PORTERVILLE, Calif., Jan. 26 /PRNewswire-FirstCall/ -- Sierra

Bancorp (NASDAQ:BSRR), parent of Bank of the Sierra, today

announced its financial results for the quarter and the year ended

December 31, 2008. Sierra Bancorp reported consolidated net income

of $13.4 million for the year, and a consolidated loss of $1.9

million for the fourth quarter of 2008. The net loss in the fourth

quarter was the result of a $13.6 million loan loss provision

necessitated by a high level of net charge-offs and loan impairment

charges, and an increase in non-performing assets. The loan loss

provision for the year totaled $19.5 million. The reversal of close

to $1.6 million in previously-recognized interest on loans placed

on non-accrual status in the fourth quarter also had a significant

negative impact on financial results. Having a positive impact was

the fourth quarter reversal of $1.6 million in accrued bonuses and

other benefits, due to lower anticipated discretionary payouts

coincidental to the Bank's lower earnings. Solid growth in core

non- interest income also helped counter the negative impact of the

large loan loss provision and interest reversals. Net income for

the year, while 36% lower than net income in 2007, still resulted

in a robust 12.86% return on average equity for 2008. Furthermore,

the consolidated Company's total risk based capital ratio at

December 31, 2008 was 13.6%, just a slight decline from the ratio

at September 30, 2008 and still very strong relative to the 10.0%

minimum required to remain classified as a well-capitalized

institution. Notable balance sheet changes during 2008 include the

following: Total deposits increased $211 million, or 25%, with most

of the increase coming in large time deposits, including a $60

million increase in wholesale-sourced brokered deposits and a $104

million increase in CDARS deposits; other borrowings were reduced

by $123 million, or 52%; investment balances are up by $64 million,

or 35%; and non-performing assets increased $27 million, due in

large part to several acquisition/development and land loans that

were placed on non-accrual status. "We are grateful for the strong

earnings momentum over the past several years that, combined with

our conservative culture, enabled us to build capital to current

levels and enhance stability and security for our customers in an

otherwise unsettled environment," remarked James C. Holly,

President and CEO. "While our capital and core earnings remain

strong, we are naturally disappointed at the fourth quarter

operating loss. However, we feel that the aggressive identification

and timely resolution of problem assets, including writing them

down to current appraised values or charging them off when merited,

is critical in helping us prepare for the opportunities that will

arise when the cycle starts to turn and the economy improves," he

added. Mr. Holly expressed confidence that the banking environment

will improve by early 2010, but suggested that non-performing

assets might increase and loan losses could continue at relatively

high levels in the near-term, and that the Company will likely

continue its focus on credit issues and core deposit generation

rather than on asset growth during 2009. "We can't overstate the

importance of loyal shareholders, customers and employees in

navigating our resilient institution through this temporary

turbulence, and we are truly appreciative of their support," he

also noted. Financial Highlights The most significant impact on the

Company's financial results in 2008 came from the provision for

loan and lease losses, which was up by $12.7 million for the fourth

quarter of 2008 relative to the fourth quarter of 2007, and

increased by $16.2 million for 2008 annual results in comparison to

2007. The increase resulted from significant growth in the balance

of non-performing assets, as discussed in greater detail below, and

from a higher level of loan losses. Net loans charged off in the

fourth quarter of 2008 totaled $9.8 million versus only $869,000 in

the fourth quarter of 2007, while net charge- offs for the year

were $16.6 million in 2008 and $2.6 million in 2007. About $6.9

million of fourth quarter 2008 charge-offs came from writing down

just six non-accruing acquisition/development and land loans, due

to updated appraisals that reflect steep declines in fair values.

Net interest income, while up slightly for the year due to a $72

million increase in average interest-earning assets, dropped for

the quarterly comparison due to the reversal of $1.6 million in

interest on loans placed on non-accrual status during the quarter.

The interest reversal appears relatively high because in addition

to reversing accrued but unpaid interest, we were also required to

reverse previously-recognized interest dating back to loan

inception for non-performing loans which had an interest reserve.

Interest reversals for the year were $2.0 million, net of interest

recoveries and the accelerated recognition of loan fees on a large

loan that paid off in the third quarter of 2008. Also having a

negative effect on our net interest margin for both the quarter and

the year were an increase in average non- performing assets, and a

decline in average non-interest bearing demand deposits. Our

tax-equivalent net interest margin thus declined to 4.57% for the

fourth quarter of 2008, relative to 5.11% in the fourth quarter of

2007. Our net interest margin for the year was 4.98% in 2008,

compared to 5.28% in 2007. When interest reversals and recoveries

are factored out, our net interest margin increases to 5.10% for

the fourth quarter and 5.14% for the year ended December 31, 2008.

Service charge income on deposits increased by 25% for the fourth

quarter and 44% for the comparative annual periods, primarily due

to returned item and overdraft fees generated by new consumer

checking accounts, mid-year fee increases in both 2007 and 2008,

and enhanced overdraft management and collection capabilities for

all transaction accounts. Loan sale and servicing income shows a

negligible change for the quarter, but dropped by $1.6 million, or

97% for the year due to a $1.6 million pre-tax gain on the sale of

credit card loans in the second quarter of 2007. The Other

Non-Interest Income category was down by $682,000, or 50%, for the

quarter, and by $763,000, or 15%, for the year, relative to like

periods in the prior year, due mainly to fluctuations in Bank-Owned

Life Insurance (BOLI) income. BOLI income experienced a $447,000

drop for the quarter and was $826,000 lower for the year in 2008

because of losses on separate account BOLI. BOLI income for the

year would have dropped even more, but losses were partially offset

by a non-taxable non-recurring gain of approximately $350,000 in

the third quarter of 2008 resulting from our exchange of certain

separate account BOLI policies related to director and executive

deferred compensation plans. While the gain from the policy

exchange boosted net income for the year, normal fluctuations in

separate account BOLI income do not have a significant impact on

net income because they are offset by changes in associated expense

accruals for participant gains/losses on deferred compensation

plans (reflected in Salaries & Benefits and Directors expenses)

and the tax impact of deferred compensation deductions. Other

Non-Interest Income also includes credit card income, which fell by

$193,000 for the year since the credit card portfolio was sold in

mid-2007, and income from our strategic alliance with Investment

Centers of America, which declined by $85,000 for the quarter and

$170,000 for the year. Other non-recurring items contributing to

the change in non-interest income for 2008 relative to 2007 include

the following: A gain on investments of $289,000 in the first

quarter of 2008 resulting from the mandatory redemption of a

portion of our Visa shares, pursuant to Visa's initial public

offering in March 2008; an $82,000 gain on the sale of property

adjacent to one of our branches in the first quarter of 2008; and a

$75,000 contingent final payment in the first quarter of 2008

related to the outsourcing of our merchant services function in

late 2006. Turning to overhead expense, salaries and benefits

declined by $1.6 million, or 34%, for the fourth quarter and by

$1.2 million, or 7%, for the year in 2008 relative to 2007. Costs

associated with normal annual salary increases, staff additions for

new offices, and staffing enhancements to help manage problem

assets were offset by the fourth-quarter 2008 reversal of $1.6

million in accrued bonuses and other expenses accrued for

discretionary benefits. The reversals were made subsequent to our

determination that the Company would fall short of profit targets.

Also having an impact were fluctuations in salaries that are

associated with successful loan originations and thus deferred

pursuant to FAS 91. Because of lower fourth-quarter loan

origination activity in 2008 relative to 2007 our FAS 91 deferral

declined by $206,000, thus increasing salaries expense by the same

amount, although the deferral was only $32,000 lower for the

comparative annual periods. Deferred compensation accruals are

reflected in employee benefits, and participant losses on deferred

compensation plans contributed to a decline in deferred

compensation expense totaling $276,000 for the fourth quarter and

$739,000 for the year. As noted above, this is also related to

separate account BOLI losses. Occupancy expense increased by

$76,000, or 5%, for the fourth quarter and by $33,000, or 1%, for

the year. Normal annual increases in rent and maintenance and

increases related to new offices were largely offset for the year

by lower furniture and equipment depreciation, resulting from

certain high-cost items becoming fully depreciated during 2007.

Also affecting comparative occupancy expense was an $87,000

increase in property taxes in 2008, resulting from non-recurring

property tax refunds received in the first quarter of 2007. Other

non-interest expenses increased by $492,000, or 18%, for the

quarter, and by $1 million, or 9%, for the year. Significant

increases in this category for the comparative 2008 and 2007

periods include the following: OREO properties were written down by

$101,000 in the fourth quarter and by $463,000 for the year in

2008; other lending-related costs, including appraisal costs,

inspection expenses, demand and foreclosure costs, and legal

expenses associated with collections, were up by $191,000 for the

quarter and by $893,000 for the year; and a legal settlement and

non-recurring operations- related loss added $191,000 to

non-interest expense for the year in 2008. Additional increases are

evident in marketing costs, supplies expense, FDIC assessments, and

costs associated with internet banking and remote deposit capture.

These increases were partially offset by expense reductions that

include the following: the elimination of costs associated with

credit cards due to the sale of our credit card portfolio last

year, resulting in a comparative expense reduction of $596,000 for

the year; and a reduction in directors' deferred compensation

expense accruals totaling $280,000 for the quarter and $720,000 for

the year, due to participant losses on balances associated with

deferred directors' fees. Additional non-recurring items reflected

in 2008 annual results include a $104,000 EFT processing rebate

received in the second quarter of 2008, one-time EFT and ATM

incentives totaling $242,000 received in the first quarter of 2008,

a $54,000 insurance recovery on check fraud losses received in the

second quarter of 2008, and $83,000 in initiation costs associated

with our new mortgage program that were incurred in the second

quarter of 2008. Another item having a relatively large impact on

net income for the year in 2008 was the release of a reserve held

against our deferred tax asset. The reserve was established last

year, due to the tentative nature of tax benefits resulting from

long-term capital losses on our investment in a title insurance

holding company. Upon finalization of 2007 tax returns we were able

to realize those tax benefits and release the reserve, which

reduced our tax provision for the third quarter of 2008 by

approximately $230,000. As noted above, balance sheet changes

during 2008 include sizeable increases in deposits and investment

securities. Total deposits increased by $211 million, or 25%. Most

of the deposit growth was in time deposits, including a $104

million increase in CDARS deposits, a $50 million increase in

collateralized balances from a governmental entity, and a $60

million increase in wholesale-sourced brokered deposits. Combined

NOW/savings balances were up by $18 million, or 13%, and money

market deposits increased by $21 million, or 16%. Non-interest

bearing demand deposits, however, show a decline for the year of

$12 million, or 5%, due primarily to migration into NOW and money

market accounts. We let $123 million in other borrowings (primarily

Federal Home Loan Bank borrowings and fed funds purchased) roll off

due to the aggregate deposit influx. Additionally, much of the cash

flow generated by the increase in deposits was utilized to increase

investment balances by $64 million, or 35%, because the investment

environment earlier in 2008 was conducive to increasing our

relative level of investment securities. Gross loan balances

increased by $22 million, or 2%, during 2008, including

approximately $10 million in mortgage loans purchased during the

third quarter. Loan growth by category is slightly distorted

because of the third quarter 2008 reclassification of $14 million

in mobile home loans from real estate loans to consumer loans.

Organic loan growth in most of our branches is low relative to

prior years, due in part to large prepayments and heightened

selectivity on the part of the Company in a difficult credit

environment. Total non-performing assets rose by $27 million, or

285%, during 2008, ending the year at $37 million. Non-accruing

loans at December 31, 2008 include seven large

acquisition/development and land loans with a combined fair value

of $22 million, with five of those loans totaling $18 million being

placed on non-accrual in the fourth quarter. There was also a

material increase in non-performing residential construction loans

and foreclosed properties during 2008. About $4 million of the $7

million foreclosed asset balance at December 31, 2008 is comprised

of three relationships, each of which includes an acquisition and

development component. Of note, at December 31, 2008 there was

approximately $127 million in acquisition/development and builder

construction loans and $21 million in other residential

construction loans remaining on our books as performing loans.

Specific loss reserves are allocated to non-performing loans based

on loss expectations, which for real estate loans are based on

current appraised values less the expected costs of disposition.

Our detailed analysis indicates that as of December 31, 2008, our

$15.1 million allowance for loan and lease losses should be

sufficient to cover potential credit losses inherent in loans and

leases outstanding as of that date. However, no assurance can be

given that the Company will not experience substantial future

losses relative to the size of the allowance. Our allowance for

loan and lease losses was 1.59% of total loans at December 31,

2008, relative to 1.33% at year-end 2007. Certain amounts reported

for 2007 have been reclassified to be consistent with the reporting

for 2008, including certain late charges on loans totaling $72,000

for the fourth quarter of 2007 and $265,000 for the year ended

December 31, 2007 that were moved from "Other Non-Interest Income"

to "Interest Income." About Sierra Bancorp Sierra Bancorp is the

holding company for Bank of the Sierra

(http://www.bankofthesierra.com/), which is in its 32nd year of

operations and is the largest independent bank headquartered in the

South San Joaquin Valley. The Company has over $1.3 billion in

total assets and currently maintains 23 branch offices, an

agricultural credit center, an SBA loan center, and an online

"virtual" branch. The statements contained in this release that are

not historical facts are forward-looking statements based on

management's current expectations and beliefs concerning future

developments and their potential effects on the Company. Readers

are cautioned not to unduly rely on forward-looking statements.

Actual results may differ from those projected. These forward-

looking statements involve risks and uncertainties including but

not limited to the health of the national and California economies,

the Company's ability to attract and retain skilled employees,

customers' service expectations, the Company's ability to

successfully de ploy new technology and gain efficiencies there

from, the success of branch expansion, changes in interest rates,

loan portfolio performance, the Company's ability to secure buyers

for foreclosed properties, and other factors detailed in the

Company's SEC filings. CONSOLIDATED INCOME STATEMENT 3-Month Period

Ended: Year Ended: (in $000's, 12/31/ 12/31/ % 12/31/ 12/31/ %

unaudited) 2008 2007 Change 2008 2007 Change Interest Income

$17,923 $21,425 -16.3% $77,938 $87,816 -11.2% Interest Expense

4,547 7,560 -39.9% 21,329 31,435 -32.1% Net Interest Income 13,376

13,865 -3.5% 56,609 56,381 0.4% Provision for Loan & Lease

Losses 13,636 951 1333.9% 19,456 3,252 498.3% Net Int after

Provision (260) 12,914 -102.0% 37,153 53,129 -30.1% Service Charges

2,948 2,360 24.9% 11,203 7,794 43.7% Loan Sale & Servicing

Income 13 14 -7.1% 43 1,670 -97.4% Other Non-Interest Income 670

1,352 -50.4% 4,394 5,157 -14.8% Gain (Loss) on Investments - - 0.0%

347 14 2378.6% Total Non- Interest Income 3,631 3,726 -2.5% 15,987

14,635 9.2% Salaries & Benefits 3,113 4,718 -34.0% 16,666

17,861 -6.7% Occupancy Expense 1,743 1,667 4.6% 6,508 6,475 0.5%

Other Non-Interest Expenses 3,295 2,803 17.6% 12,685 11,645 8.9%

Total Non- Interest Expense 8,151 9,188 -11.3% 35,859 35,981 -0.3%

Income Before Taxes (4,780) 7,452 -164.1% 17,281 31,783 -45.6%

Provision for Income Taxes (2,897) 2,507 -215.6% 3,868 10,761

-64.1% Net (Loss) Income $(1,883) $4,945 -138.1% $13,413 $21,022

-36.2% TAX DATA Tax-Exempt Muni Income $591 $566 4.4% $2,368 $2,230

6.2% Tax-Exempt BOLI Income $(153) $294 -152.0% $408 $1,234 -66.9%

Interest Income - Fully Tax Equiv $18,241 $21,730 -16.1% $79,213

$89,017 -11.0% NET CHARGE-OFFS (RECOVERIES) $9,817 $869 $16,639

$2,554 PER SHARE DATA 3-Month Period Ended: Year Ended: (unaudited)

12/31/ 12/31/ % 12/31/ 12/31/ % 2008 2007 Change 2008 2007 Change

Basic Earnings per Share ($0.19) $0.51 -137.3% $1.40 $2.17 -35.5%

Diluted Earnings per Share ($0.19) $0.50 -138.0% $1.37 $2.09 -34.4%

Common Dividends $0.17 $0.16 6.3% $0.68 $0.62 9.7% Wtd. Avg. Shares

Outstanding 9,669,519 9,661,325 9,607,184 9,700,048 Wtd. Avg.

Diluted Shares 9,799,069 9,953,279 9,779,657 10,044,915 Book Value

per Basic Share (EOP) $11.04 $10.39 6.3% $11.04 $10.39 6.3%

Tangible Book Value per Share (EOP) $10.47 $9.81 6.7% $10.47 $9.81

6.7% Common Shares Outstanding (EOP) 9,673,291 9,576,388 9,673,291

9,576,388 KEY FINANCIAL RATIOS 3-Month Period Ended: Year Ended:

(unaudited) 12/31/2008 12/31/2007 12/31/2008 12/31/2007 Return on

Average Equity -6.90% 19.83% 12.86% 22.28% Return on Average Assets

-0.57% 1.61% 1.05% 1.74% Net Interest Margin (Tax-Equiv.) 4.57%

5.11% 4.98% 5.28% Efficiency Ratio (Tax-Equiv.) 47.57% 50.86%

48.73% 49.36% Net C/O's to Avg Loans (not annualized) 1.04% 0.10%

1.79% 0.28% AVERAGE BALANCES 3-Month Period Ended: Year Ended: (in

$000's, % % unaudited) 12/31/2008 12/31/2007 Change 12/31/2008

12/31/2007 Change Average Assets $1,313,869 $1,220,431 7.7%

$1,283,362 $1,211,102 6.0% Average Interest- Earning Assets

$1,190,939 $1,099,189 8.3% $1,163,405 $1,091,271 6.6% Average Gross

Loans & Leases $947,318 $913,201 3.7% $931,382 $903,046 3.1%

Average Deposits $1,011,929 $852,069 18.8% $944,891 $887,578 6.5%

Average Equity $108,590 $98,917 9.8% $104,269 $94,339 10.5%

STATEMENT OF CONDITION End of Period: (in $000's, unaudited)

12/31/2008 12/31/2007 Annual Chg ASSETS Cash and Due from Banks

$46,010 $44,022 4.5% Securities and Fed Funds Sold 248,913 184,917

34.6% Agricultural 13,542 13,103 3.4% Commercial & Industrial

142,739 140,323 1.7% Real Estate 705,141 696,110 1.3% SBA Loans

19,463 20,366 -4.4% Consumer Loans 65,755 54,731 20.1% Gross Loans

& Leases 946,640 924,633 2.4% Deferred Loan Fees (1,365)

(3,045) -55.2% Loans & Leases Net of Deferred Fees 945,275

921,588 2.6% Allowance for Loan & Lease Losses (15,094)

(12,276) 23.0% Net Loans & Leases 930,181 909,312 2.3% Bank

Premises & Equipment 19,280 18,255 5.6% Other Assets 81,517

77,229 5.6% Total Assets $1,325,901 $1,233,735 7.5% LIABILITIES

& CAPITAL Demand Deposits $232,168 $243,764 -4.8% NOW / Savings

Deposits 156,322 138,378 13.0% Money Market Deposits 146,896

126,347 16.3% Time Certificates of Deposit 526,112 341,658 54.0%

Total Deposits 1,061,498 850,147 24.9% Junior Subordinated

Debentures 30,928 30,928 0.0% Other Interest-Bearing Liabilities

113,919 237,082 -51.9% Total Deposits & Int.-Bearing Liab.

1,206,345 1,118,157 7.9% Other Liabilities 12,756 16,114 -20.8%

Total Capital 106,800 99,464 7.4% Total Liabilities & Capital

$1,325,901 $1,233,735 7.5% CREDIT QUALITY DATA End of Period: (in

$000's, unaudited) 12/31/2008 12/31/2007 Annual Chg Non-Accruing

Loans $29,786 $9,052 229.1% Over 90 Days PD and Still Accruing 71 -

100.0% Foreclosed Assets 7,127 556 1181.8% Total Non-Performing

Assets $36,984 $9,608 284.9% Non-Perf Loans to Total Loans 3.15%

0.98% Non-Perf Assets to Total Assets 2.79% 0.78% Allowance for Ln

Losses to Loans 1.59% 1.33% OTHER PERIOD-END STATISTICS End of

Period: (unaudited) 12/31/2008 12/31/2007 Shareholders Equity /

Total Assets 8.1% 8.1% Loans / Deposits 89.2% 108.8% Non-Int.

Bearing Dep. / Total Dep. 21.9% 28.7% DATASOURCE: Sierra Bancorp

CONTACT: Ken Taylor, EVP|CFO, or Kevin McPhaill, EVP|Chief Banking

Officer, both of Sierra Bancorp, +1-559-782-4900, 1-888-454-BANK

Web site: http://www.sierrabancorp.com/

Copyright

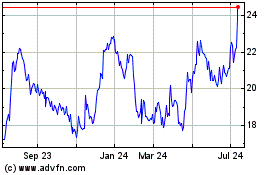

Sierra Bancorp (NASDAQ:BSRR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Sierra Bancorp (NASDAQ:BSRR)

Historical Stock Chart

From Jul 2023 to Jul 2024