Steven Madden, Ltd. Announces Third Quarter and Nine Month Results

LONG ISLAND CITY, N.Y., Oct. 26 /PRNewswire-FirstCall/ -- Steven

Madden, Ltd. (NASDAQ:SHOO), a leading designer, wholesaler and

marketer of fashion footwear for women, men and children, today

announced financial results for the third quarter and nine months

ended September 30, 2004. For the third quarter, sales were $88.6

million compared to $88.7 million in the year-ago period. Operating

income was $5.9 million versus $11.7 million in the third quarter

of 2003. The decrease was a result of higher cost of goods sold as

a percentage of sales, sustained overall markdown pressure, and

higher operating expenses primarily associated with occupancy costs

from an increased retail store base. Net income was $3.7 million,

or $0.26 per diluted share, compared to $7.1 million, or $0.50 per

diluted share, in the prior year period. Retail revenues for the

third quarter increased 3.0% to $23.8 million from $23.1 million in

the same period of 2003. Same-store sales were flat versus a

decrease of 4.9% last year. The Company opened 7 new stores during

the quarter, ending the period with 90 company-owned retail

locations, including the Internet store, and remains on schedule to

open a total of approximately 8 to 12 new stores in 2004. Revenues

from the wholesale business, comprised of the Company's seven

brands, Steve Madden Womens, Steve Madden Mens, Stevies, l.e.i.,

Steven, UNIONBAY, and Candie's, were $64.9 million for the third

quarter compared with $65.6 million in the prior year period. The

wholesale business and the Company's overall margins were

significantly impacted by an increase in cost of goods sold due to

pricing pressure from both wholesale customers and suppliers.

Additionally, the l.e.i. division, in particular, continued to face

greater than expected pressure due to weak sales combined with a

demanding markdown environment. "Despite challenges related to a

late breaking back-to-school selling season, lackluster early boot

selling, and hurricanes in the southeast, our retail stores

delivered stable results as evidenced by a 3.0% increase in sales

and store productivity reflected in sales of $635 per square foot,"

commented Richard Olicker, President and Chief Operating Officer.

"Of note, we opened 7 stores in prime locations during the quarter

and intend to further expand this profitable segment of our

business. With respect to wholesale, a scenario of weak sales and

high markdown levels was especially acute within the l.e.i.

division. This not only diluted our overall gross profit by

approximately $1 million but also significantly impacted our

operating margin. We are diligently working to improve the

profitability of l.e.i. and our other brands by reducing expenses

across select divisions in the Company." For the first nine months

of 2004, sales were $253.6 million compared to $253.1 million for

the same period in 2003. Net income was $11.9 million, or $0.83 per

diluted share, versus $17.9 million, or $1.27 per diluted share, in

the comparable period last year. Arvind Dharia, Chief Financial

Officer, said, "With $68.5 million in cash, cash equivalents, and

investment securities, no short- or long-term debt, and $166.7

million in total stockholder equity, our balance sheet remains

strong." Company Outlook Based on current visibility, the Company

expects continued markdown and gross margin pressure in both its

wholesale and retail businesses for the remainder of the year. In

addition, given trends to date in the fourth quarter, the Company

anticipates soft consumer demand for its l.e.i., Stevies, and

UNIONBAY brands. Finally, the Company believes other income growth

will moderate at least through the end of the year. Taking the

above factors into account, the Company is updating its previously

announced expectations for 2004. While reiterating its expectation

of a total annual sales increase of low single digits over 2003,

the Company now anticipates annual diluted earnings per share of

$0.86 to $0.88. Jamieson Karson, Chairman and Chief Executive

Officer, concluded, "Despite facing very challenging circumstances,

we take comfort in the viability of our superior brand equity,

unique business model, and pristine balance sheet. We are confident

not only in this strong foundation but also in the Company's

long-term prospects, as evidenced by our repurchase of

approximately 198,000 shares this quarter and a total of

approximately 283,200 shares over the past six months. "Using our

cash balance productively and maximizing shareholder value remain

among our very top priorities. Specifically, during the quarter we

expanded our productive and profitable retail store base and opened

several new concept shops that build our brand awareness and drive

sales at wholesale doors. In addition, we further extended our

international presence by beginning distribution in Australia, a

market which holds great promise for the fashion-forward Steve

Madden brand. Finally, we continue to thoroughly evaluate options

to diversify our business through licensing opportunities and

strategic acquisitions. All of these initiatives are part of our

ongoing efforts to drive profitability and enhance shareholder

value for the long- term." Conference Call Interested shareholders

are invited to listen to the third quarter earnings conference call

scheduled for today, Tuesday, October 26, 2004, at 10 a.m. Eastern

Time. The call will be broadcast live over the Internet and can be

accessed by logging onto http://www.stevemadden.com/. An online

archive of the broadcast will be available within one hour of the

conclusion of the call and will be accessible until November 9,

2004. Additionally, a replay of the call can be accessed by dialing

(877) 519-4471, pin number 5309992, and will be available until

October 28, 2004. Steven Madden, Ltd. Steven Madden, Ltd. designs

and markets fashion-forward footwear for women, men and children.

The shoes are sold through Steve Madden retail stores, department

stores, apparel and footwear specialty stores, and on-line at

http://www.stevemadden.com/. The Company has several licenses for

the Steve Madden and Stevies brands, including eyewear, hosiery,

and belts, owns and operates one retail store under its Steven

brand, and is the licensee for l.e.i Footwear, Candie's Footwear

and UNIONBAY Men's Footwear. Statements in this press release that

are not statements of historical or current fact constitute

"forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995. Such forward-looking

statements involve known and unknown risks, uncertainties and other

unknown factors that could cause the actual results of the Company

to be materially different from the historical results or from any

future results expressed or implied by such forward-looking

statements. In addition to statements which explicitly describe

such risks and uncertainties readers are urged to consider

statements labeled with the terms "believes," "belief," "expects,"

"intends," "anticipates" or "plans" to be uncertain and

forward-looking. The forward looking statements contained herein

are also subject generally to other risks and uncertainties that

are described from time to time in the Company's reports and

registration statements filed with the Securities and Exchange

Commission. (tables follow) CONSOLIDATED STATEMENT OF OPERATIONS

(In thousands, except per share data) - Unaudited Three Months

Ended Nine Months Ended Sep 30, Sep 30, Sep 30, Sep 30,

Consolidated: 2004 2003 2004 2003 Net Sales 88,610 88,663 253,612

253,105 Cost of Sales 57,160 53,067 158,178 154,236 Gross Profit

31,450 35,596 95,434 98,869 Commission and licensing fee income

1,702 2,205 4,929 6,040 Operating Expenses 27,285 26,094 81,340

75,324 Income from Operations 5,867 11,707 19,023 29,585 Interest

and other Income, Net 488 426 1,497 1,218 Income Before provision

for Income Taxes 6,355 12,133 20,520 30,803 Provision for Income

Tax 2,669 5,060 8,618 12,901 Net Income 3,686 7,073 11,902 17,902

Basic income per share 0.28 0.54 0.90 1.38 Diluted income per share

0.26 0.50 0.83 1.27 Weighted average common shares outstanding -

Basic 13,177 13,073 13,243 12,930 Weighted average common shares

outstanding - Diluted 14,220 14,267 14,328 14,061 BALANCE SHEET

HIGHLIGHTS Sep 30, 2004 Dec 31,2003 Sep 30, 2003 Consolidated

Consolidated Consolidated (Unaudited) (Unaudited) Cash and cash

equivalents 18,128 53,073 34,180 Investment Securities 50,408

32,659 44,409 Total Current Assets 112,445 121,995 109,544 Total

Assets 181,154 177,870 170,518 Total Current Liabilities 12,264

16,855 15,406 Total Stockholder Equity 166,749 159,187 153,398

DATASOURCE: Steven Madden, Ltd. CONTACT: Richard Olicker, President

& Chief Operating Officer, or Arvind Dharia, Chief Financial

Officer, both of Steven Madden, Ltd., +1-718-446-1800; or Investor

Relations, Cara O'Brien, or Lila Sharifian, or Press, Melissa

Merrill, all of Financial Dynamics, +1-212-850-5600, for Steven

Madden, Ltd. Web site: http://www.stevemadden.com/

Copyright

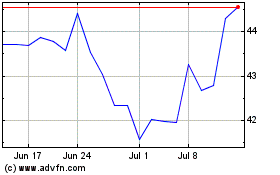

Steven Madden (NASDAQ:SHOO)

Historical Stock Chart

From Aug 2024 to Sep 2024

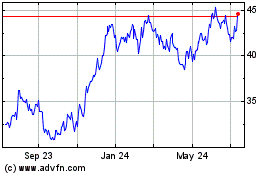

Steven Madden (NASDAQ:SHOO)

Historical Stock Chart

From Sep 2023 to Sep 2024