false

--12-31

0001533743

0001533743

2024-01-18

2024-01-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): January

18, 2024

Commission

file number 001-39531

PROCESSA

PHARMACEUTICALS, INC.

(Exact

name of Registrant as Specified in its Charter)

| Delaware |

|

45-1539785 |

(State

or Other Jurisdiction of

Incorporation or Organization) |

|

(I.R.S.

Employer

Identification Number) |

| 7380

Coca Cola Drive,

Suite

106,

Hanover,

Maryland

21076 |

| (Address

of Principal Executive Offices, Including Zip Code) |

| (443)

776-3133 |

| (Registrant’s

Telephone Number, Including Area Code) |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

symbol(s) |

|

Name

of each exchange on which registered |

| Common

stock: Par value $.0001 |

|

PCSA |

|

Nasdaq

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| |

Emerging

growth company ☐ |

| |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ |

Item

3.03 Material Modification to Rights of Security Holders

To

the extent required by Item 3.03 of Form 8-K, the information contained in Item 5.03 of this Current Report on Form 8-K is incorporated

herein by reference.

Item

5.03 Amendments to articles of incorporation or bylaws; change in fiscal year

On

January 18, 2024, Processa Pharmaceuticals, Inc. (the “Company”) filed with the Secretary of State of the State of Delaware

a Certificate of Amendment (the “Certificate of Amendment”) to the Company’s Fourth Amended and Restated Certificate

of Incorporation to effect a 1-for-20 reverse stock split (the “Reverse Stock Split”) of the Company’s issued and outstanding

shares of common stock, par value $0.0001 per share (the “Common Stock”), effective as of 12:01 a.m. Eastern Time on January

22, 2024. Beginning with the opening of trading on January 22, 2024, Processa’s Common Stock will trade on the Nasdaq Capital Market

on a split-adjusted basis under new CUSIP number 74275C304 and will continue to trade under the symbol “PCSA.”

As

a result of the Reverse Stock Split, every twenty (20) shares of Common Stock issued and outstanding will be converted into one (1) share

of Common Stock. We will not be issuing fractional shares in connection with the Reverse Stock Split. Stockholders who

otherwise would be entitled to receive fractional shares because they hold a number of shares not evenly divisible by the reverse stock

split ratio of the Reverse Stock Split, will be entitled, upon surrender of certificate(s) representing these shares, to a number of

shares rounded up to the nearest whole number and, accordingly, no money will be paid for a fractional share.

The

Reverse Stock Split will not reduce the number of authorized shares of Common Stock of 100,000,000 or change the par value of the Common

Stock. The Reverse Stock Split will affect all stockholders uniformly and will not affect any stockholder’s ownership percentage

of the Company’s shares of Common Stock except for the impact of fractional shares.

All

outstanding options, warrants, restricted stock units and similar securities entitling their holders to receive or purchase shares of

Common Stock will be adjusted as a result of the Reverse Stock Split, as required by the terms of each security.

The

foregoing description of the Certificate of Amendment to the Fourth Amended and Restated Certificate of Incorporation of the Company

is a summary of the material terms thereof, does not purport to be complete and is qualified in its entirety by reference to the full

text of the Certificate of Amendment, which is filed with this report as Exhibit 3.1 and is incorporated herein by reference.

On

January 18, 2024, the Company issued a press release announcing the Reverse Stock Split. A copy of the press release is filed herewith

as Exhibit 99.1 hereto.

Item

9.01 Financial Statements and Exhibits

(d)

Exhibits

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, hereunto duly authorized, on January 18, 2024.

| |

PROCESSA

PHARMACEUTICALS, INC. |

| |

Registrant |

| |

|

|

| |

By: |

/s/

George Ng |

| |

|

George

Ng |

| |

|

Chief

Executive Officer |

Exhibit

3.1

CERTIFICATE

OF AMENDMENT

TO

THE

FOURTH AMENDED AND RESTATED CERTIFICATE OF INCORPORATION

OF

PROCESSA PHARMACEUTICALS, INC.

Processa

Pharmaceuticals, Inc. (the “Corporation”), a corporation organized and existing under the General Corporation Law

of the State of Delaware (the “DGCL”), hereby certifies as follows:

| 1. | This

Certificate of Amendment (the “Certificate of Amendment”) amends the provisions

of the Corporation’s Fourth Amended and Restated Certificate of Incorporation filed

with the Secretary of State of the State of Delaware on September 27, 2017, as amended on

October 23, 2017, August 12, 2019, December 19, 2019, June 29, 2020, January 3, 2022, and

June 29, 2023 (the “Certificate of Incorporation”). |

| 2. | The

Board of Directors of the Corporation has duly adopted a resolution pursuant to Section 242

of the DGCL setting forth a proposed amendment to the Certificate of Incorporation and declaring

said amendment to be advisable. The amendment amends the Certificate of Incorporation as

follows: |

| (a) | Section

A of the Certificate of Incorporation setting forth the powers, privileges and rights, and

the qualifications, limitations or restrictions thereof in respect of each class of capital

stock of the Corporation is hereby supplemented by addition of the following paragraphs as

new subsection 5 under “A. Common Stock”: |

5.

Reverse Stock Split. Upon this Certificate of Amendment becoming effective pursuant to the General Corporation Law of the State

of Delaware (the “Effective Time”), the shares of Common Stock issued and outstanding or held in treasury immediately prior

to the Effective Time (the “Old Common Stock”) shall be reclassified into a different number of shares of Common Stock (the

“New Common Stock”) such that each twenty shares of Old Common Stock shall, at the Effective Time, be automatically reclassified

into one share of New Common Stock. From (the “Reverse Stock Split”) and after the Effective Time, certificates representing

the Old Common Stock shall represent the number of whole shares of New Common Stock into which such Old Common Stock shall have been

reclassified pursuant to the immediately preceding sentence. No fractional shares of Common Stock shall be issued as a result of such

reclassification. Stockholders who otherwise would be entitled to receive fractional shares because they hold a number of shares not

evenly divisible by the reverse stock split ratio of the Reverse Stock Split, will be entitled, upon surrender of certificate(s) representing

these shares, to a number of shares rounded up to the nearest whole number and, accordingly, no money will be paid for a fractional share.

From

and after the Effective Time, the term “New Common Stock” as used in this Section shall mean the Common Stock as provided

in this Certificate of Incorporation, as amended and as further amended by this Certificate of Amendment. The par value of the New Common

Stock shall be $0.0001 per share.

| 3. | The

requisite stockholders of the Corporation have duly approved this Certificate of Amendment

in accordance with Section 242 of the DGCL. |

| 4. | This

Certificate of Amendment shall be effective at 12:01 a.m. Eastern Time on January 22, 2024. |

IN

WITNESS WHEREOF, the Corporation has caused this Certificate of Amendment to be executed as of the date set forth below.

| Dated:

January 18, 2024 |

PROCESSA

PHARMACEUTICALS, INC. |

| |

|

|

| |

By:

|

/s/

James Stanker |

| |

Name: |

James Stanker |

| |

Title: |

Chief Financial Officer |

Exhibit 99.1

Processa Pharmaceuticals to Effect a 1-for-20 Reverse

Stock Split

HANOVER, MD, January 18, 2024 (GLOBE NEWSWIRE)

-- Processa Pharmaceuticals, Inc. (Nasdaq: PCSA) (“Processa” or the “Company”), a clinical-stage pharmaceutical

company focused on developing the next generation of chemotherapeutic drugs to improve the efficacy and safety for patients suffering

from cancer, announces that in conjunction with stockholder approval of the reverse stock split

on November 14, 2023, the Company’s Board of Directors, on January 8, 2024, determined to fix a split ratio of 1-for-20.

The Company’s common stock will begin trading on a reverse stock split-adjusted basis at the opening of the market on Monday, January

22, 2024. Following the reverse stock split, the Company’s common stock will continue to trade on the Nasdaq Capital Market under

the symbol “PCSA” with the new CUSIP number 74275C304. The reverse stock split is intended for the Company to regain compliance

with the minimum bid price requirement of $1.00 per share of common stock for continued listing on the Nasdaq Capital Market.

At the

effective time of the reverse stock split, every twenty (20) issued and outstanding shares of the Company’s common stock will be

automatically converted into one (1) share of the Company’s common stock without any change in the par value per share. The Company

will not be issuing fractional shares in connection with the reverse stock split. Stockholders who otherwise would be entitled

to receive fractional shares, because they hold a number of shares not evenly divisible by the reverse stock split ratio of the reverse

stock split, will be entitled, upon surrender of certificate(s) representing these shares, to a number of shares rounded up to the nearest

whole number and, accordingly, no money will be paid for a fractional share.

The reverse

stock split will reduce the number of shares of the Company’s outstanding common stock from approximately 24.6 million shares

to approximately 1.2 million shares. As a result of the anticipated reverse stock split, proportionate adjustments will be made

to the number of shares of the Company’s common stock underlying the Company’s outstanding equity awards, warrants, and the

number of shares issuable under the Company’s equity incentive plans and other existing agreements, as well as the exercise price,

as applicable. The reverse stock split will have no effect on the number of authorized shares or the par value of the Company’s

common stock, and the ownership percentage of each stockholder will remain unchanged other than as a result of fractional shares.

The Company’s

transfer agent, Continental Stock Transfer & Trust, will serve as the exchange agent for the reverse stock split.

Registered

stockholders that hold shares of pre-split common stock in the Company electronically in book-entry form are not required to take any

action in order to receive post-split shares of common stock. For stockholders that hold shares of common stock in certificate form,

such stockholders will receive a transmittal letter from Continental Stock Transfer & Trust as soon as practical following the

effective date containing instructions.

Stockholders

that hold their shares of common stock either in a brokerage or in “street name”

will have their shares of common stock automatically adjusted to reflect the reverse stock split, subject to compliance with each broker’s

particular processes. Such stockholders will not be required to take any separate action in connection with the reverse stock split.

Additional

information about the reverse stock split can be found in the Company’s definitive proxy statement (the “Proxy Statement”)

filed with the Securities and Exchange Commission (the “SEC”) on October 5, 2023, which is available free of charge at the

SEC’s website, www.sec.gov.

About Processa Pharmaceuticals,

Inc.

Processa

is a clinical stage pharmaceutical company focused on developing the Next Generation Chemotherapy (NGC) drugs to improve the safety and

efficacy of cancer treatment. By combining Processa’s novel oncology pipeline with proven cancer-killing active molecules and the

Processa Regulatory Science Approach as well as experience in defining Optimal Dosage Regimens for FDA approvals, Processa not only will

be providing better therapy options to cancer patients but also increase the probability of FDA approval for its Next Generation Chemotherapy

(NGC) drugs following an efficient path to approval. Processa’s NGC drugs are modifications of existing FDA-approved oncology drugs

resulting in an alteration of the metabolism and/or distribution of these FDA-approved drugs while maintaining the existing mechanisms

of killing the cancer cells. The company’s approach to drug development is based on more than 30 years of drug development expertise

to efficiently design and conduct clinical trials that demonstrate a positive benefit/risk relationship. The Processa team has a track

record of obtaining over 30 approvals for indications across almost every division of FDA. Using its proven Regulatory Science Approach,

the Processa Team has experience defining the Optimal Dosage Regimen using the principles of the FDA’s Project Optimus Oncology

initiative. The advantages of Processa’s NGCs are expected to include fewer patients experiencing side effects that lead to dose

discontinuation, more significant cancer response and a greater number of patients -- in excess of 200,000 for each NGC drug -- who will

benefit from each NGC drug. Currently under development are three next generation chemotherapy oncology treatments: Next Generation Capecitabine

(PCS6422 and capecitabine to treat metastatic colorectal, gastrointestinal, breast, pancreatic, and other cancers), Next Generation Gemcitabine

(PCS3117 to treat pancreatic, lung, ovarian, breast, and other cancers), and Next Generation Irinotecan (PCS11T to treat lung, colorectal,

gastrointestinal, pancreatic, and other cancers).

For more

information, visit our website at www.processapharma.com.

Forward-Looking

Statements

This release

contains forward-looking statements. The statements in this press release that are not purely historical are forward-looking statements

which involve risks and uncertainties. Actual future performance outcomes and results may differ materially from those expressed in forward-looking

statements. Please refer to the documents filed by Processa Pharmaceuticals with the SEC, specifically the most recent reports on Forms

10-K and 10-Q, which identify important risk factors which could cause actual results to differ from those contained in the forward-looking

statements.

For

More Information:

Investors:

Bret Shapiro

CORE IR

ir@processapharma.com

Company

Contact:

Patrick

Lin

(925) 683-3218

plin@processapharma.com

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

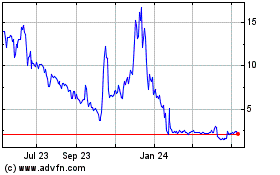

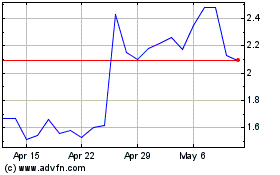

Processa Pharmaceuticals (NASDAQ:PCSA)

Historical Stock Chart

From Apr 2024 to May 2024

Processa Pharmaceuticals (NASDAQ:PCSA)

Historical Stock Chart

From May 2023 to May 2024