Sierra Bancorp Elects Not to Seek Bailout Money

November 13 2008 - 12:52PM

PR Newswire (US)

PORTERVILLE, Calif., Nov. 13 /PRNewswire-FirstCall/ -- Sierra

Bancorp (NASDAQ:BSRR), parent of Bank of the Sierra, today

announced that its Board of Directors, while applauding the U.S.

Government's systemic and creative approach to alleviating the

current National financial crisis, has determined that it would not

be in the best interests of the Company or its shareholders to

apply for aid from the U.S. Treasury under the Treasury's new

capital assistance program. This conclusion was reached based on

the Company's strong capital position relative to reasonably

foreseeable needs, as well as the capital management restrictions

that would accompany this governmental capital infusion. Risk-based

capital ratios are calculated to provide a measure of capital that

reflects the degree of risk associated with a financial

institution's assets and off-balance-sheet items. Sierra Bancorp's

total risk-based capital ratio was 13.65% at September 30, 2008,

significantly greater than the 10% level required to be classified

as "well-capitalized", the highest rating possible under FDIC and

Federal Reserve Board Guidelines. It appears that the Company would

qualify for a capital injection of close to $32 million from the

Treasury, and with that much additional capital our total

risk-based based capital ratio would have been 16.65% at September

30, 2008. This represents a level of capital that would typically

be deemed excessive and inefficient unless immediately leveraged

for loan growth, utilized to absorb loan losses or impairment

charges, or earmarked for a potential acquisition. James C. Holly,

Sierra Bancorp's President and Chief Executive Officer, remarked,

"We recognize that these are not typical times, and no one can

predict the depth and duration of the current economic malaise, but

we have projected our capital position under varying scenarios and

are confident that the Company will remain well-capitalized even

under severe conditions. Further, if an acquisition opportunity

were to arise, our preliminary inquiries indicate that private

sector alternatives, such as trust preferred securities or

subordinated debt, would likely be available, obviating the need

for reliance on public assistance." In addition to raising capital

ratios to inflated levels, the acceptance of capital from the

Treasury would place restrictions on the Company's ability to

declare dividends and repurchase stock. Furthermore, the Treasury's

capital purchase would be in the form of senior preferred stock

that carries a mandatory dividend payment of 5% (close to 8% on a

pre-tax equivalent basis), increasing to 9% (close to 14% pre-tax

equivalent) after five years. This has been described as "cheap

capital" if needed, but in reality equates to expensive debt if it

cannot be quickly utilized. In addition to preferred stock, the

Treasury would receive warrants to purchase common stock with an

aggregate market price equal to 15% of the preferred investment,

which would be dilutive to current common shareholders. Sierra

Bancorp is the holding company for Bank of the Sierra

(http://www.bankofthesierra.com/), which is in its 31st year of

operations and is the largest independent bank headquartered in the

South San Joaquin Valley. The Company has $1.3 billion in total

assets and currently maintains 22 branch offices, an agricultural

credit center, an SBA center, and an online "virtual" branch. In

May 2008, Sierra Bancorp was recognized by U.S. Banker magazine as

the best performing mid-tier bank in the nation based on 2007

return on equity, and the 6th bank overall based on 3-year average

return on equity. The statements contained in this release that are

not historical facts are forward-looking statements based on

management's current expectations and beliefs concerning future

developments and their potential effects on the Company. Readers

are cautioned not to unduly rely on forward looking statements.

Actual results may differ from those projected. These

forward-looking statements involve risks and uncertainties

including but not limited to the bank's ability to maintain current

dividend payments or increase dividend payouts to shareholder, its

ability to continue to generate record financial results, changes

in economic conditions, interest rates and loan portfolio

performance, and other factors detailed in the Company's SEC

filings. Sierra Bancorp undertakes no responsibility to update or

revise any forward-looking statements. DATASOURCE: Sierra Bancorp

CONTACT: Ken Taylor, EVP|CFO, or Kevin McPhaill, EVP|Chief Banking

Officer, +1-559-782-4900 or, 1-888-454-BANK, both of Sierra Bancorp

Web Site: http://www.bankofthesierra.com/

http://www.sierrabancorp.com/

Copyright

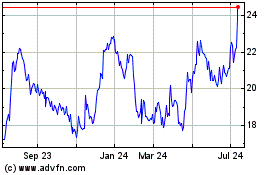

Sierra Bancorp (NASDAQ:BSRR)

Historical Stock Chart

From Jun 2024 to Jul 2024

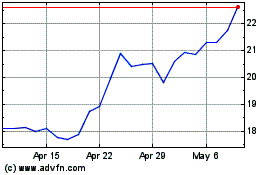

Sierra Bancorp (NASDAQ:BSRR)

Historical Stock Chart

From Jul 2023 to Jul 2024