Big Buying Opportunity in Ag Stocks - Investment Ideas

June 22 2011 - 8:00PM

Zacks

I wrote an "Investment Ideas" last fall that talked about what I

saw as a pending boom in agriculture stocks. The premise of the

strategy was based on surging prices in agrcicultural commodities

like corn, beans and wheat with a lack of impact on the equity side

of the business.

Although a lot of analysts wouldn't know the

difference between $4 and $6 corn, my 8 years of experience trading

ag futures at the Chicago Board of Trade told me that when beans

hit the teens, farmers are about to start making and spending

serious amounts of cash. The strategy turned out to be a big

winner, with all four stocks outperforming the S&P 500 for a

strong net out performance. Take a look at the chart below for a

closer look at how each individual name fared.

My 4 Ag Picks from Last Fall

*chart sourced from Yahoo!*

But what you can also see in the chart is how ag

stocks have followed the weak market lower over the last 6 weeks.

While that would seem totally normal on the surface, what is

interesting about this dynamic is that the downward pressure comes

as estimates have risen on strong Q1 earnings. And in the world of

stock and valuation analysis, that is a screaming buy.

So with the food shortage story well in play on a

booming global population and unpredictable weather, let's go ahead

and take a second swing at some of our favorite agriculture stocks.

One name was included in the first report, but I've added five

fresh ideas to help you beef up your agriculture portfolio. And if

you're interested in checking out the original peice from last

October, here's a link to that too.

Are Ag Stocks the Next Gold Trade?

Top 6 Agriculture Stocks

CNH Global (CNH) is a global leader in

farming equipment with a market cap of $9.8 billion. This Zacks #1

rank stock has recently pulled back from its 52-week high in the

weak market, falling from $54 to $37. But like I mentioned above,

it comes as estimates are on the rise, with the current year up 18

cents in the last 60 days to $2.94. That has made this a value

stock, trading with a forward P/E of 13X against its peer average

of 14X.

Bunge (BG) is a top name in agribusiness,

wholesaling grains with satellite operations in Brazil. This Zacks

#1 rank stock has also declined over the last month, but in the

meantime estimates are up, with the current year adding 36 cents in

the last two months to $6.31.

CF Industries (CF), also known as the most

insanely undervalued fertilizer stock in the world, has been

holding tough in the weak market, with shares lingering in elevated

territory. That defintely has something to do with the compelling

valuation, where this Zacks #1 rank stock has a forward P/E of

8.9X, a sharp discount to ite peer average of 11.5X.

Tractor Supply (TSCO) operates retail farm

and ranch stores in the United States with a market cap of $4.8

billion. This Zacks #2 rank stock has been a top performer over the

last year, hitting new high after new high on booming sales and

earnings. The valuation is a little richer here, but this mid

capper is still in a strong growth cycle.

The Andersons (ANDE) is basically a smaller

version of Bungee, an agirbusiness company with a market cap of

$750 million. ANDE has pulled back in the last two months while

estimates have risen, making the company's forward P/E of 10X

serious relative and absolute value.

And finally, we have the Lindsey Group

(LNN), an irrigation specialist with a market cap of $773 million.

This Zacks #2 rank stock has seen its current-year estimate climb

40 cents in the last two months to $2.69 while shares have pulled

back from $83 to $63. So even though the forward P/E of 23X is a

premium to its peers, this is another small capper that is in the

midst of an aggressive growth cycle.

Long-Term Gains in Agriculture

So as you can see, the recent pullback in the

market has created some value opportunities in agriculture stocks.

And with long-term compression between supply and demand supporting

prices, ag stocks are a good place to be looking for your next big

winner.

**Author Disclosure: I own shares of BG, DE and

CF**

Michael Vodicka is the Momentum Stock Strategist

for Zacks.com. He is also the Editor in charge of the Zacks

Momentum Trader Service.

ANDERSONS INC (ANDE): Free Stock Analysis Report

BUNGE LTD (BG): Free Stock Analysis Report

CF INDUS HLDGS (CF): Free Stock Analysis Report

CNH GLOBAL NV (CNH): Free Stock Analysis Report

LINDSAY CORP (LNN): Free Stock Analysis Report

TRACTOR SUPPLY (TSCO): Free Stock Analysis Report

Zacks Investment Research

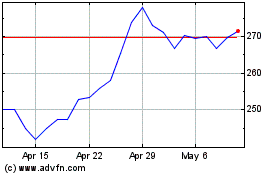

Tractor Supply (NASDAQ:TSCO)

Historical Stock Chart

From May 2024 to Jun 2024

Tractor Supply (NASDAQ:TSCO)

Historical Stock Chart

From Jun 2023 to Jun 2024