Current Report Filing (8-k)

February 28 2023 - 3:51PM

Edgar (US Regulatory)

FALSE000093541900009354192023-02-272023-02-27

United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 27, 2023

RCI HOSPITALITY HOLDINGS, INC.

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | |

| Texas | 001-13992 | 76-0458229 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

10737 Cutten Road

Houston, Texas 77066

(Address of Principal Executive Offices, Including Zip Code)

(281) 397-6730

(Issuer’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, $0.01 par value | | RICK | | The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

ITEM 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT.

As previously reported in a current report filed on December 15, 2022, RCI Hospitality Holdings, Inc. (“RCIH,” “we,” or “us”) and certain subsidiaries entered into definitive agreements on December 12, 2022 to acquire five gentlemen’s clubs, five related real estate properties, associated intellectual property and certain automated teller machines for a total purchase price of $66.5 million, which clubs and real estate are located in the Dallas-Fort Worth area and Houston, Texas. Included in these definitive agreements are (i) five different Asset Purchase Agreements under which the five clubs are to be purchased (collectively, the “Asset Purchase Agreements”), (ii) two Intellectual Property Purchase Agreements under which certain intellectual property is to be purchased, (iii) an Asset Purchase Agreement under which certain automated teller machines are to be purchased (the “ATM Purchase Agreement”), and (iv) a Purchase and Sale Agreement under which the real estate properties are to be purchased (the “Real Estate Purchase Agreement”).

As amended on January 25 and 26, 2023, each of the Asset Purchase Agreements, IP Purchase Agreements, ATM Purchase Agreement and Real Estate Purchase Agreement provided that such agreements will terminate and be of no force and effect if the transactions contemplated by such agreements are not consummated on or before February 28, 2023. On February 27, 2023, the parties to those agreements entered into new amendment agreements whereby this date was extended to March 31, 2023.

The descriptions above of the nine amendment agreements are qualified in their entirety by reference to the terms of such agreements, copies of which are filed hereto as Exhibits 10.1 through 10.9, respectively, and are incorporated herein by reference.

The agreements included as exhibits to this current report have been included to provide investors and security holders with information regarding their terms. They are not intended to provide any other factual information about RCIH, any parties to such agreements or their respective subsidiaries and affiliates. The agreements contain representations and warranties certain parties made solely for the benefit of such parties. The assertions embodied in those representations and warranties are subject to qualifications and limitations agreed to by the respective parties in negotiating the terms of the agreements. Moreover, certain representations and warranties in the agreements were made as of a specified date, may be subject to a contractual standard of materiality different from what might be viewed as material to investors, or may have been used for the purpose of allocating risk between the parties, rather than establishing matters as facts. Accordingly, the representations and warranties in the agreements should not be relied on by any persons as characterizations of the actual state of facts about RCIH or any other parties to the agreements at the time they were made or otherwise. In addition, information concerning the subject matter of the representations and warranties may change after the date of the agreements, which subsequent information may or may not be fully reflected in RCIH’s public disclosures.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits

| | | | | | | | |

| Exhibit Number | | Description |

| | | |

| 10.1 | | |

| 10.2 | | |

| 10.3 | | |

| 10.4 | | |

| 10.5 | | |

| 10.6 | | |

| 10.7 | | |

| 10.8 | | |

| 10.9 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| RCI HOSPITALITY HOLDINGS, INC. |

| | |

| Date: February 28, 2023 | By: | /s/ Eric Langan |

| | Eric Langan |

| | President and Chief Executive Officer |

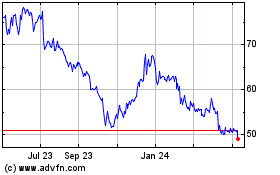

RCI Hospitality (NASDAQ:RICK)

Historical Stock Chart

From May 2024 to Jun 2024

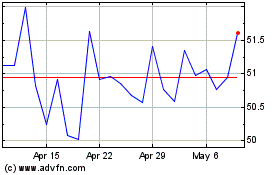

RCI Hospitality (NASDAQ:RICK)

Historical Stock Chart

From Jun 2023 to Jun 2024