| |

Filed

by Informa PLC |

| |

Pursuant

to Rule 425 under the Securities Act of 1933 |

| |

and

deemed filed pursuant to Rule 14a-12 under |

| |

the

Securities Exchange Act of 1934 |

| |

|

| |

Subject

Company: TechTarget, Inc. |

| |

Commission

File No.: 001-33472 |

The following presentation was posted on Informa PLC’s website on March 8, 2024.

Momentum and Growth 8 March 2024 2023 Full - Year Results

Disclaimer 2023 Full - Year Results 2 This presentation contains forward - looking statements concerning the financial condition, results of operations and businesses of the Group . Although the Group believes that the expectations reflected in such forward - looking statements are reasonable, these statements are not guarantees of future performance and are subject to a number of risks and uncertainties and actual results, performance and events could differ materially from those currently being anticipated, expressed or implied in such forward - looking statements . Factors which may cause future outcomes to differ from those foreseen in forward - looking statements include, but are not limited to, those identified in the “Principal Risks and Uncertainties” section of the Group’s Annual Report . The forward - looking statements contained in this presentation speak only as of the date of preparation of this presentation and the Group therefore cautions against placing undue reliance on any forward - looking statements . Nothing in this presentation should be construed as a profit forecast . Except as required by any applicable law or regulation, the Group expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward - looking statements contained in this presentation to reflect any change in the Group’s expectations or any change in events, conditions or circumstances on which any such statement is based . This presentation does not constitute or form part of any offer or invitation to purchase any securities of any person nor any offer or invitation to sell or issue, or any solicitation of any offer to purchase or subscribe for, any such securities .

Value of Live in a digital world Variable Macro - Economic Backdrop 2023 Full - Year Results 3 Significant variance in macro - economic trends across all five regions Carbon reduction Half the world is voting Geo - political uncertainty Economic diversification Investment in R&D and innovation Heightened interest rates Lingering (but slowing) inflation

Knowledge & information economy 4 Specialist Knowledge Specialist Brands Advanced Learning Specialist Market Research Pay - to - Publish On - Demand Access First Party Data Artificial Intelligence Live Experiences Pay - to - Read Audience Development Digital Demand Generation Peer Reviewed Research Lead Generation 2023 Full - Year Results

The Value of Specialisation 2023 Full - Year Results 5 Championing the specialist in B2B Markets, Academic Markets and Digital Services The Power of Live First party data Subject specialties International communities Specialist connections Niche markets Specialist Knowledge B2B audiences Lead generation Forward visibility Buyer intent Recurring revenues Deep customer relationships $33bn Forecast size of the global exhibition industry in 2025 Source: Globex $14bn Size of US technology B2B Data and Market Access Industry Source: EY Parthenon $73bn Addressable market for Knowledge Services Source: Dimensions AI, EY Parthenon, SIMBA B2B Live & On - Demand Events B2B Digital Services Academic Markets

Major Brands in Major Markets 2023 Full - Year Results 6 Healthcare & Pharmaceuticals 170k+ 30+ 2,000+ Attendees Age Exhibitors Humanities & Social Sciences 170k+ 170+ 150+ Reference Titles Age Subject categories Health & Nutrition 80k+ 35+ 3,000+ Attendees Age Exhibitors Cybersecurity 60k+ 25+ 400+ Attendees Age Exhibitors Science, Technology & Medicine 90+ 20+ 80+ OA Journals Age Subject categories B2B Markets Academic Markets Foodservice 60k+ 100+ 1,800+ Attendees Age Exhibitors Foodservice YA0

2023 Highlights 2023 Full - Year Results 7 A standout performance in 2023 with continuing momentum and growth in 2024 Strength Increasing Growing Higher Strong Underlying growth: Revenue 30%+, Adjusted Operating Profit c.60%, Free Cash Flow c.50% Operating Margin: Significant increase to 26.8% Adjusted diluted earnings per share +86% to 45.3p Dividends of 18.0p, +84% year - on - year growth Strong and flexible balance sheet with year - end leverage of 1.4x Accelerating Over £700m capital returned to shareholders through dividends and share buybacks

2024 Momentum and Growth

2024 Growth Drivers 2023 Full - Year Results 9 Growth and momentum in 2024 High single digit Revenue / Double Digit Operating Profit International Expansion Strength in the US and rapidly expanding economies in IMEA, ASEAN and China High growth B2B Markets Pharma, Healthcare, Technology, Health & Nutrition, Beauty, Aviation Academic Growth Step up to 4% underlying revenue growth through acceleration in Pay to Publish services Revenue Visibility £500m+ revenue to date and a further £1bn+ booked, committed or visible Structural Growth…the Power of Live…the Value of Specialist Knowledge Balance Sheet Strength 2023 year - end leverage of 1.4x Net Debt/EBITDA Free Cash Flow of £720m+ 2024 Underlying Growth

2023 Full - Year Results 10 2024 Revenue £500m+ to date with a further £1bn+ booked, committed or visible 2024 Forward Visibility c70% 75 %+ £500m+ Revenue to date Subscription Revenues Live & On - Demand Visibility Informa Group Revenue traded to date 2024 2024 Full Year Subscription revenue booked Informa Markets 2024 Full Year Exhibitor revenue booked

Strong Financial Performance & Effective Capital Management Gareth Wright Group Finance Director 2023 Full - Year Results

2023 Full - Year Results: Accelerating Growth 2023 Full - Year Results Shareholder returns in 2023 Revenue £3,190m + 41 % Y oY (2022: £2,262m) Underlying Revenue Growth 30.4% (2022: 31.4%) Adjusted Operating Profit £854m +72% Y oY (2022: £496m) Adjusted Diluted EPS 45.3p +86% Y oY (2022: 24.4p) Dividend Per Share 18.0p +84% Y oY (2022: 9.8p) Free Cash Flow £632m + 51 % Y oY (2022: £418m) £700m+ ✓ Strong financial performance on all metrics ✓ Accelerating growth and operating discipline deliver improved profitability ✓ Strong cash flow generation ✓ Year - end leverage of 1.4x ✓ Expanded £1.15bn share buyback completed 12 * All numbers are based on Continuing Operations

Momentum and Growth through 2023 13 2023 Underlying Growth: Revenue 30%+, Adjusted Operating Profit c.60% 2023 Full - Year Results 2022 FY Results 9 March 2023 2023 AGM 15 June 2023 2023 HY Results 27 July 2023 2023 10 - Month 14 November 2023 Pre - Close Update 10 January 2024 2023 FY Results 8 March 2024 Revenue: £2,750m – £2,850m Adj Op. Profit: £675m – £725m Adj Op. Margin +300bpts YoY Revenue: £2,950m – £3,050m Adj Op. Profit: £750m – £790m Adj Op. Margin +370bpts YoY Revenue: £3,050m ± Adj Op. Profit: £790m ± Adj Op. Margin +400bpts YoY Revenue: £3,150m+ Adj Op. Profit: £840m + Adj Op. Margin +480bpts YoY Revenue: £3,1 65 m+ Adj Op. Profit: c.£845m Adj Op. Margin +480bpts YoY Revenue: £3,190m Adj Op. Profit: £854m Adj Op. Margin +490bpts YoY

Accelerating Growth & Financial Delivery 2023 Full - Year Results 14 Continuing Operations: 2023 £m 2022 £m Revenue 3,189.6 2,262.4 Adjusted Operating Profit 853.8 496.3 Adjusted Operating Margin 26.8% 21.9% Net adjusted finance costs (19.2) (45.3) Adjusted Profit before tax 834.6 451.0 Adjusting items (342.5) (282.2) Reported Profit before tax 492.1 168.8 Adjusted tax charge (156.4) (81.2) Effective tax rate 18.7% 18.0% Adjusted profit 678.2 369.8 Non - controlling interests (43.1) (13.3) Adjusted EPS (diluted) 45.3p 24.4p Strong Revenue Growth • Reported revenue growth of 41.0%, Underlying growth of 30.4% Growing Adjusted Operating Profit • Reported growth of 72.0%, Underlying growth of 59.1% Improving Statutory Performance • Statutory Revenue, Operating Profit and Diluted EPS all higher year - on - year Effective Tax Charge • Effective tax rate (ETR) 18.7% Growth in Partnership Revenues • Minority interests in China JVs, Curinos and Tahaluf Increased Adjusted Diluted EPS • + 86 % year - on - year growth • Fully Diluted Weighted Average Shares of 1,403m

15 Informa Markets… Strong Growth • Full return of Live and On - Demand B2B Events in all regions and markets • Strong operating leverage Informa Connect… Continuing Growth • Strong demand for content - rich live experiences • Strong operating leverage and improving mix Tarsus… Combination and Growth • Strong underlying growth, combination programme Informa Tech… Diversified Growth • Robust growth through Tech market volatility • H2 margin improvement, in - line with guidance IIRIS… First Party Data Growth • Permissioned B2B audience increased to 20m+ Taylor & Francis… Consistent Growth • Robust Pay - to - Read performance and growing Open Research volumes • Consistent margin, in - line with guidance Strong underlying growth in all Divisions 2023 2022 Reported Underlying £m £m % % Revenue Informa Markets 1,593.3 933.3 70.7 65.5 Informa Connect 580.6 414.7 40.0 14.2 Informa Tech 396.7 320.8 23.7 5.6 Taylor & Francis 619.0 593.6 4.3 3.0 Group 3,189.6 2,262.4 41.0 30.4 Adjusted Operating Profit Informa Markets 460.5 174.8 163.4 166.1 Informa Connect 102.5 57.2 79.2 23.0 Informa Tech 72.9 55.5 31.4 7.8 Taylor & Francis 217.9 208.8 4.4 1.1 Group 853.8 496.3 72.0 59.1 Operating Margins % Informa Markets 28.9 18.7 Informa Connect 17.7 13.8 Informa Tech 18.4 17.3 Taylor & Francis 35.2 35.2 Group 26.8 21.9 2023 Full - Year Results * All numbers are based on Continuing Operations

Accelerating Revenue and Profit Growth 2023 Full - Year Results 16 2023 Revenue Growth (%) * 2023 Adjusted Operating Profit Growth (%) * 30.4 - 1.3 13.3 - 1.4 * All numbers are based on Continuing Operations 41.0% Reported Growth 72.0% Reported Growth

Strong Operating Leverage 2023 Full - Year Results 17 Strong revenue growth and efficient cost management delivering higher operating margins Improving Operating Margin • Strong Underlying Revenue Growth • Strong operating leverage • Efficient cost management • Additions of Tarsus and Winsight • Margin uplift from odd - year biennial events * All numbers are based on Continuing Operations 490bps

0 200 400 600 800 1000 1200 1400 1600 2023 2024 2025 2026 2027 2028 Balance Sheet Strength and Flexibility 18 Debt maturities at 31 December 2023 (£m) Covenant - free, fixed rate debt with long - term maturities and substantial liquidity Average debt maturity 2.7 years Year - end pension surplus over £40m No group level financial covenants Debt secured on fixed rates c3.2% EMTN RCF drawn --- RCF Undrawn Bank Year - end leverage of 1.4x Substantial liquidity c.£1.5bn (Undrawn RCF and Cash balances) Strong cash delivery £632 m Free Cash Flow in 2023 2023 Full - Year Results

2024 Momentum and Growth

2024 Momentum and Growth…Shareholder Returns 2023 Full - Year Results 20 Operating Cash Flow Conversion 90%+…2024 Free Cash Flow £720m+ Organic Investment Consistent Capex at 3 - 4% of revenue (£100m - £140m p.a.) Share Buybacks Annual share buybacks, flexed with inorganic investment (Minimum £340m+ in - year buybacks in 2024) Progressive Dividends 18p per share in 2023 (c.£250m cash cost p.a.) Inorganic Investment Targeted portfolio additions if available Target Leverage of 1.5x to 2.5x Net Debt / EBITDA Capital allocation delivering growth investment and strong returns to shareholders Curinos Banking Intell 56.2% Norstella Pharma Intell 6.7% Lloyd’s List Maritime Intell 20.0% Founder’s Forum B2B Events 22.3% ITN Production 20.0% PA Media Specialist Media 18.2% Bologna Fiere B2B Events 13.5% Bridge Events Events Tech 14.9% Portfolio Investments

2024 Market Guidance: Further Strong Growth 2023 Full - Year Results 21 Further strong underlying growth in Revenue and Adjusted Operating Profit Pre - Close Update 10 January 2024 2023 Full Year Results 8 March 2024 Market Guidance updated to reflect strong start to the year, including particularly strong growth in IMEA Strong underlying growth outlook in 2024 Full year benefit of 2023 additions Lower biennial revenue in even years 2024 Revenues to date £500m+ Additional £1bn+ booked, committed or visible Revenue: £3,425m to £3,475m Adjusted Operating Profit: £945m to £965m Revenue: £3,450m to £3,500m Adjusted Operating Profit: £950m to £970m Free Cash Flow: £720m+ Excluding any impact of TechTarget, USD/GBP 1.25

Momentum and Growth Stephen A. Carter Group Chief Executive 2023 Full Year Results

The Power of Live 23 The multiplier effect Promotion & Awareness Strategic value Convening power Scarcity value Discovery Economic growth Innovation accelerator The strategic value of MICE (Meetings, Incentives, Conferences, Expos) Host city Unique connections Market accelerator International investment Face - to - Face 2023 Full - Year Results

Power Brands $10m - $30m 40 Brands National Brands $1m - $3m 200+ Brands Major B2B Brands in Major Markets 2023 Full - Year Results 24 Leading Brands in growing B2B markets Marquee Brands $30m+ 20 Brands CPhI (Pharma) Natural Products (Health & Nutrition) Black Hat ( CyberSecurity ) SuperReturn (Private Equity) China Beauty/Cosmoprof (Beauty) Arab Health (Healthcare) Market Brands $3m - $10m 100+ Brands AfricaCom (Technology) A4M (Anti - Ageing) Greenbuild (Sustainability) TIDES (Therapeutics) GESS (Education) AI Summit (Artificial Intelligence) Farm Progress (Agriculture) Bio - Europe ( BioTech ) TISE (Construction) Vitafoods (Nutraceuticals) Medlab (Medical Technology) The Battery Show (Sustainability) LSX (Life Sciences) RiskMinds (Risk Management) Channel Leadership (Technology) GAIM Ops (Alternative Investment) Finovate (FinTech) Catersource ( FoodService )

Momentum & Growth…Five Geographic B2B Growth Pillars 2023 Full - Year Results c.20 new launches in rapidly growing markets in 2024 $1.2bn+ Revenues 10%+ Growth 5 2024 Launches Americas $125m+ Revenues 10%+ Growth 4 2024 Launches ASEAN $300m+ Revenues 20%+ Growth 5 2024 Launches IMEA $450m+ Revenues 5%+ Growth 2 2024 Launches China $350m+ Revenues 10%+ Growth 2 2024 Launches Europe 25 * Revenue is face - to - face revenue only, excluding ROW

Momentum & Growth…IMEA a Growing Geographic B2B Pillar 2023 Full - Year Results 26 $300m+ Revenues in IMEA, growing 20%+ United Arab Emirates Kingdom of Saudi Arabia Kingdom of Bahrain Egypt Türkiye India Major brands in IMEA Rapidly growing economies with strong demand for specialist knowledge, B2B market access and live experiences Investment in transport links, venues and infrastructure Informa the largest commercial operator, with 1,200+ Colleagues across the region Informa regional centres in Dubai, Manama, Istanbul, Cairo, Mumbai, and Riyadh Growth through partnerships eg Tahaluf , BolognaFiere

2023 Full - Year Results 4,300 Exhibitors 130k Professionals £2.5bn Transactions 75+ Exhibiting Countries $90m+ 20%+ 2024 Revenue YoY Growth Marquee Brands = Power, Impact, Value Healthcare & Pharmaceuticals

2023 Full - Year Results Marquee Brands = Power, Impact, Value Technology Innovation 1,800 Exhibitors 170k Professionals $4.9tn Investors AUM 50+ Exhibiting Countries $70m+ 30%+ 2024 Revenue YoY Growth

Momentum & Growth…First Party Data 2023 Full - Year Results 29 • Lead generation platform for sponsors and exhibitors • Powered by IIRIS first party data (enrichment, intent, segmentation) • Real - time access, single view of leads across multiple Informa brands • Launch and track marketing campaigns directly or integrate into customer platforms • Increasing return on investment for customers 20m+ Permissioned First Party B2B Audience Growing First Party B2B Data…via IIRIS Increasing Customer Value…powered by IIRIS IIRIS data powering enhanced customer experience and marketing effectiveness

The Power and Potential of Artificial Intelligence at Informa 30 AI already embedded within portfolio, with opportunity for expansion 2023 Full Year Results AI already deployed throughout Informa in a variety of products and services Existing use cases largely delivering improved productivity and cost efficiencies Potential for generative AI to enhance existing products and launch new ones Growing internal AI talent and capabilities combined with 3 rd party expertise Limited potential disruptive scenarios identified across the portfolio Content Personalised B2B rec’s and matchmaking IIRIS deploying intelligent user segmentation Marketing segmentation Journal suggestion, Researcher/Institution content recommendation engine Analysing post - show customer feedback Facial recognition and sentiment analysis Pricing and Peer Reviewer recommendation engines Data de - duplication Chatbot capabilities for service centres / vendor management Customer effort and sentiment analysis Human object detection to understand audience demographics, behaviours, intent etc B2B recommendation and matchmaking Content indexing and classification Long/Short - form content creation via ChatGPT Live speech to text conversion/translation Enhanced validation for fake detection, conflict of interest and plagiarism identification Video to text transcription Networking Service Support Customer service AI chat bots on events pages Receipt allocation to open invoices Current AI activities Near - term AI deployment

2023 Full - Year Results 31 Live & On - Demand Events, Powered by AI

Momentum and Growth…New TechTarget 2023 Full - Year Results 32 Prospective combination on track to complete in second half of 2024 * ✓ Proposed combination of Informa Tech’s digital businesses with US - listed TechTarget ✓ Informa to contribute Informa Tech’s digital businesses and c.$350m cash for 57% ownership position ✓ Ambition to double New TechTarget’s revenues of c.$500m within five years ✓ New TechTarget will be US - listed on Nasdaq, classified as a Controlled Company and led by Gary Nugent ✓ Combination to immediately enhance Informa’s revenues and operating profit and be accretive to EPS from 2026 Announcement on 10 January 2024 ✓ Appointment of Combination Director ✓ Hart - Scott - Rodino regulatory filing submitted ✓ Preparation of the Proxy Statement and other regulatory documents ✓ Engagement with Colleagues, Customers and Shareholders (both Informa and TechTarget) ✓ TechTarget reported Q4 2023 results in line with market expectations ✓ New TechTarget operating model, building on due diligence work pre - announcement Progress since announcement * Subject to TechTarget majority shareholder approval

Increased scale and depth at New Informa Connect 2023 Full - Year Results 33 c.£900m Revenue 6 Core verticals 100+ £1m+ Brands 70% | 20% | 10% Events|Subscriptions|Other £580m Revenue 5 Core verticals 75 + £1m+ Brands 60% | 25% | 15% Events|Subscriptions|Other £275m Revenue 2 Core verticals 40+ £1m+ Brands 90% | 0% | 10% Events|Subscriptions|Other 2019 2023 New Connect New Informa Connect: a $1bn+ business

New Informa Connect…Major Brands 2023 Full - Year Results 34 Biotech & Life Sciences 9k+ 15+ 290+ Attendees Age Exhibitors Foodservice 60k+ 100+ 1,800+ Attendees Age Exhibitors Finance 9k+ 25+ 400+ Attendees Age Exhibitors Cybersecurity 60k+ 25+ 600+ Attendees Age Exhibitors Anti - Ageing & Aesthetics 15k+ 20+ 600+ Attendees Age Exhibitors Entertainment 25k+ 35+ 500+ Attendees Age Exhibitors Foodservice Anti - Ageing & Aesthetics

Growing portfolio of Academic Services 2023 Full - Year Results 35 Journal Subscriptions Institutional eBooks Reference Titles Database & Access Licensing & Meta Data Advertising Reprints & Content Services eBook Retail & eCommerce Archives & Digital Resources Read & Publish Agreements Pure Open Access Hybrid Open Access Open Books Open Research Platforms Decision Support Services Research Enhancement Pay - to - Read Pay - to - Publish Enhanced Content Value Sources of Revenue Pay - to - Read Pay - to - Publish Enhanced Content Value * Not to exact scale

Momentum & Growth…Improving Underlying Growth 2023 Full - Year Results 36 GAP2 investment delivering higher levels of underlying growth 90%+ Subscription Renewals Expansion of premium reference titles Increased eBook market penetration 35+ Read & Publish Agreements Acceleration in Open Research Volumes Expansion of AI developed derivative products Regional Sales Focus in US/Asia Continuing Investment: Sales capacity Marketing effectiveness Customer experience Open Research speed to market New Product Development 2024 Underlying Revenue Growth Target 4%

2023 Full - Year Results 37 Specialist Research, Powered by AI

The Informa Group 2023 Full - Year Results 38 Portfolio Growth Investments B2B Live & On - Demand Events B2B Digital Services Academic Markets 300+ Brands, 20+ specialist markets ( Pharma, Health & Nutrition, Aviation, Beauty, Infrastructure & Construction, Luxury IIRIS (Proprietary First Party B2B Data Platform) $0.5bn+ / £0.4bn+ Revenues $4.5bn+ / £3.65bn+ Group Revenues c.$2.2bn / c.£1.75bn Revenues $0.75bn+ / £0.6bn+ Revenues c.$1.1bn / c.£0.9bn Revenues 400+ Brands, 6 growth markets: Biotech & Life Sciences, Finance, Foodservice, Anti - Ageing & Aesthetics, Lifestyle, Technology 220+ Specialist B2B Brands, c.5 0m permissioned First Party B2B audience data, Demand Gen & Buyer Intent platforms 6 publishing imprints, 2700+ peer review journals ( 3 00+ Open titles), 170k reference titles across 75+ specialist subjects Norstella Pharma Intell 6.7% Lloyd’s List Maritime Intell 20.0% Founder’s Forum B2B Events 22.3% ITN Production 20.0% PA Media Specialist Media 18.2% Bologna Fiere B2B Events 13.5% Bridge Events Events Tech 14.9% Transaction - led Live & On Demand B2B Events Content - led Live & On - Demand B2B Events B2B Data & Market Access Platform Specialist Academic Research, Advanced Learning & Open Research Brand Category Equity * Figures relate to 2024, including annualised figures for New TechTarget, assuming proposed combination between Informa Tech’s digital businesses and TechTarget completes as planned

2024 Growth Drivers 2023 Full - Year Results 39 Growth and momentum in 2024 High single digit Revenue / Double Digit Operating Profit International Expansion Strength in the US and rapidly expanding economies in IMEA, ASEAN and China High growth B2B Markets Pharma, Healthcare, Technology, Health & Nutrition, Beauty, Aviation Academic Growth Step up to 4% underlying revenue growth through acceleration in Pay to Publish services Revenue Visibility £500m+ revenue to date and a further £1bn+ booked, committed or visible Structural Growth…the Power of Live…the value of Specialist Knowledge Balance Sheet Strength 2023 year - end leverage of 1.4x Net Debt/EBITDA Free Cash Flow of £720m+ 2024 Underlying Growth

Appendix

Faster to Zero Moving faster to become a zero waste and net zero carbon business 41 2023 Full - Year Results Continuing progress against FasterForward goals and strong recognition in external indices ESG • CarbonNeutral ® Company certification for 4th consecutive year. >80% reduction in scope 1+2* • CarbonNeutral ® Publication certification for all T&F physical books & journals for 3rd consecutive year • Ongoing pilots with CarbonNeutral ® Events • Sustainable Events Fundamentals Programme embedded across 400+ B2B brands • On track for Science Based Targets: Ongoing reduction in energy usage and Scope 1,2 & 3 carbon footprint • 85% of events actively embedding sustainability content into products, increasing revenue & engagement. • 81% of top Taylor & Francis brands meet our criteria for embedding Sustainability Inside • <25,000 books and journals in SDG online • Strongly positive engagement with colleagues and customers on sustainability agenda • Connecting the Disconnected: 250,000+ disadvantaged people connected through events and publishing to date • Estimated $5.2bn of identified value created for host cities from 64% of total attendance • Estimated £12.0m of value given to charities and community groups in 2023, putting Informa in the 1% club • Launch of industry standard approach to measure travel consolidation United Nations Sustainable Development Goals AAA 2024 rating B 2023 rating Faster to Zero Sustainability Inside Impact Multiplier 100th percentile *excluding 2023 acquisitions such as Tarsus

Informa Markets Informa Markets is our transaction - led lie and on - demand events division. We bring specialist markets to life, helping businesses to connect, trade, innovate and grow through live experiences and digital services. 2023 2023 Revenue by vertical Revenue by region Healthcare & Pharma Health & Nutrition Infrastructure, Construction & Build. Fashion & Apparel Maritime, Transport & Logistics Manufacturing, Machinery & Equip. Beauty & Aesthetics Jewellery Hospitality, Food & Beverage Aviation Other 2023 Revenue by type Exhibitor Marketing Services Sponsorship Attendee Subscriptions Unit Sales North America Cont. Europe UK China (incl. Hong Kong) Middle East Rest of World £1,593m Revenue c.50% Group Revenue £461m Adj. Op. Profit c.29% Operating Margin 66% Underlying Revenue Growth 4,500+ Colleagues 42 2022 Half - Year Results Presentation 2023 Full - Year Results

Informa Connect Informa Connect delivers content - led live and on - demand events and experiences and specialist digital content that connect audiences and help professionals to know more, do more and be more. 2023 2023 Revenue by vertical Revenue by region Finance Biotech & Life Sciences Foodservice Anti - Ageing & Aesthetics Lifestyle Other North America Cont. Europe UK China (incl. Hong Kong) Middle East Rest of World 2023 Revenue by type Attendee Subscriptions Sponsorship Exhibitor Marketing Services Unit Sales £581m Revenue c.18% Group Revenue £103m Adj. Op. Profit c.18% Operating Margin 14% Underlying Revenue Growth 2,100+ Colleagues 43 2022 Half - Year Results Presentation 2023 Full - Year Results

Informa Tech Informa Tech focuses on the technology industry, providing B2B data and market access to customers through live and on - demand events, specialist research, specialist media brands, digital demand generation and buyer intent. 2023 2023 2023 Revenue by type Revenue by tech sub - vertical Revenue by region Attendee Exhibitor Subscription Sponsorship Marketing Services Unit Sales Enterprise IT Security Service Providers Gaming, Media & Entertainment AI Components & Devices Other (incl. Netline and Industry Dive) North America Cont. Europe UK China (incl. Hong Kong) Middle East Rest of World £397m Revenue c.12% Group Revenue £73m Adj. Op. Profit c.18% Operating Margin 6% Underlying Revenue Growth 1,6 00+ Colleagues 44 2022 Half - Year Results Presentation 2023 Full - Year Results

Taylor & Francis 2023 2023 2023 Taylor & Francis is a leading provider of academic research, advanced learning and open research . We work with knowledge makers around the world to ensure high - quality research has an impact, by being discovered by the right audience and contributing to human progress. Revenue by type Revenue by vertical Revenue by region Electronic Print Humanities & Social Science Science, Technical & Medical North America Cont. Europe UK China (incl. Hong Kong) Middle East Rest of World £619m Revenue c.19% Group Revenue £218m Adj. Op. Profit c.35% Operating Margin 3% Underlying Growth 2,400+ Colleagues 45 22022 Half - Year Results Presentation 022 Half - Year Results Presentation 2023 Full - Year Results

Adjusting Items 2023 Full - Year Results 46 2023 £m 2022 £m Intangible amortisation and impairment 337.3 281.4 Acquisition and integration costs 73.0 22.0 Restructuring and reorganisation costs 11.0 (1.6) Onerous contracts and one - off costs associated with COVID - 19 - 4.7 Fair value (gain) on contingent consideration (87.6) - Fair value loss on contingent consideration 12.0 5.7 Foreign exchange loss on swap settlement 5.6 - Accounts receivable credits released (5.3) - Adjusting items in operating profit 346.0 312.2 Fair value (gain)/loss on investments (1.3) 0.9 (Profit) on disposal of subsidiaries and operations (3.0) (11.6) Distributions received from investments - (20.6) Finance costs 0.8 1.3 Adjusting items in profit before tax 342.5 282.2

Currency Sensitivity 2023 Full - Year Results 47 Average Rates Closing Rates 2023 2022 2023 2022 GBP/USD 1.24 1.24 1.27 1.21 The anticipated impact of a 1 cent movement in the USD to GBP exchange rate in 2024: Annual revenue £17.5m Annual adjusted operating profit £7.0m Annual adjusted earnings per share 0.4p

Sponsored ADR Programme 48 Symbol IFJPY ISIN US45672B305 Ratio 1 ADR : 2 ORD Effective date 1 st July 2013 Underlying ISIN JE00B3WJHK45 Depositary Bank BNY Mellon Informa ADRs trade on the US over - the - counter (OTC) market Damon Rowan Tel: +44 20 7163 7511 E - mail: damon.rowan@bnymellon.com For any questions relating to Informa ADRs, please contact BNY Mellon 2023 Full - Year Results

Additional Information and Where to Find It In connection with the proposed transaction (the “ proposed transaction ”) between Informa and TechTarget, Toro CombineCo , Inc. (“ NewCo ” or, after the completion of the proposed transaction, “ New TechTarget ”) and TechTarget will prepare and file relevant materials with the Securities and Exchange Commission (the “ SEC ”), including a registration statement on Form S - 4 that will contain a proxy statement of TechTarget that also constitutes a prospectus of NewCo (the “ Proxy Statement/Prospectus ”). A definitive Proxy Statement/Prospectus will be mailed to stockholders of TechTarget. TechTarget and NewCo may also file other documents with the SEC regarding the proposed transaction. This communication is not a substitute for any proxy statement, re gis tration statement or prospectus, or any other document that TechTarget or NewCo (as applicable) may file with the SEC in connection with the proposed transaction. BEFORE MAKING ANY VOTING OR INVESTMENT DECISIO N, INVESTORS AND SECURITY HOLDERS OF TECHTARGET ARE URGED TO READ CAREFULLY AND IN THEIR ENTIRETY THE PROXY STATEMENT/PROSPECTUS WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DO CUMENTS THAT ARE FILED OR WILL BE FILED BY TECHTARGET OR NEWCO WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, IN CONNECTION WITH TH E PROPOSED TRANSACTION, WHEN THEY BECOME AVAILABLE BECAUSE THESE DOCUMENTS CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AN D R ELATED MATTERS. TechTarget investors and security holders will be able to obtain free copies of the Proxy Statement/Prospectus (when they become availab le) , as well as other filings containing important information about TechTarget, NewCo , and other parties to the proposed transaction (including Informa), without charge through the website maintained by the SEC a t www.sec.gov . Copies of the documents filed with the SEC by TechTarget will be available free of charge under the tab “Financials” on the “Investor Relations” page of TechTarget’s internet website at www. Tec hTarget.com or by contacting TechTarget’s Investor Relations Department at investor@TechTarget.com. Participants in the Solicitation Informa, TechTarget, NewCo , and their respective directors and certain of their respective executive officers and employees may be deemed to be partici pan ts in the solicitation of proxies from TechTarget’s stockholders in connection with the proposed transaction. Information regarding the directors of Informa is contained in Info rma ’s annual reports and accounts available on Informa’s website at www.informa.com/investors/ and in the National Storage Mechanism at data.fca.org.uk/#/nsm/nationalstoragemechanism. Information regarding the directors an d executive officers of TechTarget is contained in TechTarget’s proxy statement for its 2023 annual meeting of stockholders, filed with the SEC on April 19, 2023, and in other doc uments subsequently filed with the SEC. Additional information regarding the participants in the proxy solicitations and a description of their direct or indirect interests, by security holdings or othe rwi se, will be contained in the Proxy Statement/Prospectus and other relevant materials filed with the SEC (when they become available). These documents can be obtained free of charge from the sources indicated above. No Offer or Solicitation This communication is for informational purposes only and is not intended to and does not constitute an offer to sell or the sol icitation of an offer to buy any securities, or a solicitation of any vote or approval, nor shall there be any offer, solicitation or sale of securities in any jurisdiction in which such offer, solicitation or sale would be un lawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Ac t o f 1933 , as amended .

Cautionary Note Regarding Forward - Looking Statements This communication contains “forward - looking” statements within the meaning of Section 27A of the Securities Act of 1933 and Sec tion 21E of the Securities Exchange Act of 1934 that involve substantial risks and uncertainties. All statements, other than historical facts, are forward - looking statements, including: statements regarding the expected timing and structure of the proposed transaction; the ability of the parties to complete the proposed transaction considering the various closing conditions; the expected benefits of the proposed transacti on, such as improved operations, enhanced revenues and cash flow, synergies, growth potential, market profile, business plans, expanded portfolio and financial strength; the competitive ability and position of NewCo following completion of the proposed transaction; legal, economic, and regulatory conditions; and any assumptions underlying any of the foregoing. Forward - looking statements concern future circumstances and res ults and other statements that are not historical facts and are sometimes identified by the words “may,” “will,” “should,” “potential,” “intend,” “expect,” “endeavor,” “seek,” “anticipate,” “estimate,” “overes tim ate,” “underestimate,” “believe,” “plan,” “could,” “would,” “project,” “predict,” “continue,” “target,” or the negatives of these words or other similar terms or expressions that concern TechTarget’s or NewCo’s expectations, strategy, priorities, plans, or intentions. Forward - looking statements are based upon current plans, estimates, and expectations that are subject to risks, uncertainties, and assumptions. Should one or more of these ris ks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by such forward - looking statements. We can give no assurance tha t such plans, estimates, or expectations will be achieved, and therefore, actual results may differ materially from any plans, estimates, or expectations in such forward - looking statements.

Cautionary Note Regarding Forward - Looking Statements (continued) Important factors that could cause actual results to differ materially from such plans, estimates, or expectations include, a mon g others: that one or more closing conditions to the proposed transaction, including certain regulatory approvals, may not be satisfied or waived, on a timely basis or otherwise, including that a governmental e nti ty may prohibit, delay, or refuse to grant approval for the consummation of the proposed transaction, may require conditions, limitations, or restrictions in connection with such approvals or that the required appr ova l by the shareholders of TechTarget may not be obtained; the risk that the proposed transaction may not be completed in the time frame expected by Informa, TechTarget, or NewCo , or at all; unexpected costs, charges, or expenses resulting from the proposed transaction; uncertainty of the expected financial performance of NewCo following completion of the proposed transaction; failure to realize the anticipated benefits of the proposed transaction, in cl uding as a result of delay in completing the proposed transaction or integrating the relevant portion of the Informa Tech business with the business of TechTarget; the abili ty of NewCo to implement its business strategy; difficulties and delays in achieving revenue and cost synergies of NewCo ; the occurrence of any event that could give rise to termination of the proposed transaction; potential litigation in connectio n with the proposed transaction or other settlements or investigations that may affect the timing or occurrence of the proposed transaction or result in significant costs of defe nse , indemnification, and liability; evolving legal, regulatory, and tax regimes; changes in economic, financial, political, and regulatory conditions, in the United States and elsewhere, and other factors that contrib ute to uncertainty and volatility, natural and man - made disasters, civil unrest, pandemics, geopolitical uncertainty, and conditions that may result from legislative, regulatory, trade, and policy changes associated w ith the current or subsequent U.S. administration; risks related to disruption of management time from ongoing business operations due to the proposed transaction; certain restrictions during the pendency of the propos ed transaction that may impact TechTarget’s ability to pursue certain business opportunities or strategic transactions; Informa’s, TechTarget’s, and NewCo’s ability to meet expectations regarding the accounting and tax treatments of the proposed transaction; the risk that any annou nc ements relating to the proposed transaction could have adverse effects on the market price of TechTarget’s common stock; the risk th at the proposed transaction and its announcement could have an adverse effect on the ability of TechTarget to retain customers and retain and hire key personnel and maintain relationships with customers, suppli ers , employees, stockholders, strategic partners and other business relationships and on its operating results and business generally; market acceptance of TechTarget’s and the relevant portion of the Informa Tech bus iness’s products and services; the impact of pandemics and future health epidemics and any related economic downturns, on TechTarget’s business and the markets in which it and its customers operate; changes i n e conomic or regulatory conditions or other trends affecting the internet, internet advertising and information technology industries; data privacy and artificial intelligence laws, rules, and regulations; the im pact of foreign currency exchange rates; certain macroeconomic factors facing the global economy, including instability in the regional banking sector, disruptions in the capital markets, economic sanctions and eco nom ic slowdowns or recessions, rising inflation and interest rate fluctuations on TechTarget’s and the relevant portion of the Informa Tech business’s results; and other matters included in TechTarget’s filings with the SEC, including in Item 1A of its Annual Report on Form 10 - K for the year ended December 31, 2022 and its Quarterly Report on Form 10 - Q for the quarter ended September 30, 2023. These risks, as well as other risks associated with the proposed transaction, will be more fully discussed in the Proxy Statement/Prospectus that will be included in the registration statement on Form S - 4 that will be filed with the SE C in connection with the proposed transaction. While the list of factors presented here is, and the list of factors to be presented in registration statement on Form S - 4 will be, considered representative, no such list s hould be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward - looking statements. We caution you n ot to place undue reliance on any of these forward - looking statements as they are not guarantees of future performance or outcomes and that actual performance and outcomes, including, without limitation, our act ual results of operations, financial condition and liquidity, and the development of new markets or market segments in which we operate, may differ materially from those made in or suggested by the forward - looking sta tements contained in this communication. Any forward - looking statements speak only as of the date of this communication. None of Informa, TechTarget, or NewCo undertakes any obligation to update any forward - looking statements, whether as a result of new information or developments, future events, or otherwise, except as required by law. Neither future distribution of this com munication nor the continued availability of this communication in archive form on TechTarget’s website at www.TechTarget.com or Informa’s website at www.informa.com/investors should be deemed to constitute an update or re - affirmation of these statements as of any future date.

Thank you Informa.com

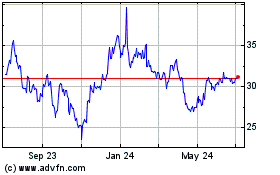

Tech Target (NASDAQ:TTGT)

Historical Stock Chart

From Mar 2024 to Apr 2024

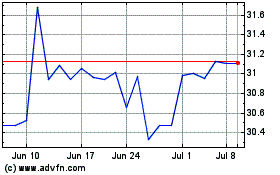

Tech Target (NASDAQ:TTGT)

Historical Stock Chart

From Apr 2023 to Apr 2024