Sierra Bancorp (Nasdaq:BSRR), parent of Bank of the Sierra, today

announced record net income of $4.8 million for the quarter ended

September 30, 2005, an increase of 23% relative to net income in

the third quarter of the previous year. Two significant factors

impacting the increase were an interest recovery and a substantial

reduction in the loan loss provision, both enabled by the sale of a

sizeable non-accruing note. Other major items affecting the

Company's financial results for the quarter include strong core

deposit and loan growth, net interest margin expansion, and the

write-down of an OREO property. "The positive net impact of

non-recurring items in the third quarter provided a boost that

offset the effect of some first quarter events," commented James C.

Holly, President and CEO. "Continued growth in loans and low-cost

deposits, a strong net interest margin, and greatly improved credit

quality indicate that our core performance is solid, as well," he

added. The Company's return on assets was 1.9% for the third

quarter of 2005, and return on equity was 25.0%. On a year-to-date

basis net income was $11.9 million, an increase of 18% over net

income for the first nine months of 2004. Year-to-date return on

assets and return on equity were 1.6% and 21.3%, respectively.

Financial Highlights (fiscal quarter and nine months ended 9/30/05,

compared to quarter and nine months ended 9/30/04) -- The

aforementioned note sale resulted in the pay-off of the $823,000

book balance of the note, as well as the recovery of $536,000 in

interest and fees (credited to income), and the recovery of

$525,000 in previously charged-off principal (added back to the

allowance for loan and lease losses) -- The Company's net interest

margin was 5.87% for the quarter versus 5.33% in the year-ago

quarter, and would have been 5.64% without the interest recovery --

The provision for loan and lease losses was down by 55% for the

quarter and 12% year-to-date -- Despite declining service charges

and lower loan sale income, non-interest income was up 1% for the

quarter due to strong growth in other areas -- Salaries and

Benefits increased by 21% for the quarter and 14% year-to-date due

in large part to regular annual increases of about 5%, a lower

credit against current period expenses for deferred loan

origination costs, and increased staffing -- Other non-interest

expense was up by 23% for the quarter and 29% year-to-date,

primarily because of OREO write-downs, higher internal and external

audit costs, higher pass-through expenses on our partnership

investments in low-income housing tax credit funds, and, for

year-to-date only, higher advertising and promotion costs -- A $2.5

million credit was placed on non-accrual during the second quarter,

yet total non-performing assets have dropped by a net $1.4 million

since the end of 2004 due to the resolution of other problem loans,

the sale of a non-accruing note, and the sale of OREO -- In

addition to the recovery of $525,000 in previously charged-off

principal in the third quarter of 2005, the Company collected

amounts totaling $564,000 during the second quarter and thus

experienced net recoveries rather than net loan losses for both the

quarter and year-to-date -- Aggregate loan and lease balances grew

by 3.5% during the quarter, an annualized growth rate of 14% --

Demand deposits increased 11% and low-cost NOW/savings deposits

increased 10% from the end of 2004 through September 30, 2005 --

During the first nine months of 2005 money market deposits declined

$32 million, or 23%, with much of the money moving into time

certificates of deposit, which increased $45 million, or 19%

Operating Results (third quarter and first nine months of 2005) The

Company's leverage strategy was implemented in April 2004, and

quarterly results from both years now include the full impact of

that strategy. The leverage strategy involved the purchase of

mortgage-backed securities, funded with matched-duration

collateralized borrowings from the Federal Home Loan Bank. Net

interest income earned from the leverage strategy for the third

quarter of 2005 was about $226,000 on an average outstanding

balance of $83 million, relative to about $458,000 on an average

balance of $102 million during the third quarter of 2004. For the

first nine months of 2005 the leverage strategy generated $840,000

in net interest income, while for the first nine months of 2004 the

number was about $809,000. For the quarter, about $1.4 million of

the $2.3 million increase in net interest income is the result of

growth in average earning assets, while the remainder is from rate

or combined rate/volume variances, including the $536,000 interest

recovery. For the first nine months, $4.5 million of the total $5.7

million increase in net interest income is due to growth in average

earning assets, while favorable rate variances and combined

rate/volume variances added about $1.2 million. The first nine

months of 2005 had one less accrual day because 2004 was a leap

year, which had a negative $100,000 impact on the variance in net

interest income. The Company's tax-equivalent net interest margin

was 5.9% for the third quarter of 2005 and 5.6% for the first nine

months of 2005, relative to 5.3% and 5.5% for the third quarter and

first nine months of 2004, respectively. Despite a rate environment

where the yield curve has flattened significantly, margins have

been higher than anticipated in 2005 because yields on

variable-rate loans have been rising but deposit costs have not

increased as much as expected. The Company's loan loss provision

was $550,000 lower in the third quarter of 2005 than in the third

quarter of 2004. Net loan recoveries of over $200,000 for the

quarter and the release of specific reserves on non-accruing loans

that paid off or were otherwise resolved partially alleviated the

need to add to the allowance for loan and lease losses. Likewise,

the provision for the first nine months was $323,000 lower than in

the previous year. Service charges on deposits declined 4% for the

quarter and 10% year-to-date, despite increases in average demand

deposits of 20% for the quarter and 23% year-to-date relative to

like periods in the previous year. The drop in service charges was

due in part to growth in free consumer demand deposit accounts, and

returned item and overdraft charges have been trending down. The

same is true for hard-dollar charges on analysis accounts, which

have declined as the earnings credit rate for those accounts has

increased. Loan sale and servicing income was down $117,000 for the

third quarter since the Company has been holding for investment

most mortgages that it originates. However, on a year-to-date basis

loan sale and servicing income is $176,000 higher due to the first

quarter gain on the bulk sale of $21 million in mortgage loans. The

small gain on investments for the third quarter of 2005 represents

gains on municipal investments that were called prior to maturity,

while the year-to-date loss on investments includes a $330,000

charge in the first quarter of 2005 to write down the Company's

investment in Diversified Holdings, Inc., a title insurance holding

company. Other non-interest income, which increased by 21% for the

quarter and 14% year-to-date, was higher primarily because of

higher credit card and check card interchange fees, and higher

credit card annual fees. Salaries and benefits increased 21% for

the quarter and 14% year-to-date. About a third of the quarterly

increase resulted from a smaller credit against current period

expenses to defer salaries and benefits associated with successful

loan originations. The remainder of the quarterly increase and most

of the annual increase can be explained by staff additions and a 5%

average increase in annual salaries. Occupancy expense was down by

1% for the quarter and up by 4% year-to-date. One reason for the

minimal change in this area is that third quarter 2004 expenses

were inflated by a $70,000 charge to write off obsolete equipment.

Furthermore, annual rent increases, costs related to enhanced

physical and information security, and depreciation on new

telecommunications equipment appear to have been partially offset

by lower maintenance and repair costs and lower charges for

telecommunications equipment rentals. Other non-interest expenses

increased $565,000, or 23%, for the quarter and $2.0 million, or

27%, year-to-date. The quarterly increase includes a $350,000

charge to write down the book value of an OREO property, while

year-to-date expenses include an additional $200,000 in OREO

write-downs. Other components contributing to the increase include

the following: marketing expenses, which were relatively flat for

the quarter but show a $374,000 year-to-date increase; audit and

review costs, which were up by $142,000 for the quarter and almost

$500,000 year-to-date due to costs incurred in order to comply with

Section 404 of the Sarbanes-Oxley Act; a $56,000 quarterly and

$166,000 year-to-date increase in legal costs related to

collections; and a $72,000 quarterly and $285,000 year-to-date

increase in partnership expenses related to low-income housing tax

credit investments, due in part to our increased investment in

those funds. Telecommunications expense was up $90,000

year-to-date, but shows a decrease of $80,000 for the quarter due

to credits received for earlier over-billings. Our tax accrual rate

was higher for the quarter since the increase in pre-tax income was

taxable at our marginal tax rate. When comparing year-to-date

results, the tax accrual rate was lower in 2005 due primarily to

additional low-income housing tax credits, an adjustment in the

second quarter of 2005 to reflect the proper amount of enterprise

zone interest deductions, and a $400,000 charge in the second

quarter of 2004 related to the Company's REIT. Balance Sheet Growth

(at September 30, 2005) Total assets increased 9% to $1.04 billion

from $948 million a year ago. Gross loan and lease balances grew by

$73 million, or 11%, to $725 million at September 30, 2005 from

$652 million at September 30, 2004. Commercial, real-estate

secured, and SBA guaranteed loans grew by 14%, 13%, and 12%,

respectively, while agricultural balances fell by 35% as some less

desirable credits were managed out of the Company. The aggregate

balance of loans outstanding fell by $13 million during the first

quarter of 2005 due to the sale of $21 million in mortgage loans in

March, but has increased by $42 million since then for a net

increase at the end of September of $29 million relative to

year-end 2004. Securities and fed funds sold grew by a combined $4

million, or 2%, over the past twelve months, while the balance of

non-earning cash and due from banks increased by $11 million, or

33%, during the same time period. The increase in cash is related

to the timing of collection of cash items. Relative to their

year-end 2004 balance, non-performing assets have declined by $1.4

million, or 27%, despite the addition of the aforementioned $2.5

million credit. The decline relative to September 30, 2004 is about

26%. Non-performing assets have fallen to 0.35% of total assets,

compared to 0.52% of total assets a year ago. The sale of a

non-accruing note accounts for $823,000 of the decline, and several

repossessed properties have also been sold for a net reduction in

OREO of $1.5 million since September 30, 2004. At September 30,

2005, the allowance for loan losses stood at $11.4 million, or

1.58% of gross loans, compared to $8.5 million, or 1.30% of total

loans a year ago. The percent of net loan charge-offs to average

loans was -0.03% in the third quarter and -0.04% in the first nine

months of 2005, compared to net charge-offs of 0.03% of average

loans in the third quarter and 0.14% in the first nine months of

2004. Over the past year, deposit balances have grown 10% to $795

million at September 30, 2005, with demand deposits up 20%, NOW and

savings balances up 15%, money market deposits down 23%, and time

deposits up by 18%. Non-interest bearing deposits improved to 33%

of total deposits from 30% a year ago. As noted above, much of the

decrease in money market deposits and increase in time deposits can

be explained by the migration of money market to time. Subordinated

debentures remained at $31 million, as no additional

trust-preferred securities have been issued since March 2004. Other

interest-bearing liabilities were also at about the same level at

September 30, 2005 that they were at September 30, 2004, however

they have declined by $24 million relative to year-end 2004. A

total of $29 million in longer-term Federal Home Loan Bank

borrowings related to the leverage strategy rolled off during the

first nine months of 2005. Overnight borrowings also declined by $8

million during the same time period, while short-term FHLB advances

increased $9 million and customer repos grew by $4 million. Total

capital increased 12% to $77.4 million at September 30, 2005

compared to $69.1 million a year ago, due to an increase in

retained earnings and capital contributed through the exercise of

stock options, net of the impact of stock repurchases. About Sierra

Bancorp Sierra Bancorp is the holding company for Bank of the

Sierra (www.bankofthesierra.com), which is in its 28th year of

operations and is the largest independent bank headquartered in the

South San Joaquin Valley. The Company has over $1 billion in total

assets and currently maintains eighteen branch offices, two

agricultural credit centers, and one SBA center. In June 2005,

Sierra Bancorp was added to the Russell 2000 index based on

relative growth in market capitalization. In its July 2005 edition,

US Banker magazine ranked Sierra Bancorp as the nation's 8th best

performing publicly-traded community bank based on three-year

average return on equity. The statements contained in this release

that are not historical facts are forward-looking statements based

on management's current expectations and beliefs concerning future

developments and their potential effects on the Company. Readers

are cautioned not to unduly rely on forward-looking statements.

Actual results may differ from those projected. These

forward-looking statements involve risks and uncertainties

including but not limited to the health of the national and

California economies, the Company's ability to attract and retain

skilled employees, customers' service expectations, the Company's

ability to successfully deploy new technology and gain efficiencies

there from, the success of branch expansion, changes in interest

rates, loan portfolio performance, the Company's ability to secure

buyers for foreclosed properties, and other factors detailed in the

Company's SEC filings. -0- *T

----------------------------------------------------------------------

CONSOLIDATED INCOME STATEMENT 3-Month Period Ended: Nine Month

Period Ended: (in $000's, % % unaudited) 9/30/2005 9/30/2004 Change

9/30/2005 9/30/2004 Change Interest Income $16,976 $13,476 26.0%

$46,990 $37,845 24.2% Interest Expense 3,499 2,274 53.9% 9,408

5,986 57.2% --------- ---------- --------- ---------- Net Interest

Income 13,477 11,202 20.3% 37,582 31,859 18.0% Provision for Loan

& Lease Losses 450 1,000 -55.0% 2,350 2,673 -12.1% ---------

---------- --------- ---------- Net Int after Provision 13,027

10,202 27.7% 35,232 29,186 20.7% Service Charges 1,512 1,576 -4.1%

4,180 4,655 -10.2% Loan Sale & Servicing Income 38 155 -75.5%

605 429 41.0% Other Non- Interest Income 1,192 987 20.8% 3,367

2,957 13.9% Gain (Loss) on Investments 9 14 -35.7% (255) 19

-1442.1% --------- ---------- --------- ---------- Total Non-

Interest Income 2,751 2,732 0.7% 7,897 8,060 -2.0% Salaries &

Benefits 3,630 2,990 21.4% 11,449 10,038 14.1% Occupancy Expense

1,544 1,566 -1.4% 4,540 4,388 3.5% Other Non- Interest Expenses

3,004 2,439 23.2% 9,432 7,450 26.6% --------- ---------- ---------

---------- Total Non- Interest Expense 8,178 6,995 16.9% 25,421

21,876 16.2% Income Before Taxes 7,600 5,939 28.0% 17,708 15,370

15.2% Provision for Income Taxes 2,754 1,996 38.0% 5,850 5,355 9.2%

--------- ---------- --------- ---------- Net Income $4,846 $3,943

22.9% $11,858 $10,015 18.4% ========= ========== =========

========== TAX DATA Tax-Exempt Muni Income $398 $317 25.6% $1,095

$988 10.8% Tax-Exempt BOLI Income $198 $176 12.5% $559 $622 -10.1%

Interest Income -- Fully Tax Equiv $17,181 $13,639 26.0% $47,554

$38,354 24.0% NET CHARGE- OFFS (RECOVERIES) $(213) $204 -204.4%

$(254) $898 -128.3%

----------------------------------------------------------------------

----------------------------------------------------------------------

PER SHARE DATA 3-Month Period Ended: Nine Month Period Ended:

(unaudited) % % 9/30/2005 9/30/2004 Change 9/30/2005 9/30/2004

Change Basic Earnings per Share $0.50 $0.41 22.0% $1.21 $1.06 14.2%

Diluted Earnings per Share $0.47 $0.39 20.5% $1.14 $0.99 15.2%

Common Dividends $0.11 $0.09 22.2% $0.33 $0.27 22.2% Wtd. Avg.

Shares Outstanding 9,786,469 9,532,498 9,774,672 9,433,255 Wtd.

Avg. Diluted Shares 10,366,161 10,133,300 10,385,287 10,095,704

Book Value per Basic Share (EOP) $7.96 $7.21 10.4% $7.96 $7.21

10.4% Tangible Book Value per Share (EOP) $7.39 $6.64 11.3% $7.39

$6.64 11.3% Common Shares Outstanding (EOP) 9,733,305 9,582,308

9,733,305 9,582,308

----------------------------------------------------------------------

----------------------------------------------------------------------

KEY FINANCIAL RATIOS 3-Month Period Ended: Nine Month Period Ended:

(unaudited) 9/30/2005 9/30/2004 9/30/2005 9/30/2004 Return on

Average Equity 25.03% 23.68% 21.35% 21.08% Return on Average Assets

1.88% 1.66% 1.58% 1.51% Net Interest Margin (Tax- Equiv.) 5.87%

5.33% 5.61% 5.49% Efficiency Ratio (Tax- Equiv.) 49.52% 49.30%

54.65% 53.69% Net C/O's to Avg Loans (not annualized) -0.03% 0.03%

-0.04% 0.14%

----------------------------------------------------------------------

----------------------------------------------------------------------

AVERAGE 3-Month Period Ended: Nine Month Period Ended: BALANCES (in

$000's, % % unaudited) 9/30/2005 9/30/2004 Change 9/30/2005

9/30/2004 Change Average Assets $1,022,206 $942,873 8.4% $1,004,628

$883,517 13.7% Average Earning Assets $924,119 $847,825 9.0%

$908,461 $788,272 15.2% Average Gross Loans & Leases $712,345

$636,492 11.9% $696,449 $624,011 11.6% Average Deposits $786,848

$722,465 8.9% $769,969 $700,436 9.9% Average Equity $76,812 $66,256

15.9% $74,267 $63,462 17.0%

----------------------------------------------------------------------

----------------------------------------------------------------------

STATEMENT OF CONDITION End of Period: (in $000's, unaudited)

9/30/2005 12/31/2004 9/30/2004 Annual Chg ASSETS Cash and Due from

Banks $43,508 $36,735 $32,609 33.4% Securities and Fed Funds Sold

202,428 198,024 197,969 2.3% Agricultural 9,639 13,146 14,811

-34.9% Commercial & Industrial 109,187 101,300 95,984 13.8%

Real Estate 523,077 500,394 463,088 13.0% SBA Loans 23,629 21,547

21,148 11.7% Consumer Loans 49,357 48,992 46,592 5.9% Credit Card

Balances 10,561 10,897 10,473 0.8% ----------- -----------

----------- Gross Loans & Leases 725,450 696,276 652,096 11.2%

Deferred Loan Fees (1,598) (1,277) (1,062) 50.5% -----------

----------- ----------- Loans & Leases Net of Deferred Fees

723,852 694,999 651,034 11.2% Allowance for Loan & Lease Losses

(11,446) (8,842) (8,476) 35.0% ----------- ----------- -----------

Net Loans & Leases 712,406 686,157 642,558 10.9% Bank Premises

& Equipment 17,469 17,731 17,678 -1.2% Other Assets 60,814

58,836 56,834 7.0% ----------- ----------- ----------- Total Assets

$1,036,625 $997,483 $947,648 9.4% =========== ===========

=========== LIABILITIES & CAPITAL Demand Deposits $262,004

$235,732 $217,951 20.2% NOW / Savings Deposits 143,724 131,079

124,548 15.4% Money Market Deposits 105,341 137,545 136,795 -23.0%

Time Certificates of Deposit 283,618 238,347 240,061 18.1%

----------- ----------- ----------- Total Deposits 794,687 742,703

719,355 10.5% Subordinated Debentures 30,928 30,928 30,928 0.0%

Other Interest-Bearing Liabilities 119,133 142,987 118,342 0.7%

----------- ----------- ----------- Total Deposits & Int.-

Bearing Liab. 944,748 916,618 868,625 8.8% Other Liabilities 14,436

9,730 9,888 46.0% Total Capital 77,441 71,135 69,135 12.0%

----------- ----------- ----------- Total Liabilities & Capital

$1,036,625 $997,483 $947,648 9.4% =========== ===========

===========

----------------------------------------------------------------------

----------------------------------------------------------------------

CREDIT QUALITY DATA End of Period: (in $000's, unaudited) 9/30/2005

12/31/2004 9/30/2004 Annual Chg Non-Accruing Loans $2,932 $2,148

$2,343 25.1% Over 90 Days PD and Still Accruing 143 300 509 -71.9%

Other Real Estate Owned 545 2,524 2,039 -73.3% -----------

----------- ----------- Total Non-Performing Assets $3,620 $4,972

$4,891 -26.0% =========== =========== =========== Non-Perf Loans to

Total Loans 0.42% 0.35% 0.44% Non-Perf Assets to Total Assets 0.35%

0.50% 0.52% Allowance for Ln Losses to Loans 1.58% 1.27% 1.30%

----------------------------------------------------------------------

----------------------------------------------------------------------

OTHER PERIOD-END End of Period: STATISTICS (unaudited) 9/30/2005

12/31/2004 9/30/2004 Shareholders Equity / Total Assets 7.5% 7.1%

7.3% Loans / Deposits 91.3% 93.7% 90.7% Non-Int. Bearing Dep. /

Total Dep. 33.0% 31.7% 30.3%

----------------------------------------------------------------------

*T

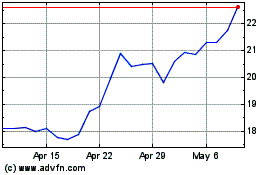

Sierra Bancorp (NASDAQ:BSRR)

Historical Stock Chart

From Jul 2024 to Jul 2024

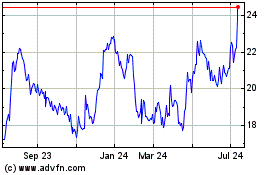

Sierra Bancorp (NASDAQ:BSRR)

Historical Stock Chart

From Jul 2023 to Jul 2024