Popular, Inc. Announces Completion of Sale of Majority Interest in EVERTEC to Funds Managed by Apollo Management, L.P.

September 30 2010 - 3:52PM

Business Wire

Popular, Inc. (NASDAQ:BPOP) announced today the completion of

the merger pursuant to which funds managed by Apollo Management,

L.P. acquired a 51% interest in Popular’s processing subsidiary,

EVERTEC, and related processing businesses, through the

establishment of a joint venture. The new joint venture is valued

at approximately $868 million. As part of the transaction, Popular

transferred its merchant acquiring and processing and technology

businesses to EVERTEC.

“This transaction concludes our capital plan,” said Popular,

Inc. Chairman & CEO Richard L. Carrión. “We retained 49 percent

in EVERTEC because we strongly believe this partnership has great

potential to expand its business.”

“We are pleased this transaction has closed, and we look forward

to partnering with Popular, the EVERTEC management team, its

employees and customers to continue the expansion and growth of

this strong franchise,” said Apollo senior partner Marc Becker.

The transaction is expected to result in a net gain after taxes

for Popular of approximately $570 million. The net cash proceeds to

be received by Popular after paying for transaction costs and taxes

are estimated at approximately $610 million. The sale has a

positive impact of approximately 2.22 percent on Tier 1 Common,

Tier 1 Capital and Total Capital ratios, and of approximately 1.43

percent on Popular’s Tier 1 Leverage ratio.

In April of this year, Popular raised $1.1 billion in a public

equity offering, which when combined with the gain in this

transaction represents approximately $1.7 billion in new

capital.

Founded in 1893, Popular, Inc. is the leading banking

institution by both assets and deposits in Puerto Rico and ranks

33rd by assets among U.S. banks. In the United States, Popular has

established a community-banking franchise providing a broad range

of financial services and products with branches in New York, New

Jersey, Illinois, Florida and California.

About Apollo

Apollo is a leading global alternative asset manager with

offices in New York, Los Angeles,

London, Frankfurt, Luxembourg, Singapore, Mumbai and Hong

Kong. Apollo had assets under management of over $53 billion as of

December 31, 2009, in private equity, credit-oriented capital

markets and real estate funds invested across a core group of nine

industries where Apollo has considerable knowledge and

resources.

An electronic version of this press release can be found at the

Corporation’s website, www.popular.com.

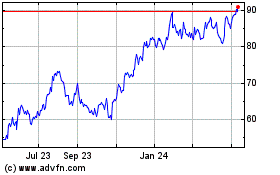

Popular (NASDAQ:BPOP)

Historical Stock Chart

From Jun 2024 to Jul 2024

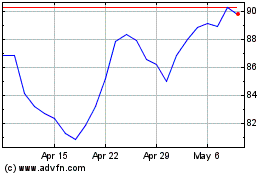

Popular (NASDAQ:BPOP)

Historical Stock Chart

From Jul 2023 to Jul 2024