Form SC 13D/A - General Statement of Acquisition of Beneficial Ownership: [Amend]

August 05 2024 - 6:03AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

SCHEDULE 13D/A

Under the Securities Exchange Act of 1934

(Amendment No. 1)*

______________________

RADCOM Ltd.

(Name of Issuer)

Ordinary Shares, NIS 0.20 par value per share

(Title of Class of Securities)

M8186511 1

(CUSIP Number)

Michael Zisapel

Klil Zisapel

24 Raoul Wallenberg Street

Building C

Tel-Aviv 69719, Israel

(+972) -54-7369030

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

August 1, 2024

(Date of Event which Requires Filing of this Statement)

______________________

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g), check

the following box. ☐

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are

to be sent.

*The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which

would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that

section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

CUSIP No. M8186511 1

|

SCHEDULE 13D/A

|

Page 2 of 6

|

|

1

|

NAME OF REPORTING PERSON

Michael Zisapel

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a)☒

(b)☐

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

OO

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

☐

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Israel

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

1,641,320(1, 2)

|

|

8

|

SHARED VOTING POWER

542,148(1)

|

|

9

|

SOLE DISPOSITIVE POWER

1,641,320(1, 2)

|

|

10

|

SHARED DISPOSITIVE POWER

542,147(1)

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,390,993(1,2)

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

☐

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

9.09% (1)

|

|

14

|

TYPE OF REPORTING PERSON

IN

|

|

(2) |

Includes options to acquire 19,799 Ordinary Shares exercisable currently or within 60 days of August 6, 2024

|

|

CUSIP No. M8186511 1

|

SCHEDULE 13D/A

|

Page 3 of 6

|

|

1

|

NAME OF REPORTING PERSON

Klil Zisapel

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a)☒

(b)☐

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

OO

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

☐

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Israel

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

1,641,322(1,2)

|

|

8

|

SHARED VOTING POWER

542,147 (1)

|

|

9

|

SOLE DISPOSITIVE POWER

1,641,322 (1,2)

|

|

10

|

SHARED DISPOSITIVE POWER

542,147 (1)

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,390,995(1,2)

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

☐

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

9.09% (1)

|

|

14

|

TYPE OF REPORTING PERSON

IN

|

|

(2) |

Includes options to acquire 19,900 Ordinary Shares exercisable currently or within 60 days of August 6, 2024

|

|

CUSIP No. M8186511 1

|

SCHEDULE 13D/A

|

Page 4 of 6

|

ITEM 1. SECURITY AND ISSUER

This Amendment No. 1 (this "Amendment") amends and supplements the Schedule 13D filed by Michael Zisapel and Klil Zisapel (the “Reporting Persons”) with the Securities and Exchange Commission (the

“SEC”) on June 13, 2024 (the “Schedule 13D”) with respect to the Ordinary Shares, par value NIS 0.20 per share (the "Ordinary Shares"), of RADCOM Ltd. (the "Issuer"), an Israeli company whose principal executive offices are located at

24 Raoul Wallenberg Street, Tel Aviv 69719, Israel.

Capitalized terms used herein but not otherwise defined herein shall have the meanings ascribed to such terms in the Schedule 13D.

ITEM 3. SOURCE AND AMOUNT OF FUNDS OR OTHER CONSIDERATION

The Reporting Persons acquired the securities reported on this Schedule 13D in connection with the illness and subsequent death of their father, Zohar Zisapel, co-founder, member of the Board of

Directors and major shareholder of the Issuer, which occurred on May 19, 2023.

On May 18, 2023, Zohar Zisapel transferred without consideration 50% of the ownership interests in each of Michael & Klil Holdings (93) Ltd. and Lomsha Ltd. to each of the Reporting Persons,

through which the Reporting Persons each hold an indirect ownership interest in an aggregate of 271,074 Ordinary Shares of the Issuer and shared voting and dispositive power with respect to an aggregate of 542,147 Ordinary Shares of the Issuer as the

50% owners of such entities.

A probate was issued by the Israeli Registrar for Matters of Succession on August 4, 2023, according to which Zohar Zisapel’s assets were divided 50% to Mr. Zisapel and 50% to Ms. Zisapel. Following

the completion of certain transfer requirements, the Reporting Persons now own an aggregate of 2,802,301 Ordinary Shares of the Issuer effective as of August 1, 2024 (including options to acquire 39,597 Ordinary Shares exercisable currently or within

60 days of August 6, 2024).

No funds or other consideration was used by the Reporting Persons to acquire the shares subject hereof, and no funds or other consideration were borrowed or otherwise obtained for the purpose of

acquiring, holding, trading, or voting the shares subject hereof.

|

CUSIP No. M8186511 1

|

SCHEDULE 13D/A

|

Page 5 of 6

|

ITEM 5. INTEREST IN SECURITIES OF THE ISSUER

|

(a)

|

Mr. Zisapel beneficially owns 1,390,993 Ordinary Shares of the Issuer, consisting of (i) 1,100,121 Ordinary Shares held directly by Mr. Zisapel, and (ii) 271,074 Ordinary Shares that are held

indirectly by Mr. Zisapel through his 50% ownership in each of Lomsha Ltd., an Israeli company, and Michael & Klil Holdings (93) Ltd., an Israeli company and (iii) options to acquire 19,798 Ordinary Shares exercisable within 60 days.

Based on 15,307,732 Ordinary Shares of the Issuer issued and outstanding as of December 31, 2023, the Ordinary Shares beneficially owned by Mr. Zisapel represent approximately 9.09% of the Ordinary Shares of the Issuer issued and outstanding.

Ms. Zisapel beneficially owns 1,390,995 Ordinary Shares of the Issuer, consisting of (i) 1,100,122 Ordinary Shares held directly by Ms. Zisapel and

(ii) 271,074 Ordinary Shares that are held indirectly by Ms. Zisapel through her 50% ownership in each of Lomsha Ltd., an Israeli company, and Michael & Klil Holdings (93) Ltd., an Israeli company and (iii) options to acquire 19,799

Ordinary Shares exercisable within 60 days. Based on 15,307,732 Ordinary Shares of the Issuer issued and outstanding as of December 31, 2023, the Ordinary Shares beneficially owned by Ms. Zisapel represent approximately 9.09% of the Ordinary

Shares of the Issuer issued and outstanding.

|

|

(b)

|

Mr. Zisapel has sole voting and dispositive power over 1,641,320 Ordinary Shares mutually held by the Reporting Persons in security bank accounts and

registered at the transfer agent (including options) and has shared voting and dispositive power over an aggregate of 542,147 Ordinary Shares owned by Lomsha Ltd and Michael & Klil Holdings (93) Ltd., in each of which Mr. Zisapel owns a

50% interest.

Ms. Zisapel has sole voting and dispositive power over 1,641,322 Ordinary Shares mutually held by the Reporting Persons in security bank accounts and

registered at the transfer agent, and has shared voting and dispositive power over an aggregate of 542,147 Ordinary Shares owned by Lomsha Ltd and Michael & Klil Holdings (93) Ltd., in each of which Ms. Zisapel owns a 50% interest.

|

|

(c)

|

During the last 60 days, the Reporting Persons have not affected any transaction in the Ordinary Shares of the Issuer.

|

| |

|

|

(d)

|

Not applicable.

|

| |

|

|

(e)

|

Not applicable.

|

ITEM 7. MATERIAL TO BE FILED AS EXHIBITS

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: August 6, 2024

|

|

/s/ Michael Zisapel

Michael Zisapel

/s/ Klil Zisapel

Klil Zisapel

|

JOINT FILING AGREEMENT

In accordance with Rule 13d-1(k) under the Securities Exchange Act of 1934, as amended, the persons named below

agree to the joint filing on behalf of them of an Amendment to statement on Schedule 13D (including amendments thereto) with respect to the Ordinary Shares, NIS 0.20 par

value per share, of RADCOM Ltd., and further agree that this Joint Filing Agreement be included as Exhibit 99.1.

In evidence thereof, the undersigned hereby execute this Joint Filing Agreement as of August 6, 2024.

|

/s/ Michael Zisapel

Michael Zisapel

/s/ Klil Zisapel

Klil Zisapel

|

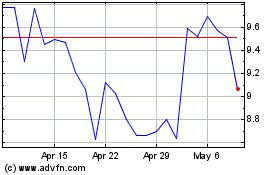

Radcom (NASDAQ:RDCM)

Historical Stock Chart

From Oct 2024 to Nov 2024

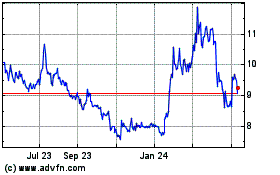

Radcom (NASDAQ:RDCM)

Historical Stock Chart

From Nov 2023 to Nov 2024