Perma-Fix Environmental Services, Inc. (NASDAQ: PESI) (the

“Company”) today announced financial results and provided a

business update for the fourth quarter and full year ended December

31, 2023.

Mark Duff, President and CEO of the Company,

commented, “I am pleased to report solid financial results for the

fourth quarter and 2023. Specifically, we achieved a 35.6% and

27.1% increase in revenue, as well as a 112.7% and 70.4% increase

in gross profit, for the fourth quarter and full year,

respectively. Most notably, we have been preparing for several key

initiatives that are progressing and we believe would be impactful

to our business later in 2024 and throughout 2025. Despite related

investments in both our internal bidding organization, as well as

research and development (R&D), we achieved positive EBITDA (as

defined and reconciled to GAAP below) and positive net income in

2023.”

“Within our Treatment Segment, we benefitted

from an improvement in waste volume receipts early in the quarter.

Within the Services Segment, we realized several new awards from

the Buffalo Corp of Engineers, U.S. Geological Survey (USGS), the

U.S. Navy and several commercial clients. At the same time, we

developed teaming relationships for several large procurements. In

addition, a joint venture in which we have a 50% interest, received

formal award of the Joint Research Council project through the

European Union at the Ispra, Italy facility, which we believe could

generate up to 50 million Euros over the next 7 years. Work under

this JV is beginning in Q1 2024, and the scope of work for the

Company is expected to ramp up in late 2025. Overall, we feel that

we finished the year strong with several strategic wins and

accomplishments that we believe will support our long-term

growth.”

“It is important to note, we are actively

bidding on large future contracts within the U.S. Department of

Energy (DOE) and U.S. Navy, as well as other mid-size procurement

initiatives at DOE, the U.S. Department of Defense (DOD) and the

U.S. Environmental Protection Agency (EPA) facilities. In addition,

we have made important advances on a new technology to treat PFAS

(Per-and Polyfluorinated Substances) contamination, which we look

forward to unveiling in the near future. Moreover, we believe we

are positioned to provide extensive waste treatment services in

support of DOE’s Hanford closure strategy, including the treatment

of effluent from the DFLAW (Direct-Feed Low-Activity Waste)

facility once it commences vitrification operations, which is

expected in early 2025. Finally, we are expanding our waste

treatment offering within the commercial and international markets,

including central Europe, Mexico and Canada. Although there may be

some lumpiness in performance resulting from delays in

procurements, project starts and waste shipments due, in part, to

the Continuing Resolution for the 2024 federal budget, we remain

encouraged by the long-term outlook for the business based on what

we expect are the growing project opportunities, sales pipeline,

and potentially company-changing projects in 2025.”

Financial Results

Fourth-Quarter 2023 ResultsRevenue for the

fourth quarter of 2023 was $22.7 million versus $16.8 million for

the same period last year. Revenue from the Services Segment

increased approximately $4.3 million to $12.5 million in the fourth

quarter of 2023 from $8.2 million for the corresponding of 2022

primarily due to continuing operation and improved productivity on

certain projects which had been delayed/curtailed in 2022 due, in

part, from the lingering effect of the COVID-19 pandemic. Revenue

from the Treatment Segment increased by approximately $1.6 million

to $10.2 million in the fourth quarter of 2023 from $8.6 million

for the corresponding period of 2022. The increase was primarily

due to overall higher waste volume which was offset by lower

averaged price from waste mix. As previously disclosed, starting in

the latter part of the second quarter of 2022, our Treatment

Segment began to see steady improvements in waste receipts from

certain customers who had previously delayed waste shipments due,

in part, from the lingering effects of COVID-19. Revenue from both

Segments were also positively impacted by new contracts awarded to

us in 2023 as procurement and planning on behalf of our government

clients continued to progress as the lingering effect of the

COVID-19 pandemic subsided.

Gross profit for the fourth quarter of 2023 was

$4.3 million versus $2.0 million for the fourth quarter of 2022.

The increase in gross profit in the Services Segment of

approximately $1.7 million or 181.4% was primarily due to higher

revenue. The improvement in gross margin to 21.3% in the fourth

quarter of 2023 as compared to 11.6% for the corresponding period

of 2022 was primarily due to improved margin projects. The increase

in gross profit in the Treatment Segment of approximately $564,000

or 52.5% and the improvement in gross margin to approximately 16.0%

in the fourth quarter of 2023 as compared to gross margin of

approximately 12.5% in the corresponding period of 2022 was

primarily due to overall higher revenue as discussed above and

overall lower fixed costs.

Operating loss for the fourth quarter of 2023

was approximately $9,000 versus operating loss of $1.7 million for

the fourth quarter of 2022. Income from continuing operations for

the fourth quarter of 2023 was approximately $470,000 as compared

to a loss from continuing operations of $1.5 million for the

corresponding period of 2022.

Net income for the fourth quarter of 2023 was

approximately $81,000 as compared to net loss of $1.7 million for

the fourth quarter of 2022. Income per share (both basic and

diluted) was $0.01 for the fourth quarter of 2023 as compared to a

loss per share (both basic and diluted) of $0.13 for the

corresponding period of 2022.

2023 Financial ResultsRevenue in 2023 was $89.7

million versus $70.6 million in 2022. Revenue from the Services

Segment increased by approximately $9.0 million to $46.2 million

for the year ended December 31, 2023, from $37.2 million for the

corresponding period of 2022. The increase was primarily due to

achievement of full operational status and improved productivity on

certain projects which had been delayed/curtailed in the early part

of 2022 due, in part, from the lingering effects of the COVID-19

pandemic. Revenue from the Treatment Segment increased by

approximately $10.1 million to $43.5 million in 2023 from $33.4

million in 2022. The increase was primarily due to overall higher

waste volume which was offset by lower averaged price from waste

mix. Similar to the fourth quarter of 2023 as discussed above, the

increase in waste volume was primarily due to steady improvements

in waste receipts from certain customers who had previously delayed

waste shipments due, in part, from the lingering effects of

COVID-19. Revenue from both Segments were also positively impacted

by new contracts awarded to us in 2023 as procurement and planning

on behalf of our government clients continued to progress as the

lingering effect of COVID-19 pandemic subsided.

Gross profit in 2023 was $16.4 million as

compared to $9.6 million in 2022. Gross profit increased in both

Segments. The increase in gross profit in the Services Segment of

approximately $5.1 million or 117.4% was primarily due to higher

revenue and the increase in gross margin to approximately 20.5%

from 11.7% was primarily due to improved margin projects. The

increase in gross profit in the Treatment Segment of approximately

$1.6 million or 31.1% was primarily due to higher revenue from

overall higher waste volume which was offset by lower averaged

price waste from waste mix. Treatment Segment gross margin

increased slightly to 15.8% for the year ended 2023 as compared to

approximately 15.7% in the prior year. Despite the slight increase

in gross margin, Treatment Segment gross margin was negatively

impacted by higher variable costs from waste mix and the impact of

overall increase in fixed costs.

Operating income in 2023 was $756,000 versus

operating loss of $5.4 million in 2022. Income from continuing

operations in 2023 was approximately $918,000 as compared to a loss

from continuing operations of $3.2 million in 2022. Loss from

continuing operations for 2022 included an income recorded in the

amount of approximately $2.0 million (within other income and

current other receivables), representing a refundable tax credit

against the Company’s shares of certain payroll taxes as permitted

by the Employee Retention Credit (“ERC”) program under the

Coronavirus Aid, Relief and Economic Securities Act (“CARES Act”),

as amended. The ERC program was provided to qualifying businesses

that kept employee on their payroll during the COVID-19

pandemic.

Net income in 2023 was approximately $485,000

compared to net loss of $3.8 million in 2022. Income per share

(both basic and diluted) was $0.04 in 2023 as compared to loss per

share (both basic and diluted) of $0.29 in 2022.

The Company achieved EBITDA of $3.3 million from

continuing operations for the twelve-months ended December 31,

2023, and Adjusted EBITDA of approximately ($3.3) million for the

same period of 2022. There was no adjustment to EBITDA for the

twelve-months ended December 31, 2023. The Company defines EBITDA

as earnings before interest, taxes, depreciation and amortization.

Adjusted EBITDA is defined as EBITDA before income from ERC refund

claim (net of costs incurred). Neither EBITDA nor Adjusted EBITDA

are measures of performance calculated in accordance with

Accounting Principles Generally Accepted in the United States of

America (GAAP), and should not be considered in isolation of, or as

a substitute for, earnings as an indicator of operating performance

or cash flows from operating activities as a measure of liquidity.

The Company believes the presentation of EBITDA and Adjusted EBITDA

is relevant and useful by enhancing the readers’ ability to

understand the Company’s operating performance. The Company’s

management utilizes EBITDA and Adjusted EBITDA as a means to

measure performance. The Company’s measurements of EBITDA and

Adjusted EBITDA may not be comparable to similar titled measures

reported by other companies. The table below reconciles EBITDA and

Adjusted EBITDA, both non-GAAP measures, to GAAP numbers for income

(loss) from continuing operations for the three and twelve-months

ended December 31, 2023, and 2022.

| |

|

Quarter Ended |

|

Twelve Months

Ended |

|

| |

|

December 31, |

|

December 31, |

|

| |

|

(Unaudited) |

|

(Unaudited) |

|

|

(In thousands) |

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

| Income

(loss) from continuing operations |

|

$ |

470 |

|

|

$ |

(1,529 |

) |

|

$ |

918 |

|

|

$ |

(3,211 |

) |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

Depreciation & amortization |

|

|

443 |

|

|

|

676 |

|

|

|

2,568 |

|

|

|

2,109 |

|

|

|

Interest income |

|

|

(161 |

) |

|

|

(30 |

) |

|

|

(606 |

) |

|

|

(99 |

) |

|

|

Interest expense |

|

|

134 |

|

|

|

52 |

|

|

|

323 |

|

|

|

175 |

|

|

|

Interest expense - financing fees |

|

|

13 |

|

|

|

17 |

|

|

|

93 |

|

|

|

61 |

|

|

|

Income tax (benefit) expense |

|

|

(465 |

) |

|

|

(231 |

) |

|

|

17 |

|

|

|

(378 |

) |

|

| |

|

|

|

|

|

|

|

|

|

| EBITDA |

|

|

434 |

|

|

|

(1,045 |

) |

|

|

3,313 |

|

|

|

(1,343 |

) |

|

| |

|

|

|

|

|

|

|

|

|

| Income from

ERC refund claim, net (1) |

|

- |

|

- |

|

- |

|

|

(1,908 |

) |

|

| |

|

|

|

|

|

|

|

|

|

| Adjusted

EBITDA |

|

$ |

434 |

|

|

$ |

(1,045 |

) |

|

$ |

3,313 |

|

|

$ |

(3,251 |

) |

|

| |

|

|

|

|

|

|

|

|

|

| (1) net of costs

incurred in connection with the ERC program in the amount of

approximately $67. |

|

|

|

The tables below present certain financial

information for the business segments, which exclude allocation of

corporate expenses.

* Any references to "Audited" in the headings as

noted in the table below and within the financial statements as

follows are derived from a previously filed Form 10-K.

| |

|

Three Months

Ended |

|

Twelve Months

Ended |

| |

|

December 31,

2023 |

|

December 31,

2023 |

| |

|

(Unaudited) |

|

(Unaudited) |

|

(In thousands) |

|

Treatment |

|

Services |

|

|

Treatment |

|

Services |

| Net

revenues |

|

$ |

10,255 |

|

|

$ |

12,464 |

|

|

$ |

43,477 |

|

$ |

46,258 |

| Gross

profit |

|

|

1,639 |

|

|

|

2,656 |

|

|

|

6,876 |

|

|

9,493 |

| Segment

(loss) profit |

|

|

(390 |

) |

|

|

2,782 |

|

|

|

2,228 |

|

|

5,716 |

| |

|

|

|

|

|

|

|

|

|

| |

|

Three Months

Ended |

|

Twelve Months

Ended |

| |

|

December 31,

2022 |

|

December 31,

2022 |

| |

|

(Unaudited) |

|

(Audited) |

|

(In thousands) |

|

Treatment |

|

Services |

|

|

Treatment |

|

Services |

| Net

revenues |

|

$ |

8,609 |

|

$ |

8,148 |

|

|

$ |

33,358 |

|

$ |

37,241 |

| Gross

profit |

|

|

1,075 |

|

|

944 |

|

|

|

5,243 |

|

|

4,366 |

| Segment

profit |

|

|

2 |

|

|

117 |

|

|

|

1,767 |

|

|

1,698 |

| |

|

|

|

|

|

|

|

|

|

Conference Call Perma-Fix will

host a conference call at 11:00 AM Eastern Time on Wednesday, March

13, 2024. The call will be available in the investors section of

the Company’s website at https://ir.perma-fix.com/conference-calls,

or by calling 888-506-0062 for U.S. callers or +1 973-528-0011 for

international callers, and by entering access code: 514355. The

conference call will be led by Mark J. Duff, Chief Executive

Officer, Dr. Louis F. Centofanti, Executive Vice President of

Strategic Initiatives, and Ben Naccarato, Executive Vice President

and Chief Financial Officer of Perma-Fix Environmental Services,

Inc.

A webcast will also be archived on the Company’s

website and a telephone replay of the call will be available

approximately one hour following the call, through Wednesday, March

20, 2024, and can be accessed by dialing 877-481-4010 for U.S.

callers or +1 919-882-2331 for international callers and entering

access code: 50109.

About Perma-Fix Environmental

ServicesPerma-Fix Environmental Services, Inc. is a

nuclear services company and leading provider of nuclear and mixed

waste management services. The Company's nuclear waste services

include management and treatment of radioactive and mixed waste for

hospitals, research labs and institutions, federal agencies,

including the DOE, the DOD, and the commercial nuclear industry.

The Company’s nuclear services group provides project management,

waste management, environmental restoration, decontamination and

decommissioning, new build construction, and radiological

protection, safety and industrial hygiene capability to our

clients. The Company operates four nuclear waste treatment

facilities and provides nuclear services at DOE, DOD, and

commercial facilities, nationwide.

Please visit us at http://www.perma-fix.com.

This press release contains “forward-looking

statements” which are based largely on the Company's expectations

and are subject to various business risks and uncertainties,

certain of which are beyond the Company's control. Forward-looking

statements generally are identifiable by use of the words such as

“believe”, “expects”, “intends”, “anticipate”, “plans to”,

“estimates”, “projects”, and similar expressions. Forward-looking

statements include, but are not limited to: long-term growth; key

initiatives impactful to our business in 2024 and throughout 2025;

revenue up to 50 million Euros generated under JV over the next 7

years; scope of work for the Company to ramp up in later phases of

JV contract; treatment of effluent from DFLAW facility in early

2025; and long-term outlook based on growing project opportunities,

sales pipeline, and potentially company-changing projects in 2025.

These forward-looking statements are intended to qualify for the

safe harbors from liability established by the Private Securities

Litigation Reform Act of 1995. While the Company believes the

expectations reflected in this news release are reasonable, it can

give no assurance such expectations will prove to be correct. There

are a variety of factors which could cause future outcomes to

differ materially from those described in this release, including,

without limitation, future economic conditions; industry

conditions; competitive pressures; our ability to apply and market

our new technologies; the government or such other party to a

contract granted to us fails to abide by or comply with the

contract or to deliver waste as anticipated under the contract;

inability to win bid projects; Congress fails to provides

continuing funding for the DOD’s and DOE’s remediation projects;

inability to obtain new foreign and domestic remediation contracts;

inability to meet financial covenants; full or partial government

shutdown; and the “Risk Factors” discussed in, and the additional

factors referred to under "Special Note Regarding Forward-Looking

Statements" of, our 2023 Form 10-K. The Company makes no commitment

to disclose any revisions to forward-looking statements, or any

facts, events or circumstances after the date hereof that bear upon

forward-looking statements.

FINANCIAL TABLES FOLLOW

Contacts:David K. Waldman-US

Investor RelationsCrescendo Communications, LLC (212) 671-1021

Herbert Strauss-European Investor Relationsherbert@eu-ir.com+43

316 296 316

| PERMA-FIX

ENVIRONMENTAL SERVICES,

INC. CONSOLIDATED STATEMENTS OF

OPERATIONS |

| |

|

Three Months

Ended |

|

Twelve Months

Ended |

| |

|

December 31, |

|

December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

(Amounts in Thousands, Except for Per Share Amounts) |

|

(Unaudited) |

|

(Unaudited) |

(Audited) |

| |

|

|

|

|

|

|

|

|

| Net

revenues |

$ |

22,719 |

|

$ |

16,757 |

|

$ |

89,735 |

|

$ |

70,599 |

|

| Cost of

goods sold |

|

18,424 |

|

|

14,738 |

|

|

73,366 |

|

|

60,990 |

|

|

Gross profit |

|

4,295 |

|

|

2,019 |

|

|

16,369 |

|

|

9,609 |

|

| |

|

|

|

|

|

|

|

|

| Selling,

general and administrative expenses |

|

4,006 |

|

|

3,617 |

|

|

14,975 |

|

|

14,652 |

|

| Research and

development |

|

221 |

|

|

90 |

|

|

561 |

|

|

336 |

|

| Loss on

disposal of property and equipment |

|

77 |

|

|

17 |

|

|

77 |

|

|

18 |

|

|

Loss (income) from operations |

|

(9 |

) |

|

(1,705 |

) |

|

756 |

|

|

(5,397 |

) |

| |

|

|

|

|

|

|

|

|

| Other income

(expense): |

|

|

|

|

|

|

|

|

| Interest

income |

|

161 |

|

|

30 |

|

|

606 |

|

|

99 |

|

| Interest

expense |

|

(134 |

) |

|

(52 |

) |

|

(323 |

) |

|

(175 |

) |

| Interest

expense-financing fees |

|

(13 |

) |

|

(17 |

) |

|

(93 |

) |

|

(61 |

) |

| Other |

|

- |

|

|

(16 |

) |

|

(11 |

) |

|

1,945 |

|

| Income

(loss) from continuing operations before taxes |

|

5 |

|

|

(1,760 |

) |

|

935 |

|

|

(3,589 |

) |

| Income tax

benefit (expense) |

|

(465 |

) |

|

(231 |

) |

|

17 |

|

|

(378 |

) |

| Income

(loss) income from continuing operations, net of taxes |

|

470 |

|

|

(1,529 |

) |

|

918 |

|

|

(3,211 |

) |

| |

|

|

|

|

|

|

|

|

| Loss from

discontinued operations, net of taxes |

|

(389 |

) |

|

(164 |

) |

|

(433 |

) |

|

(605 |

) |

|

Net income (loss) |

|

81 |

|

|

(1,693 |

) |

|

485 |

|

|

(3,816 |

) |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Net income

(loss) per common share attributable to |

|

|

|

|

|

|

|

|

|

Perma-Fix Environmental Services, Inc. stockholders - basic and

diluted: |

|

|

|

|

|

|

|

| Continuing

operations |

$ |

.04 |

$ |

(.12) |

$ |

.07 |

$ |

(.24) |

| Discontinued

operations |

|

(.03) |

|

(.01) |

|

(.03) |

|

(.05) |

|

Net income (loss) per common share |

$ |

.01 |

$ |

(.13) |

$ |

.04 |

$ |

(.29) |

| |

|

|

|

|

|

|

|

|

| Number of

common shares used in computing |

|

|

|

|

|

|

|

|

|

net income (loss) per share: |

|

|

|

|

|

|

|

|

| Basic |

|

13,619 |

|

|

13,324 |

|

|

13,506 |

|

|

13,280 |

|

| Diluted |

|

13,838 |

|

|

13,324 |

|

|

13,739 |

|

|

13,280 |

|

| |

|

|

|

|

|

|

|

|

| PERMA-FIX

ENVIRONMENTAL SERVICES, INC.CONDENSED CONSOLIDATED

BALANCE SHEETS |

| |

|

December 31, |

December 31, |

| |

|

|

2023 |

|

|

|

2022 |

|

|

(Amounts in Thousands, Except for Share and Per Share Amounts) |

|

(Unaudited) |

|

(Audited) |

| |

|

|

|

|

| ASSETS |

|

|

|

|

| Current

assets: |

|

|

|

|

|

Cash |

|

$ |

7,500 |

|

|

$ |

1,866 |

|

|

Account receivable, net of allowance for credit losses of $30 and

57, respectively |

|

|

9,722 |

|

|

|

9,364 |

|

|

Unbilled receivables |

|

|

8,432 |

|

|

|

6,062 |

|

|

Other current assets |

|

|

4,893 |

|

|

|

6,219 |

|

|

Assets of discontinued operations included in current assets |

|

|

13 |

|

|

|

15 |

|

|

Total current assets |

|

|

30,560 |

|

|

|

23,526 |

|

|

|

|

|

|

|

| Net property

and equipment |

|

|

19,009 |

|

|

|

18,957 |

|

| Property and

equipment of discontinued operations |

|

|

81 |

|

|

|

81 |

|

|

|

|

|

|

|

| Operating

lease right-of-use assets |

|

|

1,990 |

|

|

|

1,971 |

|

| |

|

|

|

|

| Intangibles

and other assets |

|

|

27,109 |

|

|

|

26,363 |

|

|

Total assets |

|

$ |

78,749 |

|

|

$ |

70,898 |

|

| |

|

|

|

|

| LIABILITIES

AND STOCKHOLDERS' EQUITY |

|

|

|

|

| Current

liabilities |

|

$ |

25,678 |

|

|

$ |

22,346 |

|

| Current

liabilities related to discontinued operations |

|

|

269 |

|

|

|

362 |

|

|

Total current liabilities |

|

|

25,947 |

|

|

|

22,708 |

|

|

|

|

|

|

|

| Long-term

liabilities |

|

|

12,472 |

|

|

|

9,749 |

|

| Long-term

liabilities related to discontinued operations |

|

|

953 |

|

|

|

908 |

|

|

Total liabilities |

|

|

39,372 |

|

|

|

33,365 |

|

| Commitments

and Contingencies |

|

|

|

|

|

Stockholders' equity: |

|

|

|

|

|

Preferred Stock, $.001 par value; 2,000,000 shares authorized, |

|

|

|

|

|

no shares issued and outstanding |

|

- |

|

- |

|

Common Stock, $.001 par value; 30,000,000 shares authorized, |

|

|

|

|

|

13,654,201 and 13,332,398 shares issued, respectively; |

|

|

|

|

|

13,646,559 and 13,324,756 shares outstanding, respectively |

|

|

14 |

|

|

|

13 |

|

|

Additional paid-in capital |

|

|

116,502 |

|

|

|

115,209 |

|

|

Accumulated deficit |

|

|

(76,951 |

) |

|

|

(77,436 |

) |

|

Accumulated other comprehensive loss |

|

|

(100 |

) |

|

|

(165 |

) |

|

Less Common Stock held in treasury, at cost: 7,642 shares |

|

|

(88 |

) |

|

|

(88 |

) |

|

Total stockholders' equity |

|

|

39,377 |

|

|

|

37,533 |

|

| |

|

|

|

|

|

Total liabilities and stockholders' equity |

|

$ |

78,749 |

|

|

$ |

70,898 |

|

| |

|

|

|

|

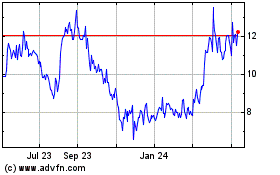

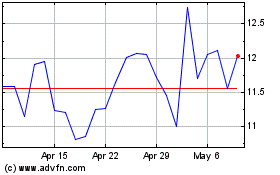

PermaFix Environmental S... (NASDAQ:PESI)

Historical Stock Chart

From Oct 2024 to Nov 2024

PermaFix Environmental S... (NASDAQ:PESI)

Historical Stock Chart

From Nov 2023 to Nov 2024