Current Report Filing (8-k)

December 30 2021 - 7:57AM

Edgar (US Regulatory)

0001113169falsePRICE T ROWE GROUP INC00011131692021-12-292021-12-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 29, 2021

T. Rowe Price Group, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

Maryland

|

000-32191

|

52-2264646

|

(State of

incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

100 East Pratt Street, Baltimore, Maryland 21202

|

|

|

|

|

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant's telephone number, including area code: (410) 345-2000

N/A

(Former Name of Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol

|

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.20

|

|

TROW

|

|

The NASDAQ Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Introductory Note

As previously disclosed, on October 28, 2021, T. Rowe Price Group, Inc. (the “Company”) entered into a transaction agreement (the “Purchase Agreement”) with Oak Hill Advisors, L.P., a Delaware limited partnership (together with its affiliated entities, “OHA”), the holders of equity interests in OHA (the “Sellers”) and the other parties thereto. Upon the terms and subject to the conditions set forth in the Purchase Agreement, on December 29, 2021 (the “Closing Date”), the Company purchased from the Sellers substantially all of the issued and outstanding equity interests in OHA, for a purchase price of approximately $3.3 billion in the aggregate, including the retirement of outstanding OHA debt, with approximately seventy-four percent (74%) payable in cash and twenty-six percent (26%) in shares of the Company’s common stock, which amounted to the issuance of 4,447,088 shares of the Company’s common stock.

Upon the satisfaction of certain milestones by the OHA business, the Company will be required to pay earnout consideration of up to $900 million as part of an earn-out payment starting in early 2025 and ending in 2027 (the “Earnout Payment”), all as more completely described in the Company’s Form 8-K filed on October 28, 2021 (the “Company 8-K”), which is incorporated herein by reference.

Section 1 Registrant’s Business and Operations

Item 1.01 Entry into a Material Definitive Agreement.

In the Company 8-K, the Company disclosed that it had entered into a memorandum of understanding which, among other things, provided for potential incentive payments for certain of Sellers, including Glenn R. August, the chief executive officer of OHA, related to the growth of the OHA business. Further to this memorandum, on December 29, 2021, the Company and each of Glenn R. August, William H. Bohnsack, Jr., Adam B. Kertzner and Alan Schrager (each individual ,an “OHA Senior Partner”) entered into a value creation agreement (the “Value Creation Agreement”). The Value Creation Agreement provides that, promptly following the fifth anniversary of the Closing Date (the “Value Creation Date”), certain employees of the OHA business, including Mr. August, will receive incentive payments in the aggregate equal to ten percent (10%) of the appreciation in value of the OHA business, subject to an annualized preferred return to the Company, between the Closing Date and the Value Creation Date, all as calculated in accordance with the Value Creation Agreement (the “Value Creation Payment”). Seventy-five percent (75%) of the Value Creation Payment will be paid in cash (subject to applicable withholding) and the remaining twenty-five percent (25%) will be paid in shares of Company common stock, based on the volume-weighted average price for the five consecutive trading days ending on the date immediately prior to the date the Value Creation Payment is made. The Value Creation Payment may be partially accelerated upon the termination by the Company of an OHA Senior Partner without cause, a resignation of an OHA Senior Partner for good reason, or a change in control of OHA or certain of its affiliated entities.

The foregoing description of the Value Creation Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Value Creation Agreement which will be filed as an exhibit to the Company’s Form 10-K for the year ended December 31, 2021.

Section 2 Completion of Acquisition or Disposition of Assets

Item 2.01. Completion of Acquisition or Disposition of Assets

The description contained under the Introductory Note above is hereby incorporated by reference in its entirety into this Item 2.01.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off Balance Sheet Arrangement or a Registrant

The information set forth under the Introductory Note, with respect to the Earnout Payment, is incorporated by reference into this Item 2.03.

Section 3 - Securities and Trading Markets

Item 3.02. Unregistered Sale of Equity Securities.

The description contained under the Introductory Note concerning the issuance of shares of the Company’s common stock above is hereby incorporated by reference in its entirety into this Item 3.02. The shares of the

Company’s common stock were not registered under the Securities Act in reliance upon the exemption from registration provided by Section 4(a)(2) of the Securities Act of 1933, as amended (the "Securities Act"), in partial consideration for the acquisition of the equity interests in OHA from the Sellers. These securities may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirement.

Section 5 - Corporate Governance and Management

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Effective December 30, 2021, the first business day after the Closing Date, the appointment of Robert W. Sharps and Glenn R. August to the board of directors of the Company became effective, along with the appointment of Mr. August to the Company's Management Committee. The information set forth in the Company’s Form 8-K filed on December 8, 2021, with respect to the appointment of Mr. Sharps and Mr. August to the board of directors, is incorporated herein by reference into this Item 5.02.

Section 7 – Regulation FD Disclosure

Item 7.01 Regulation FD Disclosure

On December 30, 2021, the Company issued a press release announcing the completion of the transaction. A copy of the press release is furnished as Exhibit 99.1 attached hereto. The information in this report furnished pursuant to Item 7.01, including Exhibit 99.1 attached hereto, shall not be deemed “filed” for the purposes of Section 18 of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section. It may only be incorporated by reference in another filing under the Exchange Act or the Securities Act of 1933, if such subsequent filing specifically references such information.

Section 9 - Financial Statements and Exhibits.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

T. Rowe Price Group, Inc.

By: /s/ Jennifer B. Dardis

Jennifer B. Dardis

Vice President, Chief Financial Officer and Treasurer

Date: December 30, 2021

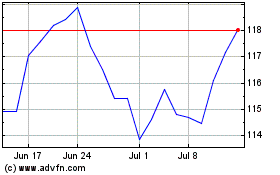

T Rowe Price (NASDAQ:TROW)

Historical Stock Chart

From Jun 2024 to Jul 2024

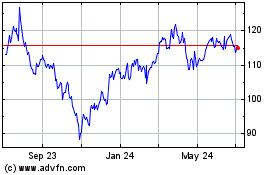

T Rowe Price (NASDAQ:TROW)

Historical Stock Chart

From Jul 2023 to Jul 2024