Photronics Reports Fourth Quarter Results BROOKFIELD, Conn., Dec. 9

/PRNewswire-FirstCall/ -- Photronics, Inc. , the world's leading

sub-wavelength reticle solutions supplier, today reported fiscal

2003 fourth quarter and full year sales and earnings results for

the period ended November 2, 2003. Sales for the fourth quarter of

fiscal 2003 were $91.5 million, up 1.6%, compared to $90.1 million

for the fiscal fourth quarter of 2002. Sequentially, sales were

1.1% higher than the $90.5 million reported in the third quarter of

fiscal 2003. Net income for the fourth quarter of fiscal 2003

amounted to $3.1 million, or $0.10 per diluted share, compared to a

net loss of $10.3 million or $0.32 per diluted share for the fourth

quarter of fiscal 2002. The fourth quarter of fiscal 2002 included

the after-tax effect of two previously announced items: a

consolidation charge of $10.0 million, or $0.31 per diluted share,

resulting from the closure of certain manufacturing operations and

a workforce reduction, and a net gain of $1.7 million, or $0.05 per

diluted share, from the repurchase of the Company's 6% Convertible

Subordinated Notes. Sales for fiscal 2003 amounted to $348.9

million, down 9.8% from the $386.9 million for fiscal 2002. The net

loss for fiscal 2003 totaled $48.2 million or $1.50 per diluted

share compared to a net loss of $4.9 million, or $0.16 per diluted

share for fiscal 2002. The results for fiscal 2003 included

consolidation and early extinguishment charges totaling $40.8

million after tax, or $1.27 per diluted share. Consolidation,

restructuring and related charges in fiscal 2003 totaled $39.9

million, or $1.24 per diluted share after tax, were recorded in a

previously announced consolidation of the Company's North American

operating infrastructure that included, among other items, the

closure of its Phoenix, Arizona manufacturing facility and a

reduction in its work force. The net loss for fiscal 2003 also

includes the impact of an early extinguishment charge of $900

thousand, or $0.03 per diluted share, associated with the Company's

redemption of all of its previously outstanding $62.1 million 6%

Convertible Subordinated Notes. In commenting about Photronics'

financial performance and position at the end of the year, Sean

Smith, Chief Financial Officer, noted, "In the face of a

challenging operating environment, the Company's dedicated team of

employees around the world rose to the challenge of generating free

cash flows and strengthening our balance sheet in fiscal 2003. In

analyzing their achievements, it is clear that as structured,

Photronics' operating model has significant leverage with

incremental revenue growth. Increased manufacturing efficiencies

and the benefits of infrastructure consolidation enabled the

Company to improve operating income in the second half of 2003 and

generate free cash at levels that enabled the steady reduction of

long-term debt during the second half of the fiscal year.

Additionally, the Company paid down all our $11 million in

borrowings outstanding under our $100 million credit facility." Mr.

Smith concluded, "Working capital is at its highest level in years.

As our global semiconductor customers see increasing momentum

develop in their business, they know they have a strategic supplier

in Photronics that is focused on delivering efficiency and that has

a strong financial position to support them irrespective of

cyclical factors." Dan Del Rosario, Chief Executive Officer,

stated, "In planning for fiscal 2003, the management team set a

number of very aggressive operating and financial goals for this

Company. Tough decisions were made, but by adhering to our

strategic plan we were able to achieve our goals and at the same

time position the Company for further operating and financial

performance improvement. " Mr. Del Rosario added, "Photronics'

competitive position is quite strong in the global regions it

serves, supported by its commitment to customer service and a

rapidly expanding technological capability. Throughout the year,

semiconductor companies have made considerable progress in

improving their 130-nanometer and below yields at the wafer level,

a situation in which Photronics' mask sets have played a role. As

end market demand begins to show some strength after the holiday

build up, we believe we will see increased design releases in 2004,

particularly for advanced wafer process nodes. Photronics' global

infrastructure, reliable performance and new high-end

qualifications with leading customers in Asia, Europe and North

America should enable the Company to further extend its strategic

customer relationships and leadership position as the photomask

technology and services supplier of choice." A conference call with

investors and the media to discuss these results can be accessed by

logging onto Photronics' web site at http://www.photronics.com/,

then clicking on the "Conference Calls" button in the upper right

hand corner of the home page. The call is scheduled for 8:30 a.m.

Eastern Standard Time on Wednesday, December 10th and will be

archived for instant replay access until the Company reports its

fiscal first quarter results in February 2004. The live call

dial-in number is (706) 634-5086. Photronics is a leading worldwide

manufacturer of photomasks. Photomasks are high precision quartz

plates that contain microscopic images of electronic circuits. A

key element in the manufacture of semiconductors, photomasks are

used to transfer circuit patterns onto semiconductor wafers during

the fabrication of integrated circuits. They are produced in

accordance with circuit designs provided by customers at

strategically located manufacturing facilities in Asia, Europe, and

North America. Additional information on the Company can be

accessed at http://www.photronics.com/. "Safe Harbor" Statement

under the Private Securities Litigation Reform Act of 1995: Certain

statements in this release are considered "forward looking

statements" within the meaning of the Private Securities Litigation

Reform Act of 1995. All forward-looking statements involve risks

and uncertainties. In particular, any statement contained in this

release regarding the consummation and benefits of future

acquisitions, expectations with respect to future sales, financial

performance, operating efficiencies and product expansion, are

subject to known and unknown risks, uncertainties and

contingencies, many of which are beyond the control of the Company.

These factors may cause actual results, performance or achievements

to differ materially from anticipated results, performances or

achievements. Factors that might affect such forward looking

statements include, but are not limited to, overall economic and

business conditions; the demand and receipt of orders for the

Company's products; competitive factors in the industries and

geographic markets in which the Company competes; changes in

federal, state and foreign tax requirements (including tax rate

changes, new tax laws and revised tax law interpretations); the

Company's ability to place new equipment in service on a timely

basis; interest rate fluctuations and other capital market

conditions, including foreign currency rate fluctuations; economic

and political conditions in international markets; the ability to

obtain a new bank facility or other financings; the ability to

achieve anticipated synergies and other cost savings in connection

with acquisitions and productivity programs; the timing, impact and

other uncertainties of future acquisitions and investments; the

seasonal and cyclical nature of the semiconductor industry; the

availability of capital; management changes; damage or destruction

to our facilities by natural disasters, labor strikes, political

unrest or terrorist activity; the ability to fully utilize its

tools; the ability of the Company to receive desired yields,

pricing, product mix, and market acceptance of its products;

changes in technology; and other risks and uncertainties set forth

in the Company's SEC filings from time to time. Any forward-looking

statements should be considered in light of these factors. The

Company assumes no obligation to update the information in this

release. PHOTRONICS, INC. AND SUBSIDIARIES Consolidated Condensed

Statements of Operations (in thousands, except per share amounts)

Three Months Ended Year Ended November 2 November 3 November 2

November 3 2003 2002 2003 2002 Net sales $91,489 $90,058 $348,884

$386,871 Costs and expenses: Cost of sales 62,090 67,386 250,687

276,451 Selling, general and administrative 13,544 14,398 56,154

57,973 Research and development 7,491 7,878 29,965 30,154

Consolidation, restructuring and related charges -- 14,500 (a)

42,000 (b) 14,500 (a) Operating income (loss) 8,364 (14,104)(a)

(29,922)(b) 7,793 (a) Other expense, net (2,431) (2,039)(c)

(11,743)(d) (13,291)(d) Income (loss) before income taxes and

minority interest 5,933 (16,143)(a)(c) (41,665)(b)(d) (5,498)(a)(c)

Income tax provision (benefit) 1,722 (7,419)(a)(c) 924 (b)(d)

(7,019)(a)(c) Income (loss) before minority interest 4,211

(8,724)(a)(c) (42,589)(b)(d) 1,521 (a)(c) Minority interest (1,088)

(1,584) (5,573) (6,378) Net income (loss) $3,123

$(10,308)(a)(c)$(48,162)(b)(d)$(4,857)(a)(c) Earnings (loss) per

share: Basic $0.10 $(0.32)(a)(c) $(1.50)(b)(d) $(0.16)(a)(c)

Diluted $0.10 $(0.32)(a)(c) $(1.50)(b)(d) $(0.16)(a)(c) Weighted

average number of common shares outstanding: Basic 32,388 32,022

32,144 31,278 Diluted 32,776 32,022 32,144 31,278 (a) Includes

consolidation charges incurred in the fourth quarter of 2002 of

$14.5 million ($10.0 million after tax, or $.31 per share for the

fourth quarter, $.32 per share for the year) in connection with the

Company's closing its manufacturing facility in Milpitas,

California and the reduction of it's North American work force. (b)

Includes consolidation charges incurred in the second quarter of

2003 of $42.0 million ($39.9 million after tax or $1.24 per diluted

share) in connection with the Company's closing its manufacturing

facility in Phoenix, Arizona and consolidation of the Company's

North American operating infrastructure. (c) Includes a net gain in

the fourth quarter of 2002 of $2.6 million ($1.7 million after tax,

or $.05 per share) from the repurchase of a portion of the

Company's 6% convertible notes (d) Includes early extinguishment

charge incurred in the third quarter of 2003 of $.9 million after

tax or $.03 per diluted share in connection with the early

redemption of the Company's 6% $62.1 million convertible notes due

June 2004. PHOTRONICS, INC. AND SUBSIDIARIES Consolidated Condensed

Balance Sheets (in thousands) November 2 November 3 2003 2002

Assets Current assets: Cash, cash equivalents and short-term

investments of $17,036 in 2003 and $15,148 in 2002 $231,813

$129,092 Accounts receivable 59,579 62,545 Inventories 14,329

19,948 Other current assets 34,161 37,475 Total current assets

339,882 249,060 Property, plant and equipment, net 387,977 443,860

Intangible assets, net 118,892 121,217 Other assets 18,789 18,305

$865,540 $832,442 Liabilities and Shareholders' Equity Current

liabilities: Current portion of long-term debt $5,505 $10,649

Accounts payable 43,997 57,401 Other accrued liabilities 31,871

38,982 Total current liabilities 81,373 107,032 Long-term debt

368,307 296,785 Deferred income taxes and other liabilities 54,723

44,539 Minority interest 52,808 44,971 Shareholders' equity 308,329

339,115 $865,540 $832,442 PHOTRONICS, INC. AND SUBSIDIARIES

Consolidated Condensed Statements of Cash Flows (in thousands) Year

Ended November 2 November 3 2003 2002 Cash flows from operating

activities: Net loss $(48,162) $(4,857) Adjustments to reconcile

net loss to net cash provided by operating activities: Depreciation

and amortization 85,097 83,187 Consolidation, restructuring and

related charges 42,000 14,500 Changes in assets and liabilities and

other 4,297 43,572 Net cash provided by operating activities 83,232

136,402 Cash flows from investing activities: Deposits on and

purchases of property, plant and equipment (47,022) (126,462) Other

(930) (14,268) Net cash used in investing activities (47,952)

(140,730) Cash flows from financing activities: Repayment of

long-term debt, net (86,535) (115,174) Proceeds from issuance of

common stock 5,501 4,590 Issuance of convertible debt, net 145,170

193,237 Net cash provided by financing activities 64,136 82,653

Effect of exchange rate changes on cash flows 1,417 935 Net

increase in cash and cash equivalents 100,833 79,260 Cash and cash

equivalents, beginning of year 113,944 34,684 Cash and cash

equivalents, end of year $214,777 $113,944 DATASOURCE: Photronics,

Inc. CONTACT: Michael W. McCarthy, VP of Corporate Communications

for Photronics, Inc., +1-203-775-9000, ; or Jane Ryan, Account

Director at MCA, +1-650-968-8900, , for Photronics, Inc. Web site:

http://www.photronics.com/

Copyright

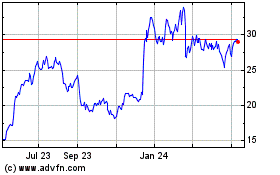

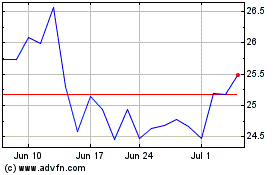

Photronics (NASDAQ:PLAB)

Historical Stock Chart

From May 2024 to Jun 2024

Photronics (NASDAQ:PLAB)

Historical Stock Chart

From Jun 2023 to Jun 2024