| |

Filed by Informa PLC |

| |

Pursuant to Rule 425 under the Securities

Act of 1933 |

| |

and deemed filed pursuant to Rule 14a-12

under |

| |

the Securities Exchange Act of 1934 |

| |

|

| |

Subject Company: TechTarget, Inc. |

| |

Commission File No.: 001-33472 |

The following is a transcript of an interview of Stephen A. Carter,

Chief Executive Officer of Informa PLC, with Karen Tso and Steve Sedgewick, on CNBC's Squawk Box on January 11, 2024.

Transcript

Karen Tso ("KT"): Informa has raised its revenue and

profit guidance for the year expecting 2023 underlying revenue growth of around 30% and high single digit growth next year. The events

and business intelligence platform also announced the merger of its Tech digital businesses with US listed TechTarget. Lord Stephen Carter

joins us now, the CEO of Informa, thank you very much for stopping in to see us.

I want to start with a trading update if that's okay, because the B2B

events market is huge. And we've got a big one next week, of course, Davos.

Stephen A. Carter ("SC"): Not one of ours.

KT: Not one of yours. We also see firsthand how the market is growing

as we get content, from a lot of different events. But it feels like the conference business is back, and strongly so, particularly in

growing areas of the world economy.

SC: Look I think you’re 100% right, COVID was a tough time if

you’re in the face to face business. COVID was a very tough period. But our business is back, and I mean and some. We're beyond

2019, which was last year before COVID. And my own view is one of the perverse consequences of the other side of COVID, and an extension

of remote working. And the extension of digital everything, which we're doing a bit of today, is that high quality opportunities to meet

face to face are even more valuable than they were. And we're seeing that in our numbers.

KT: Looking at the high growth B2B markets, pharma, healthcare, technology,

health, nutrition, beauty and aviation, why is it important to call out certain segments? Why are they different now in terms of the growth

performance?

SC: Well, we've made decisions to be in certain markets and not in

others. Generally, we tend to operate in high value markets, high value markets that are international, with extended supply chains, that

are growth markets themselves. And that tends to make for a richer product and service opportunity for our customers.

KT: You've given us 2024 guidance targeting

high single digit underlying revenue growth, recorded revenue about £3.4-3.47 billion. In terms of the guidance here and

the ability to cast out and have some visibility, what gives you the confidence because everyone we speak to talks about geopolitical

risk, it’s in every outlook forecast statement for 2024. We've heard it from a domestic retailer today saying, look, the economic

conditions, the consumer business environment, it looks uncertain. Why do you feel like you've got the visibility here, when you look

out over this year?

SC: Well we have a reasonable portion of our revenue which is forward

booked, so just under a third, so we open the year with a pretty clear forward visibility. That's even higher, if you're looking in the

next quarter or the first two quarters. Our geographic spread – we're actually listed here but we’re not so big here domestically.

So our geographic spread is in North America, Middle East, Asia, China, South America…

KT: Which leaves you even more exposed to the geopolitics?

SC: Yes, and to a degree no. Our business is much more B2B. It’s

niche. Supply chains, one of the other consequences of COVID was supply chains got emptied a bit. So the supply chain refilling, market

access, business development, it's very hard to do remotely. Our products are very perfect for that. Well look, in our guidance, we have

forward risk factors listed. And geopolitics is one of them. But I think we feel quietly confident that 2024 will, on balance, be a good

year for the company.

Steve Sedgewick ("SS"): Stephen, a deal as well. Creating

the combined digital business of Informa Tech division with Nasdaq-listed TechTarget. Tell us a little bit about this one.

SC: Well, we're excited about this because it speaks to the other side

of our business. I mean, we've been talking about our live and on demand business. And really what do we do in our live and on demand

business? We bring buyers and sellers, we connect buyers and sellers physically, that's what happens in big trade shows. This announcement

today, what TechTarget do, we do in some of our own tech digital businesses, we bring buyers and sellers together digitally. So essentially

what we're doing is making a bigger version of that, in that combination. So if you're looking at it as an Informa shareholder, we’ll

end up with a big live and on demand business, bringing buyers and sellers together physically, and a big digital business bringing buyers

and sellers together digitally.

SS: You're basically talking about some form of future proofing of

the business, so that you can kind of like – almost looking backwards, COVID obviously a big shock, what have you. If another COVID

type event were to happen again, then this gives you that digital exposure as well. That's what we're saying?

SC: Exactly, it balances the portfolio. We've got strength in face

to face and live. I don't think that's going away anytime soon. But if you live, you live through COVID, you felt that. This gives us

a very, very strong position in digital services. And they're very complementary because the data feeds between both businesses are very

complementary.

SS: It's amazing. I mean, with all due respect to the telecom providers,

and you know, you built your career around this area. Of the quality of the product, I mean, it was alright during COVID. I don't

know how many you did, but Karen and I ended up doing every interview remotely. We did every panel remotely. I had one, which was way

too ambitious. And it was based in the Middle East, I won't say which country but a very substantial country. And they tried to get

100 ministers online, including at the time Kwasi Kwarteng. I can't swear, but it was really bad. It was really awful. And the amount

of glitches – we're not future proofed yet, are we, on these kind of conferences?

SC: No, we're definitely not. The technology is pretty good. As you

say, I used to be a service provider and for a period I was a vendor. So I've got some understanding of how the technology is developed.

But it's not bad; on a day to day basis, it's very good. Yes. You know, for one on one, one on 10, but one on 20,000? No.

SS: So can I ask you, again, I'm going back to an old job of yours.

And I don’t mean to prod the tiger. But is it the regulators' fault for actually holding back the telecoms companies in actually

getting a product out there as well? Because there's mountains of hoops that telecom providers have to jump through – regulatory

– to fulfil their mandate. Is it leaving them – and we've said this many times, and you know this Stephen as well, the great

telecoms players of Europe, and services in the United States as well – have struggled to capitalise on this amazing technology

because they've had so many other commitments.

SC: Not my business anymore, I’m not a regulator anymore.

SS: I should explain to people, you were in charge of the regulator

Ofcom in the UK.

SC: My own shorthand view on that is that I think there's a general

consensus in that industry that there needs to be a regulatory reset. I don’t think there was much debate in that.

SC: We’ve only been in this century for 24 years.

SS: Yeah, and I will go back to the start of this, but I remember 3G

auctions. I remember the 4G auctions and so much money was spent on those that they actually ran themselves into quite dangerous positions.

Gordon Brown was really happy about the former, but actually, the companies themselves, they really struggled to monetise that for shareholders.

SC: Look, I think this is a growth question. I think for Europe,

in particular, you talk about Europe, when it goes back to the discussion about our business. I mean, we don't have much business in Europe,

we have some, but our business is mainly China, Asia, North America, the Middle East, South America, we do have some assets and portfolios,

the transaction announcement today is a US combination. I think in Europe, in particular, we need to look more towards growth, less towards

protection, more towards expansion and innovation, less towards price. That's what I mean by regulatory reset. If you went back 20, 25

years ago, when I was a lad, it was a little bit more focused on innovation and a bit more risk and growth orientated. That's what I mean

by reset.

KT: Speaking innovation, the acquisition puts you at the forefront

of the adoption of AI, and digital advertising a part of the TechTarget business. And we know that this has been one area where there's

been fairly speedy adoption of AI trends. How do you see your approach to AI as a company now and what sort of innovations, progress are

you expecting to make this year?

SC: AI’s a big part of our business, and you're 100% right, it's

a big part of the digital platform business. I mean, you know, between the two companies, the two bits of our business that we're putting

together, we will have a significant digital real estate in the technology and vendor space that we were just talking about. Literally

millions of interactions a day, we're reading that data. We're reading, we're reading the content flows, we're reading the depth of the

content interaction that allows us to provide real time buyer analysis to vendors and buyers. And that's what I mean by connecting buyers

and sellers digitally. So for that business, AI is already a material part of the operating model and the innovations on it are very helpful.

SS: Fabulous to get your views on a whole host of issues. Thank you

so much for joining us on I'm sure a very busy day for you. Lord Stephen Carter, the CEO of Informa.

Additional Information and Where to Find It

In connection

with the proposed transaction (the “proposed transaction”) between Informa and TechTarget, Toro CombineCo, Inc.

(“NewCo” or, after the completion of the proposed transaction, “New TechTarget”) and TechTarget

will prepare and file relevant materials with the Securities and Exchange Commission (the “SEC”), including a registration

statement on Form S-4 that will contain a proxy statement of TechTarget that also constitutes a prospectus of NewCo (the “Proxy

Statement/Prospectus”). A definitive Proxy Statement/Prospectus will be mailed to stockholders of TechTarget. TechTarget and

NewCo may also file other documents with the SEC regarding the proposed transaction. This communication is not a substitute for any proxy

statement, registration statement or prospectus, or any other document that TechTarget or NewCo (as applicable) may file with the SEC

in connection with the proposed transaction. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS OF TECHTARGET

ARE URGED TO READ CAREFULLY AND IN THEIR ENTIRETY THE PROXY STATEMENT/PROSPECTUS WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS

THAT ARE FILED OR WILL BE FILED BY TECHTARGET OR NEWCO WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, IN

CONNECTION WITH THE PROPOSED TRANSACTION, WHEN THEY BECOME AVAILABLE BECAUSE THESE DOCUMENTS CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION

ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. TechTarget investors and security holders will be able to obtain free copies of the

Proxy Statement/Prospectus (when they become available), as well as other filings containing important information about TechTarget, NewCo,

and other parties to the proposed transaction (including Informa), without charge through the website maintained by the SEC at www.sec.gov.

Copies of the documents filed with the SEC by TechTarget will be available free of charge under the tab “Financials” on the

“Investor Relations” page of TechTarget’s internet website at www.TechTarget.com or by contacting TechTarget’s

Investor Relations Department at investor@TechTarget.com.

Participants in the Solicitation

Informa, TechTarget, NewCo, and their

respective directors and certain of their respective executive officers and employees may be deemed to be participants in the solicitation

of proxies from TechTarget’s stockholders in connection with the proposed transaction. Information regarding the directors of Informa

is contained in Informa’s annual reports and accounts available on Informa’s website at www.informa.com/investors/

and in the National Storage Mechanism at data.fca.org.uk/#/nsm/nationalstoragemechanism. Information regarding the directors and executive

officers of TechTarget is contained in TechTarget’s proxy statement for its 2023 annual meeting of stockholders, filed with the

SEC on April 19, 2023, and in other documents subsequently filed with the SEC. Additional information regarding the participants

in the proxy solicitations and a description of their direct or indirect interests, by security holdings or otherwise, will be contained

in the Proxy Statement/Prospectus and other relevant materials filed with the SEC (when they become available). These documents can be

obtained free of charge from the sources indicated above.

No Offer or Solicitation

This communication is for informational

purposes only and is not intended to and does not constitute an offer to sell or the solicitation of an offer to buy any securities, or

a solicitation of any vote or approval, nor shall there be any offer, solicitation or sale of securities in any jurisdiction in which

such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act

of 1933, as amended.

Cautionary Note Regarding Forward-Looking Statements

This communication contains “forward-looking” statements

within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 that

involve substantial risks and uncertainties. All statements, other than historical facts, are forward-looking statements, including: statements

regarding the expected timing and structure of the proposed transaction; the ability of the parties to complete the proposed transaction

considering the various closing conditions; the expected benefits of the proposed transaction, such as improved operations, enhanced revenues

and cash flow, synergies, growth potential, market profile, business plans, expanded portfolio and financial strength; the competitive

ability and position of NewCo following completion of the proposed transaction; legal, economic, and regulatory conditions; and any assumptions

underlying any of the foregoing. Forward-looking statements concern future circumstances and results and other statements that are not

historical facts and are sometimes identified by the words “may,” “will,” “should,” “potential,”

“intend,” “expect,” “endeavor,” “seek,” “anticipate,” “estimate,”

“overestimate,” “underestimate,” “believe,” “plan,” “could,” “would,”

“project,” “predict,” “continue,” “target,” or the negatives of these words or other similar

terms or expressions that concern TechTarget’s or NewCo’s expectations, strategy, priorities, plans, or intentions. Forward-looking

statements are based upon current plans, estimates, and expectations that are subject to risks, uncertainties, and assumptions. Should

one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially

from those indicated or anticipated by such forward-looking statements. We can give no assurance that such plans, estimates, or expectations

will be achieved, and therefore, actual results may differ materially from any plans, estimates, or expectations in such forward-looking

statements.

Important factors that could cause actual results to differ materially

from such plans, estimates, or expectations include, among others: that one or more closing conditions to the proposed transaction, including

certain regulatory approvals, may not be satisfied or waived, on a timely basis or otherwise, including that a governmental entity may

prohibit, delay, or refuse to grant approval for the consummation of the proposed transaction, may require conditions, limitations, or

restrictions in connection with such approvals or that the required approval by the shareholders of TechTarget may not be obtained; the

risk that the proposed transaction may not be completed in the time frame expected by Informa, TechTarget, or NewCo, or at all; unexpected

costs, charges, or expenses resulting from the proposed transaction; uncertainty of the expected financial performance of NewCo following

completion of the proposed transaction; failure to realize the anticipated benefits of the proposed transaction, including as a result

of delay in completing the proposed transaction or integrating the relevant portion of the Informa Tech business with the business

of TechTarget; the ability of NewCo to implement its business strategy; difficulties and delays in achieving revenue and cost synergies

of NewCo; the occurrence of any event that could give rise to termination of the proposed transaction; potential litigation in connection

with the proposed transaction or other settlements or investigations that may affect the timing or occurrence of the proposed transaction

or result in significant costs of defense, indemnification, and liability; evolving legal, regulatory, and tax regimes; changes in economic,

financial, political, and regulatory conditions, in the United States and elsewhere, and other factors that contribute to uncertainty

and volatility, natural and man-made disasters, civil unrest, pandemics, geopolitical uncertainty, and conditions that may result from

legislative, regulatory, trade, and policy changes associated with the current or subsequent U.S. administration; risks related

to disruption of management time from ongoing business operations due to the proposed transaction; certain restrictions during the pendency

of the proposed transaction that may impact TechTarget’s ability to pursue certain business opportunities or strategic transactions;

Informa’s, TechTarget’s, and NewCo’s ability to meet expectations regarding the accounting and tax treatments of the

proposed transaction; the risk that any announcements relating to the proposed transaction could have adverse effects on the market price

of TechTarget’s common stock; the risk that the proposed transaction and its announcement could have an adverse effect on the ability

of TechTarget to retain customers and retain and hire key personnel and maintain relationships with customers, suppliers, employees, stockholders,

strategic partners and other business relationships and on its operating results and business generally; market acceptance of TechTarget’s

and the relevant portion of the Informa Tech business’s products and services; the impact of pandemics and future health epidemics

and any related economic downturns, on TechTarget’s business and the markets in which it and its customers operate; changes in economic

or regulatory conditions or other trends affecting the internet, internet advertising and information technology industries; data privacy

and artificial intelligence laws, rules, and regulations; the impact of foreign currency exchange rates; certain macroeconomic factors

facing the global economy, including instability in the regional banking sector, disruptions in the capital markets, economic sanctions

and economic slowdowns or recessions, rising inflation and interest rate fluctuations on TechTarget’s and the relevant portion of

the Informa Tech business’s results; and other matters included in TechTarget’s filings with the SEC, including in Item

1A of its Annual Report on Form 10-K for the year ended December 31, 2022 and its Quarterly Report on Form 10-Q for the

quarter ended September 30, 2023. These risks, as well as other risks associated with the proposed transaction, will be more fully

discussed in the Proxy Statement/Prospectus that will be included in the registration statement on Form S-4 that will be filed with

the SEC in connection with the proposed transaction. While the list of factors presented here is, and the list of factors to be presented

in registration statement on Form S-4 will be, considered representative, no such list should be considered to be a complete statement

of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking

statements. We caution you not to place undue reliance on any of these forward-looking statements as they are not guarantees of future

performance or outcomes and that actual performance and outcomes, including, without limitation, our actual results of operations, financial

condition and liquidity, and the development of new markets or market segments in which we operate, may differ materially from those made

in or suggested by the forward-looking statements contained in this communication.

Any forward-looking statements speak

only as of the date of this communication. None of Informa, TechTarget, or NewCo undertakes any obligation to update any forward-looking

statements, whether as a result of new information or developments, future events, or otherwise, except as required by law. Neither future

distribution of this communication nor the continued availability of this communication in archive form on TechTarget’s website

at www.TechTarget.com or Informa’s website at www.informa.com/investors should be deemed to constitute an update or re-affirmation

of these statements as of any future date.

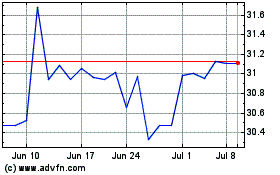

Tech Target (NASDAQ:TTGT)

Historical Stock Chart

From Mar 2024 to Apr 2024

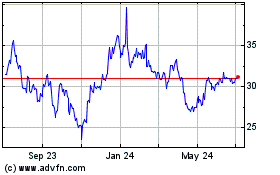

Tech Target (NASDAQ:TTGT)

Historical Stock Chart

From Apr 2023 to Apr 2024