Pool Corporation (Nasdaq/GSM:POOL) today reported record results

for the first quarter of 2021 and increased 2021 earnings guidance.

“What an incredible quarter, backed by an

incredible team. We kicked off the year with truly remarkable

results, including record net sales and phenomenal bottom line

results. We achieved over $1.0 billion in net sales in the first

quarter of 2021, a milestone in our company’s history and a

reflection of our focus on providing extraordinary customer

service. Looking ahead at the remainder of the year, we expect to

achieve strong growth tempered by tougher comps in the back half of

the year. We are well-positioned to accomplish our strategic

initiatives and have the right team in place to continue to build

on our legacy of success,” commented Peter D. Arvan, president and

CEO.

In the first quarter of 2021, net sales

increased 57% to a record $1.06 billion compared to $677.3

million in the first quarter of 2020, while base business

sales grew 51%. Our sales have continued to benefit from elevated

demand for residential pool products, driven by home-centric trends

influenced by the COVID-19 pandemic. Maintenance, replacement,

refurbishment and construction activity remains strong as families

create and expand home-based outdoor living and entertainment

spaces, resulting in broad sales gains across nearly all product

categories.

Gross profit increased 59% to a record $301.1

million in the first quarter of 2021 from $189.6 million in the

same period of 2020. Base business gross profit improved 54% over

the first quarter of 2020. Gross margin increased 40 basis points

to 28.4% in the first quarter of 2021 compared to 28.0% in the

first quarter of 2020. Gross margin was favorably impacted by

improvements from supply chain initiatives and timing differences

in customer early buy purchases year-over-year, which were

partially offset by increased sales of lower margin, big-ticket

items in the first quarter of 2021 compared to the first quarter of

2020.

Selling and administrative expenses (operating

expenses) increased 12% to $172.1 million in the first quarter

of 2021 compared to $154.0 million in the first quarter of 2020,

reflecting an increase of $11.5 million in performance-based

compensation expense and increases in other growth-driven costs. As

a percentage of net sales, operating expenses decreased to 16.2% in

the first quarter of 2021 compared to 22.7% in the same period of

2020 due to strong expense control and our ability to leverage our

existing network.

Operating income in the first quarter of 2021

increased 263% to $129.0 million compared to $35.6 million in

the same period in 2020. Operating margin was 12.2% in the first

quarter of 2021 compared to 5.3% in the first quarter of 2020.

We recorded a $4.0 million, or $0.10 per diluted

share, tax benefit from Accounting Standards Update (ASU) 2016-09,

Improvements to Employee Share-Based Payment Accounting, in the

quarter ended March 31, 2021, compared to a tax benefit of

$8.0 million, or $0.19 per diluted share, realized in the same

period of 2020.

Net income increased 219% to $98.7

million in the first quarter of 2021 compared to $30.9 million

in the first quarter of 2020. Adjusted net income, excluding the

prior year impact of non-cash impairments, net of tax, increased

165% in the first quarter of 2021 compared to the prior year

period. Earnings per diluted share increased 223% to $2.42 in the

first quarter of 2021 compared to $0.75 in the same period of 2020.

Excluding the impact from ASU 2016-09 in both periods and the

impact of non-cash impairments, net of tax, in 2020, adjusted

earnings per diluted share increased 227% to $2.32 in the first

quarter of 2021 compared to $0.71 in the first quarter of 2020. See

the reconciliation of GAAP to non-GAAP measures in the addendum of

this release.

On the balance sheet at March 31, 2021, total

net receivables, including pledged receivables, increased 41%

compared to March 31, 2020, driven by our March sales growth

and partially offset by improved collections. Inventory levels

increased 14% to $977.2 million compared to March 31, 2020,

reflecting organic business growth and inventory from recently

acquired businesses of $55.5 million. Total debt outstanding was

$433.2 million at March 31, 2021, a $152.9 million decrease from

total debt at March 31, 2020, as we continue to utilize

operating cash flows to decrease debt balances.

The increase in net income drove net cash

provided by operations to $77.1 million in the first three months

of 2021 compared to $19.7 million in the first three months of

2020. Adjusted EBITDA (as defined in the addendum to this release)

was $140.1 million for the three months ended March 31, 2021,

compared to $53.4 million in the same period of the prior year.

Interest expense decreased compared to last year primarily due to

lower average debt levels and lower average interest rates.

“We believe that our industry-leading position,

combined with strong demand trends and a solid backlog of projects,

will benefit our results throughout the 2021 season. While we

expect to face tougher year-over-year comparisons and potential

industry capacity constraints as the year progresses, our

outstanding results in the first quarter of 2021 and increased

confidence in growth through the remainder of the year leads us to

update our annual earnings guidance range to $11.85 to $12.60 per

diluted share, including the impact of year-to-date tax benefits of

$0.10. Our previous 2021 earnings guidance range was $9.12 to $9.62

per diluted share, including an estimated $0.11 tax benefit,” said

Arvan.

POOLCORP is the world’s largest wholesale

distributor of swimming pool and related backyard products.

POOLCORP operates 400 sales centers in North America, Europe and

Australia, through which it distributes more than 200,000 national

brand and private label products to roughly 120,000 wholesale

customers. For more information, please visit www.poolcorp.com.

This news release includes “forward-looking”

statements that involve risks and uncertainties that are generally

identifiable through the use of words such as “believe,” “expect,”

“anticipate,” “intend,” “plan,” “estimate,” “project,” “should” and

similar expressions and include projections of earnings. The

forward-looking statements in this release are made pursuant to the

safe harbor provisions of the Private Securities Litigation Reform

Act of 1995. Forward-looking statements speak only as of the date

of this release, and we undertake no obligation to update or revise

such statements to reflect new circumstances or unanticipated

events as they occur. Actual results may differ materially due to a

variety of factors, including impacts on our business from the

COVID-19 pandemic and the extent to which home-centric trends will

continue, accelerate or reverse; the sensitivity of our business to

weather conditions; changes in the economy and the housing market;

our ability to maintain favorable relationships with suppliers and

manufacturers; competition from other leisure product alternatives

and mass merchants; our ability to continue to execute our growth

strategies; excess tax benefits or deficiencies recognized under

ASU 2016-09 and other risks detailed in POOLCORP’s 2020 Annual

Report on Form 10-K filed with the Securities and Exchange

Commission (SEC) as updated by POOLCORP's subsequent filings with

the SEC.

CONTACT:Curtis J. ScheelDirector of Investor

Relations985.801.5341curtis.scheel@poolcorp.com

POOL

CORPORATIONConsolidated Statements of

Income(Unaudited)(In thousands, except per share data)

| |

Three Months Ended |

| |

March 31, |

| |

2021 |

|

2020 |

|

Net sales |

$ |

1,060,745 |

|

|

$ |

677,288 |

|

| Cost of sales |

759,614 |

|

|

487,659 |

|

|

Gross profit |

301,131 |

|

|

189,629 |

|

|

Percent |

28.4 |

% |

|

28.0 |

% |

| |

|

|

|

| Selling and administrative

expenses |

172,100 |

|

|

147,097 |

|

| Impairment of goodwill and

other assets |

— |

|

|

6,944 |

|

|

Operating income |

129,031 |

|

|

35,588 |

|

|

Percent |

12.2 |

% |

|

5.3 |

% |

| |

|

|

|

| Interest and other

non-operating expenses, net |

2,582 |

|

|

4,789 |

|

| Income before income taxes and

equity earnings |

126,449 |

|

|

30,799 |

|

| Income tax provision

(benefit) |

27,869 |

|

|

(25 |

) |

| Equity earnings in

unconsolidated investments, net |

75 |

|

|

88 |

|

| Net income |

$ |

98,655 |

|

|

$ |

30,912 |

|

| |

|

|

|

| Earnings per share: |

|

|

|

|

Basic |

$ |

2.45 |

|

|

$ |

0.77 |

|

|

Diluted |

$ |

2.42 |

|

|

$ |

0.75 |

|

| Weighted average shares

outstanding: |

|

|

|

|

Basic |

40,215 |

|

|

40,125 |

|

|

Diluted |

40,846 |

|

|

40,955 |

|

| |

|

|

|

| Cash dividends declared per

common share |

$ |

0.58 |

|

|

$ |

0.55 |

|

POOL

CORPORATIONCondensed Consolidated Balance

Sheets(Unaudited)(In thousands)

| |

|

March 31, |

|

March 31, |

|

|

Change |

| |

|

2021 |

|

2020 |

|

|

$ |

|

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

|

|

|

|

| Current

assets: |

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

27,078 |

|

|

$ |

17,808 |

|

|

$ |

9,270 |

|

|

52 |

% |

|

| |

Receivables, net (1) |

|

122,938 |

|

|

|

66,328 |

|

|

|

56,610 |

|

|

85 |

|

|

| |

Receivables pledged under

receivables facility |

|

364,664 |

|

|

|

279,587 |

|

|

|

85,077 |

|

|

30 |

|

|

| |

Product inventories, net (2) |

|

977,228 |

|

|

|

858,190 |

|

|

|

119,038 |

|

|

14 |

|

|

| |

Prepaid expenses and other

current assets |

|

25,390 |

|

|

|

16,465 |

|

|

|

8,925 |

|

|

54 |

|

|

| Total current

assets |

|

1,517,298 |

|

|

|

1,238,378 |

|

|

|

278,920 |

|

|

23 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Property and

equipment, net |

|

109,830 |

|

|

|

113,987 |

|

|

|

(4,157 |

) |

|

(4 |

) |

|

| Goodwill |

|

267,914 |

|

|

|

193,380 |

|

|

|

74,534 |

|

|

39 |

|

|

| Other intangible

assets, net |

|

11,854 |

|

|

|

9,832 |

|

|

|

2,022 |

|

|

21 |

|

|

| Equity interest

investments |

|

1,305 |

|

|

|

1,260 |

|

|

|

45 |

|

|

4 |

|

|

| Operating lease

assets |

|

209,036 |

|

|

|

174,653 |

|

|

|

34,383 |

|

|

20 |

|

|

| Other assets |

|

24,456 |

|

|

|

16,291 |

|

|

|

8,165 |

|

|

50 |

|

|

| Total

assets |

$ |

2,141,693 |

|

|

$ |

1,747,781 |

|

|

$ |

393,912 |

|

|

23 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and stockholders’ equity |

|

|

|

|

|

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

|

|

|

|

| |

Accounts payable |

$ |

634,998 |

|

|

$ |

517,620 |

|

|

$ |

117,378 |

|

|

23 |

% |

|

| |

Accrued expenses and other

current liabilities |

|

134,670 |

|

|

|

62,614 |

|

|

|

72,056 |

|

|

115 |

|

|

| |

Short-term borrowings and

current portion of long-term debt |

|

12,409 |

|

|

|

16,353 |

|

|

|

(3,944 |

) |

|

(24 |

) |

|

| |

Current operating lease

liabilities |

|

61,265 |

|

|

|

55,703 |

|

|

|

5,562 |

|

|

10 |

|

|

| Total current

liabilities |

|

843,342 |

|

|

|

652,290 |

|

|

|

191,052 |

|

|

29 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Deferred income

taxes |

|

31,134 |

|

|

|

30,464 |

|

|

|

670 |

|

|

2 |

|

|

| Long-term debt,

net |

|

420,762 |

|

|

|

569,697 |

|

|

|

(148,935 |

) |

|

(26 |

) |

|

| Other long-term

liabilities |

|

38,945 |

|

|

|

26,470 |

|

|

|

12,475 |

|

|

47 |

|

|

| Non-current operating

lease liabilities |

|

149,582 |

|

|

|

120,462 |

|

|

|

29,120 |

|

|

24 |

|

|

| Total

liabilities |

|

1,483,765 |

|

|

|

1,399,383 |

|

|

|

84,382 |

|

|

6 |

|

|

| Total

stockholders’ equity |

|

657,928 |

|

|

|

348,398 |

|

|

|

309,530 |

|

|

89 |

|

|

| Total

liabilities and stockholders’ equity |

$ |

2,141,693 |

|

|

$ |

1,747,781 |

|

|

$ |

393,912 |

|

|

23 |

% |

|

(1) The allowance for doubtful accounts was

$4.7 million at March 31, 2021 and $6.9 million at March 31,

2020.(2) The inventory reserve was $13.7 million

at March 31, 2021 and $10.3 million at March 31, 2020.

POOL

CORPORATIONCondensed Consolidated Statements of

Cash Flows(Unaudited)(In thousands)

| |

|

Three Months Ended |

|

|

|

| |

|

March 31, |

|

|

|

| |

|

2021 |

|

|

2020 |

|

|

Change |

| Operating

activities |

|

|

|

|

|

|

|

|

| Net income |

$ |

98,655 |

|

|

|

$ |

30,912 |

|

|

|

$ |

67,743 |

|

|

| Adjustments to

reconcile net income to net cash provided by operating

activities: |

|

|

|

|

|

|

|

|

|

|

Depreciation |

|

6,884 |

|

|

|

|

7,001 |

|

|

|

|

(117 |

) |

|

| |

Amortization |

|

421 |

|

|

|

|

336 |

|

|

|

|

85 |

|

|

| |

Share-based compensation |

|

3,837 |

|

|

|

|

3,654 |

|

|

|

|

183 |

|

|

| |

Equity earnings in

unconsolidated investments, net |

|

(75 |

) |

|

|

|

(88 |

) |

|

|

|

13 |

|

|

| |

Impairment of goodwill and

other assets |

|

— |

|

|

|

|

6,944 |

|

|

|

|

(6,944 |

) |

|

| |

Other |

|

2,723 |

|

|

|

|

3,715 |

|

|

|

|

(992 |

) |

|

| Changes in

operating assets and liabilities, net of effects of

acquisitions: |

|

|

|

|

|

|

|

|

| |

Receivables |

|

(199,672 |

) |

|

|

|

(124,542 |

) |

|

|

|

(75,130 |

) |

|

| |

Product inventories |

|

(200,185 |

) |

|

|

|

(156,856 |

) |

|

|

|

(43,329 |

) |

|

| |

Prepaid expenses and other

assets |

|

(5,507 |

) |

|

|

|

4,633 |

|

|

|

|

(10,140 |

) |

|

| |

Accounts payable |

|

369,665 |

|

|

|

|

256,874 |

|

|

|

|

112,791 |

|

|

| |

Accrued expenses and other

current liabilities |

|

367 |

|

|

|

|

(12,855 |

) |

|

|

|

13,222 |

|

|

| Net cash provided

by operating activities |

|

77,113 |

|

|

|

|

19,728 |

|

|

|

|

57,385 |

|

|

| |

|

|

|

|

|

|

|

|

| Investing

activities |

|

|

|

|

|

|

|

|

| Acquisition of

businesses, net of cash acquired |

|

(683 |

) |

|

|

|

(13,642 |

) |

|

|

|

12,959 |

|

|

| Purchases of

property and equipment, net of sale proceeds |

|

(8,839 |

) |

|

|

|

(8,340 |

) |

|

|

|

(499 |

) |

|

| Net cash used in

investing activities |

|

(9,522 |

) |

|

|

|

(21,982 |

) |

|

|

|

12,460 |

|

|

| |

|

|

|

|

|

|

|

|

| Financing

activities |

|

|

|

|

|

|

|

|

| Proceeds from

revolving line of credit |

|

342,500 |

|

|

|

|

248,700 |

|

|

|

|

93,800 |

|

|

| Payments on

revolving line of credit |

|

(308,656 |

) |

|

|

|

(256,543 |

) |

|

|

|

(52,113 |

) |

|

| Proceeds from

asset-backed financing |

|

110,000 |

|

|

|

|

97,400 |

|

|

|

|

12,600 |

|

|

| Payments on

asset-backed financing |

|

(125,000 |

) |

|

|

|

(17,300 |

) |

|

|

|

(107,700 |

) |

|

| Payments on term

facility |

|

(2,313 |

) |

|

|

|

(2,313 |

) |

|

|

|

— |

|

|

| Proceeds from

short-term borrowings and current portion of long-term debt |

|

4,280 |

|

|

|

|

6,479 |

|

|

|

|

(2,199 |

) |

|

| Payments on

short-term borrowings and current portion of long-term debt |

|

(3,740 |

) |

|

|

|

(1,871 |

) |

|

|

|

(1,869 |

) |

|

| Payments of

deferred financing costs |

|

— |

|

|

|

|

(12 |

) |

|

|

|

12 |

|

|

| Payments of

deferred and contingent acquisition consideration |

|

(362 |

) |

|

|

|

(281 |

) |

|

|

|

(81 |

) |

|

| Proceeds from

stock issued under share-based compensation plans |

|

2,912 |

|

|

|

|

6,358 |

|

|

|

|

(3,446 |

) |

|

| Payments of cash

dividends |

|

(23,299 |

) |

|

|

|

(22,147 |

) |

|

|

|

(1,152 |

) |

|

| Purchases of

treasury stock |

|

(71,516 |

) |

|

|

|

(66,619 |

) |

|

|

|

(4,897 |

) |

|

| Net cash used in

financing activities |

|

(75,194 |

) |

|

|

|

(8,149 |

) |

|

|

|

(67,045 |

) |

|

| Effect of exchange

rate changes on cash and cash equivalents |

|

553 |

|

|

|

|

(372 |

) |

|

|

|

925 |

|

|

| Change in cash and

cash equivalents |

|

(7,050 |

) |

|

|

|

(10,775 |

) |

|

|

|

3,725 |

|

|

| Cash and cash

equivalents at beginning of period |

|

34,128 |

|

|

|

|

28,583 |

|

|

|

|

5,545 |

|

|

| Cash and cash

equivalents at end of period |

$ |

27,078 |

|

|

|

$ |

17,808 |

|

|

|

$ |

9,270 |

|

|

ADDENDUM

Base Business

The following table breaks out our consolidated results into the

base business component and the excluded component (sales centers

excluded from base business):

| (Unaudited) |

|

Base Business |

|

Excluded |

|

Total |

| (in thousands) |

|

Three Months Ended |

|

Three Months Ended |

|

Three Months Ended |

| |

|

March 31, |

|

March 31, |

|

March 31, |

| |

|

2021 |

|

2020 |

|

2021 |

|

2020 |

|

2021 |

|

2020 |

| Net sales |

|

$ |

1,015,632 |

|

|

$ |

674,082 |

|

|

$ |

45,113 |

|

|

|

$ |

3,206 |

|

|

$ |

1,060,745 |

|

|

$ |

677,288 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

290,115 |

|

|

188,292 |

|

|

11,016 |

|

|

|

1,337 |

|

|

301,131 |

|

|

189,629 |

|

| Gross margin |

|

28.6 |

% |

|

27.9 |

% |

|

24.4 |

% |

|

|

41.7 |

% |

|

28.4 |

% |

|

28.0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses (1) |

|

160,995 |

|

|

152,815 |

|

|

11,105 |

|

|

|

1,226 |

|

|

172,100 |

|

|

154,041 |

|

| Expenses as a % of net

sales |

|

15.9 |

% |

|

22.7 |

% |

|

24.6 |

% |

|

|

38.2 |

% |

|

16.2 |

% |

|

22.7 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income (loss)

(1) |

|

129,120 |

|

|

35,477 |

|

|

(89 |

) |

|

|

111 |

|

|

129,031 |

|

|

35,588 |

|

| Operating margin |

|

12.7 |

% |

|

5.3 |

% |

|

(0.2 |

)% |

|

|

3.5 |

% |

|

12.2 |

% |

|

5.3 |

% |

(1) Base business and

total for 2020 reflect $6.9 million of impairment from goodwill and

other assets.

We have excluded the following acquisitions from

our base business results for the periods identified:

|

Acquired |

|

AcquisitionDate |

|

NetSales

CentersAcquired |

|

PeriodsExcluded |

| TWC

Distributors, Inc. (1) |

|

December 2020 |

|

10 |

|

January - March 2021 |

| Jet Line Products, Inc. |

|

October 2020 |

|

9 |

|

January - March 2021 |

| Northeastern Swimming Pool

Distributors, Inc. (1) |

|

September 2020 |

|

2 |

|

January - March 2021 |

| Master Tile Network LLC (1) |

|

February 2020 |

|

4 |

|

January - March 2021 and February

- March 2020 |

(1) We acquired certain

distribution assets of each of these companies.When calculating our

base business results, we exclude sales centers that are acquired,

closed or opened in new markets for a period of 15 months. We also

exclude consolidated sales centers when we do not expect to

maintain the majority of the existing business and existing sales

centers that are consolidated with acquired sales centers.

We generally allocate corporate overhead

expenses to excluded sales centers on the basis of their net sales

as a percentage of total net sales. After 15 months of operations,

we include acquired, consolidated and new market sales centers in

the base business calculation including the comparative prior year

period.

The table below summarizes the changes in our

sales center count in the first three months of 2021.

|

December 31, 2020 |

398 |

|

|

|

Acquired locations |

— |

|

|

|

New locations |

3 |

|

|

|

Consolidated location |

(1 |

) |

|

| March 31, 2021 |

400 |

|

|

Adjusted EBITDA

We define Adjusted EBITDA as net income or net

loss plus interest and other non-operating expenses, income taxes,

depreciation, amortization, share-based compensation, goodwill and

other non-cash impairments and equity earnings or loss in

unconsolidated investments. Adjusted EBITDA is not a

measure of cash flow or liquidity as determined by generally

accepted accounting principles (GAAP). We have included Adjusted

EBITDA as a supplemental disclosure because we believe that it is

widely used by our investors, industry analysts and others as a

useful supplemental accrual-based liquidity measure in conjunction

with net cash flows provided by or used in operating

activities to help investors understand our ability to provide cash

flows to fund growth, service debt, repurchase shares and pay

dividends as well as compare our cash flow generating capacity from

period to period, excluding the impact of period-to-period changes

in working capital.

We believe Adjusted EBITDA should be considered

in addition to, not as a substitute for, operating income or loss,

net income or loss, net cash flows provided by or used in

operating, investing and financing activities or other income

statement or cash flow statement line items reported in accordance

with GAAP. Other companies may calculate Adjusted EBITDA

differently than we do, which may limit its usefulness as a

comparative measure.

The table below presents a reconciliation of

Adjusted EBITDA to net cash provided by operating activities.

Please see page 5 for our Condensed Consolidated Statements of

Cash Flows.

| (Unaudited) |

|

Three Months Ended |

| (in

thousands) |

|

March 31, |

| |

|

|

2021 |

|

|

2020 |

| Adjusted

EBITDA |

$ |

140,092 |

|

|

|

$ |

53,419 |

|

|

| |

Add: |

|

|

|

|

|

| |

Interest and other non-operating expenses, net of interest

income |

|

(2,501 |

) |

|

|

|

(4,685 |

) |

|

| |

Income tax provision (benefit) |

|

(27,869 |

) |

|

|

|

25 |

|

|

| |

Other |

|

2,723 |

|

|

|

|

3,715 |

|

|

| |

Change in operating assets and liabilities |

|

(35,332 |

) |

|

|

|

(32,746 |

) |

|

| Net cash provided

by operating activities |

$ |

77,113 |

|

|

|

$ |

19,728 |

|

|

The table below presents a reconciliation of net income to

Adjusted EBITDA.

| (Unaudited) |

|

Three Months Ended |

| (in

thousands) |

|

March 31, |

| |

|

|

2021 |

|

|

2020 |

| Net income |

$ |

98,655 |

|

|

|

$ |

30,912 |

|

|

| |

Add: |

|

|

|

|

|

|

|

Interest and other non-operating expenses (1) |

|

2,582 |

|

|

|

|

4,789 |

|

|

| |

Income tax provision (benefit) |

|

27,869 |

|

|

|

|

(25 |

) |

|

| |

Share-based compensation |

|

3,837 |

|

|

|

|

3,654 |

|

|

| |

Equity earnings in unconsolidated investments |

|

(75 |

) |

|

|

|

(88 |

) |

|

| |

Impairment of goodwill and other assets |

|

— |

|

|

|

|

6,944 |

|

|

| |

Depreciation |

|

6,884 |

|

|

|

|

7,001 |

|

|

| |

Amortization (2) |

|

340 |

|

|

|

|

232 |

|

|

| Adjusted

EBITDA |

$ |

140,092 |

|

|

|

$ |

53,419 |

|

|

(1) Shown net of interest

income and includes gains and losses on foreign currency

transactions and amortization of deferred financing costs as

discussed below. (2) Excludes amortization of

deferred financing costs of $81 and $104 for the three months ended

March 31, 2021 and March 31, 2020, respectively. This non-cash

expense is included in Interest and other non-operating expenses,

net on the Consolidated Statements of Income.

Adjusted Income Statement

Information

We have included adjusted net income and

adjusted diluted EPS, which are non-GAAP financial measures, in

this press release as supplemental disclosures, because we believe

these measures are useful to investors and others in assessing our

year-over-year operating performance. We believe these measures

should be considered in addition to, not as a substitute for, net

income and diluted EPS presented in accordance with GAAP,

respectively, and in the context of our other disclosures in this

press release. Other companies may calculate these non-GAAP

financial measures differently than we do, which may limit their

usefulness as comparative measures.

The table below presents a reconciliation of net

income to adjusted net income.

| (Unaudited) |

Three Months Ended |

| (in thousands) |

March 31, |

| |

2021 |

|

2020 |

|

Net income |

$ |

98,655 |

|

|

$ |

30,912 |

|

|

|

Impairment of goodwill and other assets |

— |

|

|

6,944 |

|

|

|

Tax impact on impairment of long-term note (1) |

— |

|

|

(654 |

) |

|

| Adjusted net income |

$ |

98,655 |

|

|

$ |

37,202 |

|

|

(1) As described in our April 23,

2020 earnings release, our effective tax rate at March 31, 2020 was

a 0.1% benefit. Excluding impairment from goodwill and intangibles

and tax benefits from ASU 2016-09 recorded in the first quarter of

2020, our effective tax rate for the first quarter of 2020 was

25.4%, which we used to calculate the tax impact related to the

$2.5 million long-term note impairment.

The table below presents a reconciliation of diluted EPS to

adjusted diluted EPS.

| (Unaudited) |

Three Months Ended |

| |

March 31, |

| |

2021 |

|

2020 |

|

Diluted EPS |

$ |

2.42 |

|

|

|

$ |

0.75 |

|

|

|

After-tax non-cash impairment charges |

— |

|

|

|

0.15 |

|

|

| Adjusted diluted EPS excluding

after-tax non-cash impairment charges |

2.42 |

|

|

|

0.90 |

|

|

|

ASU 2016-09 tax benefit |

(0.10 |

) |

|

|

(0.19 |

) |

|

| Adjusted diluted EPS excluding

after-tax non-cash impairment charges and tax benefit |

$ |

2.32 |

|

|

|

$ |

0.71 |

|

|

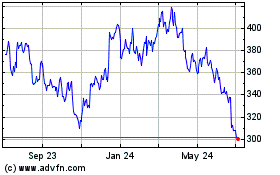

Pool (NASDAQ:POOL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pool (NASDAQ:POOL)

Historical Stock Chart

From Apr 2023 to Apr 2024