and the proceeds may

not be invested successfully.

Our

management will have broad discretion as to the use of the net

proceeds from our sale of shares of common stock to Lincoln Park,

and we could use them for purposes other than those contemplated at

the time of commencement of this offering. Accordingly, you will be

relying on the judgment of our management with regard to the use of

those net proceeds, and you will not have the opportunity, as part

of your investment decision, to assess whether the proceeds are

being used appropriately. It is possible that, pending their use,

we may invest those net proceeds in a way that does not yield a

favorable, or any, return for us. The failure of our management to

use such funds effectively could have a material adverse effect on

our business, financial condition, operating results and cash

flows.

INCORPORATION BY

REFERENCE

The

following documents filed by us with the SEC are incorporated by

reference in this prospectus:

●

our

Annual Report on Form 10-K for the year ended March 31, 2019, filed

on June 25, 2019;

●

our

Quarterly Report on Form 10-Q for the period ended June 30, 2019,

filed on August 13, 2019;

●

our

Quarterly Report on Form 10-Q for the period ended September 30,

2019, filed on November 7, 2019;

●

our

Quarterly Report on Form 10-Q for the period ended December 31,

2019, filed on February 13, 2020;

●

our

Current Report on Form 8-K, filed on April 4, 2019;

●

our

Current Report on Form 8-K, filed on May 2, 2019;

●

our

Current Report on Form 8-K, filed on June 21, 2019;

●

our

Current Report on Form 8-K, filed on July 23, 2019;

●

our

Current Report on Form 8-K, filed on August 16, 2019;

●

our

Current Report on Form 8-K, filed on August 23, 2019;

●

our

Current Report on Form 8-K, filed on September 6,

2019;

●

our

Current Report on Form 8-K, filed on September 25,

2019;

●

our Current Report

on Form 8-K, filed on October 9, 2019;

●

our Current Report on Form 8-K, filed on October

30, 2019;

●

our Current Report

on Form 8-K, filed on November 8, 2019;

●

our Current Report

on Form 8-K, filed on December 12, 2019;

●

our Current Report

on Form 8-K, filed on December 27, 2019;

●

our Current Report

on Form 8-K, filed on January 27, 2020;

●

our Current Report

on Form 8-K, filed on January 31, 2020;

●

our Current Report

on Form 8-K, filed on February 13, 2020;

●

our Current Report

on Form 8-K, filed on February 21, 2020;

●

our Current Report

on Form 8-K, filed on March 26, 2020; and

●

The

description of our common stock contained in the Registration

Statement on Form 8-A filed pursuant to Section 12(b) of the

Securities Exchange Act of 1934, as amended (the

Securities Act) on

May 3, 2016, including any amendment or report filed with the SEC

for the purpose of updating this description.

We also incorporate by reference all documents we

file pursuant to Section 13(a), 13(c), 14 or 15 of the Exchange Act

(other than any portions of filings that are furnished rather than

filed pursuant to Items 2.02 and 7.01 of a Current Report on Form

8-K) after the date of the initial registration statement of which

this prospectus is a part and prior to effectiveness of such

registration statement. All documents we file in the future

pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act

after the date of this prospectus and prior to the termination of

the offering are also incorporated by reference and are an

important part of this prospectus.

Any

statement contained in a document incorporated or deemed to be

incorporated by reference herein shall be deemed to be modified or

superseded for the purposes of this registration statement to the

extent that a statement contained herein or in any other

subsequently filed document which also is or deemed to be

incorporated by reference herein modifies or supersedes such

statement. Any statement so modified or superseded shall not be

deemed, except as so modified or superseded, to constitute a part

of this registration statement.

We

will provide to each person, including any beneficial owner, to

whom a prospectus is delivered, a copy of any or all of the

information that has been incorporated by reference in the

prospectus but not delivered with the prospectus. You may request a

copy of these filings, excluding the exhibits to such filings which

we have not specifically incorporated by reference in such filings,

at no cost, by writing to or calling us at:

VistaGen Therapeutics, Inc.

343 Allerton Avenue

South San Francisco, California 94080

(650) 577-3600

This

prospectus is part of a registration statement we filed with the

SEC. You should only rely on the information or representations

contained in this prospectus and any accompanying prospectus

supplement. We have not authorized anyone to provide information

other than that provided in this prospectus. We are not making an

offer of the securities in any state where the offer is not

permitted. You should not assume that the information in this

prospectus or any accompanying prospectus supplement is accurate as

of any date other than the date on the front of the

document.

CAUTIONARY NOTES REGARDING FORWARD-LOOKING

STATEMENTS

This

prospectus contains forward-looking statements that involve

substantial risks and uncertainties. All statements contained in

this prospectus, other than statements of historical facts, are

forward-looking statements including statements regarding our

strategy, future operations, future financial position, future

revenue, projected costs, prospects, plans, objectives of

management and expected market growth. These statements involve

known and unknown risks, uncertainties and other important factors

that may cause our actual results, performance or achievements to

be materially different from any future results, performance or

achievements expressed or implied by the forward-looking

statements.

The

words “anticipate,” “believe,”

“estimate,” “expect,” “intend,”

“may,” “plan,” “predict,”

“project,” “target,”

“potential,” “will,” “would,”

“could,” “should,” “continue,”

and similar expressions are intended to identify forward-looking

statements, although not all forward-looking statements contain

these identifying words. These forward-looking statements include,

among other things, statements about:

●

the

availability of capital to satisfy our working capital

requirements;

●

the

accuracy of our estimates regarding expenses, future revenues and

capital requirements;

●

our

plans to develop and commercialize our any of our current product

candidates;

●

our

ability to initiate and complete our clinical trials and to advance

our product candidates into additional clinical trials, including

pivotal clinical trials, and successfully complete such clinical

trials;

●

regulatory

developments in the U.S. and foreign countries;

●

the

performance of our third-party contractors involved with the

manufacturer and production of our drug candidates for nonclinical

and clinical development activities, contract research

organizations and other third-party nonclinical and clinical

development collaborators and regulatory service

providers;

●

our

ability to obtain and maintain intellectual property protection for

our core assets;

●

the

size of the potential markets for our product candidates and our

ability to serve those markets;

●

the

rate and degree of market acceptance of our product candidates for

any indication once approved;

●

the

success of competing products and product candidates in development

by others that are or become available for the indications that we

are pursuing;

●

the

loss of key scientific, clinical and nonclinical development,

and/or management personnel, internally or from one of our

third-party collaborators; and

●

other risks and uncertainties, including

those described under Item 1A, “Risk

Factors,” in our Annual

Report on Form 10-K for the fiscal year ended March 31, 2019 and

subsequent Quarterly Reports on Form 10-Q, which risk factors are

incorporated herein by reference.

These

forward-looking statements are only predictions and we may not

actually achieve the plans, intentions or expectations disclosed in

our forward-looking statements, so you should not place undue

reliance on our forward-looking statements. Actual results or

events could differ materially from the plans, intentions and

expectations disclosed in the forward-looking statements we make.

We have based these forward-looking statements largely on our

current expectations and projections about future events and trends

that we believe may affect our business, financial condition and

operating results. We have included important factors in the

cautionary statements included in this prospectus, as well as

certain information incorporated by reference into this prospectus,

that could cause actual future results or events to differ

materially from the forward-looking statements that we make. Our

forward-looking statements do not reflect the potential impact of

any future acquisitions, mergers, dispositions, joint ventures or

investments we may make.

You

should read this prospectus with the understanding that our actual

future results may be materially different from what we expect. We

do not assume any obligation to update any forward-looking

statements whether as a result of new information, future events or

otherwise, except as required by applicable law.

This

prospectus relates to shares of our common stock that may be

offered and sold from time to time by Lincoln Park. We may receive

up to $10,000,000 aggregate gross proceeds under the Purchase

Agreement from any sales we make to Lincoln Park pursuant to the

Purchase Agreement after the date of this prospectus. However, we

may not be registering for sale or offering for resale under the

registration statement of which this prospectus is a part all of

the shares issuable pursuant to the Purchase Agreement. In any

evert, we will receive no proceeds from the sale of any shares of

common stock by Lincoln Park pursuant to this prospectus. As we are

unable to predict the timing or amount of potential issuances of

all of the shares offered hereby (other than the Commitment Shares

or the Initial Purchase Shares), we have not allocated any proceeds

of such issuances to any particular purpose. Accordingly, all such

proceeds are expected to be used for working capital and

general corporate purposes.

Pending

other uses, we intend to invest any proceeds from the offering in

short-term investments or hold them as cash. We cannot predict

whether the proceeds invested will yield a favorable return. Our

management will have broad discretion in the use of the net

proceeds from this offering, and investors will be relying on the

judgment of our management regarding the application of the net

proceeds.

We

have never paid or declared any cash dividends on our common stock,

and we do not anticipate paying any cash dividends on our

common stock in the foreseeable future. Shares of our

Series B 10% Convertible Preferred Stock accrue dividends at a rate

of 10% per annum, which dividends are payable solely in

unregistered shares of our common stock at the time the Series B

10% Convertible Preferred Stock is converted into common

stock.

This

prospectus relates to only the resale by the selling stockholder,

Lincoln Park, of shares of common stock that have been or may be

issued and sold to Lincoln Park pursuant to the Purchase Agreement.

We are filing the registration statement of which this prospectus

forms a part pursuant to the provisions of the Registration Rights

Agreement, which we entered into with Lincoln Park on March 24,

2020 concurrently with our execution of the Purchase Agreement, in

which we agreed to provide certain registration rights with respect

to sales by Lincoln Park of the shares of our common stock that

have been and may be issued to Lincoln Park under the Purchase

Agreement.

Lincoln

Park, as the selling stockholder, may, from time to time, offer and

sell pursuant to this prospectus any or all of the shares that we

have sold and may sell to Lincoln Park under the Purchase

Agreement. The selling stockholder may sell some, all or none of

its shares. We do not know how long the selling stockholder will

hold the shares before selling them, and we currently have no

agreements, arrangements or understandings with the selling

stockholder regarding the sale of any of the shares.

The

following table presents information regarding the selling

stockholder and the shares that it may offer and sell from time to

time under this prospectus. The table is prepared based on

information supplied to us by the selling stockholder, and reflects

its holdings as of March 24, 2020. Neither Lincoln Park nor any of

its affiliates has held a position or office, or had any other

material relationship, with us or any of our predecessors or

affiliates. Beneficial ownership is determined in accordance with

Section 13(d) of the Exchange Act and Rule 13d-3

thereunder.

|

Selling

Stockholder

|

Shares

Beneficially

Owned

Before this

Offering

|

Percentage

of

Outstanding

Shares

Beneficially

Owned

Before

this Offering

|

Shares

to be Sold in this Offering Assuming The

Company issues the Maximum Number of Shares

Under the Purchase Agreement

|

Percentage

of

Outstanding

Shares

Beneficially

Owned

After

this Offering

|

|

Lincoln Park

Capital Fund, LLC (1)

|

3,904,966(2)

|

7.78%(3)

|

9,592,607(4)

|

6.78%

|

|

(1)

|

Josh

Scheinfeld and Jonathan Cope, the Managing Members of Lincoln Park

Capital, LLC, are deemed to be beneficial owners of all of the

shares of common stock owned by Lincoln Park Capital Fund, LLC.

Messrs. Cope and Scheinfeld have shared voting and investment power

over the shares being offered under the prospectus filed with the

SEC in connection with the transactions contemplated under the

Purchase Agreement. Lincoln Park Capital, LLC is not a licensed

broker dealer or an affiliate of a licensed broker

dealer.

|

|

|

|

|

(2)

|

Includes

(i) the 500,000 shares sold to Lincoln Park as Initial Purchase

Shares under the Purchase Agreement and the 750,000 shares issued

to Lincoln Park as Commitment Shares which are being registered

under the registration statement of which this prospectus is a

part. Includes a currently exercisable warrant to purchase

1,000,000 shares of our common stock. Excludes a warrant to

purchase 2,814,602 shares of our common stock not exercisable

within 60 days. See the description under the heading

“The Lincoln Park

Transaction” below for more information about the

Purchase Agreement.

|

|

|

|

|

(3)

|

Based

on 49,213,042 outstanding shares of our common stock as of March

30, 2020.

|

|

|

|

|

(4)

|

Although

the Purchase Agreement provides that we may sell up to $10,250,000

of our common stock to Lincoln Park, in addition to the 750,000

Commitment Shares and 500,000 Initial Purchase Shares, an

additional 8,342,607 shares of our common stock are being offered

under this prospectus that may be sold by us to Lincoln Park, at

our discretion, from time to time over a 24-month period commencing

after the Commencement Date. Depending on the price per share at

which we sell our common stock to Lincoln Park pursuant to the

Purchase Agreement, we may need to sell to Lincoln Park under the

Purchase Agreement more shares of our common stock than are offered

under this prospectus in order to receive aggregate gross proceeds

equal to the $10,250,000 total commitment available to us under the

Purchase Agreement. If we choose to do so, we must first register

for resale under the Securities Act such additional shares. The

number of shares ultimately offered for resale by Lincoln Park is

dependent upon the number of shares we sell to Lincoln Park under

the Purchase Agreement. See “The Lincoln Park

Transaction.”

|

General

On

March 24, 2020 (the Execution

Date), we entered into a Purchase Agreement and a

Registration Rights Agreement with Lincoln Park. Pursuant to the

terms of the Purchase Agreement, Lincoln Park has agreed to

purchase from us up to $10,250,000 of our common stock from time to

time during the term of the Purchase Agreement, subject to certain

limitations.

Other

than the Initial Purchase Shares, which we sold to Lincoln Park on

the Execution Date, we do not have the right to commence any sales

to Lincoln Park under the Purchase Agreement until the Commencement

Date (defined below) has occurred. Thereafter, we may, from time to

time, and at our sole discretion, on any single business day,

direct Lincoln Park to purchase shares of our common stock in

amounts up to 100,000 shares, which amounts may be increased

depending on the market price of our common stock at the time of

sale and subject to a maximum commitment by Lincoln Park of

$1,000,000 per single purchase (Regular Purchases). In addition, at our

discretion, Lincoln Park has committed to purchase other amounts

under an Accelerated Purchase (as defined below) under certain

circumstances. The purchase price per share sold will be based on

the market price of our common stock immediately preceding the time

of sale as computed under the Purchase Agreement. Lincoln Park may

not assign or transfer its rights and obligations under the

Purchase Agreement.

Under

applicable rules of The Nasdaq Capital Market, in no event may we

issue or sell to Lincoln Park under the Purchase Agreement shares

of our common stock in excess of the Exchange Cap (which is

9,592,607 shares, or 19.99% of the shares of our common stock

outstanding immediately prior to the execution of the Purchase

Agreement), unless (i) we obtain stockholder approval to issue

shares of common stock in excess of the Exchange Cap or (ii) the

average price of all applicable sales of our common stock to

Lincoln Park under the Purchase Agreement equals or exceeds the

closing price of our common stock on The Nasdaq Capital Market on

the business day immediately preceding March 24, 2020 plus an incremental amount, such

that issuances and sales of our common stock to Lincoln Park under

the Purchase Agreement would be exempt from the Exchange Cap

limitation under applicable Nasdaq rules. In any event, the

Purchase Agreement specifically provides that we may not issue or

sell any shares of our common stock under the Purchase Agreement if

such issuance or sale would breach any applicable Nasdaq

rules.

The

Purchase Agreement also prohibits us from directing Lincoln Park to

purchase any shares of common stock if those shares, when

aggregated with all other shares of our common stock then

beneficially owned by Lincoln Park and its affiliates, would result

in Lincoln Park exceeding the Beneficial Ownership

Cap.

Pursuant to the

Registration Rights Agreement, the Company is required to register

the shares of common stock that have been and may be issued to

Lincoln Park under the Purchase Agreement. We have filed the

registration statement with the SEC that includes this prospectus

to register for resale under the Securities Act, up to 9,592,607

shares of common stock, representing 19.99% of our issued and

outstanding shares of common stock on March 24, 2020.

Purchase of Shares Under the Purchase Agreement

Under

the terms and subject to the conditions of the Purchase Agreement,

the Company has the right, but not the obligation, to sell to

Lincoln Park, and Lincoln Park is obligated to purchase up to

$10,250,000 of shares of common stock, including the Initial

Purchase Shares purchased by Lincoln Park on the Execution Date.

Such sales of common stock by the Company, if any, will be subject

to certain limitations, and may occur from time to time, at the

Company’s sole discretion, over the 24-month period

commencing on the date that a registration statement covering the

resale of shares of common stock that have been and may be issued

under the Purchase Agreement, which the Company agreed to file with

the SEC pursuant to the Registration Rights Agreement, is declared

effective by the SEC and a final prospectus in connection therewith

is filed and the other conditions set forth in the Purchase

Agreement are satisfied, all of which are outside the control of

Lincoln Park (such date on which all of such conditions are

satisfied, the Commencement

Date).

Thereafter, under

the Purchase Agreement, on any business day over the term of the

Purchase Agreement, the Company has the right, in its sole

discretion, to present Lincoln Park with a purchase notice (each, a

Purchase Notice) directing

Lincoln Park to purchase up to 100,000 shares per business day (the

Regular Purchase), (subject

to adjustment for any reorganization, recapitalization, non-cash

dividend, stock split, reverse stock split or other similar

transaction as provided in the Purchase Agreement). The Regular

Purchase Amount may be increased up to 150,000 shares if the

closing price is not below $0.80 per share, may be increased up to

200,000 shares if the closing price is not below $1.00 per share,

and may be increased up to 250,000 shares if the closing price is

not below $1.50 per share.

In each

case, Lincoln Park’s maximum commitment in any single Regular

Purchase may not exceed $1,000,000. The Purchase Agreement provides

for a purchase price per Purchase Share (the Purchase Price) equal to the lesser

of:

●

the

lowest sale price of the Company’s common stock on the

purchase date; and

●

the

average of the three lowest closing sale prices for the

Company’s common stock during the ten consecutive business

days ending on the business day immediately preceding the purchase

date of such shares.

In

addition, on any date on which the Company submits a Purchase

Notice to Lincoln Park and on which date the Company has directed a

Regular Purchase in full, the Company also has the right, in its

sole discretion, to present Lincoln with an accelerated purchase

notice (each, an Accelerated

Purchase Notice) directing Lincoln Park to purchase an

amount of stock (the Accelerated

Purchase) equal to up to the lesser of (i) three times the

number of shares purchased pursuant to such Regular Purchase; or

(ii) 30% of the aggregate shares of the Company’s common

stock traded during all or, if certain trading volume or market

price thresholds specified in the Purchase Agreement are crossed on

the applicable Accelerated Purchase date, the portion of the normal

trading hours on the applicable Accelerated Purchase date prior to

such time that any one of such thresholds is crossed (such period

of time on the applicable Accelerated Purchase Date, the

Accelerated Purchase Measurement

Period). The purchase price per share for each such

Accelerated Purchase will be equal to the lesser of:

●

95% of

the volume weighted average price of the Company’s common

stock during the applicable Accelerated Purchase Measurement Period

on the applicable Accelerated Purchase date; and

●

the

closing sale price of the Company’s common stock on the

applicable Accelerated Purchase Date.

In the

case of the regular purchases and accelerated purchases, the

purchase price per share will be equitably adjusted for any

reorganization, recapitalization, non-cash dividend, stock split,

reverse stock split or other similar transaction occurring during

the business days used to compute the purchase price.

Other

than as described above, there are no trading volume requirements