UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of

February 2024

Commission File Number 000-20181

SAPIENS INTERNATIONAL CORPORATION N.V.

(Translation of Registrants name into English)

Azrieli Center

26 Harokmim St.

Holon, 5885800 Israel

(Address of Principal Executive Office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

CONTENTS

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

Sapiens International Corporation N.V. |

| |

|

| Date: February 26,

2024 |

By: |

/s/ Roni Giladi |

| |

|

Name: |

Roni Giladi |

| |

|

Title: |

Chief Financial Officer |

Exhibit Index

The following exhibit is

furnished as part of this Form 6-K:

3

Exhibit 99.1

Sapiens Proprietary & Confidential February 22nd 2024 Roni Al - Dor, CEO TASE Annual Conference

Welcome 2

Sapiens is the global partner of choice for insurance carriers that seek to digitally transform their business for the next generation 3

We are Sapiens We passed the $500M mark this year! We are one of the top leaders in the industry We have industry experts, and we continue to adapt our organization to meet our goals and market needs We are a growth company consistently growing organically and non - organically 4

We are Sapiens We are a technology partner to our customers We have a wide range of platforms meeting any type of insurance challenge We are at the center of a large and growing market opportunity 5

A Growing Number of Sapiens Customers A great community of astounding brands, people and national leaders 6

Sapiens is at the Center of a Large and Growing Market Opportunity Outdated insurers technology presents a MASSIVE market for Sapiens Source: Gartner, 2023. (1) Represents 2022 - 2027 CAGR per Gartner. (2) Includes LP&A TAM and P&C TAM for Sapiens ’ core solution areas (Software and Application Implementation & Managed Services). $48B $73B $88B 26% 12% 33% 8% 12% 6% 4% Large and growing insurance IT spend market with 8% CAGR (1) $33B LP&A TAM $60B core TAM , with upside from highly adjacent categories and products $27B P&C TAM LP&A $60B Core TAM (2) P&C Other Software Data Center Devices Telecom Services Internal Services Other IT Services (Adjacent) Core Markets Sapiens’ has the leading offerings to address 38%+ of this spend 38% Core Solutions $88B x LP&A Market $73B x 38% P&C Core Market Solutions Core Solutions …In Sapiens’ Core Markets… …Underpins an Incredible TAM Opportunity $208B Application Impl. & MS Massive Insurance IT Spend… $208B 7

Revenue Operating Profit $514.8M $94.1M Operating Margin 8 18.3% 2023 was a successful year Non - GAAP (USD millions)

Why customers choose us 9

The people we worked with at Sapiens helped us to think out of the box and come up with different ways and different solutions to meet our business needs…. Sapiens is one of the top companies in the Reinsurance space. PATRICK SCHIESSL, LEAD APPLICATION ENGINEER SECURA INSURANCE COMPANY, US Why customers 10 choose us

Why customers choose us That full package of CoreSuite, Sapiens Intelligence and DigitalSuite as an insurance company you only need that, you don't need anything else. The way that it's great, the real - time functionality that you have, it was a clear hands - down winner for us. JONATHAN MANNING, HEAD OF CHANGE LV=, UK 11

Industry analysts recognize Sapiens as a leader across both L&P and P&C 12

Sapiens is the Recognized Leader By Analysts NORTH AMERICA Clear market recognition driven by Sapiens’ innovative product strategy and leadership NA L&A POLICY ADMIN SYSTEMS NA L&A (ILLUSTRATION) Advanced Technology Breadth of Functionality Celent ‘Luminary’ Designation Celent ‘Luminary’ Designation ABC Vendor Maps Breadth of Functionality Advanced Technology NA P&C POLICY ADMIN SYSTEMS Breadth of Functionality Advanced Technology GLOBAL REINSURANCE MASTER Celent ‘Luminary’ Designation Breadth of Functionality Advanced Technology Source: Celent, 2021 - 2023. Note: Celent’s luminary designation denotes companies that excel in both Advanced Technology and Breadth of Functionality. 13 Sapiens Proprietary & Confidential

Sapiens is the Recognized Leader By Analysts… Clear market recognition driven by Sapiens’ innovative product strategy and leadership EMEA P&C POLICY ADMIN SYSTEMS Breadth of Functionality Advanced Technology Breadth of Functionality Advanced Technology APAC P&C POLICY ADMIN SYSTEMS EMEA L&P POLICY ADMIN SYSTEMS Breadth of Functionality Advanced Technology EMEA & APAC Breadth of Functionality Advanced Technology GLOBAL REINSURANCE MASTER Celent ‘Luminary’ Designation Celent ‘Luminary’ Designation Celent ‘Luminary’ Designation Celent ‘Luminary’ Designation ABC Vendor Maps Source: Celent, 2021 - 2023. Note: Celent’s luminary designation denotes companies that excel in both Advanced Technology and Breadth of Functionality. 14 Sapiens Proprietary & Confidential

Let’s take a macro view of the market 15

2024 Macroeconomic environment Macroeconomic challenges – inflation, FX stability Insurance remains stable Struggling insurtech industry Overall technology spending in insurance has increased 16

Growth & Efficiency are the top priorities for insurance carriers 17

Our Offering 18

Sapiens Strategic Proposition Business model Rich Product Portfolio Full menu of Services & Integration SaaS Across insurance verticals Property & Casualty Life & Annuities Workers’ Compensation & MPL 19

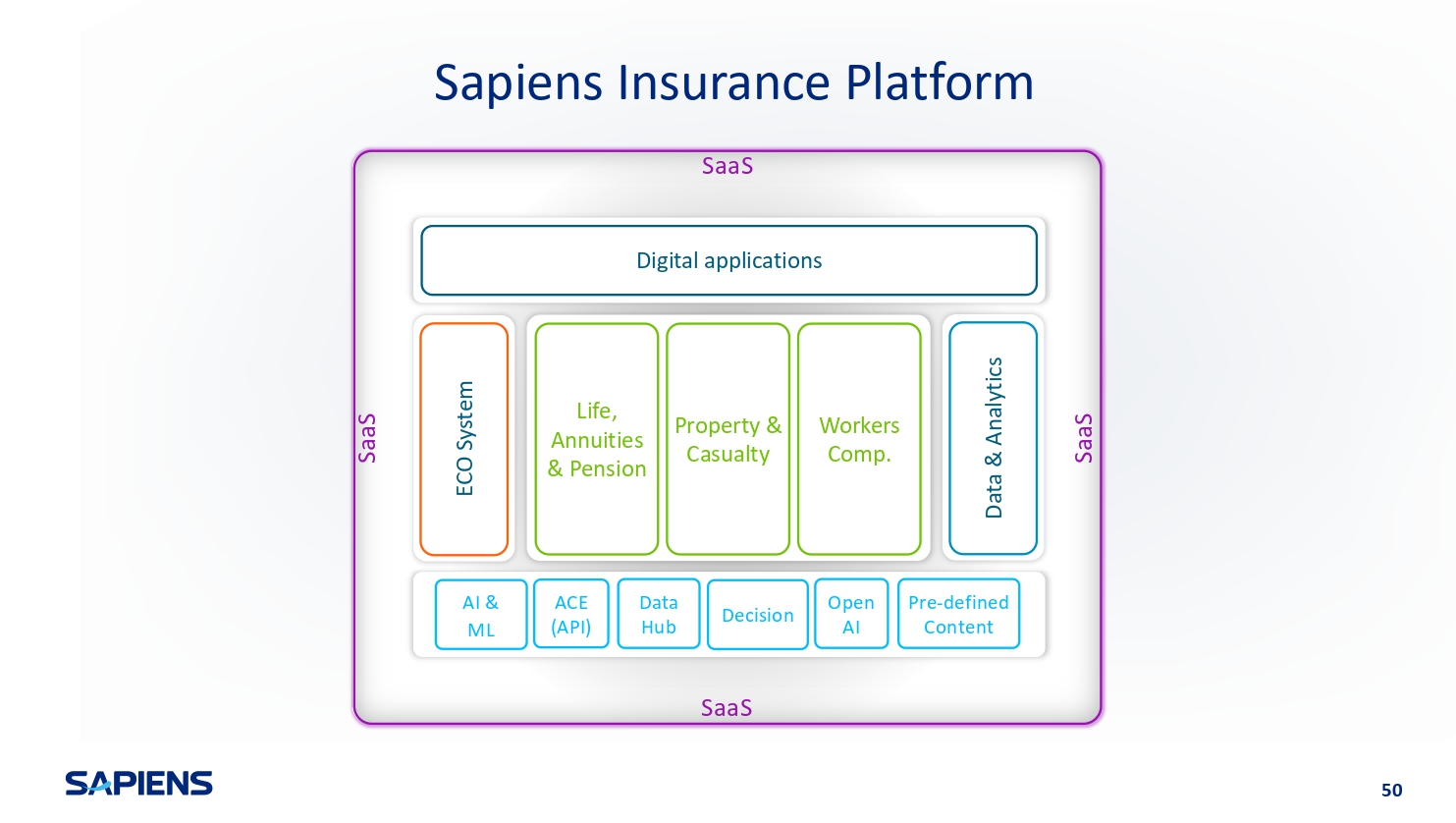

SaaS SaaS SaaS The Sapiens Insurance Platform SaaS Digital applications Data & Analytics ECO System AI & ML Integration layer Tools & engines Industry content L&A P&C WC 20

Updated business model - SIs Leverage business with System Integrators Selecting our Preferred SI’s Focusing SI’s for upper tiers customers & specific regions 21

Our Potential SI Partners 22

Microsoft partnership & AI 23

Sapiens Proprietary & Confidential SaaS offering on Single Cloud based on Microsoft Azure 24

The partnership with Microsoft is fundamental to Sapiens AI strategy and fundamental to our customers as we view this as a low - risk innovation 25

Microsoft and Sapiens Strategic Partnership An extensive technology and go - to - market strategic partnership Delighted to Announce Partnership with Microsoft Sapiens is one of the few selected vendors to strategically collaborate with Microsoft on OpenAI 26

Sapiens Transition to SaaS 27

Sapiens Transition to SaaS Perpetual license/ On prem Perpetual license + Yearly maintanance On prem implementation Term License/ Cloud 5 years term license Optional – Hosting / Cloud contract SaaS/ Subscription Subscription, mostly 5 years’ agreement 28

2024 Go - to - Market Land and Expand 29

Revenue Growth 2024 vs. 2023 $514.8M 2023 7.3% $550M - $555M 2024 30

Land New Logos 31 Offer Sapiens Insurance Platform to increase deal size and scope 2024 Go - to - Market

Cross Sell to existing customers Sapiens Proprietary & Confidential 32 Expand with core, data, digital, SaaS, and ecosystem 2024 Go - to - Market

North America continue the growth in our North American business Life P&C WC RI Decision 33

EMEA and APAC Maintain leadership position across Life and P&C Continue growth pattern Nordics UK DACH Iberia SA APAC CoreSuite Life IDIT RI Tia 34

Increase investments in sales, marketing & product strategy to accelerate growth 35

Go - to - market team 36

Sales Sales managers SI partners Bid mang. Insurance practice 37 Go - to - market team Sales operations CSE

Go - to - market team Marketing SDR Growth marketing Marcom & Brand PR & Partner marketing Regional marketing 38

Go - to - market team Strategy & Product marketing Analyst relations Product marketing Insurtech ecosystem Product strategy 39

Sales Sales managers SI partners Sales operations Bid mang. Insurance practice Go - to - market team Marketing SDR CSE Growth marketing Marcom & Brand PR & Partner marketing Regional marketing Strategy & Product marketing Analyst relations Product marketing Insurtech ecosystem Product strategy 40

To Summarize Strong customer base Insurance platform Transition to SaaS Market recognition Our industry Accelerate growth into 2025 and beyond 41

Alex Zukerman, Chief Strategy Officer Sapiens Strategy

Technology trends in a rapidly - evolving insurance market 43

The Mega Factors Impacting The Future (of insurance) 44

Climate change 45 Technological advancements Aging population Political & Economical instability, Inflation Changing Social Behavior & Covid - 19 after - effect Cybersecurity threats The Mega Factors Impacting The Future (of insurance)

Forces driving change in insurance Increased and More Innovative Competition Greater Accessibility to Both Data and Analytics Technology Shifting Consumer Behavior , Desires and Insurance Needs Demands to Enhance Operational Efficiency Crowded and Disruptive Insurtech Market Sapiens Proprietary & Confidential 46

Tech - Driven Insurance Outlook 2028 New advanced insurance models Alignment of InsurTechs & Incumbents Data & Analytics – Benefits & Risks Humans and Machines Combine Sapiens Proprietary & Confidential 47

Winning Product Strategy in an ever - changing market 48

Excellence in Customer Experience Break into New Markets with Speed Harness the Power of APIs & Ecosystems Data - driven Business Processes Cloud Maturity Product & Offering Vision & Roadmap Digital Engagement Personalization Distribution No - code Automation Flexibility Open Insurance Ecosystem Analytics AI & ML OpenAI Decision SaaS - only Offering Azure Cloud 49

SaaS SaaS SaaS Sapiens Insurance Platform SaaS Digital applications Data & Analytics ECO System Life, Annuities & Pension Property & Casualty Workers Comp. AI & ML ACE (API) Decision Data Hub Open Pre - defined AI Content 50

SaaS SaaS SaaS Sapiens Insurance Platform SaaS Digital applications Data & Analytics ECO System Life, Annuities & Pension Property & Casualty Workers Comp. Shared Infrastructure & SaaS AI & ML ACE (API) Decision Data Hub Open Pre - defined AI Content 51

SaaS SaaS SaaS Sapiens Insurance Platform SaaS Digital applications Data & Analytics ECO System Life, Annuities & Pension Property & Casualty Workers Comp. Vertical Business Apps AI & ML ACE (API) Decision Data Hub Open Pre - defined AI Content 52

SaaS SaaS SaaS SaaS Sapiens Insurance Platform Data & Analytics ECO System Life, Annuities & Pension Property & Casualty Workers Comp. Digital Engagement AI & ML ACE (API) Decision Data Hub Open Pre - defined AI Content Customer Connect Agency & PoS Connect Employer Connect LC/NC Journeys 53

SaaS SaaS SaaS SaaS Sapiens Insurance Platform Data & Analytics ECO System Life, Annuities & Pension Property & Casualty Workers Comp. AI & ML ACE (API) Decision Data Hub Open Pre - defined AI Content Customer Connect Agency & PoS Connect Employer Connect LC/NC Journeys 54 Data & Analytics

SaaS SaaS SaaS SaaS Sapiens Insurance Platform Data & Analytics ECO System Life, Annuities & Pension Property & Casualty Workers Comp. AI & ML ACE (API) Decision Data Hub Open Pre - defined AI Content Customer Connect Agency & PoS Connect Employer Connect LC/NC Journeys Data & Analytics 55

Sapiens Insurance Platform Offering GROWTH EFFICIENCY INNOVATION Digital, Data & Analytics Speed to Market E2E business - specific Use Cases InsurTechs & Industry values Geared for SI partners Lower implementation & on - going effort Process Automation Effective BAU & change management Cloud efficiencies Aligned upgrades AI, ML & OpenAI embedded Decision & Model - AI MS - Azure Stack The “3D” Promise Ecosystem ready Future - Proof & Open Architecture Platform’s Value Proposition for Customers 56

Sapiens Insurance Platform Offering Platform’s strategic value for Sapiens ► Predictive & repeatable revenue – ARR ► Increase win rate of new logos ► Increase the wallet share of new deals ► Enabling stronger cross - sell ► Infrastructure for Innovation & Future needs ► Higher Operational Efficiency 57

We are excited by AI and ChatGPT type models But we see this as an evolutionary step - Sapiens already has 12 out - of - the - box (ML) machine learning models Our predictive OOB Models Your Business Impact Customer Segmentation Sentiment Analysis Customer Lifetime Value Customer Retention Renewal Prediction Buying Propensity Cross - Sell Agent Segmentation Loss Reserving Rate Analysis UW Tier Classification Premium Audit Cat Exposure Analysis Fraud Prediction Claim Subrogation Claim Triage Claim Litigation Process Efficiency Gains Staff and Team Impact Reduced Claims Losses & maximised claim recoveries More Accurate Underwriting New Business Growth Improved Renewal Performance Improved Expense Ratio Better Loss Ratio Increased Premium Revenue 58

Sapiens Generative AI Strategy Predictive Analytics & ML Using Gen - AI to “operate on steroids” Gen - AI Chatbot Document Summary Doc to config Gen AI in development & internal usage Github copilot Chatbot over knowledge base • Microsoft OpenAI API – Enterprise solution • Large, pretrained AI models existing cognitive services • Custom AI models fine - tuned with your data • Built - in responsible AI to detect and mitigate harmful use • Enterprise - grade security with role - based access control (RBAC) • The data is private, protected and not used to train foundational AI models 59

Sapiens Proprietary & Confidential Roni Giladi, CFO 60 Sapiens Proprietary & Confidential Financial Overview

Revenue Operating Profit $514.8M $94.1M Operating Margin Sapiens Proprietary & Confidential 61 18.3% 2023 Results in a Nutshell Non - GAAP (USD millions)

Continued Growth Momentum 2022 $474.8M Non - GAAP (USD millions) Revenue Operating Profit 2023 $514.8M $94.1M $83.5M 18.3% Sapiens Proprietary & Confidential 62 17.6% Operating Margin

Operating Margin Expansion 8.4% Revenue Growth Operating Profit Growth 12.8% Operating Margin Growth 2023 2022 +70 bps Sapiens Proprietary & Confidential 63

Revenue Growth Sapiens Proprietary & Confidential Sapiens Proprietary & Confidential 64

114.2 135.4 157.5 179.3 216.2 272 290.3 325.7 384.5 474.8 514.8 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 +16.3% +13.8% +6.7% +20.6% +25.8% +18.6% +12.2% 18.1% 20.6% 463.6 2.4 % 8.4% Revenue Growth Achieved Year - Over - Year Non - GAAP Revenues (USD Millions) Sapiens Proprietary & Confidential Sapiens Proprietary & Confidential 65

Sapiens Proprietary & Confidential Sapiens Proprietary & Confidential 66 NA APAC & SA 2021 Europe* 2022 2023 Annual Revenue Growth - by Geography Non - GAAP Revenue (USD millions) • Europe includes UK, Nordics, Israel and rest of Europe • APAC includes Australia, Thailand, Singapore, Japan, India, Hong Kong, Mauritius, Philippines 7.4% 197.5 212.2 232.9 257.4 44.4 45.2 189.3 239.5 34.7 10.6%

Revenue Growth from 2022 to 2023 – By Territory Non - GAAP Revenue (USD millions) North America ROW 2022 Organic Currency 2023 197.5 14.6M 212.2 2022 Organic Currency 2023 232.9 257.4 2022 Organic Currency 2023 7.4% 0% 0M Europe 9.8% 0.8% 1.8M 22.6M 44.3 45.1 2.6% - 0.8% 1.1M 0.3M Sapiens Proprietary & Confidential 67

Business Stickiness – Recurring and Re - Occurring - 1.1% Sapiens Proprietary & Confidential 68 +14.0% 300.2 63.2% 342.2 66.5% 172.6 174.6 Revenue From Pre - production 33.5% 36.8% implementation services 2023 2022 Revenue From Software products and re - occurring post - production services

Annualized Recurring Revenue - ARR 145.2 164.8 +13.5% Sapiens Proprietary & Confidential 69 2022 • ARR Include Subscription, Term Licenses, Maintenance and cloud solutions • The Figures Are Q4 Of Each Year Multiplied By 4 2023

Unique Proposition Multiple Segments By Market 600+ Customers Across 30 + Countries Global Player By Geography 70% 25% 5% P&C L&A Other 50% 41% 9% EUROPE North America ROW Sapiens Proprietary & Confidential 70 2023 Revenue - $514.8 Million

Customers Concentration – 2022 Vs 2023 Sapiens Proprietary & Confidential 71 2022 2023 24.2% 18.8% 4.6% 3.3% 2022 2023 Top 10 Customers Largest Customers

Profitability Sapiens Proprietary & Confidential Sapiens Proprietary & Confidential 72

2023 18.3% Sapiens Proprietary & Confidential 73 40 52 68 81 84 94 2018 13.6% 2019 16.0% 2020 17.7% 2021 17.6% 2022 * 17.6% Annual Operating Profit Growth Non - GAAP Profit (USD millions) 2.5% 12.8% * 2022 Operating profit on a constant currency base is 89.7M USD 20% 32% 30%

Sapiens Proprietary & Confidential 74 290.3 514.8 2018 2023 Operating profit Revenue Margin Expansion 77% 135% 18.3% 13.6% 94 40

Sapiens Proprietary & Confidential 75 Cash and Cash Equivalents (December 31, 2023) USD millions $202M $60M $20M Paid 1/1/24 2 more installments to be paid over next 2 years 2020 - $ 7M (COVID - 19) 2021 - $ 20M 2022 - $ 39M* 2023 - $ $28.1M Dividend Distribution Up to 40% of non - GAAP net income paid twice a year Cash Cash and Cash Investments Debt S&P Israel (Mallot): ilAA - /Stable * In 2022 we distributed dividend for full year 2021 and for H1 2022.

Adjusted Free Cash Flow Non - GAAP (USD Thousands) Average 2023 2022 2021 Free Cash Flow 68 79.4 43.8 80.5 Cash flow from operating activities (6.8) (6.5) (6.1) (7.9) Increase in capitalized software development costs (3) (2.5) (2.7) (3.8) Capital expenditures 58.1 70.4 35 68.8 Free cash flow 1.1 0.3 1.1 2.2 Cash payments attributed to acquisition - related costs (included in cash flow from operating activities) 59.2 70.7 36.1 71 Adjusted Free cash flow 69.3 75.0 67.2 65.5 Non - GAAP Net Income Adjusted Free Cash Flow/Non - GAAP Net Income 108% 54% 94% 85% Sapiens Proprietary & Confidential 76

Guidance Sapiens Proprietary & Confidential Sapiens Proprietary & Confidential 77

Revenue and Profitability Increase – 2024 Guidance Non - GAAP (USD millions) 2023 Actual $514.8M Revenue $94.1M Operating Profit 18.3% Operating Margin Guidance Mid 2024 Guidance High 2024 Guidance Low Growth of 7.3% $555M $550M Passing $100M $102.7M $99.6M Stable 18.5% 18.1% Sapiens Proprietary & Confidential Sapiens Proprietary & Confidential 78

Shift to subscription model Post - Production Pre - Production Product Convert post - production services into subscription revenue 1 2 Shift implementation revenue to subscription revenue over longer period Sapiens Proprietary & Confidential 79

Shift to subscription model Post - Production Pre - Production Years Subscription Today Future 0 2 5 0 5 2 Revenue impact • Lower revenue growth in first 2 years while increasing revenue in year 3 and onwards • Higher subscription revenue Sapiens Proprietary & Confidential 80

Sapiens Proprietary & Confidential 81 Implication on growth 7.3% 474.8 514.8 8.4% 2022 2023 * Revenue guidance for FY 2024 is 550M$ - 555M$, the above reflects mid - range of guidance. 2024* 552.5 8.3%

2022 2023 2024 • Company Growth • Transition to SaaS 145.2 164.8 Annualized Recurring Revenue - ARR Sapiens Proprietary & Confidential 82

Impact on gross margin 53.2% 29.4% Revenue From Software products and re - occurring post - production services Revenue From Pre - production implementation services Total gross margin 45.3% Transition to SaaS Operational efficacy 2023 2024 Gross margin Sapiens Proprietary & Confidential 83

Wrapping Up Sapiens Proprietary & Confidential Sapiens Proprietary & Confidential 84

Sapiens Proprietary & Confidential Sapiens Proprietary & Confidential 85 Growth Operating Profit ~$100M+ $ 550M+

Sapiens Proprietary & Confidential Thank you! Sapiens Proprietary & Confidential 86

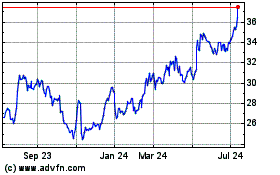

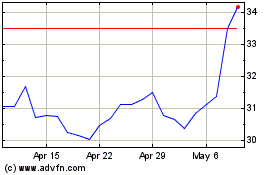

Sapiens International Co... (NASDAQ:SPNS)

Historical Stock Chart

From Oct 2024 to Nov 2024

Sapiens International Co... (NASDAQ:SPNS)

Historical Stock Chart

From Nov 2023 to Nov 2024