false0001419612NASDAQ00014196122023-10-192023-10-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): October 19, 2023

SOLAREDGE TECHNOLOGIES, INC

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-36894

|

|

20-5338862

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

| |

|

|

|

1 Hamada Street,

Herziliya Pituach, Israel

|

|

4673335

|

|

(Address of Principal executive offices)

|

|

(Zip Code)

|

Registrant’s Telephone number, including area code: 972 (9) 957-6620

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instructions A.2 below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common stock, par value $0.0001 per share

|

SEDG

|

NASDAQ (Global Select Market)

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ◻

|

Item 2.02.

|

Results of Operations and Financial Condition.

|

On October 19, 2023, SolarEdge Technologies, Inc. (the

“Company”) issued a press release announcing selected preliminary financial results for its

fiscal third quarter ended September 30, 2023. A copy of the Company’s press

release containing this information is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information contained in this Item 2.02, including Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes of

Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or

otherwise subject to the liabilities under that section, or incorporated by reference in

any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

Exhibit 104

|

|

Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused

this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

SOLAREDGE TECHNOLOGIES, INC. |

|

| |

|

|

|

|

Date: October 19, 2023

|

By:

|

/s/ Ronen Faier |

|

| |

Name:

|

Ronen Faier |

|

| |

Title:

|

Chief Financial Officer |

|

SolarEdge Announces Preliminary Financial Results;

Will Announce Financial Results for the Third Quarter 2023

on Wednesday, November 1, 2023

MILPITAS, Calif. — October 19, 2023. SolarEdge Technologies, Inc. (Nasdaq: SEDG), a global leader in smart energy technology, today provided selected preliminary unaudited financial results for the third

quarter ended September 30, 2023.

“During the second part of the third quarter of 2023, we experienced substantial unexpected cancellations and pushouts of existing

backlog from our European distributors,” said Zvi Lando, Chief Executive Officer of SolarEdge. “We attribute these cancellations and pushouts to higher than expected inventory in the channels and slower than expected installation rates. In particular,

installation rates for the third quarter were much slower at the end of the summer and in September where traditionally there is a rise in installation rates.”

As a result, third quarter revenue, gross margin and operating income will be below the low end of the prior guidance range.

Additionally, the Company anticipates significantly lower revenues in the fourth quarter of 2023 as the inventory destocking process continues.

“The adjusted guidance is unrelated to the tragic events that have unfolded in Israel. While there has been some impact on daily

routines at our headquarters, our offices and facilities are open worldwide, including in Israel, and we are manufacturing and providing customer support without interruption,” added Lando.

Third quarter revenue is now expected to be in the range of $720 million to $730 million, compared to the previous expectation of

$880 million to $920 million.

GAAP gross margin is now expected to be within the range of 19% to 20%.

Non-GAAP gross margin* is now expected to be within the range of 20.1% to 21.1%, compared to the previous expectation of 28% to 31%.

GAAP operating loss is now expected to be within the range of $9 million to $28 million.

Non-GAAP operating income* is now expected to be within the range of $12 million to $31

million, compared to the previous expectation of $115 million to $135 million.

* Non-GAAP financial measure. See “Non-GAAP Financial Measures” for additional information on non-GAAP financial measures and a

reconciliation to the most comparable GAAP measures.

Conference Call

The Company will host a conference call to discuss its results for the third quarter ended September 30, 2023 at 4:30 p.m. ET on

Wednesday, November 1, 2023. The call will be available, live, to interested parties by dialing 800--343-4136. For international callers, please dial +1 203-518-9843. The Conference ID is SEDG. To avoid a delay in

connecting to the call, please dial in 10 minutes prior to the start time. A live webcast will also be available in the Investors Relations section of the Company’s website at: http://investors.solaredge.com

A replay of the webcast will be available in the Investor Relations section of the Company’s web site approximately two hours after

the conclusion of the call and will remain available for approximately 30 calendar days.

About SolarEdge

SolarEdge is a global leader in smart energy technology. By leveraging world-class engineering capabilities and with a relentless

focus on innovation, SolarEdge creates smart energy solutions that power our lives and drive future progress. SolarEdge developed an intelligent inverter solution that changed the way power is harvested and managed in photovoltaic (PV) systems. The

SolarEdge DC optimized inverter seeks to maximize power generation while lowering the cost of energy produced by the PV system. Continuing to advance smart energy, SolarEdge addresses a broad range of energy market segments through its PV, storage, EV

charging, batteries, electric vehicle powertrains, and grid services solutions. SolarEdge is online at www.solaredge.com

Cautions Regarding Preliminary Estimates

The foregoing preliminary financial information reflects management’s current views with respect to the Company’s financial results.

Such preliminary financial information is subject to the finalization and closing of the accounting books and records of the Company, which have yet to be fully performed, and should not be viewed as a substitute for full quarterly financial statements

prepared in accordance with applicable accounting standards. In the course of preparing and finalizing the Company’s financial statements for the third quarter ended September 30, 2023, these preliminary estimates will be subject to change and the

Company may identify items that will require it to make adjustments to such estimates. For these or other reasons, these preliminary financial estimates may not ultimately be indicative of the Company’s results for the third quarter ended September 30,

2023 and actual results may differ materially from those described above. No independent registered public accounting firm has reviewed, examined or performed any procedures with respect to, nor have they expressed any form of assurance on, these

preliminary estimated results.

Use of Non-GAAP Financial Measures

The Company has presented certain non-GAAP financial measures in this release, such as non-GAAP gross margin and non-GAAP operating

income. Generally, a non-GAAP financial measure is a numerical measure of a company's performance, financial position, or cash flows that either exclude or include amounts that are not normally excluded or included in the most directly comparable

measure calculated and presented in accordance with generally accepted accounting principles in the United States, or GAAP. Reconciliation of each non-GAAP financial measure to the most directly comparable GAAP financial measure can be found in the

accompanying tables to this release. These non-GAAP financial measures do not reflect a comprehensive system of accounting, differ from GAAP measures with the same captions and may differ from non-GAAP financial measures with the same or similar

captions that are used by other companies. As such, these non-GAAP measures should be considered as a supplement to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP.

The Non-GAAP measures are presented in this press release because we believe that they provide investors with a means of evaluating

and understanding how the Company’s management evaluates the company’s operating performance. The non-GAAP financial measures in this earnings release may differ from similarly titled measures used by other companies. See “Reconciliation of GAAP

to Non-GAAP Financial Measures” below for reconciliation of relevant GAAP to non-GAAP measures presented in this release.

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995

This release contains forward looking statements which are made pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. These forward-looking statements include information, among other things, concerning: expectations as to revenues and inventory in the third and fourth quarters of 2023, our possible or assumed future results of

operations; future demands for solar energy solutions; business strategies; technology developments; financing and investment plans; dividend policy; competitive position; industry and regulatory environment; general economic conditions; potential

growth opportunities; and the effects of competition. These forward-looking statements are often characterized by the use of words such as “anticipate,” “believe,” “could,” “seek,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,”

“project,” “should,” “will,” “would” or similar expressions and the negative or plural of those terms and other like terminology.

Forward-looking statements are only predictions based on our current expectations and our projections about future events. These

forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from those expressed or implied by the

forward-looking statements. Given these factors, you should not place undue reliance on these forward-looking statements. These factors include, but are not limited to, the matters discussed in the section entitled “Risk Factors” of our Annual Report

on Form 10-K for the year ended December 31, 2022, filed on February 22, 2023 and our subsequent quarterly reports filed on Form 10-Q, Current Reports on Form 8-K and other reports filed with the SEC. All information set forth in this release is as of

October 19, 2023. The Company undertakes no duty or obligation to update any forward-looking statements contained in this release, whether as a result of new information, future events or changes in its expectations or otherwise, except as may be

required by applicable law, regulation or other competent legal authority.

Investor Contacts

SolarEdge Technologies, Inc.

JB Lowe, Head of Investor Relations

investors@solaredge.com

Sapphire Investor Relations, LLC

Erica Mannion or Michael Funari

investors@solaredge.com

Reconciliation of GAAP to Non-GAAP Financial Measures

The following table presents a reconciliation of GAAP gross margin to non-GAAP gross margin and reconciliation of GAAP operating

income (loss) to non-GAAP operating income (loss) for the three months ended September 30, 2023.

|

Reconciliation of GAAP to non-GAAP Financial

Measures

|

Q3 FY23

Preliminary Results

|

| |

Low

|

High

|

|

GAAP gross margin

|

19.0%

|

20.0%

|

|

Add:

|

|

|

|

Stock-based compensation expense

|

0.8%

|

|

Acquisition costs and other costs

|

0.3%

|

|

Non-GAAP gross margin

|

20.1%

|

21.1%

|

| |

|

|

|

GAAP operating income (loss) ($ millions)

|

$(28)

|

$(9)

|

|

Add:

|

|

|

|

Stock-based compensation expense

|

$37

|

|

Acquisition cost and other costs

|

$3

|

|

Non-GAAP operating income

|

$12

|

$31

|

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

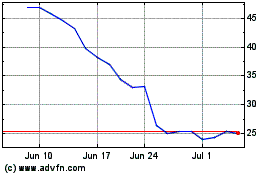

SolarEdge Technologies (NASDAQ:SEDG)

Historical Stock Chart

From Mar 2024 to Apr 2024

SolarEdge Technologies (NASDAQ:SEDG)

Historical Stock Chart

From Apr 2023 to Apr 2024