Amended Statement of Beneficial Ownership (sc 13d/a)

September 16 2019 - 6:01AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

13D

(Rule

13d-101)

INFORMATION

TO BE INCLUDED IN STATEMENTS FILED PURSUANT

TO § 240.13d-1(a) AND AMENDMENTS THERETO FILED PURSUANT TO

§

240.13d-2(a)

(Amendment

No. 3)1

Rocky

Mountain Chocolate Factory, Inc.

(Name

of Issuer)

Common

Stock, par value $0.001 per share

(Title

of Class of Securities)

774678403

(CUSIP

Number)

AB

Value Management LLC

Attn:

Andrew Berger

200

Sheffield Street, Suite 311

Mountainside,

NJ 07092

(855)

228-2583

(Name,

Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

September

16, 2019

(Date

of Event Which Requires Filing of This Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule

13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box ☐.

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See

§ 240.13d-7 for other parties to whom copies are to be sent.

|

1

|

The

remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to

the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided

in a prior cover page.

|

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section

18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act

but shall be subject to all other provisions of the Act (however, see the Notes).

CUSIP

NO. 774678403

|

1

|

NAME

OF REPORTING PERSON

AB

Value Partners, LP

|

|

2

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a): ☐

(b): ☐

|

|

3

|

SEC

USE ONLY

|

|

4

|

SOURCE

OF FUNDS

WC

|

|

5

|

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

☐

|

|

6

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

NEW

JERSEY

|

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE

VOTING POWER

0

|

|

8

|

SHARED

VOTING POWER

224,855

|

|

9

|

SOLE

DISPOSITIVE POWER

0

|

|

10

|

SHARED

DISPOSITIVE POWER

224,855

|

|

11

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

224,855

|

|

12

|

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

☐

|

|

13

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

3.77%

|

|

14

|

TYPE

OF REPORTING PERSON

PN

|

CUSIP

NO. 774678403

|

1

|

NAME

OF REPORTING PERSON

AB

Value Management LLC

|

|

2

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a): ☐

(b): ☐

|

|

3

|

SEC

USE ONLY

|

|

4

|

SOURCE

OF FUNDS

WC

|

|

5

|

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

☐

|

|

6

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

DELAWARE

|

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE

VOTING POWER

0

|

|

8

|

SHARED

VOTING POWER

460,189*

|

|

9

|

SOLE

DISPOSITIVE POWER

0

|

|

10

|

SHARED

DISPOSITIVE POWER

460,189*

|

|

11

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

460,189*

|

|

12

|

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

☐

|

|

13

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

7.71%

|

|

14

|

TYPE

OF REPORTING PERSON

CO

|

|

*

|

Consists of the Shares

owned directly by AB Value Partners and the Managed Account.

|

CUSIP

NO. 774678403

|

1

|

NAME

OF REPORTING PERSON

Andrew

Berger

|

|

2

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a): ☐

(b): ☐

|

|

3

|

SEC

USE ONLY

|

|

4

|

SOURCE

OF FUNDS

PF,

AF

|

|

5

|

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

☐

|

|

6

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

USA

|

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE

VOTING POWER

0

|

|

8

|

SHARED

VOTING POWER

460,189*

|

|

9

|

SOLE

DISPOSITIVE POWER

0

|

|

10

|

SHARED

DISPOSITIVE POWER

460,189*

|

|

11

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

460,189

|

|

12

|

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

☐

|

|

13

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

7.71%

|

|

14

|

TYPE

OF REPORTING PERSON

IN

|

|

*

|

Consists

of the Shares owned directly by AB Value Partners and the Managed Account.

|

CUSIP

NO. 774678403

|

1

|

NAME

OF REPORTING PERSON

Mary

Kennedy Thompson

|

|

2

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a): ☐

(b): ☐

|

|

3

|

SEC

USE ONLY

|

|

4

|

SOURCE

OF FUNDS

OO

|

|

5

|

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

☐

|

|

6

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

USA

|

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE

VOTING POWER

0

|

|

8

|

SHARED

VOTING POWER

0

|

|

9

|

SOLE

DISPOSITIVE POWER

0

|

|

10

|

SHARED

DISPOSITIVE POWER

0

|

|

11

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

0

|

|

12

|

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

☐

|

|

13

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0%

|

|

14

|

TYPE

OF REPORTING PERSON

IN

|

CUSIP

NO. 774678403

The

following constitutes amendment number 3 to the Schedule 13D filed by the undersigned (“Amendment No. 3”). This Amendment

No. 3 amends the Schedule 13D, as specifically set forth herein.

|

Item 4.

|

Purpose of Transaction.

|

Item

4 is hereby amended to add the following:

On

September 9, 2019, AB Value Management delivered an open letter to the Board which, among other things, condemned the Board for

disenfranchising stockholders and further entrenching itself by (i) needlessly delaying the Annual Meeting to a date that is more

than sixteen (16) months from the 2018 annual meeting of stockholders in violation of Section 211(c) of the Delaware General Corporation

Law (the “DGCL”), (ii) denying AB Value Management’s valid request, made pursuant to Section 220 of the DGCL,

to inspect the books and records of the Issuer containing information that would allow AB Value Management to confirm that the

Board has undertaken a strategic review process in direct response to our Notice and Schedule 13D and (iii) refusing to meet with

AB Value Management’s highly-qualified Nominees, despite AB Value Management’s timely and qualifying Notice. In the

letter, AB Value Management demanded that the Issuer hold the Annual Meeting as soon as possible.

The

full text of the letter is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

|

Item 7.

|

Material to be Filed

as Exhibits.

|

Item

7 is hereby amended to add the following:

CUSIP

NO. 774678403

SIGNATURES

After

reasonable inquiry and to the best of his or her knowledge and belief, each of the undersigned certifies that the information

set forth in this statement is true, complete and correct.

Dated:

September 16, 2019

|

|

AB

Value Partners, L.P.

|

|

|

|

|

|

|

|

By:

|

AB Value

Management LLC

|

|

|

|

General

Partner

|

|

|

|

|

|

|

|

By:

|

/s/

Andrew Berger

|

|

|

|

Name:

|

Andrew Berger

|

|

|

|

Title:

|

Manager

|

|

|

|

|

|

|

|

AB

Value Management LLC

|

|

|

|

|

|

By:

|

/s/

Andrew Berger

|

|

|

|

Name:

|

Andrew Berger

|

|

|

|

Title:

|

Manager

|

|

|

|

|

|

|

|

/s/

Andrew Berger

|

|

|

Name:

|

Andrew Berger

|

|

|

|

|

|

|

|

/s/

Mary Kennedy Thompson

|

|

|

Name:

|

Mary Kennedy

Thompson

|

7

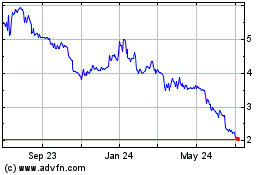

Rocky Mountain Chocolate... (NASDAQ:RMCF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rocky Mountain Chocolate... (NASDAQ:RMCF)

Historical Stock Chart

From Apr 2023 to Apr 2024