Steve Madden (Nasdaq: SHOO), a leading designer and marketer of

fashion footwear and accessories for women, men and children, today

announced financial results for the third quarter ended September

30, 2009.

- Third quarter consolidated net

sales increased 9.4% to $140.1 million.

- Operating margin rose to 20.2%

in the third quarter 2009, compared with operating margin of 13.8%

in the same period of 2008.

- Net income for the third quarter

was $17.8 million, or $0.97 per diluted share, compared to $11.1

million, or $0.62 per diluted share, in the third quarter of

2008.

- Full-year 2009 guidance for

diluted EPS is in the range of $2.55 to $2.65.

Edward Rosenfeld, Chairman and Chief Executive Officer

commented, "We were extremely pleased to have delivered record

sales and earnings for the third quarter of 2009. The strength in

our business is a reflection of Steve and his team’s ability to

consistently create trend-right product and our organization’s

speed in getting that merchandise to market. Looking ahead, we are

very enthusiastic about our recently announced business ventures

including the launch of our newly licensed Steve Madden apparel

line as well as our new license agreement for Olsenboye footwear

and accessories. Both of these ventures offer significant growth

opportunity. Overall, we feel good about our portfolio of brands

and the long term growth prospects for our company.”

Third Quarter 2009 Results:

Third quarter consolidated net sales were $140.1 million

compared to $128.1 million reported in the comparable period of

2008. Net sales from the wholesale business grew 15.0% to $112.0

million compared to $97.3 million in the third quarter of 2008,

driven by strength in the Madden Girl, Steven by Steve Madden,

Steve Madden Women’s and Steve Madden Men’s wholesale footwear

divisions. In addition, the new Elizabeth and James brand and the

recently acquired Madden Zone, formerly SML Brands, also

contributed to the sales growth.

Retail net sales totaled $28.2 million compared to $30.7 million

in the third quarter of the prior year. Same store sales decreased

7.6% in the third quarter of 2009 compared to a 7.8% same store

sales increase in the same period of 2008.

Gross margin improved to 44.0% as compared to 41.4% in the third

quarter of 2008. For the wholesale business, gross margin was 41.2%

as compared to 36.3% in the prior year's third quarter, with the

increase driven primarily by reduced markdown allowances as a

result of strong sell-through at retail. Retail division gross

margin was 55.2% as compared to 57.4% for the comparable period

last year. The decrease in retail gross margin was primarily due to

increased promotional activity at retail stores as compared to last

year’s third quarter.

Operating expenses as a percent of sales for the third quarter

of 2009 were 27.9% as compared to 31.0% in the same period of the

prior year. The 310 basis point improvement was mainly driven by

leverage on higher sales as well as fewer stores and reduced store

payroll expense in the Company’s remaining stores.

Net income for the third quarter of 2009 totaled $17.8 million,

or $0.97 per diluted share as compared to net income of $11.1

million, or $0.62 per diluted share, in the same period of

2008.

The Company closed one retail location and licensed out three

stores during the third quarter of 2009, ending the quarter with 88

retail locations, including the Internet store.

Nine-Month 2009 Results:

For the first nine months of 2009, consolidated net sales were

$364.0 million compared to $337.9 million in the comparable period

last year.

Net income totaled $36.6 million, or $2.00 per diluted share,

for the first nine months of 2009 compared to $20.8 million or

$1.11 per diluted share in the first nine months of 2008. Net

income for the first nine months of 2008 included a charge totaling

$3.0 million post-tax, or $0.16 per diluted share, related to the

resignation of the Company’s former CEO.

As of September 30, 2009, cash, cash equivalents and marketable

securities totaled $125.7 million.

Arvind Dharia, Chief Financial Officer, commented, "Our balance

sheet remains very healthy as a result of the continuation of

strong growth in our earnings and prudent capital management."

Company Outlook

For fiscal 2009, the Company expects net sales to increase in

the range of 7%-8% compared to net sales in 2008.

Diluted EPS for 2009 is expected to be in the range of $2.55 to

$2.65.

Conference Call Information

The Company will host its third quarter 2009 earnings conference

call on Tuesday, November 3, 2009, at 8:30 a.m. Eastern Time. The

call will be broadcast live over the Internet and can be accessed

by logging onto http://www.stevemadden.com under the

Investor Relations section and an online archive of the broadcast

will be available within one hour of the conclusion of the call

which will remain accessible for a period of 30 days following the

call. Additionally, a replay will also be available two hours

following the call through December 3, 2009, via telephone at

1-888-203-1112 (U.S.) and 1-719-457-0820 (international) by

entering the replay pin 8357547.

About Steve Madden

Steve Madden designs and markets fashion-forward footwear and

accessories for women, men and children. The shoes and accessories

are sold through 88 company-owned retail stores (including the

Company’s online store), department stores, and apparel, footwear,

and accessories specialty stores. The Company has several licensees

for its brands, including for apparel, outerwear, cold weather

accessories, eyewear, hosiery, and bedding and bath products. The

Company is the licensee for footwear, handbags and belts for

Fabulosity and Olsenboye, for footwear for Elizabeth and James and

l.e.i. and for handbags and belts for Betsey Johnson and Daisy

Fuentes.

Safe Harbor

This press release contains certain statements which are

“forward-looking statements” as that term is defined in the federal

securities laws. The events described in forward-looking statements

contained in this press release may not occur. Generally these

statements are based on current expectations and assumptions

relating to business plans or strategies, projected or anticipated

benefits or other consequences of the Company's plans or

strategies, projected or anticipated benefits from acquisitions to

be made by the Company, or projections involving anticipated

revenues, earnings or other aspects of the Company's operating

results. The words "may," "will," "expect," "believe,"

"anticipate," "project," "plan," "intend," "estimate," and

"continue," and their opposites and similar expressions are

intended to identify forward-looking statements. The Company

cautions you that these statements are not guarantees of future

performance or events and are subject to a number of uncertainties,

risks and other influences, many of which are beyond the Company's

control, that may influence the accuracy of the statements and the

projections upon which the statements are based. Factors which may

affect the Company's results include, but are not limited to, the

risks and uncertainties discussed in the Company's Annual Report on

Form 10-K for the year ended December 31, 2008. Any one or more of

these uncertainties, risks and other influences could materially

affect the Company's results of operations and whether

forward-looking statements made by the Company ultimately prove to

be accurate. The Company's actual results, performance and

achievements could differ materially from those expressed or

implied in these forward-looking statements.

All information in this release is as of November 3, 2009. The

Company undertakes no obligation to publicly update or revise any

forward-looking statements, whether from new information, future

events or otherwise.

STEVEN MADDEN LTD

CONSOLIDATED STATEMENT OF

OPERATIONS

(In thousands, except per share data)

Three Months Ended Nine Months Ended

Consolidated:

Sep

30, 2009

Sep

30, 2008

Sep

30, 2009

Sep

30, 2008

Net Sales $ 140,138 $ 128,093 $ 364,039 $ 337,949 Cost of

Sales 78,462 75,114 209,313 199,218

Gross Profit 61,676 52,979 154,726 138,731 Commission and licensing

fee income 5,726 4,497 15,993 11,056 Operating Expenses

39,088 39,770 112,729 117,097 Income from

Operations 28,314 17,706 57,990 32,690 Interest and other Income,

Net 488 248 1,252 1,142 Income Before

provision for Income Taxes 28,802 17,954 59,242 33,832 Provision

for Income Tax 10,971 6,866 22,690

13,058 Net Income $ 17,831 $ 11,088 $ 36,552 $ 20,774

Basic income per share $ 0.99 $ 0.62 $ 2.03 $ 1.12 Diluted income

per share $ 0.97 $ 0.62 $ 2.00 $ 1.11 Weighted average

common shares outstanding -

Basic 18,101 17,763 18,002

18,478 Weighted average common shares

outstanding - Diluted 18,449 17,986

18,239 18,675

STEVEN MADDEN LTD

BALANCE SHEET HIGHLIGHTS

(In thousands, except per share data) Sep 30

2009 Dec 31, 2008 Sep 30, 2008

Consolidated

Consolidated

Consolidated

(Unaudited)

(Unaudited)

Cash and cash equivalents $ 47,622 $ 89,588 $ 33,115

Investment Securities 78,069 35,224 23,554 Total Current Assets

182,550 194,736 175,996 Total Assets 316,290 284,693 246,296

Advances Payable - Factor - 30,168 - Total Current Liabilities

61,144 72,490 42,824 Total Stockholder Equity 249,898 206,242

198,864

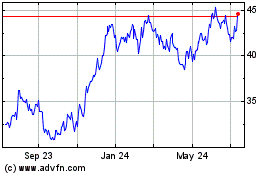

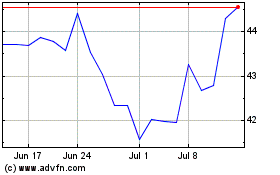

Steven Madden (NASDAQ:SHOO)

Historical Stock Chart

From Jun 2024 to Jul 2024

Steven Madden (NASDAQ:SHOO)

Historical Stock Chart

From Jul 2023 to Jul 2024