UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Schedule 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| |

|

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

|

| ☒ |

Definitive Proxy Statement |

| |

|

| ☐ |

Definitive Additional Materials |

| |

|

| ☐ |

Soliciting Material under § 240.14a-12 |

| SILO PHARMA, INC. |

| (Name of Registrant as Specified In Its Charter) |

| |

| |

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check all boxes that

apply):

| ☒ |

No fee required |

| |

|

| ☐ |

Fee paid previously with preliminary materials. |

| |

|

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a- 6(i)(1) and 0-11 |

SILO

PHARMA, INC.

560 Sylvan Avenue, Suite 3160

Englewood Cliffs, New Jersey 07632

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on December 4, 2023

Dear Stockholders:

The 2023 Annual Meeting of

Stockholders (the “2023 Annual Meeting”) of Silo Pharma, Inc., a Delaware corporation (the “Company,” “we,”

“us,” or “our”), will be held on December 4, 2023, at 11:00 a.m. Eastern Time at our satellite office located

at 677 N Washington Boulevard, Sarasota, Florida 34236.

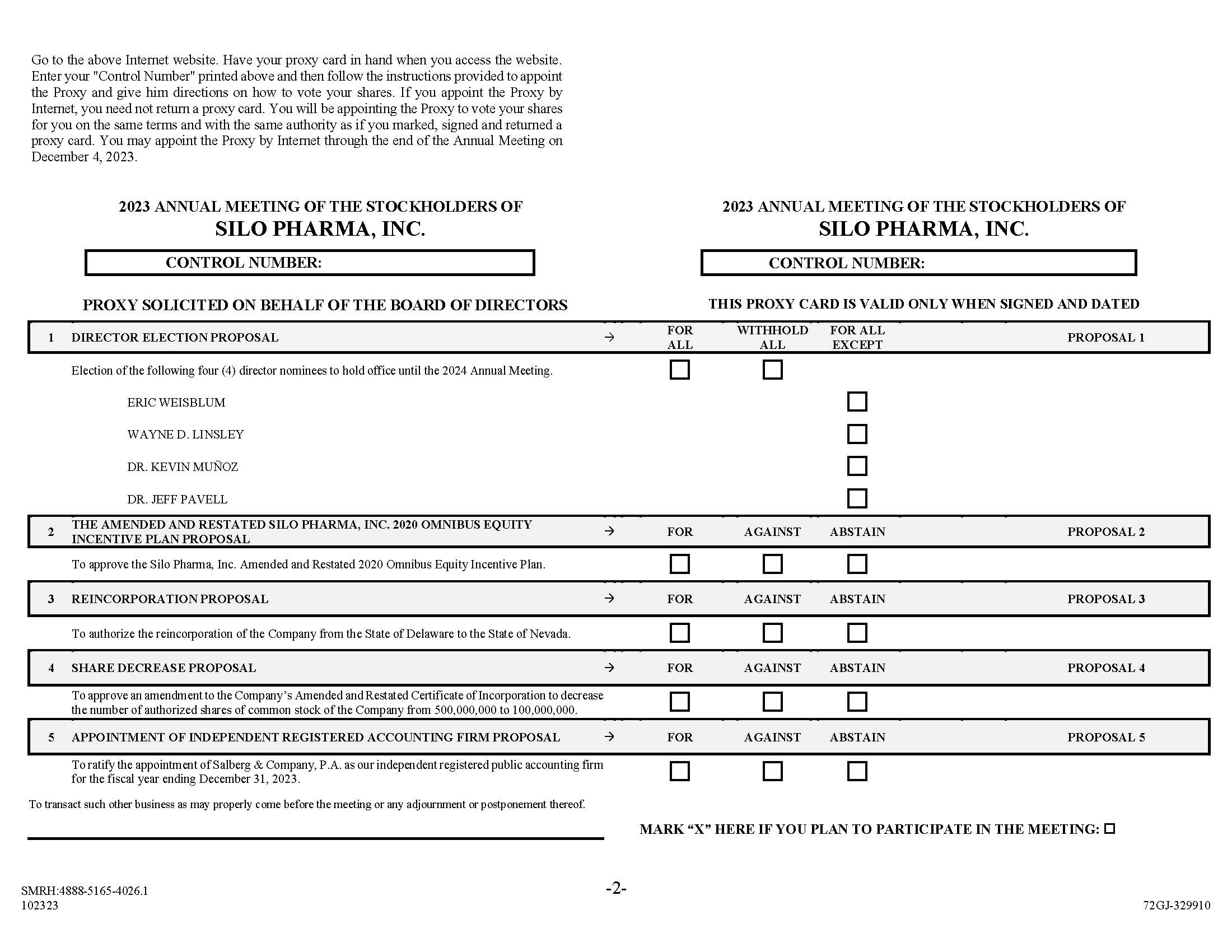

At the 2023 Annual Meeting,

the holders of our outstanding common stock will act on the following matters:

|

1. |

To elect four (4) members to our Board of Directors; |

| |

|

|

|

2. |

To approve the Silo Pharma, Inc. Amended and Restated 2020 Omnibus Equity Incentive Plan; |

| |

|

|

|

3. |

To authorize the reincorporation of the Company from the State of Delaware to the State of Nevada (the “Reincorporation”); |

| |

|

|

|

4. |

To approve an amendment to the Company’s Amended and Restated Certificate of Incorporation to decrease the number of authorized shares of common stock of the Company from 500,000,000 to 100,000,000 (the “Share Decrease Proposal”); |

| |

|

|

|

5. |

To ratify the appointment of Salberg & Company, P.A. (“Salberg”) as our independent registered public accounting firm for the fiscal year ending December 31, 2023; and |

| |

|

|

|

6. |

To transact such other business as may properly come before the meeting or any adjournment or postponement thereof. |

Our Board unanimously recommends

that you vote “FOR” the election of our Board’s director nominees (Proposal 1), “FOR” the

approval of the Amended and Restated 2020 Plan (Proposal 2), “FOR” the reincorporation from Delaware to Nevada (Proposal

3), “FOR” the approval of amendment to decrease the number of authorized shares of common stock of the Company from

500,000,000 to 100,000,000 (Proposal 4), and “FOR” the ratification of the appointment of Salberg as our independent

registered public accounting firm for the fiscal year ending December 31, 2023 (Proposal 5).

Instead of mailing a printed copy of our proxy materials to all of

our stockholders, we provide access to these materials via the Internet. This reduces the amount of paper necessary to produce these materials

as well as the costs associated with mailing these materials to all stockholders. Accordingly, on or about October 23, 2023, we will begin

mailing a Notice of Internet Availability of Proxy Materials (the “Notice”) to all stockholders of record on our books at

the close of business on October 12, 2023, the record date for the 2023 Annual Meeting, and will post our proxy materials on the website

referenced in the Notice. As more fully described in the Notice, stockholders may choose to access our proxy materials on the website

referred to in the Notice or may request to receive a printed set of our proxy materials. In addition, the Notice and website provide

information regarding how you may request to receive proxy materials in printed form by mail, or electronically by email, on an ongoing

basis.

If you are a stockholder of record, you may vote

in one of the following ways:

Stockholders of Record

For your convenience, record

holders of our common stock have four methods of voting:

|

1. |

Vote by Internet. The website address for Internet voting is on your vote instruction form; |

| |

|

|

|

2. |

Vote by mail. Mark, date, sign and promptly mail the enclosed proxy card; |

| |

|

|

|

3. |

Vote by fax. Mark, date, sign and promptly fax the enclosed proxy card to the fax number on your vote instruction form; or |

| |

|

|

|

4. |

Vote in person. Attend and vote at the Annual Meeting. |

If your shares are held in

“street name,” meaning that they are held for your account by a broker or other nominee, you will receive instructions from

the holder of record that you must follow for your shares to be voted.

Beneficial Owners of Shares Held in Street

Name

For your convenience, beneficial

owners of our common stock have four methods of voting:

| 1. | Vote by Internet. The

website address for Internet voting is on your vote instruction form; |

| 2. | Vote by mail. Mark,

date, sign and promptly mail your vote instruction form; |

| 3. | Vote by fax. Mark, date,

sign and promptly fax the enclosed proxy card to the fax number on your vote instruction form; or |

| 4. | Vote in person. Obtain

a valid legal proxy from the organization that holds your shares and attend and vote at the Annual Meeting. |

All stockholders are cordially

invited to attend the Annual Meeting. Whether or not you expect to attend the Annual Meeting, please complete, sign and date the enclosed

proxy and return it promptly. If you plan to attend the Annual Meeting and wish to vote your shares personally, you may do so at any time

before the proxy is voted.

IF YOU PLAN TO ATTEND

Please note that space limitations

make it necessary to limit attendance to stockholders of record only. Registration and seating will begin at 10:30 a.m. Eastern Time.

Shares of common stock can be voted at the Annual Meeting only if the holder is present in person or by valid proxy.

For admission to the Annual

Meeting, each stockholder may be asked to present valid picture identification, such as a driver’s license or passport, and proof

of stock ownership as of the Record Date, such as the enclosed proxy card or a brokerage statement reflecting stock ownership. Cameras,

recording devices and other electronic devices will not be permitted at the meeting.

If you have any questions

or need assistance voting your shares, please call our proxy solicitor, Campaign Management:

Strategic Stockholder Advisor and Proxy Solicitation

Agent

15 West 38th Street, Suite #747, New York,

New York 10018

North American Toll-Free Phone:

1-855-246-4705

Email: info@campaign-mgmt.com

Call Collect Outside North America: +1 (212) 632-8422

| By the Order of the Board of Directors |

|

| |

|

| /s/ Eric Weisblum |

|

| Eric Weisblum |

|

| Chairman of the Board of Directors and Chief Executive Officer |

|

| Dated: October 23, 2023 |

|

Whether or not you expect to attend the Annual

Meeting in person, we urge you to vote your shares at your earliest convenience. This will ensure the presence of a quorum at the Annual

Meeting. Promptly voting your shares will save the Company the expenses and extra work of additional solicitation. An addressed envelope

for which no postage is required if mailed in the United States is enclosed if you wish to vote by mail. Submitting your proxy now will

not prevent you from voting your shares at the Annual Meeting if your desire to do so, as your proxy is revocable at your option. Your

vote is important, so please act today!

SILO

PHARMA, INC.

560 Sylvan Avenue, Suite 3160

Englewood Cliffs, New Jersey 07632

PROXY STATEMENT FOR THE

2023 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON DECEMBER 4, 2023

IMPORTANT

NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 2023 ANNUAL MEETING TO BE HELD ON DECEMBER 4, 2023

Copies of this proxy statement, the form of

proxy card and the Annual Report on Form 10-K for the fiscal year ended December 31, 2022 (the “2022 Annual Report”) are available

without charge at https://westcoaststocktransfer.com/proxy-silo/, by telephone at 619-664-4780, by email to cs@wcsti.com, or by notifying

our Corporate Secretary, in writing, at Silo Pharma, Inc., 560 Sylvan Avenue, Suite 3160, Englewood Cliffs, New Jersey 07632.

The board of directors (“Board” or

“Board of Directors”) of Silo Pharma, Inc. (“Company,” “we,” “us,” or “our”)

is soliciting the enclosed proxy for use at its 2023 annual meeting of stockholders (the “2023 Annual Meeting” or “Annual

Meeting”). The 2023 Annual Meeting will be held on December 4, 2023 at 11:00 a.m. Eastern Time at our satellite office located at

677 N Washington Boulevard, Sarasota, Florida 34236.

On or about October 23, 2023, we will begin mailing a Notice of

Internet Availability of Proxy Materials (the “Notice”) to our stockholders (other than those who previously requested electronic

or paper delivery of proxy materials), directing stockholders to a website where they can access our proxy materials, including this proxy

statement and the 2022 Annual Report, and view instructions on how to vote. If you would prefer to receive a paper copy of our proxy materials,

please follow the instructions included in the Notice. If you have previously elected to receive our proxy materials electronically, you

will continue to receive access to those materials via e-mail unless you elect otherwise.

QUESTIONS AND ANSWERS ABOUT THIS PROXY MATERIAL

AND VOTING

Why did I Receive a Notice of Internet Availability

of Proxy Materials in the Mail instead of a Full Set of Proxy Materials?

We are pleased to take advantage

of the SEC rule that allows companies to furnish their proxy materials over the Internet. Accordingly, we have sent to our stockholders

of record a Notice of Internet Availability of Proxy Materials. Instructions on how to access the proxy materials over the Internet free

of charge or to request a paper copy may be found in the Notice. Our stockholders may request to receive proxy materials in printed form

by mail or electronically on an ongoing basis. A stockholder’s election to receive proxy materials by mail or electronically will

remain in effect until the stockholder changes its election.

What Does it Mean if I Receive More than One

Notice?

If you receive more than

one Notice, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on each

Notice to ensure that all of your shares are voted.

How do I attend the Annual Meeting?

The Annual Meeting will be

held on December 4, 2023 at 11:00 a.m. Eastern at our satellite office located at 677 N Washington Boulevard, Sarasota, Florida 34236.

Who May Attend the Annual Meeting?

Only record holders and beneficial

owners of our common stock, or their duly authorized proxies, may attend the Annual Meeting. If your shares of common stock are held in

street name, you will need to bring a copy of a brokerage statement or other documentation reflecting your stock ownership as of the Record

Date (as defined herein).

Who is Entitled to Vote?

The

Board has fixed the close of business on October 12, 2023 as the record date (the “Record Date”) for the determination

of stockholders entitled to notice of, and to vote at, the Annual Meeting or any adjournment or postponement thereof. On the Record Date,

there were 3,108,797 shares of common stock outstanding. Each share of common stock represents one vote that may be voted on each

proposal that may come before the Annual Meeting.

What is the Difference Between Holding Shares

as a Record Holder and as a Beneficial Owner (Holding Shares in Street Name)?

If your shares are registered

in your name with our transfer agent, West Coast Stock Transfer, Inc., you are the “record holder” of those shares. If you

are a record holder, these proxy materials have been provided directly to you by the Company.

If your shares are held in

a stock brokerage account, a bank or other holder of record, you are considered the “beneficial owner” of those shares held

in “street name.” If your shares are held in street name, these proxy materials have been forwarded to you by that organization.

The organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As the

beneficial owner, you have the right to instruct this organization on how to vote your shares.

What am I Voting on?

There are five matters scheduled for a vote:

| |

1. |

To elect four (4) members to our Board of Directors; |

| |

|

|

| |

2. |

To approve the Silo Pharma, Inc. Amended and Restated 2020 Omnibus Equity Incentive Plan; |

| |

|

|

| |

3. |

To authorize the reincorporation of the Company from the State of Delaware to the State of Nevada (the “Reincorporation”); |

| |

|

|

| |

4. |

To approve an amendment to the Company’s Amended and Restated Certificate of Incorporation to decrease the number of authorized shares of common stock of the Company from 500,000,000 to 100,000,000 (the “Share Decrease Proposal”); |

| |

|

|

| |

5. |

To ratify the appointment of Salberg & Company, P.A. (“Salberg”) as our independent registered public accounting firm for the fiscal year ending December 31, 2023; and |

| |

|

|

| |

6. |

To transact such other business as may properly come before the meeting or any adjournment or postponement thereof. |

What if another matter is properly brought

before the Annual Meeting?

The Board knows of no other

matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the Annual Meeting,

it is the intention of the persons named in the accompanying proxy to vote on those matters in accordance with their best judgment.

How Do I Vote?

Stockholders of Record

For your convenience, record

holders of our common stock have four methods of voting:

| |

1. |

Vote by Internet. The website address for Internet voting is on your vote instruction form; |

| |

|

|

| |

2. |

Vote by mail. Mark, date, sign and promptly mail the enclosed proxy card; |

| |

|

|

| |

3. |

Vote by fax. Mark, date, sign and promptly fax the enclosed proxy card to the fax number on your vote instruction form; or |

| |

|

|

| |

4. |

Vote in person. Attend and vote at the Annual Meeting. |

Beneficial Owners of Shares Held in Street

Name

For your convenience, beneficial

owners of our common stock have four methods of voting:

| |

1. |

Vote by Internet. The website address for Internet voting is on your vote instruction form; |

| |

2. |

Vote by mail. Mark, date, sign and promptly mail your vote instruction form; |

| |

3. |

Vote by fax. Mark, date, sign and promptly fax the enclosed proxy card to the fax number on your vote instruction form; or |

| |

4. |

Vote in person. Obtain a valid legal proxy from the organization that holds your shares and attend and vote at the Annual Meeting. |

If you vote by Internet, please DO NOT mail your proxy card.

All shares entitled to vote

and represented by a properly completed and executed proxy received before the Annual Meeting and not revoked will be voted at the Annual

Meeting as instructed in a proxy delivered before the Annual Meeting. If you do not indicate how your shares should be voted on a matter,

the shares represented by your properly completed and executed proxy will be voted as the Board recommends on each of the enumerated proposals,

with regard to any other matters that may be properly presented at the Annual Meeting and on all matters incident to the conduct of the

Annual Meeting. If you are a registered stockholder and attend the Annual Meeting, you may deliver your completed proxy card in person.

If you are a street name stockholder and wish to vote at the Annual Meeting, you will need to obtain a proxy form from the institution

that holds your shares. All votes will be tabulated by the inspector of elections appointed for the Annual Meeting, who will separately

tabulate affirmative and negative votes, abstentions and broker non-votes.

We provide Internet proxy

voting to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote

instructions. However, please be aware that you must bear any costs associated with your Internet access, such as usage charges from Internet

access providers and telephone companies.

How Many Votes do I Have?

On each matter to be voted

upon, you have one vote for each share of common stock you own as of the close of business on the Record Date.

Is My Vote Confidential?

Yes, your vote is confidential.

Only the inspector of elections, individuals who help with processing and counting your votes and persons who need access for legal reasons

will have access to your vote. This information will not be disclosed, except as required by law.

What Constitutes a Quorum?

To

carry on business at the Annual Meeting, we must have a quorum. A quorum is present when a majority of the shares entitled to vote as

of the Record Date, are represented in person or by proxy. Thus, holders of more than 50% of the 3,108,797 shares outstanding as of

the Record Date must be represented in person or by proxy to have a quorum at the Annual Meeting. Your shares will be counted towards

the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote

in person at the Annual Meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. Shares owned by us

are not considered outstanding or considered to be present at the Annual Meeting. If there is not a quorum at the Annual Meeting, the

chairperson of the Annual Meeting may adjourn the Annual Meeting.

How Will my Shares be Voted if I Give No Specific

Instruction?

We must vote your shares as

you have instructed. If there is a matter on which a stockholder of record has given no specific instruction but has authorized us generally

to vote the shares, they will be voted as follows:

|

1. |

“FOR” the election of each of the four (4) members to our Board of Directors; |

| |

|

|

|

2. |

“FOR” the approval of the Amended and Restated 2020 Plan; |

| |

|

|

|

3. |

“FOR” the approval of the Reincorporation; |

| |

|

|

|

4. |

“FOR” the approval of the Share Decrease; and |

| |

|

|

|

5. |

“FOR” the ratification of the appointment of Salberg & Company, P.A., as our independent registered public accounting firm for our fiscal year ending December 31, 2023. |

This authorization would exist,

for example, if a stockholder of record merely signs, dates and returns the proxy card but does not indicate how its shares are to be

voted on one or more proposals. If other matters properly come before the Annual Meeting and you do not provide specific voting instructions,

your shares will be voted at the discretion of the proxies.

If your shares are held in

street name, see “What is a Broker Non-Vote?” below regarding the ability of banks, brokers and other such holders

of record to vote the uninstructed shares of their customers or other beneficial owners in their discretion.

How are Votes Counted?

Votes will be counted by the

inspector of election appointed for the Annual Meeting, who will separately count, for the election of directors, “FOR,” “WITHHOLD”

and broker non-votes; and, with respect to the other proposals, votes “FOR” and “AGAINST,” abstentions and broker

non-votes.

What is a Broker Non-Vote?

If your shares are held in

street name, you must instruct the organization who holds your shares how to vote your shares. If you sign your proxy card but do not

provide instructions on how your broker should vote on “routine” proposals, your broker will vote your shares as recommended

by the Board. If you do not provide voting instructions, your shares will not be voted on any “non-routine” proposals. This

vote is called a “broker non-vote.” Because broker non-votes are not considered under Delaware law to be entitled to vote

at the Annual Meeting, broker non-votes will not be included in the tabulation of the voting results of any of the proposals and, therefore,

will have no effect on these proposals.

Brokers cannot use

discretionary authority to vote shares on the election of directors (Proposal 1), the Amended and Restated 2020 Plan (Proposal 2),

or the Reincorporation (Proposal 3) if they have not received instructions from their clients. Please submit your vote instruction

form so your vote is counted.

What is an Abstention?

An abstention is a stockholder’s

affirmative choice to decline to vote on a proposal. Under Delaware law, abstentions are counted as shares present and entitled to vote

at the Annual Meeting. However, our Amended and Restated Bylaws (“Bylaws”) provide that, except as otherwise expressly provided

by statute, an action of our stockholders (other than the election of directors) is only approved if a majority of the number of shares

of stock present and entitled to vote thereat vote in favor of such action. The Delaware General Corporation Law provides that the reincorporation

requires the approval of a majority of the total number of votes of our capital stock entitled to vote thereon.

How Many Votes are Needed for Each Proposal

to Pass?

| Proposal |

|

Vote Required |

| Election of each of the four (4) members to our Board of Directors |

|

Plurality of the votes cast (the four (4) directors receiving the most “FOR” votes) |

| |

|

|

| Approval of the Amended and Restated 2020 Plan |

|

The affirmative vote of a majority of the total number of votes of our capital stock represented at the Annual Meeting and entitled to vote thereon. |

| |

|

|

| Approval of the reincorporation of the Company from the State of Delaware to the State of Nevada |

|

The affirmative vote of a majority of the total number of votes of our capital stock entitled to vote thereon. |

| |

|

|

| The approval of an amendment to the Company’s Amended and Restated Certificate of Incorporation to decrease the number of authorized shares of common stock of the Company from 500,000,000 to 100,000,000. |

|

The affirmative vote of a majority of the total number of votes of our capital stock represented at the Annual Meeting and entitled to vote thereon. |

| |

|

|

| Ratification of the appointment of Salberg & Company, P.A. as our independent registered public accounting firm for our fiscal year ending December 31, 2023 |

|

The affirmative vote of a majority of the total number of votes of our capital stock represented at the Annual Meeting and entitled to vote thereon. |

What Are the Voting Procedures?

In voting by proxy with regard

to the election of directors, you may vote “for” or “withhold” as to each nominee. With regard to other proposals,

you may vote “for,” “against” or “abstain” for each proposal. You should specify your respective choices

on the accompanying proxy card or your vote instruction form.

Is My Proxy Revocable?

You may revoke your proxy

and reclaim your right to vote at any time before your proxy is voted by giving written notice to the Secretary of Silo Pharma, by delivering

a properly completed, later-dated proxy card or vote instruction form or by voting in person at the Annual Meeting. All written notices

of revocation and other communications with respect to revocations of proxies should be addressed to: Silo Pharma, Inc., 560 Sylvan Avenue,

Suite 3160, Englewood Cliffs, New Jersey 07632. Your most current proxy card or Internet proxy is the one that will be counted.

Who is Paying for the Expenses Involved in

Preparing and Mailing this Proxy Statement?

All of the expenses involved

in preparing, assembling and mailing these proxy materials and all costs of soliciting proxies will be paid by us. In addition to the

solicitation by mail, proxies may be solicited by our officers and other employees by telephone or in person. Such persons will receive

no compensation for their services other than their regular salaries. Arrangements will also be made with brokerage houses and other custodians,

nominees and fiduciaries to forward solicitation materials to the beneficial owners of the shares held of record by such persons, and

we may reimburse such persons for reasonable out of pocket expenses incurred by them in forwarding solicitation materials. If you have any questions or require any assistance with completing your proxy, please contact Campaign Management

by telephone toll-free 1-855-246-4705 or collect outside North America at +1 (212) 632-8422, or by email at info@campaign-mgmt.com.

Do I Have Dissenters’ Rights of Appraisal?

Our stockholders do not have

appraisal rights under Delaware law or under our governing documents with respect to the matters to be voted upon at the Annual Meeting.

How can I Find out the Results of the Voting

at the Annual Meeting?

Preliminary voting results

will be announced at the Annual Meeting. In addition, final voting results will be disclosed in a Current Report on Form 8-K that we expect

to file with the SEC within four business days after the Annual Meeting. If final voting results are not available to us in time to file

a Form 8-K with the SEC within four business days after the Annual Meeting, we intend to file a Form 8-K to publish preliminary results

and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

When are Stockholder Proposals Due for the

2024 Annual Meeting?

Stockholders who intend to have

a proposal considered for inclusion in our proxy materials for presentation at our 2024 annual meeting of stockholders (the “2024

Annual Meeting”) must submit the proposal to us at our corporate headquarters no later than September 5, 2024, which

proposal must be made in accordance with the provisions of Rule 14a-8 of the Exchange Act. In the event the date of the 2024 Annual Meeting

has been changed by more than 30 days from the date of the 2023 Annual Meeting, stockholders who intend to have a proposal considered

for inclusion in our proxy materials for presentation at our 2024 Annual Meeting must submit the proposal to us at our corporate headquarters

no later than a reasonable time before we begin to print and send our proxy materials for our 2024 Annual Meeting.

Stockholders who intend

to present a proposal at our 2024 Annual Meeting without inclusion of the proposal in our proxy materials are required to provide notice

of such proposal to our Secretary so that such notice is received by our Secretary at our principal executive office on or after August

8, 2024 but no later than September 5, 2024; provided, however, if the date of the 2024 Annual Meeting is convened more than 30 days before,

or delayed by more than 60 days after, December 4, 2024, to be considered for inclusion in proxy materials for our 2024 Annual Meeting,

a stockholder proposal must be submitted in writing to our Secretary at Silo Pharma, Inc., 560 Sylvan Avenue, Suite 3160, Englewood Cliffs,

New Jersey 07632 and received no earlier than the Close of Business (as defined in the Bylaws) on the 120th day prior to such

annual meeting and no later than the Close of Business on the later of (i) the 90th day prior to such annual meeting or (ii)

the 10th day following the day on which Public Announcement (as defined in the Bylaws) of the date of such meeting is first

made by the Company.

In

order for stockholders to give timely notice of nominations for directors for inclusion on a universal proxy card in connection with the

2024 Annual Meeting, notice must be submitted by the same deadline as disclosed above under the advance notice provisions of our Bylaws

and such notice must include all the information required by Rule 14a-19(b) under the Securities Exchange Act of 1934, as amended (the

“Exchange Act”) and such stockholders must comply with all of the requirements of Rule 14a-19 under the Exchange Act.

Stockholders are also advised

to review our Bylaws, which contain additional requirements relating to stockholder proposals and director nominations, including who

may submit them and what information must be included.

We reserve the right to reject,

rule out of order or take other appropriate action with respect to any proposal that does not comply with these and other applicable requirements.

Do the Company’s Officers and Directors

have an Interest in Any of the Matters to Be Acted Upon at the Annual Meeting?

Members of the Board have

an interest in Proposal 1, the election to the Board of the four director nominees set forth herein. In addition, our officers and directors

may be the recipient of future awards under the Amended and Restated 2020 Plan as described later in this proxy statement under the heading

“Proposal 2: Approval of the Amended and Restated 2020 Omnibus Equity Incentive Plan.” Members of the Board and executive

officers of Silo Pharma do not have any interest in Proposal 3, the Reincorporation, Proposal 4, the approval of an amendment to the Company’s

Amended and Restated Certificate of Incorporation to decrease the number of authorized shares of common stock of the Company from 500,000,000

to 100,000,000, or the ratification of the appointment of the Company’s independent registered public accounting firm, Proposal

5.

CORPORATE GOVERNANCE STANDARDS AND DIRECTOR

INDEPENDENCE

We are committed to good corporate

governance practices. These practices provide an important framework within which our Board of Directors and management pursue our strategic

objectives for the benefit of our stockholders.

Board Composition and Leadership Structure

Our Board is comprised of

four directors of which three are independent. Eric Weisblum, our Chief Executive Officer, also serves as Chairman of the Board. Due to

the size of our Company, we believe that this board size and structure are appropriate. We believe that the fact that three of the four

members of the Board are independent reinforces the independence of the Board in its oversight of our business and affairs and provides

for objective evaluation and oversight of management’s performance, as well as management accountability. Furthermore, the Board

believes that Mr. Weisblum is best situated to serve as Chairman because he is the director most familiar with the Company’s business

and industry and is also the person most capable of effectively identifying strategic priorities and leading the discussion and execution

of corporate strategy. In addition, the Board believes that the combined role of Chairman and Chief Executive Officer strengthens the

communication between the Board and management. Further, as the individual with primary responsibility for managing day-to-day operations,

Mr. Weisblum is best positioned to chair Board meetings and ensure that key business issues and risks are brought to the attention of

our Board. We therefore believe that the creation of a lead independent director position is not necessary at this time.

Board’s Role in Risk Oversight

The Company’s Board

is committed to a corporate culture that aligns day-to-day decision making with risk awareness and helps ensure that the Company’s

long-term strategic initiatives are consistent with its risk appetite. The Board of Directors has determined that overall responsibility

for overseeing enterprise risk management at the Company rests with the full Board of Directors as opposed to any specific board-level

committee. The Board recognizes the importance of identifying, assessing and monitoring risks that may have a material adverse effect

on the Company, including operational, financial, and strategic risks. In fulfilling its risk oversight function, the Board has delegated

certain oversight responsibilities to its three standing committees—Audit Committee, Compensation Committee, and Nominating and

Corporate Governance Committee. The Audit Committee assists our Board of Directors in fulfilling its oversight responsibilities with respect

to risk management in the areas of major financial risk exposures, internal control over financial reporting, disclosure controls and

procedures and legal and regulatory compliance. The Compensation Committee assists our Board of Directors in assessing risks created by

the incentives inherent in our compensation policies. The Nominating and Corporate Governance Committee assists our Board of Directors

in fulfilling its oversight responsibilities with respect to the management of corporate, legal and regulatory risk.

Director Independence

Our common stock is listed

on The Nasdaq Capital Market. Under the rules of the Nasdaq Stock Market, independent directors must constitute a majority of a listed

company’s Board of Directors. In addition, the rules of the Nasdaq Stock Market require that, subject to specified exceptions, each

member of a listed company’s Audit, Compensation, Compensation Committee and Nominating and Corporate Governance Committee must

be an “independent director.” Under the rules of the Nasdaq Stock Market, a director will only qualify as an “independent

director” if, in the opinion of that company’s board of directors, that person does not have a relationship that would interfere

with the exercise of independent judgment in carrying out the responsibilities of a director. Additionally, compensation committee members

must not have a relationship with the listed company that is material to the director’s ability to be independent from management

in connection with the duties of a compensation committee member.

Audit committee members must

also satisfy the independence criteria set forth in Rule 10A-3 under the Exchange Act. In order to be considered independent for purposes

of Rule 10A-3, a member of an audit committee of a listed company may not, other than in his or her capacity as a member of the audit

committee, the board of directors or any other board committee: (i) accept, directly or indirectly, any consulting, advisory or other

compensatory fee from the listed company or any of its subsidiaries or (ii) be an affiliated person of the listed company or any of its

subsidiaries.

Our Board of Directors has

undertaken a review of the independence of each director and considered whether each director has a material relationship with us that

could compromise his or her ability to exercise independent judgment in carrying out his or her responsibilities. As a result of this

review, our Board of Directors determined that Wayne D. Linsley, Dr. Jeff Pavell and Dr. Kevin Muñoz,

representing three of our four incumbent directors, are “independent directors” as defined under the applicable rules and

regulations of the SEC and the listing requirements and rules of the Nasdaq Stock Market. In making these determinations, our Board of

Directors reviewed and discussed information provided by the directors and us with regard to each directors’ business and personal

activities and relationships as they may relate to us and our management, including the beneficial ownership of our capital stock by each

non-employee director and any affiliates.

Committee of our Board of Directors

Our Board of Directors has

established an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee, each of which has the composition

and responsibilities described below. Members serve on these committees until their resignation or until otherwise determined by our Board

of Directors. Each of these committees has a written charter, copies of which are available on our website at www.silopharma.com.

In addition, from time to time, special committees may be established under the direction of the Board of Directors when necessary to

address specific issues.

Audit Committee

Our Audit Committee is responsible

for, among other things:

| |

● |

approving and retaining the independent auditors to conduct the annual audit of our financial statements; |

| |

|

|

| |

● |

reviewing the proposed scope and results of the audit; |

| |

|

|

| |

● |

reviewing and pre-approving audit and non-audit fees and services; |

| |

|

|

| |

● |

reviewing accounting and financial controls with the independent auditors and our financial and accounting staff; |

| |

|

|

| |

● |

reviewing and approving transactions between us and our directors, officers and affiliates; |

| |

|

|

| |

● |

establishing procedures for complaints received by us regarding accounting matters; |

| |

|

|

| |

● |

overseeing internal audit functions, if any; and |

| |

|

|

| |

● |

preparing the report of the Audit Committee that the rules of the SEC require to be included in our annual meeting proxy statement. |

Our Audit Committee consists of

Wayne D. Linsley, Dr. Jeff Pavell and Dr. Kevin Muñoz, with Wayne D. Linsley

serving as chair. Our Board of Directors has determined that Wayne D. Linsley, Dr. Jeff Pavell and

Dr. Kevin Muñoz each meet the definition of “independent director” under Nasdaq rules, and that they meet the

independence standards under Rule 10A-3 of the Exchange Act. Each member of our Audit Committee meets the financial literacy requirements

of Nasdaq. In addition, our Board of Directors has determined that Wayne Linsley qualifies as an “audit committee financial expert,”

as such term is defined in Item 407(d)(5) of Regulation S-K.

Compensation Committee

Our Compensation Committee

is responsible for, among other things:

| |

● |

reviewing and recommending the compensation arrangements for management, including the compensation for our Chief Executive Officer; |

| |

|

|

| |

● |

establishing and reviewing general compensation policies with the objective to attract and retain superior talent, to reward individual performance and to achieve our financial goals; |

| |

|

|

| |

● |

administering our stock incentive plans; and |

| |

|

|

| |

● |

preparing the report of the Compensation Committee that the rules of the SEC require to be included in our annual meeting proxy statement. |

Our Compensation Committee

consists of Wayne D. Linsley, Dr. Jeff Pavell and Dr. Kevin Muñoz, with Wayne

D. Linsley serving as chair. Our Board of Directors has determined that Wayne D. Linsley,

Dr. Jeff Pavell and Dr. Kevin Muñoz are independent directors under Nasdaq rules.

Nominating

and Corporate Governance Committee

Our Nominating and Corporate Governance Committee

is responsible for, among other things:

| |

● |

identifying and nominating members of the Board of Directors; |

| |

|

|

| |

● |

developing and recommending to the Board of Directors a set of corporate governance principles applicable to our Company; and |

| |

|

|

| |

● |

overseeing the evaluation of our Board of Directors. |

Our Nominating and Corporate

Governance Committee consists of Wayne D. Linsley, Dr. Jeff Pavell and Dr. Kevin Muñoz,

with Wayne D. Linsley serving as chair. Our Board of Directors has determined that Wayne

D. Linsley, Dr. Jeff Pavell and Dr. Kevin Muñoz are independent directors under Nasdaq rules.

Code of Business Conduct and Ethics

We have adopted a written

code of business conduct and ethics that applies to our directors, officers and employees, including our principal executive officer,

principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of the code is

posted on our website, www.silopharma.com. We intend to post on our website all disclosures that are required by law or Nasdaq

rules concerning any amendments to, or waivers from, any provision of the code.

Anti-hedging

As part of our Insider Trading

Policy, all of our officers, directors, employees and consultants and family members or others sharing a household with any of the foregoing

or that may have access to material non-public information regarding our Company are prohibited from engaging in short sales of our securities,

any hedging or monetization transactions involving our securities and in transactions involving puts, calls or other derivative securities

based on our securities. Our Insider Trading Policy further prohibits such persons from purchasing our securities on margin, borrowing

against any account in which our securities are held or pledging our securities as collateral for a loan unless pre-cleared by our Insider

Trading Compliance Officer. As of December 31, 2022, none of our directors or executive officers had pledged any shares of our common

stock.

Family Relationships and Other Arrangements

There are no family relationships

among our directors and executive officers. There are no arrangements or understandings between or among our executive officers and directors

pursuant to which any director or executive officer was or is to be selected as a director or executive officer.

Involvement in Certain Legal Proceedings

We are not aware of any of

our directors or officers being involved in any legal proceedings in the past ten years relating to any matters in bankruptcy, insolvency,

criminal proceedings (other than traffic and other minor offenses), or being subject to any of the items set forth under Item 401(f) of

Regulation S-K.

Board and Committee Meetings and Attendance

The Board of Directors and

its committees meet regularly throughout the year and also hold special meetings and act by written consent from time to time. During

the 2022 fiscal year, the Board of Directors held 4 meetings. In addition, our Audit Committee held 5 meetings, and our Compensation Committee

and our Nominating and Corporate Governance Committee did not meet. During the 2022 fiscal year, none of our directors attended fewer

than 75% of the aggregate of the total number of meetings held by the Board of Directors and the total number of meetings held by all

committees of the Board of Directors on which he/she served. The independent members of the Board of Directors also meet separately without

management directors on a regular basis to discuss such matters as the independent directors consider appropriate.

Board Attendance at Annual Stockholders’

Meeting

We invite and encourage each

member of our Board of Directors to attend our annual meetings of stockholders. We do not have a formal policy regarding attendance of

our annual meetings of stockholders by the members of our Board of Directors.

Communication with Directors

Stockholders and interested

parties who wish to communicate with our Board of Directors, non-management members of our Board of Directors as a group, a committee

of the Board of Directors or a specific member of our Board of Directors (including our Chair) may do so by letters addressed to:

Silo Pharma, Inc.

560 Sylvan Avenue, Suite 3160

Englewood Cliffs, New Jersey 07632

All communications by letter

addressed to the attention of our Secretary will be reviewed by the Secretary and provided to the members of the Board of Directors unless

such communications are unsolicited items, sales materials and other routine items and items unrelated to the duties and responsibilities

of the Board of Directors.

Considerations in Evaluating Director Nominees

Our Board of Directors is

responsible for identifying, considering and recommending candidates to the Board of Directors for Board membership. A variety of methods

are used to identify and evaluate director nominees, with the goal of maintaining and further developing a diverse, experienced and highly

qualified Board of Directors. Candidates may come to our attention through current members of our Board of Directors, professional search

firms, stockholders or other persons.

Our Board of Directors encourages

selection of directors who will contribute to the Company’s overall corporate goals. Individual directors may from time to time

review and recommend to the Board of Directors the desired qualifications, expertise and characteristics of directors, including such

factors as breadth of experience, knowledge about our business and industry, willingness and ability to devote adequate time and effort

to the Board of Directors, ability to contribute to the Board of Directors’ overall effectiveness, and the needs of the Board of

Directors and its committees. Exceptional candidates who do not meet all of these criteria may still be considered. In evaluating potential

candidates for the Board of Directors, the Board of Directors considers these factors in the light of the specific needs of the Board

of Directors at that time.

A director is expected to

spend the time and effort necessary to properly discharge such director’s responsibilities. Accordingly, a director is expected

to regularly attend meetings of the Board of Directors and committees on which such director sits, and to review prior to meetings material

distributed in advance for such meetings. Thus, the number of other public company boards and other boards (or comparable governing bodies)

on which a prospective nominee is a member, as well as his or her other professional responsibilities, will be considered. There are no

limits term that may be served by a director; however, in connection with evaluating recommendations for nomination for reelection, the

Board of Directors considers director tenure. We value diversity on a company-wide basis but have not adopted a specific policy regarding

Board diversity.

PROPOSAL 1

ELECTION OF DIRECTORS

At the Annual Meeting, the

stockholders will elect four directors to hold office until the 2024 Annual Meeting. Directors are elected by a plurality of votes cast

by stockholders. In the event the nominees are unable or unwilling to serve as directors at the time of the Annual Meeting, the proxies

will be voted for any substitute nominees designated by the present Board or the proxy holders to fill such vacancy, or for the balance

of the nominees named without nomination of a substitute, or the size of the Board will be reduced in accordance with the Bylaws of the

Company. The Board has no reason to believe that the persons named below will be unable or unwilling to serve as nominees or as directors

if elected.

Assuming a quorum is present,

the four nominees receiving the highest number of affirmative votes of shares entitled to be voted for such persons will be elected as

directors of the Company to serve for a one-year term. Unless marked otherwise, proxies received will be voted “FOR” the election

of the nominees named below. In the event that additional persons are nominated for election as directors, the proxy holders intend to

vote all proxies received by them in such a manner as will ensure the election of the nominees listed below, and, in such event, the specific

nominees to be voted for will be determined by the proxy holders.

Information with Respect to Director Nominees

Listed below are the current

directors who are nominated to hold office until their successors are elected and qualified, and their ages as of the Record Date.

| Name |

|

Age |

|

Position |

| Eric Weisblum |

|

53 |

|

Chairman, Chief Executive Officer and President |

| Wayne D. Linsley |

|

67 |

|

Director |

| Dr. Kevin Muñoz |

|

44 |

|

Director |

| Dr. Jeff Pavell |

|

56 |

|

Director |

The business background and certain other information

about our directors is set forth below.

Eric Weisblum

Eric Weisblum is the

founder, President and Chief Executive Officer of the Company, and serves as Chairman of the Company’s Board of Directors. Prior

to founding the Company, Mr. Weisblum was a private investor, board member, and advisor to several companies. Mr. Weisblum has experience

in both licensing therapeutic assets and assisting in their development. As a result, Mr. Weisblum brings with him nearly 20 years of

experience in structuring and trading financial instruments. Mr. Weisblum was a registered representative with Domestic Securities, a

New Jersey-based broker-dealer. While with Domestic Securities, Mr. Weisblum held the Series 7 - General Securities Representative, the

Series 63 – Uniform Securities Agent State Law Examination, and the Series 55 – Registered Equity Trader securities registrations. From

1993 to 2002, Mr. Weisblum originated, structured, traded, and placed structured financing transactions at M.H. Meyerson & Co. Inc.,

a publicly-traded registered investment bank. He holds a B.A. from the University of Hartford’s Barney School of Business.

Wayne D. Linsley

Wayne D. Linsley has

served as a director of the Company since January 2020. Mr. Linsley has over 40 years of experience in business management. Since April

2020, Mr. Linsley has served as a member of the board of directors of Hoth Therapeutics, Inc. (NASDAQ: HOTH), a clinical-stage biopharmaceutical

company. Since August 2021, Mr. Linsley has served as a member of the board of directors of DatChat, Inc. (NASDAQ: DATS), a blockchain,

cybersecurity, and social media company. From 2014 to September 2021, Mr. Linsley served as the Vice President of Operations at CFO Oncall,

Inc., a company that provides financial reporting and controller services on an outsourced basis and previously, from 2012 to 2014, Mr.

Linsley worked at CFO Oncall, Inc. as an independent contractor. Mr. Linsley holds a Bachelor of Science degree in Business Administration

from Siena College. We believe that Mr. Linsley is qualified to serve as a member of our board of directors because of his experience

as a director of public companies and background in financial reporting.

Dr. Kevin Muñoz

Dr. Kevin Muñoz

has served as a director of the Company since October 2020. Since December 2021, Dr. Muñoz has taught Biomedical Science and Medical

Intervention at Passaic County Technical Institute. Since June 2008, Dr. Muñoz has served as the Director of Operations and Medical

Assistant at The Physical Medicine and Rehabilitation Center, P.A., a diagnostic and treatment facility that specializes in treating sports,

spine, orthopedic and neuromuscular conditions. Dr. Muñoz holds Doctor of Medicine degree from Xavier University School of Medicine

and a Bachelor of Science degree in Kinesiology from the University of Michigan. We believe that Dr. Muñoz is qualified to serve

as a member of our board of directors because of his medical background and experience in business operations.

Dr. Jeff Pavell

Dr. Pavell has served

as our director since September 2022. Since January 2017, Dr. Pavell has served as Chief of Rehabilitation Medicine at Englewood Health,

and since November 2005, he has been on the teaching staff at New York-Presbyterian Columbia University Irving Medical Center. In addition,

since December 2020 he has been on the teaching staff at Hackensack Meridian School of Medicine at Seton Hall. Furthermore, since 2010,

Dr. Pavell has served as a partner at Patient Care Associates, an outpatient surgical center, and since 2002, he has served as a Partner

at the Physical Medicine and Rehabilitation Center, a private medical practice serving patients with spine, sports and occupational injuries.

Dr. Pavell is a Board Certified physician specializing in the field of physical medicine and rehabilitation. Dr. Pavell is also certified

in pain medicine and specializes in the most advanced non-operative treatments for spine, sports and interventional pain medicines. Dr.

Pavell received his bachelor of arts from Johns Hopkins University and his D.O. degree with honors from the New York College of Osteopathic

Medicine. Since December 2022, Dr. Pavell has served as a director of Hoth Therapeutics, Inc. (NASDAQ: HOTH), a clinical stage biopharmaceutical

company. Dr. Pavell holds a Doctor of Medicine degree from the New York College of Osteopathic Medicine and a Bachelor of Art degree in

Political Science from John Hopkins University. We believe that Dr. Pavell is qualified to serve as a member of our board of directors

due to his medical background and experience practicing in the healthcare industry.

Board Diversity Matrix

Our Nominating and Corporate

Governance Committee is committed to promoting diversity on our Board of Directors. We have surveyed our current directors and asked each

director to self-identify their race, ethnicity, and gender using one or more of the below categories. The results of this survey as of

the Record Date are included in the matrixes below.

| Board Diversity Matrix (As of October 10, 2023) |

| Total Number of Directors | |

| 4 | |

| Part I: Gender Identity | |

Female | | |

Male | | |

Non-Binary | | |

Did Not Disclose Gender | |

| Directors | |

| | | |

| 4 | | |

| | | |

| | |

| Part II: Demographic Background | |

| | | |

| | | |

| | | |

| | |

| African American or Black | |

| | | |

| | | |

| | | |

| | |

| Alaskan Native or Native American | |

| | | |

| | | |

| | | |

| | |

| Asian | |

| | | |

| | | |

| | | |

| | |

| Hispanic or Latinx | |

| | | |

| 1 | | |

| | | |

| | |

| Native Hawaiian or Pacific Islander | |

| | | |

| | | |

| | | |

| | |

| White | |

| | | |

| 1 | | |

| | | |

| | |

| Two or More Races or Ethnicities | |

| | | |

| | | |

| | | |

| | |

| LGBTQ+ | |

| | | |

| 1 | | |

| | | |

| | |

| Did Not Disclose Demographic Background | |

| | | |

| 1 | | |

| | | |

| | |

Board Recommendation

THE BOARD RECOMMENDS THAT YOU VOTE “FOR”

EACH OF THE NOMINEES TO THE BOARD SET FORTH IN THIS PROPOSAL 1.

EXECUTIVE OFFICERS

The following are biographical

summaries of our executive officers and their ages as of the Record Date, except for Mr. Weisblum, whose biography is included under the

heading “Proposal 1: Election of Directors” set forth above:

| Name |

|

Age |

|

Position |

| Eric Weisblum |

|

53 |

|

Chairman, Chief Executive Officer, President and Director |

| Daniel Ryweck |

|

59 |

|

Chief Financial Officer |

Daniel Ryweck

Mr. Ryweck has served

as Chief Financial Officer of the Company since September 2022. Since January 2020, Mr. Ryweck has served as Controller at Mill City Ventures

III Ltd. (NASDAQ: MCVT), a non-bank lender and specialty finance company. From. June 2014 to December 2019, he served as Chief Compliance

Officer of Mill City Ventures III Ltd. Mr. Ryweck holds a Bachelor of Science degree in Accounting from the Carlson School of Management

at the University of Minnesota.

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table presents

the compensation awarded to, earned by or paid to each of our named executive officers for the years ended December 31, 2022 and 2021.

| Name and Principal Position | |

Year | | |

Salary ($) | | |

Bonus ($) | | |

Stock Awards ($) | | |

Option Awards ($) | | |

Nonequity incentive plan compensation ($) | | |

Nonqualified deferred compensation earnings ($) | | |

All other compensation ($) | | |

Total ($) |

| (a) | |

(b) | | |

(c) | | |

(d) | | |

(e) | | |

(f) | | |

(g) | | |

(h) | | |

(i) | | |

(j) |

| Eric Weisblum, | |

| 2022 | | |

| 222,500 | (1) | |

| 100,000 | (2) | |

| | | |

| - | | |

| - | | |

| - | | |

| 9,750 | (6) | |

332,250 |

| Chief Executive Officer | |

| 2021 | | |

| 175,000 | (3) | |

| 170,000 | (4) | |

| | | |

| - | | |

| - | | |

| - | | |

- | | |

345,000 |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Daniel Ryweck, | |

| 2022 | | |

| 15,000 | (5) | |

| __- | | |

| - | | |

| - | | |

| - | | |

| - | | |

- | | |

15,000 |

| Chief Financial Officer (since September 28, 2022) | |

| 2021 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

- |

| (1) |

On October 12, 2022, the Company entered into an employment agreement with Eric Weisblum (the “Weisblum Employment Agreement”) pursuant to which Mr. Weisblum’s (i) base salary will be $350,000 per year, (ii) Mr. Weisblum will be paid a one-time signing bonus of $100,000, and (iii) Mr. Weisblum shall be entitled to receive an annual bonus of up to $350,000, subject to the sole discretion of the Compensation Committee of the Board of Directors of the Company. On January 18, 2021, the Company and Mr. Weisblum entered into the first amendment (the “Amendment”) to the Employment Agreement, effective as of January 1, 2021. Pursuant to the Amendment Mr. Weisblum’s base salary was increased from $120,000 per year to $180,000 per year and all the terms and provisions of the Employment Agreement shall remain in full force and effect. |

| (2) |

Pursuant to the Weisblum Employment Agreement entered into between the Company and Mr. Weisblum on October 12, 2022, Mr. Weisblum received a signing bonus of $100,000. |

| (3) |

On January 18, 2021, the Company and Mr. Weisblum entered into the first amendment (the “Amendment”) to the Employment Agreement, effective as of January 1, 2021. Pursuant to the Amendment Mr. Weisblum’s base salary was increased from $120,000 per year to $180,000 per year and all the terms and provisions of the Employment Agreement shall remain in full force and effect. |

| (4) |

Pursuant to Mr. Weisblum’s Employment Agreement dated April 17, 2020 he was eligible to earn a bonus in an amount of up to $120,000. On December 29, 2021, the Company’s Board of Directors (“Board”) approved bonus of $120,000 which was recorded as accrued liability as of December 31, 2021 and was paid out in January 2022. In addition, Mr. Weisblum also received in 2021, a cash bonus of $50,000 for his services in 2020. |

| (5) |

On September 28, 2022, the Company entered into an Employment Agreement with Mr. Ryweck under which it agreed to pay a base salary of $42,000 per year. On October 12, 2022, the Company entered into an amendment to this employment agreement under which it increased his base salary to $60,000 per year. |

| (6) |

During 2022, the Company contributed $9,750 to the Company’s 401(k) plan. |

Narrative Disclosure to Summary Compensation

Table

Except as otherwise described below, there are

no compensatory plans or arrangements, including payments to be received from the Company with respect to any named executive officer,

that would result in payments to such person because of his or her resignation, retirement or other termination of employment with the

Company, or our subsidiaries, any change in control, or a change in the person’s responsibilities following a change in control

of the Company.

Employment Agreements

Eric Weisblum

On October 12, 2022,

the Company entered into an employment agreement with Eric Weisblum (the “Weisblum Employment Agreement”) pursuant to which

Mr. Weisblum’s (i) base salary will be $350,000 per year, (ii) Mr. Weisblum will be paid a one-time signing bonus of $100,000, and

(iii) Mr. Weisblum shall be entitled to receive an annual bonus of up to $350,000, subject to the sole discretion of the Compensation

Committee of the Board of Directors of the Company (the “Compensation Committee”), and upon the achievement of additional

criteria established by the Compensation Committee from time to time (the “Annual Bonus”). In addition, pursuant to the Weisblum

Employment Agreement, upon termination of Mr. Weisblum’s employment for death or Total Disability (as defined in the Weisblum Employment

Agreement), in addition to any accrued but unpaid compensation and vacation pay through the date of his termination and any other benefits

accrued to him under any Benefit Plans (as defined in the Weisblum Employment Agreement) outstanding at such time and the reimbursement

of documented, unreimbursed expenses incurred prior to such termination date (collectively, the “Weisblum Payments”), Mr.

Weisblum shall also be entitled to the following severance benefits: (i) 24 months of his then base salary; (ii) if Mr. Weisblum elects

continuation coverage for group health coverage pursuant to COBRA Rights (as defined in the Weisblum Employment Agreement), then for a

period of 24 months following Mr. Weisblum’s termination he will be obligated to pay only the portion of the full COBRA Rights cost

of the coverage equal to an active employee’s share of premiums (if any) for coverage for the respective plan year; and (iii) payment

on a pro-rated basis of any Annual Bonus or other payments earned in connection with any bonus plan to which Mr. Weisblum was a participant

as of the date of his termination (together with the Weisblum Payments, the “Weisblum Severance”). Furthermore, pursuant to

the Weisblum Employment Agreement, upon Mr. Weisblum’s termination (i) at his option (A) upon 90 days prior written notice to the

Company or (B) for Good Reason (as defined in the Weisblum Employment Agreement), (ii) termination by the Company without Cause (as defined

in the Weisblum Employment Agreement) or (iii) termination of Mr. Weisblum’s employment within 40 days of the consummation of a

Change in Control Transaction (as defined in the Weisblum Employment Agreement), Mr. Weisblum shall receive the Weisblum Severance; provided,

however, Mr. Weisblum shall be entitled to a pro-rated Annual Bonus of at least $200,000. In addition, any equity grants issued to Mr.

Weisblum shall immediately vest upon termination of Mr. Weisblum’s employment by him for Good Reason or by the Company at its option

upon 90 days prior written notice to Mr. Weisblum, without Cause.

Daniel Ryweck

On September 28, 2022,

the Company entered into an employment agreement (the “Ryweck Employment Agreement”) with Daniel Ryweck. Pursuant to the terms

of the Employment Agreement, Mr. Ryweck will (i) receive a base salary at an annual rate of $42,000 (the “Base Compensation”)

payable in equal monthly installments, and (ii) be eligible to receive an annual discretionary bonus. The term of Mr. Ryweck’s engagement

under the Employment Agreement commences on the Effective Date (as defined in the Employment Agreement) and continues until September

28, 2023, unless earlier terminated in accordance with the terms of the Employment Agreement. The term of Mr. Ryweck’s Employment

Agreement is automatically renewed for successive one-year periods until terminated by Mr. Ryweck or the Company.

On October 12, 2022,

the Company entered into an amendment (the “Ryweck Amendment”) to the employment agreement by and between the Company and

Daniel Ryweck dated September 27, 2022, pursuant to which Mr. Ryweck’s base salary will increase to $60,000 per year.

Potential Payment Upon Termination

If Mr. Weisblum dies

or has a total disability, resigns, is terminated for good reason (as defined in the agreement), without cause (as defined in the agreement)

or within 40 days of a change of control (as defined in the agreement, then he is entitled to 24 months’ severance.

The following table sets

forth quantitative information with respect to potential payments to be made to Mr. Weisblum upon termination in various circumstances.

The potential payments are based on the terms of Mr. Weisblum’s employment agreement discussed above. For a more detailed description

of Mr. Weisblum’s employment agreement, see the “Employment Agreements” section above:

| Name | |

Potential Payment Upon Termination | |

| Eric Weisblum | |

$ | 700,000 | (1) |

| (1) |

Mr. Weisblum is entitled to 24 months’ severance at the applicable base salary rate. Mr. Weisblum’s current base salary is $350,000 per annum. |

Equity

Grant Practices

2020 Omnibus Equity Incentive Plan

On

January 18, 2021, the board of directors of the Company approved the Silo Pharma, Inc. 2020 Omnibus Equity Incentive Plan (the

“2020 Plan”). The 2020 Plan provides for the issuance of incentive stock options, non-statutory

stock options, stock appreciation rights, restricted stock, restricted stock units, and other stock-based awards.

On

September 15, 2023, our Board of Directors approved the Amended and Restated 2020 Plan (see Proposal 2 for more information) and recommended

to our stockholders and the Annual Meeting to approve the Amended and Restated 2021 Plan.

Bonus

Arrangements

Pursuant to the terms of the

executive employment agreements described above, the Company, through the board, has the discretion to determine the amounts of the annual

incentive bonus payments which executives may receive Based on the review of the Company’s performance for calendar year 2022, the

board, in its sole discretion, determined to pay the bonuses to the named executive officers listed in the summary compensation table

above.

Outstanding Equity Awards at Fiscal Year-End

Table

The following table provides

information regarding option and restricted stock unit awards held by each of our named executive officers that were outstanding as of

December 31, 2022. There were no stock awards or other equity awards outstanding as of December 31, 2022.

| | |

Option Awards | | |

Stock Awards | |

| Name | |

Number of

Securities

Underlying

Unexercised

Options (#)

(Exercisable) | | |

Number of

Securities

Underlying

Unexercised

Options (#)

(Unexercisable) | | |

Equity

Incentive

Plan

Awards:

Number of

Securities

Underlying

Unexercised

Unearned

Options (#) | | |

Option

Exercise

Price

($) | | |

Option

Expiration

Date | |

Number of

Shares or

Units of

Stock That

Have Not

Vested

(#) | | |

Market

Value of

Shares or

Units of

Stock That

Have Not

Vested (#) | | |

Equity

Incentive

Plan Awards:

Number of

Unearned

Shares, Units

or Other

Rights that

Have Not

Vested

(#) | | |

Equity

Incentive

Plan Awards:

Market or

Payout Value of Unearned

Shares, Units

or Other

Rights that

Have Not

Vested

($) | |

| (a) | |

(b) | | |

I | | |

(d) | | |

(e) | | |

(f) | |

(g) | | |

(h) | | |

(i) | | |

(j) | |

| Eric Weisblum | |

| 2,000 | (1) | |

| — | | |

| — | | |

$ | 0.005 | | |

04/15/2024 | |

| — | | |

| — | | |

| — | | |

| — | |

| Chief Executive Officer | |

| 2,000 | (2) | |

| — | | |

| — | | |

$ | 0.005 | | |

07/15/2024 | |

| — | | |

| — | | |

| — | | |

| — | |

| | |

| 2,000 | (3) | |

| — | | |

| — | | |

$ | 0.005 | | |

10/15/2024 | |

| — | | |

| — | | |

| — | | |

| — | |

| (1) |

The options were fully vested on the date of grants (4/15/19) |

| (2) |

The options were granted on April 15, 2019 and vested 100% on July 15, 2019. |

| (3) |

The options were fully vested on the date of grant (10/15/19). |

Disclosure of Equity Awards Based on Material

Nonpublic Information: None

Pay Versus Performance Disclosure

In accordance with the

SEC’s disclosure requirements regarding pay versus performance, or PVP, this section presents the SEC-defined “Compensation

Actually Paid,” or CAP of our NEOs for each of the fiscal years ended December 31, 2022 and 2021, and our financial performance.

Also required by the SEC, this section compares CAP to various measures used to gauge performance at TLSS for each such fiscal year.

Pay versus Performance

Tab–e - Compensation Definitions

Salary, Bonus, Stock

Awards, and All Other Compensation are each calculated in the same manner for purposes of both CAP and Summary Compensation Table, or

SCT values. The primary difference between the calculation of CAP and SCT total compensation is the calculation of the value of “Stock

Awards,” with the table below describing the differences in how these awards are valued for purposes of SCT total and CAP:

Pay Versus Performance Table

| Year (1) | |

Summary

Compensation

Table Total

for PEO | | |

Compensation

Actually Paid

to PEO (2) | | |

Average

Summary

Compensation

Table Total for

Non-PEO

NEOs | | |

Average

Compensation

Actually Paid

to Non-PEO

NEOs (2) | | |

Value of

Initial Fixed

$100

Investment

Based On

Total

Shareholder

Return | | |

Net Income

(Loss) | |

| (a) | |

(b) | | |

(c) | | |

(d) | | |

(e) | | |

(f) | | |

(h) | |

| 2022 | |

$ | 332,250 | | |

$ | 332,250 | | |

$ | 15,000 | | |

$ | 15,000 | | |

| 15.83 | | |

$ | (3,908,55 | ) |

| 2021 | |

$ | 345,000 | | |

$ | 345,000 | | |

| 0 | | |

| 0 | | |

| 33.57 | | |

$ | 3,903,741 | |

| (1) |

The PEO (CEO) in the 2022 and 2021 reporting year is Eric Weisblum. The non-PEO NEOs in the 2022 reporting year is Dan Ryweck. |

| (2) |

The CAP was calculated beginning with the PEO’s SCT total. No amounts were deducted from or added to the applicable SCT total compensation. Since all equity awards were fully vested prior to 2021, no reconciliation to with respect to equity awards for summary compensation numbers was required. |

Non-Employee

Director Compensation

The following table presents

the total compensation for each person who served as a non-employee member of our board of directors and received compensation for such

service during the fiscal year ended December 31, 2022. Other than as set forth in the table and described more fully below, we did

not pay any compensation, make any equity awards or non-equity awards to, or pay any other compensation to any of the non-employee members

of our board of directors in 2022.

Director Compensation

| Name | |

Fees

earned or

paid in

cash ($) | | |

Stock

awards ($) | | |

Option

awards ($)(1)(2) | | |

Non-equity

incentive

plan

compensation ($) | | |

Nonqualified

deferred

compensation

earnings ($) | | |

All other

compensation ($) | | |

Total ($) | |

| (a) | |

(b) | | |

(c) | | |

(d) | | |

(e) | | |

(f) | | |

(g) | | |

(h) | |

| Wayne Linsley(2) | |

$ | 45,000 | | |

| — | | |

$ | 15,112 | | |

| — | | |

| — | | |

| — | | |

$ | 60,112 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Dr. Kevin Muñoz | |

$ | 25,000 | | |

| — | | |

$ | 15,112 | | |

| — | | |

| — | | |

| — | | |

$ | 40,112 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Dr. Jeff Pavel(3) | |

$ | - | | |

| — | | |

| — | | |

| — | | |

| — | | |

| | | |

$ | — | |

| (1) |

Amounts reported represent the aggregate grant date fair value for option awards granted in each respective year in accordance with FASB ASC Topic 718, excluding the effect of forfeitures. See Note 6, “Stockholder’s Equity” in the Notes to the Company’s Consolidated Financial Statements for the fiscal year ended 2022 included in the Company’s Annual Report on Form 10-K for the year ended 2022 for more information regarding the Company’s accounting for share-based compensation plans. The amounts shown in the Director Compensation Table above do not represent the actual value realized by each Director. |

| (2) |

As of December 31, 2022, Mr. Linsley held options to purchase [3,425 shares of our common stock. Dr. Muñoz held options to purchase [3,425] shares of our common stock. Such options had the following vesting date(s):[These options vested on December 29, 2022] |

| (3) |

Dr. Pavell has served as a director since September 27, 2022 and has no items to disclose hereon as he received no compensation in 2022. |

Director Compensation

Program

Our current director

compensation program is designed to align our director compensation program with the long-term interests of our stockholders by implementing

a program comprised of cash and equity compensation.

In setting director compensation,

we consider the amount of time that directors expend in fulfilling their duties to the Company as well as the skill level and experience

required by our board of directors. We also consider board compensation practices at similarly situated companies, while keeping in mind

the compensation philosophy of us and the stockholders’ interests. The directors also receive reimbursement for expenses, including

reasonable travel expenses to attend board and committee meetings, reasonable outside seminar expenses, and other special board related

expenses.

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

During our fiscal years ended

December 31, 2022 and December 31, 2021 we have not been a party to transactions in which the amount involved in the transaction exceeds

the lesser of $120,000 or 1% of the average of our total assets at year-end for the last two completed fiscal years, and in which any