FRESNO, Calif., July 16 /PRNewswire-FirstCall/ -- Dennis R. Woods,

President and Chief Executive Officer of United Security Bancshares

(http://www.unitedsecuritybank.com/) (NASDAQ:UBFO) reported today

the results of operation for the 2nd quarter and six months ended

2008. Net income was $2,070,000 for the 2nd quarter of 2008, as

compared with $3,308,000 for the 2nd quarter in 2007. Basic and

diluted earnings per share for the 2nd quarter 2008 were $0.18

compared with $0.27 for the 2nd quarter 2007. For the six months

ended June 30, 2008, net income was $4,570,000 compared with

$6,911,000 in 2007. For the six months ended June 30, 2008, return

on average equity was 10.98% and the return on average assets was

1.19%. For the same period in 2007, return on average equity was

17.42% and return on average assets was 1.89%. The low interest

rate environment, weak real estate market and weakened economy all

combined to impact earnings adversely. The 79th consecutive

quarterly cash dividend of $0.13 per share, up from $0.125 for a

4.0% increase from a year ago, was declared on June 24, 2008, to be

paid on July 23, 2008, to shareholders of record on July 11, 2008.

Woods added, "The 2nd quarter began: with a weakening real estate

market; the Federal Reserve poised to lower rates for a 7th time;

weak credit market; and a general weak national economy. As the

quarter ended: we are seeing an improving real estate market; the

Federal Reserve leaving rates unchanged; credit markets essentially

unchanged and a modestly improved national economy. The California

housing market is beginning to show signs of recovery. Home sales

were up in May for the second consecutive month. Sales of new homes

are increasing as developers lower prices. Sales of existing houses

climbed 15.5% from the previous month and 18.1% from May 2007,

topping 400,000 for the first time since last year, according to a

report from the California Association of Realtors. Fresno and

Clovis sales of existing houses climbed 19% month-to- month and

year-over-year. Pending sales-transactions are up 34% from May

2007. Lower prices and a renewed Federal Housing Administration

loan program are the primary causes for the increase. Even though

signs of improvement are appearing, returning to economic normalcy

is not expected until sometime in 2009. The third quarter may

reveal extended weakness. We continue to work with customers as

they work through this difficult economic cycle." Shareholders'

equity at quarter end was $81.7 million. During the past 12 months,

dividends of $6.0 million were paid out of shareholders' equity to

shareholders and $2.5 million was utilized to purchase and retire

shares of Company stock at an average price of $16.11 per share.

Net interest income for the 2nd quarter 2008 was $7.7 million, down

$1.1 million from the 2nd quarter of 2007 for a decrease of 12.5%.

The net interest margin decreased from 5.19% in the 2nd 2007 to

4.51% in 2008. For the six months ended June 30, 2008 net interest

income was $15,713,000, down $2,856,000 from $18,569,000 for the

same period in 2007. The lower interest rate environment is the

primary cause for the decline. The decrease in the net interest

margin in the 2nd quarter of 2008 is attributable to the interest

income reversed during the quarter amounting to $450,000 on loans

transferred to nonaccrual status and the action by the Federal

Reserve lowering rates on April 30, 2008. Without reversal of the

interest income for nonaccrual of $450,000, the net interest margin

would have been 4.78% in the 2nd quarter of 2008, an increase from

the 1st quarter net interest margin of 4.61% Noninterest income for

the 2nd quarter of 2008 was $1,721,000, down $233,000 from

$1,954,000 in 2007 for a decrease of 11.9%. $219,000 of the

decrease resulted from the gain on proceeds from life insurance

that occurred in 2007 that did not reoccur in 2008. For the six

months ended June 30, 2008, noninterest income was $4,054,000, up

$520,000 from $3,535,000 for the same period in 2007. A gain from

the fair value adjustment to the carrying amount of Trust Preferred

Securities of $388,000 accounts for most of the change. Other

operating expenses for the three months ended June 30, 2008 were

$5,644,000 and $5,517,000 for 2007, an increase of $127,000 or

2.3%. For the six months ended June 30, 2008, other operating

expenses totaled $11,760,000, up $1,043,000 from $10,717,000 for

the same period in 2007. Salaries and benefits increased by

$263,000, occupancy expense rose $220,000, and an impairment loss

on core deposit intangibles during the 1st quarter 2008 totaling

$624,000 were the primary reasons for the increase. The provision

for loan loss was $548,000 for the 2nd quarter of 2008 and $208,000

for 2nd quarter of 2007. . For the six months ended June 30, 2008,

the provision was $813,000 compared with $410,000 for the same

period in 2007. In determining the adequacy of the allowance for

loan losses, Management's judgment is the primary determining

factor for establishing the amount of the provision for loan losses

and management considers the allowance for loan and lease losses at

June 30, 2008 to be adequate. Non-performing assets increased to

6.67% of total assets on June 30, 2008 from 3.90% on March 31,

2008. At year-end 2007 non-performing assets were 3.66% of total

assets and on June 30, 2007 2.55%. United Security Bancshares is a

$770+ million bank holding company. United Security Bank, it's

principal subsidiary is a state chartered bank and member of the

Federal Reserve Bank of San Francisco. FORWARD-LOOKING STATEMENTS

This news release contains forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended

and the Company intends such statements to be covered by the safe

harbor provisions for forward-looking statements contained in the

Private Securities Litigation Reform Act of 1995. Forward-looking

statements are based on management's knowledge and belief as of

today and include information concerning the Company's possible or

assumed future financial condition, and its results of operations,

business and earnings outlook. These forward-looking statements are

subject to risks and uncertainties. A number of factors, some of

which are beyond the Company's ability to control or predict, could

cause future results to differ materially from those contemplated

by such forward-looking statements. These factors include (1)

changes in interest rates, (2) significant changes in banking laws

or regulations, (3) increased competition in the company's market,

(4) other-than-expected credit losses, (5) earthquake or other

natural disasters impacting the condition of real estate

collateral, (6) the effect of acquisitions and integration of

acquired businesses, (7) the impact of proposed and/or recently

adopted changes in regulatory, judicial, or legislative tax

treatment of business transactions, particularly recently enacted

California tax legislation and the subsequent Dec. 31, 2003,

announcement by the Franchise Tax Board regarding the taxation of

REITs and RICs; and (8) unknown economic impacts caused by the

State of California's budget issues. Management cannot predict at

this time the severity or duration of the effects of the recent

business slowdown on our specific business activities and

profitability. Weaker or a further decline in capital and consumer

spending, and related recessionary trends could adversely affect

our performance in a number of ways including decreased demand for

our products and services and increased credit losses. Likewise,

changes in interest rates, among other things, could slow the rate

of growth or put pressure on current deposit levels and affect the

ability of borrowers to repay loans. Forward- looking statements

speak only as of the date they are made, and the company does not

undertake to update forward-looking statements to reflect

circumstances or events that occur after the date the statements

are made, or to update earnings guidance including the factors that

influence earnings. For a more complete discussion of these risks

and uncertainties, see the Company's Annual Report on Form 10-K for

the year ended December 31, 2007, and particularly the section of

Management's Discussion and Analysis. United Security Bancshares

Consolidated Balance Sheets (unaudited) (Dollars in thousands) June

30, June 30, 2008 2007 Cash & nonint.-bearing deposits in banks

$23,429 $24,190 Interest-bearing deposits in banks 6,770 7,910

Federal funds sold 0 2,376 Investment securities AFS 98,260 91,636

Loans, net of unearned fees 587,655 588,950 Less: allowance for

loan losses (11,223) (9,905) Loans, net 576,433 579,046 Premises

and equipment, net 14,942 15,970 Intangible assets 13,879 13,638

Other assets 39,149 37,547 TOTAL ASSETS $772,861 $772,312 Deposits:

Noninterest-bearing demand & NOW 178,663 183,474 Savings &

Money Market 178,548 191,976 Time 201,461 265,737 Total deposits

558,672 641,187 Borrowed funds 110,640 23,060 Other liabilities

9,123 9,698 Junior subordinated debentures 12,741 16,998 TOTAL

LIABILITIES $691,176 $690,943 Shareholders' equity: Common shares

outstanding: 11,798,992 at June 30, 2008 11,943,363 at June 30,

2007 $31,741 $33,966 Retained earnings 51,495 48,618 Fair Value

Adjustment - Hedge (0) (56) Accumulated other comprehensive income

(1,551) (1,159) Total shareholders' equity $81,684 $81,369 TOTAL

LIABILITIES & SHAREHOLDERS' EQUITY 772,861 772,312 United

Security Bancshares Consolidated Statements of Income (dollars in

000's, Three Three Six Six except per share Months Months Months

Months amounts) Ended Ended Ended Ended (unaudited) June 30, June

30, June 30, June 30, 2008 2007 2008 2007 Interest income $11,431

$13,962 $24,175 $28,198 Interest expense 3,702 5,126 8,461 9,629

Net interest income 7,728 8,836 15,713 18,569 Provision for loan

losses 548 208 813 410 Other income 1,721 1,954 4,054 3,535 Other

expenses 5,644 5,517 11,760 10,717 Income before income tax

provision 3,258 5,065 7,195 10,977 Provision for income taxes 1,188

1,757 2,625 4,066 NET INCOME $2,070 $3,308 $4,570 $6,911 United

Security Bancshares Selected Financial Data Three Three Six Six

(dollars in 000's Months Months Months Months except per Ended

Ended Ended Ended share amounts) June 30, June 30, June 30, June

30, 2008 2007 2008 2007 Basic Earnings Per Share $0.18 $0.27 $0.39

$0.58 Diluted Earning Per Share $0.18 $0.27 $0.39 $0.57 Annualized

Return on: Average Assets 1.08% 1.74% 1.19% 1.89% Average Equity

10.11% 15.56% 10.98% 17.42% Net Interest Margin 4.51% 5.19% 4.57%

5.68% Net Charge-offs to Average Loans 0.17% 0.09% 0.17% 0.02% June

30, June 30, 2008 2007 Book Value Per Share $6.92 $6.81 Tangible

Book Value Per Share $5.75 $5.67 Efficiency Ratio 59.49% 48.48% Non

Performing Assets to Total Assets 6.67% 2.55% Allowance for Loan

Losses to Total Loans 1.91% 1.68% Shares Outstanding - period end

11,798,992 11,943,363 Basic Shares - average weighted 11,818,665

12,078,030 Diluted Shares - average weighted 11,821,658 12,135,006

DATASOURCE: United Security Bancshares CONTACT: Dennis R. Woods,

President and Chief Executive Officer of United Security

Bancshares, +1-559-248-4928 Web site:

http://www.unitedsecuritybank.com/

Copyright

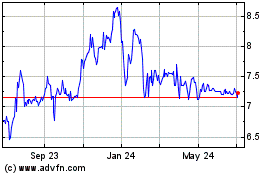

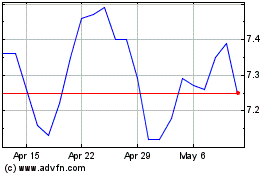

United Security Bancshares (NASDAQ:UBFO)

Historical Stock Chart

From Apr 2024 to May 2024

United Security Bancshares (NASDAQ:UBFO)

Historical Stock Chart

From May 2023 to May 2024