Current Report Filing (8-k)

July 22 2019 - 8:31AM

Edgar (US Regulatory)

United

States

Securities

and Exchange Commission

Washington,

D.C. 20549

FORM

8-K

Current

Report

Pursuant

to Section 13 or 15(d) of

The

Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): July 22, 2019

RCI

HOSPITALITY HOLDINGS, INC.

(Exact

Name of Registrant as Specified in Its Charter)

|

Texas

|

|

001-13992

|

|

76-0458229

|

|

(State

or Other Jurisdiction

of

Incorporation)

|

|

(Commission

File

Number)

|

|

(IRS

Employer

Identification

No.)

|

10737

Cutten Road

Houston,

Texas 77066

(Address

of Principal Executive Offices, Including Zip Code)

(281)

397-6730

(Issuer’s

Telephone Number, Including Area Code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

Common

stock, $0.01 par value

|

|

RICK

|

|

The

Nasdaq Global Market

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

ITEM

8.01

OTHER EVENTS.

As

previously disclosed, a special committee of the audit committee of our board of directors (the “Special Committee”)

was formed to conduct an independent internal review to look into the matters raised by an SEC inquiry and certain anonymous internet

articles. As part of the internal review, the Special Committee engaged an international law firm as independent outside counsel.

The fact-finding portion of the internal review is substantially complete. Based on the preliminary findings, the audit committee

and management have jointly concluded that certain disclosure in our Annual Report on Form 10-K for the fiscal year ended September

30, 2018 should be supplemented as follows.

Supplemental

related party transaction disclosure is as follows:

|

|

●

|

We

paid Ed Anakar, our director of operations – club division, employment compensation of $471,154, $450,000 and $375,000

during the fiscal years ended September 30, 2018, 2017 and 2016, respectively. Ed Anakar is the brother of Nourdean Anakar,

a director and audit committee member of the company.

|

|

|

|

|

|

|

●

|

During

the last three fiscal years we utilized the services of Sherwood Forest Creations, LLC and its predecessor, Creative Steel

Designs, furniture fabrication companies that manufacture tables, chairs and other furnishings for our Bombshells locations,

as well as providing ongoing maintenance. Sherwood Forest is owned by a brother of Eric Langan, our president and chief executive

officer, and Creative Steel was owned by his father. Amounts billed to us for goods and services provided by Sherwood Forest

were $321,353 in fiscal 2018, an aggregate of $135,322 by Sherwood Forest and Creative Steel in fiscal 2017, and $176,864

by Creative Steel in fiscal 2016. Sherwood Forest Creations continues to provide services to the company.

|

Revised

and supplemental executive compensation disclosure is as follows:

|

|

●

|

In

the executive compensation disclosure, personal use of aircraft amounts were incorrectly calculated for fiscal 2018 and were

inadvertently left out in 2017 and 2016. In 2018, we accounted for personal use of aircraft using a third-party consultant

based on a standard industry fare level rate, which is an accepted compensation basis for IRS purposes. We have revised our

methodology to account for personal use of aircraft to be the aggregate incremental cost of personal use of the company aircraft

as calculated based on a cost-per-flight hour charge developed by a nationally recognized and independent service. The charge

reflects the direct cost of operating the aircraft, including fuel, additives, lubricants, maintenance labor, airframe parts,

engine restoration, major periodic maintenance, and an allowance for propeller maintenance. We added actual airport/hangar

fees charged to the company on a per-flight basis. The charge does not include fixed costs that do not change based on usage,

such as aircraft depreciation, home hangar expenses, and general taxes and insurance.

|

|

|

|

|

|

|

|

Eric

Langan and Travis Reese, our executive vice president, were allocated personal use of aircraft amounts in 2018, 2017 or 2016.

The corrected amounts for personal use of aircraft for these two individuals is the following:

|

|

|

|

|

|

|

Personal Use of Aircraft

|

|

|

Name

|

|

Year

|

|

|

($)

|

|

|

Eric S. Langan

|

|

|

2018

|

|

|

|

96,797

|

|

|

|

|

|

2017

|

|

|

|

79,748

|

|

|

|

|

|

2016

|

|

|

|

55,101

|

|

|

|

|

|

|

|

|

|

|

|

|

Travis Reese

|

|

|

2018

|

|

|

|

20,410

|

|

|

|

|

|

2017

|

|

|

|

9,524

|

|

|

|

|

|

2016

|

|

|

|

5,544

|

|

The

above increases to personal use of aircraft amounts increases “all other compensation.” The corrected all other compensation

and total compensation for these two individuals is the following:

|

|

|

|

|

|

|

|

|

Stock

|

|

|

Option

|

|

|

All Other

|

|

|

|

|

|

Name and

|

|

|

|

|

Salary

|

|

|

Awards

|

|

|

Awards

|

|

|

Compensation

|

|

|

Total

|

|

|

Principal Position

|

|

Year

|

|

|

($)

|

|

|

($)

|

|

|

($)

|

|

|

($)

|

|

|

($)

|

|

|

Eric S. Langan

|

|

|

2018

|

|

|

|

1,015,384

|

|

|

|

-

|

|

|

|

-

|

|

|

|

111,191

|

|

|

|

1,126,575

|

|

|

|

|

|

2017

|

|

|

|

900,000

|

|

|

|

-

|

|

|

|

-

|

|

|

|

138,198

|

|

|

|

1,038,198

|

|

|

|

|

|

2016

|

|

|

|

878,434

|

|

|

|

-

|

|

|

|

-

|

|

|

|

122,741

|

|

|

|

1,001,175

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Travis Reese

|

|

|

2018

|

|

|

|

346,854

|

|

|

|

-

|

|

|

|

-

|

|

|

|

56,227

|

|

|

|

403,081

|

|

|

|

|

|

2017

|

|

|

|

320,000

|

|

|

|

-

|

|

|

|

-

|

|

|

|

48,228

|

|

|

|

368,228

|

|

|

|

|

|

2016

|

|

|

|

299,945

|

|

|

|

-

|

|

|

|

-

|

|

|

|

41,663

|

|

|

|

341,608

|

|

Supplemental

disclosure to the biographical information of Steve L. Jenkins, a member of the board of directors, is as follows:

|

|

●

|

Mr.

Jenkins filed voluntary petitions for Chapter 13 bankruptcy in the United States Bankruptcy Court for the Southern District

of Texas in August, 2010 and in October, 2015.

|

Additionally,

the audit committee and board of directors anticipate taking the following actions as part of the implementation of a more robust

corporate and accounting governance program:

|

|

●

|

Appoint

at least one new independent member to the board of directors to join the audit committee;

|

|

|

|

|

|

|

●

|

Appoint

a chief compliance officer who will report directly to the audit committee;

|

|

|

|

|

|

|

●

|

Adopt

an amended related party transaction policy strengthening the review process by the audit committee with respect to related

party transactions, employment of family members and charitable contributions;

|

|

|

|

|

|

|

●

|

Adopt

an enhanced code of conduct policy;

|

|

|

|

|

|

|

●

|

Engage

third party internal audit consultants to report directly to the audit committee to assist in enhancing our internal audit

program and to review corporate governance procedures;

|

|

|

●

|

Adopt

a disclosure committee charter to ensure that all relevant financial transactions requiring SEC disclosure are known by the

responsible parties;

|

|

|

|

|

|

|

●

|

Review

employee benefit procedures;

|

|

|

|

|

|

|

●

|

Adopt

an airplane policy specifically outlining personal use by employees; and

|

|

|

|

|

|

|

●

|

Sell

the three residential homes owned by the company.

|

Forward-Looking

Statements

This

current report may contain forward-looking statements that involve a number of risks and uncertainties that could cause our actual

results to differ materially from those indicated in this current report, including the risks and uncertainties associated with

operating and managing an adult business, the business climates in cities where we operate, the success or lack thereof in launching

and building our businesses, risks and uncertainties related to cybersecurity, conditions relevant to real estate transactions,

and numerous other factors such as laws governing the operation of adult entertainment businesses, competition and dependence

on key personnel. We have no obligation to update or revise the forward-looking statements to reflect the occurrence of future

events or circumstances.

ITEM

9.01 FINANCIAL STATEMENTS AND EXHIBITS.

(d)

Exhibits

99.1—Press release dated July 22, 2019

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report on Form 8-K to be signed

on its behalf by the undersigned hereunto duly authorized.

|

|

RCI

Hospitality Holdings, INC

.

|

|

|

|

|

|

Date:

July 22, 2019

|

By:

|

/s/

Eric Langan

|

|

|

|

Eric

Langan

|

|

|

|

President

and Chief Executive Officer

|

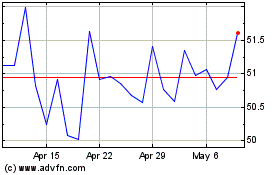

RCI Hospitality (NASDAQ:RICK)

Historical Stock Chart

From Aug 2024 to Sep 2024

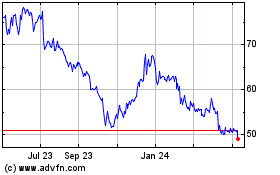

RCI Hospitality (NASDAQ:RICK)

Historical Stock Chart

From Sep 2023 to Sep 2024