UPDATE: Texas Instruments Profit Jumps On Mobile Demand

January 24 2011 - 6:35PM

Dow Jones News

Texas Instruments Inc. (TXN) reported an expected 44% increase

in fourth-quarter earnings as the chip maker benefited from strong

demand for mobile devices and analog and embedded products.

TI, which makes chips used in everything from cellphones to

industrial equipment, has seen a sharp rebound in demand after the

recession caused customers to virtually stop buying chips. While

there has been weaker consumer demand for PCs and TVs in recent

months, and industrial demand is slowing to more normal growth

levels, TI is bullish any correction will be "short and

shallow."

"Our strong financial results for the fourth quarter reinforce

our view that the inventory-driven downturn that started in the

second half of 2010 is now mostly complete," Chairman and Chief

Executive Rich Templeton said.

Consumer demand for PCs bottomed in the fourth quarter and has

resumed growing, Chief Financial Officer Kevin March said. TV

demand, meanwhile, likely also bottomed.

"We didn't see growth resume in 4Q in TVs, but we were told by

customers to expect it to resume growth in the first quarter,"

March said. He said smartphones and automotive demand remain

strong, while industrial demand returned to more normal levels of

growth, as expected.

"Consumers are buying," he added.

For the first quarter, TI forecast earnings of 54 cents to 62

cents a share on revenue of $3.27 billion to $3.55 billion.

Analysts surveyed by Thomson Reuters expect 57 cents a share on

$3.33 billion in revenue.

Despite the strong results, shares slid 2.7% to $33.73 in

after-hours trading. The stock has jumped 50% since the end of

August and was up 2.2% during the regular session Monday.

"There were no real surprises, except the one-time gains from

the sale of assets," Gleacher & Co. analyst Doug Freedman. The

gain, combined with a tax benefit associated with the reinstatement

of the federal research and development tax credit, boosted

earnings by 14 cents a share.

"Numbers were slightly better than expected, but the stock has

been a strong performer along with the semiconductor sector of

late," he said.

TI has been increasing its focus on highly profitable analog and

embedded-application chips while winding down its business selling

mobile baseband chips after major cellphone makers shifted to a

multisupplier strategy. The company also has been supplying chips

to smartphones and tablets--including for power management and for

processing with its OMAP platform.

March said TI has a lot of initial wins for OMAP in products

such as tablets, e-readers and navigation systems. And tablets

represent a $30-plus opportunity per device, he said, giving TI up

to $10 for analog chips per tablet, roughly $15 for the application

processor and $3 to $5 for connectivity such as Wi-Fi.

"We have a good portfolio that can capture those opportunities,"

he said. "There will be interesting ramps in 2011 in tablets."

Meanwhile, TI has been using its ample cash to buy other

companies, build plants, and beef up its sales and engineering

forces in China and India. The company recently bought new

manufacturing facilities in Japan and China, and it is expected to

gain share by using RFAB, its new 300-millimeter manufacturing

facility for analog semiconductors.

March said the three new factories contributed some revenue in

the fourth quarter and that utilization rates should increase

steadily through 2011.

TI reported fourth-quarter profit of $942 million, or 78 cents a

share, up from $655 million, or 52 cents, a year earlier. Revenue

jumped 17% to $3.53 billion. Fourth-quarter earnings were 64 cents

a share, excluding a gain from the sale of certain assets to Intel

Corp. (INTC) and a tax benefit associated with the reinstatement of

the federal research and development tax credit.

In December, TI narrowed its fourth-quarter per-share earnings

guidance to 61 cents to 65 cents, excluding the gain, and $3.43

billion to $3.57 billion of revenue--keeping the midpoint of both

forecasts unchanged.

Gross margin edged up to 53% from 52.9%.

Sales of analog chips, which made up 43% of total revenue,

climbed 20%, while earnings rose 27%.

The company said orders fell 4% from a year earlier and 9% from

the prior quarter, which March attributed to shorter lead times for

customers to get the products.

-By Shara Tibken, Dow Jones Newswires; 212-416-2189;

shara.tibken@dowjones.com

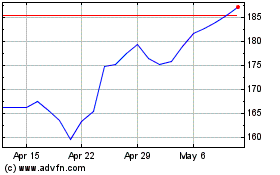

Texas Instruments (NASDAQ:TXN)

Historical Stock Chart

From May 2024 to Jun 2024

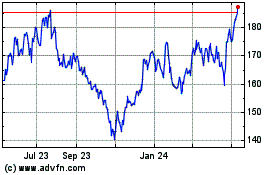

Texas Instruments (NASDAQ:TXN)

Historical Stock Chart

From Jun 2023 to Jun 2024